By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Mechanicals Intelligence

Global Mechanicals Intelligence

Die Cut Material

INSIGHTS

- In Q2 2025, the global economy and market demand showed positive development trends, with a projected GDP growth rate of 2.8%. Emerging economies are experiencing strong demand for high-end electronics, and there is active investment in clean energy and AI fields.

- The latest US tariff policy has disrupted global supply chains, increased prices, and triggered inflationary pressures. Countries most affected include China, Canada, Mexico, and the EU. For US importers, costs have risen, and supply chains need adjustment; domestically, supply has decreased, prices have risen, and inflationary pressures have intensified. These uncertainties prompt companies to take preventive measures to mitigate risks.

- On February 7, 2025, the Reserve Bank of India (RBI) cut the benchmark repo rate to 6.25%, marking its first reduction since May 2020. This aims to address the ongoing economic slowdown, with GDP growth for the fiscal year 2025 revised down from 7.2% to 6.4%. The inflation rate in December fell to 5.22%, approaching the 4% target. However, risks remain, including a 3.6% rupee depreciation since November 2024, which could lead to capital outflows and increased inflation.

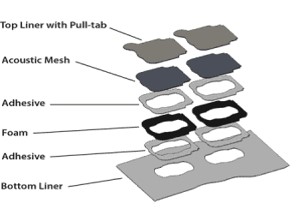

PROCESS OVERVIEW

Die-cutting techniques involve several key components: the die, a specialized metal tool with the designed pattern shape used for cutting or punching; the material, which can range from adhesive tape and foam to thin metals and plastic films; the die-cutting machine (also called a press); and digital or computerized equipment that supports advanced design software. The process is executed through various methods, including rotary, flatbed, laser, ultrasonic, and punch-and-match metal die-cutting. The details are below.

ROTARY DIE-CUTTING

Basic rotary die-cutting is commonly used to manufacture simple two-dimensional one to two-layer parts. Precision rotary die-cutting produces complex components with multiple layers of differing geometries.

Rotary dies consist of precisely machined blades mounted on a steel cylinder equipped with gears. The die rotates continuously during the process operation.

The rotary die-cutting process is a roll-to-roll process that starts with feeding the rolls of materials, which can be anything from adhesive tape, foam, sponge, silicon rubber, mesh, protective film, thin metals, and plastic film. As the material moves through the machine, the rotating die will cut the desired cutting pattern and press against an anvil cylinder. This rotary motion enables the machine to achieve high-speed cutting.

When handling complex parts, the machine adds camera vision and Automated Optical Inspection (AOI) to detect the position and alignment of the material in real time, ensuring precise cutting and minimizing errors. Rotary die-cutting can achieve high speed with great precision and deliver tighter tolerances than other die-cutting methods while offering good repeatability and high-volume output.

FLATBED DIE-CUTTING

The flatbed die-cutting machine features a flatbed for material placement and a metal die. The die, customized to meet specific requirements, is made from hardened steel and is pressed onto the material using either hydraulic or mechanical force.

The material, which can be anything from adhesive tape, foam, sponge, silicon rubber, mesh, protective film, thin metals, or plastic film, is placed on the flat or moving bed. As the die descends or the bed advances, pressure is applied to cut the material into the desired shape. The process is effective for low-to-medium-production runs, allowing quick setup and customization.

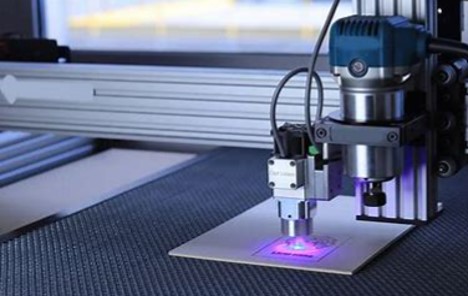

LASER CUTTING

A laser cutting machine is a cutting-edge tool that uses a high-powered laser beam to precisely cut, engrave, or etch materials such as paper, fabric, plastic film, and thin metals. This machine does not require physical dies, making it highly versatile and ideal for intricate designs, prototyping, and small production runs.

The process begins with uploading a digital design file into the machine's software, which guides the laser's movements. The material is placed on the cutting bed, and the laser beam is directed to follow the design path, vaporizing or melting the material. The laser's intensity and speed can be adjusted to suit various materials and thicknesses. Laser die-cutting is highly efficient, eliminating the need for tooling changes and enabling rapid customization.

