By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Mechanicals Intelligence

Global Mechanicals Intelligence

Resin: Process Overview

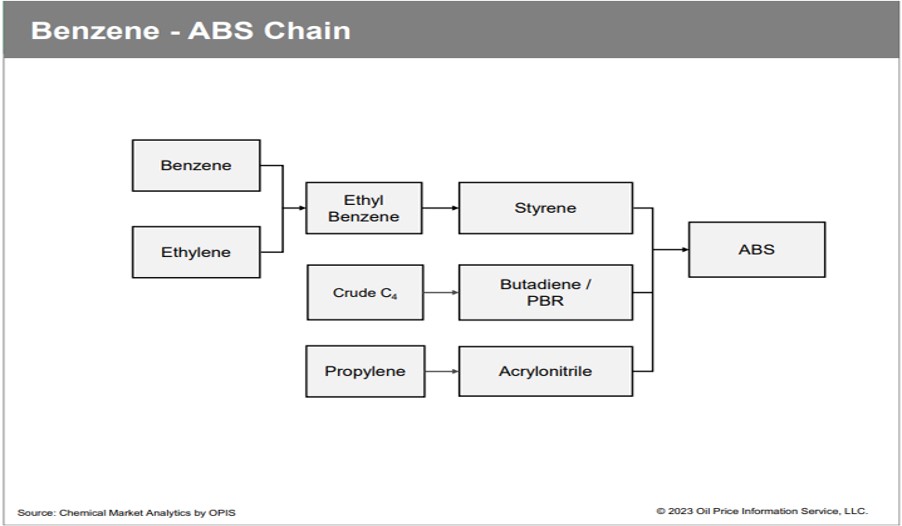

ABS (ACRYLONITRILE BUTADIENE STYRENE)

Propylene: Obtained from crude oil through steam cracking.

Propylene: Obtained from crude oil through steam cracking.

Acrylonitrile: Produced from propylene through ammoxidation.

Butadiene: Obtained from crude oil, often as a byproduct of steam cracking.

Styrene: Produced from benzene (obtained through catalytic reforming of crude oil) and ethylene (from steam cracking).

Polymerization: Acrylonitrile, butadiene, and styrene monomers are polymerized to form ABS resin.

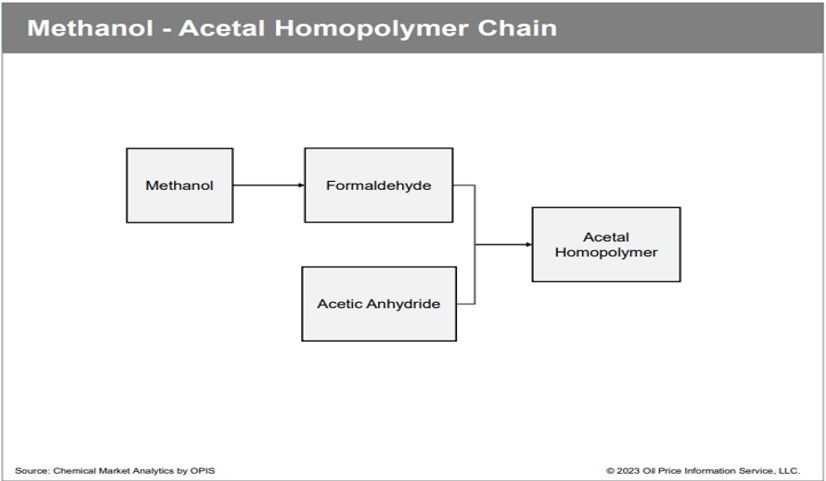

POM (POLYOXYMETHYLENE)

Methanol: Produced from natural gas (often found alongside crude oil).

Methanol: Produced from natural gas (often found alongside crude oil).

Formaldehyde: Produced from methanol through oxidation.

Polymerization: Formaldehyde is polymerized to create POM resin.

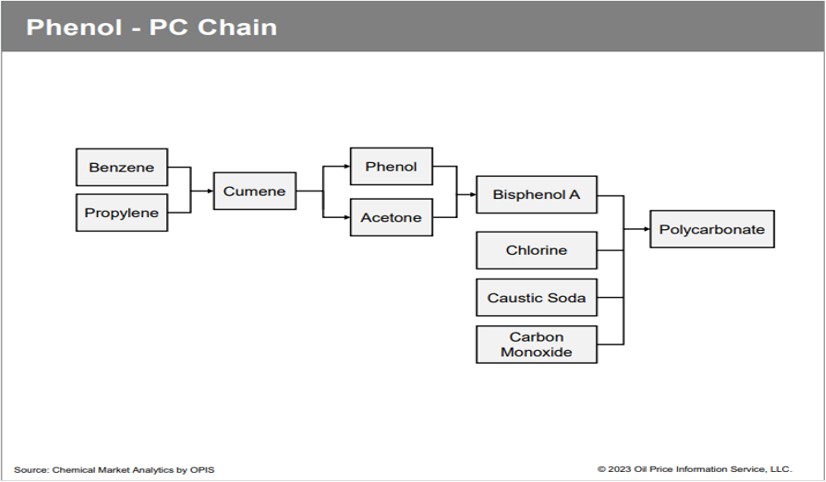

PC (POLYCARBONATE)

Bisphenol A (BPA): Produced from phenol and acetone (both derived from crude oil).

