By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Category Intelligence

Q2 2025

Global Category Intelligence

Q2 2025

ENERGY

MARKET OVERVIEW

As we progress through the first quarter of 2025, the global energy market is influenced by several key factors, including but not limited to:

1. Geopolitical Risks:

-

The ongoing Israel-Hamas conflict and the war in Ukraine continue to disrupt global energy supply chains, particularly in Europe. The expiration of the Russia-Ukraine gas transit deal at the end of 2024 has heightened concerns over natural gas supplies, leading to increased competition for liquefied natural gas (LNG) imports.

-

The war in Ukraine continues to disrupt global energy supply chains, particularly in Europe, where the transition away from Russian natural gas has led to increased competition for LNG and other energy supplies.

-

Countries that once depended heavily on Russian energy exports are doubling on securing alternative sources. The US and Qatar have become important suppliers of LNG to Europe, while countries like India and China have sought discounted Russian oil.

-

Since his January 2025 inauguration, Donald Trump has reversed U.S. energy policy. These changes emphasize fossil fuel production, deregulation, and a shift from renewable energy initiatives.

2. Commodity Volatility:

-

Recent data indicates that oil prices have experienced volatility due to various factors, including geopolitical tensions and economic indicators. For instance, oil prices fell recently as US crude supplies increased for the third consecutive week, and concerns about the American economy deepened.

-

In response to the instability in the electricity market, countries like France have pushed to revitalize nuclear power to provide stable, low-carbon electricity. In contrast, others have invested more in interconnectivity to better balance supply and demand across borders.

3. Supply Diversification:

-

Countries are intensifying efforts to diversify energy supply chains in response to geopolitical tensions. Europe's reliance on LNG imports has grown, with infrastructure expansions such as new floating LNG import terminals expected to enhance supply security.

-

While renewable energy growth is projected to continue at a strong pace, fossil fuels will still play a significant role in meeting global energy demand, particularly in developing regions. The IEA's projections, alongside analysis from industry stakeholders, indicate a period of volatility and uncertainty in the short to medium term, but also a fundamental shift toward a cleaner, more resilient energy system. .

DEMAND TRENDS & FORECASTS

Global Demand Overview

The global energy demand outlook for Q2 2025 shows significant shifts globally and is characterized by a robust increase in electricity consumption, a gradual decline in fossil fuel reliance, and a substantial rise in renewable energy adoption. According to the International Energy Agency (IEA), global energy demand is expected to continue its upward trajectory, but with varying growth rates across regions.

Key drivers of energy demand in Q2 2025 include:

-

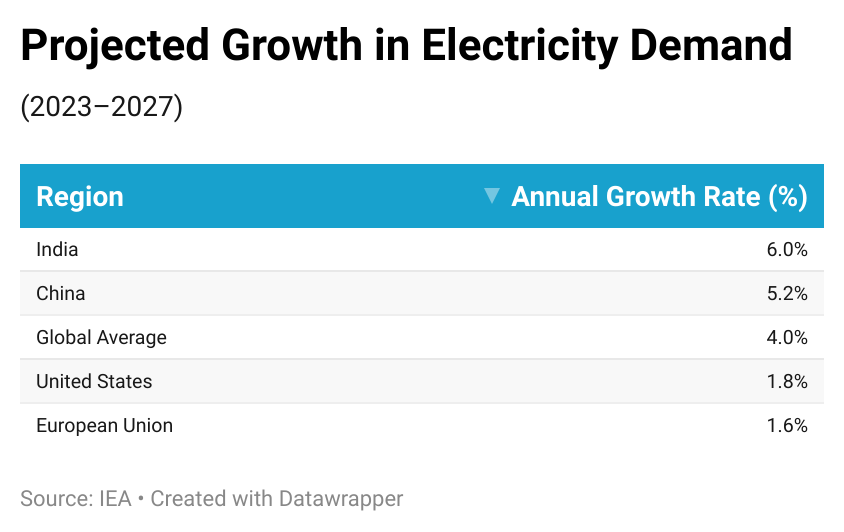

Electricity Surge: A 4% annual growth through 2027 (IEA), led by China (50%+ increase) and India (10%), driven by industrial growth and cooling needs.

-

Fossil Fuel Transition: Fossil fuels peak before 2030, dropping to 73% of supply by the decade's end, with renewables adding 80% of new capacity.

