By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q4 2022

AUTOMATION

Market Overview

- There is an increasing demand for industrial automation in manufacturing as governments globally recognize its importance in driving economic recovery. However, new investment is impacted by inflation, rising interest rates, and supply chain disruptions.

- The diversification of the robotics market continued through this quarter and extended beyond the automotive industry.

- The continued investment in robotics has become the main growth driver in the electronics industry.

- Following an increase in interest rates to curb inflation, global commodity pricing has passed its peak and begun to fall. This has eased the price of automation equipment.

- The pandemic and ongoing geopolitical conflicts continue to impact the automation supply chain.

- Anticipating extended lead times, ensuring adequate buffer stocks, and effectively allocating supply remain the best strategies to mitigate uncertainty.

Demand Commentary

- The global automation and control industry grow at a steady pace to $122.8 Billion in 2022 with a global demand CAGR of 6% anticipated between 2021-2025.

- Europe will continue to dominate the market in terms of growth prospects; however, APAC is expected to witness the highest growth rate during the forecast period.

- There is an increasing focus on adopting automation across all industry verticals whilst investments in new technology are expected to remain one of the major drivers over the coming years.

- The global robotics market experienced an annual turnover of $50 billion, with robot sales surging in Europe, Asia, and the Americas.

- Sales of industrial robots have made a strong recovery as pandemic restrictions eased.

- A new record of 486,800 units were shipped globally in 2021 – an increase of 27% compared to the previous year.

- Asia and Australia saw the largest growth in demand where installations were up 33% reaching 354,500 units.

- The Americas increased by 27%, with 49,400 units sold and Europe experienced double-digit growth of 15% with 78,000 units installed.

- In 2021, the main growth driver was the electronics industry - reaching132,000 installations, up 21% year-on-year and surpassed the automotive industry which reached 109,000 installations - up 37% - as the largest customer of industrial robots in 2020.

- Metal and machinery achieved 57,000 installations, up 38%, ahead of plastics and chemical products which stood at 22,500 installations - an increase of 21% - and food and beverages which increased by 24% and saw the installation of 15,300 machines.

- Asia remains the world’s largest industrial robot market with 73% of all newly deployed robots in 2021 installed in the region.

- A total of 354,500 units were shipped in 2021, up 33% compared to 2020.

- The electronics industry adopted by far the most units with 123,800 new installations, which represents a growth of 22% from the previous year.

- They were followed by strong demand in the automotive sector which installed 72,600 new machines - up 57% in 2020 - and the metal and machinery industry which had 36,400 installations; a growth of 29% on the previous year.

Supply Commentary

- In the global automation and control market, ABB Ltd, Omron Corporation, Emerson Electric Co, Rockwell Automation, Honeywell International, and Siemens AG are among the prominent players that contribute a major share to the global market.

- FANUC, ABB, Yaskawa, and Kuka still hold major shares of the global robotics market

Supplier Spotlight – ABB

- ABB is a leading global technology company with an electrification, robotics, automation, and motion portfolio. ABB showed strong demand and good operational performance through 2021.

- For the full year, group orders were up 20%, revenues rose by 11%, and ABB increased operational EBITA margin by 3.1% to 14.2%.

- Robotics and Discrete Automation Division sales accounted for 11% of total Revenue of $28.9B.

- Market growth is driven by megatrends of individualized consumers, labor shortage, digitalization, and uncertainty resulting in the need for automation solutions for increased productivity, highest flexibility, improved quality, and maximum simplicity.

- Strong sales were also recorded in the United States, to general industries and the automobile industry with EV-related demand, and demand from general industries in Europe also remained strong.

- In February 2021, ABB announced a new generation of stronger, faster collaborative robots that can work side-by-side with people on a broad range of tasks, dramatically expanding the reach of robotics automation and unlocking the potential for sectors and businesses that have not previously had the opportunity to automate.

- ABB further expanded its portfolio of flexible automation solutions in August 2021 by completing the acquisition of ASTI Mobile Robotics Group, which has the largest installed fleet of autonomous mobile robots (AMRs) in Europe, and a broad customer base in 20 countries.

- The market for AMRs has significant growth potential, with global sales expected to reach $14 billion by 2025, a CAGR of approximately 20 percent.

Pricing Situation

- Global commodity prices have passed their peak point and started to fall due to the global tightening of monetary policy.

- Consumer price inflation, as measured by the 12-month change in the price index for personal consumption expenditures, rose from 5.8% in December 2021 to 6.3% in April; its highest level since the early 1980s and well above the FOMC’s objective of 2 percent.

- In response to sustained inflationary pressures and a strong labor market, the FOMC has been adjusting its policies and communications since last fall. At its March meeting, the FOMC raised the target range for the federal funds rate off the effective lower bound to ¼ to ½%.

- The Committee continued to raise the target range in May and June, bringing it to 1½ to 1¾% following the June meeting and indicated that ongoing increases are likely to be appropriate.

- Both copper and steel prices have fallen which is significant because steel and copper are primary raw material inputs in many types of automation parts. That means changes in steel and copper prices can affect prices.

- Copper is estimated to be around 5% of the total robot cost and it has decreased in price by 10% over the past 12 months.

- Steel is estimated to be around 10% of the total robot cost and has decreased in price by 17% over the past 12 months.

- Global commodity price decreases will have a lagged effect on the entire supply chain which will ease the current increase in costs.

