By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q1 2024

Jabil's Global Category Intelligence Archive

Q1 2024

GLOBAL LOGISTICS

APAC

MARKET OVERVIEW

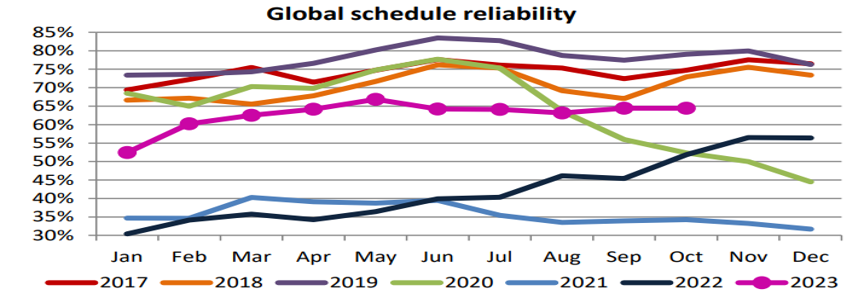

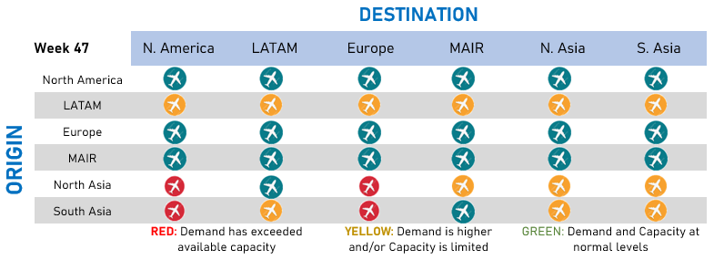

- Global airfreight demand remains subdued globally as we head into the middle of the holiday season, with the exception of specific trade lanes due to a spike in e-commerce shipments.

- This soft outlook is envisaged to remain for the balance of the year, with the Chinese manufacturing PMI returning to a downward trajectory in October.

- "Weak demand" is a common phrase during Q3, and no businesses or sectors appear immune, for instance, with significant product brands forecasting their revenue for Q4 to remain flat to last year’s level.

- Looking towards 2024, the air cargo market will likely see volume continue sideways due to weak global economies. It is not expected to return to classic seasonality until at least the year’s second half.

- On the supply side, global capacity remains sufficient in most regions with no significant backlogs, except Israel, Hong Kong, and primarily China, as belly capacity continued to improve as passenger travel demand remained high.

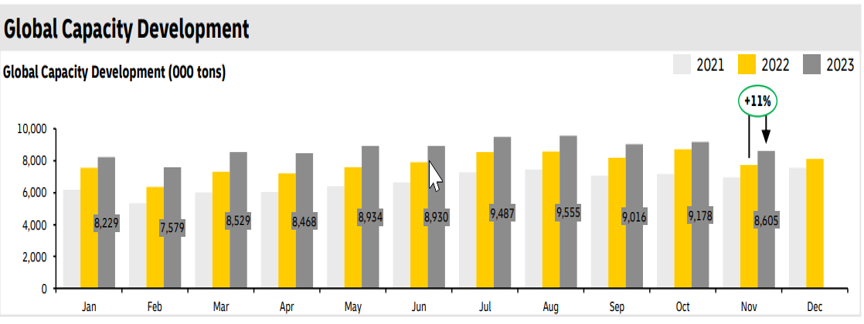

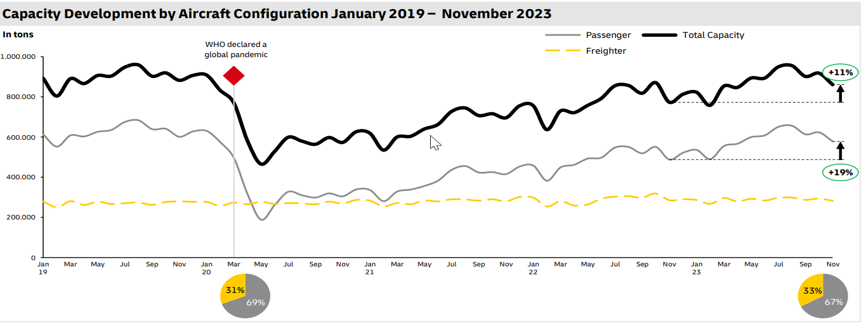

- Air cargo capacity is now at +11% higher than November 2022, boosted by a strong recovery of passenger air services.

- Belly capacity rose by +19% YoY, albeit it declined by 7% in November 2023 vs. October 2023, as airlines scaled back flights in winter.

- Booming e-commerce, due to promotional season and increased demand in the tech sector, is expected to tighten capacities outbound in Asia.

- The ocean freight market similarly remains muted with weak demand, albeit despite a pick-up in containerized exports out of Asia, with the latest data showing a record 5.2 million TEU in August. However, even allowing for a record August, total exports for the year remain down by 1.5%.

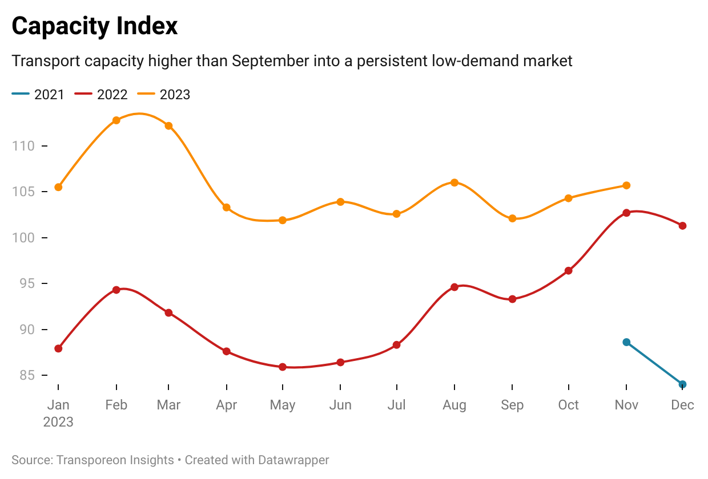

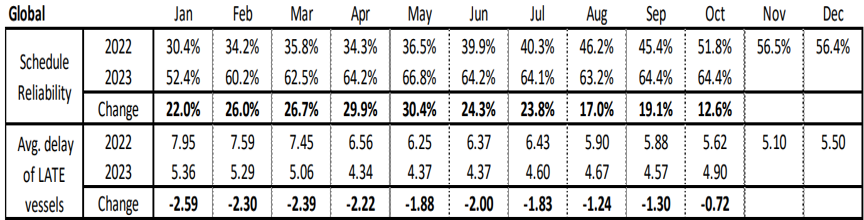

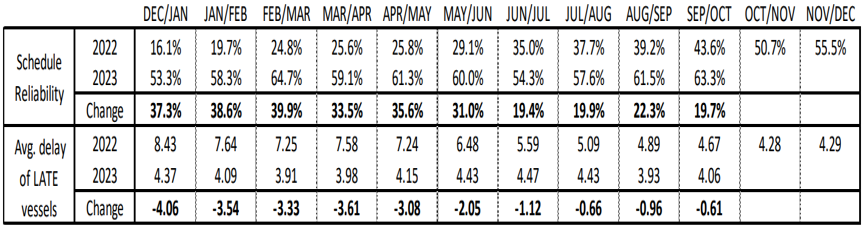

- Global schedule reliability did not change M/M in October 2023, at 64.4%. Since March 2023, schedule reliability has largely fluctuated within a two-percentage-point range.

- On a Y/Y level, schedule reliability in October 2023 was 12.6 percentage points higher.

- However, the average delay for LATE vessel arrivals increased from 0.33 M/M to 4.90 days. The average delay figure has been creeping up slowly since June 2023.

- Carriers continue to implement blank sailings, slow steaming ships, and port rotations re-scheduling in efforts to manage their capacity landscape.

- It, therefore, remains recommended that a one- to two-week short-haul and a two-to-three-week long-haul lead-time extension be included in forecasts to de-risk any potential disruptions.

- To ensure service robustness, it also remains strongly recommended to continue to provide a four-week rolling forecast for both air-ocean modes and bookings placed at least one week in advance for air mode and at least three to four weeks for the ocean.

- Courier freight mode and channels remain unchanged and are operating normally, though remaining at elevated prices/rates arising from GRIs and fuel costs.

- The domestic transportation market in China remains unchanged and is operating normally with available capacities.

- Cross-border ground transportation channels typically operate similarly, including at the Chinese, Hong Kong, and South Asian borders. Capacities are available with all channels flowing.

DEMAND COMMENTARY – AIR

- As we head into the middle of the holiday and traditional peak season of the year, the outlook suggests a muted landscape to be expected for the year, except for specific trade lanes due to e-commerce demand.

- Global air cargo demand continues to be muted with softening economic conditions and high-interest rates limiting purchases and destocking policies.

- Global dynamic load factor, which measures both volume and weight perspectives of cargo flown and capacity available, climbed to 59% in October but remained two percentage points below the level of a year ago. Across the 10 months of 2023, load factors have performed below all the corresponding monthly levels of the last five years, pointing to a persistently weak global air cargo market.

- Airlines from Asia Pacific led the growth in air cargo demand, showing a +4.2% YoY increase, followed by airlines from the Middle East (2.5%) and Latin America (1.5%).

- However, leading indicators of air cargo demand, including global goods trade, manufacturing PMIs, and Inventory sales ratio, continued to point to contractions; for example, the Eurozone manufacturing PMI posted 43.1 in October. Not only is this another reading below the 50-mark, but it is also a drop from 43.4 in September, indicating an even faster rate of decline, while the Chinese manufacturing PMI returned to a downward trajectory in October. Global growth is projected to slow from 3.5% in 2022 to 2.5% in 2023 and 2.4% in 2024, and inflation remains at elevated levels, with 2023 trends showing downward and forecasted to drop further in 2024.

