By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q4 2023

Jabil's Global Category Intelligence Archive

Q4 2023

ENERGY

MARKET OVERVIEW

- Global energy supply has risen over the last 6 months when compared with supply trends over the previous 18 months. The compelling reason for this increase is due to the record warm temperatures in winter.

- Warm weather resulted in less demand over the winter and allowed gas storage levels to increase significantly above levels seen in the past 18 months.

- Pricing across Europe has continued to trend significantly lower than prices seen last year. Volatility has also decreased significantly.

- The dominating reason for this is the increase in gas storage levels and less uncertainty regarding future supply, given the current issues with Russia and the EU.

- Low-emissions sources are set to cover almost all the growth in global electricity demand by 2025.

- This is a huge step forward for the renewable sector with renewables and nuclear energy poised to dominate the growth of global electricity supply over the next three years, meeting, on average, more than 90% of the additional demand.

- China accounts for more than 45% of the growth in renewable generation in the period 2023-2025, followed by the EU with 15%.

- This transition is sustained by lower costs. In most markets, solar PV and wind now represent the cheapest available source of new electricity generation. These changes are progressively forcing industries to change their energy spending habits to gain value in the market and act against geopolitical market volatility.

- Global electricity generation from both natural gas and coal is expected to remain broadly flat between 2022 and 2025 as shown on further pages in this report.

- Clean energy technology is becoming a major new area for investment globally. Companies are considering significant changes to their energy buying strategy.

- Large corporations are transitioning away from traditional purchasing strategies and instead looking into long-term green alternatives, such as power purchase agreements and contracts for differences with energy utilities.

- China’s share of global electricity consumption is forecast to rise to one-third by 2025, compared with one-quarter in 2015.

- After reaching an all-time high in 2022, power generation emissions are set to plateau through 2025. Global CO2 emissions from electricity generation grew in 2022 at a rate like the 2016-2019 average.

- Their increase of 1.3% in 2022 is a significant slowdown from the staggering 6% rise in 2021, which was driven by the rapid economic recovery from the Covid shock.

- Investment in clean energy has seen continual growth since 2018 as economies continue their energy transition from fossil fuels to zero-emission alternatives.

- The recovery from the COVID-19 pandemic and the response to the global energy crisis have provided a major boost to global clean energy investment.

- Asia:

- Energy is still predominantly state regulated within Asian markets.

- The price of coal has increased significantly (Asia's primary fuel source - over 50%) in line with their most recent climate change obligations: "China's recent pledge to become carbon neutral by 2060 and to peak coal consumption by 2025".

- Capacity of renewables is increasing significantly to accelerate their clean energy transition but not at the same pace as the increase in electrification causing energy security challenges. This is especially prevalent in SE Asia.

- Americas:

- LATAM

- Still predominantly regulated markets - CFE and CENACE have control over the whole market. Jabil is currently transitioning over to the WEM to gain some control accommodating unreliable market/government dynamics in these regions.

- LATAM

- US

- Natural gas pricing increased due to the Russia/Ukraine war in 2022 but not as significantly as the EU. This has decreased significantly since the beginning of 2023.

- Natural gas storage levels are high which indicates stability in the market for the coming months.

- US market continues split between regulated and unregulated sectors, as dictated by state level legislation.

- Europe:

- Pricing volatility has reduced since last year when the market was at its highest point in over 20 years, yet the price is still the highest for a continent in the world and over 100% higher than pre-2021 prices.

- EU regulation is applying more pressure on countries to consume less energy from fossil fuels and the Levelized Cost of Electricity (LCOE) of renewables is now lower than for fossil fuels.

- This means that Power Purchase Agreements are now the cheapest form of purchasing energy.

DEMAND COMMENTARY

- Reduction in electricity consumption in advanced economies creates a positive impact on global growth in power demand:

- Global electricity demand growth has been easing in 2023 before expected acceleration in 2024.

- Demand is expected to grow by slightly less than 2% in 2023, down from a rate of 2.3% in 2022 and the average annual growth rate of 2.4% observed over the 2015-2019 period.

- This moderation is strongly driven by declining electricity demand in advanced economies, which are dealing with the ongoing effects of the global energy crisis and slower economic growth.

- In 2024, as expectations for the economic outlook improve, global electricity demand growth is forecast to rebound to 3.3%.

- Electricity demand in the European Union is set to decline in 2023 for the second year in a row, falling to its lowest level in two decades. EU electricity demand is expected to record a 3% drop in 2023, after already falling 3% in 2022.

- This is despite strong growth in electrification with a record number of electric vehicles and heat pumps sold. Following these two consecutive declines, which together amount to the region’s largest slump in demand on record, EU electricity demand is set to drop to levels not seen since 2002.

- Europe's energy-intensive industries have not yet recovered from last year’s production slump, as evidenced by the staggering 6% year-on-year decline in total EU electricity demand during the first half of 2023.

