By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q4 2023

Jabil's Global Category Intelligence Archive

Q4 2023

CONTINGENT LABOR:

AMERICAS

MARKET OVERVIEW

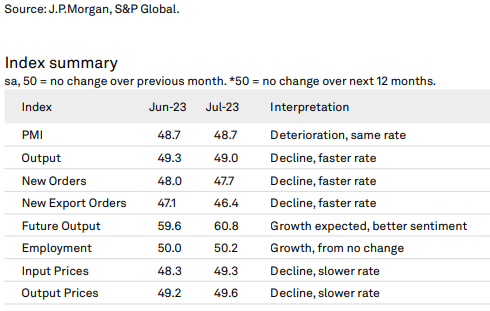

- According to JPMorgan’s Global Manufacturing Purchasing Managers’ Index, the overall global PMI has been below 50 since September 2022, falling to 48.7 at the end of July 2023, down from 49.60 in April 2023.

- New order intakes have declined for 13 months in a row. Per J.P. Morgan and S&P Global, other than the future output index, all the other indicators are showing declines, some at faster month-over-month rates while others have slowed the decline month-over-month from July 2023.

- While softness continues to be seen in Asia (particularly Japan, mainland China, South Korea, Taiwan, Vietnam, and Malaysia), there was mild growth in the US, Canada, and Mexico.

- Particularly hard hit were new order intakes in the Eurozone, as discussed in the European Contingent Labor report.

- Despite the continued potential for recession and softening of demand overall, global manufacturing employment rose slightly in July 2023.

- In North America, employers are still experiencing very tight labor market conditions and can expect challenges around attracting and retaining quality labor resources to continue.

- Competition for contingent labor, flexibility, and anticipation of changing demand/forecasts will continue to maintain uncertainty, but large consumers of staff augmentation will benefit from the flexibility a temporary labor force provides during swings in demand.

DEMAND COMMENTARY

- United States- The August 2023 PMI fell to 47, after ticking up slightly in July to 49. This month-over-month decline was the sharpest since early 2023 across all manufacturing sub-sectors.

- Durable goods saw the decline soften, while the decline for non-durable goods remained steady month over month.

- The US Bureau of Labor Statistics’ core inflation rate (excluding food and energy) fell to 4.7%, the lowest rate since October 2021, but in line with market expectations given the frequent interest rate hikes aimed at easing demand to lower the price hikes.

- Global expectations call for the core rate to fall below 4.4% by the end of 2023, and to trend around 2.70% into 2024.

- The US unemployment rate ended at 3.5% in July, down from 3.6% in June, but up a basis point since April.

- Manufacturing growth in the US has hit somewhat of a plateau, whereas a pseudo-recession in warehousing and logistics has brought down overall industrial staffing demand.

- According to the National Association of Manufacturers (NAM), employment rose by 7,000 jobs in June, but only a net increase of 15,000 for the first half of 2023.

- NAM notes that manufacturing firms continue to struggle in the ability to attract and retain workers, despite solid wage growth.

- The US employed 13 million manufacturing employees in June 2023, the highest since 2008.

- Hours worked in US commercial industrial temporary staffing decreased 9% year over year in August 2023.

- Canada- Canada’s manufacturing PMI rose to 49.6 month over month in July 2023, beating market expectations, but represented the third straight month of contraction since April’s above 50 mark.

- While new orders declined, factories focused on clearing out backlogs, leading to a small increase in output for July.

- The increase was tied to higher output from higher staffing levels in factories. There is a continued drop in new orders, meaning the increase may primarily be due to clearing backlogs.

- The longer-term PMI is forecast to trend to around 55 in 2024, even while general business confidence was positive but moving more toward a conservative outlook.

- The overall unemployment rate edged to 5.5% in July, rising steadily for 3 straight months, however still well below historical pre-pandemic levels.

- Brazil- Brazil’s PMI has been slowly rising, back up to 47.8 in July, up from 44.3 in April 2023 but is the ninth straight month of contraction. Production fell to its lowest level in three years.

- There is optimism moving into 2024 that manufacturing orders will rebound and move the PMI above 55 or so.

- Brazil’s inflation rate has fallen to 3.99% in July 2023, but down from 8.73% year over year.

- United States- There were 604,000 manufacturing job openings in May 2023, down from 668,000 in April and from 693,000 in March - around 200,000 lower than a year prior; Many companies are eliminating previously open positions.

- Total quits in the sector were 293,000 in May, an 11-month high.