Punch Press is a punch press machine typically used in metalworking and manufacturing to cut, shape, or form metal sheets and other hard materials. It uses a punch and die set, where the punch is driven into the material to create holes, shapes, or designs. The material runs through the press while a hydraulic ram at the top powers the die to cut it. This type of die-cutting is advantageous for speed and productivity. Punch presses can add automatic material feeding and packaging solutions to enhance efficiency.

Ultrasonic Cutting is a precision cutting technique that uses high-frequency mechanical vibrations to cut through materials. It is particularly effective for soft, flexible, or layered materials that are difficult to cut with traditional methods. For example, the cutting of mesh or textile materials.

Match-metal die-cutting involves passing materials through a cutting die constructed of a top and bottom die that are matched (male/female) to provide an exact cut. This process is typically used for higher-volume applications that require extreme precision.

DIE CUTTING PROCESS TREND

Automation

- Increased Speed: Automation streamlines the die-cutting process, making it faster and more efficient. This is particularly beneficial for high-volume production runs.

- Consistency: Automated systems ensure uniformity in cuts, reducing errors and waste associated with manual processes.

Hybrid Machines

- One-stop solution: Development of hybrid die-cutting machines that combine traditional die-cutting with laser cutting, embossing, printing, ultrasonic, and other processes. These machines allow manufacturers to perform multiple operations in a single setup, reducing production time and costs.

- Versatility: Meets the diverse needs of various industries, expanding into cutting advanced materials like composites, smart textiles, and flexible electronics.

Digital Die-Cutting is a die-less precision cutting method that uses computer-controlled machines to follow programmed paths for customizable cuts. Unlike traditional methods, it eliminates the need for physical dies, reducing setup costs and time.

- Precision and Efficiency: Digital die-cutting uses computer-controlled machines that allow for greater precision and quicker turnaround times. This technology eliminates the need for physical dies for every design, reducing setup costs and time.

- Customization: Brands can easily create custom designs without the limitations of traditional die-making methods, enabling personalized products to meet specific customer needs.

Enhanced Software and Design Tools

- Design Flexibility: Advanced software enables designers to create complex patterns and shapes, making it easier to visualize the final product before production.

- Data Analytics: Companies use data to optimize die-cutting processes, monitor performance, and manage inventory effectively.

Sustainability and Eco-Friendly Practices

- Minimize Waste: Asynchronous die-cutting technology involves cutting materials without gaps using cutting tools and then separating and re-aligning the cut materials before they enter the die-cutting machine for punching. This technology significantly saves materials and improves production efficiency.

- Sustainable solutions: Adopt recyclable and biodegradable materials and optimize die layouts to reduce scrap. Energy-efficient machines lessen the carbon footprint of production.

The future of die-cutting is characterized by automation, digitalization, and sustainability, with a strong focus on precision, customization, and versatility.

Technologies like laser die-cutting and hybrid machines drive innovation, while the demand for eco-friendly practices and advanced materials is reshaping the industry. As software and design tools improve, die-cutting will become even more efficient and accessible, enabling businesses to meet evolving market demands and consumer expectations.

Die Cut Materials: Adhesive Tape

MARKET DYNAMICS

- 3M announced the Vinyl Electrical Tape Product Changes and Discontinuations of some SKUs. 3M hopes to streamline our manufacturing processes with the change. Changes will be made in two stages: January 31, 2025, and May 30, 2025, as per the detailed plan, 3M Vinyl Electrical Tape Product Changes and Discontinuations Letter.

- Nitto Denko Corporation is investing $142.7 million (USD) in a new Kaohsiung, Taiwan factory, expected to be completed in 2027. The factory will produce high-performance PVC and adhesive tapes for electronic components and semiconductor manufacturing, driven by the growing demand for electric vehicles and electronic products. Key products include REVALPHA heat-release tape, which supports automated production and reduces labor by bonding at room temperature and easily peeling off with heat.

- At the end of 2024, Tesa opened new offices in Mumbai and Bengaluru, recognizing India as a strategic growth market. The Bengaluru office is strategically located to support the growing electronics and automotive sectors in the South Indian region. With the addition of these new offices, tesa now operates from four key locations in India (Mumbai, Chennai, Delhi, and Bengaluru), allowing the company to strengthen connections with its customers at various locations.

- In collaboration with ZEISS, Tesa created optically clear adhesives (OCA) for holography applications. These tapes feature UV resistance and high light transmission and are ideal for automotive and home-tech sectors.

