By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

Market Overview

- Record inflation rates continue to drive price increases across almost every section of the supply chain.

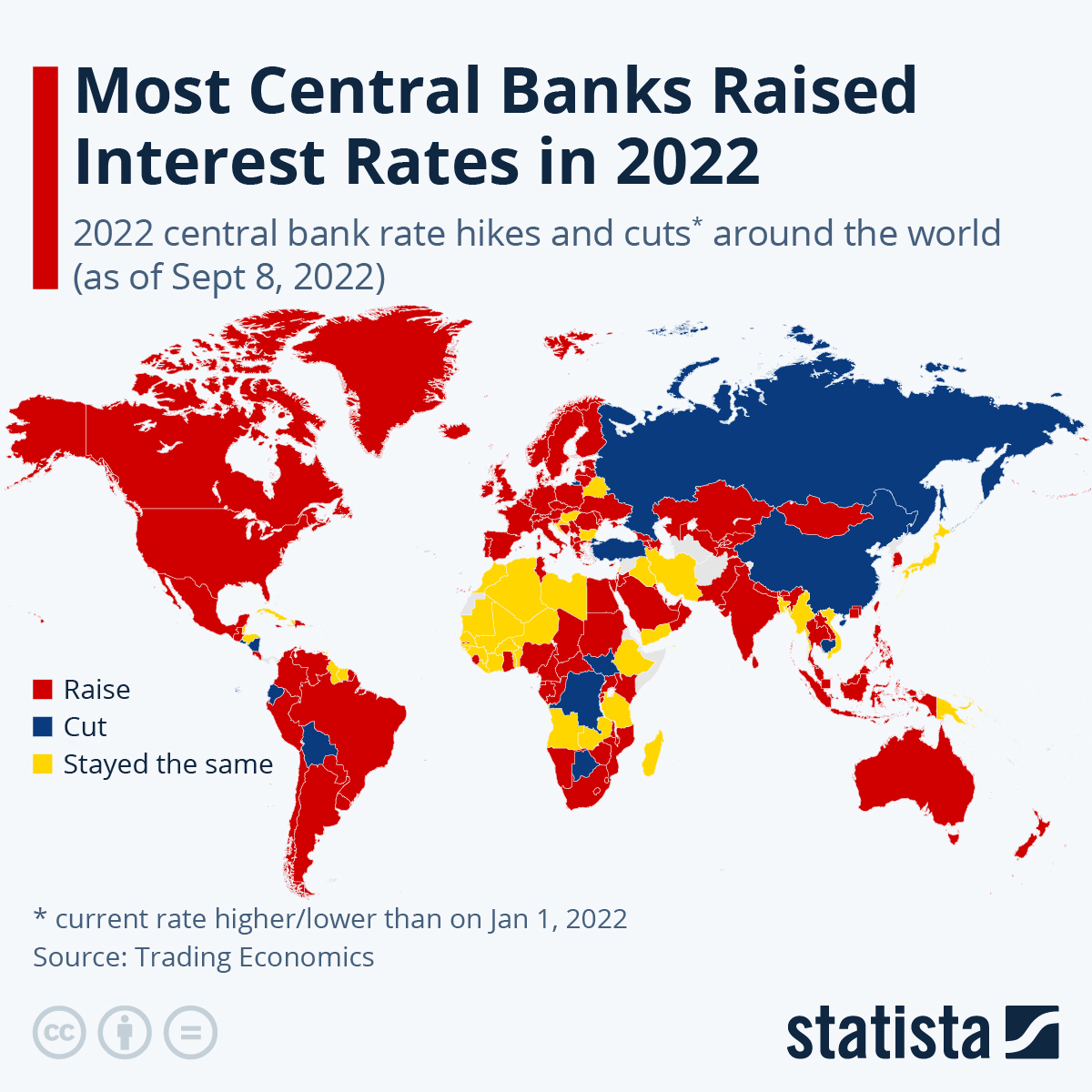

- To control spiraling cost pressures, many central banks have tightened monetary policy by increasing interest rates.

- Although most countries have either removed Covid-related restrictions completely or reduced them drastically, China continues in its pursuit of Covid-Zero.

- Geo-political conflicts and tensions continue to disrupt supply chains – creating logistical challenges, gas shortages, and driving a huge humanitarian crisis in Europe.

Record global inflation rates

- Inflation emerged as a major economic concern in 2021, fueled by post-pandemic demand for goods and services which placed unprecedented pressure on global supply chains.