- Much of the supply benchmarks and statistics for US temporary labor growth peaked during the pandemic due to the large and ‘immediate’ shift to e-commerce.

- Given those benchmarks are now used for current comparisons, real potential growth opportunities in the near term are centered around increased manufacturing construction in the US, spurred on by US Government grants around increasing onshore production of semiconductors and other high-tech strategic components.

- Current rates of manufacturing production in the US are at their highest point since 1964.

- Component manufacturing relies heavily on long and weekend shifts, further challenging an already strained market for available light industrial talent.

- The unemployment rate in US manufacturing was 2.7% in July, or nearly 1 full percent lower than the overall job market.

- There are 0.6 unemployed persons for every job opening as of late July 2023.

- TSMC has announced plans to delay opening its Phoenix, Arizona-based facility until 2025, citing labor shortages and challenges in attracting enough skilled workers.

- The company is sending more than 500 experienced workers from Taiwan to set up specialized equipment in anticipation of closing the labor gap.

- Canada- There are approximately 2.9 million ‘industrial workers’ in Canada which includes manufacturing of goods-producing industries.

- The number of jobs in this sector has not grown in five years, however, it has not shrunk either.

- 1.7 million (44%) of these jobs are in manufacturing.

- One-fifth of these manufacturing workers are over 55 years old, while 22% are under 24; this may create issues soon if more is not done to attract younger workers as older ones exit the labor force.

- Companies continue to struggle to find enough workers, with many still turning to the TFW (“Temporary Foreign Worker” Program) for help.

- The labor market is so tight that the government is introducing a two-year measure that will allow family members of current foreign national workers to apply for their own work permits in 2023.

- This program used to only be for those in high-skilled roles but is being opened to lower-stream wage roles as well.

- In June 2023, Canada is now allowing temporary workers to study while in the country with a valid permit prior to June 2023; the goal is to retain and train more foreign workers while keeping them in the country longer in support of labor needs. It does not apply to post-graduate work.

- Brazil- Brazil’s unemployment fell to 8% in June 2023, down from 8.8 % in March, but still lower than the forecast of 9%.

- Overall, Brazil’s labor force participation rate has remained relatively consistent near 61.6% for all of 2023 thus far. Relatively low historic unemployment figures is keeping the availability of labor tight. Economists expect the unemployment rate to rise to about 9.5% during 2024.

- Brazil’s temporary worker labor laws are like what Mexico has in place today. Temporary labor is not allowed if it is core to a company’s main line of business, but ancillary roles (such as accounting, finance, and back office) are approved.

- However, in August 2018, outsourcing roles that are core to a company’s core business became legal. The typical temporary employment agreement is for a 180-day duration and can be extended a further 90 days.

- Most temporary workers, for example, are brought in to replace a full-time employee who may be on a leave of absence.

PRICING SITUATION

- United States- Average hourly earnings in 2023 have grown each month at an annual average of 4.4% year over year.

- Many large metro markets are challenged to attract and maintain production workers where the wage gap between hourly pay and a minimum cost of living wage for one adult with a child can be as much as $8 per hour.

- Manufacturing wages averaged $26.47 per hour in July 2023, up from $26.33 in June 2023.

- Gross margins for the largest staffing firms in the US averaged 27.9% in 2022; Splitting out professional roles, the average gross margin for commercial roles averaged 17.5%.

- In 2023 average gross margins are falling 21 basis points from 2022 to reflect a bit of a fallback post the pandemic recovery, after historic increases given historically tight supply amid rising demand.

- Canada- Average hourly wages in manufacturing were $31.24 CDN ($23.00 USD) (about $64,000 CDN per year/ $47k USD) in 2023.

- More experienced workers can make over $120,338 CDN per year; Operators average $39,000 CDN, and Installers average $48,750 CDN.

- Overall average minimum wages are expected to reach around 16.55 CDN ($12.23 USD) at the start of Q2 2023.

- Brazil- The average salary of a person working in a factory in Brazil in 2023 is approximately 5,850 BRL per month ($1,168 USD), including housing, transport, and other benefits.

- According to salaryexplorer.com the monthly pay range for factory and manufacturing roles is between 3,820 BRL and 14,700 BRL depending on tenure and role ($763 USD to $2,936 USD).

- The average wage, not inclusive of benefits, housing, and transport, was 2,768 BRL ($565 USD) in June 2023, up 6.7% year over year.

- Minimum wage increased to 1,320 BRL ($269 USD) per month in on May 1, 2023, a 4.1% increase from January 2023.

