By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q1 2024

Jabil's Global Category Intelligence Archive

Q1 2024

ENERGY

MARKET OVERVIEW

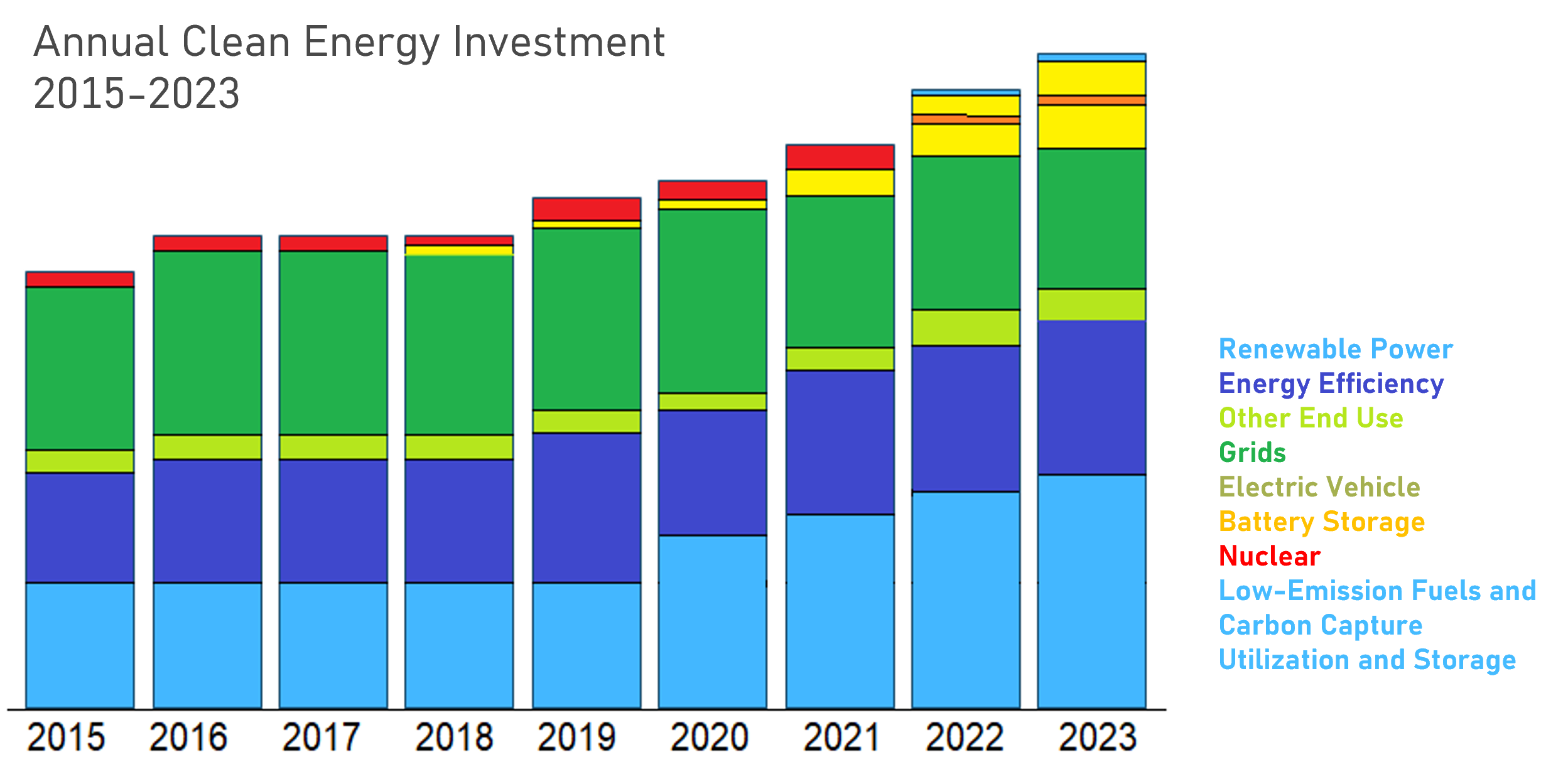

- Investment in clean energy investment has seen continual growth since 2018 as economies continue their energy transition from fossil fuels to zero-emission alternatives. Since COVID, this investment has continued to grow, and we now see further increases in investment.

- The heightened tensions between Israel and Palestine have created uncertainty in the markets for both the dynamics and the threat to supply from the Middle East. This conflict has not significantly affected the market pricing due to the high gas storage levels. For more information on impacts on shipping from Red Sea hostilities, please see the 19 December 2023 Alert.

Asia:

- Energy is still predominantly regulated by the state in Asian markets.

- The price of coal has increased significantly (Asia’s primary fuel source – over 50%) in line with their most recent climate change obligations: “China’s recent pledge to become carbon neutral by 2060 and to peak coal consumption by 2025.”

- The capacity of renewables is increasing significantly to accelerate their clean energy transition but not at the same pace as the increase in electrification, causing energy security challenges. This is especially prevalent in Southeast Asia.

Americas:

Mexico:

- Energy markets are heavily regulated - Mexico's Federal Commission of Electricity (CFE) and the National Energy Control Center (CENACE) control the market. However, Jabil is transitioning to the Wholesale Energy Market (WEM) in an effort to regain a degree of independence from government control.

