By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

PROFESSIONAL SERVICES, CONTINGENT LABOR

AMERICAS

Market Overview

- The labor market across the Americas operates similarly to other regions where unprecedented inflation, combined with low unemployment and high turnover continues to pose challenges in terms of maintaining and growing productivity.

- Low unemployment and rising wages have contributed to increased inflation across the region. However, additional income paid is failing to keep pace with the cost of living, resulting in challenges for workers to cover the costs of necessities like food, energy, and housing.

- The major economies of the Americas had been realizing strong financial growth, however, the continued uncertainty around inflation, tightening monetary policy, and rising food and energy insecurity, combined with tight labor markets will likely reduce estimated GDP results over the coming two years.

- The International Monetary Fund has downgraded real GDP growth estimates, including a reduction for the US from 2.3% to 1% in 2023, and 2.8% to 1.8% in Canada.

- The potential for a recession and softening of demand may damper the inflation rate somewhat, but employers can expect the challenges around attracting and retaining quality labor resources to continue. Competition for contingent labor, flexibility, and anticipation of changing demand will continue to maintain uncertainty.

Demand Commentary

- United States- The August 2022 PMI fell to 51.3, down from 52.2 in July 2022 and trending to show the lowest growth rate since July 2020. However, the index is still above 50 and is projected to remain flat during 2023. The US Bureau of Labor Statistics points to easing inflation in July 2022 after June’s 40-year high of 9.1%.

- Signs of improvement in the supply chain coupled with production cutbacks have not necessarily dampened the demand for contingent labor, as many large production regions still have more jobs available than applicants. For example, in the Cincinnati metropolitan area, there were 2.13 jobs available for every 1 applicant for manufacturing temporary roles.

- Overall, in June 2022 there were just 0.53 unemployed workers per job opening and only 1.42 potential workers per job opening.

- Canada- Canada’s manufacturing PMI dropped to 52.5, a 25-month low. This follows new order declines and reduced output for similar reasons to other countries, including rising energy and food prices. Despite the lower order volume, the average hours worked per week in manufacturing has remained steady at 37.6 since February and continued demand for workers remains strong.

- Brazil- Brazil’s manufacturing PMI rose from 52 in April to 54 in July and there is renewed optimism around increasing output through the next quarter. The increase is largely due to optimism in the domestic market due to softness and pricing challenges domestically.

- Brazil’s unemployment rate hit a 7-year low in May 2022, falling to 9.3%. More jobs are being created overall, however, wages for entry-level roles are decreasing.

Supply Commentary

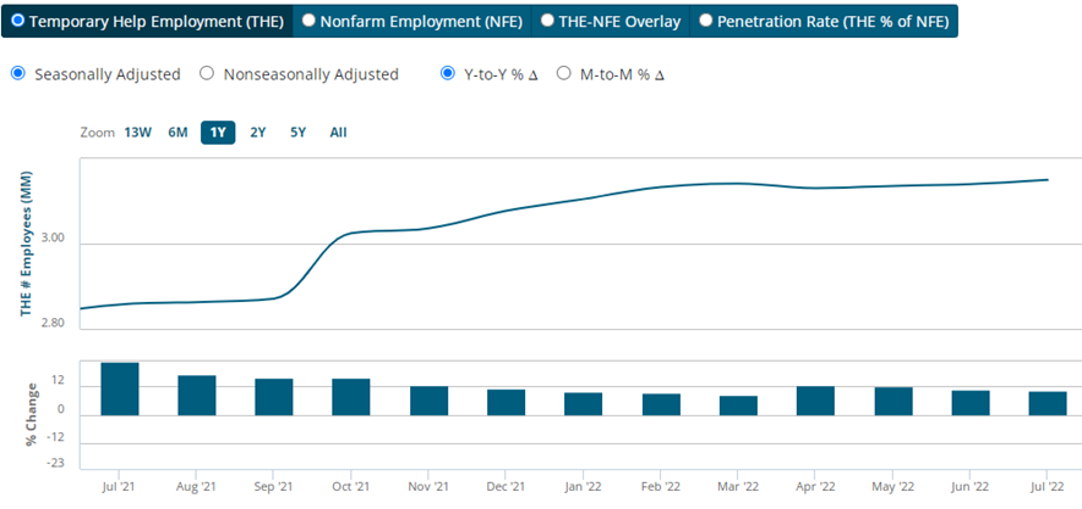

- United States- The seasonally adjusted penetration rate of non-farm temporary employees was 2.07% of the workforce in July 2022 or just over 3 million people. That figure has remained stable following the dramatic rise from September to October 2021 as employers scrambled to compete over the remnants of the federal stimulus money. Seasonally adjusted, it represents a 10.2% increase over July 2021.

