By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q3 2022

Jabil's Global Category Intelligence Archive

Q3 2022

CAPEX, MRO, INFRASTRUCTURE

MACHINING

Market Overview

- Machine tools are computer numeric control (CNC) equipment used to produce parts and subassemblies from raw materials such as aluminum, stainless steel, and polymers.

- This equipment can perform a range of operations such as cutting, forming, and drilling parts for end markets including the aerospace, automotive & transportation (A&T), medical and electronics markets. In the Q2 Category Intelligence Report, global machine tool investments were forecasted to continue to grow at a bullish Compound Annual Growth Rate (CAGR) of 5%.

- Machine tool Original Equipment Manufacturers (OEMs) continue to see accelerated investment plans and this sentiment is expected to continue in the near future.

- Asia Pacific (APAC) retains the major share of the machine tool market at greater than 37%. China, India, and South Korea are among the world’s largest A&T component manufacturers, and the adoption of machine tools in the production of automotive components in the region has been rising.

- While APAC takes the spotlight, growth in the Americas and EMEA is also on a strong run and is forecasted to continue to scale for the next three quarters. Supply continues to be constrained with most OEMs increasing their backlog and extending lead times further.

Market Dynamics

Demand

- Demand for machine tools is strong as manufacturing in key market segments are experiencing growth since the removal of some Covid-19 related restrictions.

- Demand in the Aerospace, Medical, Semiconductor, Energy & Power, and A&T markets have the highest impact on demand levels.

- While China has the highest market share, the USA and Europe are the highest consumers of machining equipment this year with no signs of slowing their investment roadmaps.

- Due to long lead times, customers are being more proactive in placing orders which is causing significant backlogs.

- The proactive order placement will cause a slowdown in demand once supply lead times improve, and backlogs diminish. This slowdown may come as early as Q4 CY22, but more pragmatic forecasts are calling for a potential slowdown in the first half of CY23.

Supply

- Supplier lead times are currently sitting between 1 to 4 months longer than standard lead time pre-pandemic. •The backlog of orders will continue to propagate long lead times until improvements in the delivery of BOM components are resolved.

- Improvements to machine supply will require developments along the entire supply chain ecosystem. It is anticipated that supply constraints will remain over the next 2 to 3 quarters.

Pricing

- Almost every machine tool is going to experience a negative price impact this year for a multitude of reasons.

- Logistics constraints are creating price increases across every mode and lane. Price for a 40-foot container ship as of April 2022 was in the region of $9,300, more than double the cost of the same ship a year ago. This price tag skyrockets to $16,000 for a ship on the common China to US West Coast route1*.

- The basic semiconductor market is forecasted to be constrained until at least mid-2022, with the market for complex semiconductors tight throughout all of 20222*. As a result, machine tools will experience increases at the foundation of the supply chain, passing through multiple supplier levels prior to reaching the OEM who will inevitably pass these increases onto to the customer.

- Labor rates increased at the highest rate since the early 1980’s. Access to qualified technicians and manufacturing resources is becoming more difficult due to employee turnover seeking higher wages, or employees becoming ill due to COVID.

- Energy & Utilities are skyrocketing at varying degrees globally. Electricity and gas are contributing to price instability, especially in the EMEA region due to the Ukraine-Russia conflict.

- One shining light is that raw material such as aluminum, copper, and steel are inching their way steadily back to early CY21 levels

Supply Analysis

- Most machining OEMs, including DMG, Mazak, and Makino, have a robust backlog of orders due to component & subassembly shortages from their Tier 1 and 2 supply network.

- Many of the challenges are with parts that require printed circuit board assemblies (PCBA) due to the significant constraints in the semiconductor commodity. IPC, I/O Racks, Amplifiers, and Controllers are just some BOM items that are impacting the OEMs ability to finish machine production.

- New part validation for BOM alternatives is currently underway with many OEMs, but the process to validate them is forecasted to take 3-6 months.

- Even with improvements to the supply of BOM components, supply constraints will persist until the backlog of orders have been reconciled. Several OEMs are currently at a backlog of more than 6 months and will continue to grow as supply constraints remain.

Key Takeaways

- Maintain open and honest communication with your key machine tool partners.

- Be proactive with order placement and prepare for worst case scenarios. Lead times are protracted and will need to be effectively planned to meet your production targets.

- Price increases are forecasted to continue over the next two quarters - expect to see increases from 5% to 15% for standard configured systems, with options and spare part increases slightly higher.

