By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q1 2024

Jabil's Global Category Intelligence Archive

Q1 2024

CONTINGENT LABOR:

AMERICAS

MARKET OVERVIEW

-

According to JP Morgan’s Global Manufacturing Purchasing Managers’ Index (produced by S&P Global), the overall global PMI ended at 48.8 in October 2023, down slightly from 49.20 at the end of September. New order intakes continued to fall, albeit at a sharper pace. Annualized global GDP growth was stalled at 0.1%, below the rolling pre-pandemic 10-year average of 3.0%. Global manufacturing production fell for the fifth straight month, at a sharper rate at the start of October, given the effect of higher interest rates and worsening global economic conditions.

-

Some good news was found around the slowing of price increases, which have been trending at their lowest pace since December 2020. The services sector showed growth activity but at a slower pace in recent months.

-

In North America, employers are still experiencing very tight labor markets. However, manufacturing employment fell by 35,000 jobs in October. Most of these losses came from motor vehicle and auto parts sectors, likely due to strikes ending in early November. Other sectors, such as warehousing and storage, fell significantly as a percentage of total employment.

DEMAND COMMENTARY

-

United States: The November 2023 PMI ended at 49.4, the lowest level in the last three months but still close to the summertime outlook. Renewed softness in new orders led to slowdowns in the manufacturing sector. Forecasts for the year ahead remained cautious and relatively flat.

-

The U.S. Bureau of Labor Statistics’ core inflation rate (excluding food and energy) fell to 4.0%, the lowest rate since October 2021, but in line with market expectations given the frequent interest rate hikes aimed at easing demand to lower the price hikes. Global expectations call for the core rate to fall below 4.0% by the end of 2023 and to trend around 2.70% into 2024.

-

The U.S. unemployment rate ended at 3.9% in October, up 0.4% since July, marking the highest jobless rate since January 2022. The Philadelphia Federal Reserve forecasts a higher overall unemployment rate into 2024, up to about 4.2% in Q4.

-

Overall temporary staffing revenue fell 10% year over year in October, an increase of 3% from the July year-over-year decline of 7%. Firms noted that demand for workers slowed down dramatically, sometimes by 40%. Fewer reported difficulty attracting talent at 14%, although attrition remained high.

-

Temporary staffing hours have decreased by 11% yearly as of October 2023.

-

There were 627,000 manufacturing job openings in September 2023.

-

By 2030, Deloitte predicts the U.S. will need over 4 million jobs in manufacturing, with over 2.1 million going unfilled, potentially costing over USD 1 Trillion in lost productivity in 2030 alone.

-

According to the International Monetary Fund’s Bureau of Economic Analysis, manufacturing in the United States, on its own, would be the world’s eighth largest economy, with only seven nations having GDP higher than the estimated USD 2.5 trillion in value added (in 2021).

-

U.S. affiliates of foreign multinational enterprises employed more than 2.8 million manufacturing workers in the United States in 2021, or roughly 22.8% of total employment in the sector.

-

-

Canada: Canada’s manufacturing PMI closed at 47.7 in November 2023, down from 48.6 in October, and posted the seventh consecutive drop in output. While new orders declined, factories focused on clearing out backlogs, leading to a slight increase in output for July. The increase was tied to higher production from higher staffing levels in factories. There is a continued drop in new orders, meaning the growth may primarily be due to clearing backlogs.

-

The longer-term PMI is forecast to trend to around 55 in 2024, even while general business confidence was positive but moving more toward a conservative utlook.

-

The unemployment rate rose to 5.8% in November, its highest rate since January 2022.

-

Demand for temporary workers increased by 40% in 2023 across Canada, particularly in manufacturing, hospitals, and nursing sectors.

-

-

Brazil: Brazil’s PMI has been slowly rising to 49.4 in November 2023, up from 48.6 in October, after slightly crossing the neutral point of 50 in August. Production and new order declines softened in November, while job creation rates rose to their highest in a year.

-

There is optimism moving into 2024 that manufacturing orders will rebound and push the PMI above 55.

-

Brazil’s inflation rate has fallen and ended at 4.82% in October, up from 3.99% in July 2023. Brazil’s economy remains one of the highest in actual inflation rates globally.

-

Brazil’s overall employment topped 100.2 million persons in October 2023, the highest ever recorded.

-

SUPPLY COMMENTARY

-

United States:

-

There are nearly 13 million manufacturing workers (temporary and full-time roles) in the United States as of October 2023, down 35,000 from September but still the highest amount since November 2008 (National Association of Manufacturers).

-

Much of the supply benchmarks and statistics for U.S. temporary labor growth hit high marks during the pandemic due to the significant shift to e-commerce; given those benchmarks are now used for current comparisons, real potential growth opportunities in the near term are centered on increased manufacturing construction in the U.S., spurred on by U.S. Government grants around increasing onshore production of semiconductors and other high tech strategic components. Current manufacturing production rates in the U.S. are at their highest point since 1964.

-

Component manufacturing relies heavily on long shifts and weekend hours, further challenging an already strained market for available light industrial talent.

