By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Category Intelligence

Q2 2025

Global Category Intelligence

Q2 2025

From the Jabil Blog: Break the Bottleneck: Global Logistics in a Disrupted Supply Chain

Jeannie Carpenter, Logistics Director

After the global logistics and freight industry was hit hard by the Great Recession in 2008, they took one lesson into the next decade: Optimize. Get lean, and get efficient. The trucking, rail, air cargo and maritime industries grew slowly but steadily, integrating new supply chain technologies to maximize efficiencies and keep costs down rather than add significantly to their fleets or warehouse footprint. Keeping operations tight and resisting the urge to expand too quickly helped logistics companies successfully navigate small global logistics disruptions as they came — like lower-than-expected demand, the rise of e-commerce and increasingly common weather phenomenon.

When COVID-19 first hit and demand fell off a cliff, it seemed logistics companies had made the right call by not massively expanding capacity post-recession. Then, as consumers started spending the money they would have spent on events, trips or restaurant meals on goods, that outlook quickly changed.

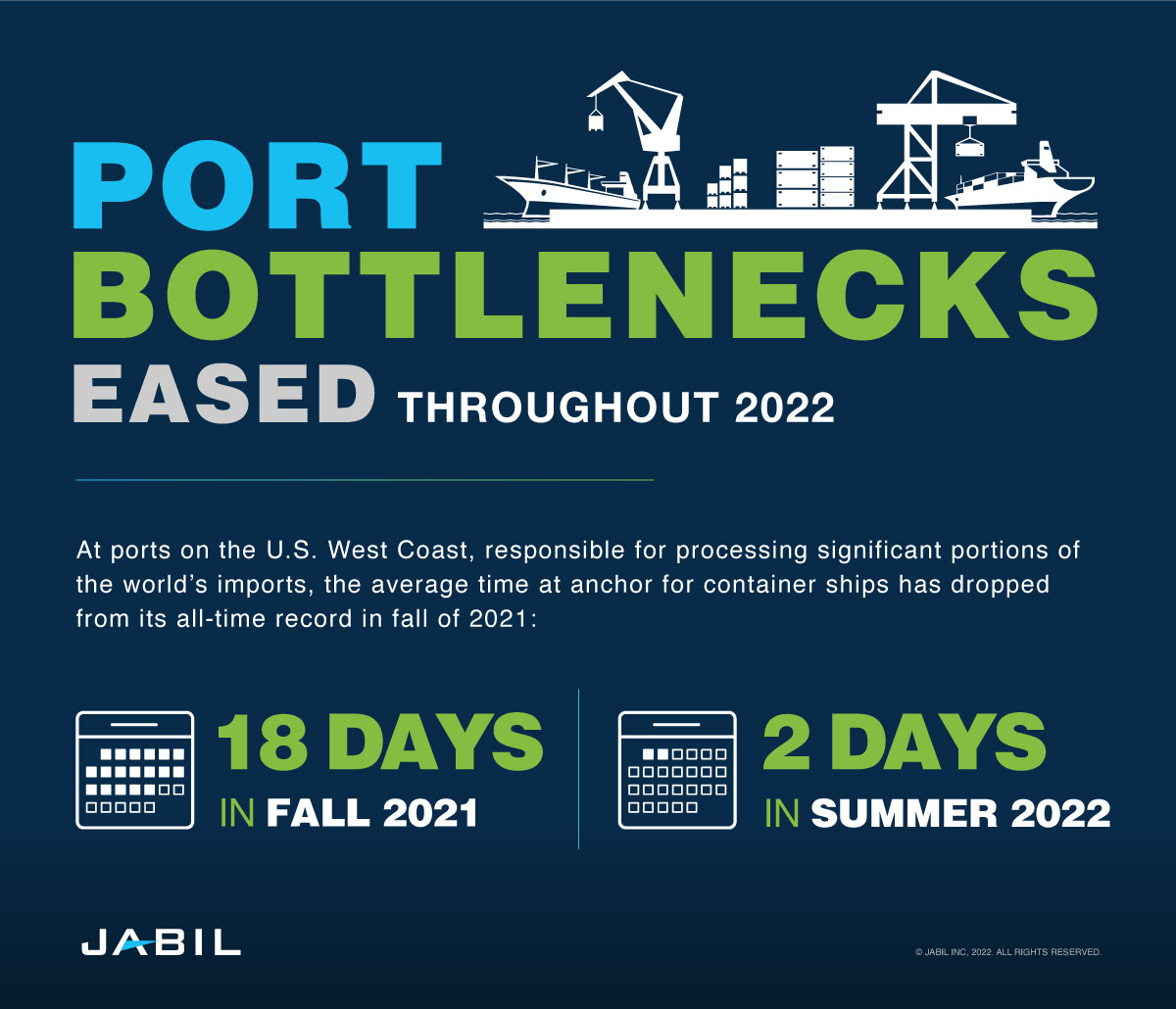

Bottlenecks developed at the Ports of Los Angeles and Long Beach in California, collectively responsible for processing about 40% of U.S. imports, and provided a visual representation of the many logistics breakdowns caused by the pandemic. When delays were at their worst in fall 2021, ships piled up in the Pacific Ocean and average time at anchor grew to 18 days, according to Bloomberg. Shipments across the ocean dropped from an on-time average of about 80% in 2019 to 35% (as of late November 2021). While these challenges were headline grabbing, they have been somewhat resolved. Ships are now waiting only two days, on average, to dock at the Ports of Los Angeles and Long Beach. However, according to Seabury, global carrier schedule reliability remains around an all-time low of 35.9% (as of April 2022).

Back to Top