- According to the July 2022 SCE Labor Market Survey, the rate of job transitioning fell to 4.1 percent from 5.9 percent in July 2021. However, satisfaction with compensation fell to 56.9 percent from 58.2 percent in July 2021, likely due to high inflation eroding buying power.

- In June 2022, there were 790,000 manufacturing job openings with 475,000 hires, but 442,000 separations, for a net decrease of 127,000 roles filled.

- Canada- Unemployment remained at an all-time low of 4.9% in July 2022 as companies continue to struggle to recruit, with many still turning to the Temporary Foreign Worker Program for help. On average, the Government has approved around 40,000 worker permits per quarter in early 2022, however, there remained over 1 million vacancies across the country.

- The program, however, is unpopular with some who believe that it is stifling wages, failing to increase productivity, and detracting from infrastructure investment.

- Brazil- Before 2018, temporary labor laws in Brazil were similar to what Mexico has in place today; that temporary labor was not permitted if it formed part of the organization's core line of business, but that ancillary roles - such as accounting, finance, back office - were allowed. However, following legislation change, outsourcing roles that are core to a company’s business became legal. The typical temporary employment agreement lasts 180-days and can be extended a further 90. Most temporary workers are brought in to replace a full-time employee who may be on a leave of absence.

Pricing Situation

- the United States- In July 2022, real wages grew 4.6% year over year, however when adjusted for high inflation, the ‘real’ wage earnings fell by 3.6%. The last time real earnings outpaced real wages was February 2021. This disparity is contributing to the high turnover rates and costing businesses billions in lost productivity. At current rates, employers will need to replace one out of three workers per year.

- Wages in manufacturing increased 5.2% year over year for non-supervisory roles in June 2022. In July 2022, average hourly wages increased to $25.01 year over year.

- Canada- Average hourly wages for non-supervisory entry-level manufacturing roles remained essentially unchanged in the third quarter of 2022. Wages across all manufacturing rose less than 0.5 percent in June when compared with March 2022. Manufacturing wages are forecast to increase around 4.5 percent in 2023 to $30.33 CDN.

- The Federal Government’s minimum wage, which applies only to Federal workers, is $15.55 CDN.

- Ontario’s minimum wage will increase from $15 CDN to $15.50 CDN on 1 October 2022

- Quebec’s minimum wage increased to $14.25 CDN on 1 May 2022

- Other province minimum wages range from $11.81 CDN to $16 CDN with annual increases across many due on the 1st of April of each year.

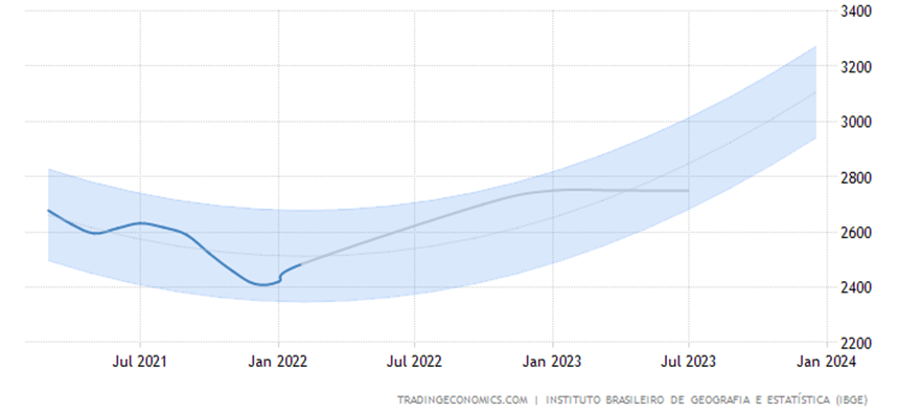

- Brazil- Manufacturing wages were shrinking in Q1 of 2022 and are expected to trend more favorably in the summer of 2022 and into 2023 when they are expected to eclipse 2800 BRL per month (USD 557).

