By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q3 2023

Jabil's Global Category Intelligence Archive

Global Category Intelligence

Q3 2023

MARKET OVERVIEW

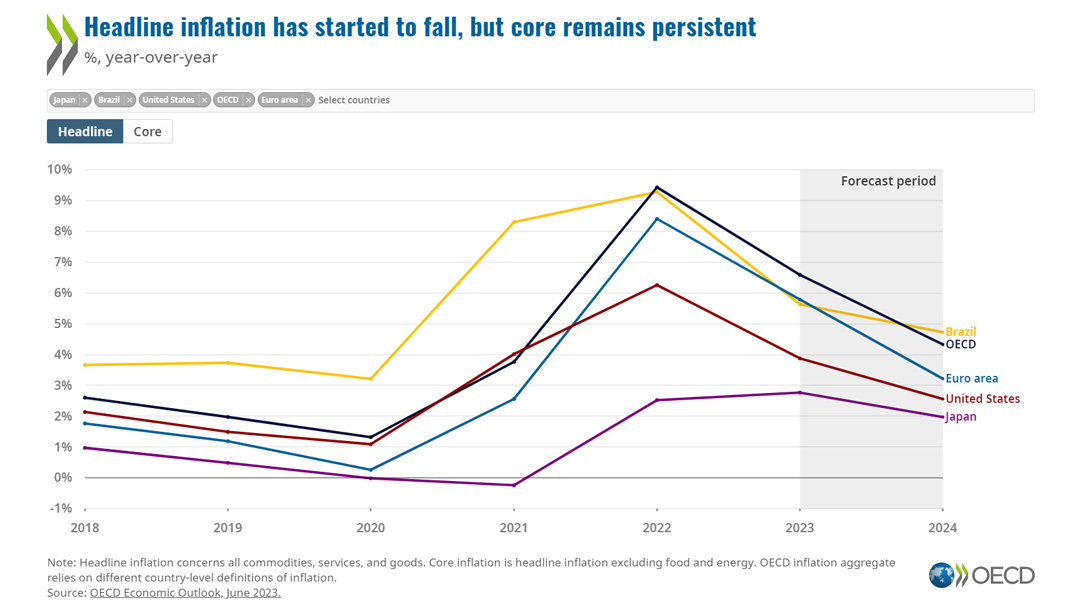

- Lower prices of energy and manufactured goods, as well as the effect of the higher interest rates, are contributing to a reduction in inflation.

- The global economic outlook remains uncertain amid financial sector turmoil, high inflation, the ongoing effects of Russia’s invasion of Ukraine, and the fallout from the pandemic.

- Geopolitical concerns continue to drive market uncertainty with localized conflicts disrupting global markets.

- To minimize future supply chain disruptions, many organizations are investing in nearshoring production to mitigate risk.

Above-target inflation is driving economic uncertainty

- The global economy is showing signs of improvement, but the upturn remains weak amid significant downside risks.

- Lower energy prices are helping reduce headline inflation and ease strains on household budgets, and the earlier-than-expected reopening of China has provided a boost to global activity.

- However, core inflation is proving persistent, and the impact of higher interest rates is increasingly being felt around the world.

- The global economy continues to face a highly uncertain period due to the cumulative effects of adverse market shocks experienced over the past three years, including the pandemic and Russia's invasion of Ukraine.

- Labor markets in advanced economies, particularly in the United States, have remained strong with historically low unemployment rates.

- However, confidence levels remain depressed compared to pre-crisis levels, influenced by ongoing geopolitical uncertainties.

- The economic outlook has become more uncertain with increased financial market volatility and conflicting indicators, and the downside risks have increased as long as the financial sector remains unsettled.

- Major forces that affected the world economy in 2022, such as tight monetary policy, limited fiscal buffers, commodity price spikes, geoeconomic fragmentation, and China's economic reopening, are expected to continue into 2023 while being overlaid with new financial stability concerns.

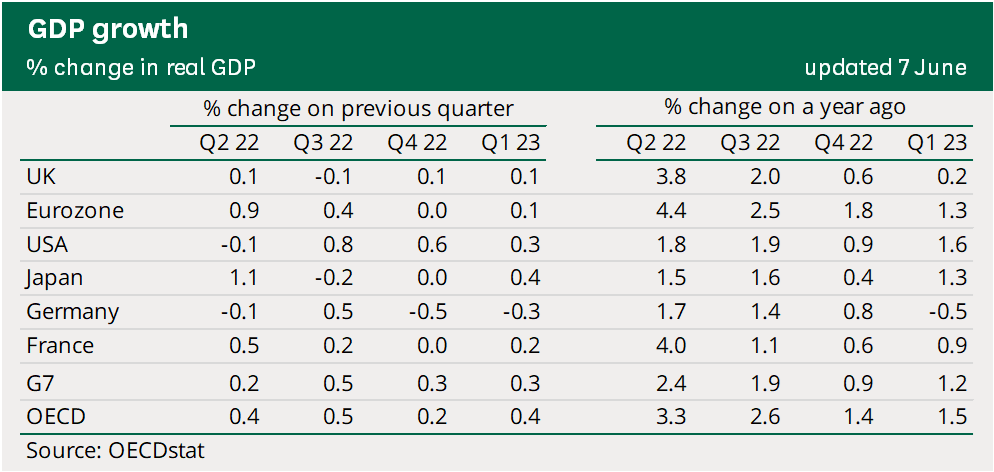

- Global GDP is projected to grow by 2.7% this year, representing the lowest annual rate since the global financial crisis - except for the pandemic – and a modest improvement to 2.9% is foreseen for 2024.