- Electronic components for the automation equipment spot market price are still elevated due to the ongoing material shortage.

Supply Analysis

- Supply chain bottlenecks remain a major impediment for domestic and foreign firms.

- While U.S. manufacturers have been recording solid output growth for more than a year, order backlogs and delivery times remain high, and producer prices have risen rapidly.

- In China, COVID-19 lockdowns drove the largest monthly declines in industrial production since early 2020 while also disrupting internal and international freight networks.

- In addition, the war in Ukraine continues to put upward pressure on energy and food prices and has raised the risk of disruption in the supply of inputs for some manufacturing industries.

- Lead time for automation parts has been extended with buffer stock and continuity of supply becoming the primary strategy.

- This is due to IC chip shortage and global logistics disruptions.

- Labor shortages due to the COVID pandemic are still causing issues with available resources to produce goods at normal rates.

- Long lead times are expected to soften gradually.

Key Takeaways

- The automation market demand continues to grow, but supply chain issues remain a burden to production and shipping.

- Global commodity price has passed peak point and started to fall due to global monetary tightening policy to stem inflation.

- Global commodity price decrease will have a lagged impact on the entire supply chain which will ease the current price trajectory.

- Extended lead times continue to disrupt global supply chains. This issue is expected to be softened gradually.

SMT

Market Overview

- Demand for Surface Mount Technology (SMT) is increasing; however, supply chain issues remain unresolved. This encouraged closer collaboration with key partners to manage factory business.

- Several companies are already preparing for a downturn. This coming winter will be challenging due to the limited availability of natural gas, particularly across Europe.

- The global SMT market is anticipated to grow at a robust CAGR of 8% between 2022 and 2032. With rising production and sales of electronic products, the overall demand is forecast to increase at a substantial pace over the forecast period.

- Exponential growth of electronic industry, miniaturization of modern electronic components, increasing use of flexible printed circuit boards, and the growing popularity of electric vehicles are some of the major factors driving the market growth.

- With rapid digitalization and increasing penetration of automation, demand for miniaturized electronic components is gaining momentum.

- Manufacturers are utilizing SMT to produce smaller and compact electronic components. This will continue to act as a catalyst for the market expansion over the forecast period.

- The increasing production and sales of electric vehicles is creating lucrative growth opportunities, and the trend is likely to continue. Most of the electronic components that used in electric vehicles are being manufactured by SMT.

- High-Speed Placement Equipment is projected to record a 7% CAGR and reach a market size of approximately US$2.0 billion by the end of the forecast period.

- Equipment segment is projected to spiral at 5.8% CAGR for the coming 7-year period.

- The U.S. market is estimated to stand at US$302.3 Million, while Asia-Pacific is Forecast to grow at 6.5% CAGR.

- Asia-Pacific is forecast to reach a projected market size of US$1 billion by the year 2027, trailing a CAGR of 6.5% over the analysis period 2020 to 2027.

- Other noteworthy markets include Japan, China and Europe - each forecast to grow at a CAGR of 4.9%, 7.2% and 3.9% respectively over the 2020-2027 period.

- Low-Speed Placement Equipment Segment is anticipated to grow by 4.8% until 2027.

- Q3 continues to be an explosive quarter for SMT equipment and Q4 is expected to continue that trend, albeit at a more subdued rate.

- Uncertainty around the supply of Russian gas may cause factory closures and lead to further supply chain disruptions.

- North America has seen growth in the SMT market, while Asia Pacific is expected to maintain & grow slowly in the future.

- According to IPC data, 68% of electronics manufacturers are worried about a recession occurring this year with that figure rising to 78% in 2023.

- Over the next 10 years, SMT equipment will require SMART capabilities - such as modular type machines - that allow the user to configure and alter an application without buying new stand-alone equipment.

- It is anticipated that remote management equipment will dominate the market over the coming 20 years.

- Technology wise, miniaturization is still the direction of component and board design.

- IC or chip set will become more complex to minimize the use of components on the PC board.

- Over the next 6 months there will be continued supply chain challenges globally.

- They include an increase in material and labors costs, a shortage of skilled talent, reductions in available inventory and the impact of disruptions on a business's profit margin.

Development trends

- Quick, Flexible and Fast-Responsive - Competition in the future will become so acute that any successful corporation must depend on quick, flexible, and fast-responsive technical equipment. If that aim is obtained, more opportunities will be captured to enter the market and more profit will be realized.

- High-Efficiency and Intelligent- The upgrading and development of equipment indicate the level of SMT assembly. Manufacturing efficiency will become an important standard to mark the performance of SMT equipment in the future. To improve manufacturing efficiency, adjustments must be made in terms of equipment structure, and some performance improvements achieved.

- Automate SMT equipment - SMT's success lies in its flexibility in allowing users to customize their service based on their unique demands. Modularization can also be used to cater to different functions and requirements. Components and mounting should be implemented at speed so that the overall manufacturing efficiency can be achieved As a new type of electronics assembly technology, SMT has been widely applied across a variety of products covering numerous fields. Due to its effectiveness, SMT has partially or completely replaced traditional electronic assembly technology. This has led to essential and revolutionary changes in the electronics industry. It is, therefore, necessary to understand the assembly procedure and its development to drive efficiency

Medical

- The medical industry continues to grow post-pandemic.

- There is an increasing global trend in the medical device packaging market and, as a result, it is expected to grow at a CAGR of 5.59% between 2022 and 2027.

