By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q4 2023 | OCTOBER - DECEMBER

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q4 2023 | OCTOBER - DECEMBER

Mechanicals

Cable

SUPPLY

- Capacity: Major suppliers’ capacity utilization remains between 30% to 60%.

- Average book-to-bill ratio is between 0.7 and 0.9, with many experiencing demand softening over the last 6 months. That said, bookings started to improve towards the end of June.

- Data computing and storage areas, commonly used in AI applications, are driving demand.

- Supply bases are experiencing demand softening compared to last year with semiconductor and consumer markets being the worst hit.

- High inventory in the pipeline is contributing to the softening of demand.

- A more conservative approach is anticipated across the market, aiming to balance inventory as a priority.

- Electronics ICs, connectors, and complex/ high conductor cables are still hovering above 6 months lead times across the major OEMs.

- Materials & Inventories: Material availability is generally stable except for some unique components like fans and sensors which continue to face long lead times.

- Several suppliers reported inventories in excess of 4 months.

- Cable suppliers in China continue to accelerate investment in automation to counter increased costs associated with rising wages and social security payments.

MARKET DYNAMICS

- Geopolitical concerns continue to drive market uncertainty leading to a growing consensus to shift investment from China to Southeast Asia.

- By the end of this year, we anticipate that there will be additional capacities outside China as a result.

- India is emerging as an attractive region to source export cables for some applications.

- In the second half of 2023, GDP in major economies generally recovered, however, many have yet to return to levels experienced pre-pandemic.

- The global economy remains relatively stable, and various indicators point to a slight recovery.

- The consumer/household confidence index has improved steadily.

- Smart home and medical business remain stable.

- IT products may perform better than anticipated in the first semester, however, it remains challenging to forecast the domestic market.

PRICE

- Prices of raw components are beginning to stabilize.

- Copper price has remained elevated hovering around $8.4K USD per ton since Jan 2023 and the market has shown no signs of softening.

- For context, copper price ranges from between $6k and $7k USD when the market is stable.

Display, Power Supply and Fan

MARKET OVERVIEW

- Q4 demand continues to show softness as a result of geopolitical and macroeconomic headwinds.

- 5G and printer consumer demand in the US has dropped significantly.

- Purchasing and supply chain are working aggressively to balance inventory due to demand downside.

- EVs alongside photovoltaic storage became the main factors driving market demand.

SUPPLY

- PSU suppliers’ factory capacity utilization ranges between 60 and 70%.

- Fan and display suppliers are almost less than 50% utilization and are flexible to support shorter lead time orders or upside demand.

