By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q1 2024

Jabil's Global Category Intelligence Archive

Q1 2024

GLOBAL TRADE COMPLIANCE

TRADE COMPLIANCE

MARKET SUMMARY

- Changes in government policies and trade regulations can significantly impact supply chain operations. The global nature of markets means that businesses often source materials and products from different countries, and trade compliance regulations must align with the increasing interconnectedness of global supply chains.

- Furthermore, geopolitical events and trade agreements between countries can alter trade dynamics – understanding and adapting to these agreements are essential for compliance.

- Remaining well-informed about regulatory updates is crucial to ensuring compliance and mitigating disruptions.

CRITICAL REGULATORY TRANSITION FOR TRADE BETWEEN JAPAN AND INDIA

- India and Japan share a robust economic alliance with substantial trade, investment, and industrial cooperation. Japan is a major investor in India, channeling significant funds into pivotal sectors like automobiles and electrical appliances. The two nations are actively engaged in strategic collaborations, particularly in crucial domains such as semiconductor technology and the decarbonization of the steel sector.

- The Comprehensive Economic Partnership Agreement (CEPA), implemented on August 1, 2011, is at the heart of this collaboration. The agreement covers trade in goods and services, the movement of natural persons, investments, intellectual property rights (IPR), customs procedures, and other trade-related issues. It has been instrumental in fostering bilateral trade, which surged to USD 21.96 billion in the fiscal year 2022-23.

- Critical Update: On July 4, 2023, the Central Board of Indirect Taxes and Customs (CBITC) announced the transition to the World Customs Organization’s 2022 Harmonized System (HS) codes in the Certificate of Origin (CO) and the Bill of Entry (B/E) for imports under CEPA. Previously, the HS 2007 codes were in effect for applying and issuing COs under the India-Japan CEPA.

JAPAN AND INDIA CONTINUED

- The 2022 edition introduced significant changes to the Harmonized System with 351 amendments at the six-digit level, covering a wide range of goods moving across borders. This change may lead to some confusion and uncertainty in the short term.

- Importers who want to claim preferential treatment under the India-Japan CEPA must use the HS 2022 version and indicate this on the bill of entry at customs clearance time.

- Recently, India and Japan revised their respective tariff codes to align with HS 2022. However, the CO issuing authority in Japan was still giving COs for India-Japan CEPA based on HS 2007. As a result, the customs authorities in India have denied the preferential claims.

Takeaway

This highlights the importance of HS classification concerning claims for preferential treatment under Free Trade Agreements (FTAs).

- Any misalignment of HS codes, whether related to the HS version or disputes on tariff classification, will risk the rejection of FTA claims.

- Importers that manage their duty footprint using FTAs must ensure that all information is aligned to reduce the risk of being challenged by Customs in India.

TAIWAN CUSTOMS AND THE INCREASE IN FALSE DECLARATIONS (continued)

Recently, the Taiwan Customs Administration Ministry of Finance identified traders who have falsely declared the country of origin of imported goods, possibly due to negligence. This action has resulted in a false declaration of origin and a violation of the Customs Anti-smuggling Act.

- Importers have faced penalties due to inaccuracies in their import declarations, including errors in product description, quantity, weight, customs value, and country of origin details.

- The rise in such cases occurs frequently with the customs clearance of e-commerce transactions.

Takeaways

Given this, Taiwan Customs emphasizes that discrepancies uncovered during customs inspection will be treated as a false declaration, irrespective of the importer's intent. False declarations will not only result in the confiscation of the goods but also a maximum fine of three times the value of the goods.

- It is essential for businesses to proactively manage their import declaration compliance and have a transparent and compliant process in place.

- Companies should perform periodic reviews to test current processes and ensure compliance on an ongoing basis.

- Importers or custom brokers making import declarations must ensure that all the documentation and information are correct to avoid penalties.

LAUNCH OF ASEAN TARIFF FINDER

Founded in 1967, the Association of Southeast Asian Nations (ASEAN) is a political and economic union of 10 Southeast Asian countries. Together, its member states represent a population of over 600 million over a land area of 4.5 million km). The bloc generated a purchasing power parity (PPP) gross domestic product (GDP) of around USD 10.2 trillion in 2022, constituting approximately 6.5% of global GDP (PPP). ASEAN member states include some of the fastest-growing economies in the world.

Critical Update: The ASEAN Tariff Finder, launched in August 2023, is helping the ASEAN member states increase their economic integration with improved cross-border trade and investment flows, including unlocking a potential USD 2 trillion (SGD 2.7 trillion) in its digital economy by 2030.