United States:

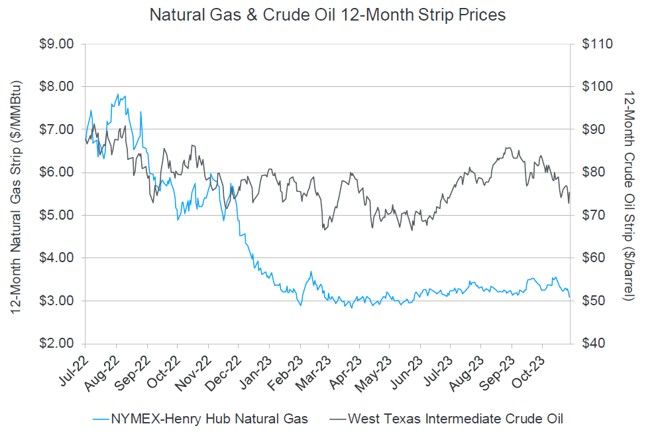

- Natural gas pricing increased due to the Russia/Ukraine war in 2022, but not as significantly as in the EU. This has decreased dramatically since the beginning of 2023.

- Natural gas storage levels are high, indicating market stability for the coming months.

- Regulated and unregulated market split in the U.S. based on the legislation specific to each state.

Europe:

-

- Pricing volatility has reduced since last year, when the market was at its highest in over 20 years. Yet, some volatility has been seen in the previous quarter primarily due to the war in Israel and Palestine.

- EU regulation is applying more pressure on countries to consume less energy from fossil fuels. The Levelized Cost of Electricity (LCOE) of renewables is now lower than that of fossil fuels. Power Purchase Agreements are now the cheapest form of purchasing energy.

DEMAND COMMENTARY

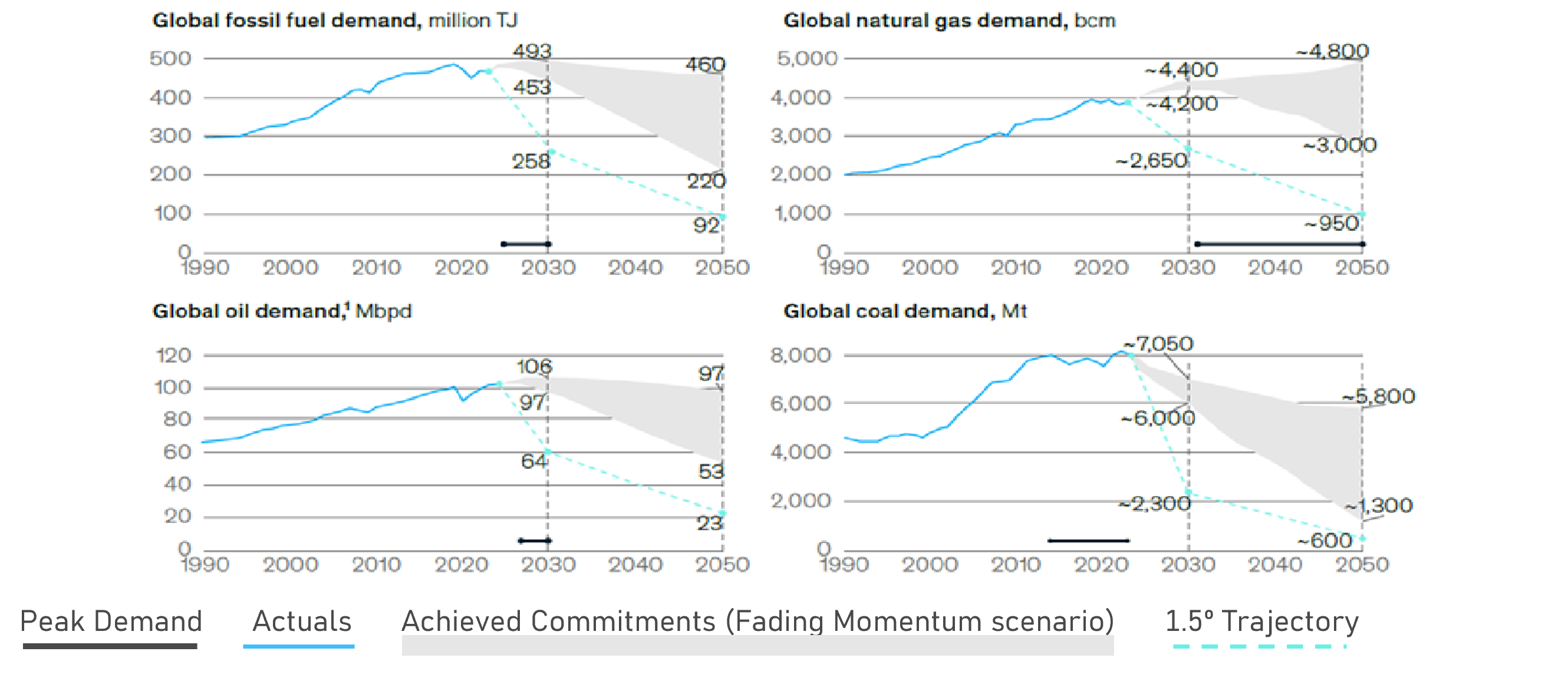

- Fossil fuel demand is projected to peak soon, but the outlook remains uncertain. Total demand for fossil fuels is projected to peak by 2030 in all scenarios. A sharp decline in coal demand is expected under all scenarios, while natural gas and oil are expected to grow further in the next few years and remain a core part of the world’s energy mix for decades.