APAC

MARKET OVERVIEW

- In Q3 2023 most Asian manufacturing demand faced continued softness, including in China, where their PMI fell below 50 for the first time since April, signifying contraction.

- New orders, high inventory levels, and difficult employment prospects are dragging the overall region down.

- India remains a bit of an exception to the regional softness, however with a PMI in expansion territory for the 25th straight month.

- Availability of contingent labor in Asia markets eased a bit more in Q3 2023 as softness in demand and new orders has allowed a bit of a recovery.

- Countries that rely on importing foreign workers have seen the gap between approved allocations and actual fill rates widen, indicating enough supply in general.

- 2023 has also seen a global ‘explosion’ in interest around artificial intelligence (AI) and machine learning (ML), with manufacturers, engineers, and the world’s biggest hard goods providers launching use cases for applying AI and ML on the factory floors.

- Many of the advancements are likely to change future demand dynamics for labor.

DEMAND COMMENTARY

- China: China’s NBS Manufacturing PMI ended at 49.2 in July 2023, falling from 50.5 in June and hitting its lowest rate in six months.

- New orders have been growing slightly in the past two months before dropping in July. Overall requirements for direct labor have been declining in line with the reduction in output growth.

- Delivery orders have improved given the slower overall production.

- The employment index was 48.1%, down slightly from June, indicating a relatively stable climate in manufacturing employment.

- Malaysia: Malaysia’s manufacturing PMI ended at 47.8 in July 2023, now the 11th straight month of contraction. Global demand for Malaysian manufactured goods remains subdued with export orders falling at their quickest level since May 2020.

- In the spring of 2023, manufacturers were hopeful for a rebound in demand by summer, however, that has not materialized, with PMI at its lowest since January.

- Merchandise exports declined 5.9% year over year in the first half of 2023.

- Forecasters expect Malaysia’s PMI to hover around 49 throughout 2024, still in contraction.

- China is Malaysia’s largest export partner, but with softness in demand, goods exports declined 13.1% year over year.

- Singapore- Manufacturing PMI ended July 2023 at 49.8, the highest level since March, but still slightly south of growth with the fifth straight month under 50.

- One bright spot in the summer of 2023 has been in the electronics sector, which is 42% of Singapore’s industrial output. Output increased for the first time in 11 months due to growing demand for enhanced integration of AI (source: Singapore Institute of Purchasing and Materials Management).

- Slight expansion is expected, with the index climbing just slightly over 50 in 2024.

- July’s unemployment rate rose slightly by 0.1 to 1.9%, continuing 2023’s lowest jobless rate since early 2015. In Q1 about 4000 persons were laid-off (‘retrenched’), falling to about 3200, with a more substantial decline of retrenchments in the manufacturing sector.

- India- India’s Manufacturing PMI ended July at 57.7, and although that is a bit lower than the last three months, the country remains one of the very few in expansion mode. July’s index represented India’s 25th straight month of factory expansion.

- As projected in the last quarterly category update, the growth has slowed a bit since May 2023, with output growth expanding at its lowest rate in 3 months, however, the rate of rise is still at its highest since July 2021.

- PMI survey respondents noted growth of orders primarily from the United States, Bangladesh, and Nepal.

- While forecasts show continued growth, India’s GDP is widely expected to average 6.2% in 2023, up from earlier estimates of around 4%. Asian Development Bank expects the GDP to rise to 6.5% by the end of India’s fiscal year end on March 31, 2024.

- Manufacturing companies have added staff in line with the growing Q3 demand.

- Even with this growth, 12 of the 23 manufacturing sectors reported contraction, however infrastructure, pharma, and motor vehicle production remained strong, pushing overall output to increase by 1.1% as of May 2023, after a few months of overall contraction.

- India’s Ministry of Electronics and Information Technology put forth a ‘vision’ earlier in 2022 to transform the country into a $300 billion powerhouse by 2026, up from $75 billion in 2021.

- Vietnam- Vietnam’s Manufacturing PMI ended at 48.7 in July, the eighth consecutive month below 50, but the highest index score over the last three months.

- Manufacturing production continues to decrease and as a result firms are reducing staffing levels, both via attrition and retrenchment. Challenges in being awarded new orders, along with a drop in exports have resulted in price drops, but with little effect in the near term.

- In the first five months of 2023, over 45,000 jobs in electronic manufacturing have been lost

- Several recent free-trade agreements with the European Union, and United Kingdom, and a Trans-Pacific Partnership have further strengthened the manufacturing position and attractiveness of Vietnam.