PRICE

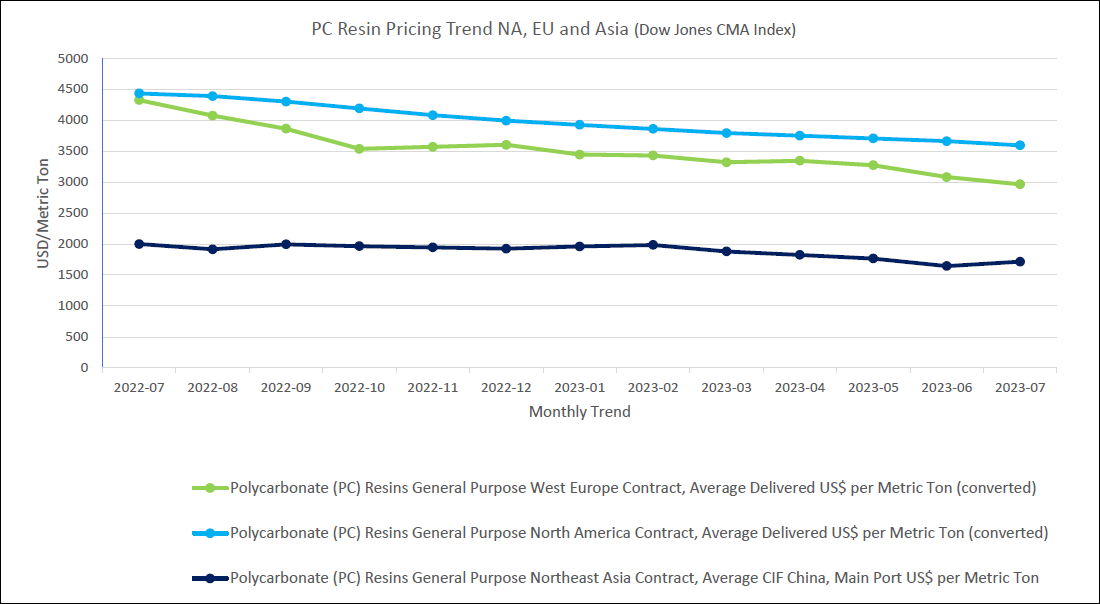

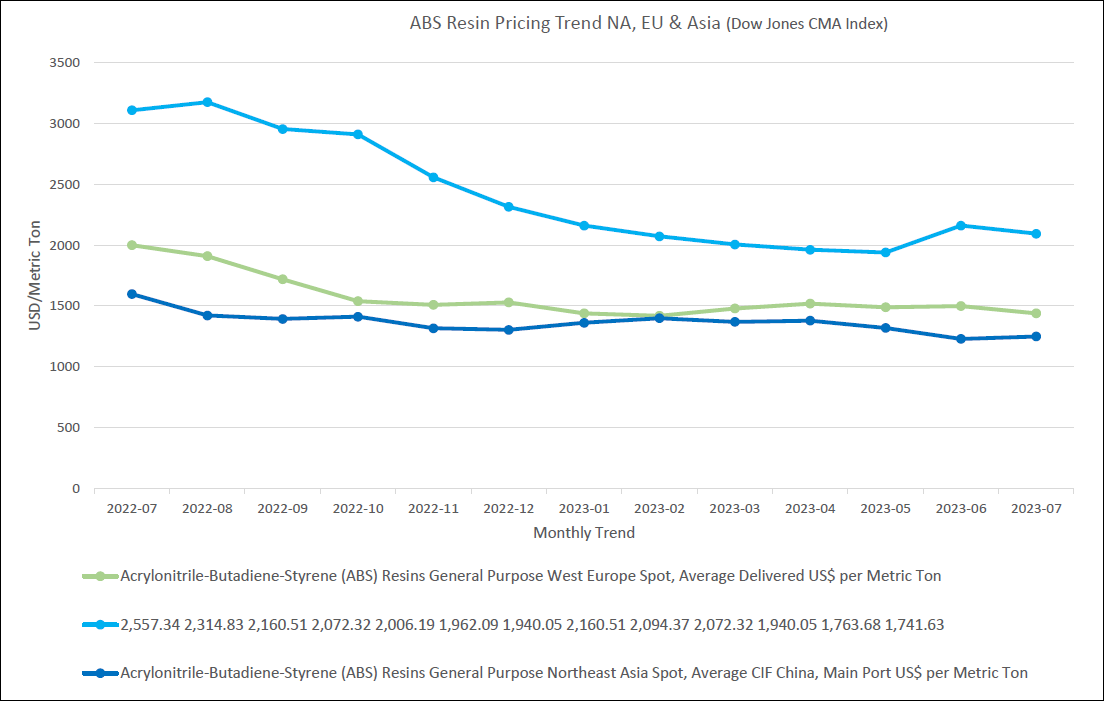

- Overall costs are falling gradually as plastic, PCB, and magnetic materials experienced a slight price reduction in Q4.

- As display demand falls across various industries and as more capacity becomes available, the opportunity to renegotiate pricing arises.

MARKET DYNAMICS

- Geopolitical forces persist in fueling uncertainty within the market.

- Consequently, in response to this uncertainty, suppliers are either establishing or in the midst of establishing their operations beyond the borders of China, with Southeast Asia emerging as a favored destination.

Metals

MARKET OVERVIEW

- Manufacturing is anticipated to take the lead in the economic recovery, although persistently high interest rates are expected to drive downward pressure on steel demand.

- In the upcoming year, most regions are projected to experience an acceleration in growth, except for China, which is expected to see a slowdown.

- The growth in demand is predominantly driven by regions outside of China, yet this expansion faces a global deceleration due to China's anticipated low growth, which casts a shadow over the overall improved economic landscape.

- The presence of sustained inflation remains a downside risk, potentially keeping interest rates elevated.

- The future trajectory of global steel demand growth will depend on reduced driving forces, with a primary focus on Asia.

- Investments in decarbonization and dynamic emerging economies are poised to increasingly propel positive momentum for global steel demand, even as China's contribution to global growth wanes.