- Overall, global volumes are in line with the levels recorded at this time last year, even though those levels were comparatively subdued.

- The air cargo market will likely see volume continue to go sideways due to continuing weak global economies. It is not expected to return to classic seasonality until at least the second half of 2024.

DEMAND COMMENTARY – OCEAN

- The global ocean market landscape remains soft going into the final months of 2023.

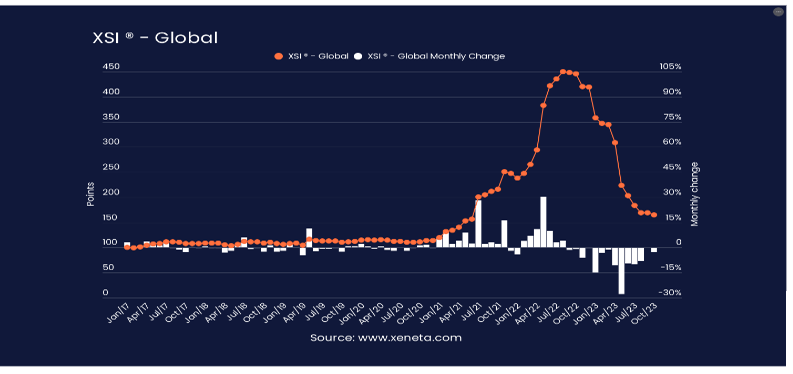

- The global XSI® (contract market) fell in October to 165.3 points, down by 2.6% month-over-month.

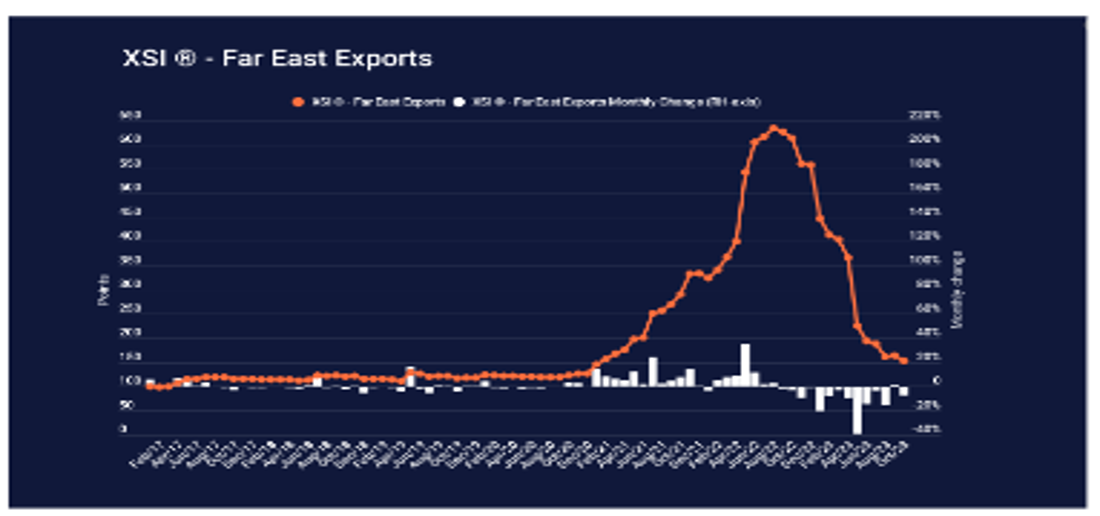

- The index for exports from the Far East fell by 6.9% in October to 152.8 points. This is a 75.1% drop from a year ago and the lowest this index has been since January 2021.

- Despite a pick-up in containerized exports out of the region, the latest data showing a record 5.2 million TEU in August. However, even allowing for a record August, total exports for the year remain down by 1.5%.

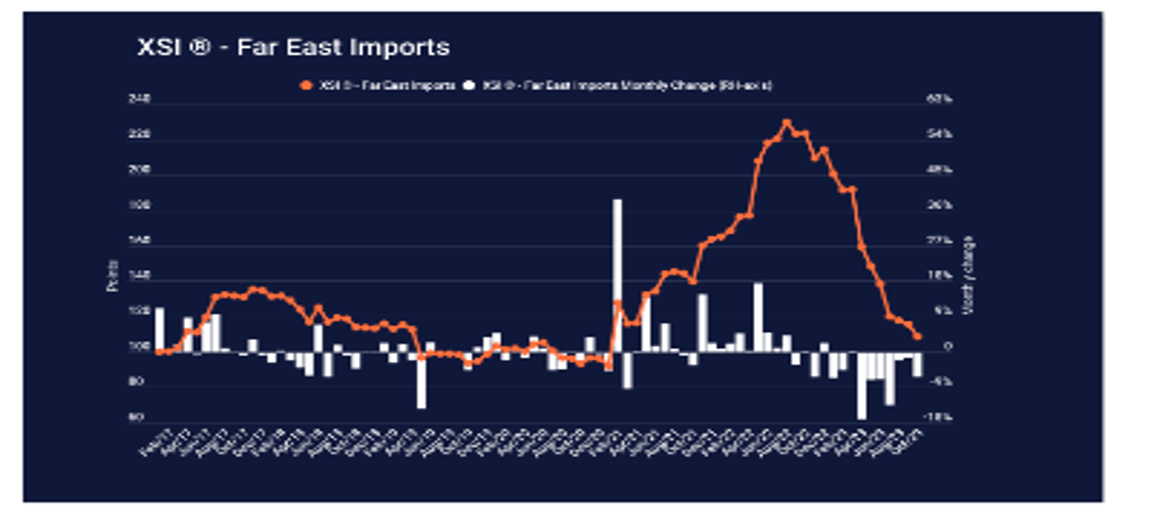

- The index for imports into the Far East fell to 108.8 points in October, 6.2% lower than in September; this is the lowest any sub-indices of the XSI® has been for two years.

- Volumes of imports into the region recorded their highest-ever month in August, and while this will be welcomed, it has less impact on the overall market due to plenty of capacity on the backhaul trades.

- The outlook remains muted and weak, and according to Xeneta, the Global XSI is forecast to post a further drop in January 2024.

DEMAND COMMENTARY – COURIER

- Demand has not undergone any change and remains weak.

- All channels are operating regularly and flowing with sufficient capacities to support.

DEMAND COMMENTARY – GROUND

- Asia's domestic truck freight mode remains unchanged, including within domestic China, as well as border trade lanes across Hong Kong and South East Asia.

- Demand remains muted as the expected economic pick-up did not recover to the desired levels.

SUPPLY COMMENTARY – AIR

- Air cargo capacity is at +11% higher than November 2022, boosted by a strong growth of +19% in belly capacity versus November 2022. On a month-on-month comparison, there's a slight capacity reduction as some airlines cut back passenger flights due to decreased winter travel demand.

- Booming e-commerce, due to the promotional season and increased demand in the tech sector, is expected to tighten outbound capacities from Asia.

- Capacity remains sufficient in most regions with no significant backlogs, except Israel, Hong Kong, and primarily China.

- Capacity is forecast to recover during 2024, with Northeast Asia having the most significant gap to close regarding returning to pre-pandemic levels.

SUPPLY COMMENTARY – OCEAN

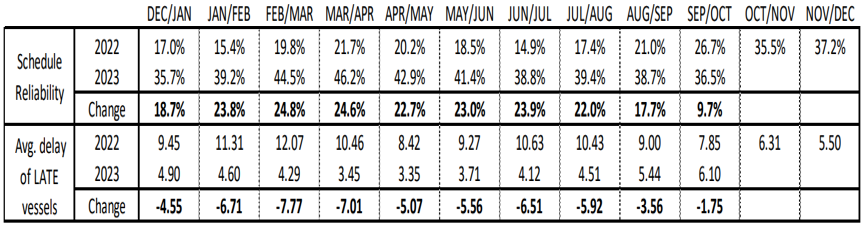

- Global schedule reliability did not change M/M in October 2023, at 64.4%. Since March 2023, schedule reliability has largely fluctuated within the two-percentage point range. On a Y/Y level, schedule reliability in October 2023 was 12.6 percentage points higher.

- The average delay for LATE vessel arrivals increased by 0.33 days M/M to 4.90 days. The average delay figure has been creeping up slowly since June 2023. On a Y/Y level, however, the average delay for LATE vessel arrivals was -0.72 days lower.

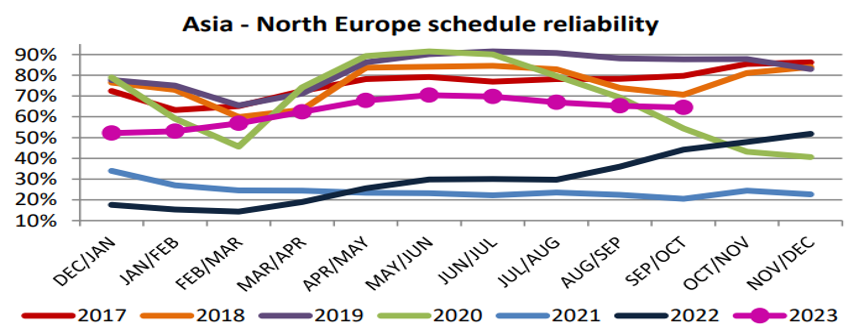

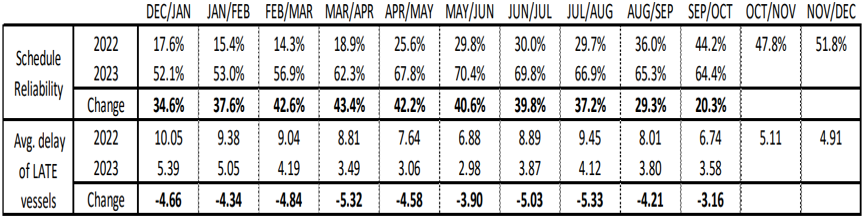

- Schedule reliability on the Asia-North Europe trade lane decreased by -0.9 percentage points M/M in September/October 2023, reaching 64.4%. On a Y/Y level, September/October 2023 schedule reliability was higher by 20.3 percentage points compared to the same point last year.