- With these partnerships, Vietnam should be in a good position to support growth in demand with the expected PMI to be 53 in 2024 and 52 in 2025, indicating expansion.

SUPPLY COMMENTARY

- China- Given the relatively flat economic growth from Q2 2023 to Q3 2023, there is currently an ample supply of contingent labor to meet requirements. This marks the first time in nearly three years that supply has stabilized against demand. Forecasts call for available market supply of labor in the near term.

- According to comments from late July of this year by the Head of the Employment Promotion Department at the Ministry of Human Resources and Social Security, the employment of young people is still under great pressure as compared with current economic development overall, as many college graduates leave school to join the employment market.

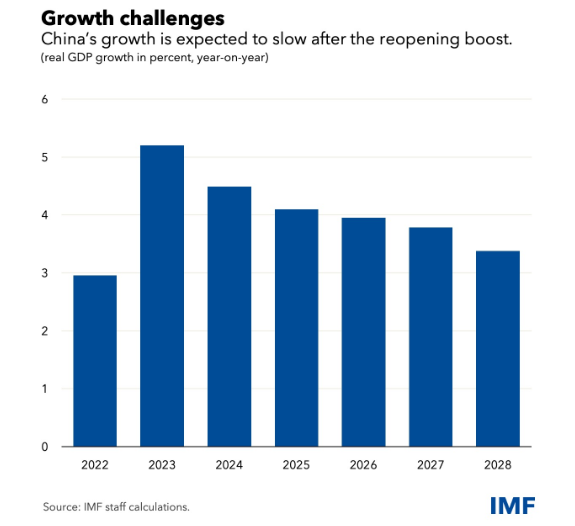

- According to the International Monetary Fund, reforms will be required in the short term for China to deal with the declining work population; ideas such as raising the retirement age, increasing health insurance benefits, and closing productivity gaps for state-owned enterprises may help. The goal is to raise China’s overall income levels by 2.5% to increase demand and boost the economy.

- China’s growth in working-age population allowed it to grow exponentially over the last several decades, but projections have China losing about half its population by the end of this century if the current low birth rates continue.

- According to comments from late July of this year by the Head of the Employment Promotion Department at the Ministry of Human Resources and Social Security, the employment of young people is still under great pressure as compared with current economic development overall, as many college graduates leave school to join the employment market.

- There is an evolution happening around the skill sets required for blue-collar jobs given the move toward more automation and intelligent manufacturing. The expectation for more technical workers within this demographic is for them to be able to work with more technical equipment and other digital technology.

- Manufacturing comprises about 18% of China’s labor force, with the majority having only a middle-school level education.

- Malaysia- About 30% of Malaysia’s workforce is comprised of foreign workers with about 7.25 million persons compared to 16.5 million Malaysian citizens.

- Unemployment fell slightly to 3.4% in June 2023, down from 3.5% in the prior 4 months. (Department of Statistics, Malaysia).

- The labor force participation rate remained at 70% in June 2023, unchanged month over month, indicating steady employment, even with reduced demand for manufacturing contingent labor.

- In early 2023, the Federation of Malaysian Manufacturers estimated that there would be over 1 million foreign workers in the country.

- Recruiting foreign workers remains a key element of continuing and ensuring the growth around electronics manufacturing, however, some companies have put a hold on bringing in additional foreign workers during the downturn in demand. Typically, quotas issued by the government to recruit foreign workers are good for up to two years, so firms may find themselves having to request new allocation approvals from the government if they do not use their full allocation, depending on the timing of any recovery and output increase.

- Companies that utilize foreign worker schemes have put more focus on vetting the RBA compliance of the agencies, and in particular their in-country agents who recruit new workers. Increasing reliance on foreign workers can bring risks around compliance if the full supply chain is not fully investigated, rather than just on the receiving supplier.

- Singapore- Total employment grew by 23,700 in Q2 2023, up for the seventh straight quarter, however, growth is slowing.

- Unemployment remains at historic lows and resident labor force participation rates have stayed close to steady at 70% in July 2023.

- Net employment growth in Q2 2023 came solely from non-residents and largely from construction with demand growing for new housing.

- The proportion of firms that plan to hire in the near term has fallen to 58.2%, down from nearly 70% at the beginning of 2023, signaling a conservative approach to stagnant demand.

- The Ministry of Manpower plans to lower the quota of foreign workers in the manufacturing sector from 20% of the workforce to 15%, beginning in 2023, to focus on higher-skilled roles and industries being attracted to Singapore.

