By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q3 2022

Jabil's Global Category Intelligence Archive

Q3 2022

PROFESSIONAL SERVICES, CONTINGENT LABOR

AMERICAS

Market Overview

- As COVID-19 cases continue to rise in many parts of the Americas, the effect they have on the demand for durable goods and services, especially in the US, appears to be on a steep decline.

- Demand has remained strong despite the highest inflation rate in 40 years. In the US, the “Great Resignation” appears to have subsided somewhat, as evidenced by the increasing penetration rate of temporary workers in the overall labor market.

- Rising wages and stiff competition for manufacturing/light industrial workers is causing companies to get much more aggressive in recruiting, paying, and retaining sustainable supply.

- Labor shortages are so severe in Canada that in April 2022, the Minister of Employment amended the country’s Temporary Foreign Worker (TFW) program to remove limits on the number of foreign workers that can be recruited into lower wage and more seasonal industries.

- In Brazil, the unemployment rate for manufacturing has remained relatively steady with average monthly wages up in March 2022, compared to wages in January and February, however the average wage remains down about 7% from April 2021.

- Companies utilizing temporary labor should continue to be agile, seek out new sources of potential supply and very likely will need to increase wages not just to attract workers, but to lower high turnover that has been well into the double-digits.

Supply Commentary

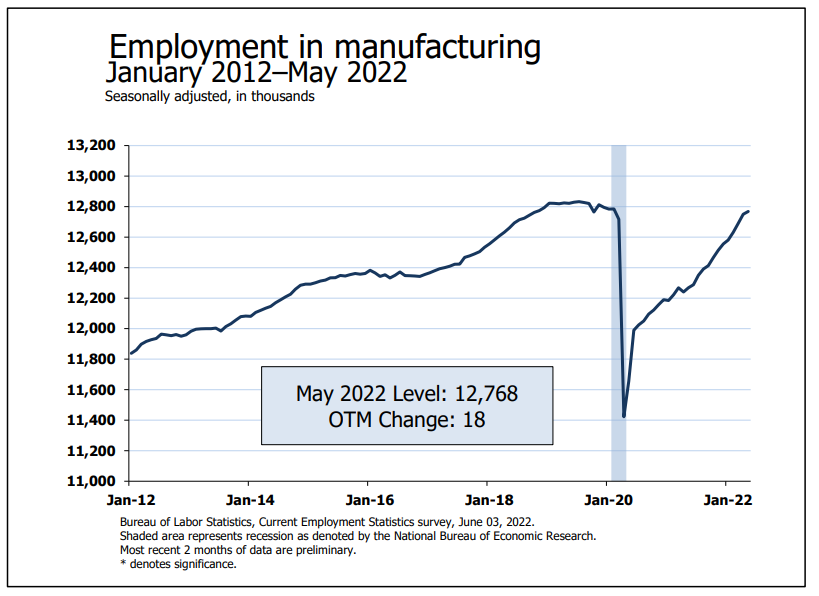

- As of early May 2022, the US recovered 1.3 million of the 1.4 million manufacturing jobs lost at the start of the pandemic in March/April 2020.

- The contingent worker penetration rate (the count of temporary workers out of the overall US employment figures), has risen from under 2% in September 2021, to 2.07% (non-farm) in April 2022, further indicating a strengthening in demand for contingent workers.

- According to the US Federal Reserve, durable goods manufacturing rose 0.8% in April 2022 over March 2022, but has climbed 5.8% year on year. Excluding the automotive industry, factory output rose 0.5%, further confirming that a return to strong demand is occurring.

- According to Deloitte, 38% of manufacturing executives state that attracting skilled workers is their top priority in 2022. The industry is expected to face a shortage of skilled labor of up to 2.1 million jobs by 2030. Staffing firms have begun to target trade schools, military veterans, and employees of nearby organizations.

- Changing market dynamics such as 10,000 workers reaching the age of 65 daily, increases in the rate of early retirement, alongside pay increases in hospitality, fast food, retail and logistics are contributing to the challenge.

- One effective strategy to increase potential sources of contingent supply quickly in a tight market is to consider the use of a master supplier agreement with ‘sub-vendors’ in a particular region. Within that program, the master supplier contracts directly with additional suppliers but acts as the one main administrative body for billing, reporting, and contracting.