ASIA

Market Overview

- Overall costs to manufacture in most Asian countries declined slightly through Q2 due to lower prices for fuel, shipping, and core commodities.

- The manufacturing PMIs of several countries in the region also edged up to just above the 50 mark, indicating slight optimism and expansion.

- Several countries have opened their borders again including Vietnam, Malaysia, Singapore, and India.

- By contrast, China and Hong Kong remain restrictive and foreign travelers can expect extended quarantine in government-operated facilities.

- Rising interest rates, stability in the region due to the ongoing invasion of Ukraine, and concerns surrounding the global economy may cause uncertainty over the next few quarters.

- Labor costs remained flat in Q2 from Q1, however, increased around 5% on average year-on-year.

Demand Commentary

- China- China’s NBS Manufacturing PMI rose slightly in August 2022 to 49.4, up from 49.0 in July 2022. This reflects a 2-month of contraction in factory output.

- The pessimism was in large part due to severe lockdowns in several cities, power rationing due to extreme heat, and the challenges around rising interest rates in their largest export countries.

- China’s PMI has hovered around the 50-point mark over the last 12 months given these market disruptions. Recent reductions in export orders fell at a faster rate in July as well.

- As a result of economic uncertainty, demand for contingent direct labor has stabilized in the Eastern, Southern, and Central regions of China. However, by contrast, it is increasing in new first-tier cities such as Hangzhou, Ningbo, and Chengdu.

- Overall demand for contingent outsourced workers remains high in aggregate, especially in some of the new first-tier cities where there is a lower cost of living, albeit some experience lower than average monthly wages.

- Malaysia- Malaysia’s GDP increased 8.9% year-on-year during Q2 of 2022 - also up sharply from Q1 - beating consensus estimates of 6.7%. The largest contributor to the increase was a boost in domestic demand as covid challenges have largely subsided.

- Manufacturing output also posted strong year-over-year growth of 9.2% in Q2. GDP from manufacturing increased to 89,153 million MYR in Q2 over Q1; a 2.2% increase.

- Unemployment fell to 3.8 percent in June, reflecting an 18% reduction in unemployed persons a year earlier.

- Manufacturing PMI rose to 50.6 in July, reflecting increased optimism amid the first growth in production in 7 months, due to softening price increases and easing of supply chain issues.

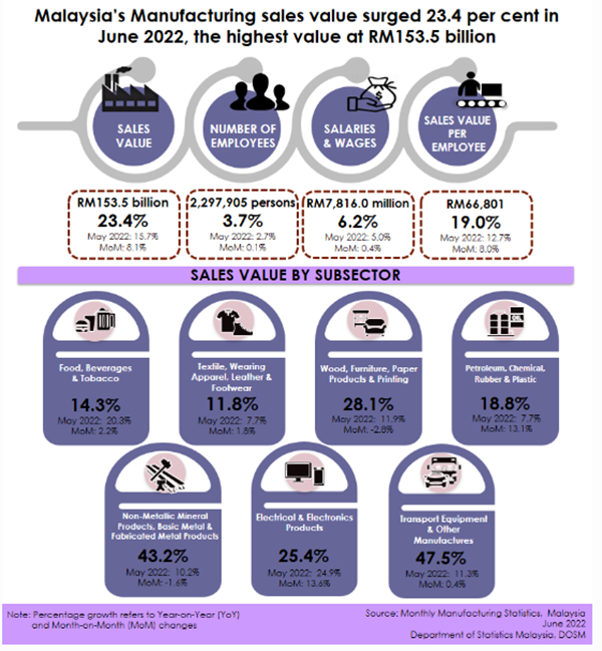

- According to the Malaysian Government’s Department of Statistics, revenues increased 23.4% year over year, valued at 153.5 Billion MYR - 34 Billion USD - of which 25% of the growth was in the electrical and electronic parts subsector.

