By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Category Intelligence

Q2 2025

Global Category Intelligence

Q2 2025

India’s Dairy Cost Surge: Strategies for Indirect Procurement in a Global Market

Time to Read: Approximately 10 minutes

Date: April 30, 2025

As of today, Mother Dairy, one of India’s leading dairy companies, has increased milk prices by up to INR 7.57 per gallon, following a similar hike in June 2024, due to rising procurement costs (INR 15.14-18.92/gallon increase).

As of today, Mother Dairy, one of India’s leading dairy companies, has increased milk prices by up to INR 7.57 per gallon, following a similar hike in June 2024, due to rising procurement costs (INR 15.14-18.92/gallon increase).

This adjustment, impacting $1B in annual dairy trade, reflects broader challenges in India’s $150B dairy industry. India is the world’s largest milk producer, with 216.5 million metric tons (MMT), contributing 24% of global supply (FAO, 2025).

The cost surge stems from a 10% rise in feed prices (e.g., maize, soybeans) due to monsoon disruptions, a 15% increase in fuel costs, and a 12% hike in logistics expenses, adding pressure on distributors like Amul and Parag Milk Foods.

For indirect procurement teams, this price hike affects MRO supplies (e.g., $50M in packaging, refrigeration equipment), logistics contracts ($30M in distribution costs), and supplier relationships with 500,000 farmers, potentially adding $200M in annual costs for firms like Nestlé India and Reliance Retail.

Dairy Sectors Compared: India vs. US

India’s dairy sector is unique. It is driven by 75 million small-scale farmers who own 10 or fewer cattle, contributing 62% of production.

-

This decentralized model offers resilience—unlike concentrated U.S. operations, a single event like a disease outbreak is less likely to disrupt India’s supply chain, as seen during the 2020 Foot-and-Mouth Disease outbreak, which cost $500M in India versus a potential $1B in the U.S. (FAO, 2020).

-

Small-scale farmers also retain 70-80% of the consumer price (INR 143.72-166.54/gallon of INR 208.18/gallon), supporting rural livelihoods, particularly for women (60% of dairy farmers).

-

However, low productivity (1.58 gallons/day per cow vs. 7.93 gallons/day in the U.S.) and informal operations (70% of farmers) complicate sourcing, increasing quality assurance costs by 5% ($2.5M for $50M in inputs).

By contrast, the U.S., the second-largest milk producer at 103 MMT, relies on large-scale, mechanized farms with 9 million cows, primarily in states like California (average herd >1,000 cows).

-

Thanks to advanced genetics and technology, U.S. farms achieve higher efficiency, with production costs at $0.76/gallon versus India’s $1.51 (USDA, 2025). This efficiency reduces MRO and logistics costs for U.S. procurement teams—$2M in added costs for $50M in dairy inputs versus $4M in India.

-

However, concentrated operations heighten systemic risks, such as California’s 2024 drought, which cut production by 5% (a $500M loss).

-

India’s small-scale model aligns with ESG goals, using low-input methods that reduce emissions by 20% per gallon, but its scale (58M cows) amplifies cost impacts, as procurement teams are now experiencing with the price hike

Impacts on Indirect Procurement

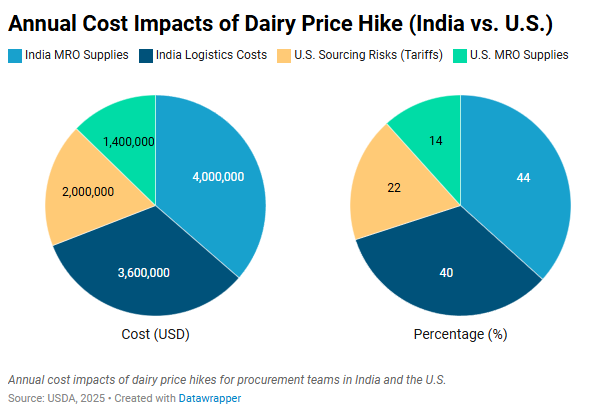

The Mother Dairy price hike creates significant challenges for indirect procurement teams in India. Logistics costs for distribution, handling $30M in refrigerated transport, have risen 12%, adding $3.6M annually for a firm like Reliance Retail (0.26M gallons/day). MRO supplies, such as packaging and refrigeration equipment ($50M/year), face 8% cost increases due to higher plastic and energy prices, risking $4M in budget overruns. Supplier relationships are strained, as 70% of India’s 500,000 dairy farmers operate informally, making contract negotiations and quality assurance difficult, with $1M in audits needed for $50M in inputs. The hike also threatens India’s $500M dairy export market, as higher prices reduce competitiveness against New Zealand and EU suppliers, potentially leading to $100M in lost export revenue by Q3 (USDA, 2025).

The U.S. Dairy Sector

The U.S. dairy industry offers a stark contrast, with implications for procurement strategies. While India produces 216.5 MMT with 58M cows, the U.S. produces 103 MMT with 9M cows, achieving five times the productivity (7.93 gallons/day vs. 1.58 gallons/day) through mechanized farming, advanced genetics, and technology like IoT sensors , which reduce disease losses by $200M annually (Dairy Herd Management, 2025). U.S. production costs are lower at $0.76/gallon versus India’s $1.51, meaning a similar price hike in the U.S. would cost $5M for $200M in dairy inputs, compared to $10M in India (USDA, 2025). However, U.S. procurement teams face unique challenges from recent tariffs—10% duties on Mexican imports and China’s 25% tariffs on U.S. dairy have cut exports by $300M in 2025, reducing total exports from $8B to $7.7B (Dairy Reporter, 2025). This lowers U.S. milk prices (Class III at $17.60/cwt, or $1.44/gallon), impacting farmer margins by 5% ($50M for a 1M-cwt producer), and increases sourcing risks for procurement teams by $20M due to potential production cuts. As noted earlier, India’s domestic focus insulates it from such trade shocks, but its informal sector raises quality risks.

