By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q1 2024

Jabil's Global Category Intelligence Archive

Q1 2024

CAPEX, MRO, INFRASTRUCTURE

Automation

MARKET OVERVIEW

- Global automation investment remained high in 2023, but the momentum is expected to decrease in 2024 due to an anticipated slowdown in the global economy.

- The adoption of cloud computing, 5G mobile networks, machine vision, and Artificial Intelligence (AI) is gaining momentum in global automation.

- Global commodity prices are trending down due to tightening monetary policy and softening demand.

- Automation parts lead time improves due to supply chain constraints easing and declining order intake.

DEMAND COMMENTARY

- Robot installations globally are growing by 7% and are expected to reach the 600,000-unit mark by the end of 2023, with almost four million industrial robots operating worldwide.

- While 2023 was characterized by a slowdown in global economic growth, robot installations in 2024 are not expected to follow this pattern. Robot demand is still at a higher level than it was before COVID-19.

- While the expected global economic slowdown may impact robot installations in 2024, growth rates will likely accelerate slightly in 2025 and more strongly in 2026.

- There is no indication that the long-term growth trend will end soon. Rather, the contrary will be the case. The mark of 600,000 units installed yearly worldwide is expected to be reached in 2024, and the 700,000-unit mark will be smashed in 2026.

- The North American market is expected to grow by 7% annually, factoring in inflation and tighter monetary policies.

- The high probability of a recession dampens medium-term perspectives for the European market.

- The Asian market will remain strong. Robot demand in China will continue to grow from a very high level at high single-digit rates. Robot installations in Japan will slightly accelerate in 2024 and grow at high single-digit rates. Medium single-digit growth rates are expected for the Korean market.

- The electronics industry is a major customer of robotics, followed by the automotive industry. The electronics industry was the largest customer of robots, a position it gained in 2020 and has maintained since. The automotive sector followed suit with 25% of installations (+3 percentage points), growing in both the car manufacturer and the parts supplier segment.

- Technological Trends

- Cloud computing and 5G mobile networks: a trend to shift to new business models with optimized performance and fully digitalized production.

- Machine vision: With simplified programming, more and more vision systems are used to detect shapes and guide grippers in complex environments for quality inspection and precise assembly positioning.

- Artificial intelligence coming to market: Al will continue to feed long-term demand for robotics and automation in manufacturing and logistics and the need to make this automation smarter, faster, more efficient, and, importantly, more accessible. Enhancing maintenance, faster programming, learning by experience, and supporting sustainability.

- Handling is the most important application, with a 48% share, followed by Welding and Assembly process.

SUPPLY COMMENTARY

- Global constraints in the automation supply chain are alleviating, with supply chain disruptions, input shortages, and various local or regional challenges still posing hurdles to project completion, albeit to a lesser extent than in the previous year.

- Inflation remains high, contributing to a slowdown of global economic growth, a continuing orders backlog from 2022, and a declining intake in 2023.

- Reconsideration of supply chains and closeness to customers: re- and near-shoring production will lead to regionalization of automation investment.

- Labor scarcity in many developed economies is driving the demand for automation:

- By 2040, Japan could see a deficit of over 11 million workers, driven by the rising average age of its population.

- Similar forecasts in the U.S. suggest more than 2.1 million manufacturing jobs will be unfilled by 2030.

- Earlier this past year, more than half of Germany's companies struggled to fill vacancies due to a lack of skilled workers.

- As well as losing key skills, those available for work increasingly reject intensive manual jobs. For many companies, there is an urgent need to bridge these labor gaps with automation.

SUPPLIER SPOTLIGHT

Emerson Electric Company (EMR) completes its acquisition of National Instruments (NI), advancing global automation leadership.

- EMR announced its acquisition of NI on 11 October 2023, a leading provider of software-connected automated test and measurement systems, at an equity value of USD 8.2 billion.

- The acquisition of NI advances EMR’s position as a global automation leader and expands its opportunity to capitalize on key trends like nearshoring, digital transformation, sustainability, and decarbonization.

- NI brings a portfolio of software, control, and intelligent devices expected to accelerate EMR’s revenue growth aligned to its 4-7% through the cycle organic growth target. NI increases EMR's End Market exposure in discrete markets will be EMR’s second largest industry segment, with approximately 20% of sales in software. NI also increases exposure to high-growth industrial software markets. The acquisition expands the company’s gross profit, with further adjusted EBITDA margin expansion opportunities as EMR delivers an expected USD 165 million of cost synergy opportunities by the end of year five through the application of best practices.

Rockwell Automation completes acquisition of autonomous robotics leader Clearpath Robotics and its industrial offering OTTO Motors.

- Rockwell Automation, Inc., the world’s largest company dedicated to industrial automation and digital transformation, announced it completed its acquisition of Ontario, Canada-based Clearpath Robotics Inc., a leader in autonomous robotics, including autonomous mobile robots (AMRs) for industrial applications on 2 October 2023.

- According to Interact Analysis, the market for AMRs in manufacturing is expected to grow about 30% per year over the next five years, with an estimated market size of USD 6.2 billion by 2027. This acquisition is expected to contribute a percentage point to Rockwell’s revenue growth for fiscal year 2024

Dürr Group completes acquisition of automation specialist BBS Automation on 31 August 2023.

- The acquisition of BBS Automation is part of the expansion Dürr is pursuing in the growth segment of automation technology.

- BBS Automation is targeting sales of around EUR 300 million in 2023. For 2026, sales of between EUR 400 million and EUR 450 million and an EBITDA margin of 13 to 15% are expected.

- This means the acquisition aligns with the Dürr Group’s growth and earnings targets. The enterprise value of BBS Automation is between EUR 440 million and EUR 480 million and depends on the development of results in 2023.

PRICING COMMENTARY

- Global commodity prices were reduced due to tightened monetary policy.

- The U.S. Federal Reserve (FED) seeks to achieve maximum employment and inflation at 2% over the long run. In support of these goals, the FED decided to maintain the target range for the U.S. federal funds rate at 5 1/4 to 5 1/2%, reflecting policymakers' dual focus on returning inflation to the 2% target while avoiding excessive monetary tightening.

- This interest rate is at a 22-year high and is acting to suppress inflation. Global commodity prices like steel and copper have been flat over the last 12 months, along with weak market demand and severe supply competition, which will drive a downtrend in automation part costs.

- Steel and copper are primary raw material inputs in many types of automation parts; changes in steel and copper prices can affect prices for automation parts.

- Copper price is at the same level over the past 12 months

- Copper is estimated to be ~5% of the total robot cost

-

- Steel price is at the same level over the past 12 months.

- Steel is estimated to be ~10% of the total robot cost

- The automation part price is on a downtrend due to softened market demand and sufficient supply capacity.

- Steel price is at the same level over the past 12 months.

AUTOMATION - SUPPLY ANALYSIS

- The automation industry supply continues returning to normal with increased capacity and shortened lead time.

- Lead time continues to improve:

- Industrial PC/PLC lead time is eight to 12 weeks,

- Robot lead time is eight to 12 weeks,

- Motion parts lead time of six to eight weeks,

- Vision system lead time is around eight weeks.

- For priority cases, lead time can be improved to four to six weeks.

- Lead time continues to improve:

- Most automation suppliers report sufficient production capacity due to declining in-take orders, and backlogs were cleared up.

SUPPLIER SPOTLIGHT

- Keyence has steadily grown since 1974 to become an innovative leader in developing and manufacturing industrial automation and inspection equipment worldwide. Keyence products include code readers, laser markers, machine vision systems, measuring systems, microscopes, sensors, and static eliminators.

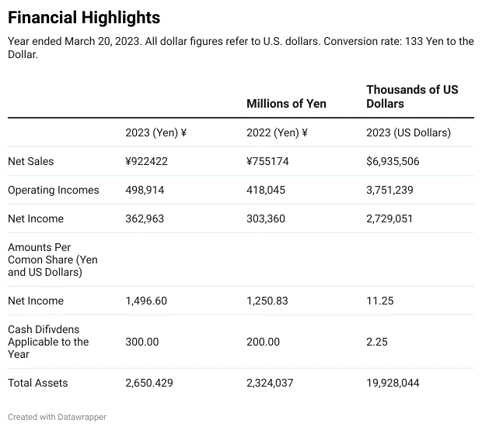

- Keyence reported record sales of USD 6.9 billion for FY23, with an operating income of USD 3.7 billion and a net income of USD 2.7 billion.

- In FY23, despite indications of vulnerability in certain sectors, the global economy has sustained its moderate recovery trajectory.

- Both consumption and capital investment in the United States have gradually expanded, while certain Asian regions have displayed economic weaknesses.

- Europe has maintained robust capital investment; in Japan, capital investment has continued its recovery trend.

AUTOMATION – KEY TAKEAWAYS

- Global automation investment is high in 2023 but may reduce in 2024.

- Global commodity prices remain flat, and automation part prices are trending downward.

- Lead time for obtaining or manufacturing components related to automation has been normalized or reduced. The normalization is attributed to increased overall capacity for producing or supplying these automation parts. Essentially, there is now more capability or resources available, leading to a more efficient and timely procurement or production process for automation components.

Warehouse Automation

MARKET OVERVIEW

- Most activities within warehousing are related to order picking, constituting 55% of the total. In contrast, the receiving process, which involves the intake of goods or materials, accounts for only 10% of the overall warehousing activities.

- Eighty percent of the activities are non-value-added actions generated by walking, writing, searching, etc. This area is the most labor-intensive part of warehousing and is ideal for automation, but it requires complex analysis and stable and predictable planning processes.

- Over the last five to six years, there has been a noticeable increase in the automation of warehousing activities. The focus has shifted towards efficient warehousing and logistics solutions. The scarcity of human resources has created a demand for processes that require less human assistance, with robotic systems proving advantageous as they are independent of labor market conditions and capable of operating 24/7.

- While in the past five to 10 years, everyone focused on automation of manufacturing during COVID, we could see significant technology advancements and the introduction of innovative solutions in warehousing, too. This untouched area provides a huge opportunity for key market players and smaller companies. The consolidated market is dominated by one to five players, but the other edge of the scale with the fragmented demand shows high competition without dominating players.

- In the past, the market had been represented by key players such as Jungheinrich, Kion Group AG, Honeywell Integrated, SSI Schafer AG, Swisslog Holding AG, and Daifuku Co. Ltd. Still, the pool in this segment has been extended with newcomers like ABB Limited, Kiva Systems (Amazon Robotics LLC), Fanuc Corporation, Toshiba Corporation, etc.

DEMAND COMMENTARY

- Currently available technologies can ensure an almost complete end-to-end automation of the order fulfillment process. Improvements in robot technology are rapidly filling in the remaining gaps.

- Most of the key global players in the market can cover almost the whole portfolio by themselves or by collaborating with other specialist subcontractors. With that advantage at the service level, there is a gap between them and smaller local or regional competitors.

- We can see increasing awareness of the optimization of used space in warehouses, so different racking systems will also be focused on in the coming years. According to the newest forecasts, the global racking system market size is expected to reach approximately USD 13.5 billion in nine-to-10 years. As of today, it moves around USD 9-9.5 billion, and the predicted Compound Annual Growth Rate (CAGR) is roughly 4%.

