By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Global Commodity Intelligence

Q2 2025 | APRIL - JUNE

Global Commodity Intelligence

Q2 2025 | APRIL - JUNE

A Changing Market Ahead – A Jabil Point of View (POV)

As the new year approaches, assessing the evolving dynamics of the electronics components market is essential. Our analysis suggests there is potential for a faster market transition than many companies expect, with a growing likelihood of a significantly tighter component market by Q2 2025. This briefing outlines the reasoning behind our conclusion.

Inventories

After peaking in Q3 of 2023, inventories have returned to normalized levels across the electronics ecosystem from supplier to channel to OEM. Except for some high-value semiconductors suffering from the residual excess inventories created by non-cancellable, non-returnable (NCNR) orders, most inventory levels are aligned to the current level of end market demand. Given the prevailing market sentiment that any broad-based recovery is unlikely until later in 2025, suppliers, distributors, and EMS companies remain reluctant to increase inventory levels.

Lead Times

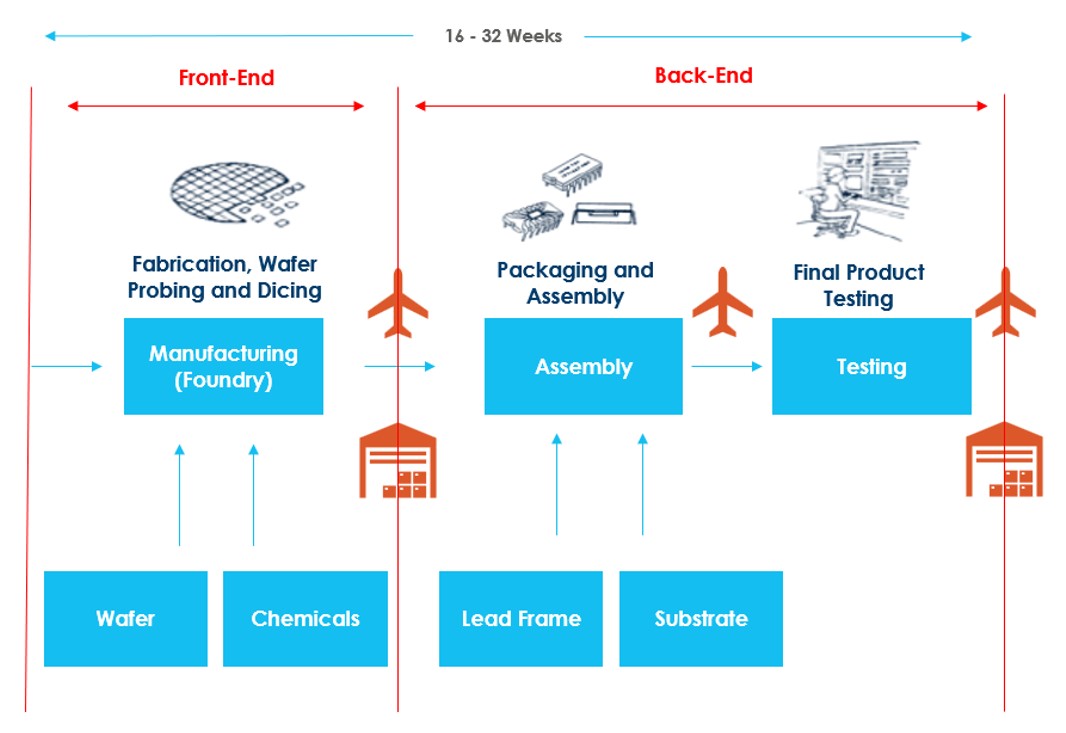

Additionally, lead times have returned to levels mirroring what we experienced pre-pandemic. It is important to highlight that the manufacturing process for semiconductors takes significantly longer than the quoted lead times due to the extensive production and process cycle times involved from "wafer start" through assembly and testing.

With shorter lead times and reasonable inventory levels, most OEMs have loaded these current levels into their respective MRP systems and become increasingly comfortable with the supply chain's agility and flexibility. In many cases, suppliers regularly ask for extended demand visibility to help with their production planning.