, which reduce disease losses by $200M annually (Dairy Herd Management, 2025). U.S. production costs are lower at $0.76/gallon versus India’s $1.51, meaning a similar price hike in the U.S. would cost $5M for $200M in dairy inputs, compared to $10M in India (USDA, 2025). However, U.S. procurement teams face unique challenges from recent tariffs—10% duties on Mexican imports and China’s 25% tariffs on U.S. dairy have cut exports by $300M in 2025, reducing total exports from $8B to $7.7B (Dairy Reporter, 2025). This lowers U.S. milk prices (Class III at $17.60/cwt, or $1.44/gallon), impacting farmer margins by 5% ($50M for a 1M-cwt producer), and increases sourcing risks for procurement teams by $20M due to potential production cuts. As noted earlier, India’s domestic focus insulates it from such trade shocks, but its informal sector raises quality risks.

Case Study: Nestlé India’s Response

Nestlé India, sourcing $200M in dairy products annually, faced a $10M cost increase due to the Mother Dairy price hike. The procurement team renegotiated contracts with 10,000 farmers, securing 5% price caps for six months, saving $5M. They shifted 15% of logistics to rail transport, reducing costs by $2M at $1,135/truckload, and invested $1M in energy-efficient refrigeration, cutting MRO expenses by $500,000 annually. These actions ensured supply continuity while supporting ESG goals, such as empowering rural farmers, a key advantage of India’s small-scale model. In the U.S., Nestlé’s procurement team might face $5M in costs for the same volume but would need to diversify suppliers to Canada to mitigate tariff risks, adding $1M in logistics costs due to longer routes (USDA, 2025).

Strategies, Insights, and Key Takeaways

Indirect procurement teams can navigate the Mother Dairy price hike with targeted strategies tailored to India’s unique context. First, renegotiate supplier contracts with farmers, secure 5% price caps for six months, and save $5M on $100M in dairy sourcing, as Nestlé India did. Second, optimize logistics by shifting 15% of distribution to rail, saving $2M annually at $1,135/truckload, and reducing emissions by 10% to meet ESG goals—a key advantage of India’s low-input farming model, which emits 20% less per gallon than U.S. mechanized farms (FAO, 2025). Third, invest $1M in energy-efficient MRO equipment (e.g., refrigeration units), cutting costs by $500,000/year while supporting sustainability. Fourth, diversify sourcing by partnering with cooperatives in less volatile regions like Gujarat, reducing risk by 20% for $50M in dairy inputs. Finally, hedge $10M in dairy futures to cap price spikes, preventing $3M in Q3 losses for export-focused firms.

Global Insights: Lessons from the U.S.

The U.S. dairy sector offers lessons for managing volatility. While India’s small-scale model ensures resilience, the U.S.’s mechanized approach provides efficiency, with production costs 50% lower ($1.51/gallon vs. $0.76/gallon) due to economies of scale and technology (e.g., IoT sensors saving $200M in disease losses). However, U.S. procurement teams face unique challenges from recent tariffs—10% duties on Mexican imports and China’s 25% tariffs on U.S. dairy have cut exports by $300M in 2025, reducing total exports from $8B to $7.7B. This increases sourcing risks by $20M as suppliers cut production, requiring U.S. teams to diversify to Canada (adding $1M in logistics costs) and renegotiate contracts to cap price increases, mirroring India’s strategy. India’s domestic focus insulates it from such trade shocks, but its informal sector raises quality risks, necessitating $1M in audits for $50M in inputs. The U.S.’s export orientation diversifies supply but amplifies tariff impacts, while India’s scale amplifies cost pressures but supports ESG goals through community empowerment (e.g., 60% women farmers).

Procurement teams can learn from both models: India’s resilience through decentralization and the U.S.’s efficiency through technology.

Key Takeaways

The Mother Dairy price hike and global dairy dynamics demand proactive strategies to manage costs and ensure supply continuity for indirect procurement teams.

Here are the key actions to take:

-

Renegotiate Supplier Contracts: Secure 5% price caps with farmers, saving $5M on $100M in sourcing.

-

Optimize Logistics: Shift 15% distribution to rail, saving $2M at $1,135/truckload, with ESG benefits.

-

Invest in Efficient MRO: Spend $1M on energy-efficient equipment, cutting $500,000 in costs.

-

Diversify Sourcing: Partner with Gujarat cooperatives, reducing risk by 20% for $50M in inputs.

-

Hedge Dairy Futures: Hedge $10M to cap price spikes, preventing $3M in Q3 losses.

-

Learn from U.S. Tariffs: Like U.S. teams, diversify suppliers to mitigate $20M in sourcing risks.

Looking Ahead

India’s dairy sector faces ongoing volatility, with procurement costs projected to rise 8% by Q3 2025 due to climate and fuel price pressures (FAO, 2025). Globally, tariffs and trade tensions, as seen in the U.S., will continue to shape dairy supply chains, requiring procurement teams to prioritize resilience and adaptability. Tomorrow, our “Global Procurement Spotlight” series launches with Singapore, exploring $500B in electronics trade challenges. Stay tuned for daily insights on piracy, tariffs, and more.

Make Indirect Impact your daily habit to navigate these challenges!

Back to Top