By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q4 2023 | OCTOBER - DECEMBER

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q4 2023 | OCTOBER - DECEMBER

INTERCONNECT COMMODITIES

CONNECTORS

SUPPLY

- Most of the suppliers’ factories are running at 70-80% capacity utilization.

- Overall key suppliers’ book-to-bill remain < 1.0.

- Lead time remains stable for connectors with no sign of supply constraints.

- Demand in communications and consumer segments remains soft - weakened demand is partially offset by the growth in demand for automotive transportation and industrial (energy renewable aector).

- The overall market is softening, and suppliers are seeing more order cancellations as a result of surplus inventory in the supply chain channels (manufacturers and sistributors).

- Suppliers are pushing to reduce their inventory levels and inventory re-balancing will continue through the end of 2023.

MARKET DYNAMICS

- Supply base remains stable with no tell-tale sign of any suppliers exiting the market.

- Amphenol :

- Closed on the previously announced acquisition of the North American cable and global base station antenna businesses of RFS. RFS will expand its position in the mobile networks market with high-technology antennas and fiber optics.

- Closed on the acquisition of EBY Electro Inc. EBY is based in the state of New York in the U.S. with annual sales of approximately $15 million. It is a designer and distributor of terminal block interconnect products to the North American industrial market. The acquisition further expands Amphenol’s offering of high-technology interconnect products in the diversified industrial market.

- Overall, the IT datacom, mobile networks, and mobile devices markets remain soft, which is partially offset by the growing demand for renewable energy and electric vehicles.

- In the IT and data communications space, our key connector suppliers are seeing artificial intelligence (AI) investments in supercomputers and data center services from players like Nvidia, Meta, and Microsoft.

- High-speed data connectors are required for ethernet switches to perform the optimal high-speed transmission.

- The renewable energy sector is a growing market. Solar farms, connected to a distribution network for power generation on a massive scale, are driving more demand for PCB connectors, signal, and power connectors.

- EV cars, both commercial and consumer, are being positioned for immense growth over the next 10 years. Governments around the world are enacting legislation that discourages the use of fossil fuels in favor of electric mobility. A new generation of connectors designed to survive automotive environments as well as utility-grade interfaces will be experiencing significant growth.

PRICE

- Generally, the overall pricing in level the 2nd half of 2023 has remained flat.

- Raw material pricing is stabilizing, and no major price changes are forecast.

- Overall, key connector suppliers’ prices remain flat despite the impact of energy costs and inflation.

- There are still some price increases on low-margin and legacy products like headers and receptacles, D-Sub, non-high speed I/O (USD2.0), and labor-intensive RJ45 magjacks.