- Most developed economies followed a similar trend; relatively low levels of inflation in the first quarter of 2020; flat or falling rates for the remainder of CY2020 into 2021, and - as global efforts moved from an emergency footing - rising rates in mid-to-late 2021.

- Over the past two years, inflation rates have doubled in 37 of the 44 advanced global economies through Q1 2022.

- Turkey experienced the highest inflation rate in the same period, reaching a staggering 54.8%.

- Israel suffered the largest increase, rising 25 times higher than levels experienced pre-Covid.

- There are exceptions, however, including in Saudi Arabia and Japan.

- Japan continued its lengthy struggle with low inflation rates and in Saudi Arabia, the inflation rate surged during the pandemic but fell sharply in late 2021. Since then, although the rate has increased slightly, it has remained low.

- The US government reported an increase in consumer pricing through August in the face of robust efforts to stem momentum.

- Despite the widely held view that the precipitous, two-month decline in gas prices would dampen inflation levels, large price increases on core items continue to rise, with housing and food remaining major concerns.

- Prices rose 8.3% in the 12 months through August, the Labor Department said, faster than the 8.1% that economists had expected.

- More than two years following the start of the pandemic, numerous competing forces continue to drive market uncertainty.

- The US labor market remains strong - maintaining low unemployment rates which have driven wage increases.

- However, due to high levels of inflation, the rise in earnings has been diluted.

- In the Euro Area, inflation hit a new record high in August of 9.1%.

- The rate was above expectations, with economists polled by Reuters anticipating a rate of 9%.

- This represents the 9th consecutive record for consumer price rises in the region, with the climb starting as far back as November 2021.

- Energy had the highest annual rate at 38.3%, down slightly from 39.6% in July.

- Food, alcohol, and tobacco were up 10.6% compared to 9.8% in July, with the impact of recent heatwaves across the continent contributing to the rise.

- The French inflation rate decreased in August, with the rate falling lower than market expectations.

- Meanwhile, the region’s largest economy, Germany, saw inflation reach its highest level in almost half a century in August.

- In the UK, inflation fell to single digits in August following a reduction in petrol prices.

- The headline consumer price index was 9.9% higher than a year earlier, down from a 40-year high of 10.1 percent in July - the first decline in the inflation rate for almost a year.

- Despite the fall, the UK’s inflation rate remained the highest in the G7 through August.

- The figures were better than expectations and economists now expect the rate to hover at the low double-digit level during the fall, rather than the previously anticipated 15% level.

- Inflation in Japan is the lowest among the major economies, with the consumer price index rising 3% in August.

- This is because the Bank of Japan has continued pursuing a large-scale monetary easing policy. However, with stagnating wages, Japanese consumers will still feel pressure from price rises.

Tightening monetary policy

- Tight monetary policy is utilized by central banks seeking to reduce the demand for money and limit the pace of economic expansion.

- By increasing the cost of borrowing for consumers, governments, and businesses the banks aim to drive down soaring consumer prices.

- The Federal Reserve announced it was raising its key rate by another 0.75 percentage points, lifting the target range to between 3% and 3.25%.

- Forecasts released by the Fed show policymakers expect it to reach 4.4% by the end of the year - and rise further in 2023, sharply higher than its prior forecasts.

- In Europe, the European Central Bank made its largest-ever interest rate rise in September of this year.

- The bank’s governing council raised its key benchmarks by an unprecedented three-quarters of a percentage point for the 19 countries operating in the monetary union.

- There are concerns the interest rate hikes - including a half-point hike at its last meeting in July - could deepen a European recession predicted for the end of this year and into the start of 2023.

- However, the ECB believes that would only occur in a worst-case scenario where all Russian gas was removed from the market, alternative supplies are not available, and governments resort to energy rationing.

- In comparison with the west, Asian economies are relatively insulated from the market forces driving inflation.

- Japan and China have not experienced a European-sized energy shock despite being significant energy importers.

- In China, inflation sits below the 3% target and is less driven by an energy squeeze–in part due to being a buyer of Russian oil, as Ural crude has been sold at a steep discount since the war began.

- There is no real income shock from inflation in Asia, nor is there a requirement to raise interest rates to combat rising prices.

- The Bank of Japan has decided to stick to its monetary easing policy amid accelerating global inflation growth.

- They are now the only major central bank in the world with a negative interest rate policy, and they have stated that they will not raise interest rates for the time being.