- Develop an approved vendor list (AVL) with multiple partners to maintain commercial competitiveness, access to supply and overall leverage.

- When increases are presented, ensure you fully understand what is driving those increases. Prices for certain raw materials are reliant on index reports. As the index price increases, so too does the price of raw material. However, as those index rates decline so should the product cost.

- Understanding what is driving price increases will empower you to achieve cost reductions when the market stabilizes.

AUTOMATION

Market Overview

- The automation industry has been evolving steadily for both hardware and software, with advancement of technology, such as big data, cloud computing, AI and Industrial 4.0.

- The automation of manufacturing processes has offered various benefits, such as effortless monitoring, reduction of waste, and speed of production. The technology offers customers an improved quality with standardization and dependable products with time.

- This is further supported by development of integrated multi-functional control systems that are modular and scalable.

- Factory automation has focused on standardized platforms and applications to make reconfiguration easier.

- Global commodity prices remain high due to inflation and conflict with price increases being passed to the industrial downstream.

- With extended lead times, buffer stock and allocation of supply have become the strategy.

- All these factors together are estimated to drive the automation systems market globally during the forecast period.

Market Dynamics

Demand

- The Process Automation Global Market size is in the region of $115.9 billion, with global demand CAGR at 6% between 2021 and 2025, with demand across all regions increasing.

- APAC is expected to witness the highest growth rate, with increased focus on adopting automation across all industry verticals to combat rising labor costs.

- China was once considered a low-cost region for manufacturing, but with hyperinflation in North Asia, it is becoming a difficult place to scale with wages now higher than some Latin American and South Asian countries.

- Companies with a large direct labor workforce will be prioritizing automation to offset increased labor expenses associated with repetitive processes.

- The robotic global market size is approximately $50 billion and includes software & peripherals, among which industrial robots account for 77%.

- New installed units reached 435,000 industrial robots in 2021 and are projected to grow to 518,000 in 2024.

- Robots in the electronics industry experienced the strongest growth of 23%, surpassing Automotive as the largest customer segment for the first time. Main applications are Material Handling, Robotic Welding and Assembly.

- China remained the largest robot market, accounting for 44% of total worldwide installations followed by Japan with 10% and the US with 8%.

Supply

- The consolidated market base with the top 9 players accounted for 70 to 75% of global automation revenue.

- The ranking of major global suppliers remains unchanged even after reorganization and structural changes over the last 2 years.

- FANUC, ABB, Yaskawa, and Kuka still have major shares in the global robotics market

Supplier Spotlight – FANUC

- FANUC remains the biggest robot supplier in the market.

- During the fiscal year ending March 2022, FANUC posted consolidated net sales totaling ¥733,008 million - up 33.0%.

- ROBOT Division sales accounted for 36.6% of consolidated net sales.

- FANUC ROBOT Division’s sales in China remained strong, mainly in IT-related industries and for EVs, heavy machinery and construction machinery.

- Strong sales were also recorded in the United States, to general industries and the automobile industry with EV-related demand, and demand from general industries in Europe remaining strong.

- In Japan, there was a gradual recovery in terms of demand, with sales increasing in comparison with the corresponding period of the previous fiscal year.

Pricing

- Commodity prices remain high due to global inflation and geopolitical issues.

- According to IMF, war-induced commodity price increases and broadening price pressures have led to inflation projections of 5.7% this year in advanced economies and 8.7% in emerging markets and developing economies—1.8 and 2.8 percentage points higher than projected last January.

- As steel and copper are primary raw material inputs for many automation parts, prices of both remain high. This also means that any changes in the price of steel and copper will have a knock-on impact on the cost of automation parts.

- Steel and copper are the primary raw materials for many types of automation parts; thus, these two raw material indices should be followed for potential price increases or decreases.

- Copper has increased in price by 90% over the last two years.

- Copper is estimated to be in the region of 5% of the total robot cost.

- Steel represents approximately 10% of total robot cost and has increased in price by 75% over the past two years.

- Price increases have been passed through the entire supply chain network.

- Many automation suppliers have announced price increases, even multiple price rises, within the past 12 months (Robots, Industrial PC, PLC, Sensors).

- General indication of price increases is Robots between 5 and 10%, Industrial PC and PLC between 10 and 20%.

- Electronics components for automation equipment spot market price increase could be as high as 300%.

Supply Analysis

- Automation parts lead times have been extended with buffer stock and continuity of supply becoming the primary strategy.