- Singapore- Manufacturing PMI dropped in July to 50.2 for similar reasons indicated across other key regions - high inflation, ongoing geo-political conflicts, sporadic covid disruptions, and uncertain supply chains. However, the index remains above 50, which translates into an overall expansion, albeit at a more subdued rate.

- Manufacturing output increased 0.6 percent year on year in July, however, excluding biomedical output, grew 2.9 percent. Over 3 months, output grew by 4.3%.

- Key subsectors such as electronics decreased 6.3 percent year on year due to softening demand and lower export orders from China and Korea.

- Overall GDP growth estimates for 2022 have decreased slightly to 3 and 4%, down from guidance of between 3 and 5%.

- India- India’s Manufacturing PMI ended August 2022 at 56.2, down slightly from 56.4 in July, but beating the market consensus of 55 on increased output and the highest new order rate since November 2021.

- In recent months, renewed interest in India’s global manufacturing footprint has occurred. Several large global electronics companies have started to look beyond China in response to uncertainty around covid lockdowns. Currently, manufacturing’s contribution to India’s economy is under 15 percent, compared to slightly over 25 percent in China.

- India’s Ministry of Electronics and Information Technology proposed a ‘vision’ earlier in 2022 to transform the country into a $300 billion powerhouse by 2026, up from $75 billion in 2021.

- To promote manufacturing growth and investment, the government launched specific incentive schemes for large-scale manufacturing, IT hardware, the production of semiconductors, and an electronics manufacturing ‘cluster’ scheme.

- As a result, in 2021, Cushman and Wakefield named India second on a global manufacturing risk index for most attractive manufacturing locations. However, staffing and labor challenges may stifle the momentum.

- Vietnam- Like other Southeast Asia countries, Vietnam continues to position itself as a leader and alternative to manufacturing in China. With competitive labor costs, favorable port locations, and large foreign direct investment, overall GDP is projected to hit between 6 and 6.5 percent in 2022, with a Q2 year-over-year increase of 7.72%.

- July’s manufacturing PMI fell to 51.2 in July 2022 from 54 in June, primarily due to a slowdown in the growth of new orders, output, and employment. However, export orders have grown steadily, and companies are increasing inventory and seeing lower inflation overall.

- Several recent free-trade agreements with the European Union, the United Kingdom, and a Trans-Pacific Partnership have further strengthened the manufacturing position and attractiveness of Vietnam.

Supply Commentary

- China- The supply of blue-collar workers remains constrained across China. According to CIIC’s 2022 labor and employment survey, more than 83% of manufacturers are or will face blue-collar labor shortages, with nearly a third of employers having the issues year-round, and nearly half experiencing shortages in peak seasons.

- First-tier cities have the largest number of shortages, but the employment gap overall is larger in second and third-tier cities due to the scale of manufacturing.

- There is also an evolution occurring around the skill sets required for blue-collar jobs given the move toward more automation and intelligent manufacturing. The expectation for more technical workers within this demographic is to be able to work with more advanced equipment and other digital technology.

- The number of college graduates is growing exponentially in China, further challenging the traditionally younger blue-collar workforce supply. There are nearly 11 million college graduates expected across China in 2022 - an increase of 5.7% year on year.

- New talent strategies are emerging around increasing the technical apprenticeships for those in college, and providing them with robust social services and financial support.

- Malaysia- Labor productivity in terms of hours worked increased 11.3% year on year, and as the growth continues, further pressure on the supply of available contingent workers has increased. In March 2022, the Malaysian government opened back up the application process for foreign workers and in May, around 14% of 179,000 applicants had completed the process. However, approvals have been slow and in August, the Government issued a temporary suspension of foreign worker applications to enable new amendments to work arrangements legislation:

- Flexible Work Arrangements - Beginning on 1 September 2022, employees in Malaysia can apply for flexible work arrangements by submitting applications to employers that can cover changes in work hours, working days, and even work location. Employers will have 60 days to review and have to justify in writing any rejections.

