By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Category Intelligence

Q2 2025

Global Category Intelligence

Q2 2025

Navigating Piracy’s Hidden Costs in the Singapore Straits

A 35% surge in piracy incidents in the first quarter (Q1) of 2025—45 cases, with 27 in the Singapore Straits—threatens $3 trillion in global trade, according to the International Maritime Bureau's (IMB) April 2025 report. The Straits, handling 60% of Europe-Asia and 20% of Americas-bound shipments, carry electronics and consumer goods critical to indirect procurement. With 37 crew taken hostage this year, piracy drives up costs and risks.

A 35% surge in piracy incidents in the first quarter (Q1) of 2025—45 cases, with 27 in the Singapore Straits—threatens $3 trillion in global trade, according to the International Maritime Bureau's (IMB) April 2025 report. The Straits, handling 60% of Europe-Asia and 20% of Americas-bound shipments, carry electronics and consumer goods critical to indirect procurement. With 37 crew taken hostage this year, piracy drives up costs and risks.

This article explores how indirect procurement teams can mitigate piracy’s impact through partnerships, technology, and planning, building on recent Indirect Impact blog posts on disruptions like the China windstorm (April 16) and tariffs (April 15).

The Growing Threat in the Singapore Straits

The Singapore Straits, connecting the Indian Ocean to the South China Sea, handles 100,000 ships annually, making it a global trade artery. Q1 2025 saw 27 piracy incidents -- up from seven in 2024 -- with 92% of targeted vessels boarded, including nine tankers and bulk carriers (IMB, April 2025). The Straits carry 20% of electronics, like servers for data centers, consumer goods for retailers like Walmart, and other commodities. Piracy’s roots in poverty in Indonesia’s Riau Islands and lax regional patrols persist despite efforts by the Regional Cooperation Agreement on Combating Piracy and Armed Robbery against Ships in Asia (ReCAAP). The Gulf of Guinea (six incidents) and Somalia (three) pose lesser threats by comparison. Crew safety is a growing concern, with 37 hostages and 13 kidnappings signaling increased violence. Indirect procurement teams face rising costs and risks, with potential disruptions to $300 billion in goods by Q3 if the trend continues.

Procurement Challenges: Costs and Risks

Piracy directly impacts indirect procurement through logistics, insurance, and security costs. Shipping rates for companies like Maersk, which operates 500 vessels through the Straits (15% of its fleet), have risen 10%, adding $1,000 per container. For a firm shipping 500 containers monthly, this translates to $6 million annually, straining budgets for indirect categories like facility operations. Insurance premiums, according to Lloyd’s, have increased 10% ($1,000/container), adding $50 million to costs for a company like COSCO, which handles 20,000 containers monthly through the Straits. Security measures—such as armed guards ($10,000 per ship) and tracking systems like Inmarsat ($10,000)—further burden budgets, with a fleet of 100 ships facing $2 million in annual security costs.

Delays also disrupt critical indirect spend categories. A 5-10% shipment delay (10 million tons) could stall IT hardware deliveries, like servers for data centers, impacting digital transformation projects. For example, a tech firm relying on $5 million in monthly electronics from the region might face $500,000 in downtime costs due to delayed upgrades.

Delays also disrupt critical indirect spend categories. A 5-10% shipment delay (10 million tons) could stall IT hardware deliveries, like servers for data centers, impacting digital transformation projects. For example, a tech firm relying on $5 million in monthly electronics from the region might face $500,000 in downtime costs due to delayed upgrades.

Procurement teams must also navigate complexity, vetting suppliers for compliance with Best Management Practices (BMP) while balancing cost against crew safety, a priority given the 37 hostages in Q1. These challenges mirror the disruptions from recent events like the northern China windstorm (April 16), requiring a strategic response to ensure supply chain continuity.

Strategic Solutions for Resilience

Indirect procurement can counter piracy through supplier collaboration, cost optimization, and technology. Partner with shipping firms like Maersk to enforce BMP compliance, which has a 50% adoption rate and can reduce boardings by 80% for 5 million tons of cargo (ReCAAP, 2025). Negotiate tiered freight contracts with COSCO to cap cost increases at 10%, potentially saving $50 million annually for high-value shipments like IT hardware. Rerouting 10% of shipments via the Cape of Good Hope, though costlier at $1,500 per container, can avoid piracy zones, saving $200 million in delay-related losses for a firm shipping 200,000 containers yearly. For urgent IT hardware, air freight at $5 per kg can expedite delivery, ensuring continuity for $100 million in critical supplies.

Investing in technology is key. AI forecasting tools can predict piracy zones, protecting $200 million in electronics shipments by optimizing routes. Stockpiling four weeks of critical goods—such as MRO supplies for facility maintenance—can prevent stockouts, a strategy that saved a retailer $100 million during a 2021 piracy surge. Training suppliers on crisis protocols reduces ransom risks, protects crews and saves $20 million in potential costs. These steps, echoing the diversification strategies from our tariff discussion in our April 15 Indirect Impact blog post, can ensure 95% on-time delivery, safeguarding $3 trillion in trade.