- Many automation suppliers have extended their lead times (General indication of extended lead time is robot from 8 weeks to 24 weeks, IPC/PLC from 8 weeks to 40 weeks) due to persistent supply chain challenges.

- This follows the IC chip shortage and global logistics disruptions.

- Logistics has yet to recover from the pandemic and is still constrained due to reduced commercial air travel and the continued congestion at ports.

- IC shortages are impacting every industry, requiring system processing as demand significantly out-paces supply and OEMs are reluctant to scale capacity.

- Labor shortages are continuing to impact the resource available to produce goods at a pre-pandemic rate.

Key Takeaways

- The automation market demand continues to grow with advancement of technology.

- Global commodity price increases have been passed downstream and it is anticipated that there will be more increases over the next two quarters.

- Automation part price is in uptrend due to global inflation, electronics component shortage and logistics disruptions.

- Lead times have been extended from 8 weeks pre-pandemic to 40 weeks currently.

- Supplier partnerships become critical to constrain price increases and secure stock.

SMT

Market Overview

- We are now witnessing the best and worst times in the history of the Surface Mount Technology (SMT) market.

- Many suppliers and OEMs are aiming for the best and preparing for the worst.

- Q2 continues to be an explosive quarter for SMT equipment.

- Q3 will continue to be strong but not at the same levels as Q2.

- Q4 is forecasted to be lighter than Q3 in terms of dollars invested as many customers are placing early POs to get ahead of the supply constraints.

- APAC is expected to dominate the SMT equipment market in future.

- APAC emerged as the leader, contributing a total revenue of $2389.2 MM to the overall SMT equipment market.

- With rising technological advancements, the printed circuit board (PCB) application in electronics products such as tablets, smartphones, liquid crystal display (LCD), and light emitting diode (LED) is increasing across various industries across APAC.

- The LED segment is expected to witness strong growth in the balance of CY2022.

- Countries such as Japan, South Korea, and China have emerged as the leaders in the printed electronics circuit board industry.

- Based on guidance from key SMT OEMs, the market is very strong with significant backlogs currently in place.

- End markets such as Automotive and Transportation, Telecom/5G, Smart Home & Appliance and Industrial are driving most of the demand.

- There is strong demand in Automotive segment mainly driven by EV. Telecommunication had a spike in Q1 mainly due to the recovery from the pandemic and the increased demand for 5G. Medical, Consumer and Industrial segments remain flat.

- Capacity was full in CY22Q2, and OEMs believe that capacity in Q3 will be filled up by at least 70%, depending on the market sentiment and conditions.

- Business in Mexico is experiencing historical growth; however, they will struggle to sustain this growth without further investments into their ecosystem.

- The war in Ukraine is continuing to have a detrimental impact on the European market and is stalling expansion capabilities.

Market Dynamics

Placement Gear

- The global SMT Placement Equipment Market is expected to grow at a CAGR of 10.9% during the forecast period and it is expected to reach $ 729.46 Mn. by 2026.

- SMT component placement systems, usually called pick-and-place machines, are robotic machines, which are used to place surface-mount devices (SMDs) onto a PCB. A key driver for the global SMT placement equipment market is the growing demand for PCBs. PCBs form the core of electronic devices and provide an electrically conductive path for many components such as capacitors, resistors, transistors, ICs, and diodes.

- Based on the application, the Global SMT Placement Equipment Market is segmented into categories: Consumer Electronics, Medical, Automotive & Transportation, and Telecom & 5G.

- The consumer electronics market lost momentum in Q2 and is facing a continued slowdown.

- The demand of electronics to support home working has reduced significantly.

- Consumer electronics prices have increased causing the purchase demand to drop further.

- This sector will remain flat globally with the exception of the increase in demand for smartphones in China. However, that spike is facing a head wind due to continuous closures in response to localized COVID outbreaks.

- Increasing demand for professional audio and video equipment including sound, video, lighting display, and projection systems are leading to substantial growth in the industry.

Medical

- This sector continues to be on a rising trend post-COVID.

- There is an increasing global trend on the medical device packaging market and, as a result, it is expected to grow at a CAGR of 5.59% between 2022 and 2027.

- The medical devices packaging market is likely to witness a mid-single digit growth rate because of the surge in demand for novel packaging solutions. This is due to an increase in manufacturing and improvements in the supply chains of medical devices globally.

- Rising environmental concerns coupled with increased focus on minimizing hospital-acquired infections (HAIs), as well as the need for sterile medical devices has led to the usage of innovative and eco-friendly packing solutions.