- Extension of maternity and paternity leave- Mothers will be eligible for 98 days, up from 60, and Fathers will be eligible for 7 consecutive days, up from 3.

- Reduction of maximum weekly hours of work- The maximum number of weekly work hours is decreasing from 48 to 45 and will apply to both shift and non-shift workers.

- Potential blacklisting of employers to employ foreign workers who violate or breach any labor legislation.

- Singapore- Singapore leaders endeavor to attract higher-skilled foreign workers; however, they continue to offer work pass applications under the “Work Permit for Migrant Worker” program for manufacturing. The program is similar to those in other regional countries and includes mandatory insurance coverage, semi-annual health checks, housing, and pay a monthly levy. There is, however, no minimum stipulated salary.

- India- The minimum wage of 178 INR per day (USD 2.23) has not increased since 2018.

- The average wage of a manufacturing worker per month is 21,800 INR (USD 273), with a low of 8080 INR (USD 101) to a high of 54,600 INR (USD 685). This is around 32% lower than other jobs in India.

- The average hourly wage of a factory worker is 130 INR (USD 1.63)

- Income increases on average by around 9% every 16 months in manufacturing.

- Vietnam- Vietnam remains an attractive country for manufacturing in comparison to China and other countries in Asia

- The average hourly rate for a manufacturing role in Vietnam is US $2.99 (70,153 VND) as compared to China’s USD 6.50 (152,506 VND)

- Most factory workers earn around USD 256 (6 million VND) per month. Depending on the region, the minimum wages increased on July 1 this year by around 6% overall.

- The government was moved to act based on the large price hikes around fuel, the Russia-Ukraine conflict, and general inflation.

EUROPE

Market Overview

- In April this year, the IMF’s World Economic Outlook forecasted growth of 2.8% in the Euro Area through 2022; however, given higher than anticipated inflation, the tightening of money supply, and the continued ramifications of the ongoing Russian invasion of Ukraine, the IMF has lowered its forecast to 2.6% this year, and to 1.2% in 2023 - a 1.1% reduction from April.

- In June 2022, inflation rose to 8.6% and reached its highest level since the inception of the monetary union. As a result of record inflation and wages not keeping pace with the cost of living, household buying power has eroded and forced a forecast GDP reduction in coming quarters.

- According to the Eurofound recovery plan, the EU is pursuing a shift into a more circular economy - emphasizing investment in digital skills and green investments, and further challenging traditional manufacturing labor in an aging population.

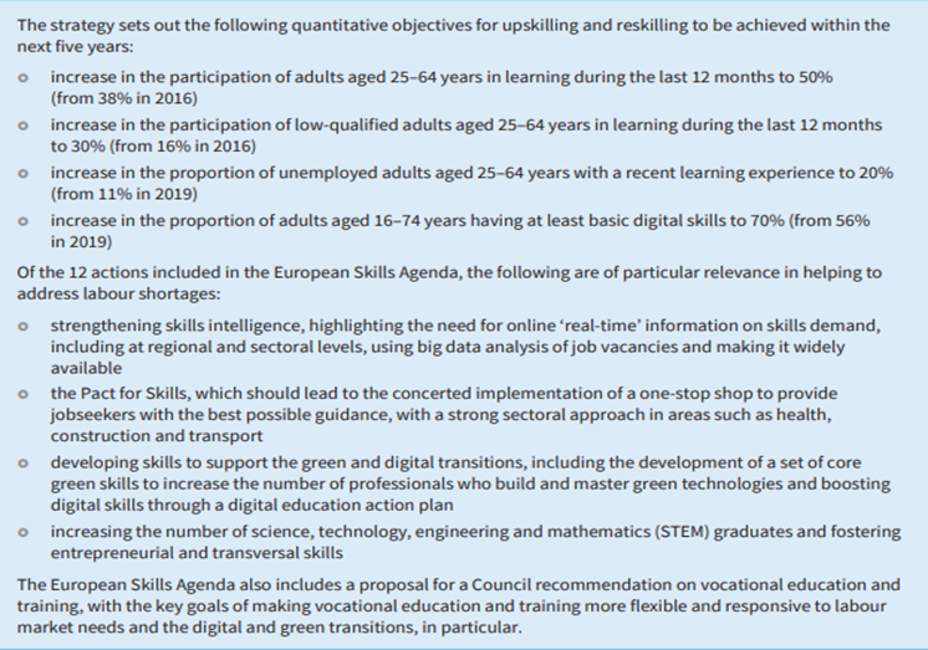

- In 2020, the European Commission launched a new “European Skills Agenda”. Likely, the impact on the availability of light industrial manufacturing contingent labor supplies will be further challenged in the coming years.