- The master supplier will directly charge a fee of 2 to 3% of the sub-contractors’ billings to support the program.

- Since these suppliers are often recruiting from the same overall general pool of candidates, this program aggregation can cast wider reach to increase successful starts, especially during demand increases.

Market Dynamics

- According to the US Bureau of Labor Statistics, demand for temporary workers across all industries has been growing at a 9% clip during the first four months of 2022, reflecting continued economic recovery as we emerge from COVID related challenges.3

- Experts disagree on whether the US economy will slow down as a result of Federal Reserve interest rate increases aimed at curbing high inflation. A recession is not likely in 2022, rather an ‘extended weakness’. 4

- Demand for temporary manufacturing jobs is not expected to decline for the remainder of 2022.

- This is because the US has largely already felt the impact of energy challenges due to the Russian invasion of Ukraine, increases in borrowing rates and continued supply chain constraints for many consumer goods.

- In many states and cities where manufacturing facilities are in close proximity to one another, and to large-scale warehouses, the available supply of light industrial contingent labor is an unprecedented challenge.

- Listing open jobs online is often met with geofencing; a recruitment tactic that uses location-based technology to target job seekers, sometimes via pop-up ads that can obscure openings posted by other companies looking for the same roles.

- Sign-on and retention bonuses are common strategies used, in addition to company paid meals, and company provided specialized uniform or safety gear requirements.

Pricing Commentary

- In April 2022, the US Bureau of Labor Statistics Employment Cost Index-Compensation showed that the average wage increase in the Manufacturing sector accelerating at 4.9% year over year, up from the 12-month trending increase of 3.6% in December 2021.5 However, that is just an average and many local increases are in the double digits, based on competition for light industrial resources that are competing across industries for talent including hospitality and other service sectors.

- Unemployment remained at 3.6% nationally, while the US added 428,000 jobs in April, led in part by manufacturing, where 55,000 positions were added. 6 The average work week for production manufacturing was 40.5 hours with average overtime at 3.4 hours.

- Since the start of the pandemic in March of 2020, average hourly wages for non-supervisory production workers have risen 9.6% to an average of $24.78 in April 2022.

- Competition in highly competitive manufacturing cities has caused even higher pay increases and companies have had to add incentives such as sign on bonuses, and retention bonuses to not just attract, but to keep workers.

Supply Commentary - Canada

- The supply challenges around contingent labor in Canada has resulted in the easing of foreign worker restrictions. At the start of 2022, labor shortages in manufacturing were up 93.1% from the start of 2020, or pre-pandemic levels, while the job vacancy rate rose from 3.1% to 5%.

- In April, Canada recorded a record low unemployment rate of 5.2%, further demonstrating the challenges around attracting and maintaining a contingent workforce without seeking additional foreign workers within the manufacturing sector.

Market Dynamics - Canada

- The demand for temporary workers in Canada is so severe that in April 2022, the government eased restrictions on foreign workers, increasing the cap from 10 to 30% across many manufacturing sectors. In addition to the increase in foreign workers, the government also increased the time allotment on Canadian work permits from 180 days to 270 days, easing the path to citizenship for immigrants who may want to become Canadian citizens.

- As in the US, the tight labor market has improved the earnings of many Canadian citizens who have become more selective in their job search, which has led to increasing wages, but also exacerbated the current shortages in manufacturing.

Pricing - Canada

- The average hourly wage for a non-supervisory entry-level manufacturing role in Canada is $16 CDN (About $12.64 USD), which equates to an annual base compensation of $31,200 CDN ($24,600 USD).3

- The average wage across all manufacturing roles was $28.90 CDN, up 7.1% from April 2021, suggesting in the short term that wages were rising faster than inflation, although that trend is slowing this year.

- The wages vary greatly across the provinces, and the average minimum wage is between $15 and $16 CDN, however the Federal Government raised the minimum wage to $15.55 on 1 April 2022, but in Provinces where it is already higher, those wages prevail.

- Canada adjusts minimum wage at least annually, in keeping pace with the published Consumer Price Index, and for 2021 that was 3.4%.