-

-

Most manufacturing firms in the U.S. are considered small, having fewer than 500 employees. Still, according to the U.S. Census Bureau, there were 239,524 manufacturing firms, with all but 4,000 considered small. However, 58.4% of all manufacturing jobs are in large firms.

-

While a global recession seems less likely now, persistent wage growth is causing companies to re-evaluate their staffing strategies.

-

Artificial intelligence (AI) is being used more quickly to identify candidates with specific skills to fill open roles. While wages continue to grow, the growth is not as fast as during 2021 and 2022.

-

Recruiters are focusing more on a skills-first mentality than just searching for job titles.

-

-

-

Canada: There are approximately 2.9 million ‘industrial workers’ in Canada, including manufacturing and goods-producing industries (Randstad.ca).

-

The number of jobs in this sector has not grown in five years. However, it has not shrunk either.

-

1.7 million (44%) of these jobs are in manufacturing.

-

One-fifth of these manufacturing workers are over 55 years old, while 22% are under 24; this may create issues shortly if more is not done to attract younger workers as older ones exit the labor force.

-

Companies struggle to find enough workers, with many still turning to the TFW (Temporary Foreign Worker) programs for help.

-

The labor market is so tight that the federal government is introducing a two-year measure that will allow family members of current foreign national workers to apply for work permits in 2023. This program used to be only for those in high-skilled roles but is also being opened up to lower-stream wage roles.

-

Manufacturing companies can hire up to 30% of their workforce via TFWP for up to two years.

-

-

92% of employers say they face challenges hiring skilled talent; 40% say they will increase starting salaries in 2024 to attract and retain more highly skilled workers.

-

-

Brazil: Unemployment fell to an 8.5-year low at 7.7% at the end of September 2023.

-

Overall, Brazil’s labor force participation rate has remained relatively consistent, at nearly 61.6% for all of 2023 thus far. Relatively low historic unemployment figures are keeping the availability of labor tight. Economists expect the unemployment rate to rise to about 9.5% during 2024.

-

Brazil’s temporary worker labor laws are like what Mexico has in place today. Temporary labor was not allowed if it was core to a company’s main line of business, but ancillary roles (such as accounting, finance, and back office) were approved.

-

-

-

-

However, in August 2018, outsourcing roles core to a company’s core business became legal. The typical temporary employment agreement is for a 180-day duration and can be extended a further 90 days. For example, most temporary workers are brought in to replace a full-time employee who may be on a leave of absence.

-

-

“Informal Jobs,” a term used to describe temporary work/contract work, comprise 39.2% of the total workforce in Brazil, down from 39% in the first quarter of 2023, as more people take up full-time employment as companies look to lock down top performers and those with more experience.

-

PRICING SITUATION

-

United States: Average hourly earnings in 2023 have grown at an average of 4.4% yearly.

-

According to Indeed’s Wage Tracker, overall posted job wages were up 4.2% in a year in October 2023, compared to a 9.3% increase year over year peak in January 2022. Forecasts believe wage growth will fall back to a pre-pandemic pace before the summer of 2024.

-

Many large metro markets are challenged to attract and maintain production workers where the wage gap between hourly pay and a minimum cost of living wage for one adult with a child can be as much as USD 8 per hour.

-

Manufacturing wages averaged USD 26.47 per hour in July 2023, up from USD 26.33 in June 2023.

-

Gross margins for the largest staffing firms in the U.S. averaged 27.9% in 2022. Splitting out professional roles, the average gross margin for commercial parts averaged 17.5%

-

In 2023, average gross margins are falling 21 basis points from 2022 to reflect a bit of a fallback post the pandemic recovery, after historic increases given historically tight supply amid rising demand.

-

-

-

Average hourly earnings in 2023 have grown each month at an annual average of 4.4% year over year.

-

According to Indeed’s Wage Tracker, overall posted job wages were up 4.2% in a year in October 2023, compared to a 9.3% increase year over year peak in January 2022. Forecasts believe wage growth will fall back to a pre-pandemic pace before the summer of 2024.

-

Many large metro markets are challenged to attract and maintain production workers where the wage gap between hourly pay and a minimum cost of living wage for one adult with a child can be as much as USD 8 per hour.

-

Manufacturing wages averaged USD 26.47 per hour in July 2023, up from USD 26.33 in June 2023.

-

Gross margins for the largest staffing firms in the U.S. averaged 27.9% in 2022. Splitting out professional roles, the average gross margin for commercial parts averaged 17.5%

-

In 2023, average gross margins are falling 21 basis points from 2022 to reflect a bit of a fallback post the pandemic recovery, after historic increases given historically tight supply amid rising demand.

-

-

Canada:

-

Overall annual hourly wages were USD 34.28 in November 2023, up 4.8% year over year.

-

Average hourly wages in manufacturing were CDN 31.24 (USD 23.00) (about CDN 64,000 per year/USD 47,000) in 2023.

-

Beginning on January 1, 2024, companies who utilize temporary workers must now review their temporary foreign worker’s wages annually to ensure they reflect increases to prevailing rates in their appropriate sector and region of the country.