- The medical devices packaging market is likely to witness a mid-single digit growth rate because of the surge in demand for novel packaging solutions. This is due to an increase in manufacturing and improvements in the supply chains of medical devices globally.

- Rising environmental concerns, coupled with an increased focus on minimizing hospital-acquired infections, as well as the need for sterile medical devices, have led to the adoption of innovative, eco-friendly packing solutions.

- Among all countries, India is likely to witness the highest absolute growth of close to 60% due to the sudden rise in demand for a wide range of medical devices.

- Covid-19 created significant growth opportunities for medical device manufacturers and has led to an increase in demand for medical applications in packaging solutions.

Automotive & Transportation

- There is no doubt that this sector is the driving force behind SMT growth.

- Over the past 3 years, the A&T market has experienced more than 200% growth.

- It is estimated that 50% of the currently installed SMT lines are commissioned to support automotive customers.

- With the increased focus on the electrification of vehicles globally, the demand for P&P gear will remain strong.

- R&D investments are focused on the miniaturization of boards and components in all sectors applying pressure on P&P OEMs to develop technology that can accurately place components barely visible to the naked eye.

Telecommunications

- The telecommunication equipment segment is leading the SMT placement equipment market. This is due to a growing demand for telecommunication systems, more intense competition, and new product launches like 5G.

- Telecommunications is the most prominent industry in India.

Inspection Equipment

- The Global SMT Inspection Equipment market size was estimated at $915.2MM in 2021 and is projected to reach $1296.4MM by 2028, exhibiting a CAGR of 5.98% over the forecast period.

- Inspection market business growth is aligned with the macro-SMT market which is expecting to see strong growth over the next 2 quarters, however, may retract slightly in Q4 2022 or Q1 2023.

- The drop is considered “back to normal” provided the market does not experience another global crisis or economic recession.

- European firms that operate globally are acutely aware of the supply-chain disruptions caused by the Russian invasion of Ukraine.

- North American manufacturers are more concerned about record inflation than geopolitical conflicts.

- Manufacturers in the Asia Pacific are less concerned about an economic recession occurring in 2023.

Demand Commentary

- Asia Pacific emerged as the leader in terms of SMT revenue. 3 out of 10 Top Ten EMS providers are from the US. The rest are either from China or Taiwan based.

- The US Government’s CHIPS Act will provide $52 billion to promote domestic semiconductor production to compete with China. Also, Intel -alongside other notable manufacturers - has announced plans to create a combined $120 billion of additional production capacity in the United States and Europe.

- Asia Pacific is expected to dominate the SMT market.

- A lot of business is getting out from China to SEA and Mexico. If China opens its border, a strong business shift and movement are anticipated.

- Essentially, some OEMs will redivert their business back to China due to supply chain issues and proximity.

- Large investments remain in Mexico from multiple electronics industries including semiconductor, 5G base stations, and automotive.

- Overall, Asia forecast back to pre-covid levels year-on-year.

- Americas and Europe remain slightly above pre-covid levels but seem to be slowing.

- After a strong start to 2022, Q3 and Q4 outlooks are challenging due to many factors noted below.

- Many US business health indicators show slowing down or trending negative with flat to no growth in 2023 from 2022 and recovery in 2024

- The conventional automotive market still down but EV activity is up

- Inflation is the largest concern in the Americas and the EU.

- Logistics shipping time and costs are at all-time highs causing delays everywhere.

Pricing situation

- Increased component prices are inevitable when demand outstrips supply and is exacerbated by elevated logistical costs.

- The Institute for Supply Management has reported dozens of commodities in short supply and at an elevated price.

- In June, prices of aluminum, copper, electronic components, epoxy, packaging materials, plastics, resins, PVC, semiconductors, and steel were higher than in May.

- Copper and aluminum have been on the increased-price list for 13 weeks, and semiconductors are expected to be scarce through 2023.

- Chip prices have increased between 10 and 40% according to general industry sources.

- Availability is king, and some suppliers that are holding inventory are using it to drive up the costs.

- Component average selling price changes are being driven by increases in manufacturer input costs, labor costs, and logistics costs to move products around the world.

- While mitigation is ongoing, the real costs to produce components have increased and consumer demand continues to outpace global supply,

- SMT partner purchasing costs have been rising. It is recommended that customers provide accurate forecasts to ensure unnecessary cost avoidance.

- The USD has strengthened against other major currencies by between10 20%.

- Most suppliers that support the SMT industries imported raw materials from overseas and are experiencing high-cost increases due to weakening currencies.

- The removal of Russian gas from the market will cause disruptions in the supply chain on increase raw material costs,

- Customers are encouraged to make additional investments in R&D areas to re-purpose value engineering to stabilize the total cost of ownership.

- Automated SMT will be required to drive from a customer initiative

- Partnership with keys supplier to drive alternative products must be established by FY23.

- FX leveraging is vital to lock the price for the next 6 to 12 months.

- Higher costs continue to dominate the electronics industry narrative. 9 out of 10 electronics Manufactures are experiencing increased material costs and 3 quarters are experiencing rising labor costs. I

- Due to the trade war between the West and China, combined with the logistical impact of Covid-19 - manufacturing hubs have moved from China to the US.

- The US market enjoys high-quality labor, however, is more expensive than in developing countries.

- SMT manufacturing tends to use automation equipment or smart factory management to reduce costs in high-wage countries or maintain quality in countries with limited manufacturing experience.