- Below are some key labor market dynamics, supply trends, and pricing impacts in select European countries, but much of the feedback applies across the region.

Demand Commentary

- Switzerland- In August 2022, the manufacturing PMI index fell to 58 - the 4th consecutive monthly decline, however, any point above 50 indicates a general expectation of manufacturing expansion. July’s index represents a 19-month low, and Credit Suisse expects a further slowdown in manufacturing, reducing the 2023 GDP to 1%, from a previous forecast of 1.6%.

- While increasing in hours worked year over year, the growth has slowed in Q2 2022 to half what it was in Q2 2021.

- Germany- Germany’s manufacturing PMI improved to 49.8 in August, half a point above July’s index. This is in part due to a slower decline in new orders, and an easing of supply chain bottlenecks over the previous quarters.

- Overall inflation eased a basis point in July over June to 7.5%. To combat doubling energy prices and the tax implications of salary increases, the Government approved a 10 billion Euro package of tax relief.

- VAT tax on fuel is also being decreased to 7% to ease workers' financial burden. Demand in certain sectors has been driven by massive increases in travel and other recovering industries in a post-Covid economy, leading to acute shortages of available temporary resources.

- Hungary- The seasonally adjusted manufacturing PMI has recovered from a large dip in May 2022, ending July at 57.8; up from 51.5 in May. 4 of the 5 sub-components of the index posted increases, except for lead times. Hungary’s annualized inflation rate rose substantially in July 2022 to 13.7%, up another 4.2% since April and well above the central bank’s target maximum of 4%.

- Hungary is at near record highs in job vacancies in July, with 87,000 vacancies and a record low unemployment rate of 3.2%. The job vacancy rate in manufacturing hit an all-time high in 2022 at 3.1%, further straining demand during a rising Manufacturing PMI.

- Ukraine- The inflation rate in Ukraine, which had been around 10% for months before the Russian invasion, now stands at 22.2% in July - up another 5.8% since April 2022. Key inflation measures for production remain at historic highs, with transportation enduring 40.4% and fuel at 77.7%.

- As of August 2022, over 200 companies that previously operated in the east of Ukraine have relocated their production sites on the western side of the country, near the borders with Hungary and Poland. The organizations have also begun strengthening ties with EU countries while re-locating their employees to keep them safe and productive. As a result of their location change, businesses are building new relationships with customers across the border which is expanding demand and supporting Ukraine’s economy.

- Ukraine’s robust IT Staff Augmentation industry has adapted during the crisis, either by re-deploying resources into Western Europe or, in many cases, relocating their resources into other hot spots such as Latin America. As the war has largely not directly affected the western portion of Ukraine, those already in place are continuing to service most clients well.

Supply Commentary

- Switzerland- In April 2022, the Q1 temporary labor market in Switzerland grew 22% year over year. In Q2 2022, the number of temp hours worked in Switzerland increased 8.8% year over year. However, the forecast for the available supply of workers is continuing to tighten with companies under pressure to retain workers by flipping from temporary to permanent contracts.

- Turnover is increasing, particularly in the Basel region, with permanent turnover eclipsing 31% and the temporary labor churn at 1.7%.

- As of mid-August 2022, overall unemployment remains at a 21-year low standing at 2.0%. For the 15 to 24-year-old demographic seeking work, only 8,000 people were unemployed across the country. On average, about 2.5% of the total working population in Switzerland works in temporary jobs, which represents around 340,000 employees.

- Germany- Germany’s temporary labor force is typically around 9% of the total working population of 45.4 million people. The country has hundreds of Temporary Worker Agencies including some of the largest global providers.