-

Renewable Rise: Clean energy outpaces demand growth, with solar and wind leading the way. By the mid-2030s, they will surpass coal.

Surge in Global Electricity Demand

The IEA projects that global electricity demand will grow by approximately 4% annually through 2027.

-

This surge is primarily driven by emerging economies, with China and India at the forefront. China alone is expected to account for over half of this increase, propelled by its expanding industrial sector and the manufacturing of clean energy technologies such as solar panels, batteries, and electric vehicles. India is anticipated to contribute about 10% to the global demand growth, fueled by robust economic activity and a rising need for air conditioning.

-

In advanced economies like the United States, increased electrification in transportation, heating, and data centers is expected to lead to renewed demand growth.

-

However, the European UniUnion'sowth forecast has been adjusted to 1.6% for 2025, reflecting a weaker economic outlook.

.2025-03-17-16-50-59.png)

Transition from Fossil Fuels

The global energy landscape is witnessing a pivotal transition, with fossil fuel consumption projected to peak before 2030. This shift is largely attributed to the accelerated adoption of renewable energy sources and the electrification of various sectors. The IEA's World Energy Outlook 2023 indicates that the share of fossil fuels in the global energy supply, which has remained around 80% for decades, is expected to decline to 73% by 2030. Renewable energy sources are set to contribute 80% of new power capacity by 2030, with solar photovoltaics alone accounting for more than half of this expansion.

Rise of Renewable Energy

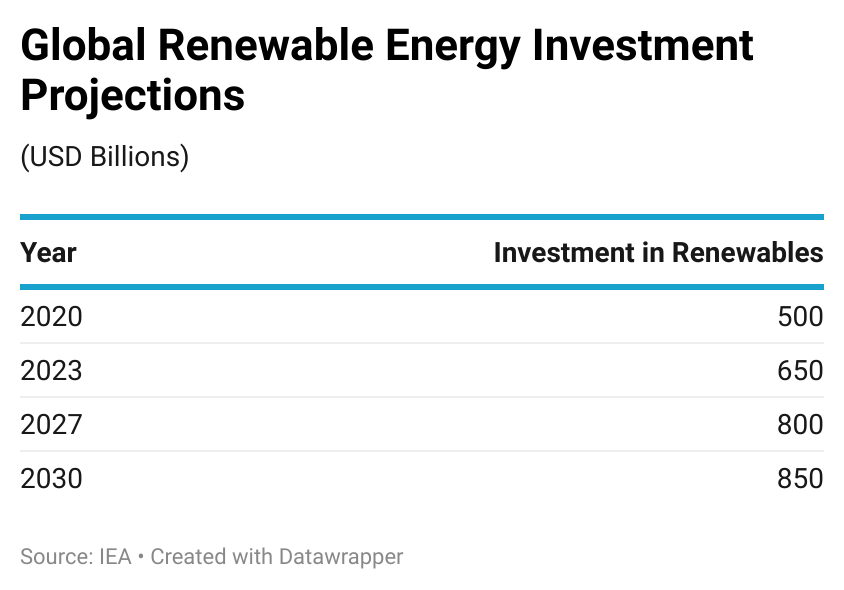

Renewable energy is rapidly becoming a cornerstone of the global power supply. The IEA forecasts that clean energy sources will grow faster than global energy demand by the decade's end, positioning renewables as the largest power source by the mid-2030s. This growth is driven by significant investments, with projections indicating that investments in renewables will reach $850 billion by 2030.

Solar energy is expected to become the second-largest low-emission source, following hydropower. Notably, renewables are anticipated to surpass coal-fired generation for the first time in a century.

Regional Perspectives

-

China: As the world's largest emitter of greenhouse gases, China is pivotal in global energy trends. The country is a leading manufacturer of solar panels and batteries, with electric vehicles comprising 40% of new car sales—a figure projected to reach 70% by 2030. Despite these advancements, China's energy demand continues to rise, leading to sustained increases in emissions.

-

India: India's energy demand is expected to grow by over 6% annually until 2026, driven by economic expansion and increasing air conditioning use. This surge underscores the need for substantial investments in renewable energy to meet the rising demand sustainably.

