By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Commodity Intelligence

Q2 2025 | APRIL - JUNE

Global Commodity Intelligence

Q2 2025 | APRIL - JUNE

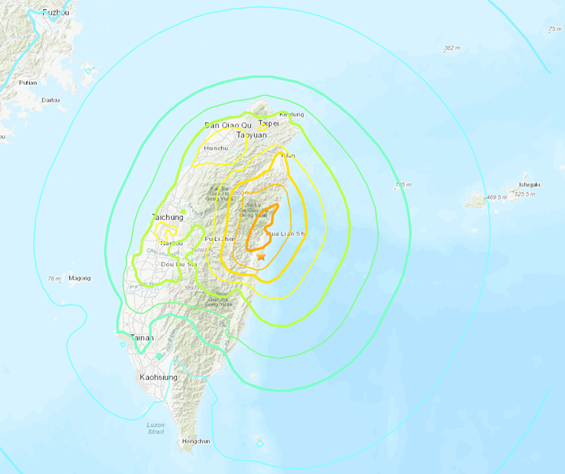

ALERT: Supply Chain Impacts of the Earthquake in Taiwan

Adam Ng

Director, Supplier Relationship Management

Taiwan's recent earthquake, the most significant since 1999, has sparked apprehension regarding potential disruptions in the semiconductor supply chain. Given Taiwan's pivotal role in hosting major semiconductor giants, including Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest chipmaker, and other key players such as United Microelectronics Corp. (UMC), Vanguard International Semiconductor, and Powerchip Semiconductor Manufacturing, the quake's aftermath is reverberating through the industry.

SUPPLIERS' FEEDBACK

We are assessing the impact with our key suppliers for semiconductors, passive connectors, switches, relays, PCB components, and distributors. Although a significant number indicated minimal to no factory impact, we will continue to gather as much information as possible, especially for impacted suppliers.

TSMC, for instance, has had to evacuate staff and halt machinery as a precaution, though most facilities are not close to the epicenter. Media reports have indicated that TSMC has already restored operations to approximately 70% to 80% of normal capacity with no major EUV equipment damage.

Based on initial feedback from the electronic supply base (Semis, Passives, PCBs), no major disruption is expected at the time of this writing.

Although impacts are being managed, these incidents underscore the fragility of the global supply chain and the necessity of geographic diversification in manufacturing. Nearly three-quarters of the world's chip fabrication plants are in Asia, with the bulk of advanced chip manufacturing concentrated in the earthquake-prone region. As of 2023, Taiwan accounted for approximately 46% of the global semiconductor foundry capacity, followed by China at 26% and South Korea at 12%.

Conversely, regions such as Arizona and Texas in the United States, selected by companies like TSMC and Samsung for their U.S. plants, present reduced seismic hazard risks. This deliberate selection underscores the industry's acknowledgment of the vulnerabilities linked to seismic activity and the strategic imperative to mitigate such risks.

KEY TAKEAWAYS

- Taiwan's recent significant earthquake has sparked concerns about potential disruptions in the semiconductor supply chain, given the presence of major semiconductor giants like TSMC and numerous other electronic component manufacturers in the region.

- GCMs and SRM are assessing the impact with key suppliers and will provide the latest update for any impacted suppliers.

- There have been no reports of major supply chain disruptions from our key suppliers.

- We will continue to assess the situation around potential supply chain disruptions and will highlight any specific situations when they occur.

Please do not hesitate to contact our GCMs or SRMs if you have further questions.

Back to Top