Bisphenol A (BPA): Produced from phenol and acetone (both derived from crude oil).

Phosgene (or alternative): Phosgene can be produced from carbon monoxide (derived from natural gas) and chlorine. However, due to phosgene's toxicity, alternative processes are often used.

Polymerization: BPA and phosgene (or an alternative) react to form PC resin.

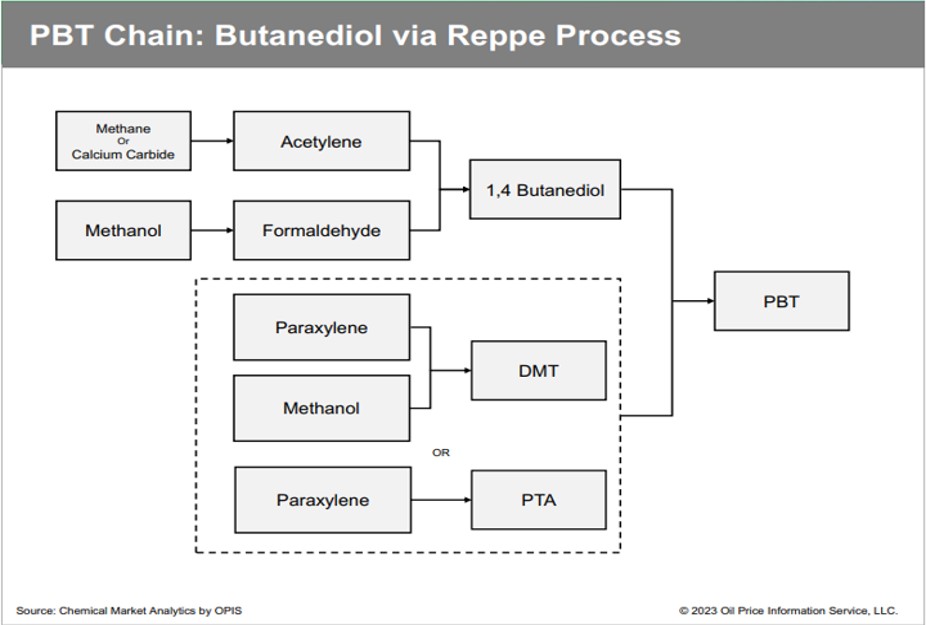

PBT (Polybutylene Terephthalate)

1,4-Butanediol: It can be produced from butadiene (obtained from crude oil).

Terephthalic Acid: Produced from p-xylene (obtained from crude oil through catalytic reforming).

Polymerization: 1,4-Butanediol and terephthalic acid are polymerized to form PBT resin.