- India- India’s relatively strong economic outlook bodes well for employment for a younger generation as private investment in new manufacturing capacity will open new opportunities, even while the rest of the world contracts a bit.

- The reality of underemployment for India’s youth remains, even as manufacturing output is outpacing the rates of the rest of the world in Q3 2023.

- India has overtaken China as the world's most populous country with 53% of the population under 30. However, the continuing presence of tens of millions of unemployed individuals is inhibiting the country’s potential economic growth.

- Unemployment in June 2023 hovered around 8%. By comparison, other large global economies are seeing unemployment between 2 and 4 percent.

- India’s labor force participation rate hovers about 48%, whereas in other global economies that figure is north of 60-70% on average.

- In the near-term India is facing difficult headwinds around the current and future supply of workers. According to the Centre for Monitoring Indian Economy, (https://www.cmie.com) a substantial portion of India's younger working-age population is opting to stay students as the existing workforce progressively grows older. In 2016-17, 42% of the workforce was in their forties and fifties; by 2019-20, this had risen to 51%; and by 2021-22, their proportion had risen to 57%.

- While unemployment has stabilized, the industry is not creating enough quality or decent-paying jobs. 20 percent of jobs are ‘formal’ meaning regular wages and job security.

- Educational qualification has been declining as well in recent years, with 12.2% of the population being graduates or post-graduates, down from 13.4% in 2018.

- Vietnam- In January 2020, Vietnam had a workforce totaling about 56 million. In July 2023, that number had fallen to 51.2 million. In mid-2022 the labor participation rate was 76% but fell to 68.9% in July 2023. However, only about 12% are considered highly skilled, and only about 26% are trained at all.

- At one of the world’s largest electronics companies, overtime has disappeared, many dorms are at half capacity, and real earnings have declined by nearly 50%.

- To raise the vocational acumen of the labor force, the government enacted “Decision 17” in mid-2021, aimed at offering free vocational training to unemployed workers who meet certain criteria. There are options for 3 months and extended training based on the type of support and a cap on reimbursement.

- In June 2021, the Government of Vietnam issued “Decree 57” which offers corporate tax incentives (CIT Incentives) that give full exemptions for four years, a 50% reduction for nine years, and a 10% preferential tax rate on the first 15 years on income coming from the project. Electronics manufacturing is one of those industries that can use the incentives.

PRICING SITUATION

- Real wage increases for 2023 should average about 3.8%.

- Requirements are shifting back to hourly rates, not monthly “outsourcing” needs, which will allow flexibility to reduce the workforce when demand has been met, rather than taking on a full month of pay.

- Overall income for blue-collar workers will remain unchanged in Q3 2023 over Q2, but the total average hours worked will decline based upon decreasing new orders.

- Regional governments are required to raise minimum wages at least every few years. The average overall hourly wage ranges between 14.9 Yuan (Anhui province) and 25.3 Yuan in Beijing and Shanghai.

- Specific to migrant workers in electronics manufacturing, skilled labor can pay up to about 8,000 RMB per month ($1,120 USD), whereas those lacking experience on a production line may earn between 3,500 to 5,500 RMB ($500-$775 USD) per month.

- Malaysia- Minimum wage increased to 1500 MYR per month in May of 2022, however, they have not increased in a year, as of May 2023. Companies with less than five staff members are also now going to increase their minimum monthly salary to 1500 MYR as of 1 July 2023.

- The average salary of a factory worker in Malaysia is around 24,820 MYR ($5,330 USD) in 2023.

- It remains to be seen what effect the decrease in maximum weekly hours worked from 48 to 45 may have on the need for shift work to hire additional resources to cover the reduction, but depending upon the number of foreign workers a company needs it may be significant.

- In addition to hourly wages, extra expenses would be recognized around recruiting, travel, training, housing, food, and wellness. Overall hours worked are increasing in 2023 to above 30 hours per week as the country fully emerges and recovers from COVID-era pullbacks in hours worked.

- Singapore- According to Employment Conditions Abroad (ECA), the average worker in Singapore will see a 3.8% increase in base salary. However, given current inflation rates, their real wages decreased by about 1.7% in 2022. The expected net real salary increase in 2023 is 1.0% after accounting for current expected inflation rates during the year.

- In June 2023, the proportion of companies that plan to raise wages in the near term has fallen to 28%, down 10 points from just March 2023, when it was at 38.2%.