-

European Union: The EU has revised its Renewable Energy Directive, setting a binding renewable energy target of at least 42.5% by 2030, up from the previous 32%. This ambitious goal aligns with the EU'EU'soader climate objectives, including reducing greenhouse gas emissions by at least 55% by 2030 and achieving climate neutrality by 2050.

Challenges and Considerations

Despite the positive trajectory, several challenges persist. The International Gas Union (IGU) has criticized current energy demand scenarios used by policymakers, arguing that they may underestimate future energy needs, potentially leading to energy shortages by 2030.

Additionally, while investments in renewable energy are increasing, the pace must accelerate, especially in emerging markets and developing economies, to effectively meet global climate goals.

The global energy landscape is undergoing a significant transformation, marked by increasing electricity demand, a shift away from fossil fuels, and a robust expansion of renewable energy sources.

While progress is evident, sustained efforts and strategic investments are crucial to address emerging challenges and ensure a secure, affordable, and sustainable energy future.

SUPPLY ANALYSIS

Global Supply Overview

As the global energy market enters Q2 2025, energy supply will continue to be influenced by several key factors, including the energy transition, geopolitical risks, regional infrastructure, and seasonal demand peaks.

-

As regions navigate the delicate balance between meeting growing demand and transitioning to cleaner, more sustainable energy sources, energy supply will face ongoing challenges and opportunities.

-

The most significant changes in this quarter are from North America, with the news of Donald Trump's inauguration as President. This section lists the repercussions of this from an energy perspective.

Global Supply to Remain Diverse

Global energy supply will remain diverse, with varying reliance on regional energy sources. The IEA's World Energy Investment Report and World Energy Outlook forecasts indicate that the global energy supply in Q2 2025 will be characterized by the following:

-

The continued dominance of fossil fuels, particularly in developing regions, but with the rising importance of renewable energy in advanced economies.

-

Renewables—especially wind, solar, and hydropower—will grow significantly, though fossil fuels will still account for a substantial share of the total energy supply in many regions.

-

Natural gas will play a central role in the transition, particularly as a backup fuel for renewable energy intermittency and heating and electricity generation in colder months.

North America: Renewables Growth and Stable Fossil Fuel Supply

With President Donald Trump's inauguration in January 2025, North America's energy supply landscape is poised for significant changes. The administration has swiftly implemented policies to bolster fossil fuel production, particularly oil and natural gas, while scaling back initiatives supporting renewable energy development.

Expansion of Fossil Fuel Production

-

Liquefied Natural Gas (LNG) Exports: The Trump administration has approved the export of LNG from the Commonwealth LNG project in Louisiana, marking the first such approval since the previous moratorium. This move is designed to enhance U.S. energy exports to Asian and European markets, aiming to reduce these regions' dependence on Russian gas.

-

Offshore Drilling Initiatives: An executive order has been signed to boost oil and gas drilling in Alaska by rolling back prior climate protections and expediting permitting processes. This includes prioritizing projects like the $44 billion Alaska LNG initiative to export liquefied natural gas to Asia.

-

Formation of the National Energy Dominance Council: Established through executive order, this council is tasked with increasing U.S. oil and gas production by reducing regulatory hurdles, enhancing private sector investments, and promoting innovation within the energy sector.

Reduction in Renewable Energy Support

-

Pausing Wind Energy Projects: The administration has ordered the withdrawal of all areas within the Outer Continental Shelf from wind energy leasing, effectively pausing new offshore wind projects. This action does not affect existing leases but halts the initiation of new wind energy developments in these federal waters.

-

Review of Environmental Regulations: A national energy emergency has been declared, granting the administration new powers to boost fossil fuel development. This includes suspending certain environmental regulations, which could potentially impact the progress of renewable energy projects and climate change mitigation efforts.

Projected Impacts on Energy Supply

-

Increased Fossil Fuel Output: U. S. drillers have added oil and gas rigs for three consecutive weeks, reaching 588. This uptick suggests a concerted effort to boost fossil fuel production in response to the administration's policies.

-

Electricity Generation Trends: The U.S. electric power sector is expected to see a 2% increase in generation in 2025, followed by a 1% rise in 2026. This growth is anticipated to be led by renewable energy sources despite the federal shift in support, indicating that state policies and market dynamics continue to favor renewables.