- Canada’s current inflation rate of 6.7% is the highest in 31 years, with the average rate at 5.9% for 2022.

Supply Commentary - Brazil

- According to TradingEconomics.com in March 2022, the Labor Force participation rate has climbed year over year, with figures increasing from 56.8% in March 2021 to 62.3% in March 2022. Despite this increase, overall unemployment in the country has remained at 11.2% and is forecast to remain at that level through 2022. While growth has accelerated for services in the country, the Manufacturing PMI has seen a slowdown in April 2022 over the previous month (51.8 vs 52.3)

- Traditionally the use of temporary labor has been restricted in Brazil, similar to the current situation in Mexico, however in 2017 the government eased outsource labor restrictions.

- Full-time employees are legally bound by unions in Brazil, so while temporary labor can be used, we have seen it more on project ramp basis, for a relatively short period of time (3-6 months) with the use of full-time employees typically much more prevalent.

Market Dynamics - Brazil

- Demand for temporary labor in Brazil does not appear to be as constrained as in other parts of the Americas. Similar to what is occurring in the US, inflation in Brazil is pushing over 9%.

- To stem the increase, the Brazilian government has increased interest rates 10 times since the fall of 2021. The current interest stands at 12.75%, the highest for the country since 2003. It remains to be seen if this will affect consumer demand, and thus whether a slowdown in manufacturing will occur.

- Since temporary labor is not as widely used in Brazil as it is in other countries, any significant change in demand for goods and services because of higher borrowing costs may not adversely affect the demand for a base of contingent labor availability.

Pricing - Brazil

- Since reaching an average monthly wage high of 2,484 BRL ($527 USD) in April 2021, wages fell 10% to a low in December 2021 before recovering to 2,420 BRL ($513 USD) in February 2022. B2 The minimum wage increased 10% in January 2022, to 1,212 BRL ($257 USD).

- Brazil’s broader economy is expected to stagnate for the remainder of 2022 and into 2023 as they grapple with excessive inflation and with a pending presidential election in October. However, inflation is expected to slow to 4.3% in 2023, and exports remain positive, encouraging investment.

ASIA

Market Overview

- At the start of 2022, the APAC region was poised to see GDP average growth of 5.4% after seeing 6.5% growth in 2021. As of April 2022, the growth estimate fell 0.5% to 4.9%.

- The Russian Invasion of Ukraine has resulted in reduced demand across Europe, affecting Asian companies. Couple that with rising inflation and stagnating manufacturing growth in key markets and the region is trying to balance managing higher prices and softening demand.

- There is still stiff competition for outsourced manufacturing workers, so supply remains a challenge. Vetting new suppliers, with proper RBA audits, takes time but is essential to keep new sources of supply based on demand spikes.

- As of the end of May 2022, most countries in Asia are at or below 5% of their daily peak Covid infections (other than Taiwan where the country is peaking at average), so while a country like China maintains a zero-case tolerance, overall direct effects of Covid on labor availability across the region has subsided.

- As of the end of May 2022, most countries in Asia are at or below 5% of their daily peak covid infections (other than Taiwan where the country is peaking at average), so while a country like China maintains a zero-case tolerance, overall direct effects of covid on labor availability across the region has subsided.

China

- As recently as February 2022, China’s Manufacturing PMI stayed above the growth line at 50.1, which indicated a positive trendline toward the climate around manufacturing production.

- However, March saw a large decline, coinciding with the Ukraine/Russia war, and it dropped to 48.1. Even more ominous, April saw a further reduction, down to a 26-month low, or 46.0.

- The COVID outbreaks in spring took a toll on production in larger cities such as Shanghai. In addition, exports fell to a two-year low

- China’s business confidence index also declined in April (47.4) over March (49.5) as lockdowns softened production and demand, however it recovered in May (49.6) as lockdowns eased. Delivery times and export order declines were falling.

- Demand for dispatch and outsource labor remains strong amid a challenging market to attract new workers, particularly in the Tier 1 industrial cities including Shanghai, Shenzhen, and Guangzhou.

- New initiatives around adding incentive payments and penalty clauses in supplier contracts aim to improve committed counts of new starts and reduced attrition and absenteeism.