- On the other hand, the average delay for LATE vessel arrivals improved, decreasing by -0.22 days M/M to 3.58 days. On a Y/Y level, the wait was -3.16 days lower than at the same point in 2022. The average wait for ALL vessel arrivals increased M/M in September/October 2023 by a marginal 0.01 days to 1.23 days

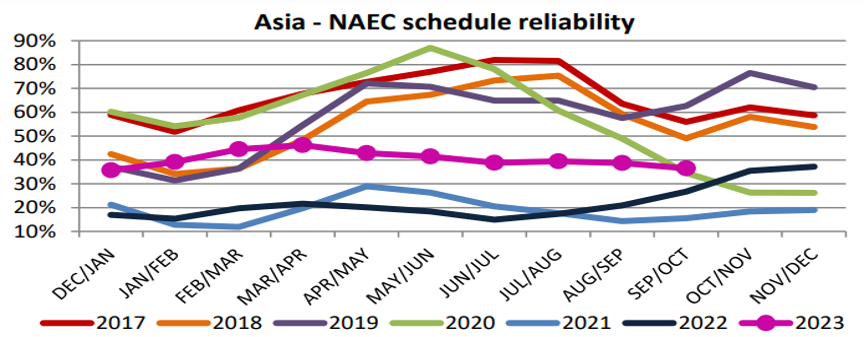

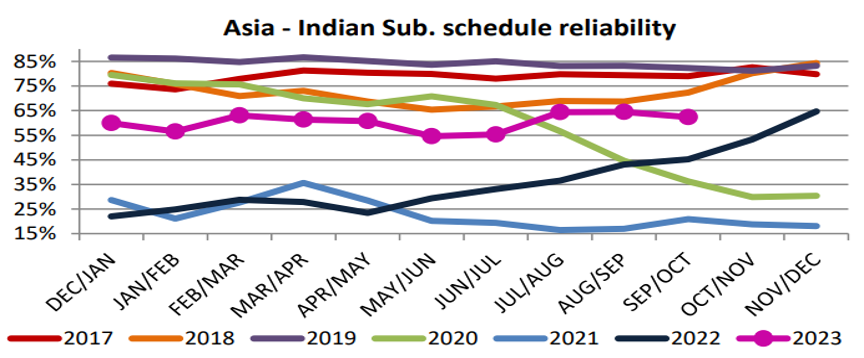

- Schedule reliability on the Asia-North America East Coast decreased by -2.2 percentage points M/M and reached 36.5% in September/October 2023. This is now the fourth-lowest figure recorded for this month. On a Y/Y level, schedule reliability was 9.7 percentage points higher than the 26.7% recorded at the same time last year.

- The average delay for LATE vessel arrivals also deteriorated, increasing by 0.67 days M/M to 6.10 days. On a Y/Y level, the wait was -1.75 days lower than in 2022. The average delay for ALL vessel arrivals increased M/M in September/October 2023 by 0.56 days to 3.77 days.

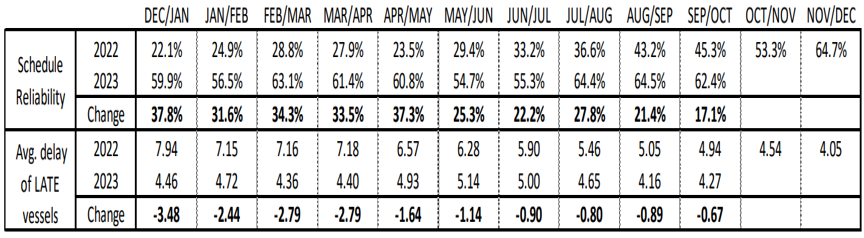

- Schedule reliability on the Asia-Indian Subcontinent trade lane decreased by -2.2 percentage points M/M in September/October 2023, reaching 62.4%. On a Y/Y level, schedule reliability was 17.1 percentage points higher than at the same point in 2022.

- The average delay for LATE vessel arrivals deteriorated, increasing by 0.11 days M/M. On a Y/Y level, the average wait was lower by -0.67 days compared to the same point in 2022. The average delay for ALL vessel arrivals decreased M/M by -0.05 days to 1.21 days.

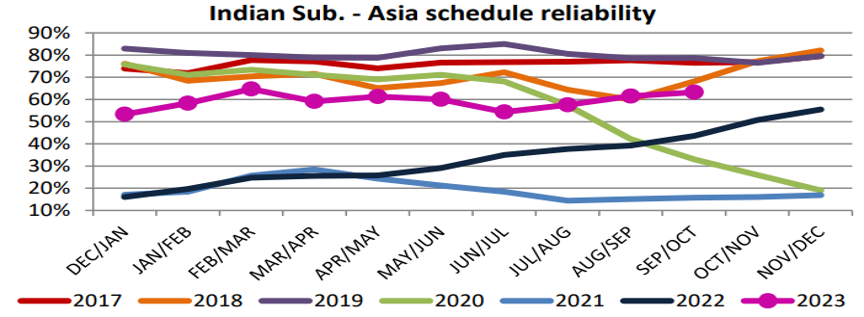

- Schedule reliability on the Indian Subcontinent-Asia trade lane increased M/M by 1.8 percentage points in September/October 2023, reaching 63.3%. On a Y/Y level, September/October 2023 schedule reliability was 19.7 percentage points higher than the 43.6% recorded at the same point in 2022.

- The average delay for LATE vessel arrivals deteriorated, increasing by 0.13 days M/M and reaching 4.06 days. On a Y/Y level, the average delay in September/October 2023 was -0.61 days lower than at the same point in 2022. The average wait for ALL vessel arrivals increased M/M by a marginal 0.01 days to 1.26 days.

SUPPLY COMMENTARY – COURIER

- Capacities remain available and can support all trade lanes, and all channels operate normally.

SUPPLY SITUATION – GROUND

- Capacities remain available, and with all channels flowing.

- Customs clearance between Shenzhen / Hong Kong and vice versa and at the border crossing between China and Vietnam flows and operates normally.

PRICING SITUATION – AIR

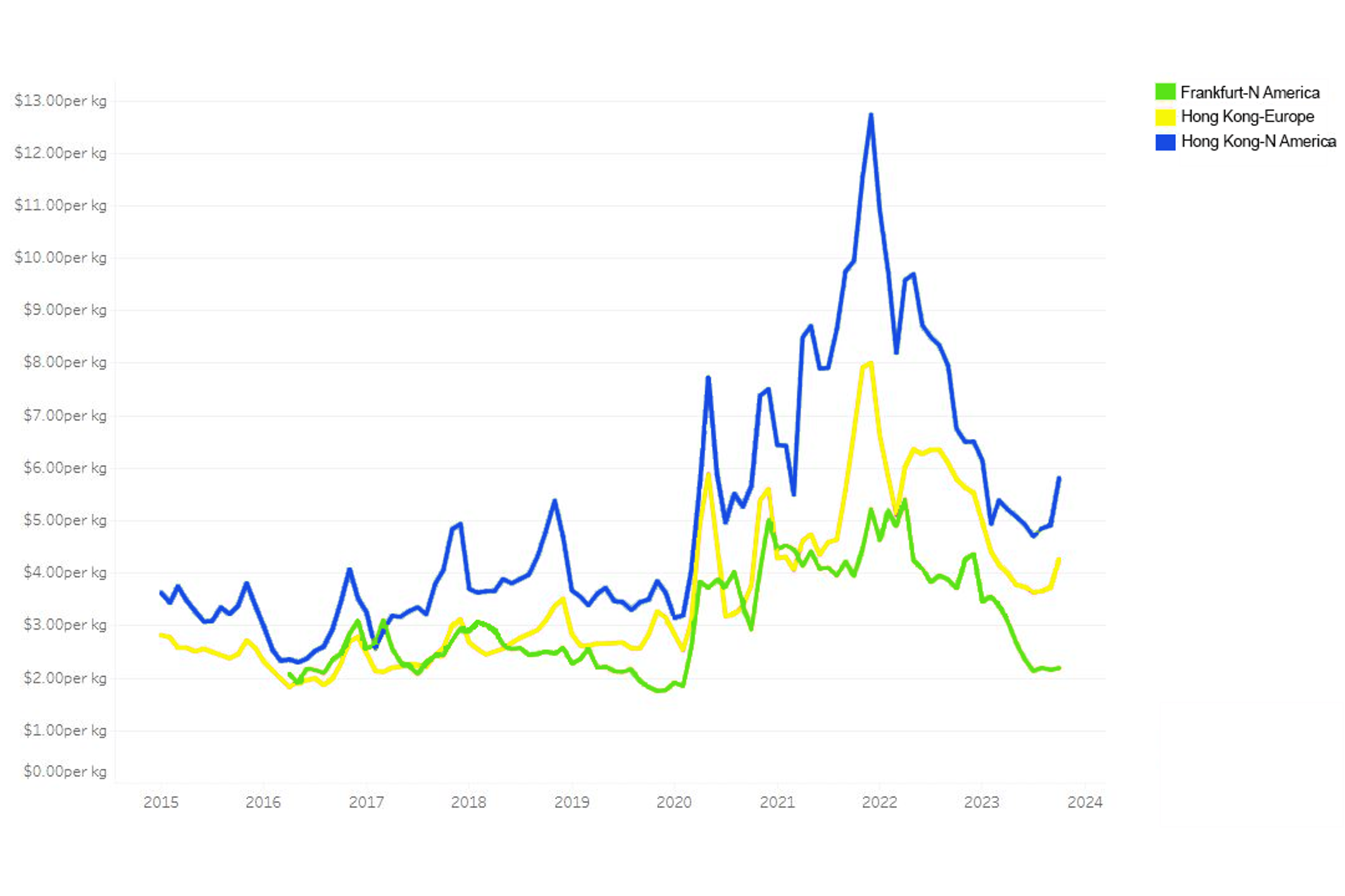

- With market demand remaining muted and sufficient available capacities, rates remain competitive.

