By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Category Intelligence Archive

Q4 2023

Jabil's Global Category Intelligence Archive

Q4 2023

GLOBAL LOGISTICS

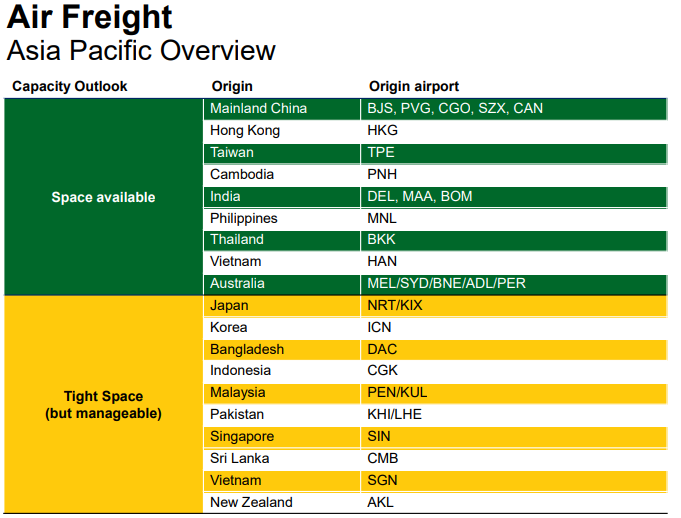

APAC

MARKET OVERVIEW

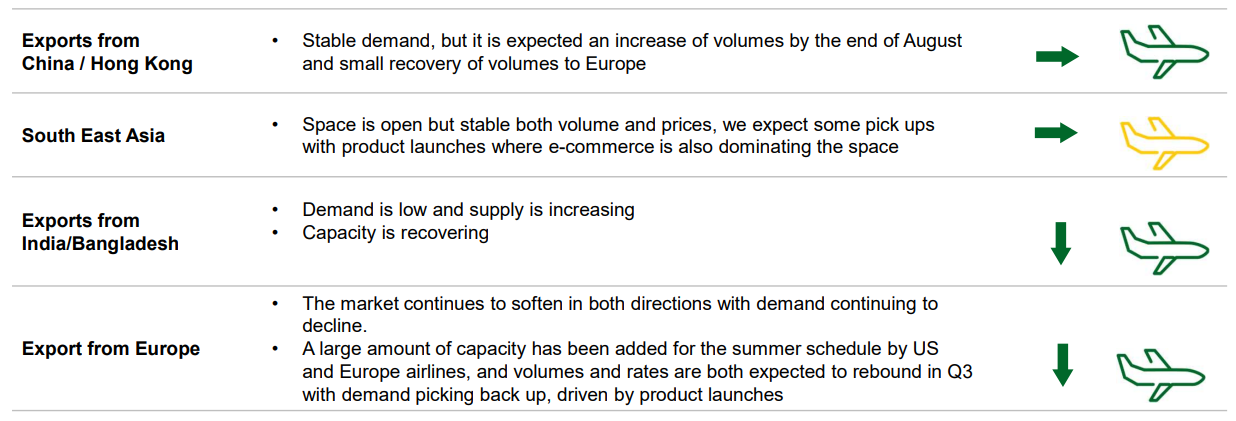

- Global air freight continues to experience weak demand, leading to soft market conditions.

- A substantial recovery in air freight demand is not expected until 2024.

- High inflation worldwide is impacting the global economy and trade, resulting in elevated inventories and reduced purchasing power, ultimately leading to lower demand.

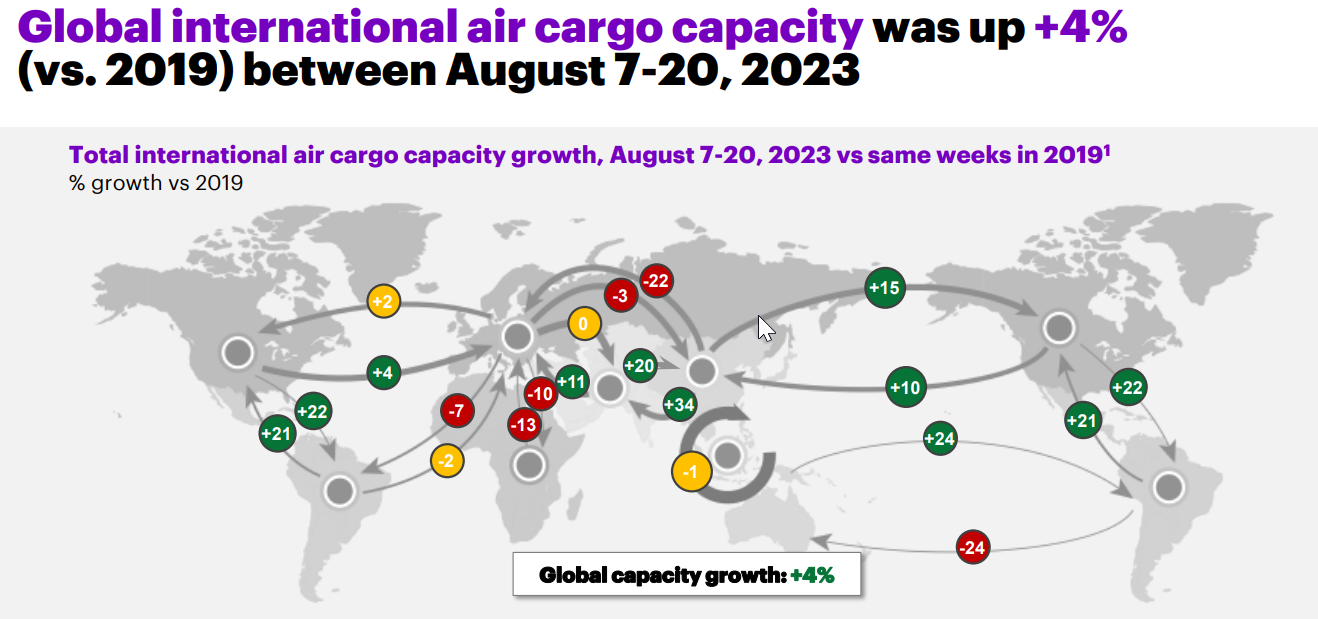

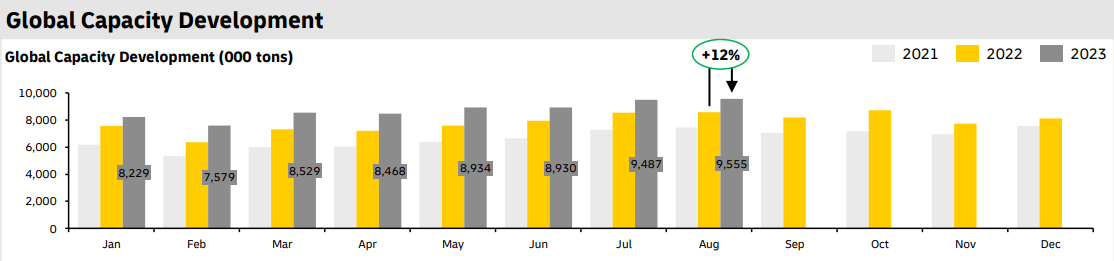

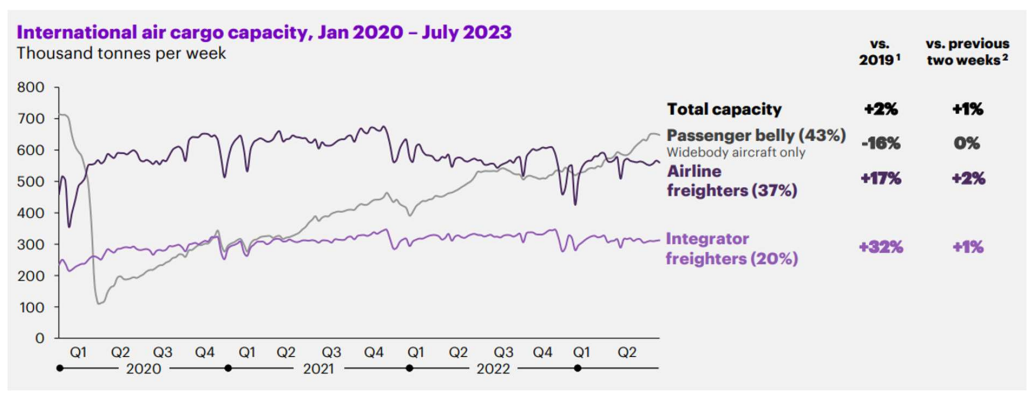

- On the supply side, there is ample capacity to meet current volume levels, with belly capacity seeing improvements due to sustained high demand for passenger travel.

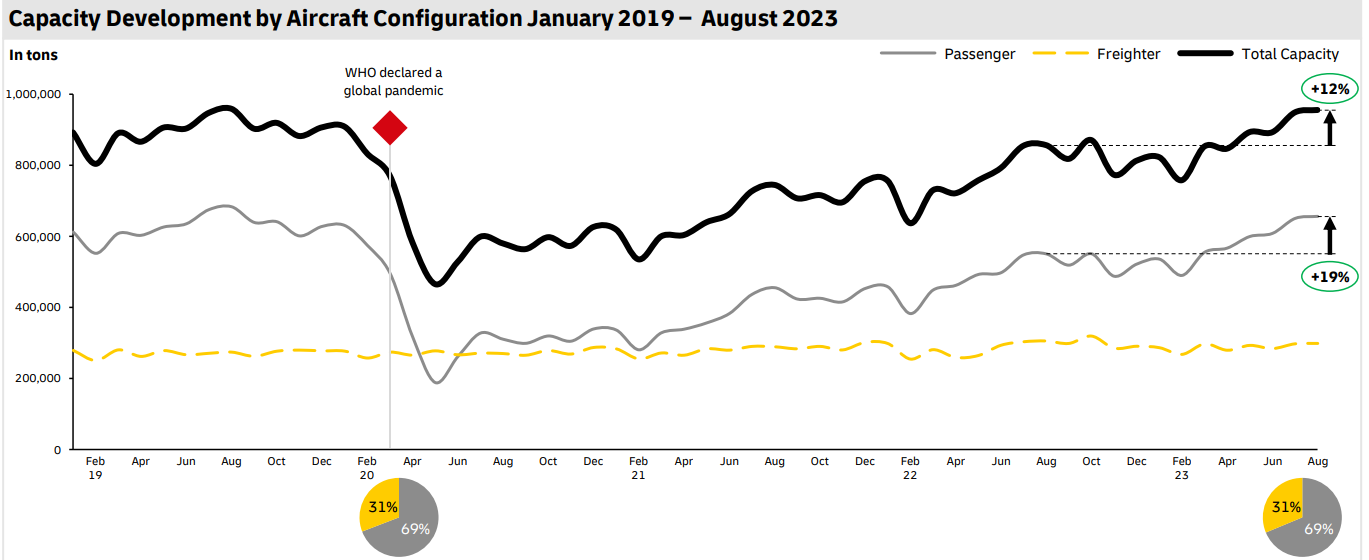

- Global capacity has increased by 12% compared to the previous year, and belly capacity has grown by 19% year-on-year due to increased demand for passenger travel and flights.