- Manufacturers of consumer goods have been competing for labor resources to gear up for the 618-e-Commerce peak season, which runs from 1 June to 18 June across e-commerce leaders like Alibaba and JD.com.

Malaysia

- Malaysia’s GDP from Manufacturing declined by 5% in March 2022 over January 2022, however remained at the highest level in almost 3 years. At the same time, unemployment rates have remained steady at about 4.1%, but still at the lowest level since July of 2021. The labor force increased 2.2% to 16.44 million.1

- Not including annual bonuses paid in December 2021, the average wages in manufacturing remained at the highest level since just before the pandemic.

- Demand for contingent labor resources has rebounded from the height of the pandemic as a result of a sharp recovery in new order volumes.

- Sentiment is mixed however given continued materials shortages and the slow action on behalf of the government to approve new foreign worker applications.

Singapore

- Singapore’s GDP from Manufacturing declined slightly in the first quarter of 2022 while remaining at all-time highs as the city-state continues to recover post-covid.

- Singapore’s Manufacturing PMI crept up in April after an 18- month low in March on higher factory output and stronger orders both domestically and abroad.

- The forecast is for the PMI to hit 51 in early 2023, continuing a positive trend.

- Demand for workers remains high, however the country prefers to bring in higher-skilled workers in areas like IT/technology; as a result, automation and robotics has become a focus as firms turn to autonomous solutions to enable future growth.

India

- Several economic indicators rose in May, including the Manufacturing PMI (54.6) after 11 straight months of expansion in the manufacturing sector; export orders rose at the highest level since 2011, and employment increased to its highest level since January.

- However, like many of the large global economies, India is facing the largest inflation rate since 2014, at an annualized rate of 7.79%, above market consensus of 7.5%.

Vietnam

- Supply remains a challenge for manufacturing contingent resources as the youth unemployment rate reached an all-time high in Q32021 and remains at a similar level as of June 2022 at over 8%.

- Historically the average is 7%; skilled workers find themselves in a good position and are tending to stay with current employers, however challenges remain among the youth and less skilled workers who find the cost of living in cities difficult, with many remaining in smaller towns when the government relaxed restrictions on in-country travel.

- Competition from hospitality firms has picked up as organizations prepare for a resumption of pre-pandemic volumes, further putting pressure on industry and manufacturing to attract workers; many are recruiting and up-skilling former workers while also working with recent graduates and schools to fill the openings.

Supply Commentary

China

- The supply of available factory direct labor continues to be unpredictable given situations like the total lockdown in Shanghai and the possibility of a similar event in the near term.

- In areas where there has not been a recent covid case or lockdown, manufacturers have generally been able to source enough direct labor to meet customer commitments.

- Procurement teams are constantly working on new suppliers and new sources of supply, focusing on schools for example.

Malaysia

- Manufacturing typically relies on importing foreign workers in Malaysia, and that has been restricted during Covid. However, the government reopened the application process in March of 2022 and has been cautious on approvals through May.

- In late April, the Minister of Human Resources stated that approximately 14% of the 179,000 applicants had completed the interview process and that throughout May they would expedite applications and bring them in over the following 6 weeks.

Singapore

- Overall, Singapore is still facing serious shortages in traditionally labor dependent industries - like construction and manufacturing - and there is not a consensus on when the issue will be resolved.

- The Singapore Business Federation wants the government to reclassify service industry roles to allow more allocation of foreign workers; it remains to be seen if manufacturing/light industrial roles will be positively impacted by any such reclassification2.

- The city state relies on foreign workers, but their number fell by 235,700 between December 2019 and September 2021, according to the Manpower Ministry, which notes how COVID-19 curbs have increased the pace of technology adoption and automation by companies.

India

- India’s total unemployment has been declining since a spike in February 2022 to 7.12% led largely by a reduction in rural areas.

- In urban regions the rate declined 1.1% in May to 8.21 but continues to vacillate between 8 and 9.2% the last 6 months (Source: CMIE.com- Centre for Monitoring Indian Economy Pvt. Ltd.).

- A large part of the increase in recent months can be attributed to nearly 7 million jobs added to the industry - 3 million in manufacturing and nearly 4 million in construction, boosting the Manufacturing PMI.