- Total natural gas demand to 2040 is projected to increase under most scenarios, driven primarily by the balancing role that gas is expected to play for renewables-based power generation until batteries are deployed at scale. In the decade to 2050, the outlook for gas demand differs widely by scenario, from a steady increase under slower transition scenarios to a steep decline under scenarios in which renewables and electrification advance faster.

- Total oil demand is projected to continue growing for much of this decade and fall after 2030 — but the extent of the decline differs significantly across scenarios. In the Achieved Commitments scenario, oil demand will almost halve by 2050, mainly driven by the slowdown in car-parc growth, enhanced engine efficiency in road transport, and the continued electrification of transport. In the Fading Momentum scenario, oil demand would decline by just 3% over the same period; this reflects much slower electrification of the global car parc and lower penetration of alternative fuels in the aviation, maritime, and chemicals sectors as bottlenecks on materials and infrastructure limit their growth.

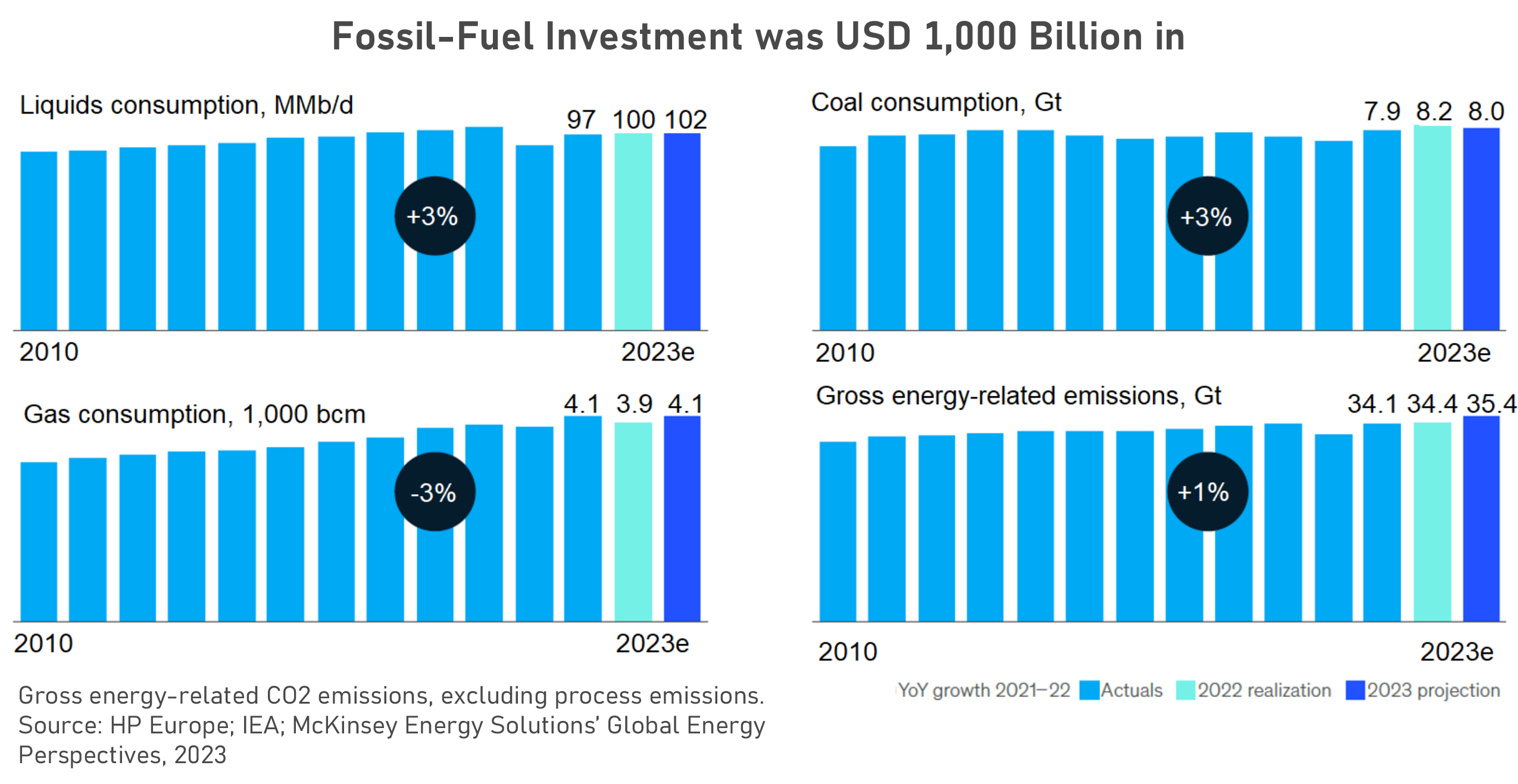

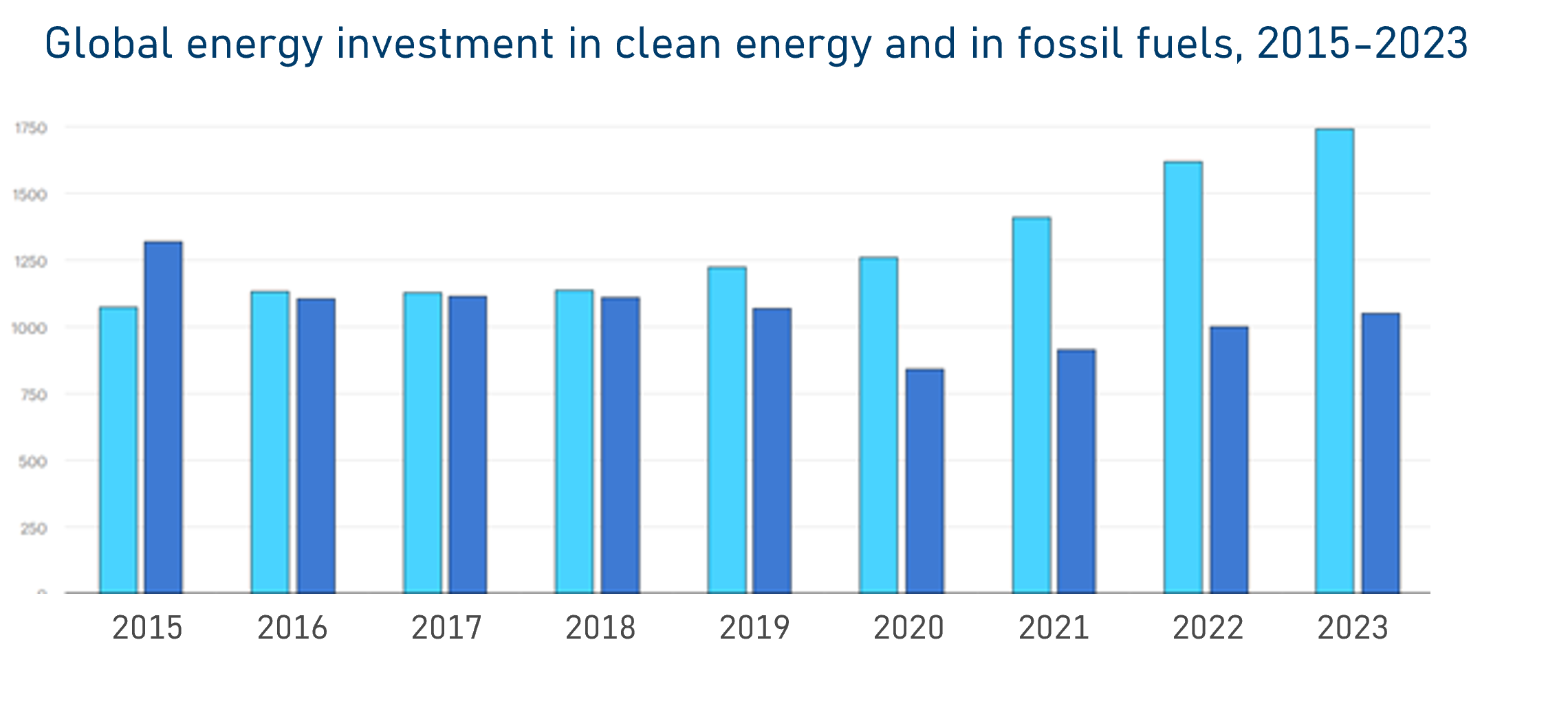

- The uptake of low-carbon technologies has continued to grow. Yet, the demand for fossil fuels has also seen continual growth since the pandemic in 2020 and is now at levels equivalent to or higher than pre-COVID levels.

- This demand increase is coupled with increased investment in fossil fuel technologies. In 2022, this investment surpassed USD 100 billion for the first time. This is forecasted to continue to grow in 2023, as shown below.

- This has all been attributed to higher emissions levels.

- Faster transition scenarios show more robust energy-efficiency gains and faster uptake of electrification and low-carbon fuels.