- Most trade lanes currently maintain sufficient capacity, without significant backlogs.

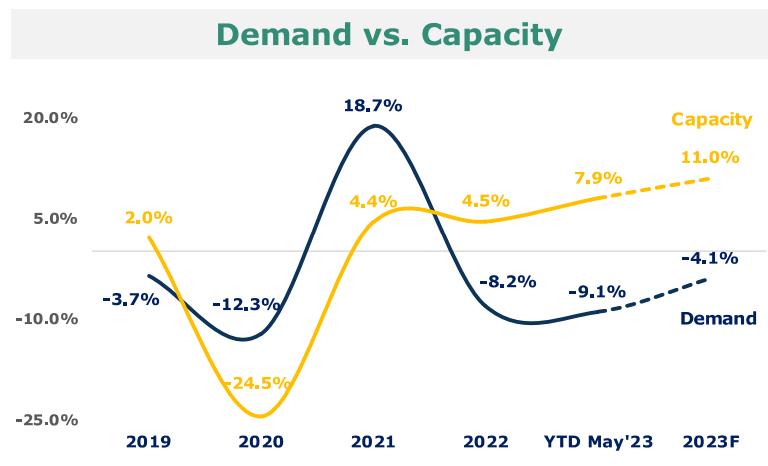

- Despite higher volumes, global container demand in the ocean freight market remains lower year-on-year.

- Carriers are anticipating higher volumes in August and the coming months due to peak season but may be disappointed, leading to an excess supply situation.

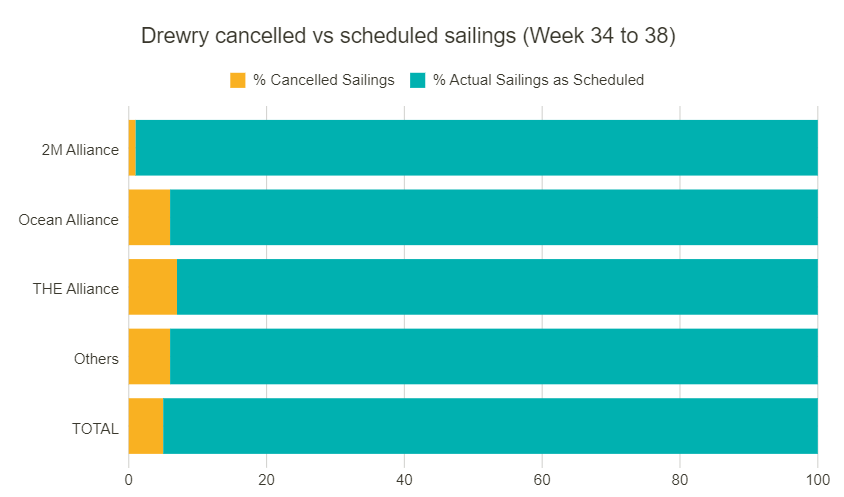

- Carriers are implementing strategies such as blank sailings and slow steaming to manage the excess supply.

- Shippers are advised to remain cautious of carriers' attempts to present the market as tighter than it is, given the ongoing weak demand and excess supply.

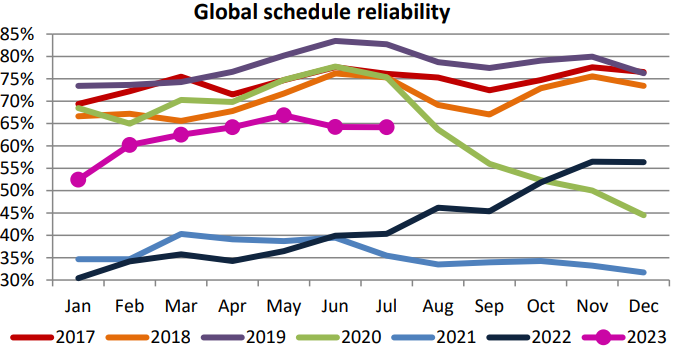

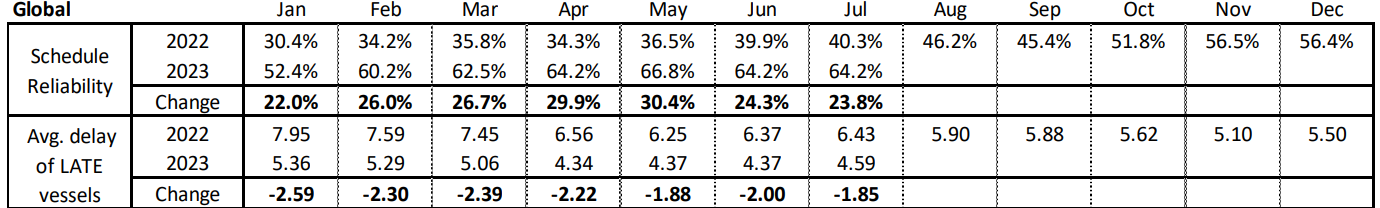

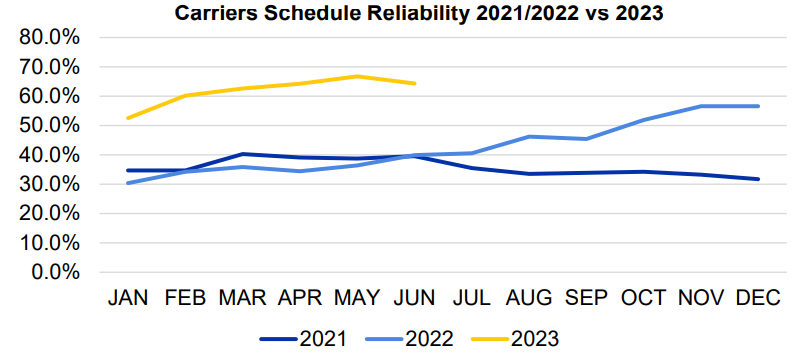

- Schedule reliability was at 64.2% in July 2023, slightly lower than the peak reached in May 2023 at 66.8%. However, it remains significantly higher year-on-year.

- To account for carriers' practices like slow steaming and blank sailings, it is recommended to include a 1 to 2-week lead-time extension for short-haul and 2 to 3 weeks for long-haul forecasts.

- A 4-week rolling forecast for both air and ocean modes is strongly recommended, and bookings should be placed at least 1 week in advance for air and 3 to 4 weeks for ocean.

- Courier freight mode and channels are operating normally, but prices and rates have increased due to General Rate Increases (GRIs) and fuel costs.

- A potential crisis among US integrators was averted in July/August, as the two largest companies in the sector avoided industrial action, with new agreements in progress.

- The domestic transportation market in China remains unchanged and is operating normally with available capacities.

- Cross-border ground transportation channels, including those at the Chinese, Hong Kong, and South Asian borders, are operating normally with available capacities and smooth flow.

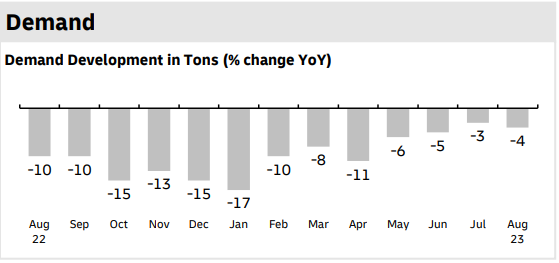

DEMAND COMMENTARY – AIR

- Global air cargo demand remains soft, experiencing a year-on-year decline of 4% in August. Year-to-date cargo tonne-kilometers (CTKs) are 8.1% below the levels seen in the previous year.

- Leading indicators of air cargo demand, such as global goods trade, manufacturing Purchasing Managers' Index (PMIs), and the inventory-to-sales ratio, continue to indicate contractions in demand.

- The impact of high inflation is prevalent in most global economies, further suggesting that cargo volumes are likely to remain low. The outlook does not indicate any immediate recovery in air freight demand, particularly in the short term.

- As we approach the traditional peak period of the year, major carriers' forecasts suggest that there will be no peak season expected in 2023.

- There are currently no signals to indicate the typical definition of a peak season, which entails a 10% to 15% volume growth from August to November.

- Air cargo demand is projected to remain stagnant at current levels until a potential pickup is anticipated in the following year.

DEMAND COMMENTARY – OCEAN

- The global ocean market landscape remains soft and is deteriorating, characterized by an excess supply of shipping capacity.

- In August, the Global XSI (Xeneta Shipping Index) recorded another substantial decline of 7.8%, following a significant drop of 9.5% from the previous month. This brought the index down to 169.2 points in August. Compared to the same period a year ago, the index has experienced a staggering collapse of 62.7%.

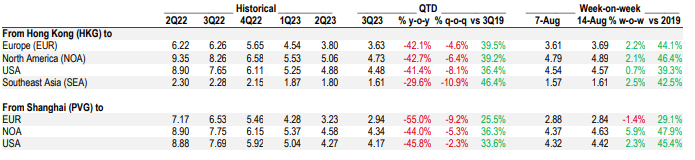

- The XSI for Far East exports has seen the most significant decline, falling by nearly 75% over the past year. In August, it registered another substantial drop of 14.2%, bringing it to 161.8 points.

- Far East imports, as indicated by the XSI, also decreased by 2.0% in August, reaching 120.2 points. This sub-index has declined by 51.1% since its peak exactly one year ago.

- The absence of a peak season is expected due to soft and tepid volumes. Even if volumes were to increase, overcapacity is anticipated because of the record number of new ships being delivered.

- In the first six months of the year, a total of 990,000 TEU (Twenty-Foot Equivalent Units) were delivered, with a similar number expected in the second half of 2023.

- Services utilization on all intra-regional trades is on an upward trend as carriers align capacity more effectively with demand.

- This has resulted in increased freight levels on certain trade corridors.

- Carriers are still implementing structural blank sailings for some services.

- Therefore, for shipments with time-sensitive requirements, advance bookings are strongly recommended, preferably opting for direct services to ensure reliable transport.