-

More experienced workers can make over USD 120,338 CDN annually; Operators average CDN 39,000 CDN, and Installers average CDN 48,750.

-

Overall, average minimum wages are expected to reach around CDN 16.65 by November 2023.

-

-

Brazil: The average salary of a person working in a factory in Brazil in 2023 is approximately BRL 5,850 per month (USD 1,168), including housing, transport, and other benefits.

-

According to salaryexplorer.com, the monthly pay range for factory and manufacturing roles is between BRL 3,820 and BRL 14,700, depending on tenure and position (USD 763 to USD 2,936).

-

The average wage, not including benefits, housing, and transport, was BRL 2,768 (USD 565) in June 2023, up 6.7% year over year.

-

Annually, wages have risen 3.9%, with an increase of 1.7% quarter on quarter in Q3 2023.

-

APAC

MARKET OVERVIEW

-

In November 2023, the Asian manufacturing Purchasing Managers’ Index (PMI) was 50.3%, the same as the previous month, and it was more than 50% for 11 consecutive months. The manufacturing industry in Asia did not fluctuate much from the previous month and has maintained a relatively stable growth trend.

-

India's economic growth remains strong, with a PMI in expansion territory for the 29th straight month.

-

Availability of contingent labor in Asia markets eased a bit more in Q3 2023 as softness in demand and new orders has allowed a bit of a recovery.

-

Countries that rely on importing foreign workers have widened the gap between approved allocations and actual fill rates, indicating enough supply.

-

2023 has also seen a global explosion in interest in artificial intelligence (AI) and machine learning (ML), with manufacturers, engineers, and the world’s biggest hard goods providers launching use cases for applying AI and ML on the factory floor. Many of the advancements will likely change future labor demand dynamics.

DEMAND COMMENTARY

-

China: In November 2023, China's PMI stood at 49.3, as reported by the National Bureau of Statistics of China. This figure reflects a marginal decrease of 0.1 points compared to the previous month, suggesting a slight easing in the overall prosperity of the manufacturing industry. Additionally, it falls below economists' anticipated expectations of 49.7.

-

From the perspective of enterprise size, the PMI of large enterprises was 50.5 points lower than last month, which continued to be higher than the critical point. The PMI of the ZTE Corporation was 48.8 points higher than last month, which was lower than the critical point, and the PMI of small enterprises was 47.8 points lower than last month, which was lower than the critical point.

-

From the perspective of sub-indexes, in the five sub-indexes that constitute the manufacturing PMI, the production index and supplier distribution time index are higher than the critical point, and the new order index, raw material inventory index, and employment index are lower than the critical point. In addition, China's November non-manufacturing PMI fell 0.4 points from the previous month to 50.2, and the November composite PMI output index fell 0.3 points from the previous month to 50.4.

-

The national urban unemployment rate in September was 5.0%, down 0.2 percentage points from the previous month and down for two consecutive months. In economic data released by China's National Bureau of Statistics, the national urban unemployment rate in September fell from 5.2% in August, and the average surveyed urban unemployment rate in the first three quarters of this year was 5.3%.

-

Economic growth slowed sharply last year due to strict quarantine controls, and unemployment, which peaked at 6.1%, has fallen to its lowest level since November 2021, according to the National Bureau of Statistics of China

-

Unofficial data showing weakness in China's Labor market contrasts sharply with the steady employment picture painted by official employment data and could dent confidence in the world's second-largest economy.

-

According to Bloomberg, while China's official surveyed urban unemployment rate remained at 5% in October, unchanged from the previous month, unofficial data tells a different story. China's job market worsened in the third quarter of this year, and the weakness extended into October and November, while consumer confidence remained low and companies' paychecks for new hires fell.

-

According to Zhi Lian recruitment network data, the 0.5% drop in assessed wages in major Chinese cities in the third quarter is the first time since 2016 that wages have fallen for two consecutive quarters.

-

Entry-level wages in high-tech manufacturing and information technology sectors are also falling, according to the BBD economic Index, down 3.2% from a year earlier to RMB 10,000 in October.

-

This past summer, the publication of official data on unemployment rates covering all age groups, including youth unemployment, was halted. Furthermore, the central bank has not updated its quarterly survey of employment prospects since June and has not explained this suspension.

-

Malaysia: Malaysia’s manufacturing PMI ended at 47.8 in November 2023, the 15th straight month of contraction.

-

Global demand for Malaysian manufactured goods in the first 10 months remains subdued with export orders declining 8% compared with last year.

-

Forecasters expect Malaysia’s PMI to hover around 49 throughout 2024, still in contraction.

-

According to the latest report of the World Bank, Malaysia's economic growth forecast for this year has been lowered to 3% from 4.3% previously, mainly due to the impact of the global economic slowdown, especially the reduction in external demand.