- Among all countries, India is likely to witness the highest absolute growth of close to 60% due to the sudden rise in demand for a wide range of medical devices among various healthcare facilities in the country.

- Covid-19 created significant growth opportunities for medical device manufacturers and has led to an increase in demand for medical applications packaging solutions.

Automotive & Transportation

- There is no doubt that this sector is the driving force behind SMT growth.

- Over the past 3 years, the A&T market has experienced in excess of 200% growth.

- It is estimated that 50% of the currently installed SMT lines are commissioned to support automotive customers.

- With increased focus on the electrification of vehicles, the demand for P&P gear will remain strong.

- R&D investments are focused on the miniaturization of boards and components in all sectors applying great pressure to P&P OEMs to develop technology that can accurately place components barely visible to the naked eye.

Telecommunications

- The telecommunication equipment segment is leading the SMT placement equipment market thanks to a growing demand of telecommunication systems, more intense competition within the market, and new product launches like 5G.

- Telecommunications is the most prominent industry in India.

Inspection Equipment

- The Global SMT Inspection Equipment market size was estimated at $915.2MM in 2021 and is projected to reach $1296.4MM by 2028, exhibiting a CAGR of 5.98% during the forecast period.

- Inspection market business growth is aligned with the macro-SMT market which is expecting to see strong growth over the next 2 quarters but may retract a bit in Q4 2022 or Q1 2023.

- The drop is considered “back to normal” provided the market does not experience another global crisis or economic recession.

- Many EMS factories have been transformed from manual inspection to auto inspection, moving into the direction of the smart factory concept.In SMT lines, factories of the future will continue to consist of the general process: Produce & Inspect.

- Inspection of PCBAs includes Solder Paste Inspection (SPI), Automated Optical Inspection (AOI), Automated X-Ray Inspection (AXI), and In-Circuit Test (ICT).

- Inspection will have an AI feature and auto judgment on the inspection of boards based on “big data information” from the daily production data collected.

- More factories will implement these AI inspection features to reduce staffing levels and address labor shortages.

- The rising adoption of automated inspection systems in the pharmaceutical and biotechnology industries, growth in the number of product recalls, an expanding number of inspection checkpoints throughout the production line, and technological advancements in inspection systems will support the markets growth.

- With the number of secondhand systems entering the used equipment market, and the growing demand for used and refurbished inspection systems to manage Capex budgets, the growth of new inspection investments will be restrained until the consumption of secondhand gear has been exhausted.

Drivers

- Growing number of regulatory mandates to maintain compliance with GMP in healthcare industry.

- Increasing adoption of automated inspection systems in the pharmaceutical sector.

- Rapid technological advancements in inspection systems.

Restraints

- Lack of access in emerging markets.

- Growing demand for used and refurbished inspection systems.

Opportunities

- Outsourcing of operations and the growing number of manufacturing facilities in emerging economies.

- Emergence of new application areas.

Challenges

- Complexities in integrating inspection machines into the SMT line.

Pricing

- Due to the market material shortages, there is no sign of recovery until at least the end of 2022, and the market will continue to experience price increases as a result.

- There are many variables impacting the cost of goods in today’s market:

- Standard shipment delays are causing suppliers to absorb expediting fees to meet customer demand.

- 3PL increasing their cost for standard shipping year-on-year by more than double.

- Salary costs of recruiting is higher than before, and inflation is impacting wages globally.

- Talent shortages are driving companies to hire employees at salaries well above the historical average.

- Electronics are set to get even more expensive as chip giants increase their prices. The world’s biggest foundries — including Taiwan Semiconductor Manufacturing Company, Samsung and Intel — are considering further price rises.

- Expect prices to rise between 10 and 15%, or roughly in line with inflation.

- Raw materials, like steel, are seeing price increases of more than 50% in some cases.

- Increases have already been passed on by many OEMs in the first half of CY2022. Subsequent increases on standard SMT equipment are forecasted in the range of 5 to 10% of the total machine cost within the next 3 to 6 months.

- Raw material price adjustment also attributed by foreign exchange as the USD has strengthened against other currencies by 10 to 20%.

- While the strengthening of USD will hurt those outside, those companies based within the US will improve their cash flow and their ability to invest more into production expansion and R&D.

- Most suppliers that support the SMT industry import their raw material from overseas and are experiencing high cost increases due to weakening currencies.