Supply Analysis

- The SMT supply from key partners is experiencing extended lead times due to several macroeconomic factors. Below are a few examples of what can be expected in the current market:

- FUJI - around 4 months.

- ASM -between 2 and 4 months.

- ITW - 4 weeks.

- Vitrox - 6 to 10 weeks product dependent.

- Koh Young - between 4 and 6 weeks.

- The major component suppliers are mainly located in either South Korea or Taiwan.

- It is vital that equipment manufacturers plan component supply 6 months in advance.

- The outbreak of Covid in August will impact production in China and encourage SMT manufacturers to reconsider their investments.

- North America and South Asia are benefiting from this action, but the talented resource is limited.

- Globally Machine Module cameras are still experiencing long lead times.

Key Takeaways

- We recommend that a renewed focus is placed on building strong partnerships with preferred suppliers for to ensure continued supply.

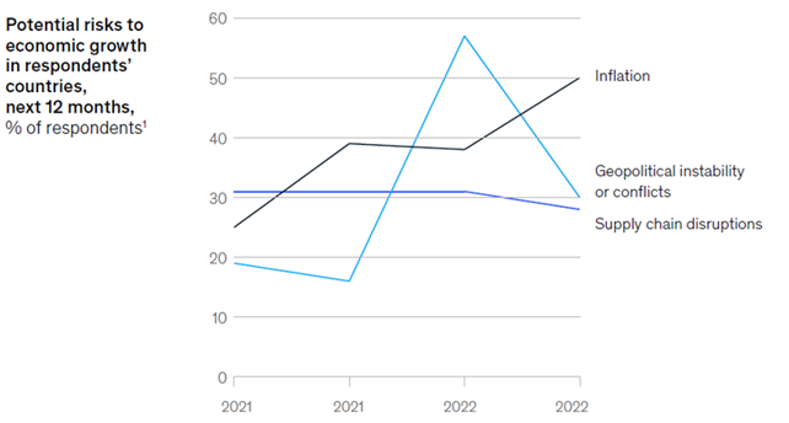

- In the latest McKinsey Global Survey on economic conditions, respondents also see inflation as a growing threat to the global economy and continue to view geopolitical instability and supply chain disruptions among the top threats to both global and domestic growth.

- For the top 5 to 10 critical spare parts, partners must have a plan in place to develop alternatives of the same quality and performance.

- Continue to utilize backyard surplus assets and ensure the operation machine is above 90% capacity utilization.

- Focus on a 6-month forecast is mandatory for selective new customer investment ramp up

- Leverage the next 6 months' currency exchange rate as an advantage for US EMS.

- USD is at record highs compared to other currencies - leverage this positive FX rate swing to your advantage when negotiating contracts.

SOLDER

Market Overview

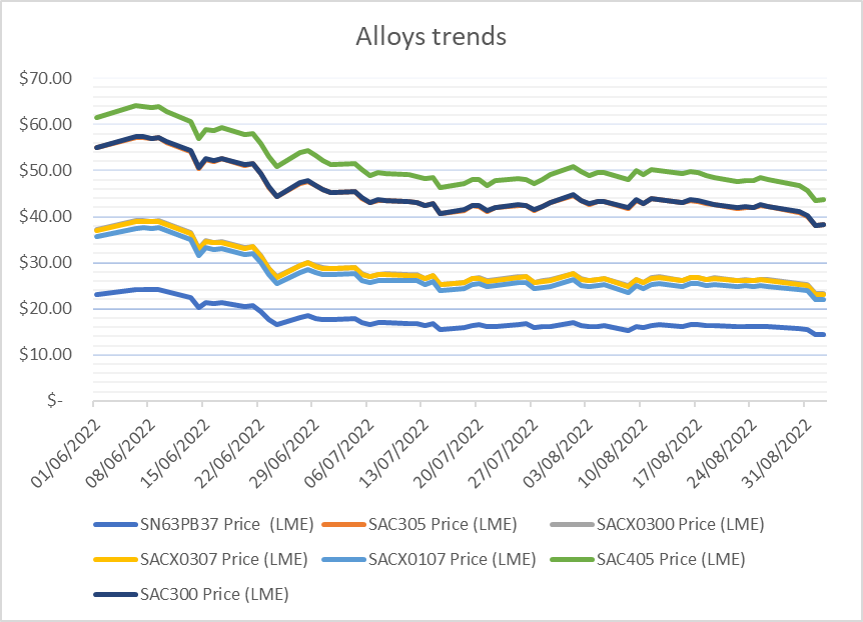

- The solder market has stabilized as the price of the metals fell and the constrained supply of alloys softens.

- This has been supported by enforced lockdowns in China which relieved global supply chains from the high demand and price hikes experienced post-COVID.

- However, as China deviates from its pursuit of Covid-Zero, it is anticipated that demand from the biggest player in the market will return.

- Geo-political conflicts continue to disrupt global supply chains.

- The price of gas has driven record global inflation and the Russian invasion of Ukraine looks unlikely to end in the short-to-medium term.

- A cautious approach when entering the market continues to be recommended for both investors and consumers.