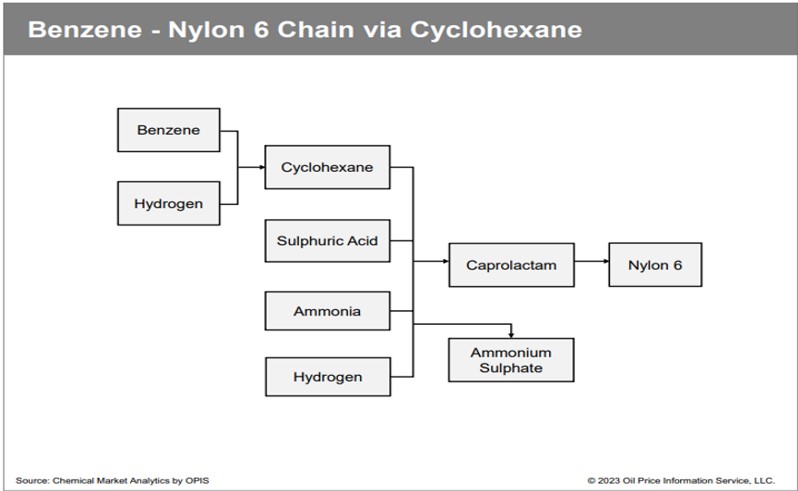

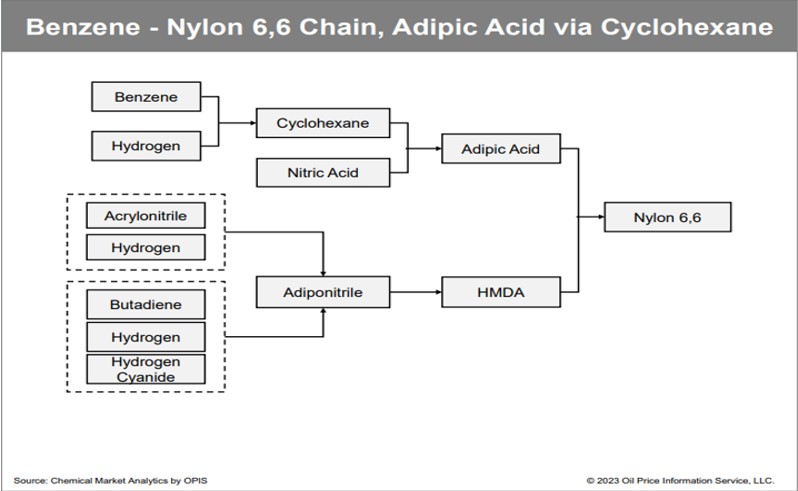

PA (POLYAMIDE, OR NYLON)

Various monomers: Different types of nylon are made from different monomers. Some typical monomers are derived from crude oil, such as:

Various monomers: Different types of nylon are made from different monomers. Some typical monomers are derived from crude oil, such as:

- Caprolactam: Produced from benzene (from catalytic reforming).

- Hexamethylenediamine: Produced from butadiene (from steam cracking).

- Adipic Acid: Produced from cyclohexane (from benzene).

Polymerization: The specific monomers are polymerized to form the desired nylon type.

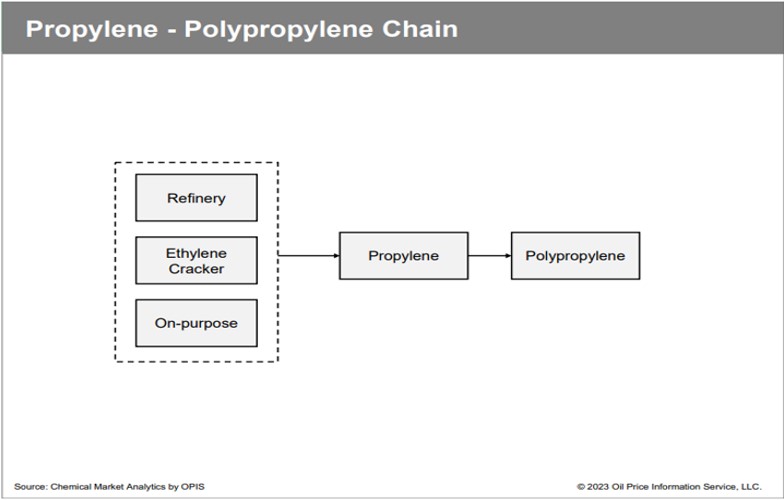

PP (POLYPROPYLENE)

Propylene: Obtained from crude oil through steam cracking.

Propylene: Obtained from crude oil through steam cracking.

Polymerization: Propylene is polymerized to form PP resin.

INJECTION MOULDING PROCESS (COMMON FOR ALL RESINS)

Material Preparation: Resin pellets are dried to remove any moisture, which can affect the quality of the final product.

Melting: The dried pellets are fed into the injection molding machine's hopper. The pellets are then conveyed into a heated barrel, where they are melted and homogenized.

Injection: The molten resin is injected into the mold cavity under high pressure. The mould consists of two halves (core and cavity) that form the shape of the desired part.

Cooling: The molten resin cools and solidifies within the mold cavity. The cooling time depends on the size and thickness of the part and the mould temperature.

Ejection: Once the resin has solidified, the mold opens, and ejector pins push the molded part out of the cavity.

Post-Processing (Optional): The moulded part may undergo post-processing steps, such as:

Trimming: Removing excess material (flash) from the parting line.

Machining: Performing secondary operations like drilling or milling.

Surface Finishing: Applying coatings or textures to the surface.

Resin: Crude Oil

MARKET DYNAMICS

The United States continues to produce more crude oil and natural gas liquids than any other country.

OPEC has held to its market forecast through 2026 of slight but steady demand and plans to loosen the self-imposed cuts previously imposed to control markets.

In China, oil demand grew slowly in 2024, leading to less being processed by refineries and fewer imports compared with the record high set in 2023. China is the world's largest importer of crude oil.