- Almost two-thirds of the net reduction in EU electricity demand in 2022 is estimated to be from energy-intensive industries grappling with elevated energy prices. This trend has continued well into 2023, despite the prices for energy commodities and electricity falling from their previous record highs.

- The European Union is at a crossroads, as policy developments abroad courting industrial investment pressures Europe’s industrial competitiveness. The outcome of policy discussions now underway could determine the future of the EU’s energy-intensive industrial sector.

- Substantial demand declines in advanced economies contrast sharply with the growth observed in emerging economies, such as China and India. Japan is similarly expected to record a significant 3% decline in electricity demand in 2023, while the United States is set to see a decrease of almost 2%.

- In contrast, China's electricity demand is expected to increase by 5.3% in 2023 and 5.1% in 2024, slightly below its 2015-2019 average of 5.4%. India is set to have an average annual growth rate of 6.5% over the outlook period, surpassing its 2015-2019 average of 5.2%.

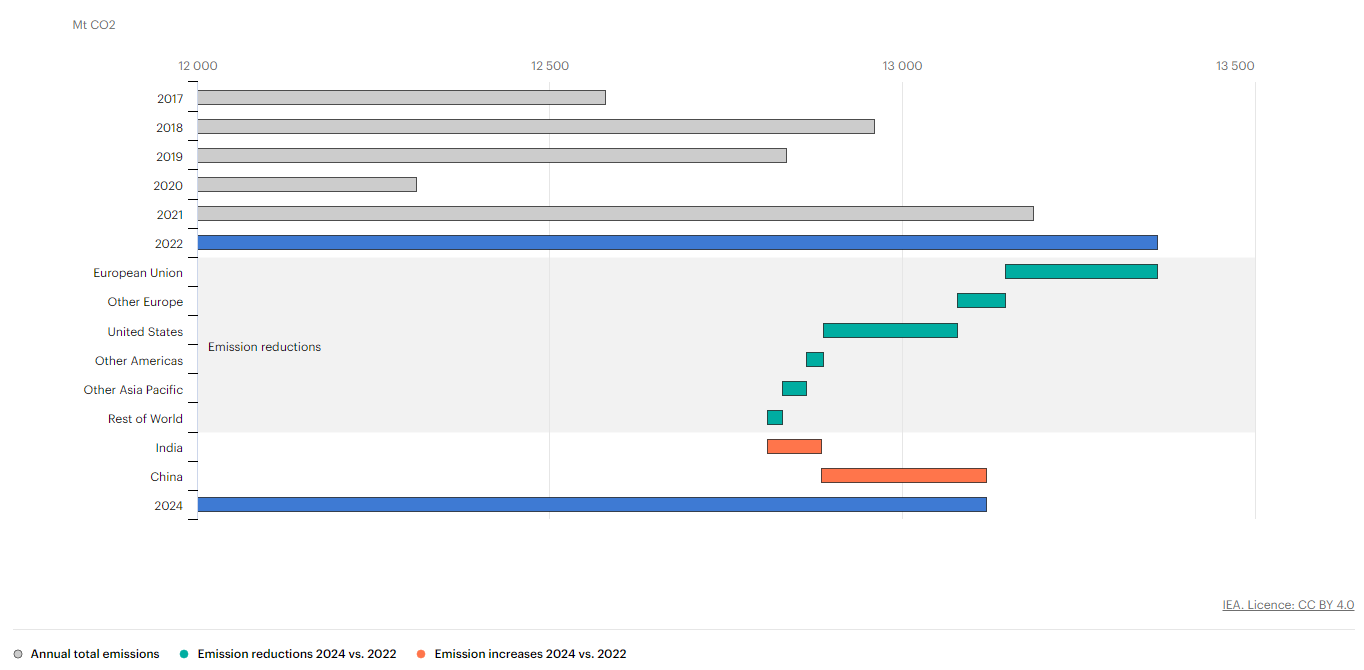

- Emissions from power generation are projected to dip slightly through 2024:

- Increases in emissions from power generation in China and India are expected to be more than offset by declines in other regions.

- The European Union alone accounts for 40% of the total decline in emissions from power generation expected to occur in 2023 and 2024, excluding China and India. The United States is also declining its emissions, where renewables deployment is growing strongly, and gas is increasingly replacing coal-fired supply.

- Extreme weather, unexpected economic shocks, and changes to government policies can cause an uptick in emissions in specific years. However, the overall trend of global power sector emissions plateauing is expected to persist.

- Changes in global CO2 emissions from electricity generation, 2024 vs. 2022:

- The impact of weather on electricity demand is increasingly noticeable:

- Rising demand for cooling is straining the world’s power systems. In many regions, summers with extreme temperatures are becoming more frequent, elevating electricity demand for cooling systems and placing strain on power supplies.

- As more households start purchasing air conditioners, the impact will increase in many countries – especially in emerging economies that currently have a much lower share of households with AC than advanced economies with comparable climates.