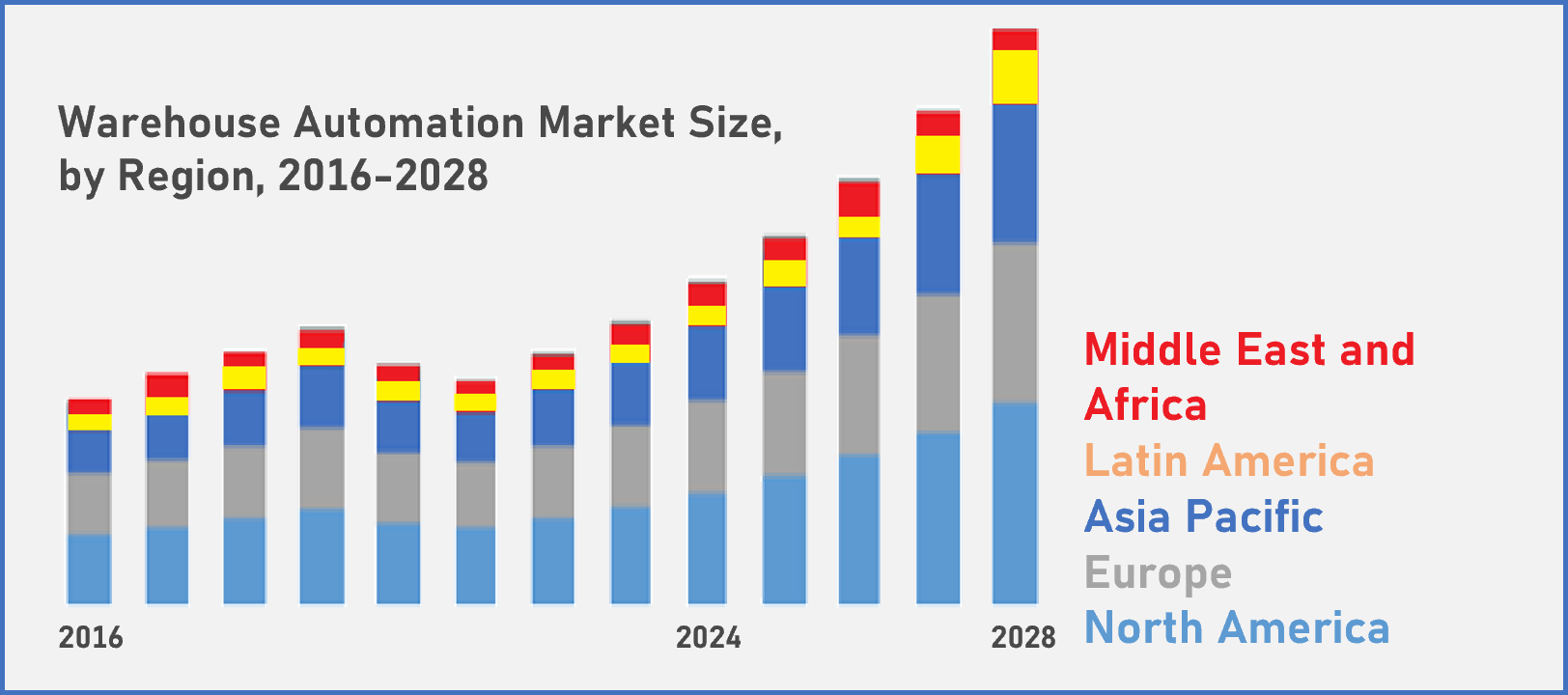

- The global warehouse automation systems market was valued at USD 14 billion in 2022 and is expected to reach USD 22 billion by the end of the calendar year 2023. Based on the newest projections, this opportunity will be worth approximately USD 41 billion by 2027 and, with a minor slowdown, could further increase up to USD 47 billion by 2028, at a CAGR of roughly 16%.

- Key segments are represented by:

- Racking systems, including the Automated Storage and Retrieval System (AS/RS), are software-controlled storage systems that help increase the efficiency of storing and retrieving warehouse materials. We can see a forecasted 11% CAGR in the next five years. The current market size is valued at USD 16.25 billion and is predicted to be USD 27.5 billion by 2028.

- Robotics in warehousing has a massive CAGR of approximately 17.5%. In the next five years, we can see an attractive market increase of up to roughly USD 15 billion while the current size moves around USD 6.5- 6.7 billion and Packing segments, even these mature segments recording the lowest vendor growth (sub 3% CAGR)

- Picking Robotics vendors' growth is higher, at around 25% CAGR.

- AGV/AMR represents a solid market with its 11.5% CAGR, but it is forecasted as an attractive market increase up to approximately USD 18.5 billion by 2028.

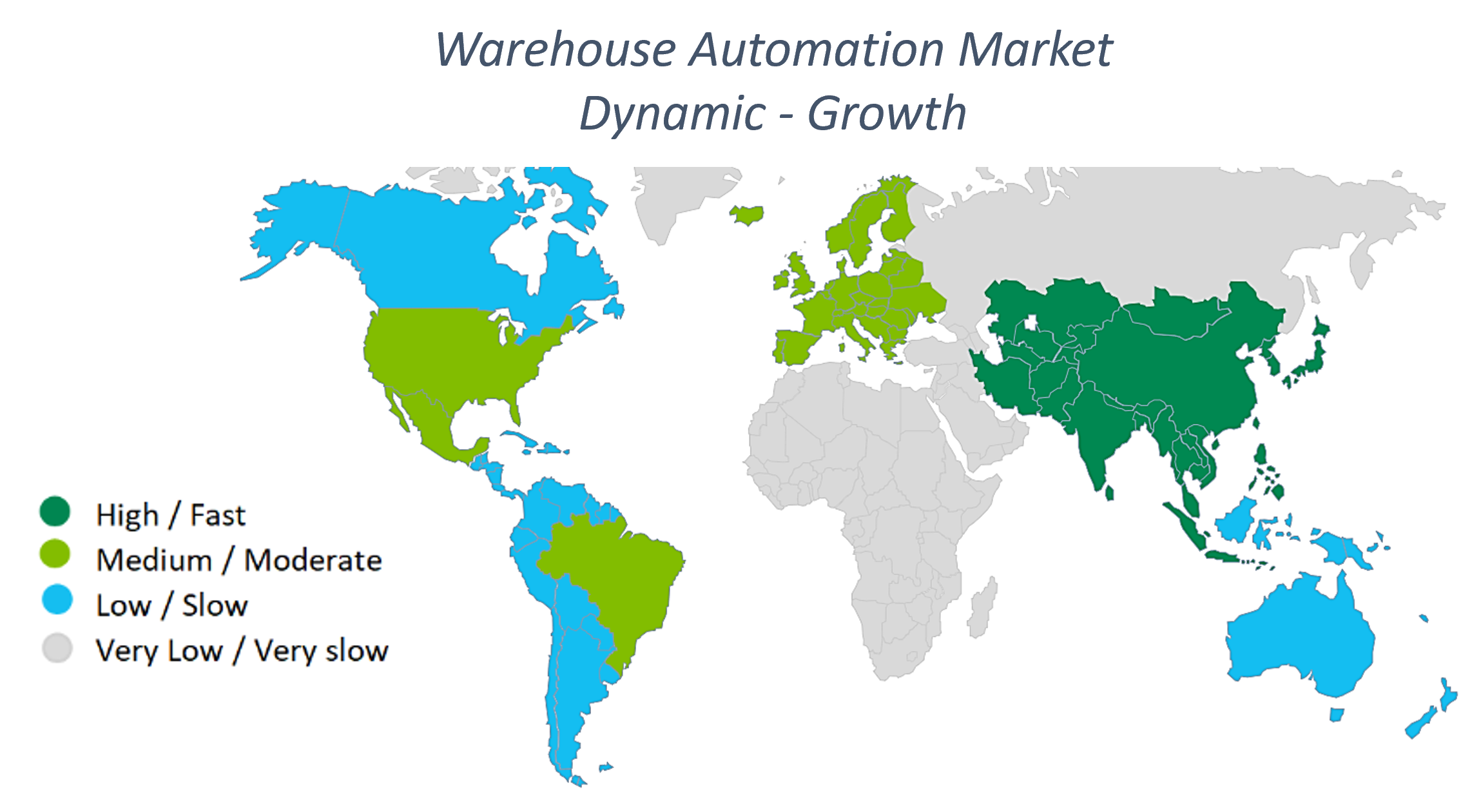

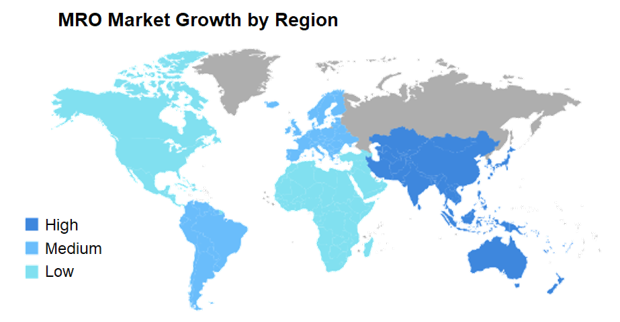

- APAC, with China, Vietnam, and Malaysia, still presents an increase in investments. The main advantage of this region is that key suppliers’ local representation offers automation solutions, so installation and maintenance are fully covered at low cost. This market is proactive and hungry for improvements and is expanding significantly.

- As of this writing, the APAC region owns the largest market share in the Warehouse Robotics market and is predicted to grow fastest among the regions in the next three to five years. South Korea and Japan are very strong in offering solutions; China is eager to adopt new technologies.

- It is important to highlight that companies in this region have challenges finding experienced employees; however, the work culture supports quick implementation and fast learning of new solutions.

- Jabil has strong representation in Malaysia and Vietnam; based on our experience and the market studies, the size of the Warehouse Automation market could reach USD 10.5-10.75 billion this year and could grow at a CAGR of 17.25% to reach USD 23.75-24 billion by 2028.

- Despite the interest of most European countries in efficient solutions, the market is still silent in this area. Germany, the Netherlands, and countries with key logistics hubs are more active when discussing new systems and warehouses.

- The market size in Europe is estimated at around USD 3.75 billion and can grow to USD 7.25 billion in the next five years, so a growing CAGR of 14.5% is forecast for the same period.

- EMEA is struggling with labor shortages. But even when companies have enough employees, wages are not competitive with APAC or LATAM. The growing number of warehouses generates automation-related requirements in almost all the main countries. However, while automation seems beneficial, the available solutions are very expensive, so without having a strong business case, most companies in EMEA are rejecting automation.

- Currently, more than 20% of warehouses in the United States use automated warehousing equipment and systems. This is a slightly higher ratio than the warehouses in Europe, which account for 15%. Due to lower interest, prices are high and constant in both regions.

- Adoption in the rest of the Americas is slower, and we have not heard of major improvements from Africa and Russia.

SUPPLY COMMENTARY

- We can record more than 700 companies operating in the warehouse automation space worldwide. It is challenging to select the right partner to work with, covering more specific areas:

- Approximately 200 on Automated Guided Vehicles/Autonomous Mobile Robots (AGV/AMR)

- Approximately 90 on Material handling solutions

- Approximately 80 on AS/RS

- Approximately 50 on Warehouse Management systems

- Approximately 40 on Navigation and Robotic software

- Approximately 30 on Automatic Identification and Data Capture as well as on Machine Vision, Imaging, and Wireless Tech

- Approximately 20 both on Micro fulfillment and Piece Picking robots

- Approximately 10 Warehouse drones

- The supply base is diversified, and the market lacks key partners who can cover all hardware-related requirements. Major companies can offer end-to-end solutions, but we still can see more regional and less global coverage.

- Unpredictable demand and a lack of transparency and collaboration within the supply chain present significant barriers to reaching business goals for many manufacturers.

- Lead time in the APAC region is acceptable and meets investors’ targets. However, in the EMEA and Americas, it is still difficult to negotiate good lead time for different automation solutions.

SPOTLIGHT – SAFETY IN AUTOMATED WAREHOUSES

- As mentioned earlier, warehouse robots and special automation are becoming increasingly popular. These new solutions help solve complex, time-consuming, and low-value-added activities and problems and offer a helping hand on labor market-generated challenges. Most of those tasks are difficult, repetitive, and sometimes dangerous. It is important to think about what kind of activities robots could take over while keeping the human workforce in a safe environment.

No one would like to be hit by a forklift in a warehouse, would not like to get injured by fast-moving AGVs, not to mention the effects of an X-ray that counts components with high accuracy. If people don’t feel safe, they will leave their employers, which could destroy the well-balanced automated warehouse implementation.