RECENT DEVELOPMENTS

|

Date |

Crude Oil Supplier |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Feb-25 |

Shell (UK) |

- |

Business Expansion |

Shell has restarted production at the Penguins field in the UK North Sea with a modern floating production, storage, and offloading (FPSO) facility (Shell 50%, operator; NEO Energy 50%). The previous export route for this field was via the Brent Charlie platform, which ceased production in 2021 and is being decommissioned. |

- |

|

Jan-25 |

Shell (UK) |

- |

Business Expansion |

Shell is investing in expanding its joint-venture petrochemicals complex in China as the supermajor bets on continued petrochemicals demand in the world’s top crude oil importer. CNOOC and Shell Petrochemicals Company Limited (CSPC), a joint venture between Shell Nanhai B.V. and CNOOC Petrochemicals Investment Ltd, had taken a final investment decision to expand its petrochemical complex in Daya Bay, Huizhou, in southern China. |

- |

|

Dec-24 |

Rosneft (Russia) |

Reliance Industries (India) |

Contract |

Russia's state oil firm Rosneft, opens new tab has agreed to supply nearly 500,000 barrels per day (bpd) of crude to Indian private refiner Reliance, opens new tab in the biggest ever energy deal between the two countries, three sources familiar with the deal said. The 10-year agreement amounts to 0.5% of global supply and is worth roughly $13 billion a year at today's prices. |

~$ 13 Bn/Year |

|

Sep-24 |

Shell (UK) |

Botas (Türkiye) |

Deal |

Shell LNG deal with Türkiye's Botas priced at under 11% to 11.2% formula to crude oil |

- |

|

Aug-24 |

ORLEN (Poland) |

BP (UK) |

Contract |

ORLEN has signed a contract with BP for the supply of 6 million tonnes of crude oil from Norwegian fields in the North Sea over twelve months. This will cover about 15 percent of the annual demand of the entire ORLEN Group for this feedstock. |

|

|

Jun-24 |

Rosneft (Russia) |

Indian Refiners |

Deal |

India wants to strengthen its energy ties with Russia and could seek deals with Rosneft as part of a broader push to boost bilateral trade. |

- |

|

May-24 |

ExxonMobil (US) |

Pioneer Natural Resources (US) |

Supply Agreement |

Long-term supply agreements for U.S. shale oil |

$ 60 Billion |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

Crude continues to be well-supplied. In 2025 and 202, crude production will grow more in non-OPEC+ countries vs in-OPEC+ countries.

World petroleum supply increased by about 0.6 million barrels per day (b/d) in 2024 and will increase by 1.9 million b/d in 2025 and 1.6 million b/d in 2026. Increasing crude oil production from four American countries, the United States, Guyana, Canada, and Brazil, is driving this growth.

The United States continues to produce more crude oil and petroleum liquids than any other country.

PRICING SITUATION

2025 prices jumped over 5 dollars per barrel vs December, starting the year with WTI US at 75.74 dollars per barrel and Brent EU at 79.27 dollars per barrel.

Pricing spiked after the US imposed sanctions on Iran and Russia, leaving substantial amounts of oil stranded on tankers.

The situation also reduces the number of available tankers, causing reduced oil shipments.

Resin: ABS (ACRYLONITRILE BUTADIENE STYRENE)

MARKET DYNAMICS

ABS demand is largely stable with automotive & construction industries driving the need for appliances. However, some regional markets show slightly weaker demand for the ABS resin.

Looming tariffs may severely affect global economies but will not affect the general supply of ABS over the long term.

Import and export activity may be reduced due to the US-imposed trade war, which may translate to local market saturation.

RECENT DEVELOPMENTS

|

Date |

ABS Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Jan-25 |

Styrenix Performance Materials (India) / DFDL (Singapore) |

INEOS Group (UK) |

Acquisition |

DFDL acted as local counsel of Styrenix in acquiring 100% shares of INEOS Styrolution (Thailand) Co., Ltd from INEOS group, one of the largest chemical companies in the world, headquartered in London. This strategic acquisition will strengthen Styrenix’s position in the engineering polymers segment by leveraging INEOS Thailand’s extensive customer base across Thailand, Southeast Asia, and China. The total transaction value amounted to around USD 20 million – one of Thailand’s largest M&A deals in the chemicals sector in the last few years. |

- |

|

Dec-24 |

Trinseo (US) |

- |

Announcement |

Trinseo and its European affiliate companies announced today a price increase for all polystyrene (PS), ABS, and SAN grades. Effective December 1, 2024, or depending on existing contract terms, the prices for the products listed below will increase as follows: |