Regional Focus: Southeast Asia’s Procurement Challenges

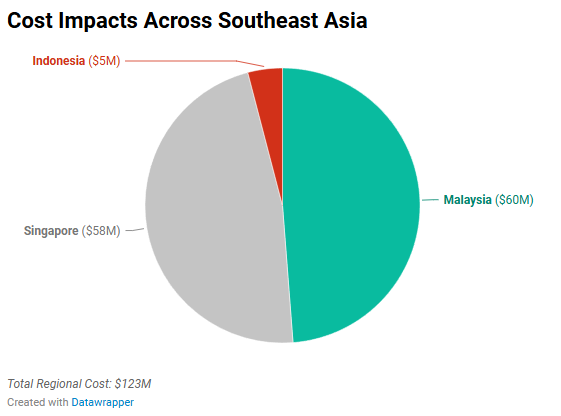

The Singapore Straits piracy surge reverberates across Southeast Asia, particularly impacting the Singapore-Malaysia-Indonesia cluster, a critical region for indirect procurement. Malaysia, a hub for electronics manufacturing, produces 15% of global semiconductors (Statista, 2025), with Penang hosting firms like Intel and Dell. Piracy delays in the Straits have stalled $300 million in chip shipments in Q1, affecting IT hardware supply chains for U.S. firms. Malaysian procurement teams face a 12% cost increase ($1,200/container) for shipping through the Straits, adding $60 million annually for a firm moving 50,000 containers (Malaysia Logistics Association, 2025).

Indonesia, meanwhile, struggles with sourcing consumer goods and MRO supplies amid piracy’s root causes—poverty in the Riau Islands fuels crime, with 37% of incidents tied to local gangs (ReCAAP, 2025). A 10% delay in shipments disrupts $200 million in goods for retailers like Walmart, while security costs for Indonesian suppliers rise by $5 million annually. Procurement professionals in Indonesia must vet suppliers for anti-piracy measures, a challenge given limited regional enforcement. The region's interconnectedness means Singapore’s piracy issues amplify risks for Malaysia and Indonesia, driving up costs and delays across Southeast Asia. Collaborative regional strategies—like joint patrols or shared AI risk forecasting—can mitigate these impacts, ensuring stability for $1 trillion in regional trade and supporting U.S. firms reliant on Southeast Asian supply chains.

ESG and Innovation: A Broader Perspective

Piracy also challenges procurement’s ESG commitments. Crew welfare—37 hostages in Q1—demands action, such as funding poverty alleviation in the Riau Islands ($10 million investment by companies like BP), addressing piracy’s root causes. Compliance with IMO’s BMP and ISPS Code requires $50 million in audits for a fleet like Maersk’s, ensuring legal trade flows. Rerouting increases emissions by 10%, adding $20 million in carbon costs for a company shipping 1 million containers annually, conflicting with sustainability goals (April 3). Procurement can innovate with blockchain for cargo tracking ($30 million investment), reducing theft by 50%, as seen in DHL’s 2023 pilot. AI risk forecasting can save electronics firms $500 million in potential losses by avoiding high-risk zones. These efforts align with procurement’s evolving role: balancing ethics, compliance, and sustainability while building resilient supply chains.

Key Takeaways

The piracy surge in the Singapore Straits threatens $3 trillion in trade, escalating costs and risks for indirect procurement teams. Proactive strategies can mitigate these challenges while aligning with ESG goals. Here are the key actions to take:

-

Assess Cost Impacts: Quantify the impact of piracy on logistics (e.g., a $1,000/container cost increase), insurance ($50 million for 20,000 containers), and security ($2 million for 100 ships), focusing on indirect categories like IT hardware and MRO supplies for facility operations.

-

Collaborate with Suppliers: Partner with shipping firms like Maersk to enforce BMP compliance, reducing boardings by 80%, and negotiate cost-capped contracts with COSCO, saving $50 million annually on high-value shipments.

-

Leverage Technology: Use AI forecasting to predict piracy zones, protecting $200 million in electronics, and implement blockchain for cargo tracking to cut theft by 50%, as DHL did in 2023.

-

Prioritize ESG: Address crew safety (37 hostages) by funding initiatives like Riau poverty alleviation ($10 million) and minimizing emissions from rerouting ($20 million in carbon costs) through optimized planning.

-

Act Proactively: Reroute shipments via safer routes (e.g., Cape of Good Hope, $200 million savings) and stockpile critical goods (e.g., four weeks of MRO supplies) to ensure 95% on-time delivery and prevent $300 billion in disruptions by Q3.

By implementing these strategies, indirect procurement can transform piracy’s challenges into opportunities, ensuring both operational stability and ethical responsibility in a high-stakes trade corridor.

Back to Top