-

Singapore: Manufacturing PMI rose 0.1 to 50.2 in October from 50.1 in September. It was the second month of expansion in the manufacturing sector after six straight months of contraction. The manufacturing PMI was 49.9 in August, but the electronics sector remained in contraction. Due to weak external demand, the manufacturing sector may continue to face pressure until early next year

-

Both the unemployment rate and the long-term unemployment rate have improved this year. Among them, the PMET unemployment rate fell from 2.6% last year to 2.4% this year; Non-PMET unemployment fell from 4.4% last year to 3.6% this year. The long-term unemployment rate also fell from 0.5% to 0.4% for the PMET and 0.7% to 0.5% for the non-PMET.

-

India: India’s Manufacturing PMI ended November at 56, and although that is a bit lower than the last three months, the country remains one of the very few in expansion mode. November’s index represented India’s 29th straight month of factory expansion.

-

The Indian government released data on November 30 that the real gross domestic product (GDP) growth rate in July and September 2023 was 7.6%, which exceeded the forecasts of the Reserve Bank of India (central bank)

-

Vietnam: Vietnam’s Manufacturing PMI ended at 47.1 in November, the 3rd consecutive month below 50.

-

From the perspective of export growth, the General Bureau of Statistics of Vietnam shows that exports in the first nine months of 2023 were close to 260 billion USD, down more than 8% from the same period in 2022.

-

Although the outlook for Vietnam in 2024 is brighter, there are still certain export risks. Vietnam’s higher degree of economic openness also means it is more dependent on exports. If the economic recovery of major export markets such as the United States, Europe, and China is less than expected, it will greatly affect Vietnam's export growth.

SUPPLY COMMENTARY

-

Malaysia: About 30% of Malaysia’s workforce comprises foreign workers, with about 7.25 million persons compared to 16.5 million Malaysian citizens.

-

Unemployment was 3.4% in Oct 2023, which remained the same as last two months, according to the Department of Statistics, Malaysia.

-

The labor force participation rate remained at 70% in October 2023, unchanged month over month, indicating steady employment, even with reduced demand for manufacturing contingent labor.

-

Recruiting foreign workers remains a key element of continuing and ensuring the growth of electronics manufacturing. However, some companies have put a hold on bringing in additional foreign workers during the downturn in demand.

-

Typically, quotas issued by the government to recruit foreign workers are good for up to two years, so firms may have to request new allocation approvals from the government if they do not use their full allocation, depending on the timing of any recovery and output increase.

-

Companies that utilize foreign worker schemes have focused more on vetting the agencies' RBA compliance, particularly their in-country agents who recruit new workers. Increasing reliance on foreign workers can bring risks around compliance if the full supply chain is not fully investigated, rather than just on the receiving supplier.

-

Singapore: The Ministry of Manpower's quarterly Labor Market Report released on 26 October estimates show that the total number of employed people in Singapore increased by 24,000 in the third quarter, and the number of employed people has risen for eight consecutive quarters.

-

Unemployment remains at historic lows. In Q2, about 3,200 persons were laid off (‘retrenched’), increasing to about 4,100,

-

The Ministry of Manpower plans to lower the quota of foreign workers in the manufacturing sector from 20% of the workforce to 15%, beginning in 2023, to focus on higher-skilled roles and industries being attracted to Singapore.

-

India: India’s relatively strong economic outlook bodes well for employment for a younger generation as private investment in new manufacturing capacity will open new opportunities, even while the rest of the world contracts a bit.

-

The reality of underemployment for India’s youth remains, even as manufacturing output is outpacing the rates of the rest of the world in Q3 2023.

-

India has overtaken China as the world's most populous country, with 53% of the population under 30. However, tens of millions of unemployed individuals continue inhibiting the country’s potential economic growth.

-

Unemployment rose to a two-year high of 10.09% in October, according to the Centre for Monitoring Indian Economy. By comparison, other large global economies are experiencing unemployment between 2 and 4%.

-

India’s labor force participation rate hovers about 48%, whereas in other global economies, that figure is north of 60-70% on average.

-

In the near-term, India is facing difficult headwinds around the current and future supply of workers. According to the Centre for Monitoring the Indian Economy, a substantial portion of India's younger working-age population is opting to stay students as the existing workforce progressively grows older. In 2016-17, 42% of the workforce was in their 40s and 50s; by 2019-20, this had risen to 51%; and by 2021-22, their proportion had increased to 57%.

-

Educational qualification has also been declining recently, with 12.2% of the population being graduates or post-graduates, down from 13.4% in 2018.

-

According to World Bank and the International Labor Organization data, the unemployment rate for 15–24-year-olds in India reached 23% in 2022. Official figures for India this year put the unemployment among educated youth at 18% or 24 million people.

-

Vietnam: In January 2020, Vietnam had a workforce totaling about 56 million. In July 2023, that number had fallen to 51.3 million.

-

In the third quarter of 2023, Vietnam's labor force aged 15 and above was estimated at 52.4 million, an increase of 92,600 compared to the previous quarter and 546,000 compared to the same period last year.

-

In the first nine months of 2023, the labor force aged 15 and above reached 52.3 million, an increase of 760,000 over the same period last year.

-

An estimated 51.3 million workers were employed in the third quarter of 2023, an increase of 87,400 compared to the previous quarter and an increase of 523,600 compared to the same period last year. In the first nine months of 2023, 776,000 more workers were employed than in the same period the previous year.