- H.B. Fuller Company is executing a multi-faceted strategy to improve its share price. The company acquired GEM S.r.l. (will be closed in Q1) and Medifill Ltd in the medical adhesive space. This acquisition broadens its global MAT business (medical adhesive solutions) and geographical reach. Operationally, it is finalizing a plan to reduce its global manufacturing footprint from 82 to 55 facilities by 2030 and cut North American warehouses from 55 to 10 by 2027, aiming to generate $75 million in annualized cost savings by 2030.

RECENT DEVELOPMENTS

|

Date |

Adhesive Tape Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Feb-25 |

Avery Dennison (US) |

- |

Medical wearable tape |

Long-term contact tapes, single-coated, white polyester nonwoven with an acrylic-based adhesive designed for up to 21-day wear. It's typical application is designed for glucose monitors, insulin pumps, activity trackers, electrocardiogram monitors, and other mobile health and wellness products. |

- |

|

Jan-25 |

H.B.Fuller (US) |

- |

Ultrathick HAF of electronic devices |

HAF offers a low- or no-flow, mess-free alternative to liquid adhesives in an easy-to-use film form. The heat-activated film adhesives (HAFs) bond to a wide range of substrates, |

- |

|

Dec-24 |

Tesa (Germany) |

- |

Sustainable material: includes rPET and bio-based adhesive |

tesa® 61616 has a solvent-free rubber-based adhesive and an rPET fleece backing with >80% recycled content, combining excellent noise dampening and high abrasion resistance. tesa® 61026 is a rPET cloth wire-harness tape with 100% recycled content of the backing and mass-balanced adhesive, providing high abrasion protection and temperature resistance in the engine compartment. |

- |

|

Dec-24 |

Tesa (Germany) |

- |

“Debonding on demand” adhesive tape |

Debonding on demand" stands for intelligent adhesive tapes that can be bonded quickly and permanently yet can be completely removed if required. The tape creates new possibilities for many industries regarding product design, reworking during manufacturing, repairs during the use phase, and recycling at the end of the product's life cycle. |

- |

|

Aug-24 |

3M (US) |

- |

Electronics bonding solutions |

Electric-release tapes help save costs during manufacturing by reusing components. Help you recover and recycle more components and materials at the end of the product life cycle. |

- |

|

Aug-24 |

3M (US) |

- |

Foldable mobile phone |

Bond polyimide films while maintaining reliable performance with 3M adhesive Transfer tape. |

- |

|

Aug-24 |

Tesa (Germany) |

- |

Achieve the sustainable goal |

tesa® 60412 now contains 90% recycled plastic in the backing |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

DEMAND COMMENTARY

- The demand for adhesive tapes will remain robust in 2025 Q2, particularly in industrial and consumer markets. According to preliminary data from the IDC, global smartphone shipments increased 2.4% year-over-year (YoY). This marks a strong recovery after two challenging years of decline- especially in China and emerging markets.

- However, the threat of new and increased tariffs from the new US administration has elevated uncertainty across the industry, driving some players to seek preventative measures to mitigate risks.

SUPPLY ANALYSIS

- The supply of raw materials for adhesive tape production, including polymers and chemicals, remains under significant pressure due to ongoing geopolitical tensions, fluctuating oil prices, and inflationary pressures. These challenges will make sourcing materials across various regions difficult, impacting productivity.

- 3M has announced discontinuing certain product lines as part of its strategic adjustments. Meanwhile, Nitto is actively investing in expanding its manufacturing capabilities and enhancing its product offerings to meet the growing market demand and address supply chain issues. In response to escalating environmental concerns, tesa is increasingly focusing on sustainable tape solutions, emphasizing the development of eco-friendly products.

PRICING SITUATION

- Fluctuations in chemical feedstock prices have resulted in higher costs for tape production, such as acrylate and other resins. This has increased manufacturing expenses for tape producers. The key global manufacturers 3M, tesa, and other leading suppliers have stated they will keep pricing stable for their adhesive tape products in Q2 2025. While raw material costs remain a concern, these suppliers intend to absorb them through operational efficiencies and productivity improvements rather than passing the costs on to consumers through price increases.

- In Q2 2025, acrylic aid prices in North America are expected to remain stable or see a slight increase due to ongoing supply chain constraints and a gradual recovery in demand. In the APAC region, prices may continue to experience the most significant price rise, but overall, they are likely to stabilize as production capacities expand and demand recovers. Meanwhile, in Europe, prices are anticipated to rise further, driven by continued low production rates and steady demand. Geopolitical tensions and supply chain disruptions may also contribute to higher production costs, adding upward pressure on prices.