Geopolitical and Economic Considerations

-

Canada-U.S. Energy Relations: In response to proposed U.S. tariffs on Canadian goods, Canada's Conservative Party leader, Pierre Poilievre, has emphasized a "Canada First" agenda. This includes plans to reduce reliance on the U.S. through energy and trade diversification, potentially affecting cross-border energy projects and collaborations.

-

Global Energy Market Dynamics: The administration's focus on increasing fossil fuel exports, particularly LNG, is poised to reshape global energy markets. The U.S. aims to offer alternatives to Russian gas by supplying more LNG to Europe and Asia, thereby influencing global energy security and trade balances.

Europe: Renewable Expansion and Energy Security Challenges

Energy security concerns will continue to shape the energy supply situation in Europe, particularly in the wake of the ongoing energy crisis caused by the Russia-Ukraine war and Russia's reduction of natural gas supplies to the region.

-

Renewable Energy: Europe is set to experience further expansion in wind and solar capacity, with the EU on track to meet its target of generating 40% of its electricity from renewables by 2030. By Q1 2025, countries like Germany, Spain, and Denmark will continue to see increased wind and solar generation, particularly in offshore wind (e.g., the North Sea).

-

Natural Gas and LNG: While Europe is diversifying its sources of natural gas, including LNG imports from the U.S., Qatar, and other suppliers, natural gas will still be a key part of the energy mix during the winter months, especially in countries like Germany and Italy. Efforts to reduce gas consumption and invest in energy efficiency will remain central to Europe's energy strategy.

-

Nuclear Power: France and other European countries will continue to rely on nuclear power to provide low-carbon electricity. Nuclear will be vital in meeting winter heating and electricity needs, especially as intermittent renewable generation (solar and wind) may not meet demand.

Asia-Pacific: Coal Dominance and Rapid Renewable Expansion

The Asia-Pacific region will continue to experience the most rapid energy supply growth, driven by China, India, and Southeast Asian nations. Despite strong expansion in renewables, fossil fuels—especially coal and natural gas—will remain dominant in meeting growing energy demand.

-

China: China's energy supply will remain heavily reliant on coal, which will still account for more than 50% of the country's total energy generation in Q2 2025. However, China will also continue to scale up solar and wind power, with solar energy expected to account for around 15-20% of electricity generation by 2025. Hydropower will also contribute significantly, particularly in the southwest.

-

India: In Q2 2025, India will grow reliant on coal for electricity generation. The country will continue diversifying its energy mix with significant investments in solar energy, but coal will still dominate the power sector. Natural gas will play a larger role in industry and transportation.

-

Southeast Asia: Countries like Indonesia, Vietnam, and Thailand will see increased demand for coal in power generation, though wind and solar energy are expected to grow rapidly. These nations will continue to import LNG as they balance energy security with the need for cleaner energy sources.

Indirect Procurement for Supply Infrastructure

The supply landscape shapes indirect procurement:

-

Renewable Equipment: Solar panels, wind turbines, and batteries see high demand; U.S. policy shifts may increase reliance on China/Europe.

-

LNG Infrastructure: Terminal construction and shipping contracts are critical, especially in Europe and Asia-Pacific.

-

Nuclear and Grid Tech: France and others procure nuclear components and grid interconnectors to balance the supply.

PRICING TRENDS & INSIGHTS

Global Pricing Trends Forecast in Q2 2025

In the first quarter of 2025, energy prices worldwide reflect the evolving balance between energy supply and demand, geopolitical factors, and the ongoing transition to cleaner energy sources. The most significant factors influencing the 2025 prices will be continued volatility in natural gas supply, renewable energy growth, geopolitical factors, and seasonal demand peaks.

The main energy prices that we track are oil, gas, electricity, and renewables:

-

Oil Prices: In early January 2025, Brent crude oil prices surged to a four-month high of $81 per barrel. This increase was primarily driven by intensified U.S. sanctions on Iran and Russia and severe cold weather across the Northern Hemisphere. However, by mid-November 2024, prices were around $72 per barrel due to easing geopolitical tensions and concerns over global economic health. The U.S. Energy Information Administration (EIA) forecasts that Brent prices will average $74 per barrel in 2025, declining to $66 per barrel in 2026 as global production outpaces demand.