- Global average air cargo rates have held steady, showing a subtle seasonal upward trend in the early days of November.

- Current global average rates are 27% lower than last year's, although they still significantly surpass pre-COVID levels.

- Despite the YoY reduction in air freight rates, most regions witnessed a MoM increase in October, mainly driven by e-commerce volumes outbound from China.

- Compared to September, spot rate growth slowed down in early November across top trades out of Asia, namely Mainland China and Vietnam to Europe and the U.S. However, the growth momentum continues for Hong Kong to Europe and the U.S. trades.

- Some seasonal upticks are observed on specific trade lanes, yet in most regions, this trend might be less impacted by low air cargo demand.

- EIA Brent crude oil spot price forecast is expected to increase from USD 90/b in Q4’23 to an average of USD 93/b in 2024.

- Ongoing OPEC+ production cuts offset non-OPEC growth, steadying the global oil market ahead with the outlook of a slight oil price increase expected in early 2024 amid ongoing supply disruption risks in the months ahead. The Israel and Gaza conflict has not significantly affected oil supply up to date, although with hostilities in the Red Sea continuing, this may change. See Jabil's 19 December 2023 Alert for more on this.

- Continued uncertainties surrounding the competition and other global oil supply conditions could put upward pressure on crude oil prices in the coming months.

PRICING SITUATION – OCEAN

- The container shipping industry remains in challenging times, with The global XSI® (contract market) falling in October to 165.3 points, down by 2.6% month-over-month

- Any hopes of a revival in long-term ocean freight shipping rates were short-lived after the latest data indicated the market is again declining.

- September saw global rates on the XSI® increase for the first time in 12 months, raising questions about whether this was a sign of a resurging market or a temporary halt in its decline.

- However, the latest XSI® figures for October show the upward tick in September was indeed a false dawn as the index reverted to the downward trend we have seen over the past year.

- While the 0.2% increase in September was slender, it was still a welcome sign for carriers on the tide potentially starting to turn in their favor. However, this respite proved short-lived, as evidenced by the October updates.

- The XSI® index for exports out of the Far East fell 6.9% in October to 152.8 points. This is a 75.1% drop from a year ago; this index has been the lowest since January 2021.

- Despite a pick-up in containerized exports out of the region, the latest data shows a record 5.2 million TEU in August. However, even allowing for a record August, total exports for the year remain down by 1.5%.

- From an import into the Far East perspective, the index fell to 108.8 points in October, 6.2% lower than in September.

- With long-term rates just 8.8% higher than the start of 2017 (the base period for this index), this is the lowest any sub-indices of the XSI® has been for two years.

- As with Far East exports, imports into the region also posted their highest-ever month in August, totaling 0.9 million TEU. Unlike the year-to-date drop in exports, the record month for imports also contributes to an increase of 10.8% in 2023.

- Though carriers will welcome these higher volumes, their impact on the overall market is much lower than if exports were growing.

- This is because the backhaul trades have plenty of capacity to deal with increasing import volumes.

PRICING SITUATION – COURIER

- Pricing levels remain elevated post-yearly GRIs of 2023 by carriers and ongoing elevated fuel surcharges.

- FedEx has announced their 2024 GRI on their Ground, Home Delivery, Express, and WW International rates with an average increase of 5.9%. Accessorials, fees, and surcharges will take another hit in 2024, with increases ranging from 5.4% to over 21%. Ground Economy and Ground Multi-Weight rates have not been announced yet.

- Following suit, UPS announced their 2024 General Rate Increase effective 26 December 2023.

- On their UPS Ground, Air, and International Rates, at an average of 5.9%, similarly, their Accessorials, Fees, and Surcharges will see increases as high as up to 22%.

- DHL Express similarly announced they will adjust/increase their rates by an average of 5.9% as well to take effect from 1 January 2024; as well as several surcharges will also be adjusted accordingly.

PRICING SITUATION – GROUND

- Domestic truck freight rates, as an example in China, have softened as volumes remain soft and with sufficient capacities to support.

- Similar observation as well for the cross-border intra-Asia truck mode freight.

KEY TAKEAWAYS – AIR

- The muted air freight market continues without a potential recovery forecast until mid-2024.

- The continued inflation curtailing consumer spending, soft economy, slower industrial production, a persistent inventory overhang, and other factors are suppressing orders. Hence, the need for freight transportation is being cited as the continuing drivers.

- Airfreight demand is impacted further by improving schedule reliability and lower rates in ocean freight shipping. This situation could change in the event of another black swan event (for example, another pandemic or war). Still, for the time being, it appears ocean freight is becoming a more attractive proposition for many shippers.

- Aside from the supply/demand recalibration, the green transition will also stay in the spotlight within the air freight sector.

- Looking towards 2024, the air cargo market outlook will likely see it continue to go sideways due to these various drivers, and it is not expected to return to classic seasonality until at least the second half of 2024.

KEY TAKEAWAYS - OCEAN

- The global ocean market landscape continues to remain soft, and demand is still subdued with the traditional peak season so far has been observed as a distinctly muted affair.

- As illustrated by the October index of 165.3 points, a 51.5% increase from October 2019, carriers still enjoy some benefits from the older long-term contracts. But once these disappear and new agreements are signed at lower rates, carriers will be much less insulated from falling freight rates.

- Additionally, new ships are on the way as well, and with 1.6 million TEU new capacity delivered up to September 2023 YTD, a 7.1% increase YoY while volumes are expected to grow following year record order books of new ships due for delivery is envisaged will continue to feed overcapacity in the market.

- A further complication to the capacity conundrum is the impending breakup of the 2M Alliance between MSC and Maersk – the biggest alliance in ocean freight shipping when measured by fleet size.

- The alliance will officially end in 2025. Still, we are already seeing the paths of the two carriers of the block starting to diverge, increasing the stand-alone capacity offered by each airline.

- More divergence is expected over the course of 2024. For example, the Ocean Alliance, consisting of CMA CGM, Cosco (OOCL), and Evergreen, may consider dissolution in the year ahead due to divergent aspirations and political ambitions among its members. This has the potential to impact carriers’ hopes of managing capacity in an already overcapacity landscape.

MENA

MARKET OVERVIEW

- Hapag-Lloyd, a German shipping company, has introduced the 'Red Sea Shuttle' service using the SEASPAN HAMBURG vessel. This service links Tanger Med and Damietta with Jeddah, operating every ten days for connections between Saudi Arabia and various global destinations. The shuttle was launched in response to Hapag-Lloyd rerouting its main liner services due to security concerns in the Red Sea, ensuring continuous service without compromising safety.

- The U.S. and its allies, including the U.K., have conducted a major military strike against the Houthi forces in Yemen. This action, a response to the Houthis' unprecedented attacks on maritime vessels in the Red Sea using anti-ship ballistic missiles, targeted 60 locations including Iranian-backed Houthi militant sites. Key facilities like munitions departments, launch systems, and radar systems were hit. The strikes involved U.S. and U.K. aircraft, ships, and submarines, with the U.S. deploying Tomahawk missiles from a guided-missile submarine.

- As of January 12th, there has been a significant shift in maritime logistics, with 354 containerships having been redirected from the Suez Canal to the Cape route since December 15, 2023. This diversion accounts for 80% of the maritime traffic between the Atlantic/Mediterranean basins and the Indian Ocean. The trend is expected to persist, as the majority of major carriers are currently favoring the Cape route for their operations. This shift is indicative of a notable change in global shipping patterns.

- Amidst the Red Sea crisis, the airfreight sector has not seen a significant demand increase, although there's a rising interest in alternatives to sea transport. This trend shows a cautious stance among shippers and logistics managers, who are exploring other options in response to potential maritime disruptions. This growing interest hints at a possible shift towards airfreight if maritime challenges intensify or persist.

- The Med/North Africa to Jeddah shuttle service is poised to be highly popular with BCOs. They are seeking access not only to other ports in the Red Sea but are also exploring trucking options to ports/destinations in the Persian Gulf. The distances for trucking from Jeddah are as follows: approximately 1,300 kilometers to Kuwait, about 1,400 kilometers to Dammam, and around 2,000 kilometers to Abu Dhabi in the UAE.

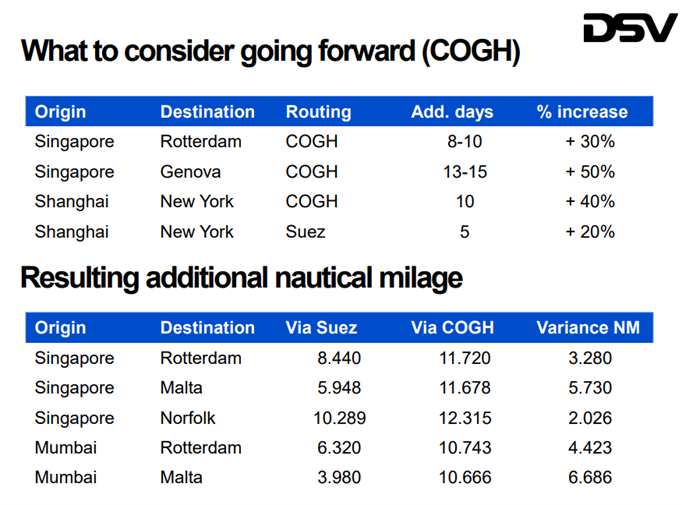

- One of our logistics partners DSV, illustrates the additional transit time required for voyages via the Cape of Good Hope compared to the Red Sea route.