DEMAND COMMENTARY – COURIER/PARCEL

- Demand is unchanged and remains on the soft side.

- All channels are operating normally with sufficient capacities to support demand.

- A potential crisis in the US door-to-door integrator business was averted in July when the two largest companies in the sector avoided industrial action.

- UPS reached a tentative agreement with the labor union, Teamsters, after its drivers, pilots, and ground workers threatened to strike beginning August 1.

- However, the risk of industrial action is not completely averted as the agreement requires ratification, with votes scheduled from August 3 to August 22.

- In contrast, FedEx failed to reach an agreement with its pilots despite offering a tentative increase in pay and pension benefits by 30%, which was rejected.

- However, business operations at FedEx were not affected. FedEx pilots are also subject to labor laws, meaning Congress could intervene if pilots were to strike.

DEMAND COMMENTARY – GROUND

- The domestic truck freight mode in Asia remains unchanged, both within domestic China and across cross-border trade lanes to Hong Kong and Southeast Asia.

- Demand in this sector is experiencing softness, as the anticipated economic rebound following the lifting of COVID-19 restrictions in China did not reach the expected levels.

SUPPLY COMMENTARY – AIR

- On the supply/capacity side, the market currently has sufficient capacity to meet the demand volume.

- Global capacity has increased by 12% compared to August 2022, with continuous growth in belly capacities year-on-year at approximately 19%, primarily due to strong passenger travel.

- In Q3, scheduled capacity is expected to be up by 9% compared to Q2 and 18% compared to Q1 of 2023. Most trade lanes have sufficient capacity with no significant backlogs, and many airlines still have available capacity despite lean volumes.

- Despite increased capacity, flat volume growth has resulted in reduced load factors across all regions.

- The Cargo Load Factor (CLF), an indicator of the demand-supply balance, reflects balanced utilization under the current demand vs. capacity situation. This balance is likely to persist in the near term.

- Capacity from China, Hong Kong, and Southeast Asia also remains readily available, with sufficient supply to support current demand levels.

SUPPLY COMMENTARY – OCEAN

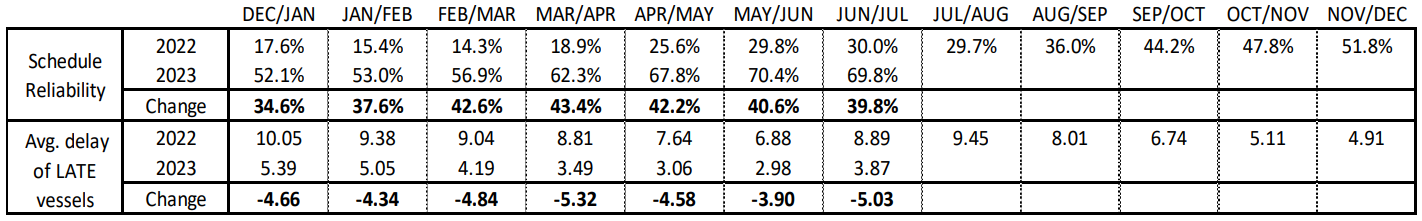

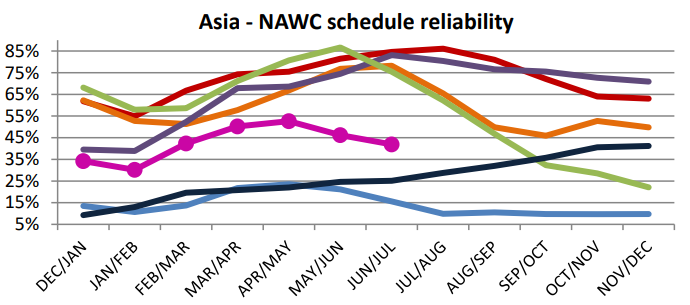

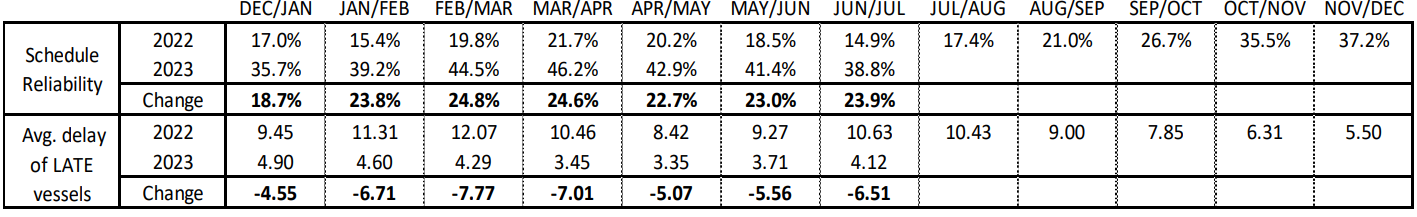

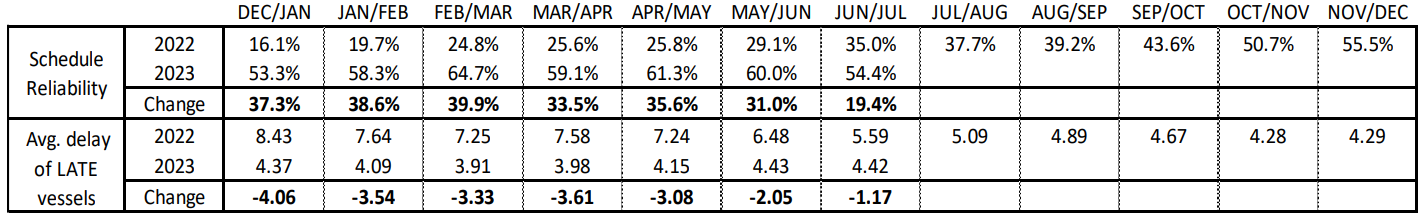

- Global schedule reliability remained unchanged from June to July 2023, holding at 64.2%. This level is slightly lower than the peak reached in May 2023 at 66.8%.

- However, on a year-on-year basis, schedule reliability in June and July 2023 is still significantly higher, up by 23.8 percentage points.

- On the other hand, the average delay for LATE vessel arrivals deteriorated by 0.21 days from the previous month, reaching 4.59 days. This marks the first substantial increase of the year, following two months of stability at 4.37 days.

- Despite the month-on-month increase, the average delay for LATE vessel arrivals is still 1.85 days better than the same period last year.

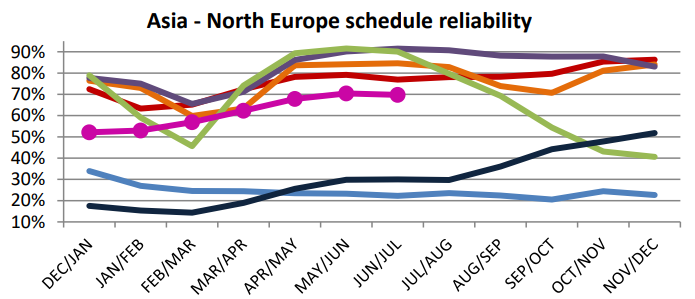

- Schedule reliability on the Asia-North Europe trade lane decreased by 0.7 percentage points from June to July 2023, reaching 69.8%.

- On a year-on-year basis, schedule reliability in June and July 2023 was significantly higher, up by 39.8 percentage points compared to the same period last year.

- The average delay for LATE vessel arrivals on this trade lane deteriorated, increasing by 0.89 days from the previous month, reaching 3.87 days.

- However, on a year-on-year basis, the delay was significantly lower, down by 5.03 days compared to the same period in 2022.

- The average delay for ALL vessel arrivals also increased month-on-month in June and July 2023 by 0.25 days, reaching 0.91 day.

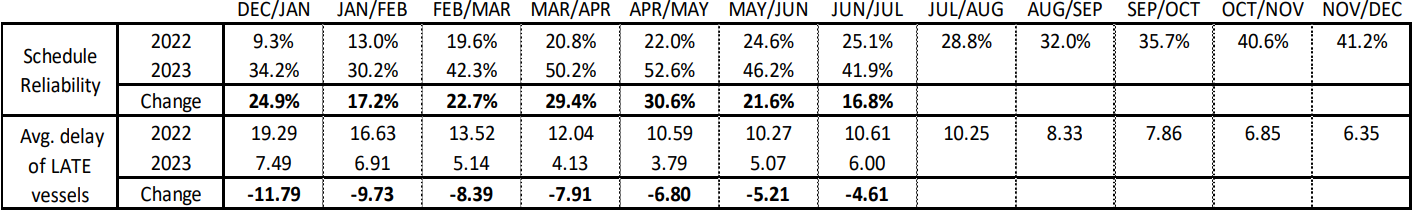

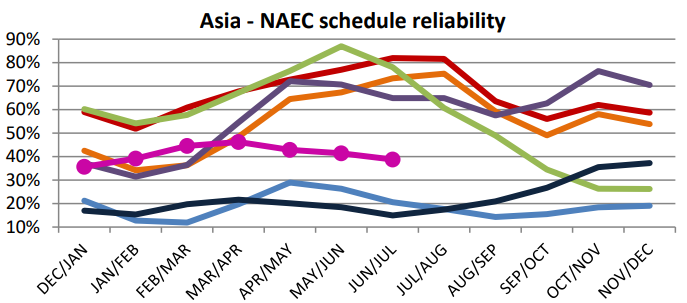

- Schedule reliability on the Asia-North America West Coast trade lane decreased by 4.3 percentage points from June to July 2023, reaching 41.9%. This is the third-lowest figure recorded for this month.

- On a year-on-year basis, schedule reliability in June and July 2023 was higher.

- The average delay for LATE vessel arrivals also deteriorated, increasing by 0.93 days month-on-month to 6.00 days in June and July 2023. This marks the third-highest figure recorded for this period.

- However, on a year-on-year basis, the delay was lower by -4.61 days. The average delay for ALL vessel arrivals increased by 0.88 days month-on-month to 3.18 days.

- Schedule reliability on the Asia-North America East Coast trade lane decreased by 2.6 percentage points from June to July 2023, reaching 38.8%. This represents the third-lowest figure recorded for this period.

- However, on a year-on-year basis, schedule reliability in June and July 2023 was significantly higher, up by 23.9 percentage points compared to the 14.9% recorded at the same time last year.

- The average delay for LATE vessel arrivals on this trade lane also deteriorated, increasing by 0.40 days month-on-month to 4.12 days in June and July 2023. On a year-on-year basis, the delay was substantially lower, down by -6.51 days compared to 2022.

- The average delay for vessel arrivals increased by 0.29 days month-on-month to 2.48 days in June and July 2023.