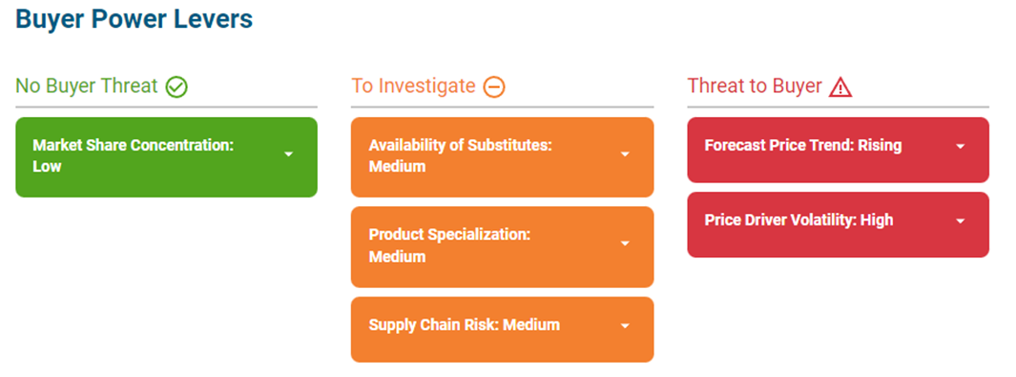

- As buying power is balanced, leverage with suppliers will be key secure supply-chain resilience.

- Allocation risks are not expected in the short-term, however, it continues to be our recommendation that reorders points are adjusted and safety stock is reviewed every quarter.

Demand Commentary

- The solder market is projected to grow from 4.1 billion in 2022 to 4.9 billion in 2027 at a CAGR of 4.2%.

- The growth trends continue to be optimistic due to high demand post-covid and the changing nature of consumer trends. However, supply continues to be constrained with organizations anticipating the return of demand from Chinese markets.

- The major suppliers in this category are:

- MacDiarmid Alpha who strengthened its position and gained increased market share following the acquisition of Kester.

- AIM: who are increasing market share in ASIA and gaining business from his largest competitor, Alpha.

- Indium: The solder paste leader in the market which focuses on high flow pastes and the constant development of new types.

- Senju, CRM, Inventec, and other solder bar suppliers are fighting for the remaining market share.

- Due to low margins on metals - which represent the biggest cost driver on the solder bar - suppliers are focusing efforts on growing their paste and wire operations.

- Following their lowest point in 2021, the metals production market is recovering. However, investors continue to exercise caution due to the Ukrainian crisis and the threat of Chinese lockdowns.

- Tin and Silver have stabilized; however, they remain sensitive to any geopolitical or market changes.

- Russia is a major producer of non-ferrous metals, ranking in the top 10 producing nations for both nickel and copper.

- The prices of these commodities - as well as other key non-ferrous metals - have experienced high levels of volatility due to fears of a reduction in supply.

- Automotive and Electrical vehicles continue as key contributors to the growth in demand across the solder industry. The plan to achieve zero emissions by 2050 continues to drive progress and has accelerated due to large government investments.

- Solder companies such as Alpha and AIM have dedicated significant resources to meet the high demand in this emerging industry.

- LF SAC 305 and SAC 307 are utilized most due to their capabilities to work in high-temperature environments.

- The demand from EV companies is aggressive and requires high-quality and automated processes. This represents a challenge for the EMS sector which continue to invest heavily in innovation and R&D.

Solder Scrap Market

- Solder techniques have improved significantly, and new technology has enabled suppliers to recover large portions of solder scrap.

- This, combined with demand constraints, has motivated suppliers to invest in recovery centers and bid aggressively to buy solder scrap.

- The recovery of scrap also allows suppliers to minimize their margins and reduce their dependence on mines.

- The supply of solder is driven by the availability of base metals that comprise the main alloys.

- Tin and silver continue to be the main reasons for cost increases over the past three months.

- By their nature, both metals are subject to speculation and manipulation and are impacted by geopolitical and market conditions.

- However, solder companies are also incurring increases due to global spikes in inflation.

Supply Commentary

- The supply of the solder is stable. The principal mining companies are recovering from the lockdowns suffered in January 2022. They are also producing adequate capacity to fulfill the needs of the market, especially the Chinese demand.

- China tin consumption is around 49% of the global rate - 9% more than they produce. However, due to the lockdown in key Chinese cities, demand is constrained providing relief within global supply chains.

- In the second quarter of 2022, China’s GDP expanded by just 0.4% - its slowest rate in two years, while shrinking by 2.6% compared to the first quarter.

- Continued lockdowns and weakening consumer confidence will restrict economic growth in the third quarter and a superficial point of demand stabilization.

- In July, Chinese manufacturing activity contracted. Declining production of ferrous metals, coking coal and oil are primarily responsible for the recent contraction.

- China’s lockdowns have also acutely impacted on the real estate sector.

- As economic growth has slowed, property sales have decreased, reducing income for developers in need of funds to complete housing and infrastructure projects.

- These developments continue to shake consumer confidence and demand for both industrial and consumer goods.

- COVID cases in China have continued to climb, with new lockdown measures implemented in July impacting over 40% of all Chinese companies. Major manufacturing hubs such as Shanghai, Wuhan and Shenzhen are at risk of suffering severe restrictions and lockdowns.

- When China moves from Covid-Zero, the risk of a demand spike in the market is high. As a result, suppliers are shifting their focus to waste management and solder dross recovery – especially across China as the country looks to reduce its pollution levels.

- Capacity in the supply of solder is ample to cover forecasted demand over the next 20 to 30 years. However, this remains dependent on geopolitical developments, especially between China and US.