- Setting higher efficiency standards for air conditioning would greatly help limit the impact of additional cooling demand on power systems.

- To ensure system reliability, it will be crucial to have adequate backup generation capacities, encourage demand management and energy storage, accelerate grid investments, and enhance fuel supply security for power plants.

- Insufficient preparedness in these areas could lead to more frequent stress on grids, resulting in load-shedding and blackouts.

SUPPLY COMMENTARY

- Power systems faced challenges in multiple regions in 2022 due to extreme weather events. Heatwaves and droughts strained the supply situation in both China and India.

- A historic drought in Europe resulted in low hydropower output, putting increased pressure on dispatchable capacities amid record-low nuclear generation in France.

- In the United States, winter storms caused widespread power outages. These extreme events reinforce the urgent need to increase the flexibility of the power system and enhance the security of the electricity supply to better cope with weather-related contingencies.

- The global energy supply is largely affected by macro-weather conditions as this defines the demand whilst also directly affecting power generation sources.

- Hydropower is very significant for the global energy mix as it provides a renewable fuel source that can effectively be switched on and off, unlike other renewable sources. However, 2022 has highlighted issues that this technology can have in the presence of droughts which means we cannot place full reliance on hydro alone.

- In 2022, the surge in fossil fuel prices following Russia’s invasion of Ukraine also compounded the supply situation, this was especially apparent for gas reserves. The relatively higher increase in natural gas and LNG prices prompted a wave of fuel switching in the world to coal for use in power generation.

- Global coal-fired generation rose by 1.5% in 2022, with the largest absolute increases in the Asia Pacific region.

- Coal-fired generation also rose significantly in the European Union amid low hydro and nuclear output. However, 2022 is likely to be an exception, and global coal-fired generation is forecast to plateau in 2023-2025, as higher output in the Asia Pacific region is offset by declines in Europe and the Americas.

- Global gas-fired generation remained relatively unchanged in 2022 compared to 2021, as declines in China, India and other regions were largely offset by a rise in gas-fired output in the United States. We expect global gas-fired generation to stagnate to 2025 on average, after declining by 3% in 2023, then growing by 1.4% in 2024 and 2% in 2025.

- Substantial declines in the EU will partly be offset by significant growth in the Middle East.

- Our outlook for 2023 to 2025 shows that renewable power generation is set to increase more than all other sources combined, with an annualized growth of over 9%. Renewables will make up over one-third of the global generation mix by 2025. This trend is supported by government pledges to increase spending on renewables as part of economic recovery plans such as the Inflation Reduction Act (IRA) in the United States.

- Global energy supply commentary by the data:

- In the OECD, total net electricity production amounted to 941.9 TWh in January 2023, down by 5.9% year-on-year1 compared to January 2022.

- Electricity production from renewables went up by 1.6% year-on-year to 313.4 TWh in January 2023, driven by strong wind (+5.5% y-o-y or 5.9 TWh) and solar (+7.7% y-o-y or 2.4 TWh) output. This growth couldn’t compensate the negative trend witnessed by fossil fuels, amounting to a loss of 56.8 TWh (-10.9% year-to-date2) compared to 2022.

- Electricity production from coal fell by -16.4% y-o-y or 34.1 TWh, essentially driven by lower output in the OECD Americas (-29.8% y-o-y) and in OECD Europe (-10.2% y-o-y), while in OECD Asia-Oceania production slightly increased (+0.9% y-o-y).

- Electricity production from natural gas went down by 5.5% y-o-y or 15.6 TWh, with OECD Europe being the main contributor to this drop (-22.3% y-o-y or 16.1 TWh). Nuclear electricity production in the OECD decreased by 4.3% y-o-y or 7.3 TWh in January 2023, mainly because of reduced nuclear output in the OECD Europe region (-10.0% y-o-y or 6.7 TWh).

SUPPLY COMMENTARY

- Declines in fossil-fired electricity generation are becoming structural:

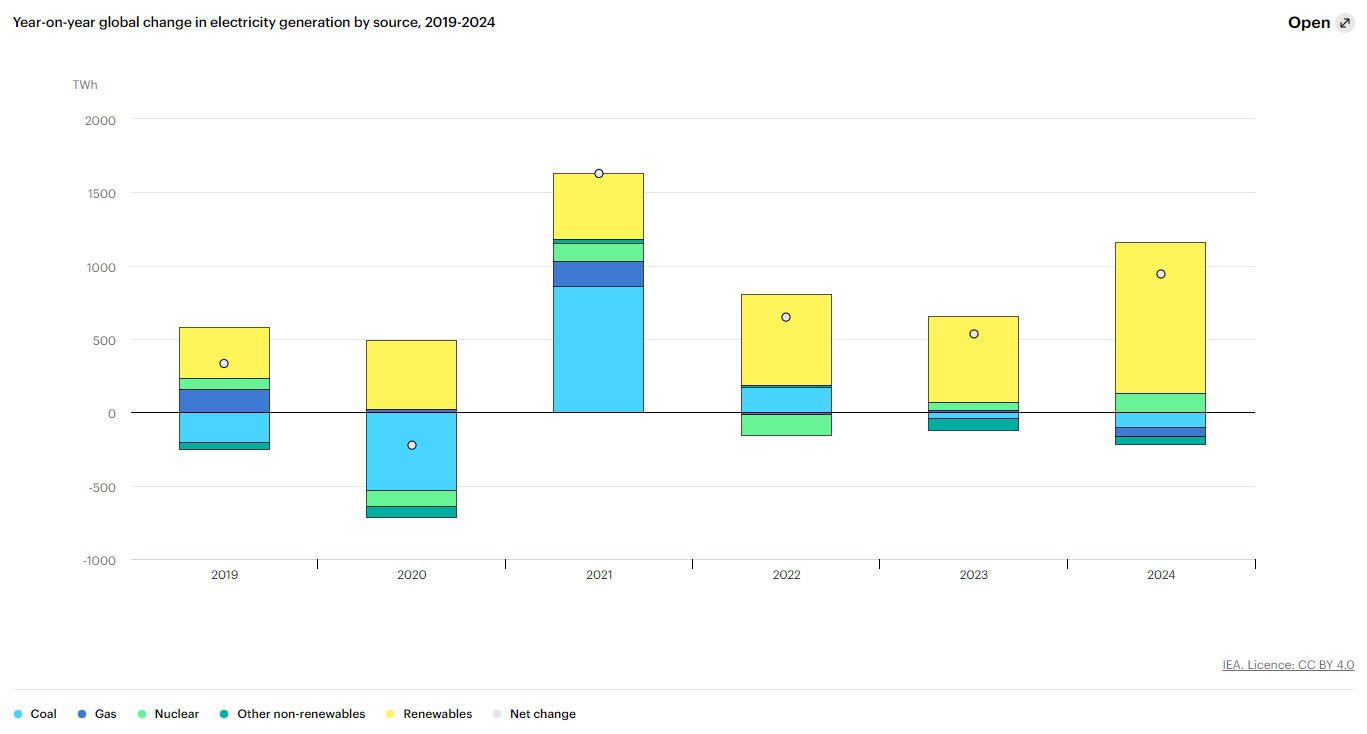

- The accelerated pace of new renewable capacity additions shows that renewable generation could surpass coal as early as 2024 if weather conditions are favorable. This is supported by the expectation that coal-fired generation will slightly decline in 2023 and 2024 after rising 1.5% in 2022 when high gas prices boosted demand for alternatives.

- Increases in coal-fired generation in Asia in 2023 and 2024 are poised to be offset by strong drops in the United States and Europe. These increases in Asian coal generation are to ensure energy security for the region as electrification grows significantly. Currently, renewable generation is unable to account for this growth alone.

- Renewables are set to meet all additional demand in 2023 and 2024. With global demand growth easing in 2023, incremental increases in renewables alone are expected to cover all additional demand not only this year but also in 2024, when demand growth is expected to accelerate again. By 2024, the share of renewable generation in the global electricity supply will exceed one-third for the first time.

- Year-on-Year Global Change in Electricity Generation By Source, 2019-2024:

Source: IEA (2023), Electricity market report, (https://www.iea.org/reports/electricity-market-report-update-2023/executive-summary)

SUPPLY COMMENTARY

- By 2024, electricity generation from fossil fuels is expected to have fallen four times in six years. Declines in fossil-fired generation were rare in the past and occurred primarily after global energy and financial shocks, such as following the oil crises of the 1970s or during the Great Recession in 2009, when overall electricity demand was suppressed.

- However, in recent years, fossil-fired supply has lagged or fallen even when electricity demand expanded. These trends are driven by a new global carbon reduction policy and a significant increase in renewable capacity.

- These changes suggest that declines in fossil electricity generation are becoming structural. The world is rapidly moving towards a tipping point where global electricity generation from fossil fuels begins to decline and is increasingly replaced by electricity from clean energy sources.

- The impact of weather on electricity supply is increasingly noticeable:

- The availability of hydropower requires greater attention. The capacity factor of global hydropower has been in decline over the past decade, falling from an average of 38% in 1990-2016 to about 36% in 2020-2022.

- This difference of two percentage points means that, globally, today’s hydropower capacity is producing about 240 TWh less electricity per year than would have been the case if capacity factors had remained unchanged. This indicates a volume of energy as large as Spain’s annual electricity consumption needs to be supplied instead of by other sources, a gap that is currently filled mostly by fossil-fired generation.

- Recent years saw intense droughts that caused a significant reduction in hydropower availability in affected regions such as Europe, Brazil, and China. Anticipating challenges on hydropower related to climate change, and planning accordingly, will be crucial for the efficient and sustainable use of hydro resources. Hydropower is still a very important part of the global energy mix and will continue to be prominent.