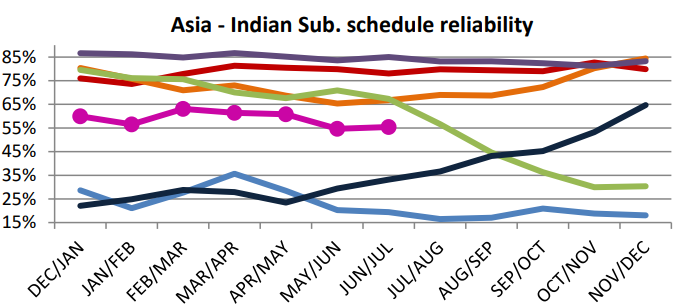

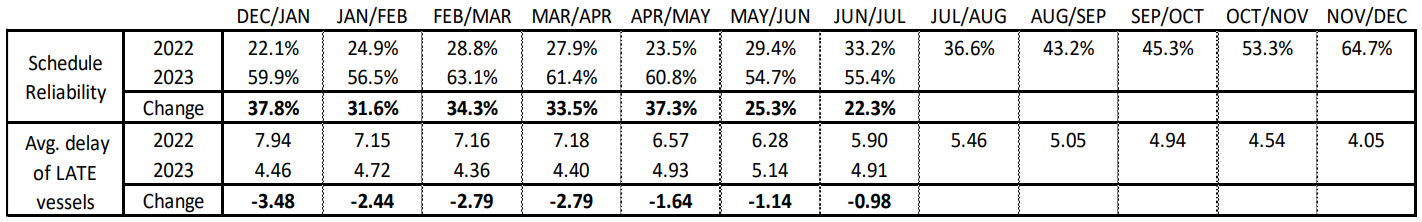

- Schedule reliability on the Asia-Indian Subcontinent trade lane increased by 0.8 percentage points from June to July 2023, reaching 55.4%.

- On a year-on-year basis, schedule reliability in June and July 2023 was significantly higher, up by 22.3 percentage points compared to the same period in 2022.

- The average delay for LATE vessel arrivals on this trade lane improved, decreasing by -0.23 days month-on-month to 4.91 days in June and July 2023.

- On a year-on-year basis, the average delay was lower by -0.98 days compared to the same period in 2022. However, the average delay for ALL vessel arrivals increased by 0.13 days month-on-month to 2.11 days in June and July 2023.

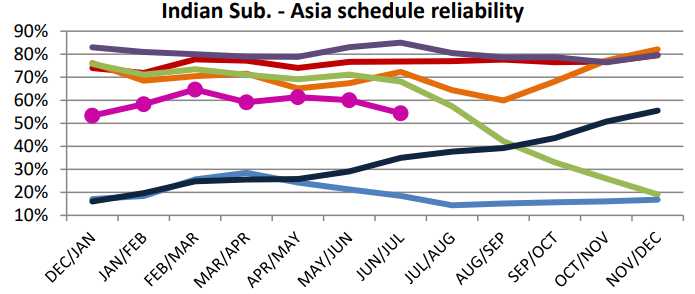

- Schedule reliability on the Indian Subcontinent-Asia trade lane decreased by -5.7 percentage points from June to July 2023, reaching 54.4%.

- On a year-on-year basis, schedule reliability in June and July 2023 was 19.4 percentage points higher than the 35.0% recorded at the same point in 2022.

- The average delay for LATE vessel arrivals improved, decreasing by -0.02 days month-on-month and reaching 4.42 days in June and July 2023.

- On a year-on-year basis, the average delay was -1.17 days lower than at the same point in 2022.

- However, the average delay for ALL vessel arrivals increased month-on-month by 0.31 days, reaching 1.84 days in June and July 2023.

SUPPLY COMMENTARY – COURIER

- Capacity remains available and able to support all trade lanes, and all channels are operating normally.

- There were some developments in US destination operations in July and August, involving the two largest companies in the sector potentially facing industrial actions.

- However, these actions have been avoided as new agreements are being worked on and/or are set to be ratified.

SUPPLY COMMENTARY – GROUND

- Adequate capacities are currently available, and all channels are functioning smoothly.

- It is noted that customs clearance procedures at border points between Shenzhen and Hong Kong, as well as between China and Vietnam, are operating efficiently and without disruptions.

PRICING SITUATION – AIR

- Market demand for air freight is soft, leading to aggressive and competitive rates.

- Global air freight capacity has increased by 12% compared to the previous year, while chargeable weight has only increased by 2%.

- Carriers anticipate an upturn in demand for the fourth quarter (Q4) and expect winter schedule rates to be affected.

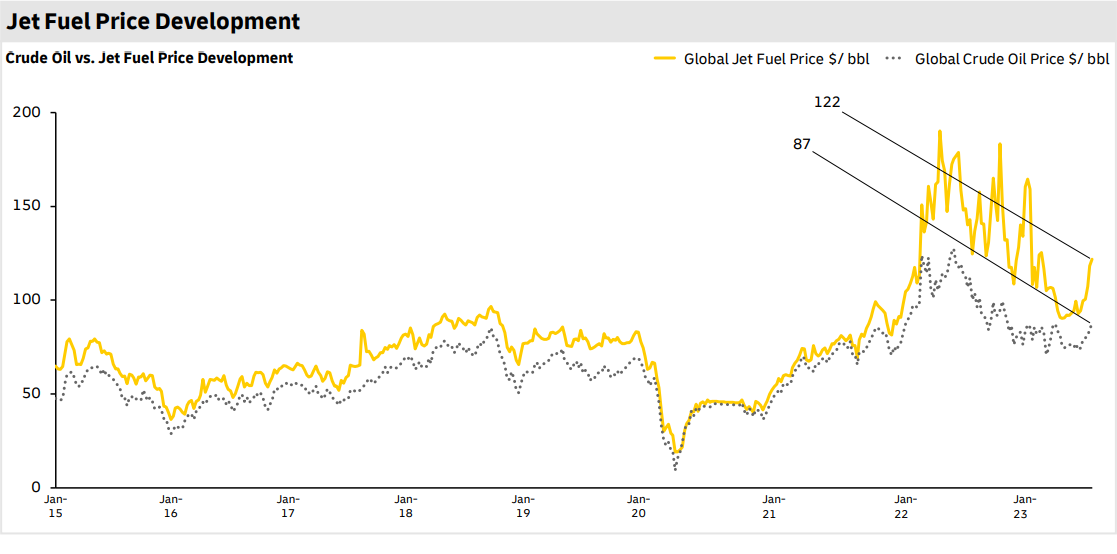

- Jet fuel prices remain high due to extended voluntary cuts in Saudi Arabia's crude oil production, with prices exceeding $100 per barrel.

- The Energy Information Administration (EIA) forecasts an average jet fuel price of $86 per barrel for Q4 '23.

- Global oil inventories are expected to remain low, with rising demand throughout the year, resulting in higher jet fuel prices.

- Crude oil production and demand are anticipated to balance around 2024, which may lead to downward pressure on crude oil and jet fuel prices in the future.

PRICING SITUATION – OCEAN

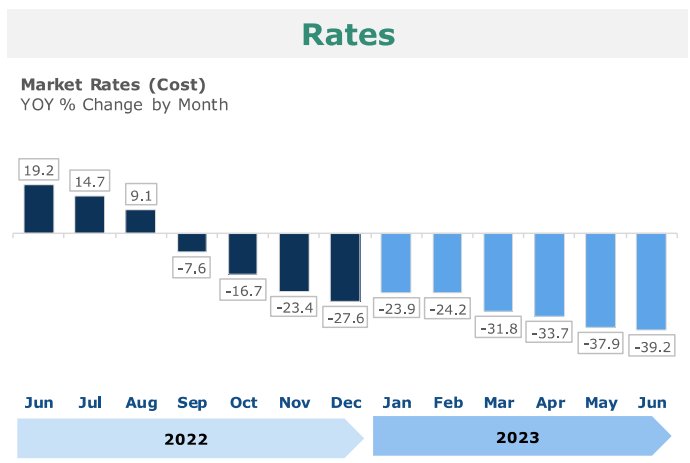

- Global XSI® Declines: The Global XSI® (Container Shipping Industry Index) has faced significant challenges, with a 9.5% slump in the previous month followed by another fall of 7.8% in August. The index now stands at 169.2, marking a collapse of 62.7% compared to rates from just one year ago. These declines have been consistent month-on-month.

- Soft Demand and Excess Capacities: Continuous soft demand and excess capacities in the container shipping industry have led to challenges in utilization and pricing. Market sentiment has turned negative, and carriers have struggled to retain recent rate increases, with the SCFI slipping by 1.2% last week.

- Peak Season Disappointment: Carriers had hoped for higher volumes in August and the upcoming months during the traditional peak season but have been disappointed so far.

- Impact on Rate Hikes: The setback in rates will make it more challenging for carriers to push for the next round of rate hikes in September.

- Increasing Capacity: The industry has witnessed a continual increase in capacity, with a record number of new ships delivered. In the first six months of the year, approximately 990,000 TEU of additional capacity was delivered, and a similar amount is expected in the second half of 2023.

- Demand/Supply Management: Carriers have been implementing strategies such as blank sailing (canceling planned sailings) and slow steaming (reducing ship speed) to manage the balance between demand and capacity.

- Far East Exports and Imports: The XSI® for Far East exports has experienced a significant decline, falling by close to 75% over the last year.

- In August, it dropped by another 14.2%, reaching 161.8 points. This is notable as the Far East is a major exporting region for containerized goods.

- From an import perspective, the Far East imports XSI® fell by 2.0% in August, reaching 120.2 points, and has dropped by 51.1% since its peak one year ago.

KEY TAKEAWAYS - AIR

- Pessimistic outlook for the air freight market with no potential recovery forecasted until possibly 2024.

- Factors suppressing demand include a soft Chinese economy, slower industrial production, excess inventory, and more.

- A full rebound in global airfreight cargo volumes is not currently in sight.

- Carriers are expecting a weak traditional peak season due to weak macroeconomic conditions and low rates.

- Air freight has been in a 16-month downturn and is worsening on the verge of the traditional busy season.

- Excess capacities versus demand are contributing to the prolonged muted market outlook.

KEY TAKEAWAYS – OCEAN

- The global ocean market continues to experience challenging conditions, with demand remaining subdued compared to recent years.

- The ongoing peak season has been notably lackluster, particularly with a noticeable dip in demand originating from China, which is weaker than anticipated.

- In Southeast Asia, demand levels are generally soft, except for Vietnam, where utilization rates range from 80% to 87%.