-

Natural Gas Prices: Natural gas prices remained relatively low during this period. The EIA reported that the Henry Hub spot price averaged just over $2.00 per million British thermal units (MMBtu) in November 2024. Prices are expected to rise to about $3.00/MMBtu for the remainder of the winter heating season, influenced by seasonal demand and increased liquefied natural gas (LNG) exports.

-

Electricity Prices: In regions with a growing share of renewable energy, electricity prices will likely experience more volatility due to weather-dependent generation. Conversely, in regions with a high share of coal or natural gas, electricity prices depend on fluctuations in fuel.

-

Renewables: Although renewable energy prices generally fall due to technological advancements and cost reductions, the integration of intermittent generation will continue to challenge grid reliability, influencing short-term electricity prices.

North America: Stable but Higher Natural Gas and Electricity Prices

-

Oil Prices: Crude oil prices in North America are expected to remain stable in Q1 2025, averaging between $75 and $85 per barrel, depending on global supply-demand factors and geopolitical risks. The U.S. Energy Information Administration (EIA) anticipates slightly higher prices than in 2024 due to ongoing supply cuts by OPEC+ and the potential for higher demand from major consuming countries.

-

Natural Gas Prices: Natural gas prices in the U.S. are expected to be moderately higher in Q1 2025 due to seasonal demand peaks, particularly for heating in colder regions. Prices in Henry Hub (U.S. benchmark) could range from $3.50 to $4.50 per MMBtu. The U.S. will continue to see growing LNG exports, which could keep domestic prices relatively high.

-

Canada: Natural gas prices will align closely with U.S. pricing trends in Canada. However, Alberta's oil and gas industry may see higher price fluctuations based on Asian demand for liquefied natural gas (LNG) exports.

-

-

Electricity Prices: U.S. electricity prices will increase moderately in Q1 2025 due to higher natural gas prices and the growing role of renewable energy. Prices in regions like Texas and the Midwest could range from $50 to $80 per MWh. California and other renewable-heavy states could see lower electricity prices during periods of high renewable output but could face volatility during low wind and solar generation periods.

Europe: Volatile Natural Gas and Electricity Prices

-

Oil Prices: European oil prices are expected to follow global trends. However, prices could remain volatile, particularly in the Brent crude benchmark, which is projected to average between $80 and $90 per barrel in Q1 2025 due to global supply and demand imbalances and potential disruptions in major oil-producing regions like Russia and the Middle East.

-

Natural Gas Prices: Natural gas prices in Europe are expected to remain elevated in Q1 2025, especially as LNG imports from countries like the U.S. and Qatar help mitigate some of Russia's supply disruptions. Prices could range from €35 to €50 per MWh ($11 to $16 per MMBtu), depending on storage levels, winter demand, and weather conditions. The IEA estimates that European gas prices may remain volatile, especially during cold spells or if geopolitical tensions disrupt LNG shipments.

-

Russia's disruptive impact on natural gas supply is expected to continue, leading to higher prices unless European countries can further diversify sources or increase renewable energy generation.

-

-

Electricity Prices: Electricity prices in Europe will remain volatile, especially in Germany and France, where reliance on gas-fired power plants remains high. Prices in these regions could see a wide range of fluctuations, from €50 to €120 per MWh, driven by natural gas prices, renewable energy supply, and seasonal demand. However, integrating offshore wind and solar will help moderate price increases during favorable weather conditions.

Asia-Pacific: High Natural Gas Prices and Renewable Expansion

-

Oil Prices: Asia-Pacific will see higher oil prices in Q1 2025, with Brent crude prices impacting countries like Japan, China, and India. Prices are expected to remain within the $75 to $85 per barrel range, influenced by global demand, OPEC+ production decisions, and geopolitical developments in the Middle East and Russia.

-

Natural Gas Prices: Natural gas prices in Asia (particularly Japan, Korea, and China) will be significantly higher in Q1 2025 due to continued LNG imports from global suppliers. The region's dependency on LNG imports means pricing will be subject to the global LNG market. In China and India, natural gas prices could range from $10 to $15 per MMBtu based on supply-demand factors and transportation costs. These regions will continue to face volatility based on winter demand and LNG supply constraints.

-

Japan will likely elevate natural gas prices as LNG supply chains remain tight.

-

China will likely be relieved as domestic gas production grows, but the demand surge will still drive price fluctuations.