- Companies are continuing to offer incentives to contingent labor providers for hitting specific onboarding benchmarks, in addition to monthly management charges per head.

- Conversely, there are penalty clauses in place for failure to procure and maintain agreed staffing levels, along with consideration for attrition and absenteeism.

- Some companies are also incentivizing contingent labor providers to offer opportunities for women by incentivizing them to successfully onboard more women than men.

- Conversely, some have retribution clauses if the ratio goes under 50% for women.

- IT staff augmentation services within India remain a flourishing global industry and accounted for 8% of India’s overall GDP, the highest level since FY15 and growing.

Vietnam

- Supply remains a challenge for manufacturing contingent resources as the unemployment rate for youth reached an all-time high in the third quarter of 2021 and remains near that high as of June 2022 at over 8%.

- Historically the average is 7%; skilled workers find themselves in a good position and are tending to stay with current employers, however, challenges remain among the younger and less-skilled workers who find the cost of living in cities difficult, and many are still in smaller hometowns once the government relaxed restrictions on in-country travel in the fall of 2021.

- Competition from hospitality firms has picked up as well as they prepare for a resumption of pre-pandemic volumes, putting further pressure on industry and manufacturing to attract workers; many are recruiting and up-skilling former workers while also working with recent graduates and schools to fill the openings.

Pricing Commentary

China

- The overall unemployment rate is expected to remain between 4.8 and 5.2% into 2023 while manufacturing wages are forecast to increase 4% in 2022 and 3.3% in 2023.

- Average overall wages in China are about 11.1% higher than the average manufacturing annual salary which may add to the challenge of attracting and retaining workers4.

- Management fees for administering outsource/dispatch labor have remained consistent over the past two years and are not forecast to increase significantly in the near term.

Malaysia

- Foreign worker management firms’ prices can vary widely in recent RFPs for handling the full recruiting, travel, payroll, and accommodations, so RFPs with multiple RBA qualified suppliers should be conducted.

- It is not uncommon to see variances of up to 20% in initial bids as several seek to recoup losses on empty dormitories that were planned and built during and prior to the pandemic lockdowns.

- Average manufacturing wages have been on slight upward monthly trend in 2022, but on a slightly downward trend over the past 5 years; the forecast is expected to average an 11% increase in 2023, and another 4% in 2024.

Singapore

- Given the extreme shortage of contingent manufacturing worker availability in Singapore, most companies are focused on attracting full time direct labor via agency support.

- Companies that are not paying close to the average wage of about SGD 3,000 or above are likely not going to attract enough new hires to meet demand schedules.

- Recruitment fees ranging from 12% to 18% depending on role and base monthly salary are common and focus on incentivizing recruiting suppliers with additional tiered fees based on successful volumes are common.

- If a company is fortunate enough to bring in foreign workers on an S Pass, the Singapore government is raising the minimum monthly salary from 2,500 SGD to 3,000 SGD ($2200 USD) on 1 September 2022; these are typically mid-level roles, not entry level factory positions, so it’s not likely the volume will be significant.

India

- Monthly management fees for contingent suppliers have remained relatively flat over the last 3 years but can range from between 500-750 INR per head per month (about $8.50 USD at the median) depending on the overall headcount a company requires and not counting incentives or retribution clauses.

- The National Floor level minimum wage across India has remained flat since 2017, at about 178 INR ($2.30 USD) per day; States can set their own minimums as long as they do not go below this floor; skilled labor in larger cities can earn up to about 800 INR per day ($10.80 USD).

- Average salary increases in India are estimated to be around 8%, but skilled IT roles are seeing double-digit increases in 2022 as demand for their services is increasing in general, and in part due to the conflict in Ukraine, another large IT services global hub.

Vietnam

- Wages in manufacturing, while up slightly in recent months, are volatile and do not stay on an upward trend line for the long-term.

- The average monthly wage in 2021 was 7139 thousand VND ($308 USD) and is projected to be 7,250 thousand VND ($312 USD), or only a 1.3% increase; 2023 projects a 3.6% increase.

- Recent RFPs for adding contingent labor have shown opportunity to negotiate savings around management fees being charged along with wide quote variances around quality/productivity bonuses, and attendance allowances.