- However, it is significantly easier to increase the capacity of other renewable energy sources such as wind and solar. Due to this, the global capacity factor of hydro is decreasing.

PRICING SITUATION

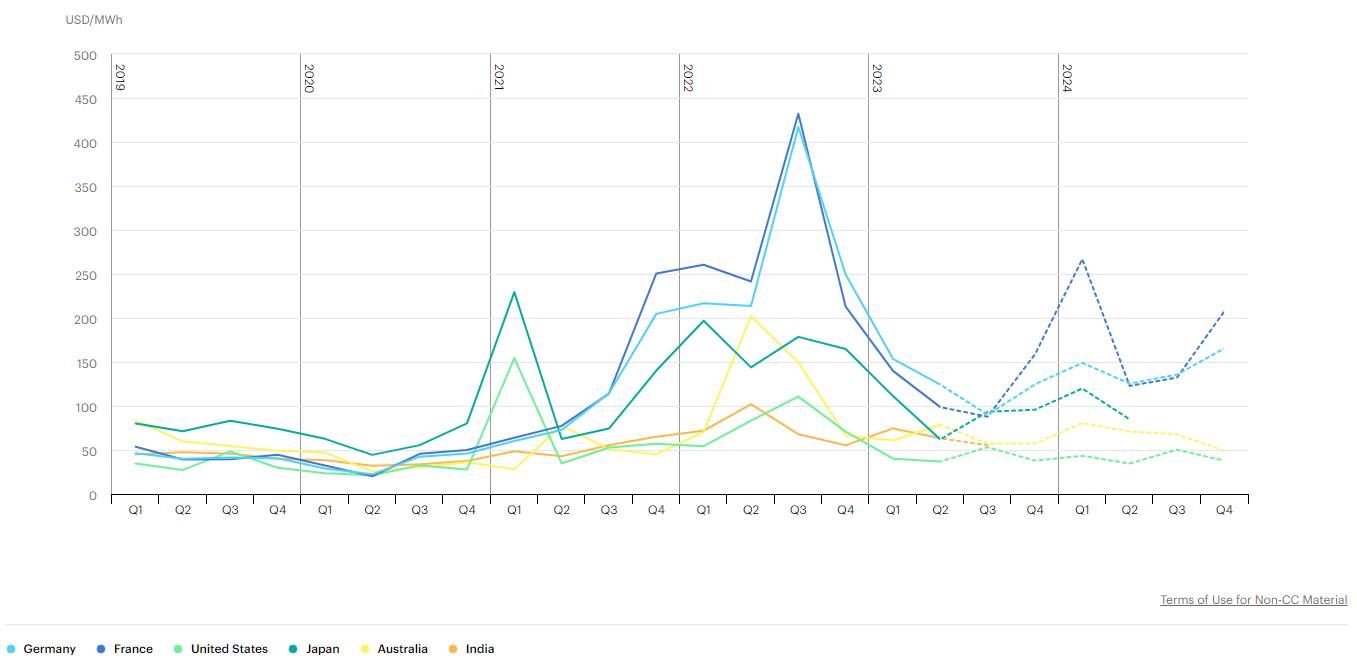

- Wholesale electricity prices signal an increased need for flexibility:

- The number of hours in which electricity prices dropped below zero doubled in European countries such as Germany and the Netherlands in the first half of 2023 compared to the same period in 2022. This was driven by strong renewables output at times of significantly reduced demand.

- Negative prices indicate generation is not sufficiently flexible, the demand side is not adequately price-responsive or there is not enough storage to conduct energy arbitrage. Negative prices also provide signals to invest in solutions and technologies to improve system flexibility.

- These signals will have to be accompanied by updated regulatory frameworks to incentivize demand-side flexibility and storage to increase the flexibility of the broader system.

- Wholesale electricity prices remain elevated in many countries despite substantial declines, although there are regional differences. As prices for energy commodities such as gas and coal have fallen significantly in the first half of 2023, wholesale electricity prices in many regions have declined from their previous peaks. European wholesale prices halved from their record highs in 2022, falling closer to their 2021 average.

- Despite this, average prices in Europe are still more than double 2019 levels. Similarly, average wholesale electricity prices in India in the first half of 2023 were still 80% higher than 2019 levels, and in Japan, they were 30% higher compared to 2019. In contrast, wholesale electricity prices in the United States have almost fallen back to 2019 levels.