-

The working-age unemployment rate in the third quarter of 2023 was 2.3%, unchanged from the previous quarter and 0.02% higher than last year.

-

In June 2021, the Government of Vietnam issued “Decree 57,” which offers corporate tax incentives (CIT Incentives) that give full exemptions for four years, a 50% reduction for nine years, and a 10% preferential tax rate on the first 15 years on income coming from the project. Electronics manufacturing is one of those industries that can use the incentives.

-

Malaysia: The minimum wage increased to 1500 MYR per month in May 2022. However, they have not increased in a year as of May 2023. Companies with less than five staff members will also now increase their minimum monthly salary to 1500 MYR as of 1 July 2023.

-

The average salary of a factory worker in Malaysia is around 24,820 MYR (USD 5,330) in 2023.

-

It remains to be seen what effect the decrease in maximum weekly hours worked from 48 to 45 may have on the need for shift work to hire additional resources to cover the reduction. However, depending on the number of foreign workers a company needs, it may be significant.

-

-

In addition to hourly wages, extra expenses would be recognized around recruiting, travel, training, housing, food, and wellness. Overall hours worked are increasing in 2023 to above 30 hours per week as the country fully emerges and recovers from COVID-era pullbacks in hours worked.

-

Singapore: The Ministry of Manpower released the Labor Force 2023 Report (30 November), which estimates that the nominal income of resident (citizen and PR) employees this year is higher than last year, with the median monthly nominal income increasing by 2.5% from USD 5,070 to 5,197.

-

On average, salaries typically increase by about 9% every 15 months in manufacturing within Singapore.

-

India: The minimum wage of 178 INR per day (USD 2.23) has not increased since 2018; however, the forecasted “India National Floor Level Minimum Wage” is expected to hit 185 INR per day in 2023 and 190 INR per day in 2024. There is no country-level minimum wage requirement, but it can be set by each state or even industry sector.

-

The average wage of a manufacturing worker per month is INR 21,800 (USD 273), with a low of INR 8080 (USD 101) to a high of INR 54,600 (USD 685). This is about 32% lower than other jobs in India.

-

The average hourly wage of a factory worker is INR 130 (USD 1.63).

-

Recent pricing proposals for managing contingent work in India have seen monthly management fees averaging about 800 INR per head per month (USD 9.68), ranging from INR 500 to 1,194 (USD 6.05 to 14.45).

-

Vietnam: Vietnam remains an attractive country for manufacturing in terms of labor costs when compared to China and other countries in Asia

-

In the first nine months of 2023, the average monthly wage was USD 288 (VND 7,000,000), a year-on-year increase of 6.8%, equivalent to an increase of USD 18.61 (VND 451,000) over the same period last year.

-

For comparison, China’s monthly wage is about USD 1,150 (VND 26,993,375). Low-skilled/entry level is about USD 229 monthly (VND 5,375,202).

-

Despite the lower cost, Vietnam has 14 times fewer workers than China.

-

Depending on the region, minimum wages increased on July 1, 2022, approximately 6% overall.