DEMAND COMMENTARY

Ocean

- The volume of imports and exports for the Indian Subcontinent and the Middle East, as reported by Container Trade Statistics (CTS), appears to be maintaining a steady trajectory with only minor fluctuations observed on a month-to-month basis. This stability in trade volumes suggests a consistent level of demand and supply interactions between these regions.

Air

- One of our freight partners said that it expects a slow but steady increase in airfreight volumes amid predictions that the Red Sea conflict could last for months, but demand has yet to materialize.

- In November 2023, Middle Eastern carriers exhibited a robust performance, marked by a notable 13.5% year-on-year increase in cargo volumes. This impressive growth aligns with the substantial improvement observed in the preceding month, which saw a 13.0% rise.

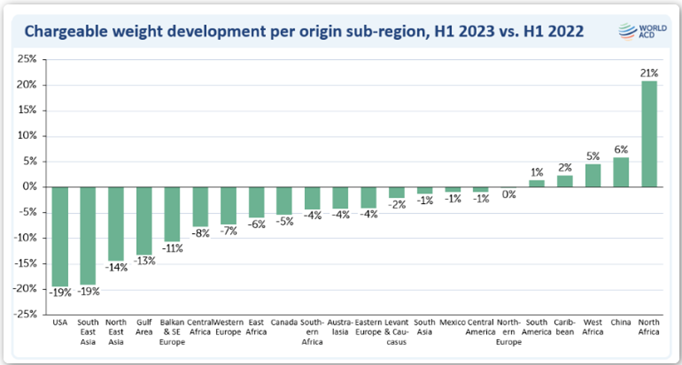

- North Africa is among a handful of global air cargo origin subregions to record growth in the first half of 2023, according to analysis by WorldACD Market Data, reports Sydney's Asian Aviation. It reveals, for example, that chargeable weight from North Africa in the first six months of this year rose 21 per cent.

- Recently, Ethiopian Airlines Cargo, in partnership with Poste Air Cargo, opened new routes to connect Tunisia to more than 84 destinations in Africa which offer more capacity and solution to Tunisian Economic operators. Increased demand is driving additional capacity.

SUPPLY COMMENTARY

Ocean

- Due to the recent Houthi attacks in the Red Sea, cargo destined for the Eastern Mediterranean and Europe is now often discharged at Arabian Gulf/Persian Gulf (AG/PG) ports. From there, it's either trucked via the Northern Gulf to the Eastern Mediterranean or rerouted through alternative sea or air transport modes to reach European destinations. This shift in logistics reflects a strategic response to ensure safe and timely delivery amidst regional security challenges. Therefore, space is very tight on Asia-AG/PG trade lanes.

- The shipping industry is currently facing significant uncertainty, especially for Asian exports. This is due to services being temporarily held back from departing Asia and subsequent delays in Asia-Europe arrivals, resulting in notable capacity drops.

- The observed capacity spike in late December and early January, often misinterpreted as a significant trend, is linked to origin delays and is less consequential. This pattern, reflecting similar trends in both Asia-Mediterranean and Asia-North America East Coast routes, manifested a week earlier, suggesting a broader, yet misunderstood, pattern in global shipping dynamics.

Air

- North Africa is an increasingly attractive market for the airfreight industry, showing buoyant growth during an otherwise relatively flat year. Data shows that North Africa was one of just five sub-regions to grow in the first six months of 2023, surging 21% year-on-year.

- Despite the clear interest in the region and the potential it provides, Africa remains a challenging market in the airfreight sector due to limited facilities in the region.

- Tunisia, for example, has seven international airports but only one main international airport in use at the moment for 95% of air cargo traffic “Tunis Carthage Airport”, limiting the number of flights that can go in or out of the hub. Regional authorities have noted the challenges around this already, looking to rectify it through the addition of other facilities in the near future.

- With the risk of instability and the challenges around infrastructure, multimodal transportation has become a crucial element of operations.

KEY TAKEAWAYS

- The long-term impact of the Houthi attacks in the Red Sea includes sustained higher shipping costs and increased transit times due to rerouting, leading to global supply chain disruptions and higher prices for goods and energy. It also raises geopolitical tensions, with potential implications for international trade and security.

- The threat of Houthi attacks has significantly raised insurance premiums for ships operating in the Red Sea, with a particular focus on vessels with Israeli links. This situation has complicated the process of tracking ship ownership and management, adding to the uncertainties and costs for companies involved in maritime trade in the region

- Substantial inquiries for sea/air and railway services have been observed, indicating a heightened interest in alternative transportation methods, yet there has been no concrete shift in shipping patterns as of now.

- In 2024, the air cargo sector is expected to experience positive growth globally. The Middle East, primarily driven by GCC countries, is projected to lead with a substantial growth rate of 12.3%. In contrast, Africa is forecasted to see a more modest increase of 1.5%. Overall, IATA predicts a 4.5% growth in the air cargo industry for the year.

- The road transport sector is emerging as the fastest-growing segment within the United Arab Emirates Freight and Logistics Market. This growth is supported by substantial investments in road infrastructure, notably exemplified by projects like the USD 2.7 billion Sheikh Zayed double-deck road scheme. This focus on enhancing road transport capabilities signifies a strategic move to bolster the efficiency and capacity of the UAE's freight and logistics sector.

- The United Arab Emirates Freight and Logistics Market is estimated to be valued at USD 15.77 billion in 2023 and is projected to grow to USD 21.67 billion by 2028. This growth represents a Compound Annual Growth Rate (CAGR) of 6.24% during the forecast period from 2023 to 2028. This significant growth underscores the market's expanding role in the UAE's economy and its potential for future developments in the logistics sector as per analysts.

AMERICAS

MARKET OVERVIEW - AIR

- The peak season for e-commerce peak season started in November and December

- E-commerce currently occupies up to 70% of capacity and is anticipated to experience a 6.6% growth in 2024.

MARKET OVERVIEW – OCEAN

- Utilization is trending upwards as carriers fit the capacity better to the demand output, resulting in GRIs across various short sea corridors.

- Protests in Panama are having an impact on the supply chain. Protesters have blocked streets, making transporting goods around the country very difficult. Some International Roads are closed.

- Larger container ships sailing from Asia to the U.S. East and Gulf Coast ports already feel the effect of Panama’s drought.

- As the restrictions on traversing the Panama Canal continue, carriers are exploring other routing options to limit delays and uncertainty.

- In September, the Brasil Terminal Portuario in the Port of Santos, the largest in Brazil, refused ships due to operating at 95% capacity.

- Port congestion globally improved over the past weeks despite disruptions in several areas.

MARKET OVERVIEW - GROUND

- While most cross-border services use cross docks at the border and transfer loads between Mexican and U.S. carriers, there is an alternative. Direct-through services keep a load on the same trailer, eliminating the time and handling associated with cross-dock services. Direct services are faster and tend to cost more than cross-dock services.

DEMAND – AIR

- Global Cargo Ton-Kilometers (CTKs) were up 1.9% year-on-year (YoY) in September. Compared to the pre-COVID level, global CTKs remained 1.3% lower

- Less available Capacity drives costs up

- Longer lead times in general

DEMAND – OCEAN

- The demand out of China is trending very strong. Various carriers report space sold out for the month of November.

- Stock inventory is being filled up – shortage of inventory drives the demand in November

- Major ocean carriers continue to inject new capacity into the market even as new containerships begin service.

DEMAND – GROUND

- Overall, route guides are performing very well, with primary service providers accepting loads at pre-pandemic levels and the first backup provider accepting rejected tenders most of the time. Placeholder Text

- Today's market is oversupplied in for-hire truckload capacity, and the carrier community is working to balance the market, which is the first phase of a new cycle. Analysts and market participants watch shifts in trucking labor, net shifts in the active number of for-hire trucking companies, changes in active fleet size of the nation's largest fleets, and key operating costs like diesel that can be influential to the slim margins of the smallest carriers in this phase.

PRICING SITUATION – AIR

- E-Commerce peak Season started in November and December

- Airfreight rates on significant east-west trade routes increased in October as the industry entered its customary peak season.

- Air cargo rates have reached their highest levels of the year on shipments from Asia to the U.S.. Although demand during the typical peak season remains muted compared with previous years, constrained capacity and surging demand from e-commerce shipments have driven rates up on key transpacific trade lanes.

- IATA Jet Fuel Price Monitor shows the jet fuel price for the week ending November 10th was down 17.2% compared with the prior year’s average of USD USD114.74/bbl.

PRICING SITUATION – OCEAN

- The market will increase as higher demand vs. a steady capacity supply is the new norm. GRIs are widely implemented on the front haul lanes in the short sea market.

- The Transpacific rates faced increased pressure as liner operators introduced more capacity. According to the Shanghai Containerized Freight Index (SCFI), rates from Shanghai to the U.S. West Coast experienced a 12% decline, while rates to the U.S. East Coast dipped by 3%.

PRICING SITUATION – GROUND

- Contractual pricing remains low. Suppose a shipper's contract pricing is exceptionally low. In that case, it is possible to experience some first tender rejections during the seasonal moves and higher backup pricing as the market experiences seasonal and regional pressures and year-end market evolution.

- Retail diesel's national U.S.A average price per gallon has moved from USD 3.86 in June to USD 4.52 in October, with recent softening.