Source: IEA (2023), Electricity market report 2023, (https://www.iea.org/reports/electricity-market-report-update-2023/executive-summary)

PRICING SITUATION

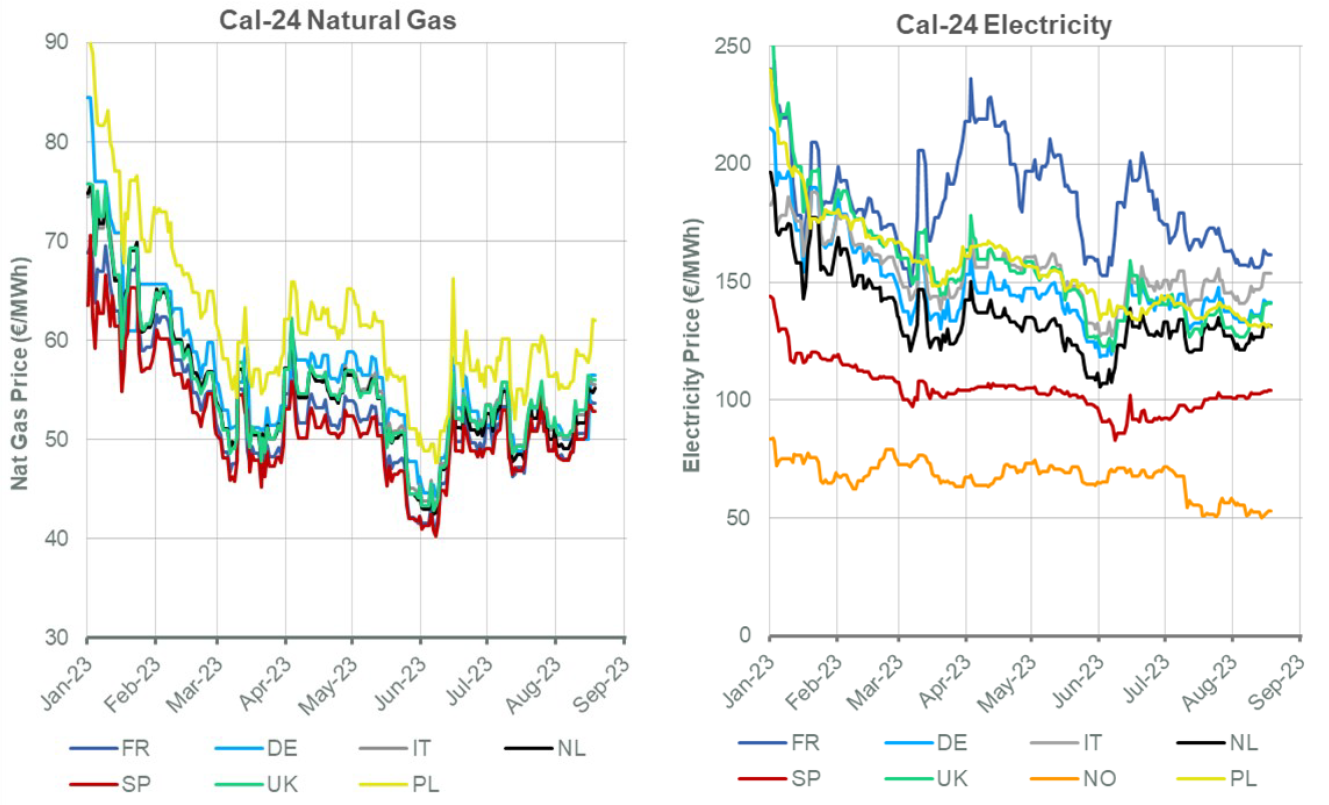

- Global electricity pricing has stabilized significantly since the madness that was experienced in 2022 which shocked global markets. Deregulated regions and countries have been experiencing bearish markets since the beginning of 2023.

- Europe was impacted the greatest by the Russia Ukraine war due to their proximity and reliance on Russian oil and gas. In solidarity with Ukraine, the European Union (EU) initiated an embargo on imports of Russian energy, leaving the region with a significant deficit in supply, hence, prices skyrocketed.

- 2023 pricing across Europe has been steadily decreasing since January 2023 – largely driven by the high gas reserves across the region and given the record warm winter experienced over the 2022/2023 winter.

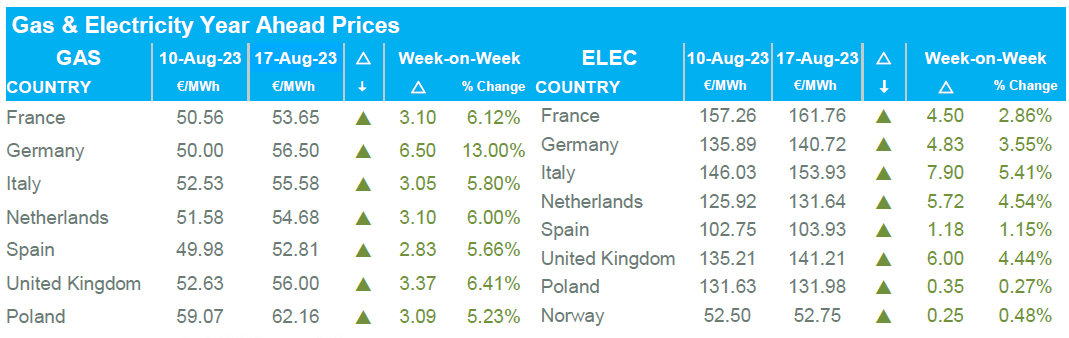

Source: ENGIE IMPACT European report 18th Aug 2023.