EUROPE

MARKET OVERVIEW

-

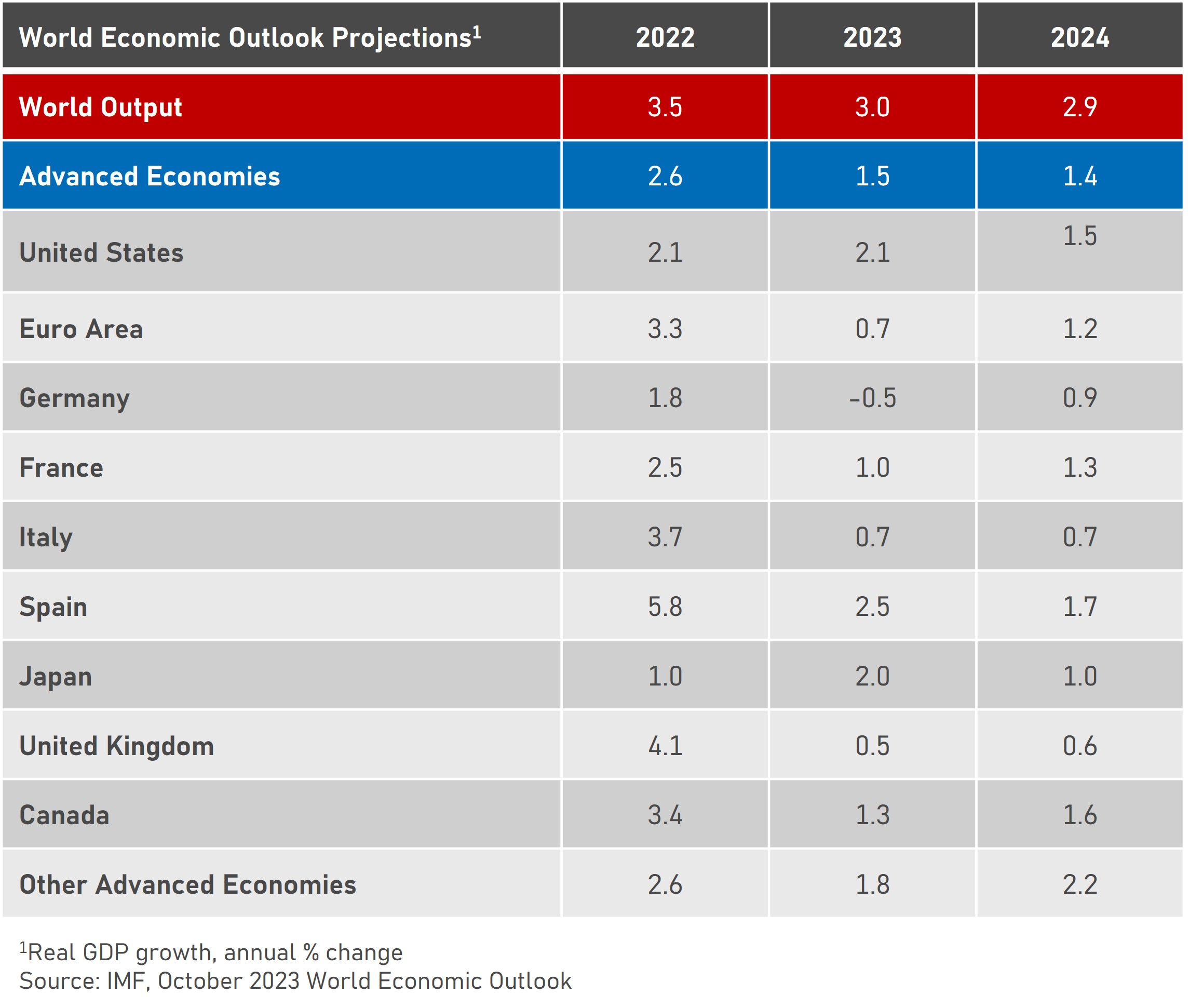

In October 2023, at the International Monetary Fund’s Budapest Economic Forum, Laura Papi, Deputy Director of the IMF’s European Department, noted that the IMF now expects Europe to achieve overall 2023 growth at 1.3%, compared with the post-pandemic 2.7% growth in 2022.

-

As inflation overall continued to moderate across the region, a result of tightening monetary policy, an easing of supply chain restraints, and easing commodity prices, real wages were able to improve slightly. In April 2023, the World Economic Outlook forecasted the 2023 growth in the Euro Area aggregated GDP at 0.8%. The belief is now that most of the economies in the region will avoid recession, instead seeing a soft landing during the ease in inflationary pressure.

-

Countries that rely more heavily on energy-intensive manufacturing have not fared as well as the regional average, including Germany and Hungary.

-

Continued low unemployment in most advanced and rising economies has resulted in a caution around wage spiraling as countries continue to play catch-up from historical inflation rates regarding wage improvements.

-

The IMF has slightly raised their 2024 Euro Area GDP growth forecast from the July publication. Germany’s expected retraction increased from -0.3 to -0.5 in 2023, as has their 2024 ‘recovery’ from 1.3 to 0.9. Availability of temporary labor across the EU remains tight, as described in a few country highlights below.

DEMAND COMMENTARY

-

Switzerland: In October 2023, the Credit Suisse Manufacturing PMI index fell further to 40.6 after increasing to near 45 the prior two months and just off July’s 38.5, which was a 14-year low. Production output has continued contraction and sluggishness, and new orders have declined.

-

The overall outlook on Switzerland’s economy remains subdued, primarily due to challenges in Germany and China, two of its more significant trading partners.

-

The inflation rate moderated in the fall of 2023, hovering between 1.6-1.7% from May through October. Excluding food and energy, the core rate increased slightly to 1.5% from 1.3% in September.

-

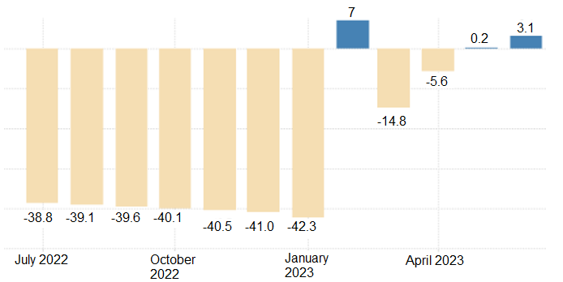

According to swissstaffing.com, in October 2023, the year-over-year statistics for temporary labor show sharp declines for key indicators, with a drop of 7.6%. A slowing economy, particularly in manufacturing, has led to the decline despite a historic shortage of available workers. Forty-three percent of staffing firm CEOs express negative sentiment regarding near-term business improvement, while only 23% expect business to improve.

-

Temporary market working hours declined 7% year over year in Q3.

-

Demand for permanent staffing has increased 6.8% year over year, continuing the trend toward trying to keep workers by offering full-time work and benefits, compared to the more flexible temporary alternatives.

-

-

Germany: Germany’s manufacturing PMI climbed to 42.3 in November, marking an increase over 40.8 in October, reflecting a bit more optimism than the 38.3 2023 bottom in July. New orders continued downward but fell at a softer rate than over the summer.