- Salary typically increases about 9% every 15 months in manufacturing within Singapore, on average.

- India- The minimum wage of 178 INR per day ($2.23 USD) has not increased since 2018, however, the forecasted “India National Floor Level Minimum Wage” is expected to hit 185 INR per day in 2023, and 190 INR per day in 2024. There is no country-level minimum wage requirement, but it can be set by state or even industry sector.

- The average wage of a manufacturing worker per month is 21,800 INR ($273 USD), with a low of 8080 INR ($101 USD) to a high of 54,600 INR ($685 USD). This is about 32% lower than other jobs in India.

- The average hourly wage of a factory worker is 130 INR ($1.63 USD)

- Recent pricing proposals for management of contingent work in India have seen monthly management fees averaging about 800 INR per head per month ($9.68 USD), with a range of 500 INR to 1,194 INR ($6.05 USD to $14.45 USD).

- Vietnam- Vietnam remains an attractive country for manufacturing in terms of labor costs when compared to China and other countries in Asia

- The average monthly wage for a manufacturing role in Vietnam is $336 USD (7,900,000 VND) in July 2023, up 3.9% from Q4 2022 but down slightly from Q1 2023.

- For comparison, China’s monthly wage is about $1,150 USD (26,993,375). Low skilled/entry level is about $229 USD per month (5,375,202 VND).

- Despite the lower cost, Vietnam has 14 times less the number of workers than China.

- Depending on region, minimum wages increased on July 1, 2022, approximately 6% overall.

EUROPE

MARKET OVERVIEW

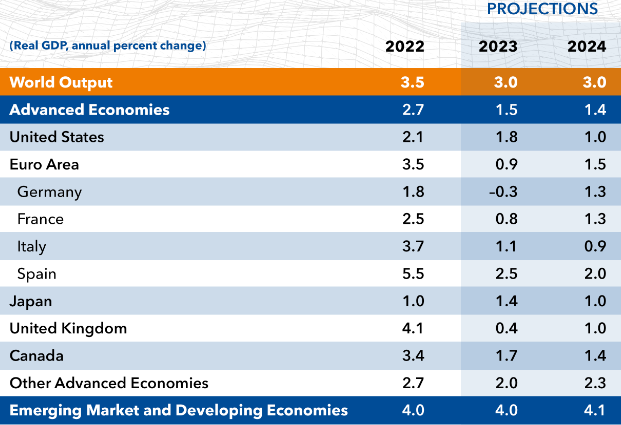

- In April 2023, the International Monetary Fund’s World Economic Outlook forecasted 2023 growth in Euro Area aggregated GDP at 0.8%, which is an increase from January’s outlook of 0.7% and 0.3% higher than originally predicted in October 2022.

- In the July 2023 update, growth ticked up another basis point to 0.9%, however, Germany’s outlook has fallen a bit further from a predicted -0.1% to a -0.3% for 2023.

- The UK has fared better in the last 3 months rising from a projected -.03% to slight growth of 0.4%. There is optimism that global inflation will ease further into 2024, however, uncertainty around potential escalations in the war in Ukraine, along with extreme weather events may damper recovery more than currently projected.

- Banks have largely avoided fulfilling broader stability concerns arising in early March 2023, but have tightened credit, particularly in Switzerland. Availability of temporary labor across the EU remains tight, as described in a few country highlights below.

DEMAND COMMENTARY

- Switzerland- In July 2023, the Credit Suisse Manufacturing PMI index fell further to 38.5, the seventh consecutive monthly decline and down from 45.3 in April 2023. This represents the lowest reading since April 2009.

- In the spring of 2023, some analysts predicted an increase to near 50, however, the decline has continued, primarily due to negative indicators for production, new orders, and declining purchasing volumes.

- The overall outlook on Switzerland’s economy increased in July, however with solid prospects in finance, services sector, and insurance, despite the manufacturing sector’s sluggishness.

- The brighter news is that the inflation rate has dropped a further 1.0% to 1.6%, down from 2.6% in April. Prices slowed as inflation dropped on things like housing and energy. It is slowly returning to average historical rates between 0.5-2%. Experts forecast rates to return to historical averages in 2024 and 2025.