- First and most important is planning. As in many other areas, we should dedicate enough time to the first step of PDCA (Planning before Do, Check, and Act). Implementation must be prepared with appropriate precautions to avoid injuries caused by robots or automated systems. During the design phase, developers have to focus on security, too. To be efficient and to get the right system, it is necessary to map possible risks and to identify various sources of the danger. With proper Failure Mode and Effects Analysis (FMEA), most potential future accidents can be reduced to a minimum; in the best case, we can eliminate them all.

- Warehouse staff must also be trained, rules must be communicated clearly, settings must be kept in line with the manuals, and installation must be completed safely. On the other hand, it is very important to keep robots, equipment, and all the systems in good condition, maintained frequently according to the regulations

- Critical considerations on what could cause huge safety risks in automated warehouses:

- Racking Systems:

- Improper calculation on ground load-collapsing system.

- Gaps in floor flatness – semi-automated or automated forklifts can hit and destroy the system.

- Missing fall-out protection – semi-automated systems.

- Forklifts:

- Not controlled speed – unauthorized access to setups.

- Forgetting about the pedestrian safety system.

- Not taking care of fleet management software (detecting risks in time).

- Not thinking about Autostop in case of an accident.

- AGV:

- Not controlled speed – unauthorized access to setups.

- Forgetting about the pedestrian safety system.

- VLM, other automated equipment:

- LOTO (Lock Out-Tag Out) during maintenance.

- Dedicated area for employees:

- Forgetting about separated and controlled areas within the warehouse.

- Racking Systems:

- Robots hand over a huge load from human resources – since these devices can lift several tons and handle materials in closed systems with high speed and accuracy. In addition, they can work safely with substances that are dangerous to humans so that they can be used effectively in chemical plants, for example. We can find more collaborative robots (“cobots”) that stop working if a human enters the collaborative scope. They can automatically work next to people, avoid them while moving, lift heavier objects from high shelves, and select workpieces according to given parameters with incredible speed. However, these solutions are more common, and we still have a gap in what we have to manage on other solutions. Pedestrian safety is one of these specialized on forklifts.

- Pedestrian safety systems focus on the following:

- Pedestrian detection: Vehicle to Pedestrian.

- Collision warning: Vehicle to Vehicle.

- Proximity and speed detection: Zoning of speed and activities.

- Key Suppliers on the market for forklift pedestrian safety:

- Siewo

- Trio Mobil

- SIERA AI

- ELOKon

- Zone Safe

- Of course, main forklift providers have built-in solutions, but when we plan any improvement related to the current fleet, we can find systems and tools we can implement or install later.

PRICING SITUATION

- Negotiation power varies by region. In APAC, the power lies on the buyer’s side: the price and payment terms are easily negotiable. In EMEA, an Americas buyer’s ability to impact prices, terms, or payment conditions is weak, but we can report a slight increase in the past months.

- Suppliers are more open-minded regarding combined payment conditions; they can accept long-term, closed-ended leases (three to five years) that replace one-time investments. In that way, cash flow management can be improved on the Investors’ side.

- A typical high-volume operations warehouse-related ROI expectation is 18 to 48 months. Still, it depends on selected solutions and the complexity of the manual warehouse, which is transformed into an automated one.

- Investing into an AS/RS can save 60-80% of the utilized shopfloor area (depending on building conditions, height, etc.) and cut the labor cost by 50%.

- Fluctuation in foreign exchange (mainly in the EMEA region) makes the market prices unpredictable.

- The interest in automation and dedication toward change is high. Still, as mentioned earlier, only approximately 20% of the warehouses are automated today, so this outlines a long runway for the automation markets to grow fast.

- ROI calculations are key criteria in warehouse automation. The ROI keeps improving as the cost of the manually trained labor force is increasing.

KEY TAKEAWAY

- Our recommendation for developing an Approved Vendor List (AVL) has no major change. Working with multiple partners helps requesters maintain commercial competitiveness, access to supply, and overall leverage. An AVL could bring another benefit for the companies: the maintenance, software upgrades, and system integration to current systems will be smoother after time and improving or extending automated solutions.

- Drawing from experience, numerous companies express interest in automation; however, many lack precise specifications regarding their desired outcomes. Before reaching out to potential partners, ensure the stability of your planning, the robustness of your current processes, and your readiness for change management-related demands.

- Without investing time in data collection and analysis, the automation project could fail. Design should be managed with the involvement of the supplier. Based on their feedback, you should be able to present a flexible Statement of Work (SOW) to optimize outcomes.

- Given the differences in buildings, stored materials, warehouse space, and layout, there is no universally applicable solution. Warehouse automation demands personalized, tailor-fit solutions. Reiterating the earlier point, distinguishing between the current and future states is crucial!

- We can see minor improvements in suppliers’ response time and lead time, but it is still slower than pre-COVID times.

- Automated storage and retrieval systems (AS/RS) and Conveyor systems are still the most beneficial in warehouse applications.

- The need for efficient and effective warehouse automation solutions is still increasing. The maintenance background could appear challenging, and spare parts and skilled technicians must be available in all regions.

- The forecasted savings from reduced warehouse footprints can be up to 85%, and reductions in operational costs can be up to 65%.

Surface Mount Technology

MARKET OVERVIEW

- The global Surface Mount Technology (SMT) equipment market has witnessed steady growth in recent years and is anticipated to maintain a positive progression until 2030.

- One notable trend within the SMT Equipment market is the growing preference for sustainable and eco-friendly products.

- Another significant trend in the SMT Equipment market is the escalating integration of technology to enhance product quality and efficiency.

- Cutting-edge technologies like artificial intelligence (AI), machine learning, and blockchain are being leveraged to develop innovative products that outperform traditional alternatives in effectiveness and efficiency.

- The global economy appears to be losing momentum towards the end of 2023. Inflation remains stubbornly high, and labor markets are showing signs of cooling. The banking crisis also continues to impact the economy, leading to tighter lending, which will affect not only ongoing operations but also the ability of businesses to invest. At the same time, China's reopening has given its economy a good start, and some indicators point to solid underlying strength in both the United States and Europe.

- The SMT Equipment Market size is estimated to grow at a Compound Annual Growth Rate (CAGR) of 7.72% between 2023 and 2028. The market size is forecast to increase by USD 2,548.05 million. The market's growth depends on several factors, including the miniaturization of components, rising use of IoT devices and wearable technologies, rising wireless communications, and increasing use of 3G, 4G, and 5G networks. SMT is a method where the electrical components are fitted directly onto the surface of a printed circuit board (PCB). An electrical component mounted in such a manner is known as a surface-mount device (SMD).

- This SMT equipment market report extensively covers market segmentation by end-user (telecommunication, consumer electronics, aerospace, and defense, automotive, and others), type (placement equipment, inspection equipment, soldering equipment, screen printing equipment, and others), and geography (APAC, North America, Europe, Middle East and Africa, and South America). It also includes an in-depth analysis of drivers, trends, and challenges. Furthermore, the report consists of historic market data from 2018 to 2022.

- SMT Equipment Market Overview: The market size was valued at USD 6.5 billion in 2022 and is projected to grow from USD 7.1 Billion in 2023 to USD 14.7 Billion by 2032, exhibiting a CAGR of 9.5% during the forecasted period (2023-2032).

- Increased demand for miniature consumer electronics products and those highly used in home projects are the key market drivers enhancing the market growth.

- SMT equipment components insights:

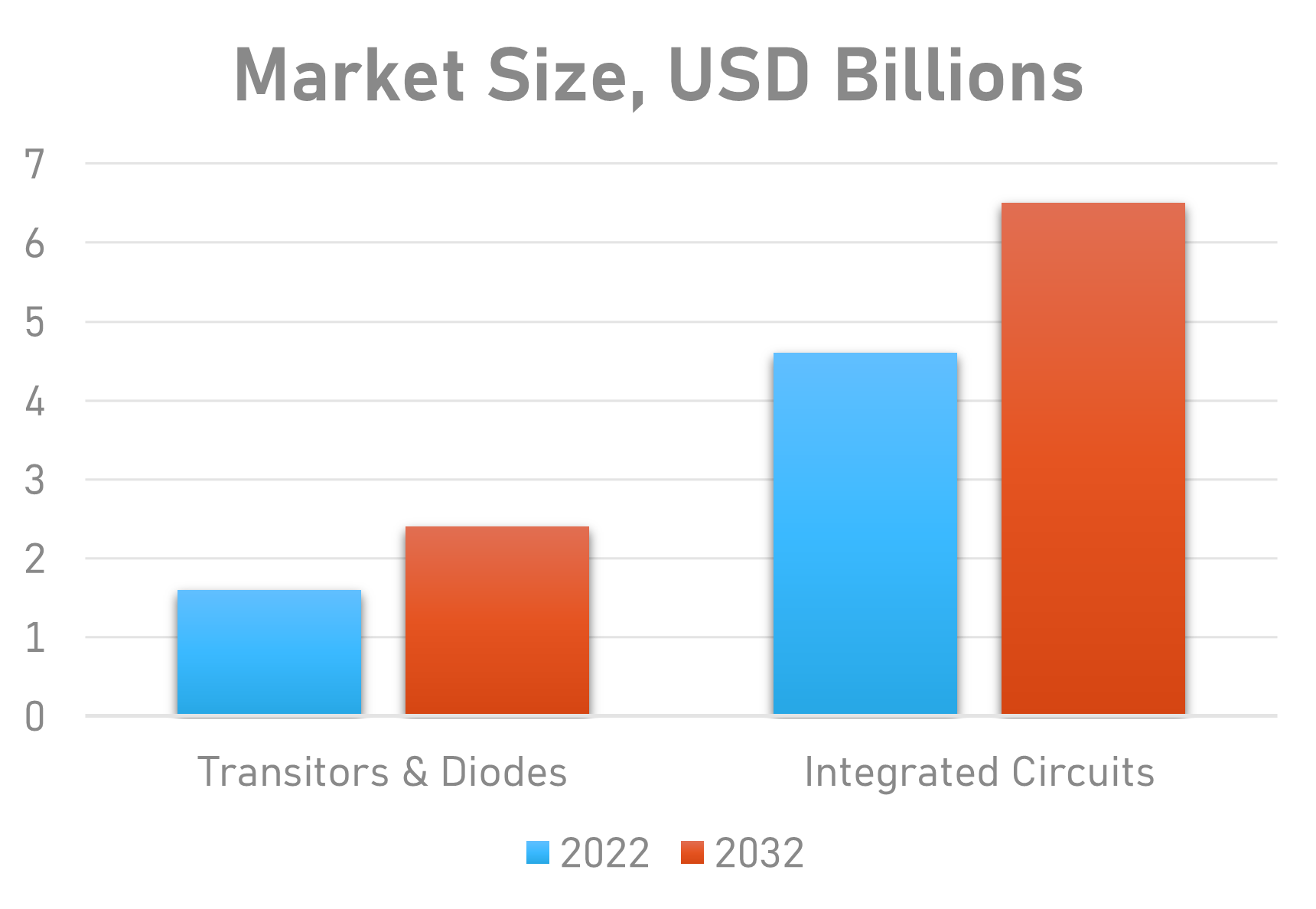

- Based on components, the global SMT equipment segmentation includes transistors, diodes, and integrated circuits. The integrated circuits segment has dominated the market due to the rising consumption of consumer electronics.

- The development of AI, machine learning (ML), and the Internet of Things (IoT) technologies offer new market growth opportunities. These technologies enable memory chips to handle large amounts of data in less time.

- The rising demand for faster and more advanced memory chips in industrial applications will also drive the growth of the integrated circuits segment in the projected period, as shown below.

- China and Taiwanese companies are shifting to India but are facing obstacles. Many Chinese companies meet with challenges and ultimately give up. Most companies will subcontract all manufacturing jobs to India's Electronic Manufacturing Services (EMS) companies. Local EMS companies have benefitted greatly from this move.

- India is similar to China in the early days. They attract a lot of foreign investors with great incentives. India will eventually have its brand manufactured.

- In the future, global SMT must be guided or managed with a strategic corporate control approach. Without effective corporate control, global SMT might face challenges and potential disadvantages in competing with other entities that benefit from economies of scale.