Supply

- Raw material is heavily constrained due to the Chinese lockdown and the conflict in Ukraine.

- The major component (IC) suppliers are from South Korea (Samsung) and Taiwan (TSMC).

- Equipment manufacturers must plan components (Controller card, mechanical part, etc.) 6 months in advance.

- Currently experiencing a sharp drop in semiconductor OEMs expanding production plants (Intel, Siltera, Analog Device, Micron) to support the market demand.

- Suppliers and customers will be negatively impacted by the global supply chain crisis.

- OEMs are exploring the opportunity to expand their production footprint, but many need time to build their factories and are concerned about scaling during uncertainty.

- An extension of the Chinese lockdowns to June FY22 will trigger further "move out from China" sentiment from the SMT segment.

- Mexico and South Asia are benefiting; however, they have almost reached capacity.

- Lead times are rising from 4 to 5 months or more in some instances.

- SPI lead-time has increased from 4 to 5 weeks to between 5 and 6 weeks.

Key Takeaways

- It is highly recommended to develop global and/or regional supplier strategies based on customer forecast and location of production.

- For spare parts that are currently constrained, consider qualifying alternative parts that are of the same quality and performance.

- Focus on asset utilization rates as a key metric within your operations.

- Idle gear may be utilized as a stop gap for the extended lead times currently in place.

- Develop relationships with distributors or auction houses who frequently come across available equipment at a fraction of the cost of new gear.

- The supplier, EMS & customer should have 3rd party collaboration to be successful.

- While winning more business is a great thing, so is managing expectations with the customer.

- As a rule of thumb, prepare for the worst and be pleasantly surprised when you exceed that expectation.

SOLDER

- Solder market has been very dynamic since the start of 2021. This industry has been affected by the turbulence in the metal’s market which is the main driver in the price of solder alloy. There are different types of solder depending on the application:

- 1. Solder Bar - Simply a formula of melted metals, principally tin, and the balance is between Silver, copper bismute and others.

- 2. Solder Paste - A mix of powder metal and flux.

- 3. Solder Wire - As the name says, is wire of different rolled alloys.

- 4. Solder Preform - Different forms customized for specific applications.

- The function of the diverse types of solder is the same, to ensure strong joints of varied materials. For the purpose of this edition, we will focus on the solder types used more so in the electronics industry such as bar, paste and wire.

- The solder market has been dynamic since 2021. This is due to the price and supply volatility of raw materials. Tin, silver, and copper have been impacted the most due to increased demand and the geopolitical issues we have faced since COVID started in 2020. The key factors plaguing the solder market are the raw material price variations, growth in emerging markets, and high demand from the current markets.

Market Dynamics

Demand

- The demand for solder has increased in almost every region due to the re-activation of the economy post-COVID. According to Grand View Research (GVR), the global solder market is expected to grow at a CAGR of 3.4%. This is due to the increased demand for consumer electronics, EVs and home appliances.

- The EV industry has taken a principal role driving the demand in the solder industry.

- All the principal automotive companies are developing aggressive programs and are increasingly focusing on the electrification of vehicles. Ford has announced a growth rate of 139%, VW 65%, and Tesla 81% in the production of EVs.

- This has modified the demand of components, chemicals, and solders tremendously. The high temperature environment found in EVs require solder with more flexibility and life as well as being resistant to cracking and voiding.

- Aside from the high demand of the EV industry, COVID has changed the way people live and work. The adaptation of employees working from home alongside increases in the Ecommerce, home appliance, and mobility sectors have triggered a higher demand for solder.

- Main alloys have increased their demand due to the continued growth of the industries and sectors. Special and high-tech applications demand the use of high silver solders putting SAC 305 as the most demanded solder in its different forms (BAR, PASTE, WIRE, Preform).

- SN100C has gained some interest in the market, and some studies have shown that this solder performs better under some applications. Many customers are cautious to make the change to SN100C despite it being cheaper and has satisfactory results on yield strength, vibration, and erosion. This solder continues as a cost-effective alternative to SAC 305 solder.

Supply

- Competition has become more aggressive, with new suppliers gaining a market share that was traditionally ignored by the top producers.

- Solder bar, which does not have as big of profit margin as wire and paste, is the primary area where market share is decentralized. New suppliers gravitate to the perceived simplicity of making bars and the well-known process to maintain the appropriate percentage purity.

- McDermid Alpha continues to be the leader in the segment and - after the acquisition of Kester in 2019 - has consolidated their position with an umbrella of products covering different industries and segments. (Solder, Chemicals, lubs).