Die Cut Materials: Foam

MARKET DYNAMICS

- Inoac and Rogers Corporation ("Rogers") have agreed to dissolve our joint venture businesses in Japan and China as of November 5, 2024.

- Rogers Inoac Corporation ("RIC"), the parties' joint venture in Japan, will become a wholly owned subsidiary of Inoac upon the transfer to Inoac group of 50% of RIC's shares now held by Rogers. Suzhou Corporation ("RIS"), the parties' joint venture in China, will become a wholly owned subsidiary of Rogers upon the transfer to Rogers of 50% of RIS's shares now held by Inoac group.

- Inoac Group has purchased and moved one foam manufacturing line owned by RIS to Inoac Shenzhen to ensure continuous supply. Inoac foam product will be changed to "SlimFlex".

- The Rogers Suzhou Xiangcheng companies are now running at full capacity with the two newly added Poron foam lines. Both companies secure the supply without constraint.

- The dissolution could lead to increased competition in the market as both companies may seek to capture the market share held by the joint venture. Both Rogers and Inoac must reassess their strategic goals and market approaches post-dissolution. Stakeholders should closely monitor market trends and pricing changes that stem from this dissolution. The competitive landscape may shift in unpredictable ways, and companies will need to adapt quickly.

- The new silicon foaming line for BISCO series materials runs pilot production as scheduled, starting from the HT series foam. The massive supply will be in Q2. This expansion reduces the overseas shipment lead times. Furthermore, it supports Rogers’ ongoing technological innovations and proactive efforts to broaden applications in new energy vehicles and hybrid electric battery systems, delivering safer solutions for emerging energy markets.

DEMAND/SUPPLY OVERVIEW

DEMAND COMMENTARY

- The foam industry rapidly expands, driven by escalating demand across diverse sectors. Notably, the surge in wireless infrastructure sales, predominantly fuelled by India's market, underscores this growth trajectory. Conversely, EV/HEV sales decline is attributed to customers' strategic inventory management and a sluggish demand recovery from power module clients. Amidst the ongoing trade tensions between nations, there lies an opportunity for manufacturing resurgence for some regional suppliers, particularly within the US and European markets. Furthermore, Europe's ESG consciousness catalyzes the burgeoning demand for sustainable and recyclable foam materials.

- India's electric vehicle (EV) industry is developing rapidly, driven by government initiatives to support fossil-fuel-free transportation, along with population growth and rising living standards. Saint-Gobain showcased its latest EV battery solutions at the India Battery Show in December 2024. Its Norseal® Compression Pad and Thermal Runaway Protection solutions are evidence of the company's focus on the Indian market and its commitment to tapping into the vast potential of the EV market. These solutions demonstrate Saint-Gobain's technical prowess and its understanding of the unique requirements of the Indian EV sector, aiming to contribute to the further development of the local EV industry.

- Evonik has upgraded the production of ROHACELL® high-performance foams at its Darmstadt site to use 100% renewable energy. This is achieved through green electricity certificates and Power Purchase Agreements. It is expected to cut 3,400 tons of CO₂ emissions annually. Sustainability is crucial for Evonik's High-Performance Polymers business. ROHACELL®, a lightweight and heat-resistant foam, is used in high-end applications. Evonik aims to get over 50% of its sales from “Next Generation Solutions” like ROHACELL® by 2030, contributing to a more sustainable future for the company and its customers.

SUPPLY ANALYSIS

- As the BISCO silicone foam line starts the massive supply in Q2, Rogers Corporation's Suzhou factory can fully meet customer demand across the Asia-Pacific region. This new facility also supports Rogers Corporation’s strategy to increase reliance on local customers, enhancing supply chain efficiency and responsiveness.

PRICING SITUATION

- In Q2 2025, the price of Polyurethane (PU) foam is expected to vary across regions. North America and Europe may see moderate price increases due to higher raw material (MDI) costs and strong demand from the construction and automotive sectors. In contrast, Asia-Pacific might experience stability due to improved supply conditions and competitive market dynamics. For Polyethylene (PE) foam, prices in Q2 2025 are anticipated to remain stable globally.

- In the first quarter of 2025, MDI has a rising price trend in all regions. All key producers announced a price increase from 100~200$ per ton. MDI prices in Q2 2025 are expected to vary by region. North American prices are likely to remain stable or slightly decrease. Asia’s MDI market is anticipated to experience mixed performance. Strong demand from the automotive sector will support prices. However, the price increase may be limited or pulled back when new production capacity is released beyond expectations and demand growth is lower than expected.