- The European Union is working toward creating policies to increase worker mobility between member countries, which means Germany’s total temp worker base should grow. Currently, the only industry where temporary work is not allowed is building and construction. Germany is similar to other countries, like Mexico, where they seek to protect workers and labor market requirements.

- The overall temporary worker population in Germany has not changed significantly in at least the last 7 years, remaining between 4.2 and 4.5 million, with one spike over 5 million in Q4 2016.

- In the summer of 2022, and response to an extraordinary shortage, Labor Minister Hubertus Heil indicated that the government would allow several thousand workers from Turkey to work and live in Germany temporarily in support of their stretched airport operations. The companies bringing in support would be required to pay collectively agreed wages and to provide suitable accommodation.

- Hungary- The available supply of temporary labor in Hungary continues to reduce given the historic low unemployment rates and changes in how the Ukrainian refugees are traveling further west into Europe. Demand for foreign workers is highest in the manufacturing industry, and the government is implementing additional measures to attract more migrant workers from Asia.

- Given the recent exit of many Ukrainian refugees, the Hungarian Statistical Office estimates the shortage to be around 90,000 workers as of late summer 2022.

- In July 2021, the Hungarian Government passed an emergency resolution for companies in affected industries to apply to become qualified employers and bring in additional resources from Mongolia, Indonesia, Vietnam, and the Philippines.

- The added advantage is that the hourly wages required by these workers are on par or lower than local Hungarian workers. There are additional costs to consider, however, including housing and specific diet and religious accommodations, but employers are no longer able to bus in workers from more rural areas within Hungary to meet the growing demand

- Ukraine- The International Labor Organization estimates that about 5 million people have lost their jobs or been displaced from work because of the war, which translates to an unemployment rate of 35%. In recent months, employment has slowly begun to recover, largely in the western region of the country which is furthest from the front line. Job openings increased in July by 14% to 40,000. Before the conflict, the average listings averaged 100,000-120,000.

Pricing Situation

- Switzerland- While inflation is running at a higher-than-expected rate of 2.7% over Q2, wages on average increased by between 7 and 9% in mid-level jobs.

- Average annual salaries in manufacturing range from about 35,000 CHF for an assembly line worker, 45,000 CHF for a Forklift Driver, to 61,000 for a General Warehouse Associate.

- Germany- Germany’s Parliament raised the statutory minimum wage to 10.45 EUR on 1 July 2022. That will increase further to 12.00 EUR on 1 October 2022 in response to the Minimum Wage Commission, which is a group of employer and union representatives who negotiate the minimums. The Commission is currently not expected to make any further decisions on minimum wages until June 2023, and any further increase is not expected until 1 January 2024.

- The 2022 minimum monthly wage in manufacturing ranges from between 1,070 and 2,280 EUR for roles as machinists, assembly line workers, demand planners, and factory workers 2022.

- The average range for factory salaries is between 960 EUR and 6,520 EUR.

- Hungary- The average monthly salary for a factory worker in Hungary is 337,000 HUF - or 819 USD- which is around 34% above the current overall minimum average wage of 200,000 HUF - 486 USD. Since the start of the Covid pandemic, the national monthly minimum wage has risen 24% and 19.47% since June 2021- staying ahead of the large inflation rate.

- Increasing the supply of available temporary workers in manufacturing must consider costs of recruitment, transportation, and housing. However, foreign workers are not being paid a premium monthly wage above the national average.

- Ukraine- With inflation at record levels and a short-term resolution with Russia unlikely, companies with global service centers are offering hourly rate increases from 11 to over 20% for staff in Application Development, Systems Analysts, and Data Architects. Price increase requests for those remaining in the country have ranged from 10 to 20% in recent months.

- Minimum monthly wages increased 8.3% year-on-year to 6500 UAH, representing approximately USD 176. Salaries in manufacturing range from a minimum of 6500 UAH to 39,100 UAH - about USD 1060 - for a Director of Manufacturing role. Many companies have been forced to cut salaries by up to 50% to survive, however, since the start of the conflict.

Back to Top