The ASEAN Tariff Finder is an online platform designed to help traders maximize the benefits of concluded or upgraded Free Trade Agreements (FTAs), including the ASEAN Trade in Goods Agreement (ATIGA), ASEAN+1 FTAs, the Regional Comprehensive Economic Partnership (RCEP), and bilateral FTAs concluded by the ASEAN Member States.

- The ASEAN Tariff Finder is now ready to support users who wish to explore the markets of more than 160 countries.

- Companies can use the platform to input a product's tariff classification, origin, and destination territories.

- However, it is essential to note that this platform is intended to provide general guidance on the import requirements and processes in the destination territory, not formal legal advice.

Takeaway

The ASEAN Tariff Finder will undoubtedly be useful for preliminary assessments of any FTA utilization or expansion plans a company may have. This platform will help traders understand the key areas to investigate and assist SMEs in the region.

ANNOUNCEMENT OF THE GENERAL ADMINISTRATION OF CU.S.TOMS [2023] NO. 98

- According to the provisions of the Anti-Dumping Regulations of the People's Republic of China, the Tariff Commission of the State Council has decided to implement temporary anti-dumping measures on imported polycarbonate originating from the Taiwan region (HS Code: 39074000) starting from August 15, 2023.

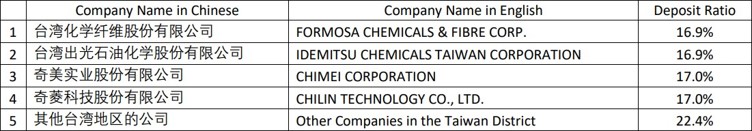

- When importing polycarbonate from the Taiwan region, companies must provide corresponding security deposits to the Chinese Customs based on the deposit ratio determined by the initial ruling.

- A deposit may be applied to the importation of raw polycarbonate materials originating from the Taiwan region into mainland China.

- When importing materials classified under 39074000.10 and originating from the Taiwan region, the consignee or agent is exempted from making any deposit payment if they are recorded as bonded materials in the eBook. Otherwise, there will be a deposit based on who is the manufacturer.

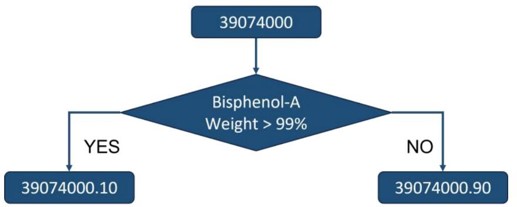

- 39074000 has been specified to 39074000.10, and 39074000.90 based on the weight ratio of bisphenol-A sites may have to modify their part number according to the new rule.

Takeaways

- Non-bonded raw materials under 39074000.10 may be charged deposits.

- Extra caution is required in classifying 39074000.10, 39074000.90, and the country of origin. The wrong classification may lead to a violation of customs regulations and penalties.

- Watch which customs supervision model is used when importing polycarbonate from Taiwan; a deposit may be applied.

- Due to this policy, some sites may need to change the part numbers.

TRADE MATERIAL COMPLIANCE and REGULATIONS – COST SITUATION

Announcement of the General Administration of Customs [2023] No. 98

- ·When importing unbonded polycarbonate from the Taiwan region, companies must provide corresponding security deposits to the Chinese Customs based on the deposit ratio determined by the initial ruling.

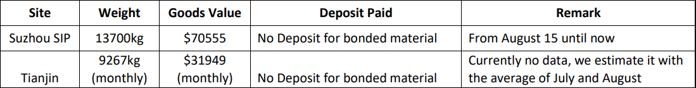

- Currently, we have detected two sites that import polycarbonate from Taiwan. Since the policy was just released on August 15, there needs to be more import and export activities for the Tianjin site, and we are making assumptions from previous data.

IMPACT ANALYSIS

- Transition to HS 2022 from HS 2007 for preferential origin claims under India-Japan CEPA.

- Any misalignment of HS codes will put companies at risk of having their FTA claims rejected. Importers that manage their duty footprint through FTAs must ensure that all information is aligned to reduce the risk of being challenged by India Customs.

- Taiwan Customs is concerned about the increasing number of erroneous declarations.

- Taiwan Customs has become increasingly vigilant in detecting false import declarations, and the repercussions of false declarations are severe. Therefore, it is essential for businesses to proactively manage their import declaration compliance and have a clear and compliant process in place.

- Launch of ASEAN Tariff Finder

- The ASEAN Tariff Finder comes in handy for companies to make preliminary assessments of any FTA utilization or expansion plans. This platform will help traders understand the key areas to investigate.

- Announcement of the General Administration of Customs [2023] No. 98

- Pay extra caution for the HS codes 39074000.10 and 39074000.90 and the country of origin, as the wrong classification may violate customs regulations and penalties.

Back to Top