- Surprisingly, there has been no surge in demand from Thailand and Indonesia during their usual holiday seasons, as is customary.

- Fortunately, there is currently an ample supply of capacity to accommodate all trade lanes, and equipment shortages are no longer a concern as carriers have successfully replenished their equipment pool.

- Carriers are diligently seeking a balance between supply and demand while striving to maintain profitability and operational excellence.

- The overall outlook remains challenging due to persisting factors such as a lackluster global economy characterized by high interest rates, inflation, volatile energy prices, geopolitical instability, and a prevailing sense of uncertainty.

AMERICAS

MARKET OVERVIEW - AIR

- Air demand has dropped in 2023, while for the first 28 weeks of the year, international air cargo was up +5.8% Y/Y.

- Growth is driven by international widebody passenger flights, while international freighter capacity has declined -4.2%.

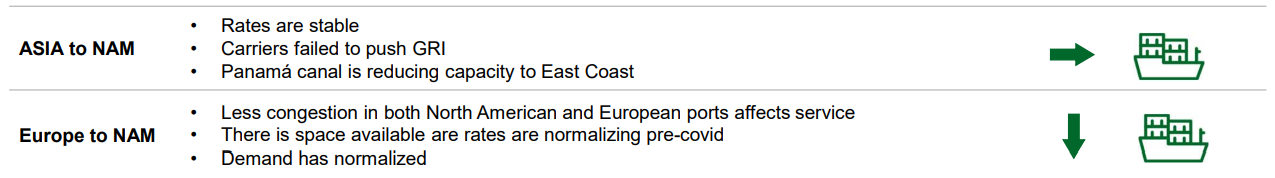

MARKET OVERVIEW – OCEAN

- Manzanillo Port - Main roads from Mexico Port of Manzanillo were blocked last August 17th by the union of Men Truck due to the working conditions that Port Terminals are presenting.

- The Union is claiming that Port Authorities have increased the checkpoints and revisions during the transit to recover the container at the port, forcing them to spend more time during the internal transit, losing appointments at the Terminals.

- The blocking impacted the Port Operations, which were reflected in longer waiting time due to the long line of trucks, in and outside the Port Terminals.

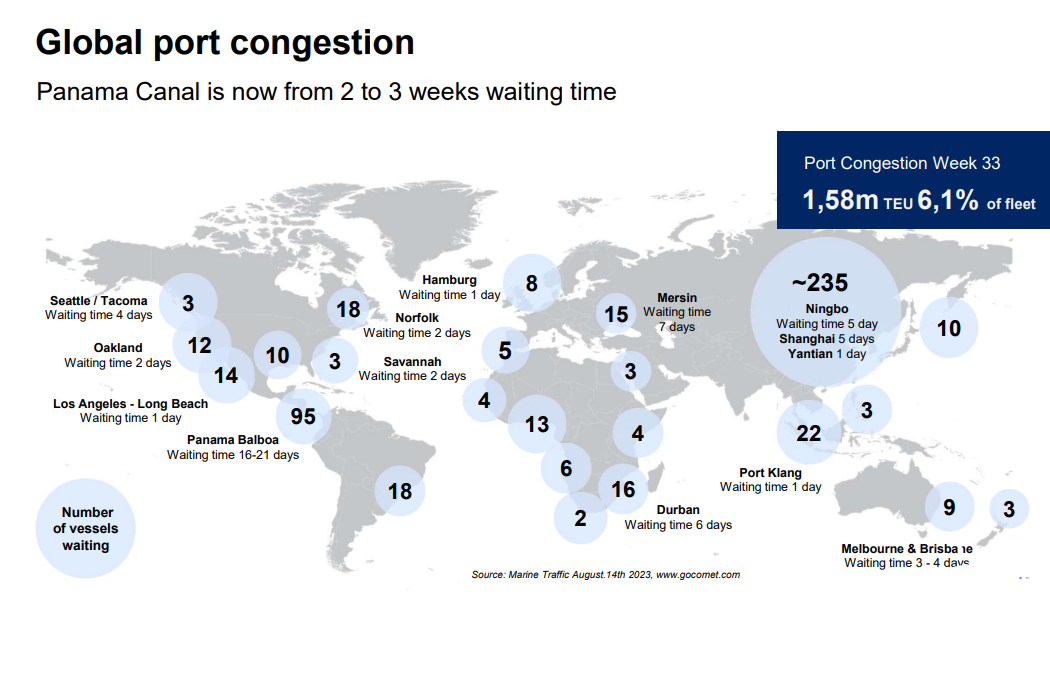

- Panamá Canal Drought - After the decrease in the draft level (how low the vessels can sit in the water) during the months of April and June, on July 25th there have been no further restrictions on the number of vessels allowed to transit the canal.

- As of August 10th, there were 161 vessels near the canal, an increase from the roughly 90 ships typically seen during the rainy season.

- Delays are being noticed; however, they are not having a huge impact on container vessels. Waiting times for containerships are less than 2 days, compared to the much longer waiting times for other ships of up to 3 weeks.

- The situation could worsen with “El Niño” if the rainy season is shortened this year and there is not enough water for 2024´s dry season.

MARKET OVERVIEW - GROUND

- The ground transportation market has been characterized by uncertainty over the past quarter as unions and employers negotiated to avert potential strikes.

- The most notable being the UPS and Teamsters’ successful discussions that avoided huge disruptions across the logistics network.

- The impact of those negotiations, although represent a positive breakthrough, has the potential to further increase rates across the ground logistics market over the next year.

- Following breakdowns in discussions with their unions, trucking company Yellow Corp. declared bankruptcy after years of financial struggles and growing debt, which marked a significant shift for the U.S. transportation industry and shippers nationwide.

DEMAND COMMENTARY – AIR

- IATA is forecasting air cargo demand growth to be -4.1% in 2023 Y/Y.

- The weaker air cargo demand is a result of continued high inventory levels, further increases in capacity, and the relative pricing between air and ocean shipping has driven some mode shifting.

- Air demand has dropped in 2023, and China to North America decreased by 21% (telecoms -40%, laptops -25%, automotive parts -35%).

- Some large suppliers have shown this decrease in the demand in the telecom area.

- For the first twenty-eight weeks of 2023, international air cargo is up +5.8% Y/Y.

- Growth is exclusively driven by international widebody passenger flights (+25% versus a year ago), while international freighter capacity has declined -4.2%.

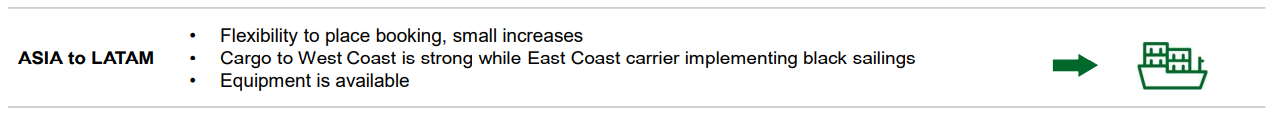

DEMAND COMMENTARY – OCEAN

- Volume growth has been rising steadily over the 2nd quarter of the year, but the positive trend has reversed on 3 or the 4 main trades routes (Asia to North America and Asia to Europe).

- Volumes on the Asia to North America West Coast (also to Mexican West Coast) are still holding but growth rates have been trending negative throughout this year.

- Total capacity is down 6.8% compared to the growth in capacity in the other trade routes.

- There is no expectation to have Peak Season this year. August is forecasted as the peak month for ocean shipping in 2023 but far off the mark from previous year’s Peak Seasons.

DEMAND COMMENTARY – GROUND

- On the week of August 21st, the Mexican Truck Association (Alianza Mexicana de Organizaciones de Transportes A.C. – AMOTAC) announced a partial roadblock in demand of the low security, the increasing tolls rates, and the Carta Porte requirements.

- On August 25th, the authorities requested AMOTAC 3 months to review their requirements and find a solution through regular meetings with authorities and the Mexican National Guard.

- The manifestation has been postponed for at least 3 months until AMOTAC achieves a resolution from Mexican Authorities.

SUPPLY COMMENTARY – AIR

- The overall market has stabilized, with the remainder of 2023 looking like the first half except for a relatively small peak in Q4.

- Market rates continue to decline but remain higher than pre-pandemic levels.

- Capacity continues to increase while demand remains relatively soft, indicating rates will likely continue to decline.

- Jet fuel and crude prices have leveled out but show significant Y/Y decreases although they remain elevated vs. pre-pandemic levels

SUPPLY COMMENTARY – OCEAN

- North American ports continue to see big improvements in the congestion situation across both the West Coast and East Coast.

- In contrast, North Asian ports have been hit by elevated congestion following severe weather conditions brought by typhoon Kanu that followed in the wake of typhoon Doksori.

- As a result, the ports of Ningbo and Shanghai recorded their largest increase in ships waiting at anchor.

- Global schedule reliability has seen the first M/M drop in June 2023 of - 2.5% points. That said, schedule reliability is still a massive 24.4% points higher Y/Y.

- The average delay for LATE vessel arrivals improved by a marginal - 0.1 days to 4.36 days.

- From April to June the average delay for LATE vessel arrivals have been within a narrow 0.03-day range. On a Y/Y level, the average delay figure was -2.01 days lower Y/Y.

SUPPLY COMMENTARY – GROUND

- Ground full truck is offering plentiful capacity currently, posing few challenges to the market.

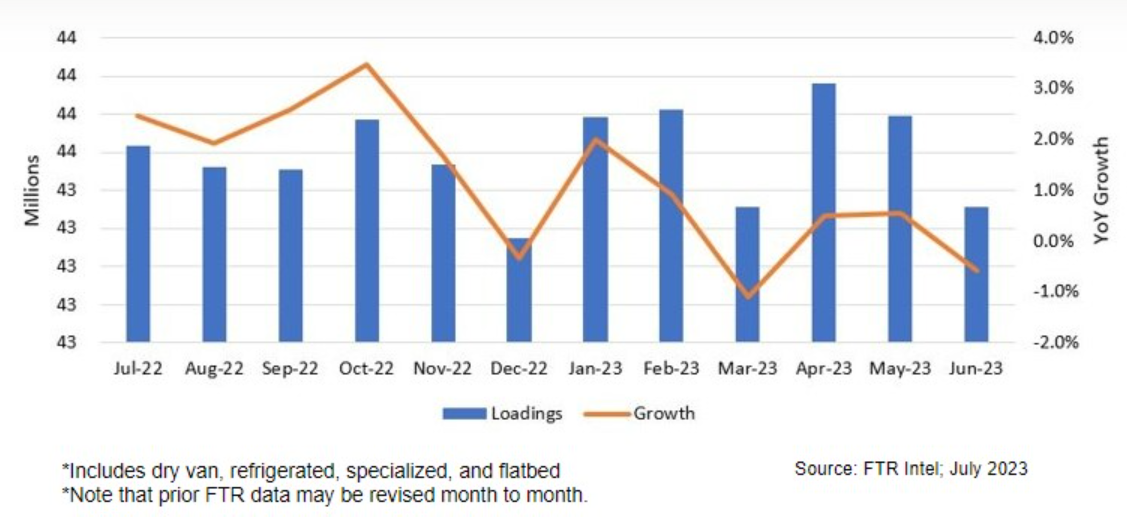

- US Truck loadings declined in June from the prior 2 months, now holding slightly below the levels of the same months last year.

