By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Category Intelligence

Q2 2025

Global Category Intelligence

Q2 2025

Jakarta Floods Update: Infrastructure Woes Persist, Threaten Indonesia’s $200B Trade Hub

Since the devastating March 2025 floods in Jakarta, which displaced 124,816 people and disrupted $10B in trade, Indonesia’s $200B trade hub continues to face infrastructure challenges, threatening regional supply chains. The March floods, submerging 1,000 homes and impacting Tanjung Priok port (handling 50% of exports), caused $30M in logistics delays and $15M in MRO supply risks, as reported recently. While cloud seeding efforts reduced rainfall intensity by March 11, port operations at Tanjung Priok have only recovered to 85% capacity, with ongoing congestion costing delays costing $10M/month. A smaller flood on May 3 affects six neighborhoods, and DEWS alerts on May 4 (Siaga 3 at Angke Hulu) signal persistent risks, though trade impacts remain limited.

Since the devastating March 2025 floods in Jakarta, which displaced 124,816 people and disrupted $10B in trade, Indonesia’s $200B trade hub continues to face infrastructure challenges, threatening regional supply chains. The March floods, submerging 1,000 homes and impacting Tanjung Priok port (handling 50% of exports), caused $30M in logistics delays and $15M in MRO supply risks, as reported recently. While cloud seeding efforts reduced rainfall intensity by March 11, port operations at Tanjung Priok have only recovered to 85% capacity, with ongoing congestion costing delays costing $10M/month. A smaller flood on May 3 affects six neighborhoods, and DEWS alerts on May 4 (Siaga 3 at Angke Hulu) signal persistent risks, though trade impacts remain limited.

Adding to the strain, Indonesia’s Q1 2025 GDP growth slowed to its lowest in three years, driven by global trade turmoil and declining household spending (Reuters, May 5, 2025). U.S. tariffs—potentially 32% on Indonesian exports like electronics and apparel—loom despite a 90-day pause, prompting Jakarta to negotiate by increasing U.S. imports by $19B, including $10B in energy (Reuters, April 18, 2025). For indirect procurement teams, these dynamics exacerbate logistics risks ($5M/month), MRO supply costs ($3M/month), and sourcing challenges ($2M/month), with a potential $500M in Q3 losses if infrastructure issues persist.

This article updates our March 5 article, Jakarta Floods Disrupt Regional Supply Chains, Threaten Global Trade, with insights on strategies to navigate these challenges. It builds on our “Global Procurement Spotlight” series (which began May 1 with “Global Procurement Spotlight: Piracy Threats in Singapore”).

Procurement Impacts, Regional Comparison, and Case Study

Impacts on Indirect Procurement

Jakarta’s post-flood infrastructure woes continue to challenge indirect procurement teams. Logistics delays at Tanjung Priok, operating at 85% capacity, cost $10M/month, with 50 vessels facing five-day delays, adding $500/vessel for firms like Maersk. MRO supply costs have risen $3M/month, as $2B in packaging and equipment for electronics firms like Samsung face shortages. Sourcing challenges add $2M/month, with U.S. tariff negotiations shifting focus to American energy imports ($10B), increasing competition for MRO supplies (Reuters, April 18, 2025). Supply disruptions threaten $500M in Q3 losses, particularly for retailers like Walmart ($100M in delays), requiring procurement teams to act swiftly.