- |

|

Nov-24 |

Ineos Styrolution (UK) |

- |

Announcement |

Ineos announced the abrupt closure of one of two last remaining ABS plants in the US, moving all production to their Altamira plant in Mexico. Reactions from customers and converters are now dealing with last time buy constraints and a limited timeline to plan for replacements or new validations as this location made all the medical grades. |

|

|

Aug-24 |

LG Chem (South Korea) |

- |

Business Expansion |

LG Chem announced today that it has inaugurated a new customer solution (CS) centre dedicated to providing personalized support to its customers across North America. LG Chem plans to strengthen its presence in the North American market through synergies with its acrylonitrile butadiene styrene (ABS) compound plant. |

- |

|

May-24 |

LG Chem (South Korea) |

- |

Product Development |

LG Chem has embarked on a project focused on researching and developing innovative plastic materials by recycling waste plastics. Among our notable research achievements is the development of PCR (Post-Consumer Recycle) ABS, a plastic product that matches the properties of traditional plastics. |

- |

|

Apr-24 |

Trinseo (US) |

- |

Product Development & Launch |

Trinseo announced its new offering of flame-retardant EMERGE PC 8600PV and 8600PR resins, as well as EMERGE PC/ABS 7360E65 resins, manufactured without the use of per-and polyfluoroalkyl substances (PFAS) or halogenated additives. |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

The general supply range of ABS is stable to over-supplied.

Market softness continues to keep supply and lead times ideal for converters.

Certain medical grades were severely affected by the recent closure announcement of INEOS production in the US, imposing allocations on customers.

Two major ABS plants in China are operating at 50% capacity, showing weakness in market demand.

PRICING SITUATION

ABS costs were stable for most of 2024 but were about 20% higher than the previous year, 2023.

2025 has remained at current levels, remaining flat through the start of the new year.

A major Styrene feedstock producer is temporarily shut down, possibly affecting ABS pricing if prolonged.

Resin: POM (POLYOXYMETHYLENE/ACETAL)

MARKET DYNAMICS

A stable-to-weak market is expected to continue into 2025, driven by lower demand in the construction and automotive sectors.

Delrin, the popular POM brand, is forging ahead as an independent company after its recent divestiture from Dupont.

Polyplastics is adding a focus on POM for medical applications and is currently being evaluated across the industry for GLP-1 products.

RECENT DEVELOPMENTS

|

Date |

POM Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Nov-24 |

Polyplastics Co., Ltd., (Japan) |

- |

Business Expansion |

Polyplastics Co., Ltd. is pleased to announce that the first phase of the polyacetal (POM) manufacturing company in China in which Polyplastics invests indirectly, is ready for operation and begin commercial operation from the end of November 2024. |

- |

|

Oct-24 |

Celanese (US) |

- |

Product Development & Launch |

Celanese Corporation, a global specialty materials and chemical company, introduced three new sustainable engineering thermoplastics. Hostaform® | Celcon® POM ECO-C: These are the first POM materials made from low-carbon ISCC Carbon Footprint Certification methanol. |

- |

|

Oct-24 |

Polyplastics Co., Ltd., (Japan) |

- |

Innovation |

Polyplastics Co., Ltd., has announced the development of new DURACON(R) POM grades that are reinforced with short cellulose fibre for lower environmental impact while maintaining today's performance requirements. The new products are a focus of Polyplastics' DURACIRCLE(R) initiative which delivers eco-friendly engineering plastics to drive a circular economy. |

- |

|

Jun-24 |

DuPont (US) |

Donatelle Plastics Incorporated (US) |

Acquisition |

DuPont announced signing an agreement to acquire Donatelle Plastics Incorporated, a leading medical device contract manufacturer specializing in the design, development, and manufacture of medical components and devices. |

- |

|

Apr-24 |

Celanese (US) |

- |

Product Development & Launch |

Celanese Corporation unveiled its latest innovations in engineered materials for the electrical/electronics (E&E) and automotive industries. One of these Products is the Hostaform® POM ECO-C/Celcon® POM ECO-C, the only globally POM derived from captured and utilized CO2 emissions. |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

Supply is currently stable, and there are no significant issues globally.

Standard lead times or better are the current norm for converters.

Some producers are scaling down production and operating under capacity.

PRICING SITUATION

Pricing has been flat to slightly softening due to weak demand.

Feedstocks are also stable, which contributes to pricing stability.

Producers will work to keep capacities in line with demand to minimize pricing erosion.

Resin: PC (Polycarbonate)

MARKET DYNAMICS

Demand is still stable, but we are not seeing much growth.

The trade wars must play out and affect converters operating in areas requiring import/export.

Demand is still strong in the healthcare sector, which aligns with GLP-1 products.

Chimei is planning a new production plant in Fujian, China, which is slated to open in 2025.

