By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

ENERGY

ENERGY OVERVIEW

Market Overview

- Renewables are growing faster than demand and replacing fossil fuels. Strong capacity additions are helping global renewable power generation towards growth of more than 10% in 2022. Despite nuclear’s 3% decline, low-carbon generation is set to rise by 7%, this has resulted in a 1% drop in total fossil fuel-based generation. Coal power globally increases slightly as declines in China and the United States are balanced by growth in Europe. Gas power falls by 2.6% as growth in North America and the Middle East offsets some of the declines in Europe and Central and South America.

- Electricity sector emissions are set to decline slightly. CO2 emissions from the global electricity sector are set to decline in 2022, albeit by less than 1%, after having risen to an all-time high in 2021. Emissions intensity is set to fall by more than 2%.

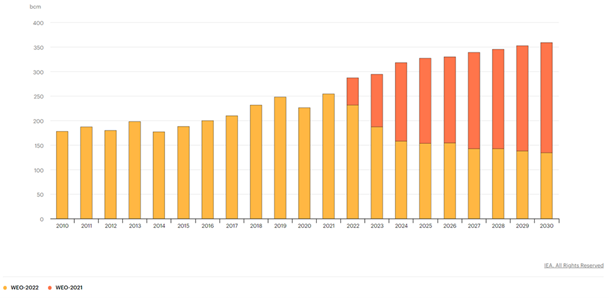

- With the loss of its largest export market in Europe, Russia faces the prospect of a much-diminished role in international energy affairs. 2021 proves to be a high watermark for Russian export flows. Its’ share of internationally traded gas, which stood at 30% in 2021, falls to 15% by 2030 in the STEPS and to 10% in the APS. Importers in China have been actively contracting for liquified natural gas, and there is no room in China’s projected gas balance for another large-scale pipeline from Russia.

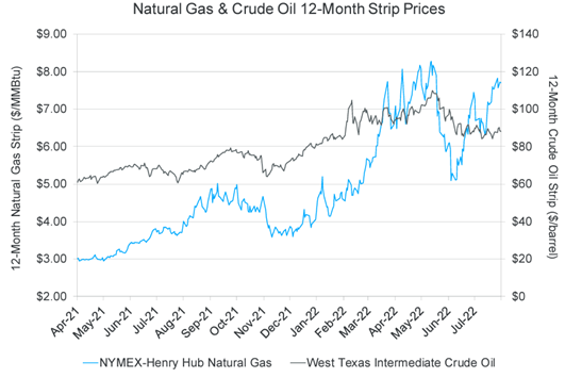

- Wholesale electricity prices are settling since the catastrophic increases seen in the first half of 2022. In the first half of 2022, gas and coal prices in Europe rose by over 400% and 300% respectively from the same period in 2021, resulting in wholesale electricity prices more than tripling in many markets. Our price index for major global electricity wholesale markets reached levels that were twice the first-half average from 2016 to 2021. Prices in the second half of 2022 have now settled and are beginning to reduce.

- Today’s high energy prices underscore the benefits of greater energy efficiency and are prompting behavioral and technology changes in some countries to reduce energy use.

- Large uncertainties for 2023. The main uncertainties affecting our 2023 forecasts for electricity demand and generation mix concern fossil fuel prices and economic growth. As of mid-2022, we expect global electricity demand growth in 2023 to remain on a similar path as this year. Strong renewables growth of 8% and recovering nuclear generation could displace some gas and coal power, resulting in the electricity sector’s CO2 emissions declining by 1%. One commonality is the rising share of electricity in the final energy consumption. From 20% today, this increases in each scenario, reaching more than 50% by mid-century in the NZE scenario.

Demand Commentary

- Electricity demand growth is slowing significantly in 2022. After global electricity demand grew by a strong 6% in 2021, propelled by rapid economic recovery as Covid-19 lockdowns eased, we expect growth to slow to 2.4% in 2022 – about the same as the average from 2015 to 2019. This ease in demand growth reflects slower global economic growth, higher energy prices following Russia’s invasion of Ukraine, and renewed public health restrictions, particularly in China.

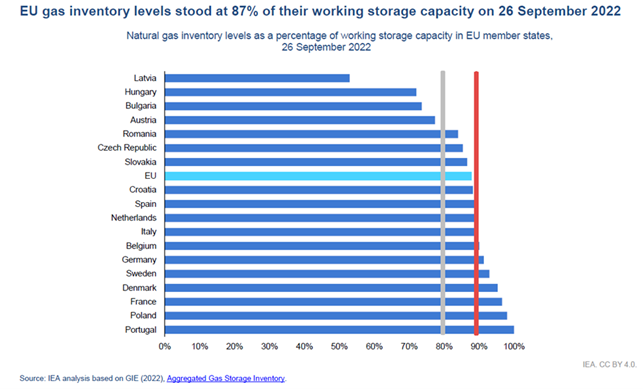

- This year’s winter gas season opens with extreme natural gas price levels and volatility, caused by unprecedented uncertainty of supply as Russia steeply curtails its pipeline deliveries to Europe. The result is considerable market tension in alternative sources of supply. Security of supply has become a top priority in Europe and other importing regions as a total cut-off in Russian flows to Europe cannot be ruled out, creating further tensions and demand destruction for all competing LNG importers.