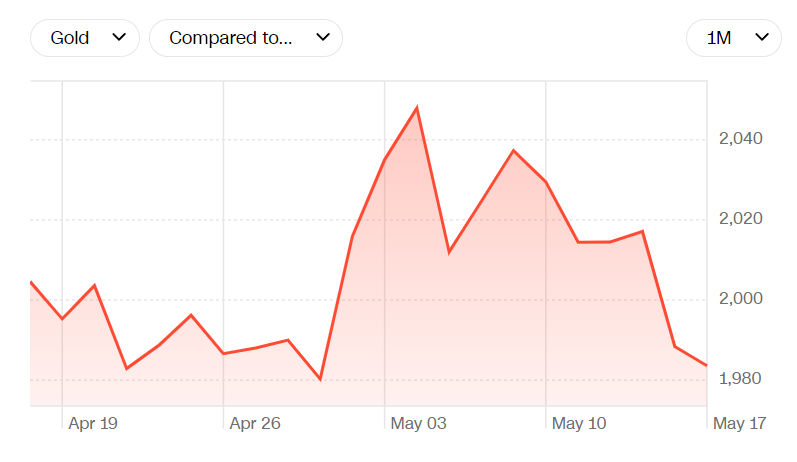

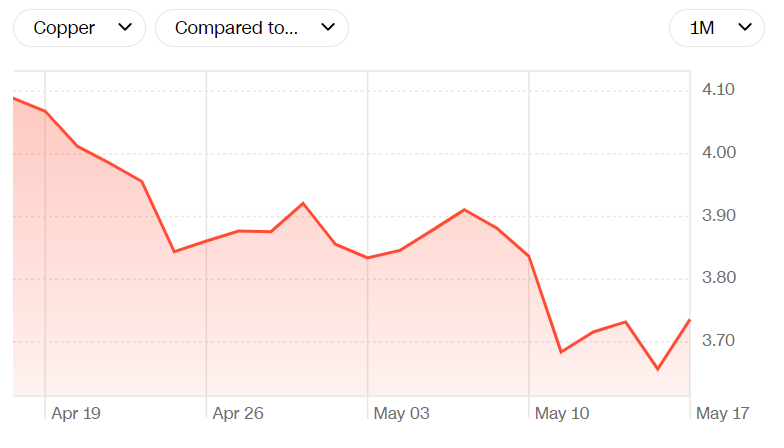

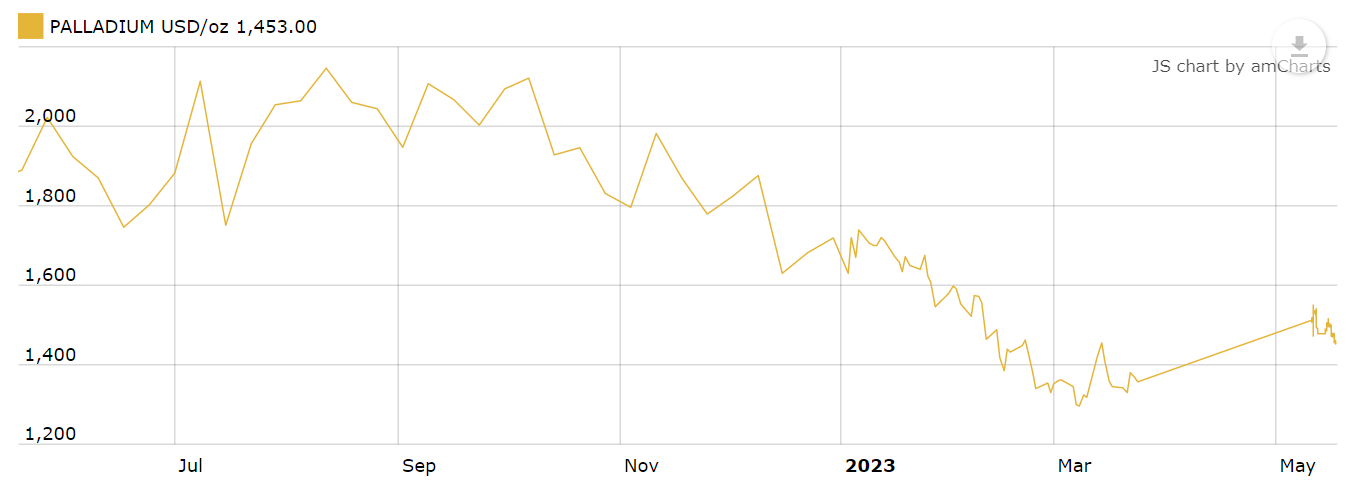

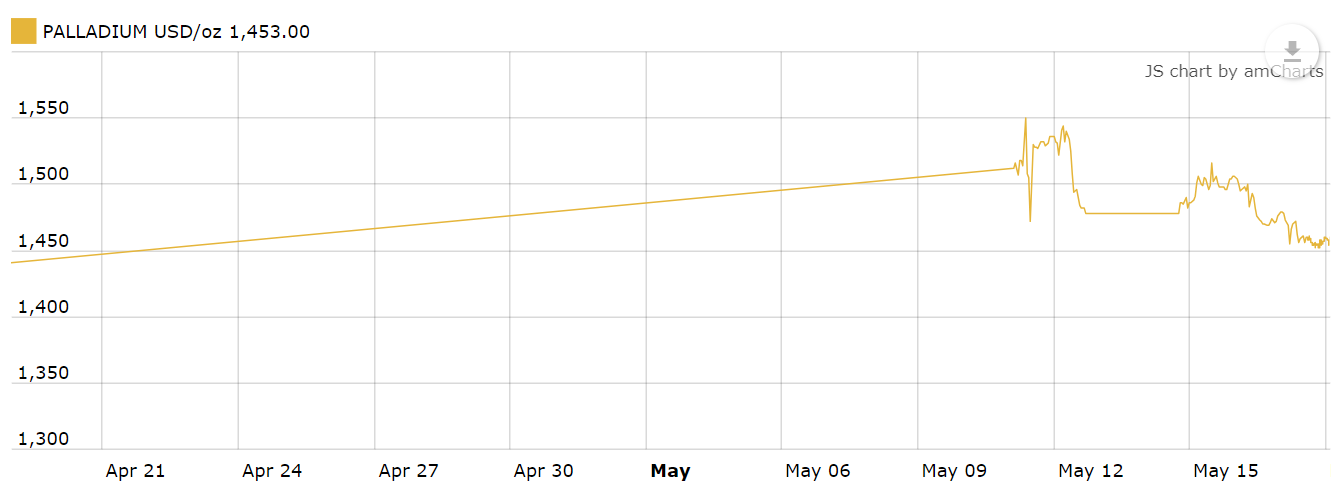

GOLD, COPPER & PALLADIUM PRICE TRENDS

RELAY

SUPPLY

- Supplier factories utilization running at 60% generally, but series related to EV and renewable energy markets are still running very tight and under allocation.