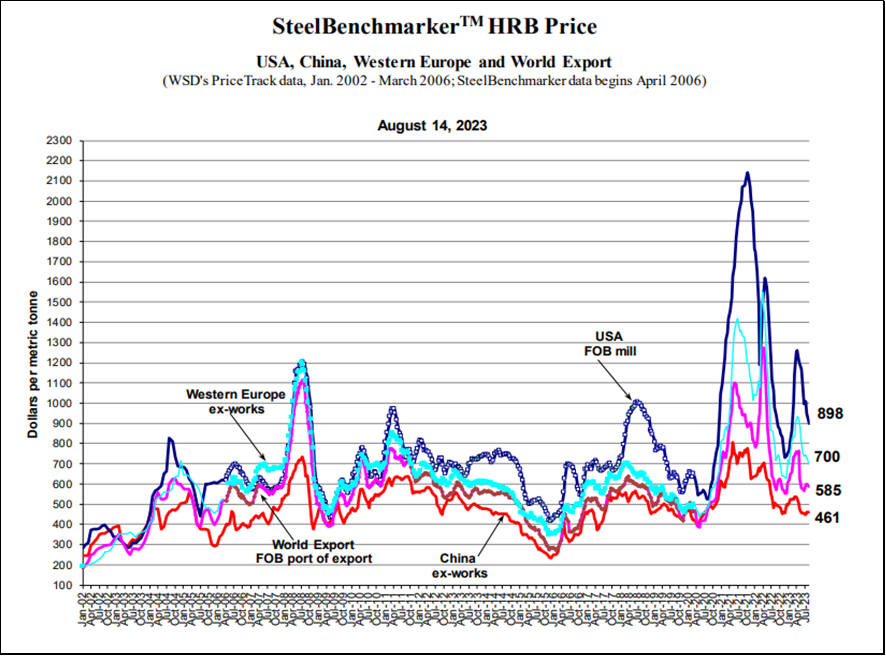

- As of June 2023, crude steel production has declined by 1.1% compared to the previous year. Steel prices have started a global decline since April 2023, particularly in America and the EU region. China's steel prices are also on a downward trend, although the extent of the decrease remains relatively small.

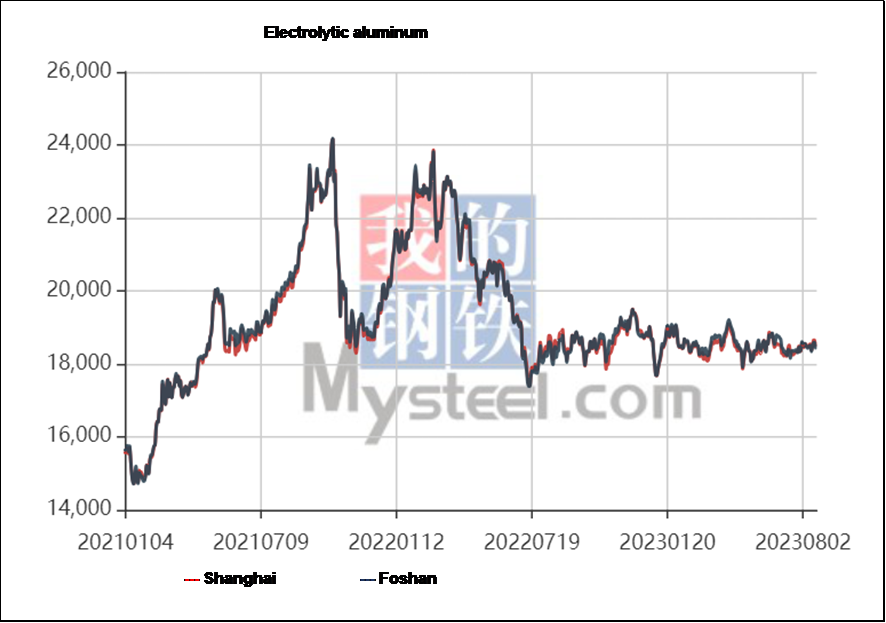

- In contrast, aluminum prices in China have remained stable, with no indications of imminent price increases in the coming months.

SUPPLY

- Supply and lead times remain stable.

MARKET DYNAMICS

- Chinese suppliers are displaying a heightened appetite for new business opportunities, while customers are increasingly relocating their business operations away from China.

PRICE

- Steel price decreased in Q3 2023 in the US and the EU region, however, remained flat in China.

- Aluminum price is stable in China.

Plastics

MARKET OVERVIEW

- EV charger customers remain inclined towards seeking solutions from the USA market.

- Customers are persistently advocating for a global China+1 strategy.