PRICING SITUATION

Source: ENGIE IMPACT European report 18th Aug 2023.

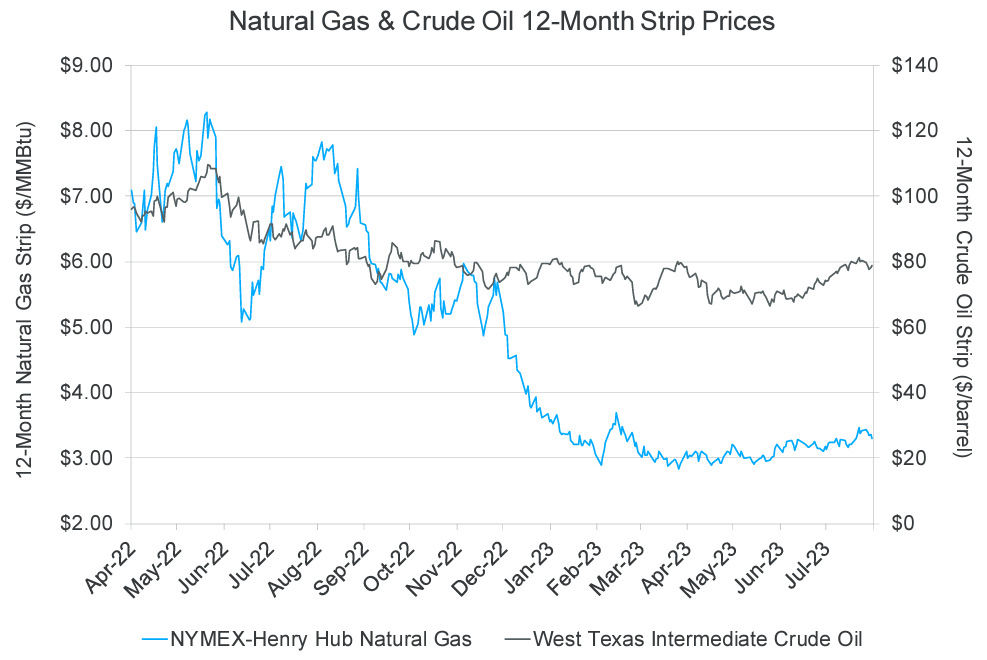

- In the United States the trend for the price on the Henry Hub Natural Gas market has been decreasing sharply since January 2023 and has now begun to stabilize since April 2023.

- The West Texas Intermediate Crude oil index has been relatively consistent over the past 6 months with a gradual downward price trend over this time.

- Both markets show strong indications that we are in a bearish trend and that relatively normal pricing dynamics are returning.

Source: ENGIE IMPACT market Watch 22nd Aug 2023.