EUROPE

MARKET OVERVIEW - AIR

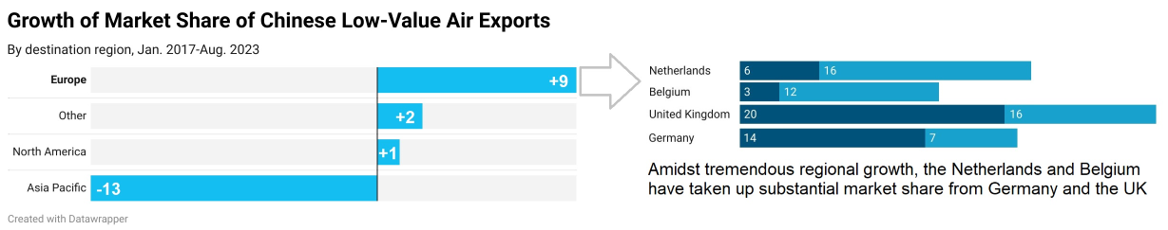

- The increasing need for e-commerce companies to move goods quickly creates upward pressure on air cargo prices.

- According to the International Air Transport Association (IATA), e-commerce represented 15% of air cargo volumes in 2019. IATA estimates that the share of e-commerce products shipped via air cargo will likely increase to 22% in 2022.

- Airfreight rates, which dropped at the start of 2023 and remained relatively flat during the summer, have risen since early October, mainly in Hong Kong, Vietnam, and South China.

- Major e-commerce firms are securing airline space, even preemptively for anticipated orders, irrespective of immediate utilization. This strategy aims to ensure swift transit times to end markets in North America and Europe.

- The reduced winter schedules on Transatlantic flights from Europe have led to capacity constraints, increasing pricing pressures.

- This demand may taper somewhat after the December shopping and shipping season, allowing pricing to drop again.

MARKET OVERVIEW - OCEAN

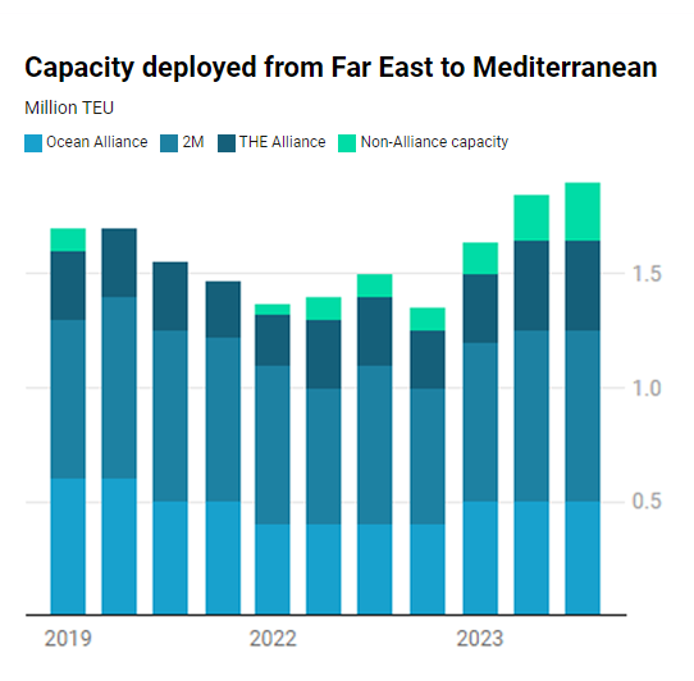

- Key ocean shipping routes, such as Asia-North America and Asia-Europe, are experiencing significantly higher capacity growth than pre-pandemic years, surpassing current demand levels. The situation is particularly pronounced in Europe, where the incorporation of new vessels exceeding 20,000 TEU contributes to the imbalance.

- Shipping companies are confronted with a dilemma: either announce substantial blank sailings, causing disruptions for shippers, or maintain elevated capacity levels, potentially resulting in decreased freight rates.

- This trend, driven by forwarders and intensified by direct competition among shipping firms, leads to unsustainable market conditions and adversely affects the industry's profitability and stability.

MARKET OVERVIEW – ALL MODES

- European legislation aligned with carbon emission targets will elevate pricing and pose challenges for shippers, air and ocean lines, and freight forwarders across all modes of transport.

DEMAND COMMENTARY - AIR

- Popular shopping holidays like Black Friday, Cyber Monday, Christmas, Singles Day, and some high-tech product launches have created backlogs in airports like Shanghai and Hong Kong.

- The Chinese shopping holiday, Singles Day, is of note since it’s grown above and beyond all the other shopping holidays combined. Its popularity is now spreading throughout the rest of Asia and into Europe.

- While e-commerce is projected to expand by 6.6% in 2024, there is a prevailing belief that this growth rate is not sustainable for the continued shipment of low-cost products on aircraft, which are more expensive and produce higher emissions.

- Cargo migrating from air to ocean and a long-term trend of decreasing shipment sizes put pressure on forwarders in a market where overall volume growth is static.

- While this year’s market has seen volumes, on average, down about 4% globally, HACTL, Hong Kong Airport’s ground handler, saw volumes fall just 1.3%. This is mainly due to e-commerce fashion brands.

- While e-commerce appears to be lifting demand and rates for airfreight, many logistics providers have been late to the B2C party and are now struggling in other sectors with low demand for airfreight.

- B2C involves small packages weighing 5kg and 10kg and reverse logistics. Airlines have established e-commerce divisions to accommodate these unique processes and comply with VAT regulations. Airlines express satisfaction with time-critical or high-yield shipments, preferring them over general cargo with lower yields.

DEMAND COMMENTARY – OCEAN

- The economic recovery in China is showing mixed signals, impacting European markets in various ways. Chinese exports have declined six consecutive months since October, affecting the European Union, which heavily relies on imports. Additionally, China's domestic demand struggles are evident from its negative inflation rate.

- The latest (September) CTS container demand data reveals a moderate global rebound with a 16.1% year-on-year increase in TEU-Miles, a recovery from last year's decline but still reflecting a modest 7.3% growth since pre-pandemic levels (September 2019). This growth is not uniform across regions, with significant increases in the Indian Subcontinent and the Middle East contrasting starkly with Europe's stagnation and decline in trade volume.

- Drewry forecasts a flat global container volume for 2023, with a slight uplift expected in 2024 as freight activities about GDP normalized. A return to average growth of 3% annually is anticipated in 2025. Specifically, for the Asia-Europe trade lane, a 1% growth is projected for 2023, while 2024 is expected to see a contraction of 0.9%.

- Global freight volume growth in 2024 is forecasted to have about 2% growth in ocean volumes and about 5% growth year over year in air freight volumes for FY24. Europe shows a better backdrop for growth compared to the U.S..

DEMAND COMMENTARY – GROUND

- Road freight in Europe is experiencing a sustained decrease in short-term demand pressure. The reduction is attributed to consumers facing a decline in real wealth, cutting back on goods consumption, and businesses scaling down production amid diminishing demand.

- Notably, consumption and manufacturing are declining in Germany, Europe's largest market.

- According to Eurostat data for Q3 2023, there is no quarter-on-quarter change in European retail trade, but manufacturing shows a significant 3.6-point decrease.

- Germany's elevated business costs and sluggish international demand for goods contribute substantially to the overall decline in activity.

- Consequently, the total demand pressure on road freight decreases, increasing capacity availability.

- In the rest of the continent, the rate of decline in the spot price has slowed due to dropping inflation. The result is more minor falls in the demand for goods, thus reducing the weight of downward pressure on prices.

SUPPLY COMMENTARY– AIR

-

E-commerce uses up 70% of South China and Hong Kong’s capacity. Space is complex for other commodities, and backlogs are building in the main airports, especially in Shanghai and Hong Kong.

SUPPLY COMMENTARY – AIR

- On the passenger side, Chinese Airlines have 12 weekly flights, whereas pre-pandemic flights would run 12 -20 daily. With most of the lower deck passenger belly cargo occupied by e-commerce companies, a shortage will continue until the complete passenger network returns. A further constraint is that available passenger flights are fully occupied, so much of the belly space is filled with baggage.

- While passenger airlines benefit from a resurgence in international travel, the market for freighter operators on trade lanes out of Asia is a growing concern. Airlines are still suffering after COVID-19, and if Q1 and Q2 2024 are poor, there will be a significant impact on freighter capacity being parked. Niall van de Wouw, chief air freight analyst at Xeneta, stated, “You can’t do anything about your fixed costs – your fuel and the cost of your airplane. If the rates remain at the current level, it is challenging to have a profitable freighter rotation.

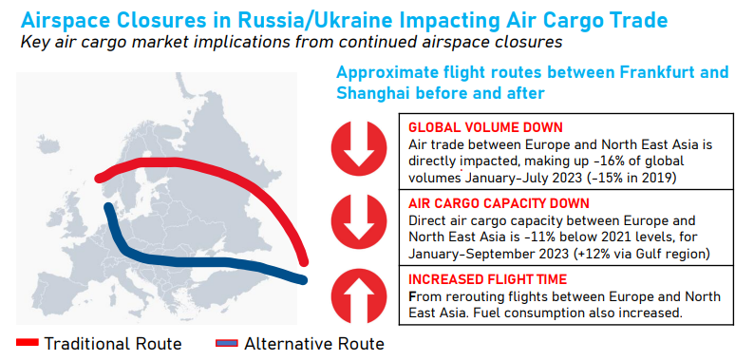

- The continuing conflict in Ukraine adds time and cost to airfreight from North Asia to Europe.

SUPPLY COMMENTARY – AIR

- One of the most immediate impacts of the war between Israel and Hamas has been the suspension of flights to and from Israel by major carriers such as FedEx, UPS, and Lufthansa. UPS and FedEx have reinstated their flights, but from time to time, the main Ben Gurion airport has been closed due to rocket attacks. Israel’s three airlines, El AL, Israir, and Arkia are operating extra flights to pick up the slack.

- DHL Express continued their service with cancellations from the start of the conflict.

