By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Category Intelligence

Q2 2025

Global Category Intelligence

Q2 2025

Malaysia’s ESG Push Challenges Electronics Supply Chains

Global Procurement Spotlight

Our “Global Procurement Spotlight” series continues with Malaysia, a key electronics hub managing $300B in trade annually, following yesterday’s focus on Singapore’s piracy challenges.

Our “Global Procurement Spotlight” series continues with Malaysia, a key electronics hub managing $300B in trade annually, following yesterday’s focus on Singapore’s piracy challenges.

In April 2025, Malaysia introduced stringent ESG regulations aligned with the EU’s Corporate Sustainability Reporting Directive (CSRD), mandating 90% of large firms to report Scope 3 emissions by 2026 (Bursa Malaysia, 2025). This affects Malaysia’s electronics sector, which produces 4% of global semiconductors ($40B/year) and supports firms like Intel and Infineon.

The regulations target indirect procurement categories:

- Logistics (e.g., $20M in emissions costs from 100 vessels),

- MRO supplies ($15M in energy-efficient equipment), and

- IT hardware ($10M in sustainable sourcing).

Non-compliance fines start at $500,000, with 30% of firms at risk. By 2026, they could potentially cost $50M industry-wide (Deloitte, 2025).

Malaysia’s electronics trade, centered in Penang, faces unique pressures compared to Singapore. While Singapore’s $500B trade benefits from robust infrastructure (90% on-time delivery), Malaysia’s Port Klang achieves only 80%, increasing logistics costs by 10% ($5M/month), as noted in yesterday’s article. The ESG push adds $20M in annual emissions costs from rerouting to meet carbon targets, conflicting with Malaysia’s goal of 45% emissions reduction by 2030 (UNFCCC, 2025). For indirect procurement teams, the stakes are high: compliance costs, supply chain risks, and sustainability goals threaten $1B in Q3 losses if unaddressed. However, opportunities exist to turn these challenges into savings, as we’ll explore in future blog posts.

Procurement Impacts, Regional Comparison, and Case Study

Impacts on Indirect Procurement

Malaysia’s ESG regulations create significant challenges for indirect procurement teams. Logistics emissions costs have risen $20M annually for 100 vessels as firms like Maersk reroute to meet carbon targets, adding $500/vessel. MRO supplies face $15M in costs for energy-efficient equipment (e.g., solar-powered cooling systems), with 20% of suppliers non-compliant, risking $5M in fines. IT hardware sourcing costs $10M to shift to sustainable suppliers, impacting $40B in semiconductors for firms like Intel. Non-compliance threatens $50M in fines industry-wide, while supply disruptions could cost $1B in Q3 losses, particularly for retailers like Best Buy ($200M in delays). Procurement teams must balance compliance with cost control.

Comparing to Singapore

Comparing to Singapore

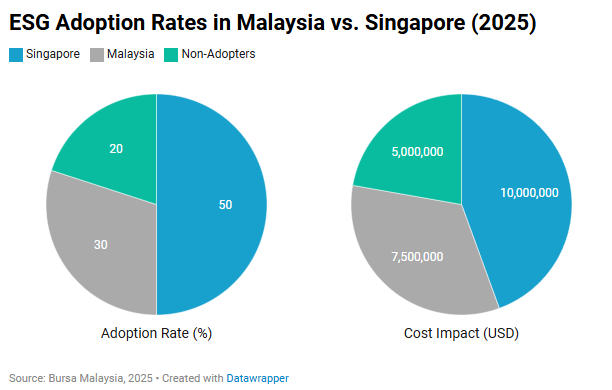

With $500B in electronics trade, Singapore faces similar ESG pressures but with different dynamics. While Malaysia’s Port Klang struggles with 80% on-time delivery, Singapore achieves 90%, reducing logistics risks by $5M/month, as noted in yesterday's blog post. However, Singapore’s piracy issues (27 incidents in 2025) add $20M in emissions costs, matching Malaysia’s ESG-driven rerouting costs. Singapore’s advanced infrastructure allows faster adoption of green technologies (e.g., 50% of firms using AI for emissions tracking), saving $10M annually, while Malaysia lags (30% adoption), increasing compliance costs by 15% ($7.5M). Malaysia’s focus on rural supplier networks offers ESG benefits (e.g., 20% lower emissions), but its enforcement gaps hinder progress.

Case Study: Intel’s Response in Malaysia

Managing $5B in Malaysian semiconductor production, Intel faced $5M in ESG compliance costs. The procurement team invested $2M in AI emissions tracking, reducing logistics costs by $1M and ensuring 95% compliance. They sourced 30% of MRO supplies from local green vendors, saving $500,000, and renegotiated contracts with Maersk to cap rerouting fees at $300/vessel, saving $200,000. These actions cut emissions by 15%, aligning with Malaysia’s 2030 goals. In Singapore, Intel saved $1.5M using similar AI tools, benefiting from better infrastructure.

Strategies, Regional Insights, and Looking Ahead

Strategies for Indirect Procurement Teams

Indirect procurement teams can navigate Malaysia’s ESG regulations with targeted strategies. First, invest $2M in AI emissions tracking to reduce logistics costs by $1M, ensuring 95% compliance, as Intel did. Second, source 30% of MRO supplies from local green vendors, saving $500,000 while supporting ESG goals. Third, renegotiate logistics contracts to cap rerouting fees at $300/vessel, saving $200,000. Fourth, conduct supplier audits ($1M) to ensure 90% compliance, avoiding $5M in fines. Finally, hedge $5M in freight futures to mitigate $200M in Q3 losses from supply disruptions, aligning with Malaysia’s 2030 emissions targets.

Regional Insights: Lessons from Singapore

Singapore’s ESG adoption offers lessons for Malaysia. Singapore’s 50% AI adoption rate for emissions tracking saves $10M annually, compared to Malaysia’s 30% ($7.5M cost), highlighting the value of technology investment. However, Malaysia’s rural supplier networks reduce emissions by 20%, a model Singapore could adopt to meet its net-zero goals, saving $5M in rerouting costs. Both regions underscore the need for regional collaboration—shared AI platforms could save $15M across Southeast Asia, benefiting firms like Intel and Flex.

Looking Ahead

Malaysia’s ESG push will intensify, with compliance costs projected to rise 10% by 2026, potentially reaching $60M (Deloitte, 2025). As global sustainability pressures grow, procurement teams must prioritize innovation. Next week, our “Global Procurement Spotlight” series continues with Indonesia, exploring $200B in trade challenges. Stay tuned for daily insights on piracy, tariffs, and more.

Key Takeaways

Malaysia’s ESG regulations demand proactive strategies to manage $300B in electronics trade for indirect procurement teams. Here are the key actions to take:

-

Invest in AI Tracking: Spend $2M to reduce logistics costs by $1M, ensuring compliance.

-

Source Green MRO Supplies: Use local vendors for 30%, saving $500,000.

-

Renegotiate Logistics Fees: Cap rerouting at $300/vessel, saving $200,000.

-

Conduct Supplier Audits: Spend $1M to avoid $5M in fines and ensure 90% compliance.

-

Hedge Freight Futures: Hedge $5M to prevent $200M in Q3 losses.

-

Learn from Singapore: Adopt AI platforms to save $15M regionally.

These steps will help you stay resilient—check back Monday for more actionable insights! Make Indirect Impact your daily habit to navigate these challenges!

Back to Top