- The supply of solder remains strong, but the price is sensitive to any volatility in the silver, tin, and copper markets. We recommend that buyers hedge or fix the prices on a monthly or bi-monthly basis.

Pricing Situation

- As mentioned above, metals appear to be in a bubble of stabilization.

- The metal of major use, tin, has lowered its value between USD 23 - 27 per kilogram.

- However, it continues to be very sensitive to the market and other geopolitical factors.

- The new Chinese lockdowns are affecting demand and it is expected that once they recover, the renewed demand will affect price and supply.

- The supply variations in the metals market directly affect the solder industry due to the high usage of this metal.

- The top alloys use more than 90% of tin in their composition and, despite not being the cost driver, have a large impact on either price or supply.

- Even as the cost remains reasonable, it is vital that variations are observed closely.

- "Tin has been a poster child for the boom we've had in consumer electronics over the last two and a half years...For tin to fall further, people will need to short tin," said Macquarie analyst, Marcus Garvey.

- Silver is a precious metal of low usage but high cost within lead-free alloys. This is due to their anti-corrosion, leak tightness, conductivity, and higher melting point.

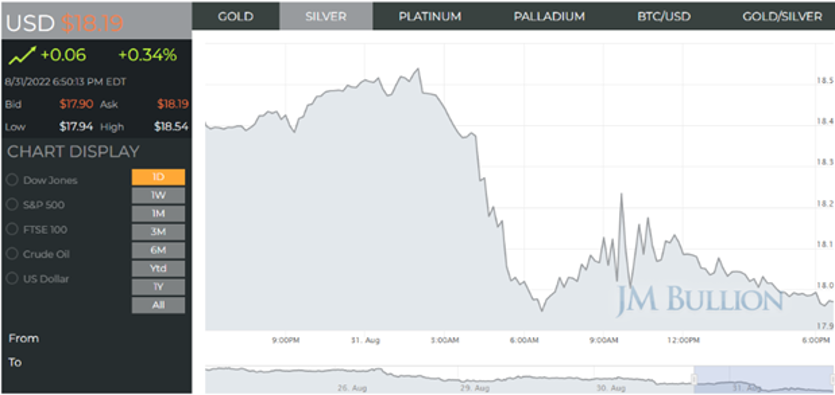

- Silver is a metal used in times of uncertainty; however, its value remains at over 18$ per ounce.

- Top alloy costs are in a relatively good position – far from the hike reached in March, however, several macroeconomic factors affecting the global markets could impact future prices.

- We recommend that buyers and investors remain in a ‘wait and see position.

- Hedges on metals should also be conservative to cover 1 to 2 months of supply.

- The price of nickel surged, nearly doubling in the week of March 8th to nearly $100,000 per metric ton. This surge resulted in the London Metal Exchange suspending trading, which effectively brought the nickel market to a halt.

- Other key non-ferrous metals have been surging in price as well; however, these surges have not been as dramatic as the rise of the price of nickel.

- Copper and tin both surged to record highs, with tin increasing by around 25% since the beginning of the year, while copper has risen in price by nearly 10% in this period.

- Even as these metals begin to come down slightly from their record highs, commodities experts expect prices of these metals to remain high in the short to medium term as supply worries persist.

Supply Analysis

- Solder scrap recovery is becoming more prominent in the market with organizations utilizing surfactant chemicals to recover almost 95% of the solder bar.

- Recovered solder can be used in any other process without challenge, however, some limit the usage to 40% of the pot.

- The decision on whether to sell scrap or recover internally will depend on the outcome of scrap sales negotiations, scrap level generation, and the efficiency of the internal recovery.

- No matter which option represents the best value, it is vital that solder companies recover scrap internally to reduce their dependence on the mine's production.

- The 3 major suppliers continue to hold the largest market share and are in good positions to negotiate.

- Due to the high prices, customers are actively sourcing alternatives to solder that will lead to cost reductions.

MRO

Market Overview

- General market conditions for MRO are promising; manufacturing capacity has grown by at least 2.2% over Q2.

- The US Census Bureau reported that manufacturers new MRO orders -mostly consumables, office supplies & hand tools - increased 14.2% year-over-year in June 2022.

- In addition to the Federal Reserve, US industrial production grew 4.2% year-over-year.

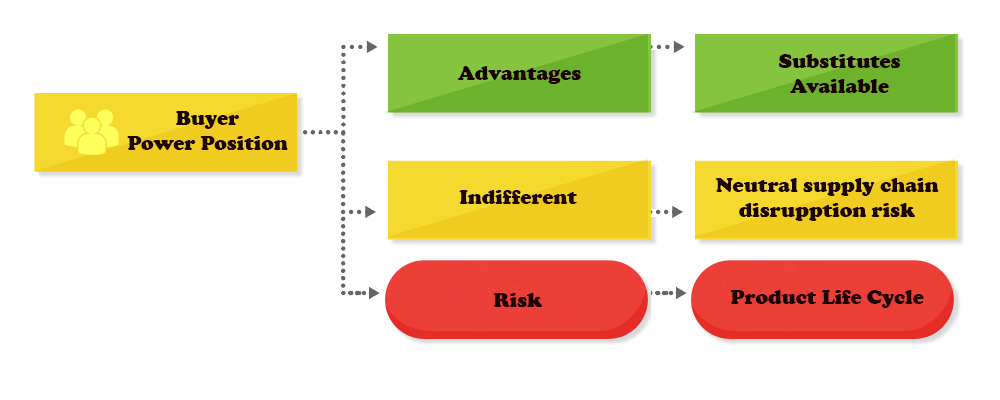

- Considering market conditions for most MRO items are high value and low risk, buyers' positions should be easily leveraged to secure reasonable prices.