- Transportation fees have not been a differentiator. Savings as a percentage of spend may be nominal in this marketplace, between 1 and 3%.

EUROPE

Market Dynamics

Switzerland

- Despite Switzerland’s robust high-tech manufacturing landscape, the current overall Manufacturing PMI of 60.0 is at its lowest level since January of 2021.

- Any level above 50 indicates expansion, but the steady decline in the trend line projects a PMI average closer to 55 points in 2023 and 52 in 2024.

- The decline comes on the heels of a reduction in output, orders booked, and purchasing volumes.

- Inflation in May was trending at 2.9%, the highest level since 2008, although expected to be more in line with historical averages of just under 1% in 2023.1

- Despite these macro concerns, growth in the temporary employment market grew 21.9% in Q1 2022 over the same quarter a year prior2.

- CEOs of Swiss staffing firms expect even further growth for temporary work over the remainder of 2022, according to a survey by Swiss Staffing.

Germany

- There is sustained softness in demand for German manufactured goods, resulting in the lowest Manufacturing PMI since early 2021(54.8).

- The recent lockdowns in China have greatly reduced new orders with inflation standing at 7.9% in April 2022, the highest rate since the winter of 1973.3

- Employment is growing in part due to a somewhat improved supply availability, therefore there is the need for additional contingent resources.

- According to Germany’s Federal Employment Agency, the country requires at least 400,000 immigrants from the EU and abroad to meet the annual demand for skilled labor, however the pandemic and travel restrictions further hampered efforts after the passage of the Skilled Workers Immigration Act of 2020.

- Recently, Germany has reached cooperation agreements with Colombia, Mexico, and Indonesia in hopes of increasing the numbers.

Hungary

- The seasonally adjusted manufacturing PMI fell sharply in May from April, pointing to the slowest growth activity in the last four months, although the index remains in positive territory.

- Demand for workers of all types has fully recovered from the challenges during the pandemic.

- The unemployment rate dropped to 3.5% in April 2022, almost reaching the all-time low of 3.30% set in June 2019. Even prior to the Russian invasion of Ukraine, Hungary was facing severe shortages in both skilled and unskilled labor, with well over 350,000 positions unfilled in the summer of 2021.4 .

- Hungary’s inflation rate of 9.5% in April 2022 is also putting more wage pressure on employers in a historically tight labor market.

Ukraine

- Prior to the Ukraine-Russia conflict, Ukraine was enjoying unprecedented annual double-digit growth in IT staff augmentation/outsourcing roles.

- It was projected to reach $10 billion USD by the end of calendar year 2021.5 The country had become a global hub for IT outsourcing by companies in some the world’s largest economies, including the US.

- Many statistics around GDP, real inflation rate, unemployment are suspect given the uncertainty around the full impact in the short and near-terms.

- Inflation skyrocketed in April 2022 to 16.4% - around 5% above the mean over the last few years.

- As of early June 2022, the western portion of the country has been ableprovide those IT outsourced services - either from those who left the country and are able to continue working remotely from countries providing asylum, or in factories that are still operational and being provided supply chain materials from nearby countries to the west.

Supply

Switzerland

- Contingent staffing firms have provided a robust volume of workers, many to support the overall increase in manufacturing due to delays in goods and services leaving China and as a result of the war in Ukraine.

- On average, about 2.5% of the total working population in Switzerland work temp jobs, or a bit over 340,000 persons.

- Temp workers in Switzerland have protections under the staff leasing collective bargaining agreement.

- They pay 0.7% of their pay to the CBA but with that comes an entitlement to upskilling and training, pension provisions, robust holidays and paid time off leave, and competitive health and welfare insurance benefits,

- This makes contingent work more than just ‘a job’ as can be seen in other countries without these protections.

Germany

- Germany’s temporary labor force is typically around 9% of the total working population of 45.4 million people.

- The country has hundreds of Temporary Worker Agencies, including some of the largest global providers.

- The EU is working toward creating policies that will increase worker mobility between member countries, which means Germany’s total temp worker base should grow.

- Currently the only industry where temp work is not allowed is in building and construction. Germany is similar to other countries, like Mexico, where they seek to protect workers and labor market requirements.