SUPPLY COMMENTARY – OCEAN

- The market struggles to accommodate the capacity added in the past four years, especially in Europe, with the integration of new 20,000+ TEU vessels amid minimal growth in the Far East-to-Europe trade. This and a modest rise in the CTS global rate index since pre-pandemic times highlight persistent challenges in the container shipping market.

- There has been a noticeable trend of growing delays in the orderbook, primarily due to over-ordering capacity since 2021. This phenomenon, common in weak markets and called "slippage," reflects the sector's challenging supply and demand outlook. The delays in ship orderbooks have become a characteristic feature of the industry's current landscape, indicating a struggle to balance the increased capacity with actual market demand.

- In 2023, the container shipping industry saw its delivery schedule for 2.5 million TEU revised to 2.4 million TEU, indicating a modest slippage. However, a notable discrepancy emerged between June and September, with actual deliveries at 0.79 million TEU versus the planned 1.1 million TEU, resulting in a substantial 28% shortfall.

- The supply is predicted to grow by 7.2% in 2023 and 6.4% in 2024. However, the global supply-demand index is projected to worsen, reaching an all-time low of 74.3 in 2024 (from 79 in 2023), indicating a market far from equilibrium.

- The Asia-Europe trade lane, which is most exposed to the influx of new deliveries, will see contract rates fall below break-even points in 2024.

- There's a slight decrease in global port congestion, but congestion levels on the U.S. West and East Coasts have remained the same.

- Increasing non-alliance capacity on significant trades.

SUPPLY COMMENTARY - GROUND

- The forecasted driver shortage will strongly depend on economic activity, with a mild rebound in growth projected next year; as inflation keeps easing, the labor market remains robust, and real incomes will gradually recover.

- Over one-third of truck drivers in Europe are currently over 55 years old and will retire in 5 to 10 years, while the number of new entrants joining the profession is insufficient to ensure the replacement of older ones (less than 6% of truck drivers are below 25 years old in Europe).

- Driver shortage medium-term forecasts estimate that over 745,000 truck driver jobs could be unfilled in 2028 due to driver retirements.

PRICING SITUATION – AIR

- Airfreight rates continued to rise last week as weather conditions, potential volcanic activity, and wars put capacity under pressure.

- The latest figures from the TAC Index show that the overall Baltic Air Freight Index was up 4.6% in the week to November 20 compared with the previous seven days.

- The increases were led by China as prices out of Hong Kong increased by 11.5% compared with a week earlier and are now down by 2.2% compared with a year ago.

- Outbound Shanghai increased by 5.3% compared with a week earlier, reducing its year-on-year decline to 1.3% “led by double-digit gains to Europe”.

- Another upward pressure on air freight pricing looming in the future comes from a deal on sustainable aviation fuel (SAF) expectations for airlines on flights within and departing from the EU between 2025 and 2050.

PRICING SITUATION – AIR

PRICING SITUATION – AIR

- The green fuels law for aviation known as ReFuelEU stipulates that from 2025, all flights departing from an EU airport must use a minimum share of SAF, starting at 2% in 2025, rising to 6% from 2030, and gradually to 70% by 2050. There are concerns that this requirement could force the price of SAF to be higher. IATA warned that the measure required more flexible supply rules to incentivize sustainable fuel production.

- On 28 November 2023, history will be made when the first transatlantic flight powered purely by 100% sustainable aviation fuel (SAF) wings across the Atlantic from London to New York. The Virgin Atlantic flight is intended to show the feasibility of flying on 100% SAF and is supported by Boeing, Rolls Royce, and BP, among others.

- Currently, aviation fuel pricing remains volatile as Russia and Saudi Arabia have started voluntary production cuts on top of existing OPEC+ supply reductions. European prices were affected by an outage in the Al-Zour refinery in Kuwait, which exports a significant portion of its jets to Europe. Supply concern was also heightened after a call for stricter enforcement of EU sanctions on Russia, including a ban on fuel imports from overseas refineries using Russian crude.

PRICING SITUATION – OCEAN

- The ocean freight industry is experiencing strain due to a competitive trend of lowering rates. This trend, driven by forwarders and intensified by direct competition among shipping firms, leads to unsustainable market conditions and adversely affects the industry's profitability and stability.

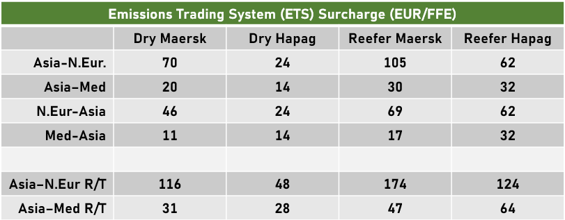

- Starting January 1, 2024, the EU's Emissions Trading System (ETS) will include CO2 emissions from maritime transport, particularly large ships over 5000 GT. It will cover all emissions within EU waters and for EU port voyages. Shipping companies like Maersk and Hapag-Lloyd are struggling with ETS surcharges on freight rates due to legal limitations hindering a uniform surcharge approach, resulting in potential industry-wide cost management disparities.

- The backhaul trade rates from Europe to Asia have significantly dropped, leading carriers to subsidize eastbound cargo effectively. This situation is characterized by highly low-rate levels, with carriers focusing more on strategic container positioning and moving inland containers back to Asia. The Container Trades Statistics (CTS) price index for this trade has reached its lowest recorded level, indicating a substantial decline in backhaul rates.

- The charter rates for container ships have fallen to a three-year low. Despite this significant drop, these rates are still 36% higher than the average levels recorded in 2019, before the COVID-19 pandemic influenced the market.

- Due to the supply-demand imbalance, container spot rates are expected to remain under pressure. For 2024, excluding fuel surcharges, rates are forecast to be 16% lower than the 2016 cyclical low.

- It is challenging to see contract rates achieving a premium over spot rates in the current market. Historically, customers could achieve a 16% discount over the spot during annual contract negotiations. The current market offers significant options for customers, leading to expectations of substantial freight cost reductions, especially in sectors like Retail and chemical.

- There's an expectation that spot freight rates will continue to hover around breakeven levels and align with contract rates as shipment volumes increase and capacity discipline is enforced. The report suggests caution in the near-term development of spot freight rates.

- Asia-Europe contracts, typically running from January to December, are currently being negotiated. Despite a significant supply-demand imbalance, rising carrier costs may prevent buyers from fully capitalizing on this situation.

- Costs in 2024 and beyond are expected to be 25-30% higher than in 2019. The EU Emissions Trading System (ETS) is expected to significantly impact costs, with projections of escalating expenses for major carriers.

- The market has seen fluctuations in spot rates, with a spike in late October. This is partly due to carriers reducing available capacity, although the overall low-rate levels are attributed more to the capacity overhang than to weakening demand.

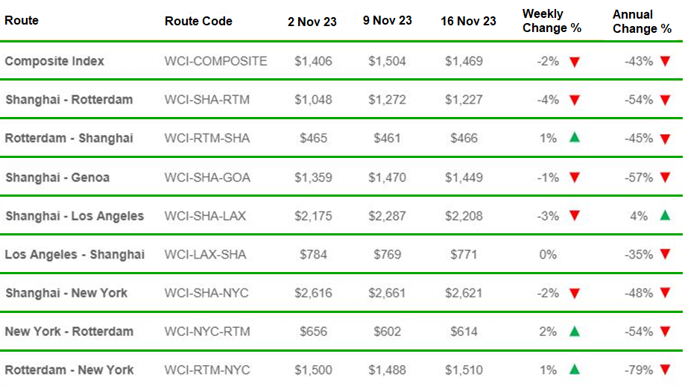

- Carriers are making a final attempt to increase spot rates on the Asia-North Europe route before the year ends, introducing new GRIs for 1 December, mirroring those set on 1 November, which have primarily lost effectiveness. Concurrently, Drewry’s World Container Index for Asia-North Europe decreased by 4% this week.