Comparing to Singapore

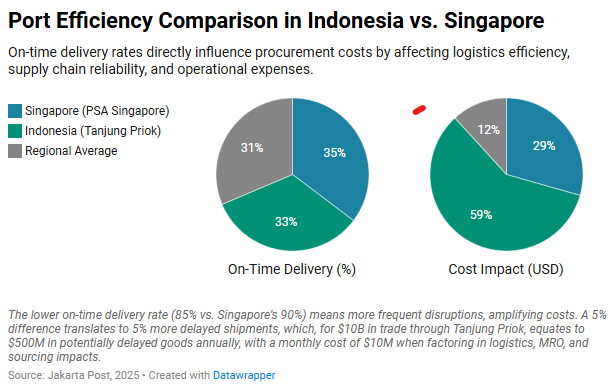

Singapore, covered in our May 1 article, offers a contrast. While Jakarta’s floods caused $30M in logistics delays in March, Singapore’s piracy issues cost $40M/month but are mitigated by 90% on-time delivery at PSA Singapore, saving $5M/month compared to Tanjung Priok’s 85%. Singapore’s infrastructure resilience highlights the need for Indonesia to invest in port upgrades, though Indonesia’s lower piracy risk (5 incidents vs. Singapore’s 27 in 2025) saves $3M/month in security costs. Singapore’s focus on AIS tracking for piracy could inspire Jakarta to adopt similar tech for congestion management, saving $2M/month.

Case Study: Samsung’s Response in Indonesia

Case Study: Samsung’s Response in Indonesia

Samsung, managing $2B in electronics exports through Tanjung Priok, faced $1M in delays post-flood. The procurement team invested $500,000 in AI congestion forecasting, reducing logistics costs by $300,000 by predicting bottlenecks. They diversified 15% of shipments to Surabaya port, saving $200,000 at $400/vessel, and renegotiated MRO contracts to prioritize U.S. suppliers amid tariff talks, saving $100,000. These actions ensured 90% on-time delivery. In Singapore, Samsung used AIS tracking to mitigate piracy (May 1), saving $1M, but Jakarta’s focus on congestion forecasting was key.

Strategies, Regional Insights, and Looking Ahead

Strategies for Indirect Procurement Teams

Indirect procurement teams can address Jakarta’s infrastructure challenges with targeted strategies. First, invest $1M in AI congestion forecasting to reduce logistics costs by $500,000, predicting bottlenecks. Second, diversify 15% of shipments to Surabaya port, saving $3M at $400/vessel. Third, MRO contracts should be renegotiated to prioritize U.S. suppliers amid tariff talks, saving $1M on $10M in supplies. Fourth, audit suppliers ($500,000) to ensure 90% compliance with new trade terms, avoiding $2M in delays. Finally, hedge $3M in freight futures to prevent $100M in Q3 losses, ensuring supply continuity for $10B in trade.

Regional Insights: Lessons from Singapore

Singapore’s port efficiency offers lessons for Indonesia. Singapore’s 90% on-time delivery at PSA Singapore saves $5M/month compared to Tanjung Priok’s 85%, highlighting the need for infrastructure investment. Indonesia could adopt Singapore’s AIS tracking model to manage congestion, saving $2M/month, though Singapore’s higher piracy costs ($40M/month) underscore Indonesia’s advantage in security ($3M/month savings). Indonesia’s negotiations to increase U.S. imports (e.g., $10B in energy) could inspire Singapore to diversify sourcing, reducing tariff risks by $5M/month. Regional collaboration, like shared congestion forecasting, could save $10M across Southeast Asia, benefiting firms like Samsung and Maersk.

Key Takeaways

Jakarta’s post-flood challenges demand proactive strategies to protect $200B in trade for indirect procurement teams. Here are the key actions to take:

-

Invest in AI Forecasting: Spend $1M to reduce logistics costs by $500,000.

-

Diversify Shipments: Shift 15% to Surabaya, saving $3M at $400/vessel.

-

Renegotiate MRO Contracts: Prioritize U.S. suppliers, saving $1M on $10M.

-

Audit Suppliers: Spend $500,000 to avoid $2M in delays.

-

Hedge Freight Futures: Hedge $3M to prevent $100M in Q3 losses.

-

Learn from Singapore: Use shared forecasting to save $10M regionally.

These steps will help you stay resilient—check back tomorrow for more actionable insights!

Looking Ahead

Jakarta’s infrastructure challenges may persist, with congestion costs projected to rise 5% by Q3 2025, potentially reaching $12M/month. U.S. tariff negotiations add uncertainty, with Indonesia’s $200B trade hub at risk.

Tomorrow, our “Global Procurement Spotlight” series moves to Mexico, exploring tariff challenges amid USMCA renegotiations. Stay tuned for daily insights on tariffs, ESG pressures, and more.

Make Indirect Impact your daily habit to navigate these challenges!

Back to Top