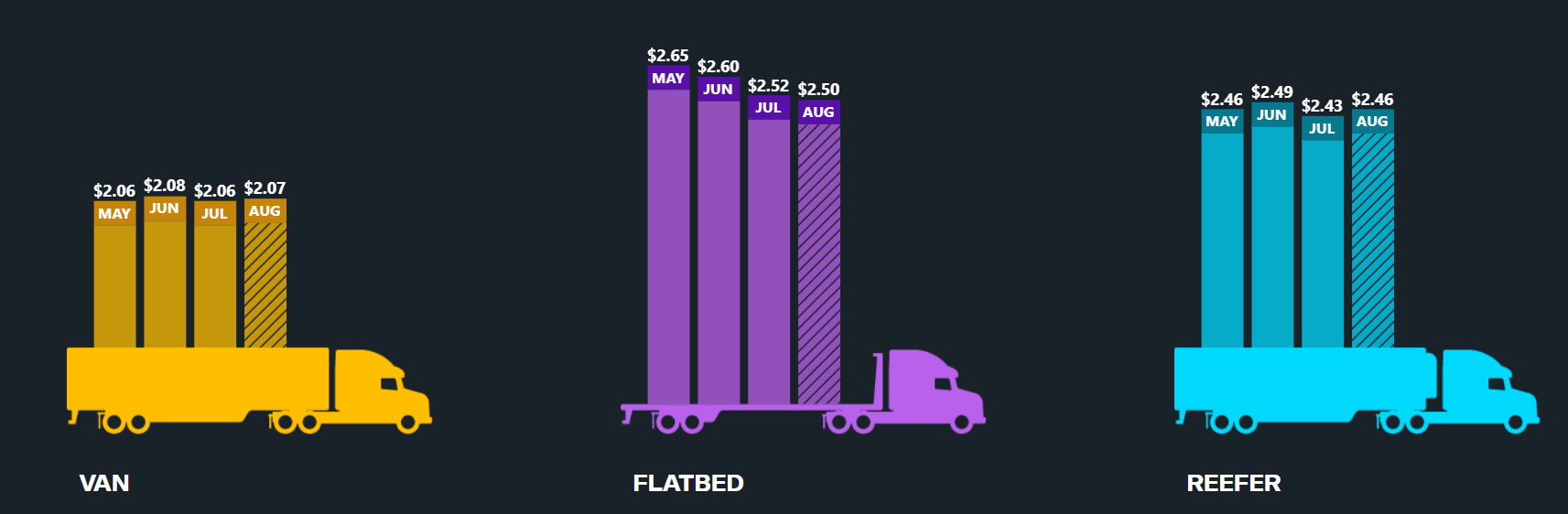

- Dry van is the largest segment of the truckload market. It is often the primary reference for the US truckload market’s performance.

- For context, the dry van spot market has followed the somewhat normal seasonal tightening before the American Independence Day holiday on July 4, then was followed by normal seasonal softening post-holiday.

PRICING SITUATION– AIR

- The state of the market has shown signs of stabilization as we progress through 2023.

- While it largely mirrors the conditions observed in the first half of the year, there is a notable but relatively modest uptick anticipated in Q4.

- Market Stability: The market has reached a point of relative equilibrium.

- Rate Trends: Market rates are on a consistent downward trajectory, although they still stand above the levels seen before the onset of the pandemic.

- Capacity Expansion: Capacity in the market is steadily on the rise.

- Demand Dynamics: Demand, on the other hand, remains somewhat subdued, indicating a continued likelihood of rate declines.

- Fuel Prices: Both jet fuel and crude oil prices have stabilized, showing noteworthy year-over-year decreases, although they remain notably higher when compared to the pre-pandemic era.

- The market appears to be finding its footing in 2023, with rates gradually declining, capacity expanding, and a cautious eye on the fuel price landscape.

PRICING SITUATION– OCEAN

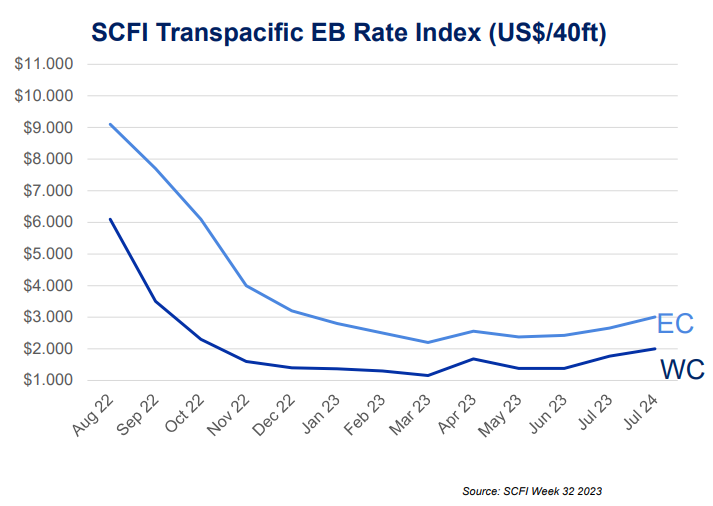

- Spot rates in the Pacific declined in the first half of 2023 due to weak demand.

- However, in July, rates began to rise and are now significantly higher than pre-pandemic levels, thanks to a reduction in sailings by carriers in the spring.

- Notably, there was a sudden increase in blank sailings in the latter half of June, which led to a surge in spot rates.

- Current ocean rates reflect carriers' efforts to increase prices due to the impact of blank sailings.

- According to the Shanghai Freight Index, rates are approximately $2,002.00 USD per FEU (Forty-foot Equivalent Unit) to the US West Coast and $3,013.00 USD per FEU to the US East Coast, surpassing the sub-$2,000.00 USD per FEU range seen in previous months.

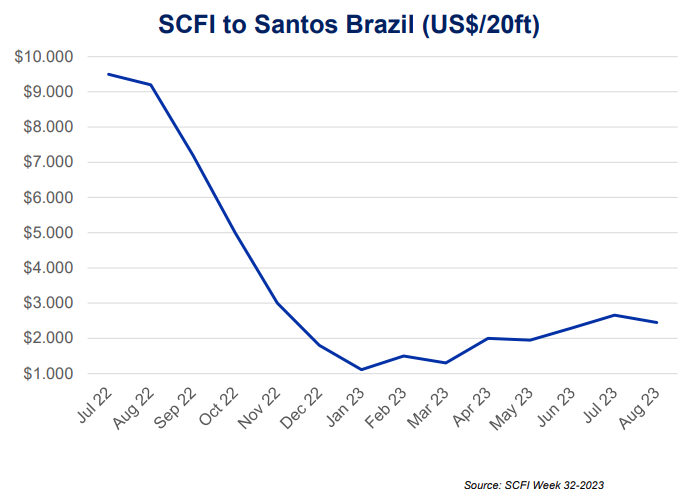

- Similar market dynamics are observed in trade routes connecting Asia to South America.

- The Santos Freight Index indicates a gradual recovery in rates during the month of July.

- However, this positive trend experienced a reversal in August, with rates showing a decline once more.

- Demand remains relatively stable but is notably influenced by the implementation of blank sailing programs in the subsequent weeks, exerting pressure on rate fluctuations.

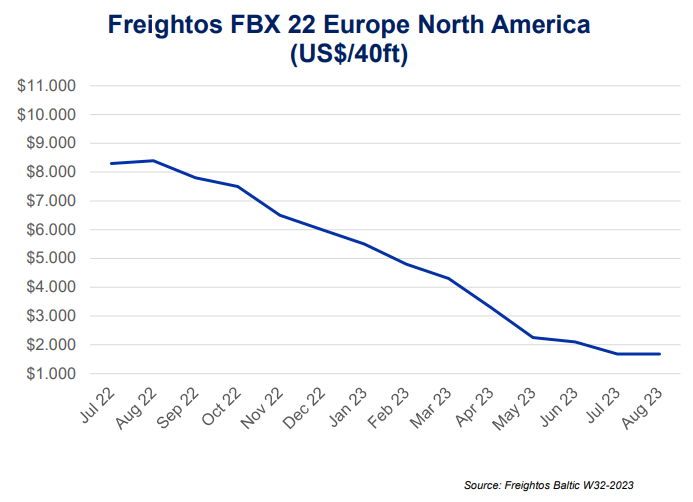

- The Freight Baltic Index also shows a decrease in the Freight Rates from Europe to North America (NYC).

- Current Index prices show a cost of $1,688.00 USD / FEU.

PRICING SITUATION– GROUND

- Ground full trucking services currently face an oversupply of capacity and pricing pressures that challenge the profitability and sustainability of both spot market carriers and contract capacity carriers.

- In the United States, truck loadings declined in June relative to the previous two months, now resting just below the loadings observed during the same period in the prior year.

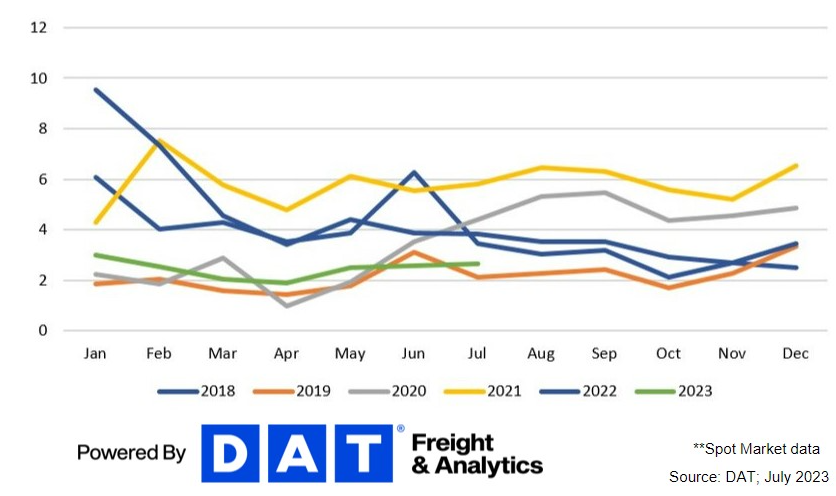

- Currently, the load-to-truck ratios (LTR) remain below the five-year averages, which typically sit around the 4:1 mark.