SUPPLY COMMENTARY – GROUND

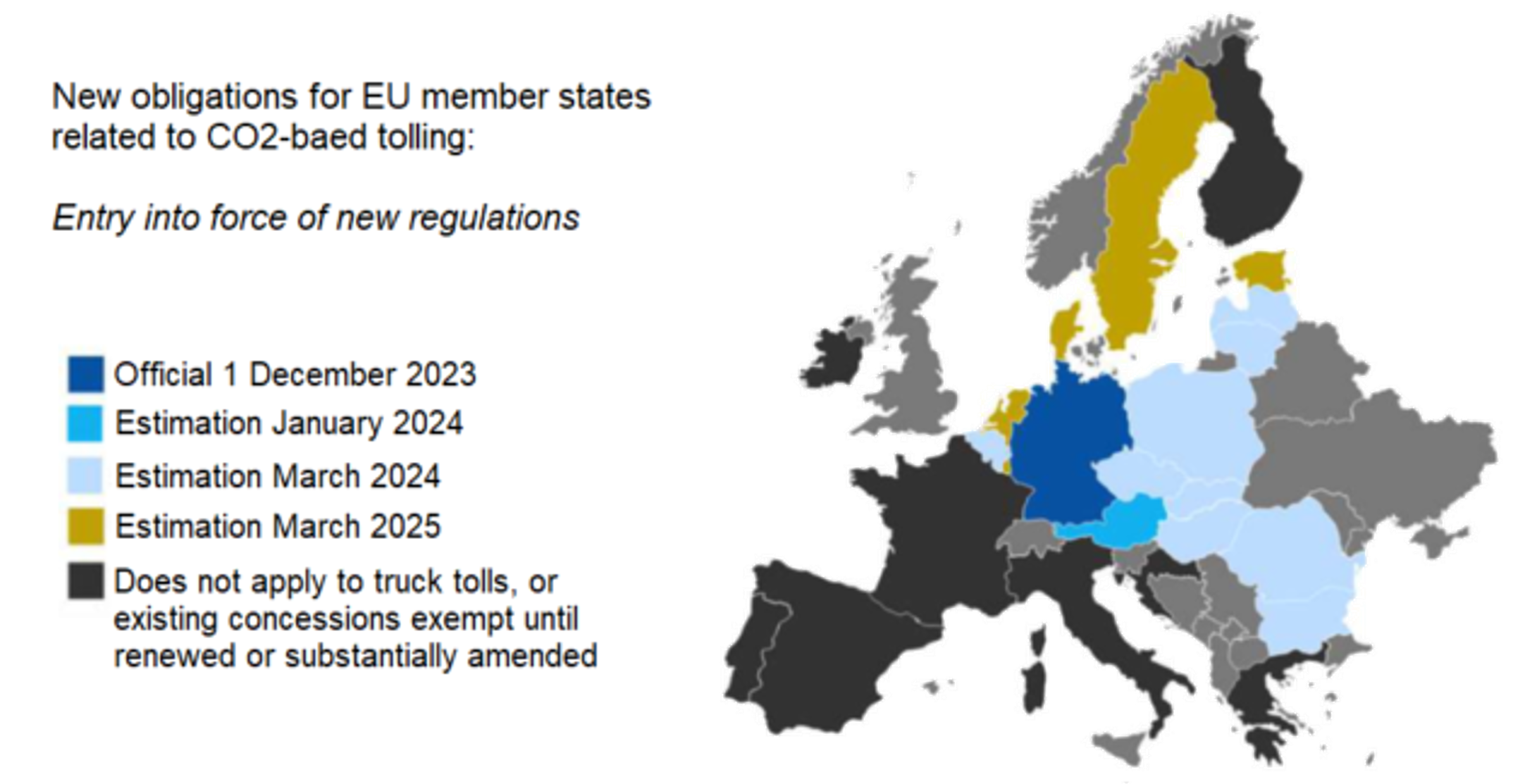

- Europe’s forwarders and road freight operators are warning customers to expect a significant increase in toll fees as a new European toll system linked to CO2 emissions is rolled out starting in Germany on Dec 1st.

- According to a European Union directive, heavy goods vehicles will be categorized into five classes based on CO2 emissions, which will be used to determine toll rates. Austria will implement the measure in January, and the rest of the EU is expected to follow by March 2025. Toll payment solutions provider DKV Mobility estimated forwarders would pay a surcharge of EUR 200 per ton of CO2 on all commercial vehicles over 7.5T, which could increase toll costs in Germany for the trucking industry by 83%.

- Truck operators will need to pass these costs on to their customers. To put this in perspective, however, even with the increase, the toll is a small percentage of the total freight price.

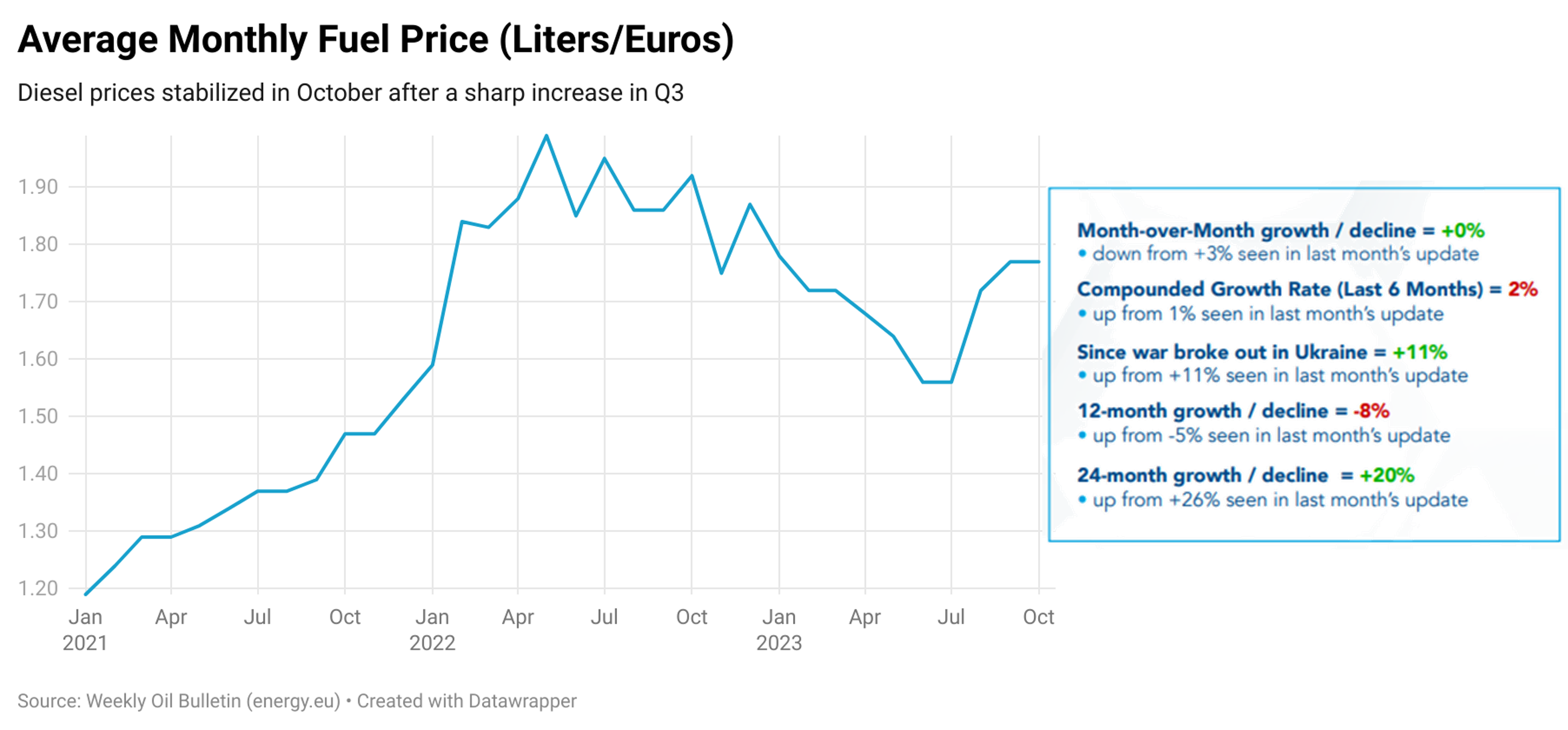

- This regulation shift away from fossil fuels comes at a time of weak European demand and soaring operating costs for truck operators driven by fuel prices, rising wages, increasing insurance premiums, and the rising cost of maintenance and spares.

- Crude oil prices have increased since June primarily because of extended, voluntary cuts to Saudi Arabia’s crude oil production (1 million barrels per day from July 2023) and rising global demand. In September, they increased further after Saudi Arabia and Russia announced an extension of its voluntary crude oil production cut through the end of the year.

- The Brent crude oil price reached USD 94/b in September (a 25% increase compared to June 2023) before falling below USD 90/b during the first week of October. This comes on top of OPEC+ members’ crude oil production voluntary cut of 1.2 million b/d cut in place from May 2023, announced to be extended through 2024.

KEY TAKEAWAYS – AIR

- Passenger numbers and flights continue to recover globally but not at the same rate out of China.

- The increase in e-commerce companies using airfreight between Asia, the EU, and the U.S. is driving rates up out of Hong Kong, Southern China, and Vietnam. There is much speculation that this is unsustainable as it is hard to see how relatively low-value exports can continue to be shipped by such a costly mode of transport. It seems more likely that the shippers involved will be unable to continue entering into high-cost block space agreements with airlines and still profit on relatively low-cost sales.

KEY TAKEAWAYS – OCEAN

A significant portion (at least 65%) of the new shipping capacity (over 7 million TEUs) consists of large vessels (over 15,000 TEUs), predominantly deployed on the Asia-Europe trade lane.

- Geopolitical tensions, especially potential conflicts involving China-Taiwan and Israel-Hamas, threaten global supply chain resilience. These could impact crucial maritime routes like the Suez Canal. However, the container shipping industry's current overcapacity, with an excess of 2 million TEUs, suggests a more robust capability to manage disruptions, including a possible prolonged Suez Canal blockage requiring extensive vessel rerouting.

- Sea-Intelligence's September 2023 report shows ongoing stagnation in global container shipping reliability, maintaining around 64% for four months. Though up from the pandemic's early 2022 low of 30% on-time performance, it remains below the pre-pandemic norm of 70-80%, indicating a post-pandemic stabilization at a lower efficiency level.

- The container shipping industry faces overcapacity issues, especially in Transpacific and Asia-Europe trades, with unsustainable growth and insufficient cancellations. This, combined with difficulties absorbing new capacity, increases the supply-demand imbalance.

- Shipping companies are experiencing financial strain due to competitive pressures to lower freight rates, a trend exacerbated by direct competition. This situation is leading to unsustainable market conditions and affecting profitability. The industry also faces a dilemma between reducing capacity, which could cause disruptions, and maintaining high capacity, risking reduced freight rates.

- The industry is witnessing significant drops in backhaul trade and charter rates for container ships while struggling with the alignment of spot and contract freight rates. The Asia-Europe trade lane is particularly affected, with contract rates expected to fall below break-even points in 2024. Additionally, negotiations for Asia-Europe contracts are ongoing, with rising carrier costs and market volatility influencing the outcomes.

KEY TAKEAWAYS – GROUND

- A European Union directive addressing the CO2 emissions of heavy goods vehicles is adding to the uncertainties in the road freight market. This directive will be vital in setting toll rates across the 27 member states, which will come at a challenging time with weak European demand and escalating operating costs for truck operators.

- Factors such as surging fuel prices, rising wages, higher insurance premiums, and increased costs for maintenance and spares contribute to the complexity. The impact of these factors on the overall cost to customers is still uncertain and awaits further clarification.

Back to Top