- There is moderate availability of substitutes, high service specialization & moderate buying lead time.

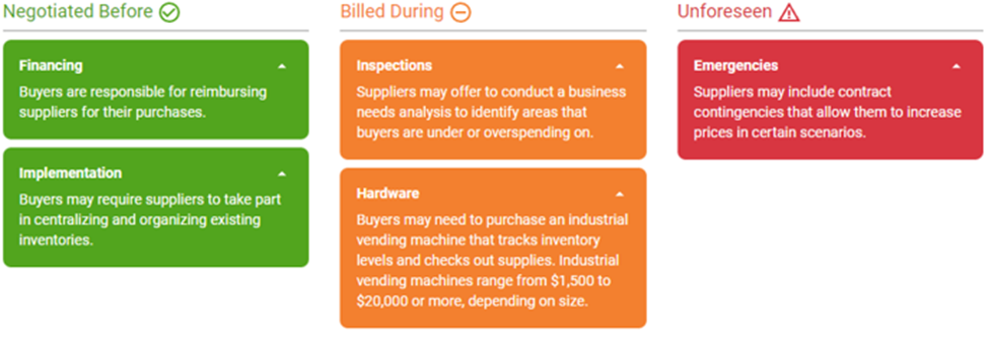

- Buyers must, however, consider:

- The high risk of considerable costs associated when switching suppliers.

- Low market share concentration will most likely be distributed among specific groups of suppliers.

- When sourcing MRO supplies, buyers must also consider:

- Utilizing experience within their organization to generate significant cost savings.

- Programming planned services to avoid downtime.

- Investigate sourcing services with value add.

- To ensure a high-quality service is maintained, negotiating a Service Level Agreement with vendors is vital.

- By doing so, organizations are protected from a reduction in pre-agreed service levels and suppliers are incentivized to ensure no slippage occurs.

- Unlike the Asia Pacific and the Middle East and Africa which are showing medium and low maturity levels, North America and Europe are mature markets with high levels of penetration.

- North American and European MRO markets are more accessible in terms of adopting modern business practices.

- Considering the anticipated economic recession, buyers should focus on sourcing suppliers with strong financial positions.

- Demand for MRO has been driven by growth in the electronic, medical, and aerospace industries.

- Rising costs are forcing customers to reduce operational expenditure through process efficiencies; optimizing supply chain management by utilizing SLAs or Vendor Managed Inventory.

- There is a moderate availability of substitutes available in the market which is empowering buyers to leverage.

- One of the most feasible substitutes is in-house MRO inventory management tools and consumables.

- To offset tariff impacts, organizations should continue their focus on local sourcing for non-critical and spare parts. For OEM products, the focus should be on negotiating long-term contracts with suppliers.

- In North America and Western Europe, the strategy for MRO outsourcing and integration should be creating strong partnerships with key suppliers.

- The divided MRO markets in APAC and MEA have created new opportunities for global distributors.

- These regions are developing in terms of MRO sourcing maturity.

- The increasing standardization of services and equipment is expected to accelerate the MRO market growth.

- Key Global industrial distributors:

- WW Grainger

- RS Components

- Sonepar SA

- WESKO

- Gastenal

- RS Hughes

- McMaster

- High market Maturity Regions:

- US, UK, Germany, France, Netherlands & Belgium

- Medium market maturity

- China, India, Austria, South Africa, Canada, Brazil, Rest of West Europe.

Pricing Situation

- The majority of distributors have reported increased prices from upstream suppliers through CY22.

- Raw material cost has increased affecting the price of goods:

- The price index for petroleum lubricating oil and grease has grown 22.3% from July 2021 to July 2022.

- The producer price index for electrical equipment manufacturing has increased by 20.5% year-on-year.

- In the 2022 Survey of Distributor Operations, 93.0% of distributors reported price increases in 2022 - this compares with 86.0% in 2021 and 89.0% in 2020.

- Price volatility has been high due to shifts in the cost of other raw materials – impacting buyer power due to budget under allocation.

- The increase in the price of paper, plastic & rubber is expected to drive the price of general office supplies up over the next three years.

- We recommend that buyers eliminate the use of many general office supplies by substituting digital document services.

- Businesses looking to reduce their environmental footprint will also be unlikely to purchase large amounts of general office supplies.

- Strategic planning, along with strong supplier partnerships, can avoid high-season pricing.

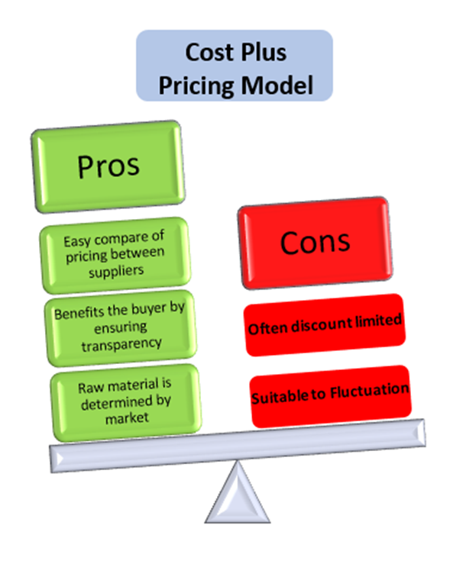

- Fresh pricing model negotiations are recommended for those operating in the PPE, general consumables & office supplier industries.