- Additionally, there is an ongoing exploration of India as a potential alternative for sourcing plastics.

- Furthermore, logistics costs continue to decrease, with the Shenzhen to Long Beach route, for instance, now costing $1600 port-to-port for spot buys.

SUPPLY

- No supply issues within regions.

PRICE

- Price is stable.

MARKET DYNAMICS

- Customers are increasingly advocating for regional localization as they maintain their strong desire to reduce their reliance on China as a sourcing destination.

Antenna

SUPPLY

- A significant portion of supplier factories are currently operating at utilization rates ranging from 40% to 60%.

- There is a potential for an increase in demand for WLAN and Bluetooth standard antennas for IoT applications, as well as GNSS antennas for automotive applications.

- However, there hasn't been a significant change in general lead times currently.

PRICE

- The overall pricing landscape has remained relatively stable, primarily due to the steady trend in major raw material prices, including resin, gold, copper, and palladium, which have been on an upward trajectory.

- However, there are fewer opportunities for cost reductions soon.

- The pricing outlook for the first half of CY24 will heavily rely on raw material prices and freight costs, and as of now, there are no indications of these factors easing.

- Consequently, pricing for existing businesses is expected to remain flat.

Battery (Rechargeable)

SUPPLY

- The overall supply situation remains stable, with a reduced supply risk for consumer device batteries.

- General lead times for lithium batteries have been consistent, hovering between 45 to 60 days.

PRICE

- Lithium carbonate prices continued their downward trend, reaching below CNY 220,000 per tonne in August.

- This marks the lowest price in three months and is approaching the two-and-a-half-year low of CNY 165,500 seen in April 2023.

- Meanwhile, cobalt prices have decreased by 18,535 USD per ton or 35.68% since the beginning of 2023, with prices remaining relatively flat compared to the last quarter.

- Looking ahead to Q124, it is expected that lithium battery prices may decline, potentially returning to levels last seen in the second half of 2021.

Cover Glass

SUPPLY

- The global market for ceramic glass (CG) raw materials is predominantly controlled by three major suppliers: Corning, Schott, and Asahi, collectively accounting for 90% of the market share worldwide.

- In the CG supply sector, the top players include LENS, BIEL, and Corning.

- The standard lead time for CG production is approximately 5 weeks, comprising of 2 weeks for acquiring glass raw materials and 3 weeks for processing and production.

- The sluggish conditions in the terminal market have led to a significant drop in consumer demand for mobile phones, laptops, and tablets.

- Global smartphone deliveries have experienced a year-on-year decrease of 14.1% for FY23Q1, marking a sustained decline over seven consecutive quarters.

- This prolonged decrease in consumer electronics demand has had a substantial impact on the demand for ceramic glass.

MARKET DYNAMICS

- Domestic glass raw material suppliers in China, such as Caihong, Xuhong, Nanbo A, Qi Bin Bo, and Kaisheng, are making significant strides in their efforts to compete with industry leader Corning.

- Corning has recently unveiled a cutting-edge glass composition designed to advance the development of diffractive waveguides for augmented and mixed reality (AR/MR) wearable devices.

- This innovative glass offers optical improvements that enhance the AR experience, providing larger, clearer digital content and creating more immersive user experiences.

- SCHOTT has introduced a chemically strengthened cover glass crafted from lithium aluminum borosilicate (LABS).

- This material significantly enhances anti-drop performance, improving it by up to 100%. The upcoming flagship model from vivo will be equipped with SCHOTT's advanced lithium-aluminum borosilicate cover glass, Saixuan®, marking the first device to feature this cutting-edge technology.

- LG has developed an innovative material known as the "real folding window." This material boasts a surface that is both harder and thinner than traditional glass, all while retaining the flexibility required for folding.

- Intended for use in smartphones, laptops, and tablets, this material is set for mass production in 2023, promising exciting advancements in device design and durability.

- The HUAWEI P50 PRO has introduced a novel domestic cover glass raw material called "Nano-ceramic crystals."

- This material delivers exceptional drop performance, surpassing the performance of Corning ceramic shield by a significant margin, offering protection that is five times more effective.

- According to the Xu Ri Research Institute, the market for foldable phones is projected to experience substantial growth in 2023, with an expected increase to 27.8 million units.

- This marks a year-on-year growth rate of 51.9%, highlighting the increasing popularity and demand for foldable phone technology.

- By 2027, it is estimated that foldable phones will reach 128 million units, constituting 8% of the smartphone market.