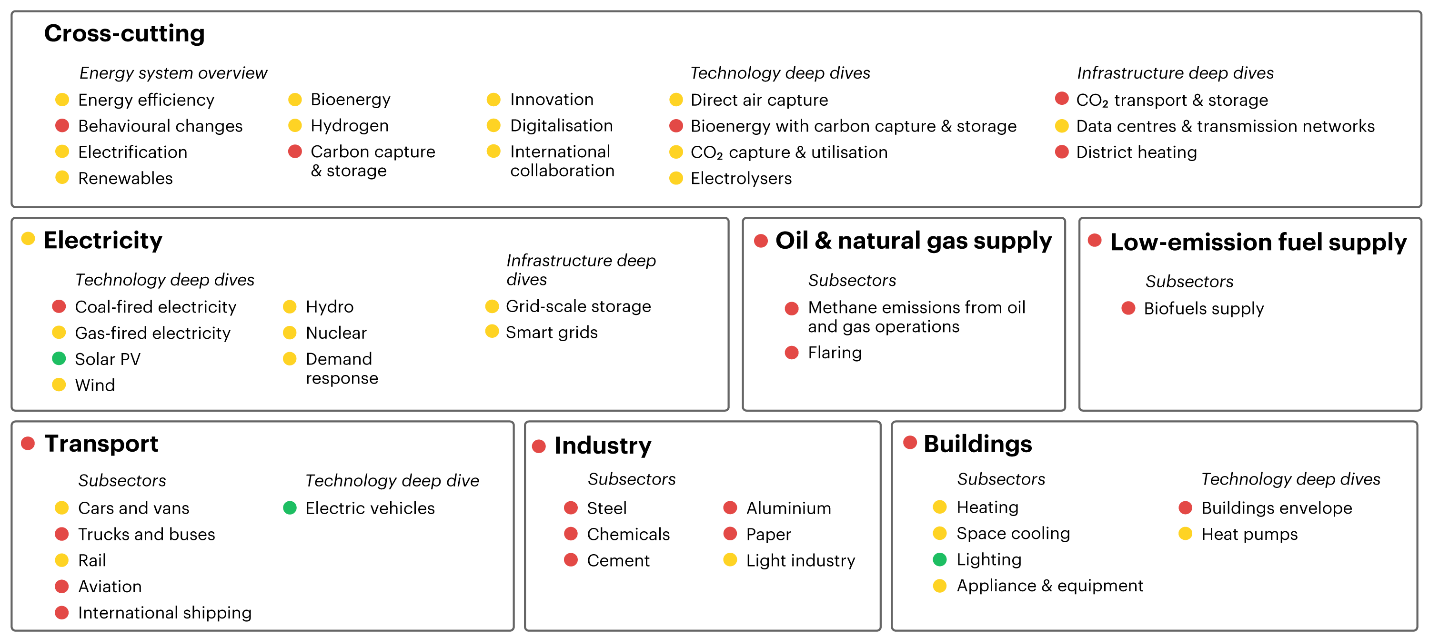

Tracking Clean Energy 2023: How are we doing?

- In the 2023 edition, 3 of more than 50 components tracked are evaluated as fully “On Track” with the Net Zero by 2050 Scenario trajectory – solar PV, electric vehicles, and lighting.

- Progress on clean energy technology deployment was very rapid in 2022, even if many components are not yet fully on track at the global level. The momentum towards a clean energy economy is clearly accelerating. Some highlights from 2022 include the following:

- Electric vehicle sales grew by 55%, reaching a record high of more than 10 million. Also, for the first time ever, the announced manufacturing capacity for electric vehicle batteries is sufficient to fulfill expected demand requirements in 2030 in the NZE Scenario.

- Nuclear capacity additions grew by 40%, with 8 GW newly installed. While higher deployment is needed in the Net Zero Scenario, the growth in 2022 represents a clear step forward after capacity additions had remained stable from 2019 to 2021.

- Heat pumps saw another record year, with 11% growth in sales. This is close to the 15% average compound annual growth needed to fully align with the Net Zero Scenario.

- Electrolyzer installed capacity grew by more than 20%, while electrolyzer manufacturing capacity grew by more than 25%. The bigger story though is likely yet to come - based on the current pipeline of projects under development and their expected operation dates, electrolyzer capacity could reach almost 3 GW by the end of 2023, a more than four-fold increase in total capacity compared to 2022.

- Energy efficiency of the economy overall grew by more than twice the level the previous year. This is a positive step forward following several years of relatively weak improvements.

- Progress is taking place faster in those parts of the energy system for which clean technologies are already available and costs are falling quickly, such as for electricity generation and passenger cars. However, a full transition to net-zero emissions will require decarbonizing all areas of energy production and use.

Tracking Clean Energy 2023: How are we doing?

- Rapid innovation is needed to bring clean technologies to market for those parts of the energy system where emissions are harder to address, such as heavy industry and long-distance transport. The past few years have recorded substantial improvements but moving into 2024 and beyond an acceleration is needed to move towards more aggressive deployments of novel low emission technologies for these areas.

- The transition is also occurring at different speeds across regions and sectors, for example, nearly 95% of electric car sales in 2022 occurred in China, the United States, and Europe.

- Meanwhile, nearly 75% of the globe’s operating and planned carbon capture capacity is in North America and Europe.

- The global evaluation that a technology is “on track” does not mean that it is on track in all countries, and, conversely, a technology that is “not on track” globally could be progressing more quickly in some specific countries.

- Stronger international cooperation and robust policy development is needed to spread progress to all regions, particularly emerging market and developing economies.

Source: IEA (2023), Tracking Clean Energy Progress 2023, IEA, Paris https://www.iea.org/reports/tracking-clean-energy-progress-2023, License: CC BY 4.0

KEY TAKEAWAYS

- Energy market volatility has reduced consistently over the past quarter given the increase in supply globally, however, as a commodity, it remains very prone to dramatic changes in weather or geopolitics which can change the global markets significantly in a short period of time.

- Renewables are growing faster than demand to reduce dependency on fossil fuels. This is accelerating with increased governmental actions towards reduced fossil fuel emissions and more support for renewable solutions.

- Large uncertainties for our 2023 electricity demand, generation mix, and pricing forecast remain, including fossil fuel supply and economic growth, combined with political pressure to transition over to renewable energy sources.

- Electricity in Europe has continued the stability of the early months of 2023 with a significant decrease in pricing.

- Our guidance:

- Investigate for any alternative options available that could drive reduced consumption for your business.

- Implement a longer-term energy strategy that creates long-term benefits through reduced exposure to market volatility. Examples include a staged strategy with a combination of purchasing RECs, on-site energy generation, off-site energy generation, PPA, and VPPA.

- Ensure that your risk exposure is manageable. If it is not, fix pricing where possible to mitigate unmanageable risk.

- Now is a good time to investigate locking contracts as the price for energy has significantly dropped and stabilized. This may change in the coming winter months when pricing is forecast to begin increasing again.

Back to Top