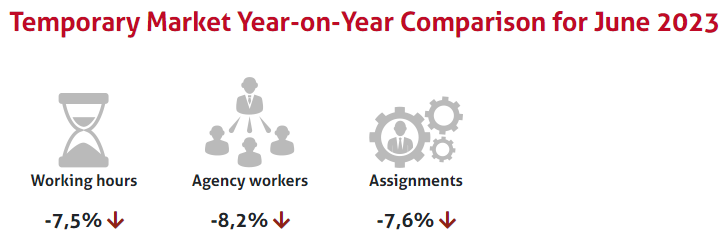

- According to swissstaffing.com in July 2023, the year-over-year statistics for temporary labor show sharp declines for key indicators, in line with the PMI outlook.

- One major change related to economic uncertainty has been a shift away from demand for temporary labor and more in favor of permanent positions.

- Softening demand in manufacturing has reduced the need for temporary workers, but near-full employment means fewer people are looking for short-term roles.

- More companies are hiring permanent staff, either by converting temp to perm or direct hire, due to more stability in demand and better retention rates.

- A few industries, such as healthcare have seen steadier demand, but not an increase in 2023.

- Germany- Germany’s manufacturing PMI ended at 38.8 in July 2023, its lowest since the start of the COVID pandemic in May 2020, and down further from 44.5 in April 2023.

- Downward pressure on new orders is sustaining pessimism, with orders at their lowest in 3 years.

- On the positive side, manufacturing companies have been able to catch up on backlogs, and input price increases have fallen to their lowest levels since 2009.

- Inflation fell another 1% to 6.2% in July, down from 7.2% in May; Economists predict a steep drop in 2024, with rates expected to hover around 2.4-2.2%.

- With expected flat to negative GDP growth in 2023, economists predict a 5% decline in temporary employment activities during the year.

- Hungary- After starting 2023 with PMI hovering around 55, it increased to 61.9 in April 2023. However, after April the regional and global economic challenges have appeared to reduce the optimism in Hungary as well, with the PMI falling to 44.60 in June and ending July at 45.72, or in the expected range of contraction. Most of the key indicators of manufacturing health contracted in June, including extended lead times, reduced employment (-3.5%), a 43% decrease in the amount of stock purchased, and a decrease in finished goods inventories of about 14.4%.

- Inflation slowed to an eleven-month low in July, ending at 17.6%, but offering little real relief for consumers. However, the rate is still not far off from the 27-year high of 25.6%, but less than market forecasts.

- Forecasters expect a steady drop into 2024, based upon global macroeconomic indicators and pressures, dropping all the way to a bit over 2.2% toward the end of 2024.

- Demand for temporary workers remains robust despite the softness, in large part due to the severe shortage of workers and fierce competition to attract and retain those who are looking for a role in manufacturing.

- Particularly challenged areas include the western side of the country.

- Ukraine- Although combat during the Russian invasion is highly localized to the eastern side of the country, the overall GDP in 2023 is projected to be only 0.5%.

- According to the World Bank, poverty has increased from 5.5% to 24.2% of the population since the start of the war, meaning another 7.1 million people have been pushed into poverty.

- Exports remain low due to a lack of infrastructure and disrupted supply chain routes.

- Prior to the war, manufacturing accounted for 11.7% of Ukrainian GDP, with plans to have about $2 billion USD in foreign investments in manufacturing within Ukraine.

- Ukraine’s robust IT Staff Augmentation industry has adapted during the crisis, either by re-deploying resources into Western Europe or in many cases for larger firms, relocating their resources into other hot spots such as Latin America. As the war has largely not directly affected the Western portion of Ukraine, those already in place are continuing to service most clients well.

- Switzerland- Labor shortages are still acute across Switzerland, despite the economic cooldown. While the increase in working hours across the temporary market has declined in Q2 of 2023.

- Demand for permanent workers has risen dramatically in 2023 over 2022. Less than half of staffing providers think there will be an increase in temporary worker demand.

- There was a 5.6% decrease in temporary staffing in the second quarter of 2023, year over year.

- Revenue in the staffing industry increased 7.9% due to increases in permanent placement.

- According to Kelly Services in Switzerland, “The shortage of skilled workers is still THE topic concerning companies. There is a lot of movement in the market. For staffing service providers like Kelly, this means that if you can deliver, you will win. In this regard, we can prove that we find the talent people are searching for.”

- The medium-term outlook for temp work is a bit brighter as near full employment may cause some worker burn-out leading to some seeking more flexibility around temp work.

- Currently the aging worker demographic shows Switzerland losing thousands of workers per year, leading to challenges on how they can be replaced.

- Germany- Lower economic growth has companies pulling back on hiring and market volumes will lead to lower demand.