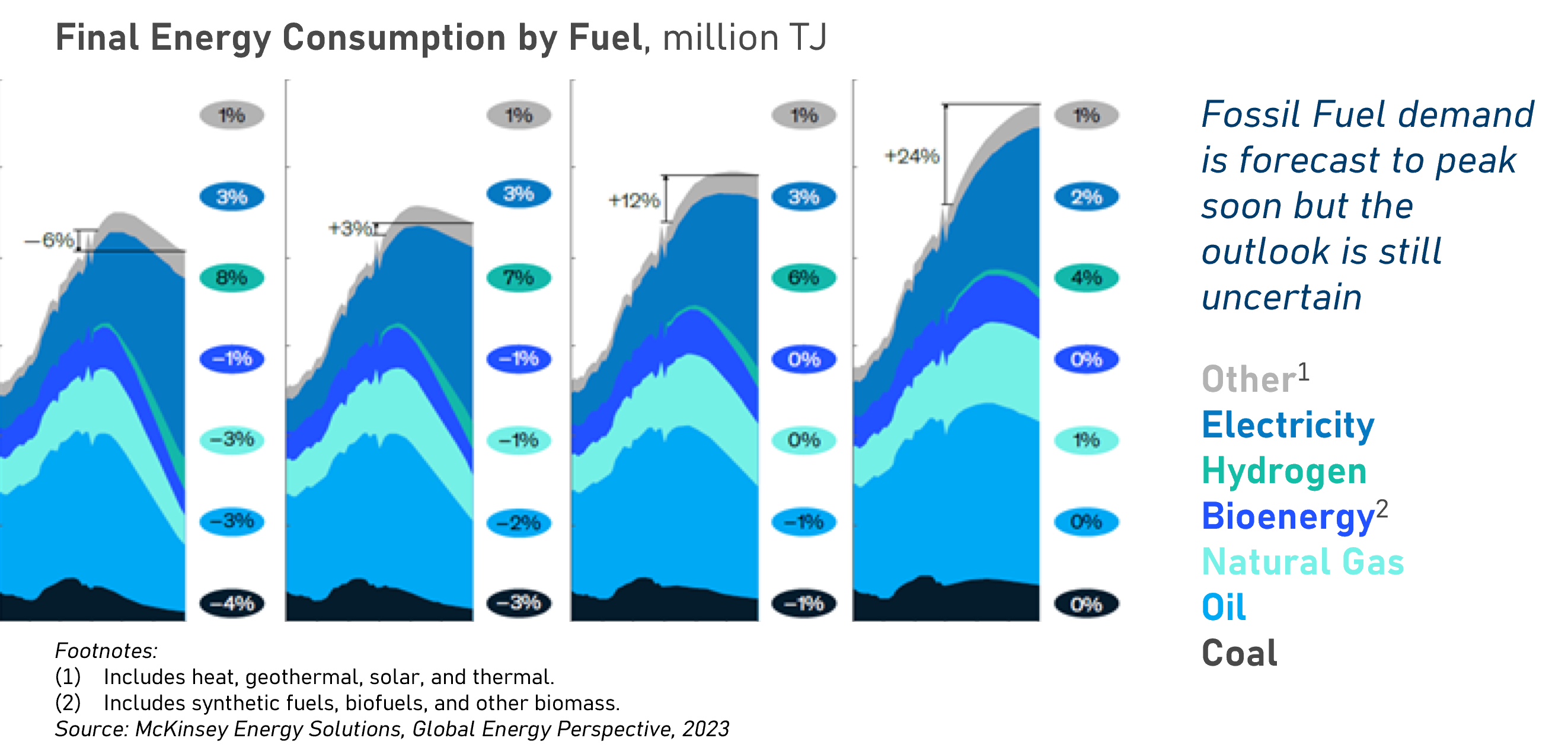

- The share of electricity and hydrogen in final consumption is projected to be 27–37% by 2035 and 35–60% by 2050 across energy transition scenarios.

- Overall energy consumption is flattening or even declining in more progressive scenarios as the share of electrification increases (to 31–49% of the total energy mix). Electrification includes more efficient technologies:

- An electric vehicle is approximately three to four times more efficient than an internal combustion engine vehicle.

- A residential heat pump is ~2–4 times more efficient than a natural gas boiler.

- An industrial heat pump is ~3–5 times more efficient than a coal or gas furnace for low to medium-temperature heat.

- Oil demand is projected to peak between 2025 and 2028, while coal will continue its downward trend and have a minimal impact on the generation mix.

- Total fossil fuel demand is projected to peak before 2030, depending on the scenario, and is expected to make up 36% to 66% of global energy demand by 2050.

- Total natural gas demand until 2040 is projected to increase under most scenarios. This is mainly driven by increasing electrification and the balancing role that gas is expected to play for high renewables-based power generation until batteries and alternative long-duration energy storage become economically feasible and deployed at scale. In the decade to 2050, the outlook widens between scenarios as higher decarbonization ambitions limit the role of gas to pure balancing.

- As noted previously, oil demand growth is expected to slow substantially, with a projected peak in the mid-2020s, followed by a 48% decline in demand by 2050, mainly driven by combustion vehicle growth slowdown, enhanced engine efficiency in road transport, and electrification.

- Coal demand is projected to decrease by almost 25% to 85% between 2019 and 2050, depending on the scenario, driven mainly by the phaseout of coal plants in the power sector across regions.