- Annual GDP growth is projected to be below trend in both 2023 and 2024, although it will gradually pick up through 2024 as inflation moderates and real incomes strengthen.

- The OECD also projects that headline inflation will fall in 2023 and 2024 from 6.6% to 4.3% - remaining above most monetary policy targets of 2% continuous inflation.

- In the United States, inflation is expected to reach 4.2% in 2023 and then ease to 2.5% in 2024. The normalization of energy prices and the implementation of tighter monetary policies by the Federal Reserve are contributing to the moderation of inflation.

- One of the significant challenges to managing inflationary pressures in 2023-2024 is the tight labor market.

- In the Eurozone, the risks of inflation have diminished primarily due to the stabilization of energy prices. However, inflation in the largest economies of the Eurozone, namely Germany and France, is projected to reach 6.4% and 5.2% respectively, in 2023.

- Factors such as volatility in energy markets, rising service prices, and the phasing out of government subsidies are keeping inflation levels above the targets set by central banks.

- China's inflation is forecasted to be 2.4% in 2023 and 2.3% in 2024. Despite the reopening of the economy and faster-than-expected GDP growth in Q1 2023, inflationary pressures in China remain mild.

- China's inflation is forecasted to be 2.4% in 2023 and 2.3% in 2024.

- Despite the reopening of the economy and faster-than-expected GDP growth in Q1 2023, inflationary pressures in China remain mild.

- Chinese households continue to be cautious due to weak income and labor market prospects.

- Lower energy and metal prices have also contributed to a decline in producer prices, thereby easing inflationary pressures.

- In India, inflation is expected to reach 5.2% in 2023 and then moderate to 4.6% in 2024.

- Softer food and energy prices have helped to cap price growth and keep inflation within the target range set by the Reserve Bank of India in Q1 2023.

- Weaker household spending, higher borrowing costs, fading pent-up demand, and weaker global commodity prices are expected to contribute to further moderation of inflation.

- Brazil is projected to experience an inflation rate of 5.1% in 2023, which is expected to ease to 4.6% in 2024.

- Moderating energy and food prices, slower economic growth, weaker consumer demand, and higher interest rates are contributing to a slower pace of price growth in Brazil.

- In response to the cooling inflation, Brazil's central bank maintained the base interest rate at 13.75% during its latest meeting in May 2023.

Monetary policy trend continues

- In response to the cooling inflation, Brazil's central bank maintained the base interest rate at 13.75% during its latest meeting in May 2023.

- High inflation led central banks to tighten monetary policy aggressively to manipulate the price level and return inflation to target rates.

- In the US, interest rates were left unchanged in a range of 5.00% to 5.25% by the Fed at its policy meeting ending 14 June 2023.

- The Fed said that while it ‘skipped’ raising rates for the first time in over a year, further rate increases were likely later in 2023.

- The pause in the cycle of rate rises came as the inflation rate has fallen from recent highs.

- The Fed is reducing the number of assets it holds in its Quantitative Easing program by $95bn per month.

- Responding to the Covid-19 pandemic, the Fed had by 15 March 2020 cut interest rates to close to 0% from 1.5%‑1.75% prior to the pandemic.

- On 23 March 2020, the Fed announced a wide range of measures designed to support the economy.

- This included buying debt from the government, and corporations and purchasing other securities.

- The Fed began to raise rates again in March 2022

- At its 15 June 2023 meeting, the ECB raised its main interest rates by 0.25 percentage points. This took the deposit rate up to 3.5%.

- The ECB has lifted rates by 4 percentage points since it began raising rates in July 2022.

- The inflation rate in the Eurozone remains well above its 2% target, though it is forecast to decline.

- The ECB has started unwinding its quantitative easing programs from March 2023, by not reinvesting €15bn per month of maturing assets it holds in one of its two main QE programs.

- The ECB launched its pandemic response on 12 March 2020 and expanded it significantly on 18 March and 4 June. The ECB has also made cheap loans available to banks to encourage them to lend to businesses.

- In July 2022, the ECB announced the creation of a new bond purchase program, the Transmission Protection Instrument (TPI).

- The TPI is designed to be used, if needed, to lower government borrowing costs in individual countries, if these costs are rising due to “unwarranted, disorderly market dynamics”.

- The rapid rise in interest rates and anticipated economic slowdown to combat inflation, along with supervisory and regulatory gaps and specific risks in the financial system, have contributed to stresses in parts of the financial sector, raising concerns about financial stability.

- The return to pre-pandemic rates depends on the realization of scenarios involving higher government debt or financial fragmentation.

