By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Category Intelligence

Q2 2025

Global Category Intelligence

Q2 2025

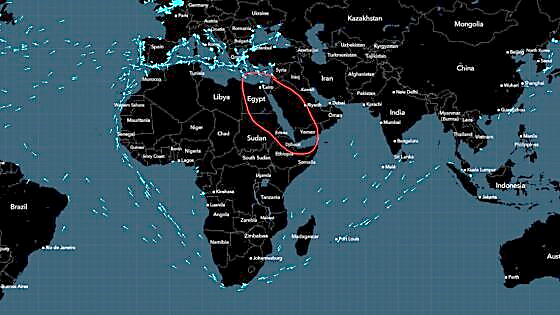

UPDATE: Red Sea Risks, Impacts on the Supply Chain & Mitigation Strategies

Global Shipping in Flux: Navigating Through Rate Volatility, Red Sea Crisis, and Strategic Carrier Responses

Amidst unprecedented challenges in the global shipping sector, we have compiled a comprehensive 10-point summary to provide a clear overview of the current situation in the Red Sea. This summary is an update to our December 19, 2023, Alert and highlights key aspects such as the swift changes in shipping rates and surcharges, significant policy shifts by major carriers, and the complex implications of the Red Sea crisis on global logistics. One caution: the situation is extremely fluid and could change quickly.

-

Rapid Rate Changes: The shipping industry has seen quick and significant changes in rates and surcharges, impacting the cost of transporting goods by sea. Freight Rates to Europe from Asia have moved from USD 1500 in early December to USD 5000 in late December to USD 8000 in January for a 40-foot container.

-

Container 20/40 Price Differential: There was a marked decline in the relative cost of a 20-foot container vis-à-vis a 40-foot container, plummeting from 72% to 58% of the 40-foot container's cost within a month (December 15 to January 15), thereby influencing shippers' strategies in selecting container sizes. Shippers may need to reconsider the ratio of 20-foot to 40-foot containers in use for cargo based on the changing pricing dynamics. Adjusting this ratio can help shippers optimize shipping costs.

-

Inconsistent Information: Carriers provide different and sometimes contradictory information regarding their shipping schedules and routes. For example, one carrier's online schedule might show a vessel proceeding through the Red Sea, while the Automatic Identification System (AIS) data indicates a different route or holding position. Such discrepancies make it difficult for shippers to track the status and location of shipments.

-

The New Liner Service: The Med/North Africa to Jeddah shuttle service is poised to be highly popular with Beneficial Cargo Owners. They are seeking access not only to other Red Sea ports but also exploring trucking options to ports/destinations in the Persian Gulf. The distances for trucking from Jeddah are approximately 1,300 kilometers to Kuwait, about 1,400 kilometers to Dammam, and around 2,000 kilometers to Abu Dhabi in the UAE.

-

Increased Number of Vessels Turning Off AIS Transponders: The increased number of vessels turning off Automatic Identification System (AIS) transponders in the Red Sea and the Indian Ocean raises safety, security, and monitoring concerns, as it hinders the ability to track and assess vessel movements, potentially impacting maritime safety and security efforts.

-

Increased Air Freight Demand Due to Maritime Disruptions: The conflict in the Red Sea has severely impacted shipping through the Suez Canal, leading to a significant rise in demand for air freight. Companies are seeking alternative transportation methods due to rerouted or halted maritime operations, causing congestion and delays in sea freight.

-

Military Involvement and Escalation of Tensions: In response to the crisis, several nations have deployed military assets to safeguard their interests and ensure the security of shipping lanes. This involvement can range from naval patrols to more direct military actions against perceived threats. Such developments can escalate tensions in the region, further jeopardizing the safety of maritime routes. The United States, the United Kingdom, and some EU countries have a naval presence in the Red Sea, and some have escorted their national flagged ships.

-

Risk of Spillover to Other Areas: The crisis could potentially escalate to affect other nearby strategic locations, such as the Strait of Hormuz, another critical chokepoint for global oil shipments. Increased military activity or conflict in the Red Sea region could heighten risks in these adjacent areas, amplifying the impact on the worldwide oil supply.

-

The U.S. Federal Maritime Commission (FMC): The U.S. Federal Maritime Commission (FMC) granted in response to the Red Sea crisis. Special permissions for ocean carriers to implement surcharges with less than the usual 30-day notice, acknowledging the immediate and unforeseen operational challenges and costs, such as rerouting and heightened security measures, thereby balancing the urgent needs of carriers with the broader interests of the shipping industry and commerce.

-

Map of the Day Avoiding the Red Sea: This map highlights the current routes of container ships headed for Europe and North America, showing avoidance of the Red Sea (marked in red). This comes over two weeks after the US-led 'Prosperity Guardian' operation, with the Houthi forces still dominant in the Red Sea area (Map Courtesy of BBG).

Back to Top