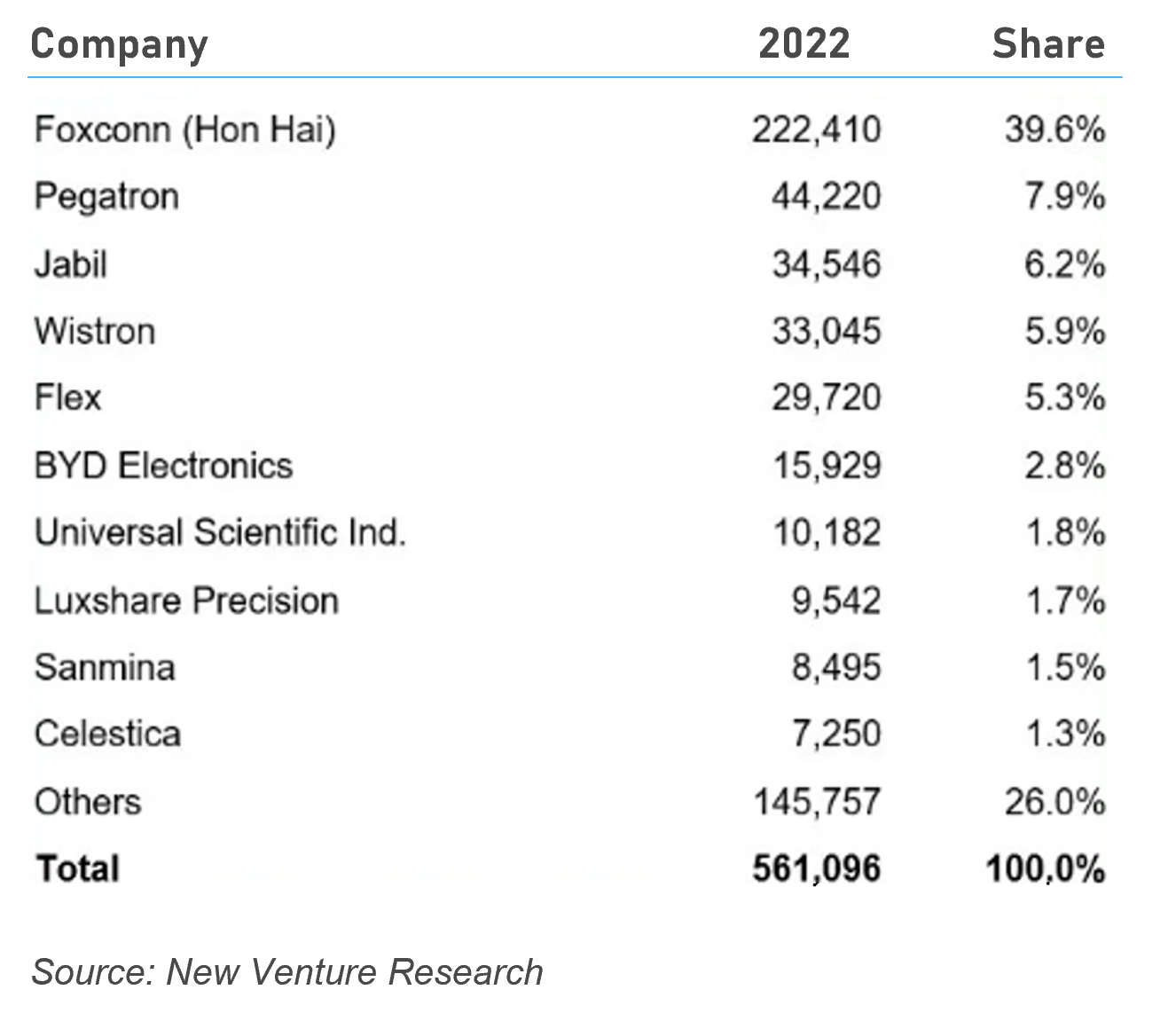

- SMT contract manufacturers (Foxconn, Pegatron, Wistron, Quanta) continue moving business out from China to South Asia and Mexico. The new expectation is that 50% of new lines set up in Mexico this year will come from Chinese/Taiwanese contract manufacturers (CM). This will be a threat to U.S. CM when it comes to price offerings. Hence, it is even important for U.S. CM to differentiate themselves from Chinese CM, not on the pricing but on the services – for example, scratch (design) to box (complete solution) with a wide regional supply chain.

- India imposes import restrictions on laptops and tablets, and electronic manufacturing experts praise the move, which increases SMT opportunities in India.

.

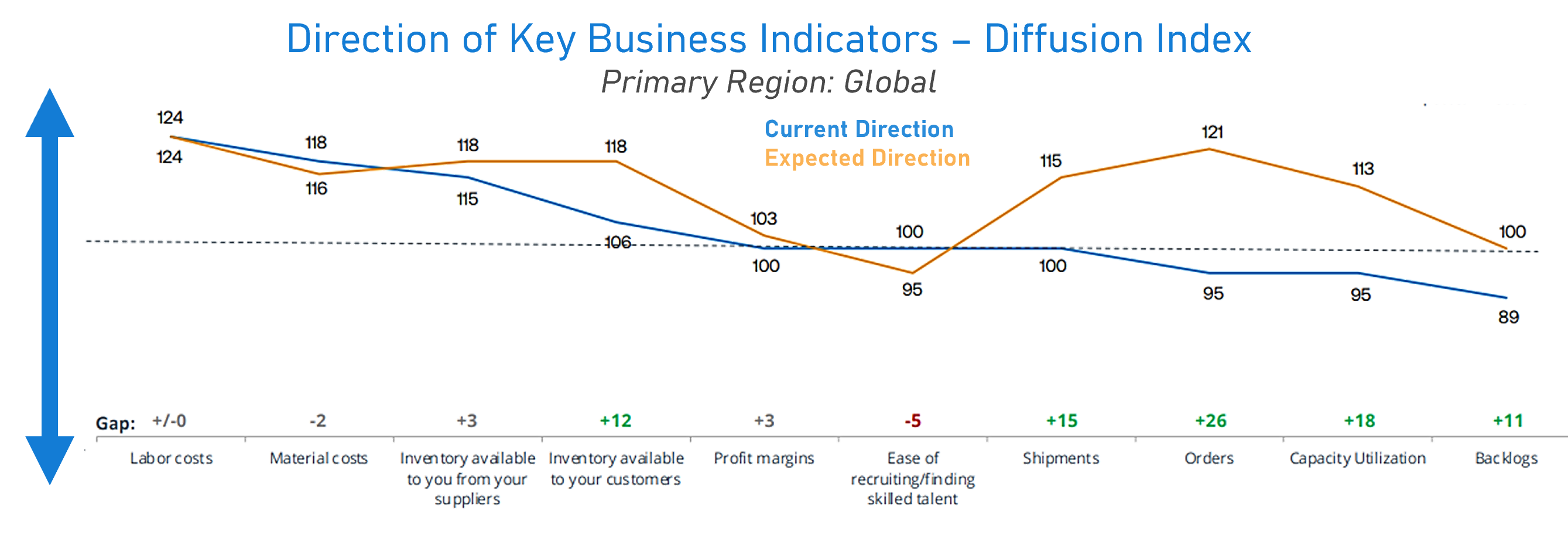

Three-fifths (60%) of electronics manufacturers are experiencing rising labor costs, with half (50%) reporting rising material costs. At the same time, ease of recruiting, backlogs, and profit margins are declining.

- There is much global interest in moving manufacturing away from China for various political reasons and as part of the overall supply chain risk mitigation plan. India is a key country where SMT production is moving in heavy waves. However, there are huge supply chain challenges in establishing SMT manufacturing in India.

- Several factors, including a large domestic market — coupled with the potential to increase productivity, cheap labor, and more supportive government policies, are key factors in improving the business environment and attracting increasing foreign investment. These factors should lead to relatively sustainable growth in the years ahead. Each economy will develop in its own way, and integration remains the key.

DEMAND COMMENTARY

- Most companies' investments are slowing compared to the last few years, but there are pockets of increasing investment here and there, and collaboration is key for customers.

- Some companies are downsizing and consolidating resources.

- There is a fear that the U.S. economy will enter a recession in 2024, but it is still very much unknown. The United States has a presidential election in November 2024. Historically, the party in control of the White House will do whatever it takes to ensure the economy is as strong as possible to bolster chances for re-election.

- New incentive measures will be announced for re-shoring to Mexico. This may bring about and entice the expansion of electronics manufacturing in the coming years.

- Key industries to watch are semiconductors, EV battery manufacturing, and medical.

- This approach differs from the conventional way of assembly, which calls for inserting the components through holes. The SMT technique has increased automation to a point where it is now simple to produce and manufacture complicated electronic circuits. This process is further enhanced by the possibility of creating ever-smaller assemblies without sacrificing high repeatability or quality. Conversely, surface mount devices (SMDs) are electronic components utilized in the surface assembly mount process that are readily available in various packages in various sizes and forms. Numerous end-user verticals, such as medical devices, automotive electronics, industrial electronics, renewable energy, telecommunications, aerospace and military, and many more, utilize surface mount technology. A steady growth rate is anticipated throughout the projected period in the SMT business.

- According to our research analysis, during the forecast period (2023–2030), the global surface mount technology market is expected to grow yearly at a CAGR of about 7.14%. The global surface mount technology market is expected to reach 9.88 billion USD by 2030, with a sales valuation of approximately 5.69 billion USD in 2022. Since the demand for smaller consumer electronics is growing, the surface mount technology industry is expected to expand significantly.

- Miniaturized consumer electronics are becoming more and more popular, which will fuel industry expansion. The SMT industry is anticipated to expand globally because of the rising demand for and consumption of smaller consumer electronics. A growing number of people are moving around the country for personal or professional reasons, which has increased demand for small, lightweight gadgets with cutting-edge capabilities like smartphones, tablets, and laptops. Compact TVs and other entertainment devices have increased sales due to their increasing use in various outdoor activities, including sports, recreation, and healthcare.

- Increased susceptibility of SMT to external factors may limit market growth. Alternative technologies, including through-silicon vias (TSVs) and through-hole technology (THT), are less sensitive to temperature and humidity in the external environment than surface mount technology. This characteristic has made it necessary to think about spending money on temperature and high-frequency control in devices made with SMT, and it could cause more issues while the product is being built. Also, many of the semiconductor industry's players continue to employ older assembly techniques because they have experience and knowledge in these more traditional yet efficient methods. The expanding applications of substitute technologies like THTs and TSVs further segment the surface mount technology market revenue.

- The semiconductor industry is diversifying regionally to propel market conductors. The semiconductor sector indirectly influences the demand for surface mount technology because SMT is a commonly utilized method of assembling semiconductor devices.

- The semiconductor business was restricted, with several regions controlling most of the global market share. But recently, several new countries—particularly rising ones with significant resources—have set their sights on the semiconductor market, creating fresh opportunities for foreign investors to participate in developing a regional semiconductor industry.

- The Indian government declared in July 2023 that it intended to establish a comprehensive, operational ecosystem for the country's semiconductor industry.

- Repairing or reworking SMT-based PCBs can be challenging, which could hinder market growth. Since the primary goal of SMT is to enable the creation of small devices with a restricted amount of free space, it is challenging to repair the parts if the PCB is created using SMT malfunctions.

- Conventional soldering procedures might not work well on these pieces, and more sophisticated approaches are needed. But it's important to remember that there is a significant shortage of qualified specialists, particularly in developing nations or those with weak technological foundations.

- Furthermore, the need for a specialist workforce and equipment greatly influences the initial expense of establishing SMT units. Additionally, the technique could not work well for low production requirements because it might be challenging to achieve economies of scale.

- Electric Vehicles (EVs) are becoming competitive in sales, raising the value differential on manufacturing costs. This will continue to increase because of the rising demand for their use, offering this market promising growth opportunities.