- However, it is noteworthy that the present ratios indicate a more balanced market condition than has been observed in recent times.

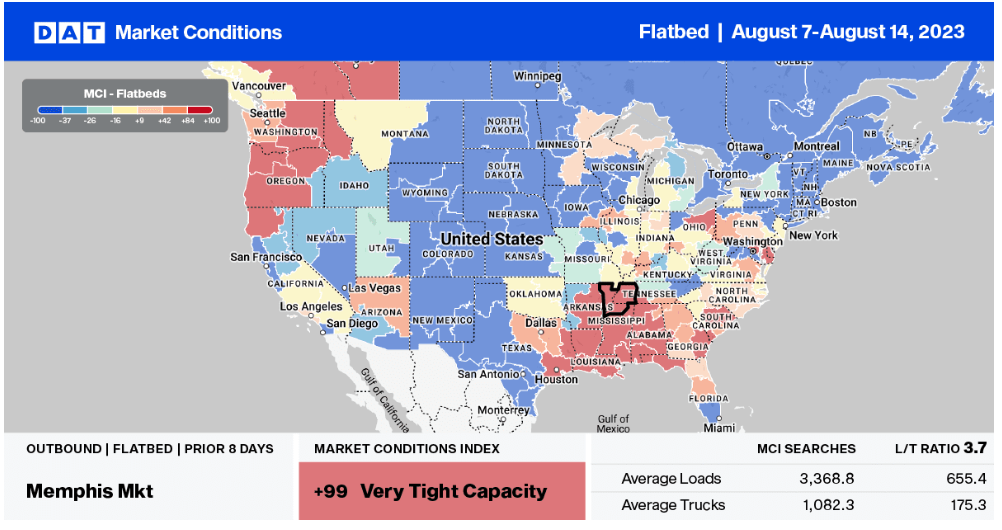

- Over the past month, flatbed spot market volumes have experienced a significant decline of 31%, with the most recent week showing a 16% decrease. This marks the lowest Week 32 recorded since 2016.

- Load posts are currently 61% lower than they were in the same period in 2022, representing nearly half of what they were in 2019.

- Last week, carrier equipment posts remained relatively unchanged, resulting in a slight increase in the flatbed load-to-truck ratio (LTR) from 6.77 to 5.63.

- Notably, in the past six years, the flatbed LTR has been below 6.0 only once, which was during the early stages of the pandemic in 2020.

- In terms of flatbed linehaul spot rates, there has been a decline of $0.25 USD per mile (equivalent to an 11% decrease) since Mother's Day, with an additional $0.05 USD per mile decrease observed in the most recent week.

- The national average flatbed spot rate now stands at $1.95 USD per mile, marking the first time it has dipped below the $2.00 USD per mile mark this year and presenting a $0.39 USD per mile decrease compared to 2022.

- When compared to 2019, flatbed spot rates are only $0.06 USD per mile higher.

- National Spot Rates:

EUROPE

MARKET OVERVIEW

- Despite a recent uptick in container shipping rates along the primary Asia-to-Europe trade route over the last four weeks, the current supply and demand dynamics continue to lean toward an excess of capacity in the market.

- This suggests that rates are likely to remain under pressure for the foreseeable future.

- Challenges stemming from draft restrictions in the Panama Canal and ongoing delays are creating significant disruptions in vessel deployments, particularly affecting Trans-Pacific and Trans-Atlantic trade routes.

- These disruptions are having a ripple effect on interconnected trade lanes.

- The performance of global air cargo demand has been weaker compared to ocean freight, mirroring the trends in the relative pricing between the two modes.

- In April, air cargo rates remained 46% higher than rates in 2019, while ocean rates were only 17% higher than their 2019 levels.

- Shippers are predominantly opting for short-term rate agreements, hoping that prices will decrease, especially if there are no significant spikes during the peak season.

DEMAND COMMENTARY – AIR

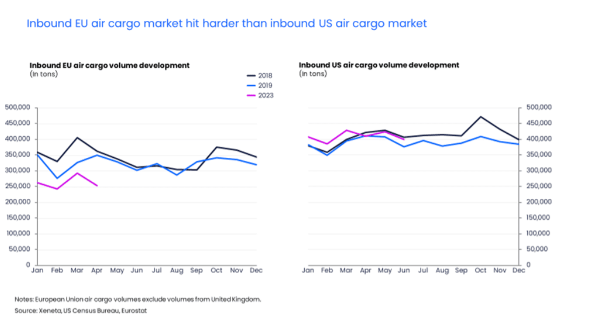

- The air cargo market, which experienced its peak in 2021-2022, has witnessed a significant decline in inbound EU cargo volumes during the first four months of 2023.

- These volumes plummeted by 19% when compared to 2019 and dropped by 28% compared to 2018 levels, as reported by Eurostat.

- In stark contrast, inbound US cargo volumes for the same period exhibited growth, with a 6% increase compared to 2019 and a 5% rise compared to 2018, as per data from the US Census Bureau.

- The notable disparity between the inbound EU and inbound US cargo markets is expected to set the tone for this year's peak season.

- In the US, the air cargo market is likely to experience a normal peak season, similar to the pre-pandemic periods of 2018-2019.

- Meanwhile, conditions on the other side of the Atlantic suggest that there may be no peak season for the EU air cargo market.

- Companies offering passenger and cargo services are giving priority again to the passenger business, which is growing fast. The cargo business has returned to its supporting role.

- Volumes continued to remain low, with flat growth month on month.

- Conservative increase in volumes expected towards peak season.

- High inflation continues to affect the world economy and trade.

- High inventories and lower purchase power contribute to comparatively low demand.

DEMAND COMMENTARY – OCEAN

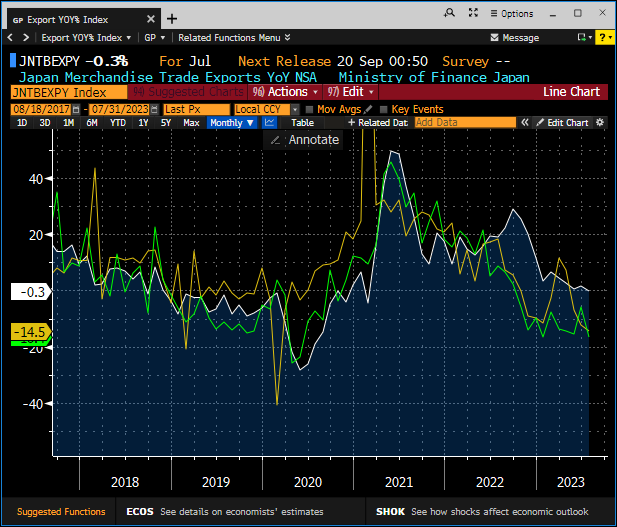

- Chinese export data indicates an ongoing deterioration, while Japanese exports contracted for the first time in over two years in July.

- While minor improvements are evident in select shipping trade lanes, the primary trade lane data continues to reflect signs of stagnation.

- Global demand measured in TEU*Miles basically flatlined with a marginal decline of -0.2% compared to a year ago. Slightly more positively for the carriers, the TEU*Miles demand purely on the head haul trades showed growth of +0.9%.

- The main Asia to Europe trade lane is currently experiencing a mild to moderate level of demand, which is expected to diminish in October due to the closure of China for their Golden Week holidays.

- Shipping lines have raised concern over a heightened decline in global shipping demand attributed to lackluster economic growth and customer inventory reductions, highlighting the ongoing absence of signals indicating a resolution to the destocking impact that has been constraining global trade, with the anticipated mid-year inventory drawdown remaining elusive.

- As per the Sea-Intelligence report, Europe's imports display an ongoing rebound, while exports continue a downward trajectory, contributing to a deteriorating trade balance, subsequently impacting exports' utilization and exerting downward pressure on freight rates.

- Exports from China, Japan, and South Korea are all exhibiting a downward trajectory on a year-over-year basis, as illustrated in the chart below. (Japan in white, China in yellow & South Korea in green)

DEMAND COMMENTARY - GROUND

- 2023 Q2 rates data suggests short-term road freight demand is down with high consumer prices and lagging wages pushing down demand for the distribution of goods throughout Europe, resulting in further falls in freight rates on the spot market.

- The contract market has seen much smaller rate falls due to the elevated cost base and shipper sentiment suggesting that it is now a good time to lock in lower rates under contracts. This has allowed the Spot Index to drop below the Contract Index for the first time in 6 years.

SUPPLY COMMENTARY – AIR

- Sufficient capacity for current volume levels; belly capacity continued to improve as passenger travel demand remained high. There are no significant backlogs.

- Global capacity +12% higher than last year.

- Despite the prevailing gloom surrounding the air cargo market, Lufthansa Cargo continues to expand its intra-European network with more flights to and from its Frankfurt Airport hub.

- Air traffic controllers in Europe announced a strike this summer, in an ongoing dispute over pay, working hours, and staffing issues.

- However, it looks like the strike will be called off following a deal with Union Syndicale Bruxelles (USB).

- An offer will be put to a vote with union members which seems to be generating positive reaction from the Union.

SUPPLY COMMENTARY – OCEAN

- As per industry reports, markets are anticipating a substantial influx of new capacity against a backdrop of waning demand and resolved congestion, the market is poised for a significant shift.

- Projections indicate over 680 vessels are expected for delivery in 2023-24, with an additional 150 vessels in 2025 as per ING. Close to 50% of these will be Neo-Panamax tonnage ranging from 12500 /to 18000 TEUs.

- As per BIMCO the order book has reduced slightly but still expect 4.9 million TEU to be delivered from 2023 to 2024.

- Congestion conditions that immobilized up to 14% of the fleet between 2021 and 2022 has now abated, resulting in a projected 6% increase in supply for 2023 as compared to the previous year.

- Global schedule reliability, which has been on an upward trend throughout 2023, has seen the first M/M drop in June 2023 of -2.5 percentage points to 64.3%. That said, schedule reliability is still a massive 24.4 percentage points higher Y/Y as per Sea-Intelligence.

- As per Drewry Transpacific, Transatlantic, and Asia-North Europe & Med, 36 canceled sailings have been announced between weeks 34 (21 Aug-27 Aug) and week 38 (18 Sep-24 Sep), out of a total of 665 scheduled sailings, representing 5% cancellation rate.