- Recent interest rate increases are likely temporary, and as inflation is controlled, central banks in advanced economies are expected to ease policy and return rates to pre-pandemic levels.

Geopolitical concerns drive market uncertainty

- Geoeconomic fragmentation, including events such as the UK leaving the EU, the ongoing US-China trade disputes, and Russia's invasion of Ukraine, has added to the weakened economic outlook, along with slower supply-enhancing reforms.

- The impact of Russia's invasion of Ukraine in February 2022 continues to have global repercussions.

- Despite the significant negative fallout from the war and economic sanctions, economic activity in Europe last year showed more resilience than anticipated.

- The European Union implemented substantial budgetary support measures, equivalent to approximately 1.3 percent of GDP, to assist households and firms during the energy crisis.

- The surge in prices prompted a redirection of gas flows, with increased deliveries from non-Russian pipelines and liquefied natural gas, while industries adjusted substitute gas and modify production processes.

- Oil and gas prices have started to decline from their mid-2022 peak levels.

- These actions and adjustments have mitigated the adverse effects of the energy crisis in Europe, leading to better-than-expected consumption and investment levels in Q3 2022.

- Globally, food and energy prices experienced a general decline in Q4 2022, albeit remaining high, providing some relief to consumers and commodity importers, and contributing to the decrease in headline inflation.

- Maintaining lower prices this year will depend on the absence of additional negative supply shocks.

- As geopolitical tensions continue to rise, organizations are investing in supply chain resiliency by relocating production closer to the end user.

- Aided by global policymakers, organizations are taking advantage of the various incentives offered to nearshore production capabilities, including:

- US Treasury Secretary's call for friend-shoring of supply chains

- The European Commission's proposed Net Zero Industry Act

- China's aim to reduce dependence on imported technology.

- Recent trends show divergent patterns in the flow of strategic foreign direct investment, particularly in sectors like semiconductors.

- Strategic FDI flows to Asian countries began declining in 2019 and have only mildly recovered, except for flows to China.

- Geopolitical preferences increasingly drive the distribution of FDI, with a rising share of FDI flows among geopolitically aligned economies.

- If tensions continue to intensify, FDI may become even more concentrated within blocs of aligned countries.

- Reshoring and FDI manufacturing job announcements are continuing to outpace recent records, adding 101,500 jobs in 2023 Q1.

- If the current rate continues, new job announcements as a result of reshoring will reach over 400,000 by year-end.

- The electrical equipment industry is leading the transition out of China due to large investments in EV batteries, moving from 42% of total jobs announced in 2022 to 47% in 2023 Q1.

- Rising wages in China and technological advancements are reducing the traditional drivers of offshoring, while technologies like robotics, 3D printing, and machine learning decrease the labor share in output.

- Regionalization is increasing as globalization plateaus, with regional free trade agreements gaining importance.

- Environmental, social, and governance (ESG) concerns have led to a shift in focus, as offshoring has resulted in environmental damage and poor ESG credentials in low-cost manufacturing locations.

- The preferred manufacturing locations change under a nearshoring strategy, favoring stable high-income economies with good ESG credentials.

- Reorganizing global supply chains to increase resilience and reconnect with consumers may result in a cost, but the ongoing cost of disruption may make it worthwhile.

- However, despite the nearshoring sentiment growing, China’s position in the global market is entrenched and the ability of businesses to divert operations elsewhere remains challenging, at least in the short term.

- The cost of localizing the supply chain also represents a significant barrier, estimated at around $1 trillion in capital expenditure over five years to shift foreign manufacturing out of China.

- OECD simulations also suggest that a localized scenario with less connected global supply chains could lead to a 5% drop in global GDP.

Chinese economy reopens

- China resumed issuing visas to foreign tourists in Q1 of this year the first time since the Covid pandemic was declared three years ago.

- Due to China’s approach to limiting community transmission of the virus, they had largely escaped any major outbreaks and limited the volume of viral mutations that led to the extremely contagious variants in the West.

- However, as the country’s COVID restrictions were ultimately lifted, multiple large outbreaks led to declines in mobility and economic activity in the fourth quarter of 2022 due to the disease’s direct impact on health and confidence.

- Supply disruptions also returned to the fore, even if temporarily, leading to a rise in supplier delivery times.

- The surge in infections compounded the headwinds from property market stresses in China.

- Declining property sales and real estate investment posed a drag on economic activity last year.

- There remains a large backlog of presold unfinished housing to be delivered, generating downward pressure on house prices, which price floors have so far limited in some regions.

- The Chinese authorities have responded with a variety of measures, including additional monetary easing, tax relief for firms, new vaccination targets for the elderly, and measures to encourage the completion and delivery of unfinished real estate projects.

- As COVID-19 waves subsided in January of this year, mobility normalized, and high-frequency economic indicators—such as retail sales and travel bookings— started picking up.

- With China absorbing about a quarter of exports from Asia and between 5 and 10 percent from other geographic regions, the reopening and growth of its economy will likely generate growth, with even greater impacts for countries with stronger trade links and reliance on Chinese tourism.

Back to Top