- The main cost drivers for MRO are logistical challenges and geopolitical conflicts.

- The current crisis in Ukraine has caused the market to behave shift to an “Emergency mode” with customers panic buying to ensure continuity of supply.

Supply Analysis

- The top distributors operating in the MRO space believe economic conditions and increased operating costs as their top risks moving into Q4 2022 & early 2023.

- The other concerns noted are:

- Retaining highly skilled employees.

- Skilled labor shortage.

- Record high inflation.

- In July 2022, a survey by “the Materials Handling Institute” found that:

- 57% of respondents were challenged by supply chain disruptions, while

- 54.0% said hiring and retaining labor was challenging.

- These challenges impact not only cost structure, but also the input cost drivers for planning processes.

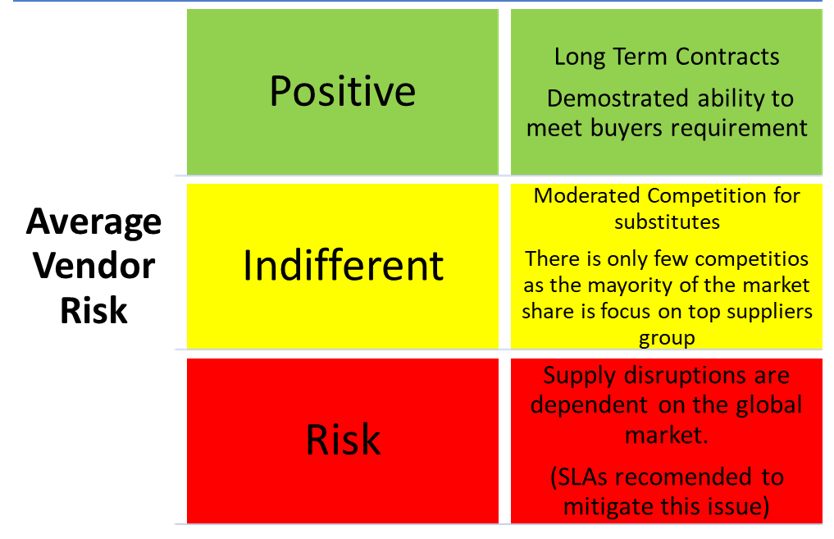

- Even when MRO has a medium supply chain risk, key suppliers are “excluded” from commodity and input price shocks.

- This reduces vendor risk and ensures suppliers can mitigate financial distress emerging from supply chain disruptions.

- Based on their demonstration of favorable behavior in the environmental, social, and governance spheres, buyers have gained confidence in the major suppliers,

- In general, the risk for suppliers in the general market is moderate.

- Buyers are now trending to have employees monitoring supply inventory and sourcing supplies in-house.

- Even if an organization is effective at maintaining inventory levels, it is difficult for in-house management to achieve the same cost savings as outsourced management.

- Leaning on a strong supplier has the potential to achieve more cost savings in the long run due to supplier footprint.

- For general office supplies, there is also a medium level of supply chain risk.

- Paper, plastic, and material manufacturers contributed most of the level of risk following the reduction in downstream demand.

- The largest portion of specialization will include aesthetics, colors, or non-performance affecting changes.

- Having access to substitute suppliers will ensure shortages are minimized.

- Low specialization benefits buyers as most suppliers offer similar products.

- Buyers can reduce the number of items and consumables by standardizing and sourcing substitutes for unique items.

- Substitutes are highly accessible to users and easy to validate.

- The high availability of substitutes and alternative products empowers buyers by allowing leverage in negotiations with market providers.

Key Takeaways

- Over the previous two years, user Prices have slightly been stoked due to stagnating demand.

- Key suppliers faced rising and unstable purchase costs while demand for market services is increasing.

- SLAs are highly recommended to mitigate the impact of rising costs.

- Although the price has fluctuated, changes in market prices have been relatively stable.

- Buyers would be well-served to pursue fixed-price variations in contract negotiations.

- For VMI Services, the demand for specialization is high due to high customization for each operation.

- The level of service specialization limits the number of potential suppliers and brings difficulties when comparing service prices.

- There is a moderate availability of substitutes for MRO inventory management services.

- MRO buyers must fulfill business needs in-house, potentially using MRO inventory management software or the creation of a dedicated MRO inventory management team.

- According to the industry trends, it is likely that inflation of up to 12% will be experienced in the MRO spare parts market.

- If appropriate preventive action is taken, market players can mitigate the impact of inflation on their supply chains.

- It is highly recommended that for OEM-driven products, long-term contracts should be negotiated

- Buyers are acutely aware of market conditions that generate demand for supply-chain transparency.

- Buyers are now investigating customized solutions and requesting information and timely delivery of products and services.

- Industrial production is driving the expansion of the MRO market.

- In Asia, India, and China the e-procurement market is developing.

- E-commerce provides several benefits for organizations, including enabling buyers to focus on tail spend management.

- MRO Market analysis shows that outsourcing is on the rise - driving high savings and reduced reliance on skilled labor.

- Medium and low maturity markets such as LATAM, APAC, and MEA are not alien to this, however, have yet to leverage the opportunity.

Back to Top