SUPPLY COMMENTARY

Declines in fossil-fired electricity generation are becoming structural:

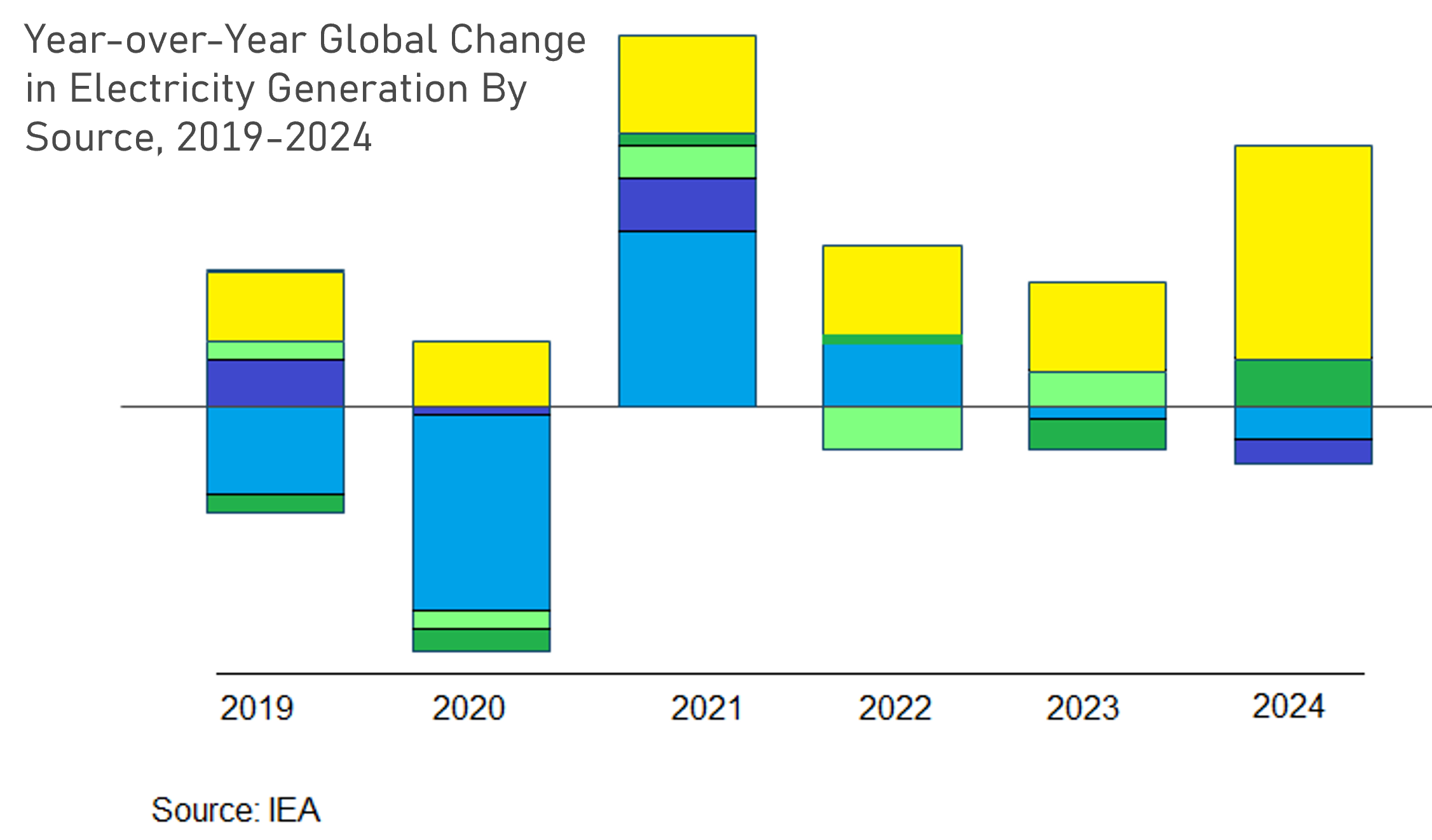

- The accelerated pace of new renewable capacity additions shows that renewable generation could surpass coal as early as 2024 if weather conditions are favorable. This is supported by the expectation that coal-fired generation will slightly decline in 2023 and 2024 after rising 1.5% in 2022 when high gas prices boosted demand for alternatives. Increases in coal-fired generation in Asia in 2023 and 2024 are poised to offset solid drops in the United States and Europe.

- Renewables are set to meet all additional demand in 2023 and 2024. With global demand growth easing in 2023, incremental increases in renewables alone are expected to cover all other demand not only this year but also in 2024, when demand growth is expected to accelerate again. By 2024, the share of renewable generation in the global electricity supply will exceed one-third for the first time.

- By 2024, electricity generation from fossil fuels is expected to have fallen four times in six years. Declines in fossil-fired generation were rare in the past. They occurred primarily after global energy and financial shocks, such as following the oil crises of the 1970s or during the Great Recession in 2009 when overall electricity demand was suppressed. But in recent years, fossil-fired supply has lagged or fallen even when electricity demand expanded. These trends – driven by the strong growth in renewable generation – suggest that the declines in fossil electricity generation are becoming structural. The world is rapidly moving towards a tipping point where global electricity generation from fossil fuels begins to decline and is increasingly replaced by electricity from clean energy sources.

The impact of weather on the electricity supply is increasingly noticeable:

- The availability of hydropower requires greater attention as the capacity factor of global hydropower has declined over the past decade, falling from an average of 38% in 1990-2016 to about 36% in 2020-2022. This difference of two percentage points means that, globally, today’s hydropower capacity is producing about 240 TWh less electricity per year than would have been the case if capacity factors had remained unchanged.

- This change in output indicates a volume of energy as large as Spain’s annual electricity consumption needs to be supplied instead of by other sources, a gap currently filled mostly by fossil-fired generation.