Factory Loading

Suppliers increasingly invest in supply, demand, and inventory planning (S&OP) processes and tools to optimize inventory levels and distribution while enhancing the customer experience through improved on-time delivery performance. As a result of these internal disciplines, the supplier community has adjusted factory loading and output to match the current demand profiles. We see factory utilization rates at around 70% for both passive and semiconductor suppliers. It is important to note that while factory utilization rates may increase, there will be a “lag” before the impact of the additional factory outputs becomes apparent. For semiconductors, this could be between 16 and 32 weeks until the end market sees any upside from additional incremental wafer starts. Another contributing factor to delays is the time required to hire, train, and certify new operators, which can take several months to complete.

Semiconductor Manufacturing cycle time

Source: Jabil Market Intelligence

Source: Jabil Market Intelligence

A "Perfect Storm" Brewing

Jabil sees the potential for a “perfect storm” with any unplanned demand or significant disruption to global supply chains. These disruptions are not limited to physical product movements, such as freight and logistics’ but include geopolitical issues, such as trade & tariffs, import or export restrictions, and an even more challenging trade model with China.

Normalized inventory levels, short lead times, and reduced factory output all set the stage for a rapid change in the market, which could upset the current supply and demand balance.

Let’s look at some potential drivers for unplanned demand or supply chain disruptions:

- Most major end market segments, such as automotive, consumer electronics, industrial, and communications, are all experiencing low to no growth prospects in the short term. The exceptions to this are data centers, especially those supporting hyperscalers building AI business models, and, to a lesser extent, the Mil-Aero segment providing overall industry tailwinds.

With the election season behind us and the U.S. economy strong with continued growth forecast, the potential for lower interest rates, and inflation in check, a pickup in the above markets could bias the demand model and shift the overall supply/demand balance.

- The new US administration intends to use its influence to support the conclusion of the Russian-Ukrainian conflict early in the new year. That, combined with reshaping the power structure in the Middle East, could provide stability and higher levels of confidence in the Eurozone. The Eurozone, led by Germany, is currently in recession territory, hitting the automotive and industrial segments particularly hard. These factors could be a real catalyst for Eurozone growth, and any unplanned demand, especially from these two segments, could affect the overall supply-demand balance for electronic components.

- Significant import tariffs on goods from China, Canada, and Mexico are possible, and many supply chain executives are urgently seeking alternative strategies. However, this is a complex challenge, even for those who have pursued a China +1 strategy for several years. Although some supply chain shifts have moved to countries like Vietnam, the Philippines, Malaysia, and Mexico, relocating existing supply chains from China remains challenging. Many support companies, such as plating, stamping, molding, and other subcontractors, are deeply entrenched in the Chinese manufacturing ecosystem. In addition, different countries' labor rates and overall labor capacity are difficult to compare with those of indigenous China. For example, despite the efforts to mitigate the risk of PCB manufacturing in China, it is still forecast that over 60% of all PCBs will be manufactured in China for the foreseeable future.

- Trade restrictions, export controls, investment control, and other international trade regulatory issues could also impact the free flow of goods supporting our current supply chains. As the US has increased bans on shipping the most advanced semiconductor manufacturing equipment (ASML) to China, along with specific AI chips from Nvidia, China has responded by banning certain rare earth minerals used in various parts of electronics manufacturing, including semiconductors for shipment to the US. It is important to note that China is the world's largest miner/producer of rare earth minerals, followed by the United States, Australia, Myanmar, and Thailand. Recently, China has imposed export bans on critical elements such as gallium, germanium, and antimony to the U.S. This tit-for-tat dynamic is expected to escalate further, with significant implications for both sides.

Jabil Procurement believes that if any of the above scenarios accelerate in Q1 2025, the current equilibrium of electronic components supply and demand balance will shift to a tightening market condition. If one or more of the scenarios impact the market at the beginning of the year, there will be a rapid change in the market conditions. With the widespread consensus of a recovery in the back half of 2025, most companies have become comfortable with readily available products and ample supply chain agility.

A rapidly tightening market compounds very quickly as inventories are consumed, lead times extend, and physical constraints dampen suppliers' efforts to respond to ramping factory capacity and output.

Recommendations

Our recommendations remain consistent:

- Provide as much visibility as possible, especially for custom, high-end semiconductors, and any build-to-order products.

- Qualify multiple suppliers, minimize single source situations, and work at the front end of technology life cycles.

- Regularly adjust lead times in planning windows to avoid being behind the supply curve.

- Work with your Jabil team to help mitigate risk and provide supply chain agility.

If you have any questions, please get in touch with the Commodity Management team or myself directly.

Graham Scott

VP, Global Procurement

Back to Top