- Southeast Asia has several promising industries across its regional economy that will report quicker than the global average growth. Despite a concerning macroeconomic backdrop, various factors will continue to pull in investment and businesses to this region. SMT's next focus is on the alternative vs. "China Plus One" (China+1). Many manufacturers commonly adopt this strategy. Still, they have no choice but to produce the same product at a higher cost outside of China. The cost is eventually passed to the end consumer.

- The consumer electronics industry is evolving with innovations. There is a growing need for miniaturized products such as PCB and integrated components. SMT helps use and assemble much smaller components that can be developed using SMT. This emergence is supported by the advancement of self-monitoring, analysis, and reporting technology (SMART). The SMT equipment partner is vital in mounting and inspecting compact PCBs.

PRICING COMMENTARY

- Global Supply Chain procurement service close collaboration with partners and customers will increase the company's cash flow.

- FX leveraging collaboration is mandatory and will continue to drive more cost avoidance for the next 12 months with key high-spend SMT partners for strategy moves.

- Level up on SMT equipment on the total cost ownership on the equipment partnership about new value; lean process pricing will continue to be reviewed. Suppliers need to drive the Tier 2 supply chain.

- SMT alternative or consolidation supplier base investment should continue to focus on a rebate margin generation or proactive value process improvement partnership. In general, pricing for SMT equipment should focus on driving cost avoidance vs future investment should be captured.

- The first half of 2024 will be soft, and we will continue to explore opportunities to drive cost avoidance and new customer investment. Vendors with a global support footprint are experiencing similar labor cost increases in the U.S. and EU with no reduction in Asia. The decrease in the cost bill of materials (BOM) is to hedge the increase in operation cost. The first and second quarters are for the company to correct the operating cost vs revenue vs BOM cost.

- Also, in the first half of 2024, we expect tight financial conditions and an uncertain economic outlook that will likely make businesses and consumers cautious.

- Generating cost avoidance requires close partnerships with key suppliers. Customers must provide better forecasts to mitigate potential cost increases and reduce the ability to drive cost improvements.

SUPPLY COMMENTARY

- Key Supplier Lead-Time (LT) Analysis

- FUJI is eight weeks

- ASM is 12 to 16 weeks

- ITW is four weeks

- Vitrox AOI is four to six weeks / AXI is eight to 12 weeks

- Koh Young is four to six weeks

- LT challenges can be overcome when planning is well-managed and with the right decision-maker. SMT has improved considerably on the LT and ways to shorten the LT.

- Continue to collaborate with the SMT partners' tier 2 vendors to mitigate the sole source component situation in the future. This will avoid the LT issue.

- Co-collaboration with global strategy partners/Customers is crucial for long-term investment and eliminates a lot of non-value activity (NVA).

- The outlook for the next six months:

- India will be an uptrend investment expansion based on EMS customers.

- The United States and Europe will continue to have many project discussions but not in significant business volume due to the war in Ukraine.

- Mexico's investment might drop based on the last two years' surplus and the minimum labor cost increase. The EMS market share will grow in the coming years.

- U.S. EMS has minimum organic growth vs. China's and Taiwanese EMS.

KEY TAKEAWAYS

- SMT demand will continue to be soft in some locations. In the days to come, identifying the right customer to collaborate with will be vital.

- Key industries to watch are Semiconductor, Medical, and EV Battery customers.

- Global EMS Industry is down >10%, depending on the region. Things are slower as compared to the last few years. But there are pockets of investment here and there.

- SMT surplus utilization, upgrade, and retooling are the focus before new CAPEX investment.

- Procurement supply chain value differentiation or rebate incentive improvements will continue to be the strategy since labor costs and materials increase globally.

- Artificial Intelligence (AI) and Machine learning (ML) with SMT partners will be the future of predictive maintenance, inventory management, quality control, and supply chains over the next three years.

- Increased use of AI and associated benefits will help advance the manufacturing industry as it confronts challenges like the lack of skilled workforce and cost minimization.

- Collaborate with global SMT AI partners in the factory of the future. Customers want to have standardized quality given by EMS.

- Printed Circuit Board Assemblies (PCBAs) are increasingly getting more compact, leading to the application of SIP (System in Package) to save space and increase product features.

- China and Taiwan CM are moving to Southeast Asia, and they are also bringing their preferred brands of SMT equipment. Mostly China-made machines. This has significantly disrupted the entire sales process in Asia. We firmly believe that this trend will continue to follow. Next year itself will be a big challenge for all major SMT brands. China distributors have started setting up sales and service offices in Asia. Previously, the Chinese government hindered this, but that is changing.

- India is booming, but the growing customer is not global CM but local India CM. This is simply because of Prime Minister Narendra Modi’s strong “Made in India” policies and Production-Linked Incentives (PLI). Most of India’s local listed companies’ shares soared rapidly, creating great wealth and additional revenue for investment.

- However, India’s local CM will only invest in top-tier SMT equipment because of branding, solid reputation, and good customer relationships. Global CMs who enter the market in India must join ventures with local CMs.

- Automotive EVs will continue to be the leading industry in SE Asia. Tesla and BYD will be the two biggest giants to be aware of.

- From chip manufacturers like Samsung to battery makers like LG and SK, South Korean technology companies are increasing their dependence on American and European markets. India is now becoming a significant manufacturing hub for the West.

- Souring relations between the governments in Washington and Beijing have made businesses increasingly fretful about geopolitical risks. Asian nations that stand to benefit from strengthening ties to the West but are, at the same time, cautious about alienating neighboring China

- More and more products are required to be built outside of China, forcing quite some Chinese and Taiwanese CM to move their business to South Asia, India, and Mexico. Many don't have local operations and require starting the process from scratch. Due to government challenges, many Taiwanese were forced to outsource to India’s local EMS.

- Many companies are taking precautionary action to drive cost avoidance versus the previous budget. This implies that the electronics market is moving into a downturn, as the forecast for the next two quarters is not vital for everyone. On the other hand, many companies are performing company correction as there was too much hiring with some overpaying.

- Robots and AI taking over SMT: machines must make decisions independently, learn, and solve problems. It means faster and wiser to help optimize the process.

- Automotive remains the most vital segment in the first half and is expected to lead the segment revenue in the second half in some regions. Currently, China, Mexico, and the EU have the best automotive manufacturing capabilities and the highest. The sites should be the focus of subsequent growth.

Solder

MARKET OVERVIEW

- The market size is forecast to increase by USD 840.63 million. The market's growth depends on several factors, including the increasing use of electronic components in vehicles, increasing product launches, and growing customer demand.

- The electronics market includes computers, servers, communications, and consumer goods. Various electronic products need different types and forms of electronic solders. The increasing demand for the miniaturization and automation of mobile devices, touch screens and displays, and medical electronic systems is driving demand for PCB and surface mount devices.

- The growing demand for these products has led to an increase in the consumption of solder materials. The market for solder materials is also expected to expand due to the rising demand for smart devices and the introduction of energy-efficient electronics. Furthermore, increased manufacturing of electronic devices or gadgets in emerging nations and the development of a significant electronics aftermarket business will likely enhance the demand for solder materials.

- Asia Pacific was the largest market for solder materials in terms of value in 2021. Emerging economies in the region are expected to experience significant demand for solder materials because of the expansion of consumer electronics and automotive sectors due to rapid economic development and government initiatives toward economic development. In addition, the growing population in these countries represents a solid customer base.

- Asia Pacific is the fastest-growing market for solder materials globally, in terms of value and volume, during the forecast period.

DEMAND COMMENTARY

- Solder bar’s biggest consumption alloy continues to be the SAC305. Still, some customers who are not automotive or medical opt to use the alloy SN100C because it has a good performance, and the prices are lower than SAC305 or any other that contains silver.

- Solder wire will be significant during the forecast period. There is a factor directly related to demand: if demand increases with clients, the use of solder wire in repair and maintenance increases in various sectors, especially in the consumer electronics, automotive, and infrastructure segments. The increased number of vehicles also leads to a higher requirement for maintenance and repair services, driving the demand for solder wires.

- The Solder Paste Market is expected to increase due to the customers and industries creating and innovating products for segment outlook. These are the growth opportunities for 2027; the product overview is in the following order: wire, bar, paste, and flux, and the most crucial end users are still consumer electronics and automotive.

- The increasing deployment of automation systems in vehicles leads to the higher integration of advanced electronic components, such as microcontrollers and sensors, to enable in-vehicle communication.

- The growing trend in the market involves a rising preference for automated soldering solutions. Vendors, increasingly aware of automation benefits and aiming for a competitive edge, have significantly increased the application of automation in soldering. Initially limited to small-scale mechanization, the progression in robotics technology has now facilitated the integration of robots into soldering processes. The incorporation of robots enhances soldering efficiency, elevates soldering quality, boosts productivity, and reduces material wastage.

- The Asia Pacific region is projected to witness substantial demand for solder materials, driven by the growth of the consumer electronics and automotive sectors fueled by rapid economic development and government initiatives.

SUPPLY COMMENTARY

- Solder pastes stand out as the most reliable and stable supply within the solder market, presenting a minimal risk of obsolescence. Companies using this type of material experience lower impacts from expired materials, which are crucial components in their processes.

- Solder paste supply remains the primary focus for suppliers, characterized by its stability and the availability of a diverse range of brands and alloys for customers. However, end-users tend to be conservative when trying new brands or products. The solder paste comprises powder metal and flux, with the latter being the proprietary formula for each company. Suppliers heavily depend on their research and development efforts to ensure the success of solder paste in meeting various industry requirements.

- Post-pandemic, the solder paste market has achieved stability with notable supply growth. The soldering flux paste market is expected to exhibit a CAGR of over 6% in the North American region from 2023 to 2032.

- Industries such as automotive, construction, and consumer goods drive the demand for soldering flux paste due to diverse applications.

- The Asia-Pacific region's cost-effective labor has resulted in the proliferation of numerous manufacturing plants, solidifying the region as a central hub for producing soldering flux paste.

- The bar holds crucial significance in the process, and despite narrow profit margins, the potential to alter an alloy within the internal process presents a promising opportunity for cost savings.