-

-

Electricity Prices: In India and China, electricity prices in Q1 2025 will reflect the ongoing expansion of renewable energy. While prices could stabilize in the long term, short-term fluctuations could still occur, especially in regions with high dependence on coal. For example, electricity prices in China could range from $50 to $75 per MWh in colder months, influenced by coal and gas prices. At the same time, India could see prices range from $40 to $65 per MWh, with variations depending on regional coal and solar power availability.

Latin America: Stable Oil Prices and Growing Renewable Energy Supply

-

Oil Prices: Latin America will generally follow global oil price trends, with crude oil prices averaging between $75 and $85 per barrel in Q1 2025. However, countries with oil production, like Brazil and Mexico, may see less price volatility than major importing nations.

-

Natural Gas Prices: Natural gas prices in Latin America will remain relatively stable but slightly higher than in the U.S. as the region imports natural gas from the U.S. and other LNG suppliers. Prices could range from $4.50 to $7.00 per MMBtu in countries like Mexico and Brazil, where the energy mix increasingly relies on natural gas for power generation.

-

Electricity Prices: In Brazil, Chile, and Argentina, where hydropower and renewable energy are important contributors to electricity supply, prices may fluctuate slightly depending on hydrological conditions. For example, Brazil's electricity prices could fluctuate between $50 and $70 per MWh, with solar and wind energy expected to reduce long-term volatility.

Indirect Procurement Implications

The energy pricing and supply trends in Q2 2025 have significant implications for indirect procurement strategies:

-

Equipment and Services: The rise of renewable energy drives infrastructure procurement like solar panels, wind turbines, and battery storage, particularly in Europe and Asia-Pacific. Grid modernization technologies (e.g., smart meters, interconnectors) are also critical to ensure supply reliability, with procurement teams needing to secure vendors amidst growing global demand and potential U.S. supply constraints under new fossil fuel-focused policies.

-

Vendor Diversification: Geopolitical risks—such as the Russia-Ukraine war and Middle East tensions—prompt companies to diversify suppliers for LNG terminals, nuclear components, and energy efficiency solutions. For example, Europe is increasingly sourcing LNG from the U.S. and Qatar, while Asia-Pacific firms tap India for solar tech to hedge against supply disruptions.

-

Cost Management: To address price volatility (e.g., natural gas at $10-$15/MMBtu in Asia, electricity at €50-€120/MWh in Europe), procurement teams can leverage long-term contracts for equipment and services or use hedging strategies to stabilize costs, ensuring budget predictability in an uncertain market.

KEY TAKEAWAYS

In Q2 2025, the global energy market will face opportunities and risks. Renewable energy will continue to grow, offering long-term cost benefits and reducing dependence on fossil fuels. However, the transition to cleaner energy will require careful management of price volatility, energy security, and grid reliability. Consumers and industries will need to adapt to higher prices in the short term. Still, strategic investments in renewable energy, energy efficiency, and grid infrastructure will help stabilize markets and mitigate risks in the longer term.

Recommendations:

-

Invest in Renewable Energy and Grid Modernization: Governments and businesses should prioritize renewable energy investments, particularly in solar and wind technologies, and modernize grids to accommodate intermittent power generation. Investment in battery storage and other grid flexibility solutions will be key to mitigating price volatility and ensuring long-term energy security.

-

Diversify Energy Supply: To enhance energy security, regions should diversify their energy sources by investing in LNG infrastructure, expanding renewable capacity, and considering nuclear and hydropower as part of the energy mix. This is particularly important for Europe and Asia, which rely on LNG imports for natural gas.

-

Increase Energy Efficiency: Governments and industries should focus on energy efficiency measures across sectors, from residential heating to industrial processes. Energy efficiency technologies can help reduce overall demand, alleviate price pressure, and accelerate the transition to low-carbon energy systems.

-

Mitigate Consumer Price Volatility: Governments should implement policies that provide energy subsidies or financial assistance to vulnerable consumers, especially during high energy costs. Furthermore, demand-response programs and smart grid technologies can help reduce consumption during peak times and provide price relief.

-

Monitor Geopolitical Risks: Businesses, particularly those in energy-intensive industries, should closely monitor geopolitical developments and energy supply chains. Having contingency plans in place, including alternative suppliers and long-term energy contracts, can help mitigate the risks of sudden price surges or disruptions in supply.

Back to Top