Die Cut Materials: Protective Film

MARKET DYNAMICS

- The shipment volume of foldable phones witnessed a 10.5% growth in 2024. Looking ahead from 2024 to 2028, a compound annual growth rate (CAGR) of 15.9% is forecasted. The protective film used for these devices is designed to accommodate bending performance (200k times bending) in addition to standard functions like anti-reflection, anti-scratch, and anti-fingerprint properties. This unique bending requirement drives innovative technology within the tape and protective film coating companies.

- Only a few Korean and Chinese companies have been approved to supply protective films to smartphone manufacturers. Segyung Hitech is the exclusive supplier of protective films for Samsung Display. A newly disclosed patent indicates the integration of an anti-impact layer within the film, enhancing the impact resistance of the ultra-thin glass (UTG) and the overall display module. Chinese company Ginva entered this sector earlier, offering a wider range of customized products and solutions. Recently, SDK has also started delivering qualified products, taking a portion of the market share previously held by Ginva.

- Novacel keeps innovating by enlarging its OXYGEN range. It was made from over 80% renewable raw materials without deforestation or food competition. The new Vegetal+ range reduces the film's carbon emissions by over 80%. The first Vegetal+ film dedicated to traditional laser films is Novacel 3300 GAC. The famous 4228REF, the global benchmark for laser-cutting films, now has its eco-designed alternative.

- POLIFILM PROTECTION presents its High Strength Plus laser protection films. This new generation of protective films is significantly thinner and more resource efficient while still providing excellent surface protection and optimal process characteristics – whether made from 100% virgin material or with a 20% recycled content.

RECENT DEVELOPMENTS

|

Date |

Protective Film Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Jan-25 |

Segyung Hitech (South Korea) |

Samsung (South Korea) |

Protective film of foldable phone |

Multiple layer materials laminate to bond on the surface of UTG. Provide the AF, AR, etc., performance and anti-impact to the thin glass. |

- |

|

Dec-24 |

Ginva (China) |

Chinese phone customers |

Protective film of foldable phone

|

Folding OCA tape is used for reliable bonding of new folding mobile phone screens. The product has excellent bending resistance, good light transmission, and low haze. |

- |

|

Sep-24 |

POLIFILM (Germany) |

- |

Raising sustainability and efficiency |

High Strength Plus Protection Films – climate-friendly and cost-saving |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

DEMAND COMMENTARY

- In the second quarter of 2025, the demand for protective films in various regions shows different trends.

- In the Asia-Pacific region, China, as a major electronics manufacturing and consuming country, drives the growth of protective film demand at both the production and consumption ends.

- The developing electronics industry in other Asia-Pacific countries also increases demand.

- In Europe and the United States, the United States has a stable demand for protective films with different functions in the electronics manufacturing and consumer markets, but it is affected by tariff policies.

- With its developed automotive and electronics industries and consumers' emphasis on quality, Europe has a market for environmentally friendly protective films.

- In other regions, the popularization of electronic products in the Middle East drives the demand in the retail market, and there is a demand for industrial protective films in the petrochemical industry.

- In Africa, the growth in the sales of electronic products creates a huge potential demand for protective films in both the retail and industrial sectors.

SUPPLY ANALYSIS

- The global supply of protective films meets overall demand; however, supply for high-end and specialty function protective films is somewhat constrained.

- The increasing demand from emerging markets may lead to a short-term imbalance in supply and demand.

- Factors such as trade protectionism and currency fluctuations can also impact the supply landscape and prices, prompting companies to optimize their supply chains.

PRICING SITUATION

- Prices for protective films are expected to stay stable in the upcoming quarter. However, they may experience upward pressure due to the economic recovery in the consumer product industry and the growing demand for sustainable packaging solutions. The shift toward recycled PET (rPET) will likely affect pricing strategies as brands aim to incorporate more sustainable materials into their products.

Key Takeaways

- In the second quarter of 2025, the global economy indicates growth with a projected GDP increase of 2.8%, driven by strong demand for high-end electronics and active investment in clean energy and AI.

- The adhesive tape market is stable, with demand for sustainable, high-performance products driving innovation.

- The foam market is expanding rapidly, particularly in wireless infrastructure and electric vehicles, with a focus on sustainable materials.

- The protective film market shows varying regional demand, with robust growth in Asia-Pacific due to electronics manufacturing.

- Overall, the die-cut industry is characterized by sustainability, technological advancements, and evolving market demands amidst geopolitical uncertainties.

Back to Top