Covid-Zero in China

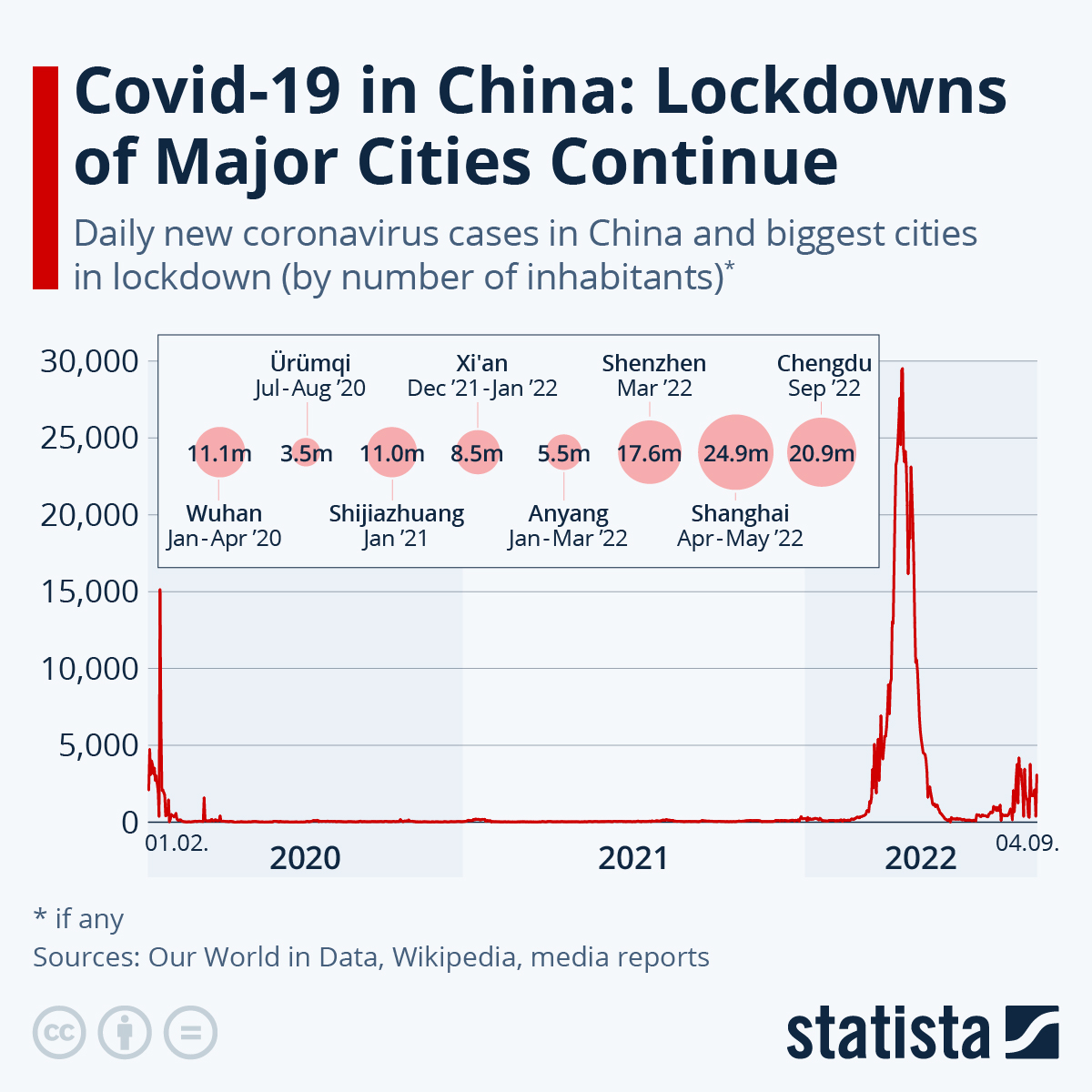

- Whilst most major economies have moved from perpetual cycles of lockdowns and restrictions to managing the virus through mass vaccination, China remains wedded to its pursuit of Covid-Zero.

- Covid-Zero was a popular approach taken by several countries throughout 2020 and 2021, including New Zealand and Singapore. It meant the closure of international borders, mass testing, strict quarantine for positive cases and large-scale lockdowns should community transmission be identified.

- However, despite being hailed as a success through the initial phases of the global response to the pandemic, China has become isolated in its refusal to adopt a more liberal approach to limiting the spread of the virus.