-

Job losses in manufacturing fell sharpest in 3 years, coinciding with the softness in the sector.

-

-

-

Inflation fell another 0.7% in October, down to 3.8% year-on-year and significantly lower than rates above 7% six months prior. Economists predict a steep drop in 2024, with rates expected to hover around 2.4-2.2%.

-

With expected flat to negative GDP growth in 2023, economists predict a 5% decline in temporary employment activities. Through September, the reduction in temporary employment is down 4.7% year over year, or down 34,000 people.

-

-

Hungary: After starting 2023 with PMI hovering around 55, it increased to 61.9 in April 2023. However, after April, the regional and global economic challenges appeared to reduce optimism in Hungary, with the PMI falling to 44.60 in June and ending July at 45.72 or in the expected range of contraction. The index rose again to slight expansion/positive territory, finishing at 50.5 in October, the first increase in 5 months.

-

New orders increased by almost 10%, with purchase and production indexes rising by 11.2 and 2.2%, respectively.

-

Also adding to renewed optimism, the overall inflation rate in October fell to 9.9%, the lowest level in over 18 months, and down from the 27-year high of 25.6% and less than market expectations of 10.4%. Based on global macroeconomic indicators and pressures, forecasters expect a steady drop into 2024, dropping to a bit over 4.0% toward the end of 2024.

-

Demand for temporary workers remains robust despite the softness, mainly due to the severe shortage of workers and fierce competition to attract and retain those looking for a role in manufacturing. Particularly challenged areas include the western side of the country.

-

Hungary’s government investment in industry declined 12% year over year, except in the manufacturing sector, where they increased investment by over 6%, in line with the rising optimism of the industry in the country. (source: https://www.ksh.hu/gyorstajekoztatok/ber/ber2309.html)

-

-

Ukraine: According to the National Bank of Ukraine, unemployment is estimated to be about 18.5% in October, down from 20% in July 2023. There are regional disparities because of the war, and the number will struggle to fall as migrants start to return from abroad.

-

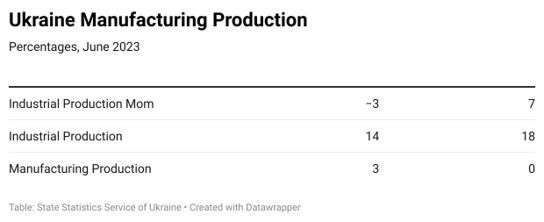

Manufacturing production increased by 3.10% year over year in June 2023, the most recent available month of data. (source: State Statistics Service of Ukraine)

-

-

While many other countries in the EU are extending temporary protection status to Ukrainian residents until March 2024 (and is expected to be extended until March 2025) to continue helping with their labor shortages and to provide haven, warehouse and factory workers, remain in the top 10 of needed roles within the country.

-

Overall business sentiment declined to 49.6, indicating more pessimism than optimism caused by the ongoing military actions, the logistical/supply chain challenges the war creates, and the labor shortage.

SUPPLY COMMENTARY

-

Switzerland: Over 400,000 people are affected by the provisions of the collective bargaining agreement on staff leasing. It is the largest in Switzerland, so the recent four-year extension sets a framework for steady growth. Supply, however, is still a challenge as more people are converted to full-time employment, widening the availability gap.

-

Participating in the collective employment contract ensures temp workers have uniformity on minimum wage, holiday and overtime pay, and pension fund rules. Union members also have generous daily sickness benefit options and training opportunities.

-

Currently, the aging worker demographic shows Switzerland losing thousands of workers annually, leading to challenges in replacing them.

-

Adding to the supply challenges, when permanent workers go on strike, it is a criminal offense to supply temporary agency workers to cover the duties of striking workers. This regulation has gone back and forth in Parliament for years, but as of 10 August 2023, it has again become illegal. (source: globalcompliancenews.com 2023 19 July)

-

-

Germany: According to Germany’s Federal Employment Agency, Germany’s overall unemployment rate stood at 5.7% in October 2023, up 0.4% year over year.

-

Despite the overall softness in the economy, according to Bundesbank.DE, access to skilled workers remains widespread in 2023, with half of all firms surveyed reporting challenges in retaining or recruiting skilled labor. They do not expect the shortage to ease for the remainder of 2023.

-

There are approximately 684,000 in temporary roles as of September 2023, down 5.7% in a year; the overall number of actual employment rose, however, indicating a continuing trend in Europe to convert temp workers into full-time roles in a tight, skilled labor market.

-

These figures include overall temporary labor across sectors. In manufacturing, the decline in orders has generally reduced the need for temporary workers. According to Eurostat, the job vacancy rate in manufacturing was 2.60% in September, down from a record of 3.2% in late 2022.

-

Germany is already a market that doesn’t use a lot of temp labor (about 1.7% of the workforce on average, compared to about 3% for France, the UK, and the Netherlands), so a slowdown in demand won’t necessarily open a lot of available temp labor supply.

-

Among those aged 15-29 (not participating in formal education), about 17% work via temporary contracts.