- Recent years saw intense droughts that caused a significant reduction in hydropower availability in affected regions such as Europe, Brazil, and China. Anticipating challenges related to climate change-related hydropower and planning accordingly will be crucial for the efficient and sustainable use of hydro resources.

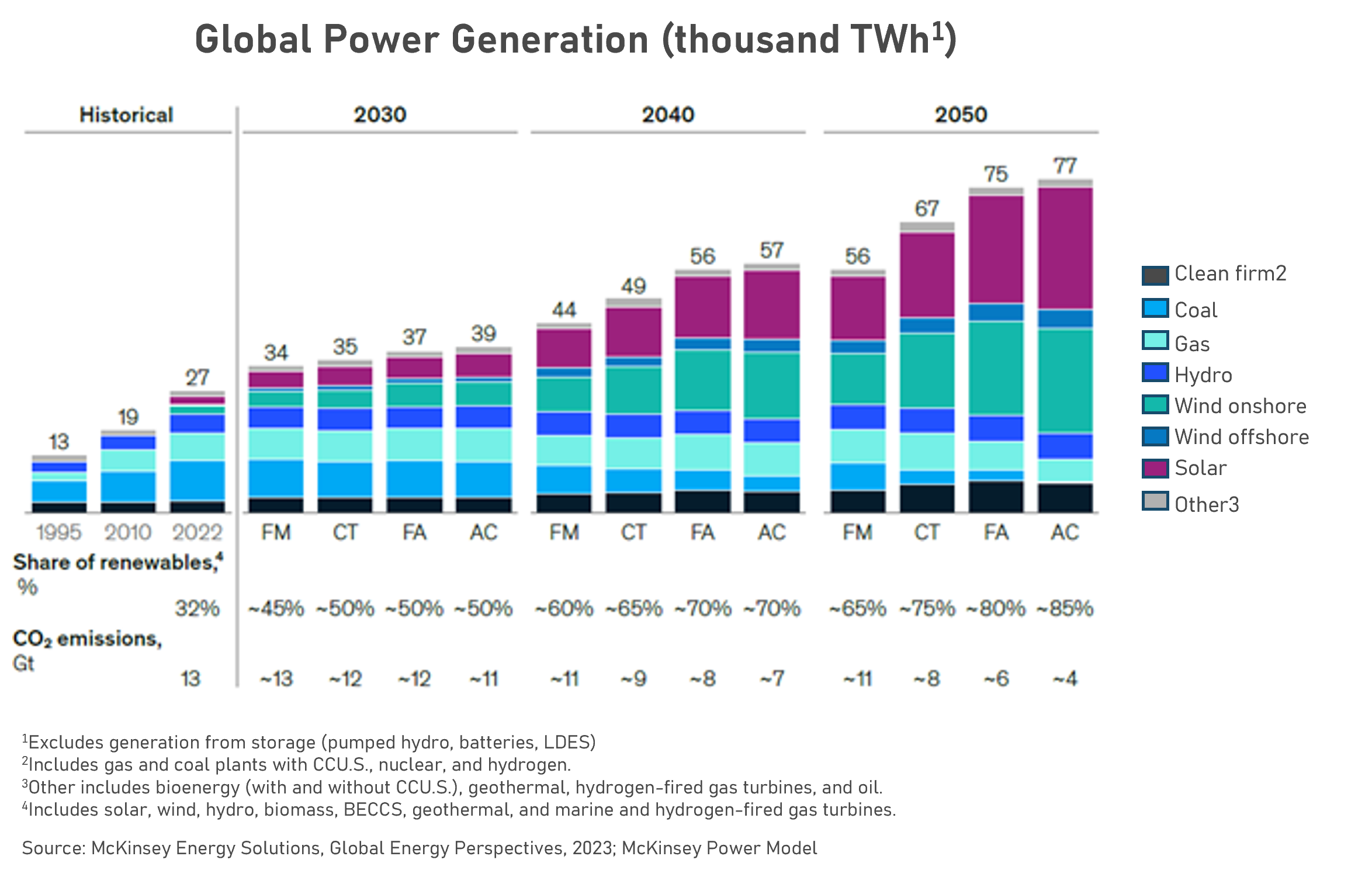

- Renewables are projected to make up the bulk of the power mix into the future, while clean firm and gas power generation increase across most scenarios.

- The share of renewables in the power mix could double in the next 20 years if the investment and uptake remain consistent.

- Renewables are expected to proliferate and are projected to provide ~45–50% of generation by 2030 and ~65–85% by 2050.

- By 2050, emissions could be reduced by 18–72% compared to present levels, depending on the outcome scenario. However, the build-out of renewables poses several challenges, from supply chain issues to slow permitting and local resistance.

- The uptake of nuclear and CCU.S. technologies could lower the burden on renewables build-out but depends on the political landscape and future cost development.

- Amongst the thermal technologies, coal (without CCS) is expected to be phased out gradually. Power generation from H2-ready gas plants is likely to rise due to their importance for grid stability.

ENERGY INVESTMENT

- Investment in clean energy has never been higher with the increased investment across all significant clean energy solutions.