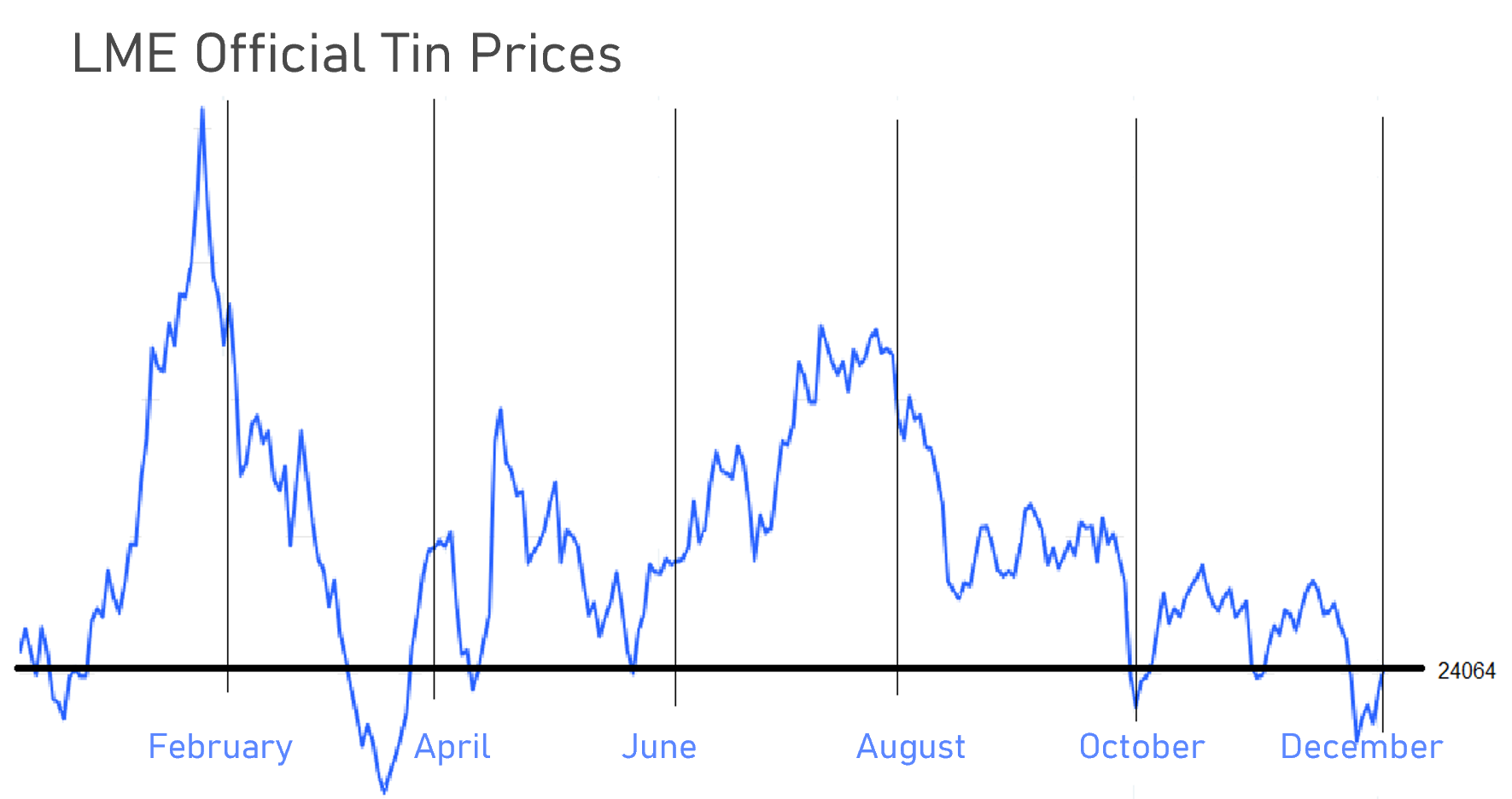

- Setting prices for extended periods remains challenging due to the variable cost of raw materials, which depends on global market conditions. The tin supply chain has benefited from a stroke of luck, as the production loss from a major supplier coincided with a time of market surplus.

- Despite Myanmar's United Wa State Army's (UWSA) directive to halt mining and processing activities in August for a comprehensive audit of the tin sector, the fortunate circumstance of this occurring during a period of market surplus has mitigated the impact. The Wa mines, responsible for over 70% of Myanmar's production, play a significant role as the world's third-largest tin producer and the primary supplier to China's smelters.

- Tin supply is still on a good path. However, the metal is very sensitive to all the geopolitical factors that could affect the countries where it is produced. Such as the threats from the United Wa State Army to Myanmar's mining operations. Just this rumor creates an inflationary effect in the pricing, and even though it seems to be in a safe position again, this reminds us how the production of this metal could be affected at any moment with a big impact on the solder supply.

PRICING SITUATION

- Tin had a price drop since the beginning of 2023, reaching USD 32.00 per kg (highest point in 2023) as it is an alloy base metal for welding manufacturing. The price drop starting in February 2023 and the behavior in the following months helped maintain a more stable price for welding.

- Tin futures experienced an increase, surpassing the USD 24,500 per ton threshold, marking a recovery from the one-month low of USD 23,910 recorded on November 1st. This uptick is attributed to concerns about diminished supply, with mining and processing activities in Myanmar's prominent producing area of Wa remaining halted since August.

- Examining the decline in tin prices, it's crucial to recognize that the prolonged bullish trend during the pandemic established a distinctive environment for demand. The global lockdowns led to a heightened demand for electronic devices, supporting remote work and increasing the need for semiconductors. As semiconductor manufacturing is a significant driver of tin demand, when the pandemic alleviated and the demand for electronic devices declined, so did the market for tin.

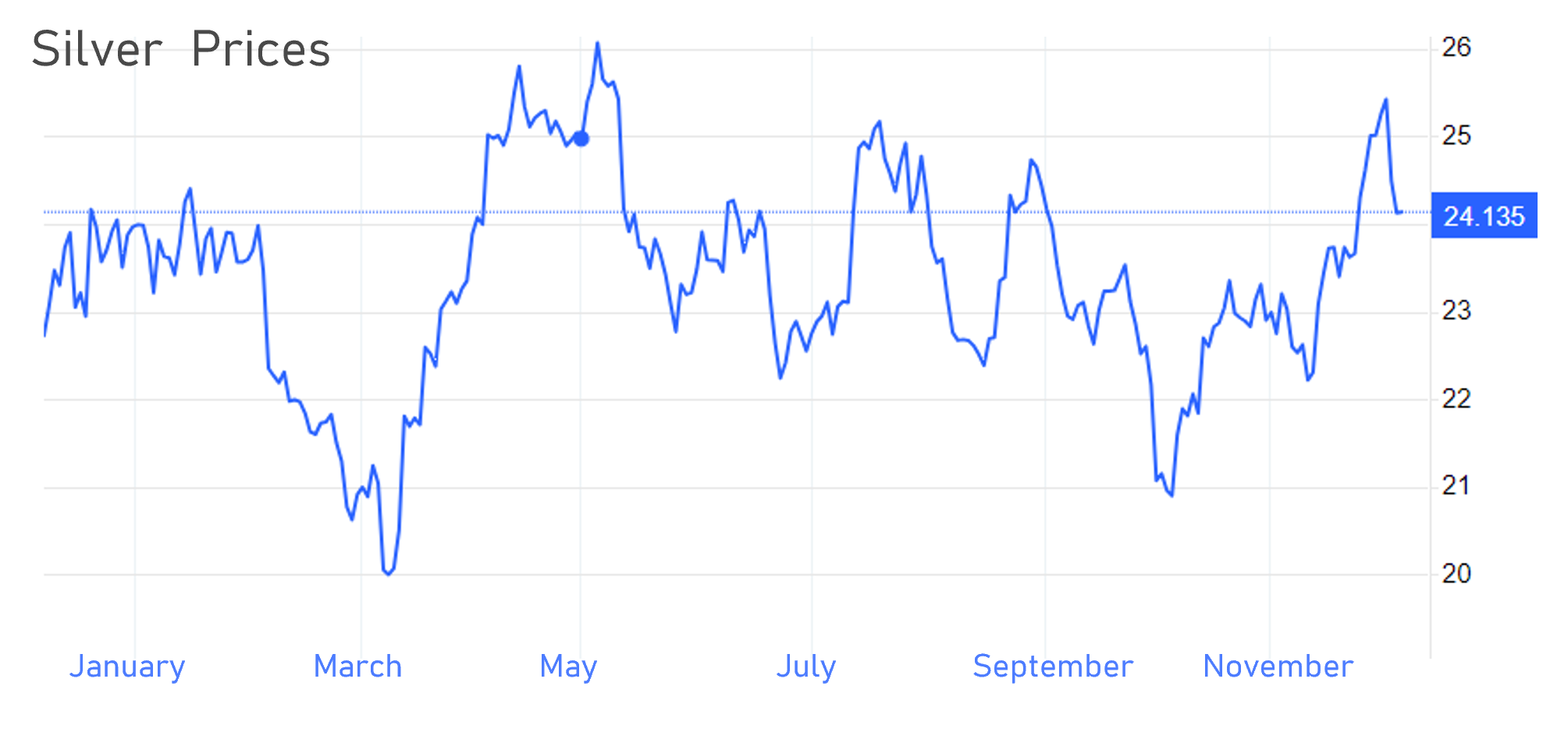

- Silver markets have risen from lows of USD 12 per ounce hit at the start of the COVID-19 pandemic, as investors have purchased physical precious metals and financial instruments as safe-haven assets during the current economic uncertainty.

- The price of silver peaked at USD 28 in August 2020 and ended the year around USD 22.

- The price then jumped to the highest in eight years in February 2021, briefly touching the psychological level of USD 30 per ounce as the market attracted the attention of retail investors.

- While the price of gold has had an unstable behavior in 2023 and has increased since the last month, silver has been stable, having its highest price in April of the same year, reaching USD 26.025 per ounce and its lowest price. In March, it will be priced at USD 20.09 per ounce.

- As of the end of June 2023, the gold held in London vaults was 8,865 tons (a 0.4% decrease on the previous month), valued at USD 545.0 billion, equating to approximately 709,200 gold bars. There were also 26,748 tons of silver (a 1.3% increase on the previous month), valued at USD 19.3 billion, which equates to approximately 891,589 silver bars.

- The current automotive electronics market is worth USD 1.1 trillion and continues to grow. It has two different demand factors: on the one hand, the increase in the use of electronic components per vehicle, and on the other, the electrification of vehicle transmissions. Both will mean an increase in the demand for silver with the arrival of the new 5G technology.

- Silver consumption is expected to increase in the coming years due to the integration of more vehicle components, increasing the demand for silver in the automobile industry. Furthermore, the growing electrification of the sector, with hybrid, plug-in vehicle batteries... increases the number of electrical and electronic components that need to be connected through circuits.

- In terms of solder alloys, it is essential to closely follow the behavior of the metals and the geopolitical factors of the regions where they are produced since this can help prevent and take action.

- Regarding the silver supply, analysts foresee robust demand propelled by the solar industry. In contrast, limited growth in mine supply is anticipated to bolster silver prices after heightened global interest rates. Silver is an investment and a crucial component in jewelry, electronics, electric vehicles, and solar panels, with the latter gaining prominence amid the global shift towards green energy. Silver prices have declined by 4% this year despite its multifaceted applications, currently at USD 23 per troy ounce, mainly due to elevated global interest rates discouraging precious metals investment, which lacks interest returns. The recent firm stance of the U.S. Federal Reserve on interest rates has further exacerbated this trend.

- The forecast for industrial demand in 2023 indicates an anticipated new annual high. This growth is primarily driven by the burgeoning green economy, characterized by increased investments in photovoltaics (PV), power grids, 5G networks, and augmented utilization of automotive electronics and supporting infrastructure. The advancement in PV technology has notably contributed to heightened cell production, surpassing silver thrifting efforts and consequently escalating the demand for electronics and electrical components containing silver.

- In the anticipated landscape of 2023, global mined silver production is forecasted to decline by 2% year-on-year to an estimated 820 million ounces (Moz). This reduction primarily stems from decreased outputs in Mexico and Peru. Mexico is expected to experience a 16 Moz decrease attributed to the suspension of operations at Peñasquito during the second and third quarters due to a labor strike. Nonetheless, the overall production from primary silver mines is projected to increase, primarily driven by the anticipated escalation in production at the Juanicipio mine. Furthermore, the output from lead/zinc mines is set to rise with the commencement of operations at Udokan in Russia. Factors such as diminished by-product credits augmented sustaining capital spending, and rising input costs will collectively contribute to double-digit year-on-year growth in All-In Sustaining Costs (AISC).

- Despite a weaker demand outlook and a marginal decrease in total supply, the global silver market is foreseen to encounter a substantial physical deficit in 2023, marking the third consecutive year of an annual deficit. Projected at 140 Moz, this deficit represents a 45% decrease from the record-high deficit witnessed in 2022, although it remains notably elevated based on historical standards. Notably, Metals Focus anticipates this deficit trend to persist in the silver market for the foreseeable future.

- An estimated 6% year-on-year increase in the average silver price is projected, reaching USD 23.10 in 2023. Notably, until November 7, prices have already shown an 8% year-on-year growth. Looking ahead, Metals Focus maintains a stance in favor of a sustained upward trajectory in silver prices, particularly concerning expectations around U.S. interest rates, aligning with the viewpoint of prolonged elevated rates. However, this financial backdrop is less favorable for non-yielding assets like silver. Additionally, the investment attractiveness of silver as an industrial commodity might suffer due to waning confidence in the wake of a decelerating Chinese economy. Consequently, a cautious outlook for silver prices should be adopted soon, extending into much of 2024.