- As a result, the Chinese economy faced flat growth year-on-year and negative growth quarter-over-quarter in Q2.

- The two-month lockdown in Shanghai caused lead times to grow exponentially and forced exports from the region to fall to a two-year low.

- The closely watched Caixin business survey also showed activity in China’s vast factory sector slipped into contraction territory in August as new orders fell for the first time in three months.

- This continued uncertainty has encouraged politicians outside the region to grasp the opportunity and lobby global businesses to localize their operations.

- Following the US Government’s $250 billion investment to boost the US manufacturing of semiconductors and offset the shortage caused by forced lockdowns in the far east, Joe Biden announced at the Summit of Americas that he recognizes the challenges in the market and will continue his support for building more resilient and secure supply chains.

- This will be welcomed by most, however, despite the efforts of the west, Covid-Zero, and higher wages eroding some of their competitive advantages, China’s position in the global market is entrenched and the ability of a business to divert operations elsewhere remains challenging in the short-term.

- And while the Chinese economy is expected to rebound strongly again, the threat of more shutdowns will remain.

Geo-political developments

- The world changed irrevocably on February 24 when Russia decided to invade Ukraine.

- Very few categories are insulated from the impacts of this conflict, either directly or indirectly, at some level in a connected supply chain.

- The first and most serious consequence of the war has been a humanitarian crisis experienced by those living in Ukraine.

- Some 30% of the country's population has been displaced, which has contributed to drastic rises in immigration to neighboring countries - with rates doubling in Slovakia.

- This poses a significant challenge as governments struggle to integrate large numbers of refugees, with a particular impact on labor markets.

- The war continues to disrupt global supply chains, impeding the flow of goods, fueling dramatic cost increases, and product shortages, and creating food shortages around the world.

- Prices of oil, gas, and certain agricultural products have risen, intensifying inflation pressures and threatening food security in some developing economies.

- Increased gas prices are also increasing freight costs for all modes of transportation.

- Train routes connecting the regions, which became highly competitive through the pandemic - especially for industries seeking short lead times such as automotive and electronics - have stalled.

- Global demand for raw and industrial materials increased post-pandemic and, as a result of the war, the prices of items such as coal, steel, and nickel initially soared as Russia and Ukraine supplied up to 50% of some materials.

- Russia accounts for 5.5% of world aluminum production and a similar share of world aluminum exports, making it the world’s third-largest producer after China and India.

- Russia holds 11% of global nickel production and 15% of world nickel exports.

- Russia also accounts for 43% of global palladium production and 21% of world palladium exports.

- The country is also one of four major exporters of vanadium oxides - a catalyst in many industrial chemical reactions - accounting for 21% of global production and 25% of world exports.

- As a result, prices of aluminum and nickel reached their 10-year high in February 2022, and prices of palladium and vanadium experienced huge increases.

- However, since the summer rally following the invasion, the prices of industrial metals have sharply reversed as the worsening energy crisis in Europe and signs of a slowdown in manufacturing in China exacerbate market concerns.

- The S&P GSCI index of industrial metals has dropped more than 9% since mid-August, leaving it almost reaching lows in July when fears of a global recession were elevated.

- The gauge, which tracks the spot price of metals including copper, nickel, and aluminum, is down 17 percent in 2022.

- The renewed selling of metals used to make a wide range of products in the automotive and solder markets highlights that concerns in global demand are returning as fears around rising energy prices weigh heavily on the industry.

- Copper, a barometer for global economic health, has fallen about 6% to above $7,650 a ton in just over a week, reducing its rebound following the crash in March.

- Steelmaking ingredient iron ore has dropped below $100 a ton, from a high of more than $160 per ton earlier this year.

- The ongoing tension between China, the US, and Taiwan is also driving uncertainty in global supply chains.

- China recently conducted its largest military exercise on record following a visit by Nancy Pelosi, speaker of the US House of Representatives.

- The semiconductor industry – and any sector that relies on chips – remain acutely vulnerable to disruptions in the region, which controls 63% of the global market.

- With the automotive and tech industries already impacted by global shortages, any disruption to Taiwanese supply chains would further place pressures on an already stretched industry.

- As a result, research by Gartner found that supply chain teams are already investigating options to diversify away from China as political tensions rise.

- It found that 75% of supply chain leaders are evaluating or executing changes to their China sourcing and manufacturing strategy, and 55% of those had already acted on their plans.

Back to Top