- In 2023, the global investment in clean energy will surpass USD1,750 billion. Solar and the uptake of electric vehicles led to this transition. In addition to this, energy efficiency investments have also seen a significant increase.

- The investment amount is impressive but has recently been dominated by only a handful of countries. Since 2019, China, the USA, and the EU have accounted for most of the clean energy investments, as shown below.

- The recovery from the COVID-19 pandemic and the response to the global energy crisis have significantly boosted global clean energy investment.

PRICING COMMENTARY

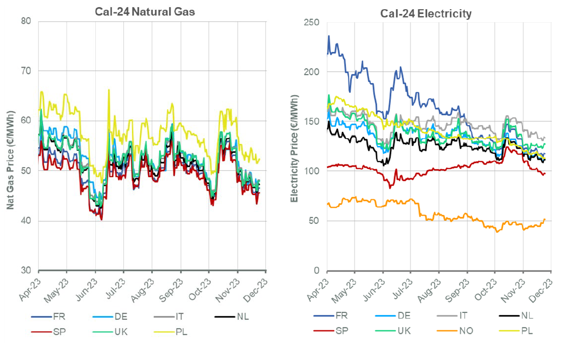

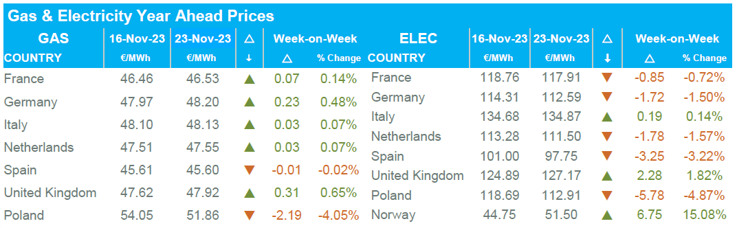

- Global electricity pricing has stabilized significantly since the madness experienced in 2022, which shocked global markets.

- Deregulated regions and countries have been experiencing bearish markets since the beginning of 2023.

- The European region saw a significant spike in the pricing of gas and electricity in October as tensions between Israel and Palestine intensified, which produced a risk of supply to the region. Over the last month, the risk of collection has settled, but prices have steadily declined.

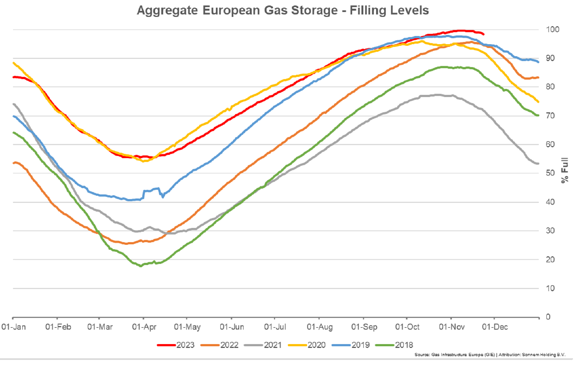

- Aside from this spike, 2023 pricing across Europe has been significantly steadier than in 2022 – primarily driven by the high gas reserves across the region. Gas reserves are at a five-year high.

Source: ENGIE IMPACT European report 23rd Nov 2023.

Source: ENGIE IMPACT European report 23rd Nov 2023.

Source: ENGIE IMPACT European report 23rd Nov 2023.

Source: ENGIE IMPACT European report 23rd Nov 2023.

PRICING COMMENTARY

- In the United States, the price trend on the Henry Hub Natural Gas market has been decreasing sharply since January 2023 and has begun to stabilize since April 2023.

- The West Texas Intermediate Crude oil index dipped below USD 70 per barrel in the summer months before increasing steeply to its peak of ~USD 85 per barrel in September.

- Both markets show strong indications that the pricing is returning to more normality, and we are currently in a bearish market.

Source: ENGIE IMPACT market Watch 17th Nov 2023.

KEY TAKEAWAYS

- Energy market volatility has increased in the last quarter, given the war that has accelerated between Israel and Palestine. This has placed tensions on the region’s supply, impacting Europe and European prices. However, as the gas storage levels are at a five-year high and 95%+ filled, the repercussions of this war have not been felt as severely in the markets.

- Renewables are growing faster than demand to reduce dependency on fossil fuels. This is accelerating with governments’ increasing action to reduce fossil fuel emissions and offer more support for renewable solutions.

- Large uncertainties for early 2024 remain. The main delays affecting our 2023 forecasts for electricity demand, generation mix, and price concern are fossil fuel supply and economic growth, combined with political pressure to transition to renewable energy sources.

- Advice would be to:

- Investigate if there are any alternative options available that could benefit the business to reduce consumption.

- Implement a longer-term energy strategy to create long-term benefits that reduce exposure to market volatility. Examples include a staged approach combining purchasing RECs, on-site energy generation, off-site energy generation, Power Purchase Agreements (PPA), and Virtual Power Purchase Agreements (VPPA).

- Ensure that the risk is manageable. If it is not, fix pricing where possible to mitigate unmanageable risk.

- Now is an excellent time to investigate locking contracts as the price for energy has significantly dropped and stabilized. This may change in the winter months when the pricing is forecasted to increase again.

Back to Top