MRO

MARKET OVERVIEW - MRO

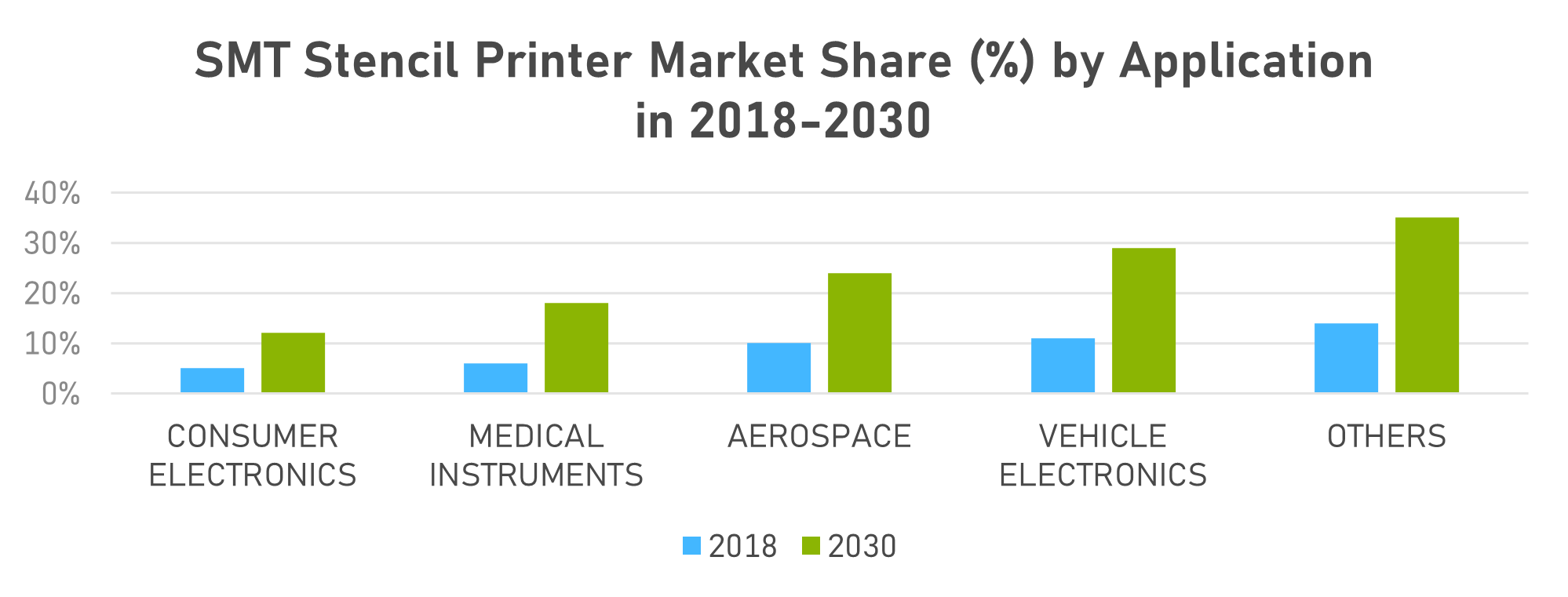

- The global Stencil Printer sector is undergoing substantial transformations, unveiling new opportunities across the industry value chain. Stencil Printer businesses must implement innovative strategies to thrive in this imminent expansion phase.

- Concurrently, the Stencil Printer industry actively conducts a geographic assessment, explicitly focusing on targeted markets to support its expansion initiatives. Europe and the United States are poised for consistent growth, while the Asia Pacific region is rapidly adopting shared and autonomous mobility solutions. Moreover, the North American market anticipates significant growth by 2030, driven by robust demand, leading to product innovation and brand development investments.

- The industry places a significant emphasis on fostering innovation and establishing cross-industry partnerships to discover new opportunities and address evolving customer needs. The associated report provides valuable insights into market trends, various types, applications, and in-depth country-specific analyses, focusing on the United States, Canada, and Mexico. The primary objective remains the pursuit of profitable growth and the promotion of innovation within North America.

- The escalating demand for improved organizational efficiency across industries is a crucial driver of market growth. This is also attributed to the increasing adoption of professional services, as Maintenance, Repair, and Operations (MRO) significantly optimize supply chain management and process efficiencies.

- The dollar index exhibited an upward trajectory in early October, building on positive performance in the preceding consecutive weeks. The dollar index registered a 0.62% increase, reaching 106.89, while the euro exhibited a 0.75% decline, settling at USD 1.0491. Simultaneously, the Japanese yen experienced a 0.31% weakening against the U.S. dollar, closing at 149.77, following a descent to 149.90.

- The escalating emphasis on workplace safety regulations has been a critical driver in the steady growth of the safety shoe market. This growth trajectory is particularly evident in the segment catering to construction, given the inherently high-risk nature of the industry. The construction sector's elevated fatality rates underscore the critical need for robust safety measures, including appropriate footwear. The rising construction activity in countries like the United States, China, and India promotes increased adoption of safety shoes.

- Developing countries, especially China and India, are expected to experience substantial growth due to their ambitious building initiatives. Their rapid urbanization and infrastructure development projects contribute significantly to the increased adoption of safety shoes. Given the scale and pace of their construction endeavors, this growth in developing nations often surpasses that of developed countries.

- North America, particularly in the residential sector, is also experiencing noteworthy growth in the adoption of safety shoes. This surge could be attributed to increased awareness and stringent safety protocols, especially in home construction.

MARKET DYNAMICS - MRO

- In 2023, the fixtures and stencils market has undergone a series of noteworthy developments and challenges, with the ongoing geopolitical conflicts between the United States and China taking center stage. These global tensions have significantly impacted the market, particularly influencing the pricing of raw materials such as essential components like ESD materials and solid acrylic.

- In response to these market dynamics, companies have actively sought innovative solutions to mitigate the effects of escalating raw material costs. One notable strategy involves bundling, wherein procurement departments negotiate with suppliers to consolidate fixtures, optimizing prices. By leveraging the consolidated power derived from suppliers, procurement departments can secure more favorable terms as projects are confirmed.

- While challenges persist, the evolving market landscape presents opportunities for agile companies. Staying ahead in this dynamic environment requires a proactive approach, including efforts to enhance supply chain resilience and optimize procurement practices.

- The Maintenance, Repair, and Operations (MRO) Market is poised for growth, expected to increase from USD 421.37 billion in 2023 to USD 471.65 billion by 2028, reflecting a compound annual growth rate (CAGR) of 2.28% during the forecast period (2023-2028).

Key observations include:

- Steady market growth in recent years is projected to reach USD 471.65 billion over the forecast period.

- The adoption of smart technologies in manufacturing industries and outsourcing strategies to improve operational efficiency and reduce costs are significant drivers of market growth.

- The emphasis on sustainability has led to a shift towards repairing parts instead of replacing them, generating demand for MRO products.

- Technological advancements and the need for enhanced competitiveness have transformed the MRO industry, with vendors offering a diverse range of products to meet varied customer needs.

- However, compliance with various regulations and safety standards poses a challenge, resulting in higher costs for MRO products and impacting market growth. Additionally, heightened competition among suppliers to compete on price has reduced profit margins and slowed market growth.

Nearshoring presents a significant opportunity in Mexico, positioning itself as an attractive investment destination because it is the second-largest economic bloc globally. The close commercial integration among Mexico, the United States, and Canada, accounting for nearly 20% of the global GDP, has resulted in the relocation of numerous North American companies to Mexico. The advantages that Mexico offers include:

- Geographic and Cultural Proximity: Mexico's proximity to the United States and Canada facilitates smoother communication, reduces cultural barriers, and promotes collaboration between contracting companies and Mexican suppliers.

- Competitive Costs: Mexico provides highly skilled labor at lower wages than developed countries, ensuring quality services at more competitive prices.

- Access to Specialized Talent: Mexico boasts professionals with expertise in various sectors, offering specialized and qualified talent to meet diverse business needs.

- Physical Proximity: The geographical closeness enables more efficient business travel, site visits, and direct oversight of contracted operations.

- Several Maintenance, Repair, and Operations (MRO) items in the broader market environment deserve exploration to define strategic actions. For instance:

- Safety Shoes: The pricing of safety shoes is influenced by raw materials like leather and rubber and average wages. As governments worldwide enforce regulations mandating safety shoes, the demand for these specialized shoes continues to rise.

- The construction industry remains a significant driver of this demand, particularly in emerging economies. Additionally, safety shoes are expanding into new markets, such as healthcare, food processing, and hospitality, as these industries recognize the importance of workplace safety.