- AIM, Indium, Senju, Nihon, and others are also focused on gaining market share. Invented and CRM are EU suppliers with aggressive strategies on the Americas.

- Recycling has also gained importance in the cost of the solder. Most of the tin suppliers and mines are based in APAC region. These are subject to several external factors like environmental restrictions, Covid-19, government tariffs, unions, and the high demand from China. This affects not only the availability, but also affects the pricing for the rest of the world.

- Suppliers have found a useful alternative in sourcing material through the solder scrap market. Further to that, modern technologies are allowing suppliers to recover pure metal - in some cases with less contamination - than the material processed from mines.

Pricing

- The price of the principal alloys continues to be dynamic and sensitive to market conditions, especially tin and silver. Due to high inflation, suppliers are increasing their prices from between 5 and 7% on the portion not related to metals.

- Tin continues to be the spoiled child of the metals market. Between 2021 and 2022, tin increased in price from $13/kg to $50/kg - reaching historical values in March of this year. The growing importance of tin across all industries maintained the metal at over $40/kg with no expectation that it will revert to the values held last year.

- In May, tin fell to $34/kg. Although this represents a welcome break, it is not expected to last more than one quarter.

- This is the result of the metal being highly manipulable due to supply and demand forces and the number of mines and the output has reduced. They are also mainly based in APAC.

- Prices are contingent on production reduction to balance the offer-demand, mostly now that operating rates from producers dropping by 4.72% recently. Expectations are that tin will stabilize between the $35/kg to $40/kg once China moves out of lockdown.

- Silver has maintained relatively stable conditions with movements under the historic margin. However, due to its high price, certain variables will significantly affect the closing price of the solders. The principal variable is geopolitical factors.

- The Russian-Ukraine conflict, and the sanctions imposed on Russia by the West, has investors behaving cautiously in relation to the dollar and other currencies.

- High inflation is forcing countries to increase interest rates as the US Federal Reserve did recently; adjusting from .5% to 1%, with an additional 0.75% expecting to close by June.

- All these actions are reducing the transaction and demand of the precious metal which has maintained low prices in May, around $22.06/OZ. However, prices could rebound in the next quarter once the Chinese lockdown ends, and the markets adapt to the new rates.

- Principal alloys have shown a decrease in the price strictly based on the metals. However, these reductions are not expected to be sustained for more than one quarter once the metal markets stabilize from the current situation.

- It is therefore sensible to monitor the raw materials indices daily.

- Hedge strategies continue to be a good option to reduce price variations, however executing hedges for more than one month is a risk. Most investors find themselves in a 'wait and see' position.

Supply Analysis

- With the current growth of the EV industry, solder companies are investing in modern technologies and products. Solders with better capabilities related to cracking and tensile strength in high temperature environments could be impacted the most.

- Regionalization of solder supply will be a key strategy to mitigate the risk of shortage. Other ways to mitigate supply constraints include adopting consignment, VMI, and buffer inventory models.

- The recent lockdowns in China affected the principal cities. Firstly, in Shenzhen and subsequently Shanghai. The Shenzhen lockdown was felt acutely by Alpha who own a large manufacturing plant in the city.

- Both lockdowns impacted on many suppliers and customers with communication from the Chinese authorities often unclear and subject to frequent change.

- A key lesson from these lockdowns is to source alternative supply locations or additional trade lanes with key suppliers to ensure more options to pull material.

- The COVID domino effect will continue to impact supply chains. It is recommended that you review your internal inventory levels and safety stock calculations to focus on customer priorities and the required material to facilitate production.

Key Takeaways

- Supply will continue to be at risk over the next three quarters. Review your inventory and safety stock calculations to protect supply.

- Follow the raw materials indices closely. Focus on the key raw materials for the solder you consume (predominately tin, silver and copper). Take a cautious position, and if you prefer to speculate on futures, be conservative.

- Invest in testing alternative alloys. SAC 305 is the most used alloy in the industry but consider SN100C if your buying position is weak – this will avoid shortages due to high demand.

- Identify your supplier’s manufacturing locations and develop sourcing strategies to improve supply lines. Consignment, VMI, and buffer inventories are good models to explore.

- Strengthen your relationships with key suppliers as well as locating alternative sources. It is a good time to forget about the name on the solder and focus more on the content and performance.

- Investigate solder recovery technologies. Using MS2 you can recover almost 60% of solder scrap material. This could bring improved commercial benefits and provide another option for supply.