- The gas crisis triggered by Russia’s invasion of Ukraine in February 2022 has caused a series of market adjustments. European buyers have strongly increased their LNG procurement, resulting in market tightening and demand destruction in various importing regions. This has also had a visible impact on LNG contracting behaviors, with a return to more traditional features such as fixed-destination and longer-duration contracts.

- New targets continue to spur the massive build-out of clean energy in China, meaning that its coal and oil consumption both peak before the end of this decade. Faster deployment of renewables and efficiency improvements in the European Union bring down EU natural gas and oil demand by 20% this decade, and coal demand by 50%, a push given additional urgency by the need to find new sources of economic and industrial advantage beyond Russian gas (Source: https://www.iea.org/reports/world-energy-outlook-2022).

- As markets rebalance, renewables, supported by nuclear power, see sustained gains; the upside for coal from today’s crisis is temporary. The increase in renewable electricity generation is sufficiently fast to outpace growth in total electricity generation, driving down the contribution of fossil fuels for power. This trend is forecasted to continue into the long-term future but without significant change to the current total demand for fossil fuels.

- For the first time, a WEO scenario based on prevailing policy settings has the global demand for each of the fossil fuels exhibiting a peak or plateau. In the STEPS, coal use falls back within the next few years, natural gas demand reaches a plateau by the end of the decade, and rising sales of electric vehicles (EVs) mean that oil demand levels off in the mid-2030s before ebbing slightly to mid-century. Total demand for fossil fuels declines steadily from the mid-2020s by around 2 exajoules per year on average to 2050, an annual reduction roughly equivalent to the lifetime output of a large oil field.

- In Asia Pacific, we expect demand to grow at around 3.4% for 2022, a downward revision by more than one percentage point from early 2022. Lower economic growth, high energy prices, strict sanitary measures, and extended effects from the coal shortage for power generation are the main drivers. For 2023, we expect demand growth of close to 4%, making up for some of the 2022 slowdowns.

- In the Americas, renewables continue to drive growth, led by the United States, where we expect year-on-year increases exceeding 11% in 2022 and 6% in 2023. Five states updated or adopted new clean energy standards in 2021, three of which committed to 100% clean energy or carbon-free electricity. To complement this, nuclear capacity is expected to increase by 1.4 GW by the end of 2023, as the Vogtle Units 3 and 4 in Georgia (1.1 GW each) come online, partially offsetting the recent retirement of the Palisades in Michigan (0.8 GW).

- Europe is particularly affected by rising fossil fuel prices and supply shortages, most of all for natural gas. The situation is exacerbated by a significant decline in nuclear generation, which we expect to decrease by 12% (more than 100 TWh) in 2022. Lower plant availability in France - following safety investigations over corrosion problems - is the main contributor, with additional drops reflecting the retirement of 4 GW of nuclear power in Germany and the impact of the Russian invasion of Ukraine’s nuclear plants. In total for 2022, we expect coal-fired electricity generation to increase by 8% (50 TWh) while gas declines by close to 7% (60 TWh).

- Immediate shortfalls in fossil fuel production from Russia will need to be replaced by production elsewhere – even in a world working towards net zero emissions by 2050. The most suitable near-term substitutes are projects with short lead times that bring oil and gas to market quickly, as well as capture some of the 260 bcm of gas that is wasted each year through flaring and methane leaks to the atmosphere. But lasting solutions to today’s crisis lie in reducing fossil fuel demand.

- The outlook for the rest of 2022 remains highly uncertain and will depend on the stringency of sanitary measures. Potential reform of China’s “dual control” policy, which would replace caps on total energy consumption and energy intensity with caps on total carbon emissions and carbon intensity, could trigger an increase in total demand. For 2023, over 4% demand growth is forecasted by the IEA, supported by recovery from suppressed demand in the previous year.

- In the Americas, it is expected for demand growth to moderate to almost 2% in 2022 and fall to below 1% in 2023 – after exceptional growth of about 2.4% in 2021 (due to the strong rebound in economic activity after the lockdowns in 2020). These projections are slightly higher for 2022 and lower for 2023 than in our January 2022 forecast, largely due to the rapid economic recovery in the United States.

- For the USA – demand is forecast to increase by 2%. This is expected to remain consistent for 2023 due to the slow economic growth predicted.

- In Europe, demand is expected to remain flat for the remainder of 2022 and into 2023. A cocktail of reasons has impacted the demand in this region, most prominently caused by the sanctions on Russian imports into the EU and retaliation measures by Russia. This has also had severe impacts on the economy.

Back to Top