- These devices, particularly those priced above $835, are anticipated to hold a 30% market share in China, leading to increased demand for flexible cover glass.

- In the market, the use of 2D/2.5D technology for front covers and 3D technology for back covers is a well-established solution.

- As technology matures and more functionality is required, 3D technology is becoming increasingly popular in Android systems.

- However, iOS still predominantly employs 2D/2.5D technology, prioritizing drop and scratch resistance.

PRICE

- Optical glass raw material prices have been on a consistent upward trajectory, with a projected increase to 91,600 CNY per ton in 2023, marking a roughly 10% rise compared to the previous year's price of 90,003 CNY per ton.

- Major glass raw material suppliers, including CDGM and NHG, officially announced a cost increase beginning in September 2021, which has contributed to the ongoing price escalation.

- The price of cover glass has experienced increases in tandem with the rising cost of glass raw materials, reflecting a direct correlation between the two.

- In general, prices have remained relatively stable due to supply centralization, despite a decline in market demand.

- However, opportunities for cost reduction are limited, except for scenarios where high-volume production continues throughout a product's lifecycle.

- The depreciation of the Chinese Yuan against the US Dollar has placed sites involved in CNY transactions at a disadvantage.

- This necessitates regular price updates to align with the latest exchange rates.

Display

SUPPLY

- Due to improved market conditions in the LCD industry at the time, Display Supply Chain Consultants (DSCC) had been increasing its display capacity forecast for six consecutive quarters, over a period spanning 2020 and 2021.

- In the seven consecutive quarters since Q1 2022, however, the trend has reversed, with DSCC citing delays, cancellations, and fab closures as key contributing factors.

- Their latest quarterly forecast is down by 1% compared to the previous quarter, while registering a substantial 14% decline from peak levels.

- Display capacity is now anticipated to grow at a modest 1.1% compound annual growth rate (CAGR) from 2022 to 2027. This could potentially result in another significant shortage if there is a surge in unit or area demand.

- Fab utilization has continued to increase in Q3 2023, raising concerns within the industry about the possibility of oversupply, which could have implications for market dynamics and pricing.

MARKET DYNAMICS

- Color-changing e-paper technology gained initial popularity, garnering significant attention when it was applied to a high-end concept car in early 2022.

- Following this success, a kitchen brand applied this technology to a toilet, resulting in a refreshing and innovative product.

- The latest iteration of color-changing e-paper has been integrated into the brand's newly released robotic dog, once again piquing interest and curiosity among consumers.

- PlayNitride is eyeing substantial penetration of microLED technology in the automotive sector in the coming year, aiming to make a significant impact in this market.

- It has been reported that Samsung Display (SDC) has plans to acquire all the shares of the US-based Micro OLED manufacturer eMagin by the end of 2023.

- If successful, this move will provide SDC with a valuable entry point into the military extended reality (XR) device market, signaling significant potential in this sector.

PRICE

- The rally in LCD TV panel prices, which started in February, has continued in the third quarter and has been accompanied by a widespread increase in supply as LCD makers increase utilization.

- Prices have increased enough to bring many panel makers into positive margins and the TV supply chain is building inventory toward the big selling season in the fourth quarter.

- We now expect that panel prices will peak in September and that an abundance of supply will lead to price declines in the fourth quarter.

Optical Lens

SUPPLY

- Standard lead time is 16 weeks (glass raw material 12 weeks; +4 weeks processing etc.)

- No supply constraints currently for glass raw material and optical resin.

- Optical lens configuration for mobile phones has grown from 2 to 4 plastic lenses to 7 plastic lenses, even 8 plastic lenses. China's optical plastic lens commands approximately 71% market share in the world.

- Technical advancements across the automotive and mobility industries have driven the increase in the number of on-board cameras on vehicles.

- The earliest car camera usage was generally about 3 units. By 2025, it is estimated that the average number of vehicle cameras will reach 6.5 units.

MARKET DYNAMICS

- The global smartphone delivery numbers for the first half of 2023 amounted to 524 million units, marking a notable year-on-year decline of 12.81%.

- This decline has had adverse effects on lens suppliers, resulting in sluggish financial performances.

- Several factors have contributed to this downturn which has led to lower capacity utilization, including reduced demand, increased manufacturing costs, and the depreciation of the USD.

- These market conditions have affected numerous suppliers, with companies like Sunny reporting a 66% decline in net profit for the first half of 2023, and Q-tech experiencing a 56% decrease in profits.