RECENT DEVELOPMENTS

|

Date |

PC Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Dec-24 |

SABIC (Saudi Arabia) |

- |

Product Development & Launch |

SABIC introduced its new LNP™ ELCRES™ CXL polycarbonate (PC) copolymer resins featuring exceptional chemical resistance. These specialty materials are well suited to help customers in the mobility, electronics, industrial, and infrastructure markets address increased exposure to harsh chemicals that can cause environmental stress cracking and premature failure. In addition to providing higher chemical resistance than incumbent materials, LNP ELCRES CXL copolymer resins can enhance part durability and reliability with excellent low-temperature impact resistance and weatherability. |

- |

|

Nov-24 |

Covestro AG (Germany) |

Ausell (China) |

Collaboration |

Covestro has announced an enhanced collaboration with the Chinese plastics recycling company Ausell. Building on their partnership in recycling polycarbonate water barrels, this new collaboration aims to accelerate the recycling of plastics from end-of-life vehicles, contributing to the automotive industry’s circularity by transforming waste into valuable materials for new automotive components. |

- |

|

Oct-24 |

Covestro AG (Germany) |

Abu Dhabi National Oil Co. (ADNOC) Group (UAE) |

Investment |

Covestro AG has signed an investment agreement with the Abu Dhabi National Oil Co. (ADNOC) Group, including ADNOC International Ltd. and its subsidiary, ADNOC International Germany Holding AG. Post completion of this transaction, ADNOC will control a sizeable chunk of engineering thermoplastic resins including Covestro’s Makrolon PC, Apec high-heat PC and Makroblend PC/PBT blends. |

$ 67 per share (€62 per share) |

|

Aug-24 |

SABIC (Saudi Arabia) |

Fujian government |

Agreement |

SABIC signed a potential investment agreement with the Fujian government on August 1, under the auspices of the Saudi Ministry of Energy, to build an engineering thermoplastics compounding plant in China’s Fujian Province. The planned compounding plant will be in the Gulei Port Economic Development Zone, Zhangzhou, Fujian. It will primarily produce pelletized Lexan Polycarbonate (PC) and Cycoloy PC/ABS blends for use in advanced materials tailored to the needs of industries, including electrical and consumer electronics, automotive, and emerging sectors such as solar energy, electrification, and 5G. |

- |

|

Jun-24 |

Covestro (Germany) |

Neste, Borealis (Austria) |

Collaboration |

Neste, Borealis, and Covestro have signed a project agreement to enable the recycling of discarded tires into plastics for automotive applications. When no longer fit for use, tires are liquefied using chemical recycling and then processed into base chemicals and further into polycarbonates. |

- |

|

Jun-24 |

Teijin Limited (Japan) |

- |

Product Development & Launch |

Teijin Adds New Production Line for Polycarbonate Resin Panlite® Sheet and Film Used in Automotive and E/E Applications |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

There are no issues with supply globally, with lead times staying around 4-6 weeks for standard grades.

Longshoreman port strike risks have been resolved, which would likely have impacted imported/exported grades.

A cold snap in the Gulf region did not significantly impact resin producers.

Overall, PC is oversupplied compared to the current demand.

PRICING SITUATION

Pricing in the US remains flat but elevated, citing increased production costs. The EU and Asia are seeing an 8% decline compared to a year ago for the same period.

Growth is expected to be only 1%-2%, so pricing should remain stable into 2025.

Upcoming Tariffs may significantly affect pricing for grades moving across USA borders.

Resin: PBT (POLYBUTYLENE TEREPHTHALATE)

MARKET DYNAMICS

The market is stable and declining, with minimal growth, particularly in the automotive and appliance industries.

US imports have decreased by +40% from both China and the EU as of the close of 2024.

The US will remain a net importer of PBT in the long term as most of its production remains in Asia and the EU.

Imports will be significantly affected by new tariffs that may come online.

RECENT DEVELOPMENTS

|

Date |

PBT Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Jan-25 |

Toray Industries (Japan) |

- |

Business Development |

Toray Industries, Inc., announced that Toray Plastics (China) Co., Ltd., will establish a new production site for high-performance resin compounds. These materials deliver excellent heat and chemical resistance and mechanical strength. Common applications are automotive electrical components and electrical and electronic connectors. The new facility at the premises of the manufacturing subsidiary Toray Resins (Foshan) Co., Ltd., in Guangdong Province will inaugurate operations in April 2025. |

- |

|

Nov-24 |

SABIC (Saudi Arabia) |

- |

Business Development |

SABIC announced the official launch of its new ULTEM™ resin manufacturing facility in Singapore, marking the company’s first advanced specialty chemical manufacturing facility in the region producing the high-performance thermoplastic, ULTEM™ resin. The new facility is a strategic move to support SABIC’s goal of increasing global ULTEM™ specialty resin production by more than 50%, responding to the growing demand from high-tech and manufacturing industries in Asia, including Japan and China. |