- Despite the overall softness in the economy, according to Bundesbank.DE, access to skilled workers remains widespread in 2023, with half of all firms surveyed reporting challenges in retaining or recruiting skilled labor. They do not expect the shortage to ease for the remainder of 2023.

- Germany is already a market that doesn’t use a lot of temp labor (about 1.7% of the workforce on average, compared to about 3% for France, the UK, and the Netherlands) so a slowdown in demand won’t necessarily open a lot of available temp labor supply.

- Among the age range 15-29 (of those not participating in formal education), about 17% work via temporary contracts.

- The July 2023 unemployment has held relatively steady at 5.6% since the summer of 2022.

- Hungary- Hungary’s unemployment rate fell to 3.9% in July, a slight decrease from earlier in 2023, but just a slight bit higher than a year ago.

- Since January 2023, industrial production has been declining monthly, down 3.8% year over year in July 2023.

- Forecasts are for production to return to growth, averaging 3.5% in 2024.

- There remains a severe shortage of skilled workers, further challenged due to an aging population

- Ukraine- The International Labor Organization (ILO) estimates that about 5 million people have lost their jobs or been displaced from work because of the war, which translated to an unemployment rate of 35%, triple the average before the invasion.

- According to the National Bank of Ukraine, unemployment is estimated to be about 20% in July 2023.

- There are regional disparities due to the effects of the war, and the number will struggle to fall as migrants start to return from abroad.

- On the work platform work.ua, in western regions like Lviv, the number of job openings has returned to about 80% of pre-war figures, although largely in the hospitality sector.

- According to the ILO, Ukrainian trade unions are trying to continue serving the millions of displaced refugees, amidst falling membership and dues.

- The President of the Federation of Trade Unions of Ukraine said:

- “The war has undermined the trade unions’ ambitious plans for their members and for the future of the trade union movement in Ukraine. Work has shifted to helping soldiers, refugees, and members that have lost their jobs as well as to ensuring that fundamental workers’ rights and basic living and working conditions are upheld."

- Switzerland- The average annual salary of a factory worker in Switzerland ranges between 43k CHF and 72k CHF depending on experience, which averages about 24 CHF per hour ($25.50 USD). This is for roles such as line worker, assembly foreman, dock worker, and equipment operator.

- The current minimum wage is also 24 CHF per hour (as of August 2023) and is subject to adjustment annually each January based on the consumer price index.

- Long-term projections anticipate an 11% increase over 5 years to 54k CHF by 2028 or a non-compounded annual increase of just over 2%.

- Germany- According to salaryexpert.com, the 2023 average annual base wage in manufacturing in Germany is 33.06 EUR ($34,800 USD) for roles as machinists, assembly line workers, demand planners, and factory workers.

- The average range for factory salaries is between 27k EUR (1-3 years of experience) and 39,281 EUR (8+ years of experience)

- Negotiated wages are expected to increase 4.5-4.7% in 2024 and 2025, with gross wage increases expected to average around 6.0% in 2024 and 5.2% for the overall labor market.

- In early 2023 trade unions representing temporary workers negotiated increases for about 816,000 workers in specific pay groups from April 2023 and in January 2024. The pay increases will amount to about 13.07% for pay groups 3 and 4, and about 9% for wage group 9.

- Hungary- Through May of 2023, there is an average increase of 17.9% in monthly gross wages across all workers, however, this has still resulted in the erosion of real buying power with inflation averaging higher the last 18 months or so.

- The average monthly salary for a factory worker in Hungary is 337,000 HUF (821 EUR/$819 USD), which is about 45% above the current overall minimum average wage of 232,000 HUF that was implemented in January 2023.

- The country is averaging a labor force participation rate of 75.3%, higher than their historical average of around 64%, further demonstrating that the supply is tight with real wage pressure brought on by demand and inflation, even in a contracting market.

- Ukraine- With inflation in the double digits and no timeline for a resolution to the conflict with Russia, those companies with other global service centers are offering options ranging from a low of 11% to over 20% hourly rate increases for resources in Application Development, Systems Analysts, and Data Architects.

- Price increase requests for those remaining in the country have ranged from 10-20% in recent months.

- Average annual wage growth entering 2022 was about 18%, with estimates for Q1 and Q2 of 2023 hovering around 8%.

- As of July 2023, the average hourly wage is 65 UAH, while the national minimum wage is UAH 40.46 per hour/ UAH 6,700.00 per month, on a maximum 40-hour work week. ($1.10 USD per hour/$181.39 USD per month).

Back to Top