MRO

Market Overview

- As we assess Maintenance, Repair and Operation (MRO) trends for 2022, data-driven technologies are poised to move to the forefront of optimization plans for the future, supported by the onset of 5G technology. MRO has long been an analog and manual process, even in throughout the digital age.

- MRO trends can apply to nearly any area of the factory - the breadth of which can make improvements seem overwhelming and difficult to manage.

- Data is at the heart of the digital revolution in MRO and facilities are beginning to see the benefits of sensors and smart equipment.

- North America and Europe are the most experienced markets with the highest penetration of global distributors.

- APAC and the Middle East and Africa (MEA) markets are showing medium and low maturity levels, respectively.

- The North American and European MRO markets possess high growth potential related to the adoption of modern business models, e-procurement, increased outsourcing levels and vendor consolidation.

Market Dynamics

- Most operations within plants require MRO products that are utilized during the production process, such as the consumables, equipment, cleaning, or office supplies. They then work alongside pumps, compressors, or valves, and maintenance tools such as lubricants, repair tools and gaskets.

- The global MRO market is expected to reach a value of US$ 626.2 billion by 2022, and US$ 747.7 billion by 2027, showing a CAGR of 2.7% during the period 2022 to 2027.

- Following the relaxation of Covid restrictions, MRO has experienced an increase in demand based on the electronic, medical, and aerospace industries.

- Demand in the global market is experiencing significant increases which is impacting on the availability of goods and leading to shortages and backlogs.

- The MRO market is being driven by technological advancements and increasing production processes in the various end-use industries.

- The rising costs within the MRO sector is forcing customers to reduce operational expenditure through implementing process efficiency measures. These improvements to the supply chain are likely to augment the MRO market throughout the forecast period.

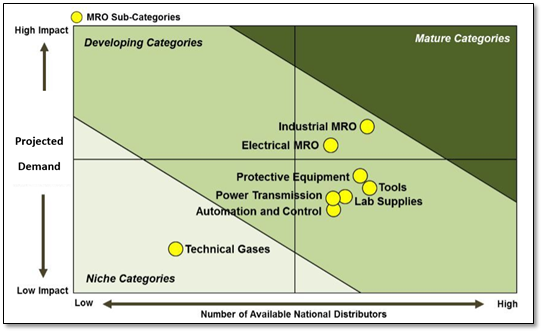

- The chart below shows the balance between the projected demand versus the availability of distributors in EU and Americas for top spend items:

**Graphic does not apply for Asia

- APAC has a significant share in the market and there has been considerable growth in the first half of 2022, pushing the region to step up their supply chain management.

Supplier Analysis

Americas

- Market conditions are strong and based on the high quantity of distributors and suppliers within the MRO portfolio.

- The leading MRO companies all have the ability to service multiple categories and should be part of your procurement strategy to develop supplier diversity. The key partners include:

- W.W. Grainger

- Amazon

- Fastenal Co.

- McMaster Carr

- MSC Industrial Supply

Europe

- Market conditions mean Europe remains one of the best options for market consolidation.

- Based on its geographical location, organizations have the opportunity to increase national suppliers, generate better stock, and lower pricing agreements on MRO consumption.

- Several key partners have invested in new technologies which will fortify their position in the MRO supply chain. They have also adopted a product development plan to enable market expansion. They include:

- Cromwell Group (Holdings) Ltd.

- Graco Inc.

- WABCO

- Mento AS

- Valeo Service U.K. Ltd.

Asia

- Although the market has several players and options for the same commodity it remains a challenge to contract a regional or country level supplier that can perform on a regular and stable basis.

- There are cost reduction opportunities on various commodities including tape, PPE, ESD cloth, gloves, clean room materials, uniforms, and general hardware but pricing can vary between localities

- APAC has a significant share in the market and there has been considerable growth in the first half of 2022, pushing the region to step up their supply chain management.

Supplier Analysis

- Although the market has several players and options for the same commodity it remains a challenge to contract a regional or country level supplier that can perform on a regular and stable basis.

- There are cost reduction opportunities on various commodities including tape, PPE, ESD cloth, gloves, clean room materials, uniforms, and general hardware but pricing can vary between localities

- There have been several issues impacting supply chains, including the well documented Covid-19 restrictions and the associated logistics constraints. Due to the uncertainty, companies are looking to nearshore supply and reduce their exposure to macro influences.