$ 170 Mn |

|

Oct-24 |

UBE Corporation (Japan) |

LANXESS Urethane Systems (Germany) |

Acquisition |

UBE Corporation has reached an agreement to acquire the Urethane Systems business unit from specialty chemicals company Lanxess. |

$539 Million (€500 Million) |

|

May-24 |

Toray Industries (Japan) |

Yazaki Corporation (Japan) |

Collaboration (Product Development) |

Yazaki Corporation and Toray Industries, Inc. announced today that they have jointly developed a recycled polybutylene terephthalate (PBT) resin grade that uses scrap materials from manufacturing processes to make connectors for automotive wire harnesses. |

- |

|

May-24 |

BASF India Ltd. |

- |

Business Strategy |

BASF India Limited will increase its Ultramid® polyamide (PA) production capacity and Ultradur® polybutylene terephthalate (PBT) compounding plant in Panoli, Gujarat, and Thane, Maharashtra. Its Polyurethane Technical Development Center India, to be inaugurated on 28 May in Mumbai, will support market development of polyurethane applications in industries such as transportation, construction, footwear, appliances, and furniture. |

- |

|

May-24 |

SABIC (Saudi Arabia) |

- |

Product Development & Launch |

SABIC announced the availability of VALOX HX325HP resin, a new high-performance, medical-grade, injection molding polybutylene terephthalate (PBT) resin. Developed especially for high-precision parts, such as components of insulin delivery pens, insulin pumps, auto-injectors, and continuous glucose monitors, this new resin combines outstanding processability with high chemical resistance and validated biocompatibility. |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

Supply is stable, and lead times are standard or less.

There are no significant plans for global capacity expansions except for a 100KT expansion in the Middle East.

Some supply tightness on flame retardant grades and associated additives will persist, relating to export controls from China.

PRICING SITUATION

General pricing is expected to remain flat or slightly decrease into 2025.

Buyers are watching possible cost increases specific to flame retardant grades as most FR additives are exported from China due to its export ban on gallium, germanium, and antimony.

Antimony is also used in solar panel production, leading to further tightness in 2025.

Resin: PA (POLYAMIDE/NYLON)

MARKET DYNAMICS

Automotive markets are one of the primary drivers for volume, and demand remains soft in North America and the EU.

Markets in China fared better, experiencing growth close to 10%, although growth is expected to be less in 2025: around 5%.

Celanese and AdvanSix both announced price increases starting in February.

RECENT DEVELOPMENTS

|

Date |

PA Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Oct-24 |

BASF (Germany) |

- |

Product Development |

For next-generation power electronics, BASF has developed a polyphthalamide (PPA) that is especially suited for manufacturing housings of IGBT (insulated-gate bipolar transistor) semi-conductors. Ultramid® Advanced N3U41 G6 addresses the growing demand for high-performance, reliable electronic components e.g., electric vehicles, high-speed trains, smart manufacturing and the generation of renewable energy. |

- |

|

Jul-24 |

BASF (Germany) |

Mercedes-Benz (Germany) |

Collaboration |

For the Mercedes-Benz VISION EQXX technology program, BASF and Mercedes-Benz jointly developed an impact absorber made of the polyamide particle foam Ultramid Expand. |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

There are no significant issues with supply into 2025. Lead times are historically short for standard grades.

Winter storm Enzo in Texas did not cause material shortages as initially thought.

In the EU, a Force Majeure at BASF Ludwigshafen Germany due to an unforeseen technical failure may lead to short-term shortages if prolonged.

PRICING SITUATION

Pricing has been stable and declining due to weakness on the demand side, but rising feedstock and energy costs may eventually drive pricing upward.

Nylon grades with flame retardants are seeing increases due to market tightness.

Increased tariffs are a concern and may play into cost increases, as many flame retardants are exported from China.

Resin: PP (POLYPROPYLENE)

MARKET DYNAMICS

Feedstock pricing adds volatility in line with crude oil pricing, a key feedstock.

Heartland Polymers is preparing for a planned outage on Q1 25.

Formosa began its new PP line in Q4'24 and is expected to be fully commissioned in Q1- Q2’25.

The Long Shoreman US port strike was averted, which was a previous concern for materials moving through the east and southern ports.