- During this period, 58% of the blank sailings will occur in the Transpacific Eastbound, 17% in Asia-North Europe and Med, and 25% in the Transatlantic Westbound trade.

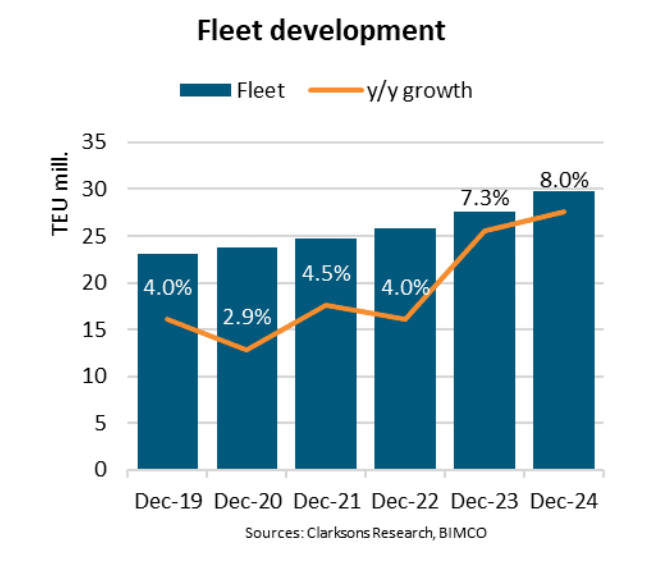

- As per BIMCO, fleet growth forecasts are 7.3% and 8.0% for 2023 and 2024, respectively.

- BIMCO expects the fleet to end 2024 with 29.8 million TEU after a total of 4.9 million TEU has been delivered during 2023 and 2024, while 0.9 million TEU has been sent to recycling.

SUPPLY COMMENTARY– GROUND

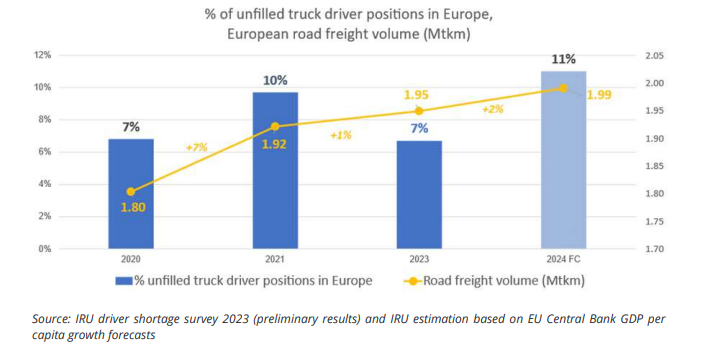

- Over one-third of truck drivers in Europe are currently over 55 years old and will retire in 5 to 10 years, while the number of new entrants joining the profession is insufficient to ensure the replacement of older ones. Less than 6% of truck drivers are below 25 years old in Europe.

- Driver shortage medium-term forecasts estimate over 1.2 million truck driver jobs could be unfilled in 5 to 10 years, solely due to driver retirements.

PRICING SITUATION – AIR

- The Baltic Air Freight Index increased 1.2% w-o-w on rate hikes across almost all trade lanes and is down 37% YTD, but still 28% above the 2019 level.

- Cathay Pacific’s cargo yields fell 51% y-o-y or 39% h-o-h in 1H23. Air cargo rates are normalizing due to the return of passenger belly capacity and a modal shift back to ocean shipping, albeit at a slower pace than container shipping.

- After a steep fall in rates and now a summer lull, hopes are rising for some sort of modest peak season in air freight.

- However, it’s a tale of two markets when comparing the development of air cargo imports to the US with those into the European Union, with healthy growth for the former and a stark decline for the latter.

- Global air cargo spot rates, offered by carriers to freight forwarders, climbed slightly in the first half of August after seemingly ‘bottoming out’ at around $2.27 USD per kg in July.

- Driven by month-on-month growth of 3% in global cargo volumes in the first two weeks of August, rates climbed to $2.29 USD per kg. Nevertheless, prices remain 36% lower than this time last year.

- The recent surge in jet fuel prices failed to sustain fuel surcharges pushed by freight forwarders to shippers.

- The US Gulf Coast jet fuel spot price on August 11 was $2.97 USD per gallon, up 36% from its low in May this year. In contrast, fuel surcharges from freight forwarders to shippers from Northeast Asia to the US fell by 6% in the same timeframe. It appears that, in a weak market, shippers may be able to use their increased negotiating power to push back on surcharge hikes.

PRICING SITUATION – OCEAN

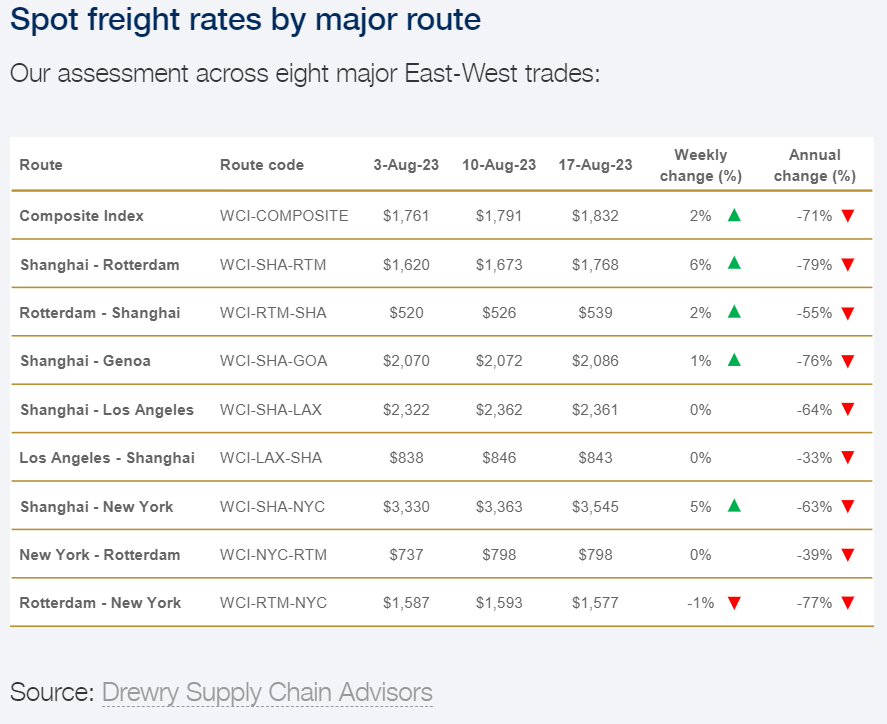

- The Asia to North Europe trade route has witnessed yet another rise, marking the fifth consecutive week of either increase or steadfast maintenance.

- Across this five-week span, rates have surged by 37% (Coming from a low base), presently standing 10% above the August 2019 average level.

- Similarly, the Asia to Mediterranean route has seen its rates climb for the fourth successive week, resulting in a cumulative 10% increase over this interval. (See Drewry chart below)

- Trans-Atlantic head-haul rates continue to decline, exhibiting a stark 77% reduction in comparison to the corresponding period of the previous year.

- In July, the freight rates displayed a performance below the expected seasonality, even in the presence of General Rate Increases.

- However, August has shown a noticeable improvement in the SCFI (Shanghai Containerized Freight Index), while the CCFI (China Containerized Freight Index) persists in its underperformance.

- A mild peak season, coupled with the existing transit limitations at the Panama Canal, contributes to the reinforcement of container spot rates for August/September.

- Marking a significant departure from recent months, spot rates on some trade lanes have now exceeded contract rates.

- This persisting spot rate volatility is anticipated to endure due to factors such as sailing cancellations, delayed vessel deliveries, and climate-related challenges, exemplified by the ongoing scenario at the Panama Canal where a substantial number of ships are presently queued for transit.

- Spot rates and contract rates reached parity in Q2 for the first time in 6 years.

- The outlook for European road freight in the coming months is for further reduction in demand pressure freeing up capacity and allowing for the possibility of further rate falls in the spot market.

- Wage growth may limit further falls in consumption, but we can expect it to remain low relative to inflation.

- Contract rates are under temporary pressure from improved sentiment vs. 2022 with lower road freight prices encouraging companies to secure greater capacity than predicted a year ago on annual contracts.

- Thanks to lower energy prices, and in turn more sustainable producer prices, Ti (Transport Intelligence) predicts the road freight industry will grow 1.3% in 2023.

- This does, however, reflect a significant slowdown vs 2022 and 2021.

KEY TAKEAWAYS– AIR

- Expect stability on long-term rates inbound to Europe from Asia

- Conservative increase in volumes expected towards peak season, primarily Asia into the US.

- There is sufficient capacity for current volumes.

- Transatlantic capacity and demand are relatively stable. The overall low demand keeps the market relatively stable for both United States and European exports.

- Capacity on passenger aircraft is at its peak during this high-travel demand period. Due to the decreased demand, there are many opportunities for cost savings in the spot market.

KEY TAKEAWAYS– OCEAN

- Container rates have observed upward movement across most lanes during the past 4-5 weeks, albeit from a lower base.

- Barring the exacerbation of challenges in the Panama Canal and unforeseen natural disruptions, this current trend is anticipated to be transitory, with an outlook for rates to eventually revert to pre-pandemic levels or potentially lower over the long term.

- The persistent expansion of the containership order book is coupled with a subdued demand for ocean transportation anticipated over the next one to two years, resulting in an imbalance of supply and demand equilibrium.

- Emerging small to medium-sized entrants in the container shipping market are expected to bridge the gap left by canceled sailings undertaken by mega-carriers, effectively restoring rates to a competitive balance.

- Ocean carriers seem to have retained a substantial portion of their August General Rate Increase (GRI) gains this week within the transpacific and Asia-Europe trade lanes, concurrently arresting the decline in spot rates on the transatlantic route.

- We anticipate ongoing rate volatility throughout the last quarter, we project a lack of significant rate escalation in the immediate future, barring unforeseen natural disasters.

KEY TAKEAWAYS– GROUND

- Demand in Europe is flat and although supply has increased slightly there is currently no pressure on pricing.

- The current draft legislation of the German government, for example, provides for an increase in tolls on German highways and federal roads as of December, which will lead to a doubling of charges, at least for diesel trucks.

- Also, in other European countries, e.g. Belgium, adjustments to toll rates are being introduced which will have an impact on freight prices in the short term.

- At this stage, however, it is not yet possible to fully assess the impact on the overall market.

Back to Top