- The automotive market remains a significant focus within the industry.

- Many suppliers view it as a key avenue for achieving substantial revenue growth in the coming years. Opportunities in the automotive market may help offset challenges in the smartphone market.

- Level 2 autonomous vehicles are expected to be equipped with more than two cameras, while higher-level autonomous models will have even more cameras.

- Currently, Level 3 high-end cars typically feature 5 to 6 cameras, while Level 2+ autonomous vehicles from emerging electric car manufacturers often have more than 8 cameras.

- The latest Level 4 luxury models are equipped with 11 8-megapixel cameras. As autonomous driving technology continues to advance, the number of cameras in vehicles is expected to increase further, potentially reaching 11 to 15 cameras.

- The trend in front-view camera lens resolution is shifting towards 8-megapixel cameras, while surrounding camera lenses are being upgraded from 1-megapixel to 3-megapixel resolution.

- According to supply chain information, RealityPro is adopting pancake optical solutions for its MR (mixed reality) headsets, which will account for approximately 5% of the total device cost.

- This aligns with previous predictions by analysts, indicating that pancake solutions are becoming a standard feature in new VR (virtual reality) products.

- In 2022, nearly 60% of new VR products were equipped with pancake solutions, and since then many companies have announced the release of next-generation pancake products.

- Leading manufacturers are driving the adoption of pancake optics as a standard feature in VR headsets.

- Looking ahead, it is expected that 12-unit camera configurations will become the standard for XR (extended reality) applications, with mobile devices, automotive systems, and the optical industry being the primary areas of mainstream application.

PRICE

- The optical resins market is currently dominated by Japanese suppliers, including Mitsubishi Gas Chemicals, Mitsui Chemicals, and Zeon.

- Prices in this market have been on the rise due to factors such as increased labor costs, higher freight and handling expenses, as well as trade and traffic-related challenges.

- Many suppliers, including Mitsui Chemicals, have responded to these factors by raising their prices.

- Additionally, APEL-type prices saw another increase in April 2022.

- Optical glass raw material prices have been consistently increasing year by year, with expectations of reaching 91,600 CNY per ton in 2023.

- This represents a roughly 10% increase from the 2022 price of 90,003 CNY per ton.

- Key glass raw material suppliers such as CDGM and NHG officially announced cost increases starting in September 2021.

- As a result, the price of glass lenses has been adjusted to reflect these changes, as they are directly impacted by the cost of glass raw materials.

- The market for Advanced Driver Assistance Systems (ADAS) cameras is technology-driven, which will likely keep prices high. In contrast, for display cameras, price depreciation may be offset by increased production volume.

- Currently, there is little margin for 2M cameras due to intense competition. However, 8M cameras still maintain a high margin.

- Many optical suppliers adopted strategies such as cutting investment, reducing labor, and decreasing capacity to navigate the economic challenges posed by the COVID-19 pandemic. These measures led to a reduction in total production.

- As a result, it is estimated that market prices will rebound, and the pricing for lenses with a 5P configuration will return to their original levels.

Die Cut Raw Material

SUPPLY

- Protective film – As the pace of the global economy's growth decelerates, clients are trimming their on-hand inventory reserves. This prudent action ensures the reliable availability of PE/CPP protective film throughout CY23 Q4.

- During peak season, the capacity of the PET protective film provider is restricted

- Adhesive tape – The effects of the end-market decline in electronics, consumer retail, and China persisted, influencing the industrial adhesives and tapes sector.

- Introduction of new-generation products into the market have resulted in a gradual expansion in the demand for electronics.

- Production capacity of industry leaders such as 3M, Teas, and Nitto Companies are well-equipped to meet the requirements for the upcoming quarter.

- Foam – Rogers Foam Company is enhancing its "local for local" presence by establishing a plant in China, thereby bolstering the security of supply for Rogers Foam materials.

- Arkema's supply remains steady in the fourth quarter, maintaining a consistent performance that has persisted throughout the entire year.

PRICE

- Protective film – Considering the raw material costs, the prices of PE/CPP protective film have remained stable in alignment with Q3.

- The cost of recycled protective film is gradually decreasing due to heightened competition, although it still maintains a premium over standard options.

- Adhesive tape – The pricing for Nitto, Tesa, and 3M products will remain unchanged in the upcoming quarter.

- Foam – Manufacturing activity has been declining in most regions, while the price of foam has remained the same as in Q3, including ROGERS, Nitto, Sekisui, etc.

Back to Top