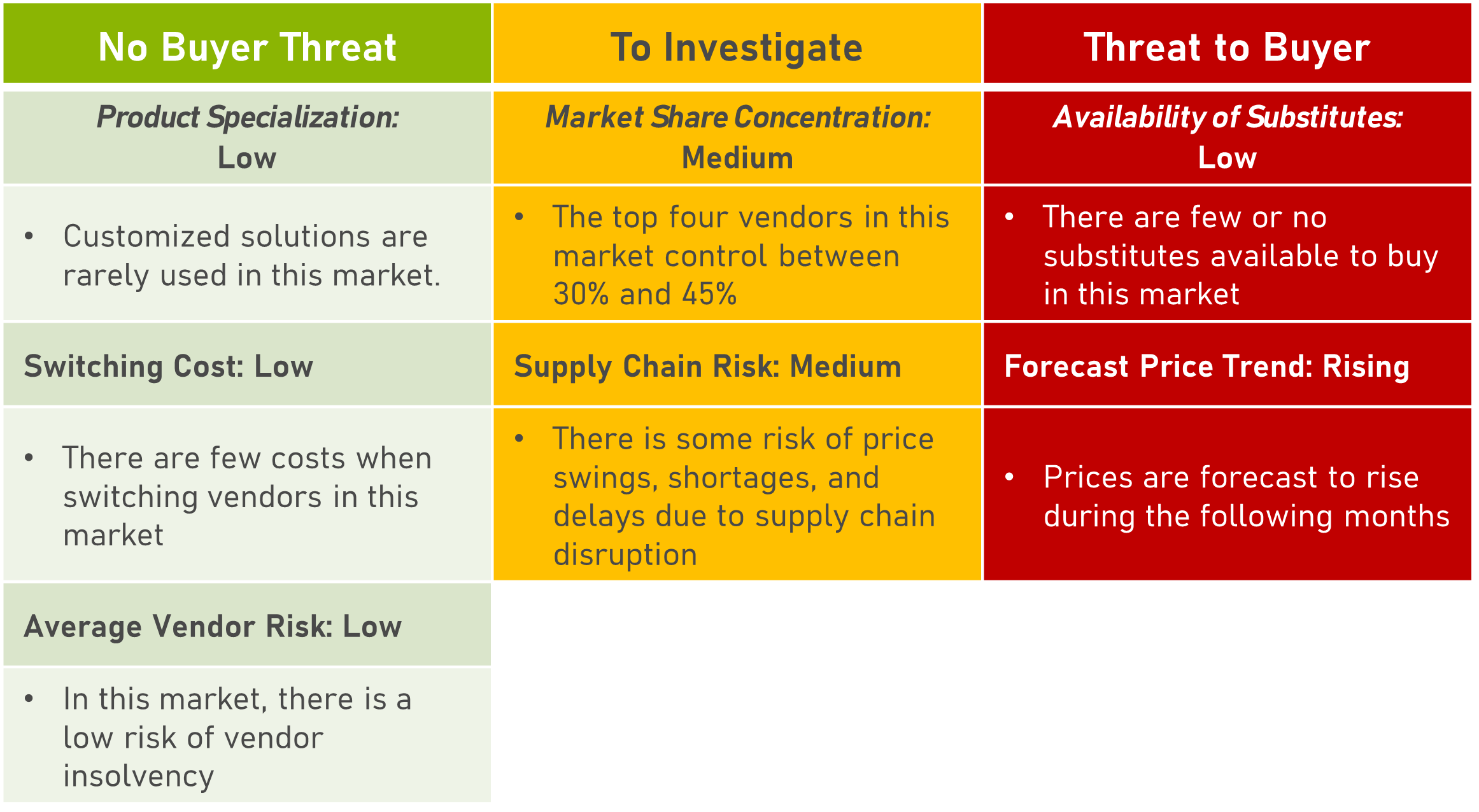

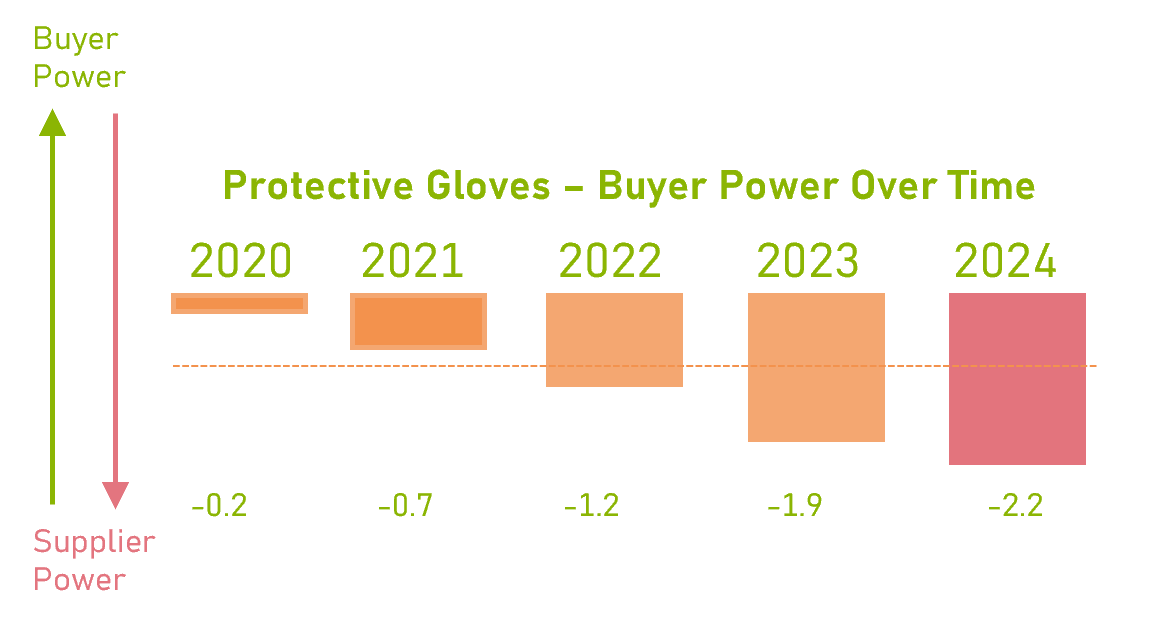

- Gloves: The Industrial Gloves market's substantial size and anticipated growth reflect the increasing emphasis on worker safety across various industries. These gloves provide essential protective gear, offering a range of protection, including cut-slash and thermal protection.

- Safety Eyewear: The projected growth of the Safety Eyewear Market underscores the global emphasis on worker safety regulations and implementing stringent safety standards across industries.

- With a forecasted market size of USD 5.9 Billion by 2032, growing at a CAGR of 4.40% from 2023 to 2032, safety eyewear is crucial in ensuring workplace safety. This trend indicates a broader commitment to creating safer work environments globally.

PRICING SITUATION

Rising Costs of Raw Materials:

- The ongoing conflict between the United States and China has resulted in a pronounced and tangible consequence: a notable surge in raw material costs. Manufacturers and suppliers contend with escalated expenses as they strive to procure the necessary materials to sustain their operations. This inflationary trend is not confined to core materials, such as ESD components and solid acrylic, but extends across a broader spectrum of inputs, presenting a multifaceted challenge.

- The global market has undergone a significant transformation influenced by various factors, with the pandemic being a key catalyst. Preceding the pandemic, importing raw materials like metal, stencil frames, and polyester from China at approximately USD 3,500 per container was commonplace. However, in 2023, these costs have surged exponentially, increasing almost tenfold. This substantial shift in cost dynamics underscores the far-reaching impact of geopolitical tensions on the global supply chain and manufacturing landscape.

Mexico as a Promising Alternative:

- With escalating costs and uncertainties associated with importing from China, Mexico is increasingly considered an appealing alternative for stencil frame manufacturing. This strategic shift extends beyond cost savings, emphasizing fortifying supply chain resilience and establishing a dependable source for essential components.

- The decision to transition manufacturing operations to Mexico reflects a proactive approach by companies seeking to mitigate financial pressures and ensure a stable and reliable supply of critical components. By diversifying their sourcing strategy, businesses aim to reduce vulnerability to geopolitical and economic uncertainties, thereby enhancing the overall robustness of their supply chains.

- Furthermore, the commitment to continuous market research and scope analysis is pivotal for companies navigating this evolving landscape. This proactive approach enables organizations to stay well-informed about new developments, ensuring their Personal Protective Equipment (PPE) management strategies remain effective and aligned with the latest safety standards and technological advancements. Keeping abreast of industry trends positions companies to adapt swiftly to changing conditions, fostering a resilient and adaptive operational framework.

Electronic Industry Expansion Drives Stencil Printer Market:

- The expansion of the electronic industry stands as a pivotal driver for the stencil printer market, spurred by several key factors:

- Rapid Growth in the Electronic Industry: The stencil printer market is experiencing significant growth, primarily fueled by the rapid expansion of the electronic industry. The escalating demand for smart appliances has increased the need for laser stencil printers.

- Cost-Effective Electronic Manufacturing: Electronic manufacturing service providers actively seek cost-effective technologies to produce high-quality electronic and printed circuit boards (PCBs). The emphasis is on ensuring easily maintainable components while simultaneously managing expenses.

- Forecasted Substantial Growth: The growth witnessed in the electronic industry is anticipated to propel the stencil printer market substantially throughout the forecast period. This surge indicates the critical role of stencil printing technologies in meeting the evolving needs of electronic manufacturers.

- Moreover, the stencil printer market is poised for promising growth due to notable technological advancements:

- Advancements in Flip Chip Bumping Technology: Significant progress has been made in low-cost flip chip bumping technology. Implementing the electrolysis nickel plating process under bump metallization (UBM) and stencil printing for solder paste application has become a reality. This combination results in the efficient formation of solder bumps.

- Cost-Effective Stencil Printing for Flip Chip Wafer Bumping: Stencil printing of solder paste, particularly for flip chip wafer bumping, has emerged as a cost-effective and efficient process. This innovation contributes to streamlining manufacturing processes while ensuring precision and cost efficiency.

- Dynamic and Promising Future: These technological advancements are expected to play a substantial role in propelling the growth of the stencil printer market. The industry is evolving dynamically, positioning itself with a promising future as it adapts to the changing landscape of electronic manufacturing technologies.

|

|

SUPPLY ANALYSIS - MRO

The stencil printer market is experiencing significant growth, primarily driven by the expansion of the electronic industry. Several key factors contribute to this trend:

- Rapid growth in the electronic industry: The escalating demand for smart appliances has fueled substantial growth in the electronic industry. As a result, there is an increased need for laser stencil printers within the market.

- Cost-effective electronic manufacturing: Electronic manufacturing service providers actively seek cost-effective technologies to produce high-quality electronic and printed circuit boards (PCBs). The focus is on achieving easily maintainable components while effectively managing expenses.

- Anticipated substantial growth: The observed growth in the electronic industry is expected to drive the stencil printer market substantially throughout the forecast period. This surge underscores the critical role of stencil printing technologies in meeting the evolving needs of electronic manufacturers.

Additionally, the stencil printer market is poised for promising growth due to noteworthy technological advancements:

- Advancements in flip chip bumping technology: Significant progress has been made in low-cost flip chip bumping technology. Integrating the electrolysis nickel plating process for under bump metallization (UBM) in conjunction with stencil printing for solder paste application has become a reality. This innovative combination efficiently forms solder bumps.

- Cost-effective stencil printing for flip chip wafer bumping: Stencil printing of solder paste, particularly for flip chip wafer bumping, has emerged as a cost-effective and efficient process. This innovation contributes to streamlining manufacturing processes, ensuring precision, and enhancing cost efficiency.

- Dynamic and Promising Future: These technological advancements are expected to contribute significantly to the stencil printer market's growth. The industry is dynamically evolving, positioning itself for a promising future as it adapts to the changing landscape of electronic manufacturing technologies.

Acquisition Terms and Financing: In connection with the transaction, DSG has agreed to pay USD 269.1 million at closing, with a potential additional earn-out payment of up to USD 12.6 million, subject to Hisco achieving specific performance targets. DSG will also pay USD 37.5 million in cash or DSG common stock in retention bonuses to certain Hisco employees who remain employed with Hisco or its affiliates for twelve or more months after the transaction’s closing.

- The anticipated closure of the transaction is slated for the second quarter of 2023, contingent upon regulatory approvals and adherence to customary closing conditions.

- Despite a moderate supply chain risk, market suppliers appear relatively insulated from commodity and input price shocks. This resilience translates to a low level of financial trouble for vendors, enhancing their capacity to withstand any economic challenges arising from disruptions in the supply chain.

- A notable market characteristic is the low concentration level among suppliers, with the majority having fewer than five employees. This lack of supplier dominance suggests a decentralized market where vendors are motivated to compete primarily on price, providing advantageous conditions for buyers.

SUPPLY ANALYSIS

Supplier growth trends

- Stencils, a global market giant, has demonstrated remarkable growth in 2023, marked by significant expansions.

- The acquisition of companies such as Advanced Tooling Design in the United States and manufacturers of Stencils, Photo Etch Technology, and UTZ highlights the Supplier’s commitment to solidifying its position as a leading brand.

- Suppliers have actively forged robust alliances, exemplified by collaboration with companies like Jabil. This proactive approach to acquisitions and partnerships reflects the company's determination to maintain leadership and enhance its global presence and influence in the industry.

- Suppliers’ continuous growth trajectory and strategic collaborations position it as a prominent force in the marketplace, creating new opportunities and reinforcing its competitive edge.

- MSC Industrial Supply Co.'s Strategic Acquisitions:

- In January 2023, MSC Industrial Supply Co. made strategic acquisitions, adding Buckeye Industrial Supply Co. and True-Edge Grinding Inc. to its portfolio.

- These specialized companies excel in crafting custom tools and distributing Maintenance, Repair, and Operations (MRO) products and services for metalworking.

- MSC's acquisition strategy enhances its position as a leading multichannel MRO product and service provider, emphasizing its commitment to offering its customers a comprehensive range of solutions.

- MSC's role as a vital supplier for Jabil reflects a strategic partnership aligning with Jabil's focus on building solid alliances for sustainable growth. This collaboration positions MSC as a critical player in Jabil's supply chain strategy.

KEY TAKEAWAYS

- The global stencil printer sector is undergoing significant changes, prompting businesses to adopt innovative strategies for future growth.

- The stencil printer industry is actively evaluating targeted markets for expansion, with Europe and the United States positioned for consistent growth. Asia Pacific is rapidly adopting mobility solutions, while North America anticipates substantial growth by 2030.

- Increasing demand for organizational efficiency is driving growth in the Maintenance, Repair, and Operations (MRO) market. The dollar index exhibited an upward trajectory in early October.

- Workplace safety regulations are fueling steady growth in the safety shoe market. The construction sector, particularly in the United States, China, and India, is driving increased adoption of safety shoes.

- Geopolitical conflicts impact the fixtures and stencils market, influencing raw material pricing. Companies are adopting innovative solutions, including bundling strategies, to mitigate rising raw material costs.

- The MRO market is expected to grow from USD 421.37 billion in 2023 to USD 471.65 billion by 2028. Steady growth is driven by smart technologies, outsourcing, and sustainability, though compliance poses challenges.

- Mexico is emerging as an attractive nearshoring destination due to its proximity to the United States and Canada, competitive costs, and access to specialized talent.

- Pricing of safety shoes, industrial gloves, and safety eyewear is influenced by raw materials and government regulations, reflecting a global emphasis on worker safety.

- Geopolitical tensions have led to a significant surge in raw material costs, impacting the global market. Costs for importing raw materials from China have increased substantially.