RECENT DEVELOPMENTS

|

Date |

PP Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

Dec-24 |

UBE Corporation (Japan) |

Manufacturas Paulowsky SLU (Spain) |

Acquisition |

UBE Corporation announced that its consolidated subsidiary, UBE Corporation Europe SAU has decided to acquire a Spanish Recycled Plastics Manufacturer Manufacturas Paulowsky SLU and signed a share transfer agreement. UBE and PAULOWSKY entered into a share transfer agreement, under which UBE will receive majority shares in PAULOWSKY. Paulowsky uses the latest technology to manufacture high-quality recycled plastics such as polypropylene (PP) and polyethylene (PE) with cumulated experiences and know-how; moreover, the plastics are certified by third-party organizations such as RecyClass |

- |

|

Sep-24 |

Braskem (Brazil) |

- |

Product Development & Launch |

Braskem announced the launch of its innovative bio-circular polypropylene (PP), which it sells under the brand name WENEW. WENEW is a groundbreaking advancement in sustainability for the restaurant and snack food industries. Derived from used cooking oil (UCO), this certified bio-circular ISCC Plus mass-balanced product represents a significant step towards a more sustainable economy, helping to displace fossil fuels. |

- |

|

Jun-24 |

LyondellBasell (Netherlands) |

- |

Business Expansion |

LyondellBasell (LYB) announced today the start-up of an additional production line at the Dalian site of its Advanced Polymer Solutions (APS) business, further expanding its presence in China. The new production line will produce a wide range of high-performance, high-quality polypropylene compounds, mainly supplying the automotive industry. |

- |

|

Jun-24 |

Braskem (Brazil) |

- |

Product Development |

Braskem is excited to announce the first sale of chemically recycled polypropylene (PP). Under its circular eco-system brand Wenew, Braskem is now supplying Georg Utz AG, a leading manufacturer of reusable transport packaging in Switzerland. |

- |

|

Jun-24 |

Borealis (Austria) |

Plastivaloire (France) |

Partnership |

Borealis is pleased to introduce Borcycle™ GD3600SY, a glass-fiber-reinforced polypropylene (PP) compound with 65% post-consumer recycled (PCR) polymer content. It will first be used in automotive interiors in a landmark project delivered in partnership with Plastivaloire, a thermoplastic injection specialist and Tier 1 supplier to the automotive sector, and Stellantis, an OEM and the owner of 14 automotive brands. |

- |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

There are no major supply issues globally, but there are pockets of problems related to some producers’ Force Majeure, mainly in the EU.

Supply is generally healthy, and producers are operating on a make-to-order basis.

The two existing Force Majeures in NA (Ineos and Invista) were lifted. However, two are still active in the EU: Total Energies and Braskem Belgium.

PRICING SITUATION

Historically low, but a recent spike tied to oil markets drove pricing up at the start of the new year.

Pricing is estimated to increase in the following months as demand shows positive signs for 2025.

Pricing in the EU and Asia may decline due to lower demand and plants running at historically lower capacities.

Key Takeaways

CRUDE OIL

- Crude supply is plentiful, and production in the short term is expected to increase, driving pricing downward toward midyear.

- Supply may concern certain regions due to recent sanctions, and tanker availability may also be an issue.

ABS (ACRYLONITRILE BUTADIENE STYRENE)

- As weak demand continues, ABS supply remains stable if not oversupplied.

- Pricing may fluctuate if a significant Styrene supplier downtime is prolonged.

POM (ACETAL)

- The supply of POM is stable and plentiful; costs are expected to trend downward, but producers are keen to control their outputs for pricing controls.

- Tariffs may impact pricing in countries relying on imports.

PC (POLYCARBONATE)

- PC supply is stable if not oversupplied.

- Pricing remains flat or is declining depending on region, with the US seeing the least movement compared to the EU and Asia.

PBT (POLYBUTYLENE TEREPHTHALATE)

- PBT supply is stable and globally well supplied.

- Like many Engineering Thermoplastics (ETPs), demand has been subdued globally with softer markets, including the automotive and appliance sectors.

PA (NYLON)

- Nylon is well supplied globally and is not experiencing many supply challenges except for grades with flame retardants.

- Pricing is expected to decline into 2025 in general.

PP (POLYPROPYLENE)

- PP supply is stable and has enjoyed minimal disruptions compared to weather-related events in recent years.

- Some pockets of Force Majeure in the EU and associated allocations remain.

SUMMARY

- The crude oil supply is robust and predicted to increase, with the US leading the way as the world's largest producer.

- Resin supply, in general, is healthy if not oversupplied.

- Tariffs and overall trade wars will be a growing factor, particularly with materials with significant sourcing that cross the USA's borders.

- High interest rates have curtailed loans and building projects, which has translated to weaker demand for appliances and some electronics. This is affecting ETP grades in a similar way to the automotive sector.

- A subdued Automotive market continues to drive global plastics, contributing to weaker demand.

- The International Longshoreman's Association union at the Atlantic and US Gulf Coast ports was resolved and is no longer an issue.

Back to Top