- Based on the general need to find local distributors and suppliers, it remains challenging to identify all of the key players, but they include:

- JD

- ZKH

- Hengdai

- Horb

- Karecin

Pricing

- A key area for cost control in the MRO space is preventive maintenance.

- Preventative maintenance helps to generate the best pre-negotiated rates for repairs and spare parts.

- Technological innovations require employees to upskill and are therefore driving an increase in salary expectation.

- The data and technology-driven tools have generated a new group of skilled workers that are able to implement, service, and make use of sensors and other cutting-edge equipment.

- As the skills gap and labor shortage continue to present difficulties, many manufacturers have drawn upon turn-key workforce solutions to meet their requirements.

- Correct estimation for minimum stock levels and alternate parts development are key to driving efficiency.

- MRO spend should sit between the 5 to 10% of the overall annual budget.

- Segmentation and prioritization of inventories to prevent the accumulation of idle stocks will drive efficiency and will help the company plan effectively.

- Invest in CMMS or EAM software to help manage MRO data in an “on time” environment.

- These solutions will help avoid unnecessary purchases and will improve smart order pricing by:

- Centralizing data management

- Increase supply chain visibility

- Providing real-time insights on the utilization of MRO supplies

- To control costs and inventory levels, it is recommended that organizations should:

- Identify substitutes and second source for MRO items across the enterprise by reducing multiple source purchases and unnecessary stock of similar supplies.

- Generate larger discounts based on increased demand by purchasing MRO items in bulk. This will also decrease logistics costs by reducing the number of shipments required.

- Choosing the right supplier will also help reduce supply risks and improve inventory management with the adoption of a VMI strategy.

Supply Analysis

- MRO process mapping must continue to evolve with the industry.

- MRO planning should be further integrated and considered as a critical supply chain area.

- When MRO is not properly managed or planned, the organization will end up with higher Total Cost of Ownership (TCO) for critical parts.

- Key ideas to consider are:

- Inventory accuracy is critical to ensure unnecessary items are not allocated on company books.

- Maintaining days-on-hand below 30 is optimal for most industries – with the exception of long lead time items or items moving through conflict zones.

- Reduce the ratio of “urgent” orders to planned orders from around 1:8 to 1:10.

- Stock Outs should be maintained at less than 1% on a daily or weekly basis.

- Place focus on preventive maintenance including:

- Maintenance carried out per manufacturer recommendations.

- Having parts stored in inventory for when a system requires repair.

- This could result in benefits across the board - from pricing to turnaround time. It also allows purchasing managers to identify efficiencies in supplier selection and ordering.

- The COVID-19 pandemic continues to create unpredictability in the supply chain, exposing flexibility deficits when shortages and shipping disruptions occur. The need for innovation and agility in procurement and sourcing remains critical.

- Lead times have increased significantly across all of the major regions:

- Lead times have increased from between 8 to 12 weeks to 20 weeks and beyond.

- Many external variables such as electronics shortages, logistics issues, lack of containers, sea traffic, and an increase in demand are the key drivers impacting the current lead times.

- China has self-imposed supply issues due to the closure of Tier 1 cities - Shanghai and Shenzhen - in response to COVID outbreaks, and the lack of fluidity to neighboring provinces.

- Europe is experiencing supply challenges due the Russian invasion of Ukraine, with transit restrictions by air and ground.

Key Takeaways

- Buyers must consider the global environment when planning the purchase of key items.

- It is critical to observe and evaluate both the logistics cost and transit time to ensure the correct TCO.

- It is important to continue to analyze spend related to maintenance and repair for improved planning and tracking of spend.

- Inventory management and a well-planned safety stock are key to avoiding an increased carrying cost or shortages on critical parts.

- This will also help to reduce the cost of transportation.

- Establish agreements for preventive maintenance including spare part packages.

- Develop internal training solutions for machine repairs.

- Building maintenance should also be considered as a critical spend as it drives higher costs if not properly forecast.

- Specialized activities are highly recommended - or obligated because of insurance regulations - to be performed by contractors or 3rd parties.

- Having hourly rates and programmed maintenance negotiated in front will drive the best commercial outcomes.

- MRO is constantly changing and is one of the most dynamic categories in the industry. With this in mind, MRO should be considered as an opportunity for the continuous development of alternative products, suppliers, and process changes. As long as MRO has the appropriate importance within your organization, from the development of budgets through to implementation, you will be well positioned to react to new and evolving issues whilst ensuring the maximum output of your production.

Back to Top