- The overall temporary worker population in Germany has not changed significantly in at least the last 7 years, remaining between 4.2 and 4.5 million, with one spike over 5 million in Q4 2016.

Hungary

- Hungary has been experiencing a severe shortage or workers of all skill sets for over a decade. However, in recent months, the government has been reacting quickly to offer support to around 10,000 Ukrainians who arrive daily fleeing war.

- As of mid-April 2022, over 600,000 Ukrainians had fled to Hungary, and estimates are up to 900,000 may eventually arrive.

- The government is moving quickly to provide asylum in hopes of filling roughly 40,000 jobs in areas like hospitality, before the migrants move on to EU countries who may provide quicker options. 8

- The main concern is that Hungary is used as a steppingstone for better opportunities in nearby Germany and Netherlands, for example.

- In 2020, Covid took the number of temporary workers in Hungary from about 180,000 to below 120,000.

- In the summer of 2021, the numbers returned to those pre-pandemic, but shortages linger9.

- The market for available temporary workers, even in the western parts of the country has been difficult.

- Adding suppliers in order to mitigate the shortages has not resulted in a significant improvement as wages and statutory payments are not the differentiator; more around incentives for number of successful starts, lowering attrition and minimizing absenteeism.

Ukraine

- Most companies with resources in Ukraine, or who are contracting with suppliers who provide contingent services in the country, have built business continuity plans to continue services in other regions.

- Within IT, rate cards are being set up in countries such as Mexico, Columbia, China, and on a smaller scale, Belarus.

- In other cases, stories about companies with operations in nearby Hungary and Poland have employees who have opened their doors to co-workers and their families who have fled from the Ukraine so they can continue working and providing for their families, including those who have remained in the country.

Pricing

Switzerland

- Switzerland does not have a national minimum wage; however, their average annual salary is one of the highest in the world, only trailing 8 countries such as Denmark, the United Kingdom, Ireland, and France.

- Several of Switzerland’s 26 cantons have established their own minimums; in 2020, Geneva set the world’s highest hourly minimum wage at 23 CHF ($23.67 USD)10.

- Actual salaries are often dependent on experience and other qualifications like education and training.

- The 2022 average annual salaries in manufacturing range from about 35,000 CHF for an assembly line worker, 45,000 CHF for a Forklift Driver, to 61,000 for a ‘General Warehouse Associate’.

Germany

- Germany’s minimum statutory minimum wage stood at 9,82 EUR in January 2022 (about $10.50 USD)

- Given the high inflation rate the country is set to raise the rate to 10,45 EUR on July 1 and to 12 EUR per hour (about $12.89 USD) on October 1, 2022; the increase is estimated to help at least 6 million low wage earners.

- According to salaryexplorer.com, the minimum monthly wage in manufacturing in Germany ranges between 1,070 and 2,280 EUR for roles as machinists, assembly line workers, demand planners and factory workers in 2022.

- In April, many agencies raised rates 4% per hour due to a uniform nationwide increase in pay, per the Collective Agreement on Temporary Employment due to cost increases and sickness rates.

Hungary

- Hungary increased its statutory minimum wage in early 2022, by an about 14% from 476 EUR per month to 541.73 EUR per month over the third quarter of 2021.

- Although this increase was the highest so far in 2022 within the EU as percentage increase, the country remains in the bottom third of countries in the EU with statutory rates and is one of 13 member states with monthly minimum wages below 1,000 EUR per month.

- Attracting, or more importantly, keeping migrants to fill more unskilled and temp roles will be challenging in both the short and near term to alleviate the shortfall.

Ukraine

- With inflation at record levels and no timeline for a resolution to the conflict with Russia, those companies with other global service centers are offering options ranging from a low of 11% to over 20% hourly rate increases for resources in Application Development, Systems Analysts, and Data Architects.

- Price increase requests for those remaining in the country have ranged from 10-20% in recent months.

- Some companies are trying to continue supporting their employees who may have left Ukraine but continue to work.

- There are online payroll platforms that can fund and pay monthly pay to these employees via debit cards and other financial instruments, since depositing their funds into their current Ukraine banks no longer allows them to pull money if out of the country.

Back to Top