-

-

-

Hungary: Hungary’s unemployment rose to 4.3% in October, above the 3.9% rate in July. Overall total employment increased, however, but it takes people an average of 9 months to a year to find permanent work (not counting underemployment).

-

In 2023, the average number of temporary to permanent conversions will climb to over 43%. In late 2020, that figure was just 33.2%, indicating more employers were converting temp workers to retain talent during the post-COVID rebound.

-

-

-

As the country continues to struggle to fill all roles, the Hungarian Parliament created a new category of worker, “Guest Workers,” which allow foreigners to apply to work in Hungary for greater than 90 days and up to two years; stipulations do not allow these workers to bring their dependents, and the permits may only be sponsored by companies deemed by Parliament to be “strategic” and subject to annual quotas. Not all nationalities are eligible, and the goal is to support Hungary’s temporary workforce needs. The law takes effect from 1 November 2023.

-

-

Ukraine: Since the beginning of the conflict with Russia, the Ukrainian State Statistics Service has not published official unemployment data. Independent research agency Info Sapiens makes their estimates, indicating a decrease in job-seeking activity among those looking for a job is much lower than a baseline of 2021, by about 25%.

-

The number has been declining since May 2023, while total job openings have started to rise again after weeks of decline in October 2023, widening the gap between demand and supply.

-

Supply of available and willing labor is not expected to improve significantly until situations around the invasion subside.

PRICING SITUATION

-

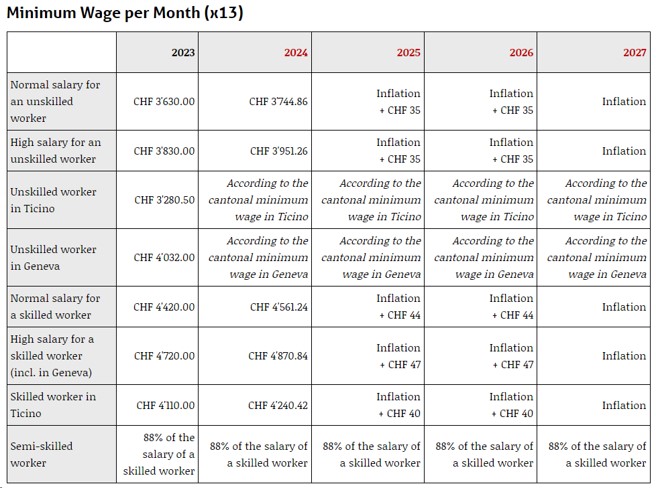

Switzerland: In November 2023, Unia and Syna, Staff Leasing Unions, signed a new collective bargaining agreement that applies automatic inflation compensation increases to minimum wages, beginning in 2024. It increases the current minimum wage by 3.2%

The CBA breaks out the minimum wage per month for a 13-month annual pay cycle based on the following skills, region, and year (source: swisstaffing.ch)

-

Germany: According to salaryexpert.com, the 2023 average annual base wage in manufacturing in Germany is 33,060 EUR (USD 34,800) for roles as machinists, assembly line workers, demand planners, and factory workers.

-

The average range for factory salaries is between 27k EUR (1-3 years of experience) and 39,281 EUR (8+ years of experience)

-

Negotiated wages are expected to increase 4.5-4.7% in 2024 and 2025, with gross wage increases expected to average around 6.0% in 2024 and 5.2% for the overall labor market.

-

The German consumer price inflation rate was confirmed at 3.8% year-on-year in October 2023, easing sharply from the previous month’s 4.5%.

-

In early 2023, trade unions representing temporary workers negotiated increases for about 816,000 workers in specific pay groups from April 2023 to January 2024. The pay increases will amount to approximately 13.07% for pay groups 3 and 4 and about 9% for wage group 9.

-

-

Hungary:

-

Average salaries increased 14.1% year over year in September 2023.

-

The average monthly salary for a factory worker in Hungary is 344,000 HUF (821 EUR/819 USD), about 45% above the current minimum salary of 232,000 HUF implemented in January 2023.

-

Those who remain in factory jobs for more than two years can expect to make about 32% more than first- and second-year employees. This is a primary reason why temporary workers are in such demand: to allow for the flexibility of turnover and lower overall average wages paid; however, there is a trade-off on experience, depending on the role being performed.

-

-

The country is averaging a labor force participation rate of 75.3%, higher than their historical average of around 64%, further demonstrating that the supply is tight with real wage pressure brought on by demand and inflation, even in a contracting market.

-

Ukraine:

-

As of October 2023, the average hourly wage is 65 UAH, while the national minimum wage is UAH 40.46 per hour/ UAH 6,700.00 per month, on a maximum 40-hour work week. (USD 1.10 per hour/ USD 181.39 per month). These figures are essentially unchanged from 2022.

-

Average annual wage growth entering 2022 was about 18%, with estimates for Q1 and Q2 of 2023 hovering around 8%.

-

A sample of factory and warehouse-type available jobs (Loaders, Pickers, Truck Drivers) in November 2023 list wages of between 20,000 and 25,000 UAH per month (USD 550-700).

-

Back to Top