- Book-to-bill is below 1 (overall). EV and renewable energy-related relays are still tight, and lead time remains flat, but the end customer’s requirement is getting shorter.

- There are certain items in TE (RT and RZ type) that are still under allocation due to TE being unwilling to increase capacity.

- The market demand for relays is expected to grow in EV and renewable energy related businesses; home appliance, instrumentation, and capital equipment demand is soft.

MARKET DYNAMICS

- Market remains uncertain due to geopolitical concern. China’s market hasn’t performed to expectations.

- Tier 1 relay manufacturers are focusing on high-power DC relays to capture future EV market share.

- Relay EV market is booming, especially in China. Numerous new EV car models were recently released at the Shanghai Automotive Road Show.

- Omron will further invest in Malaysia by expanding their power relay (commercial/home appliances) and switch (for power tools) manufacturing operation either in Penang or Negeri Sembilan.

- HongFa plans to invest new manufacturing facility in the EU. No solid plan or location announced yet.

PRICE

- Relay overall pricing stays flat to increase. Raw material costs are still volatile. Normal relay pricing will remain stable except for solid state relay due to gallium and germanium (semiconductor raw material) which are under China export control.

- TE’s relay, industrial relay (Eaton, ABB, Schneider, etc.), and niche reed relay from Coto and SanYu Switch are still subject to cost increases.

- Omron, HongFa, Fujitsu, and other conventional relay suppliers’ pricing stays flat.

- Will continue to monitor the overall situation for the balance of 2023.

SWITCH

SUPPLY

- Lead time overall remains flat with no constraints for capacity or raw material.

- Book-to-bill is below 1 with very soft bookings.

- Most of the supply base’s factory utilization is around 60% or lower.

MARKET DYNAMICS

- The supply base remains slow and stable except for those unique industrial-used switches.

- Many switch suppliers had invested in expanding their production capacity back in 2022.

- The switch market is shrinking and being replaced by touch panels or other pressure or touch-sensing components.

- Most of the switch suppliers do not keep stock. Cancelations and push-out are almost impossible.

- Diptronics is moving more production from its China factory to Vietnam. The current ratio is China (60%) vs. Vietnam (40%). Target to move another 20% from China to Vietnam to avoid any geopolitical issues.

- C&K/Littelfuse integration will be delayed further until 2024.

- China’s market is not growing per previous expectations.

PRICE

- Overall pricing remains flat. Although there are no capacity or raw material constraints the suppliers continue to face increased energy costs, labor costs, and inflation which diminishes the possibility of cost reductions.

- Schneider had announced price increases for most of their industrial switches.

- There will be cost increases from C&K after Littelfuse investigates C&K’s current cost structure.

- Will need to continue to monitor the overall situation for the balance of 2023.

BATTERY

SUPPLY

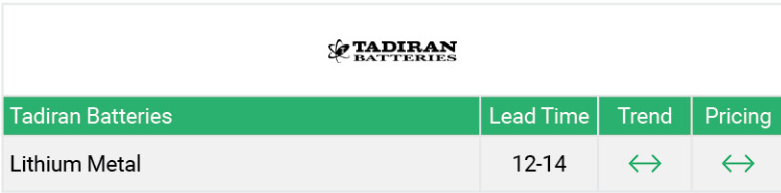

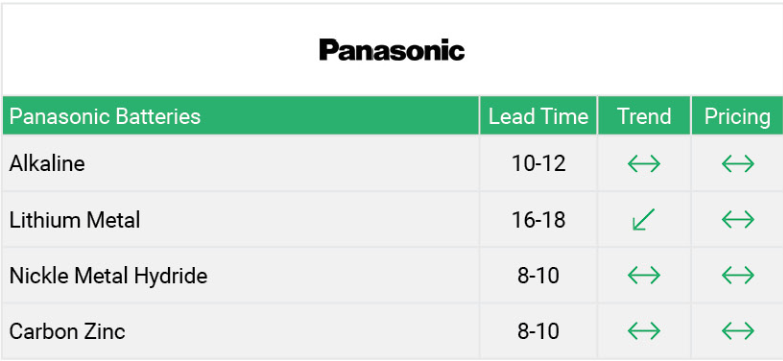

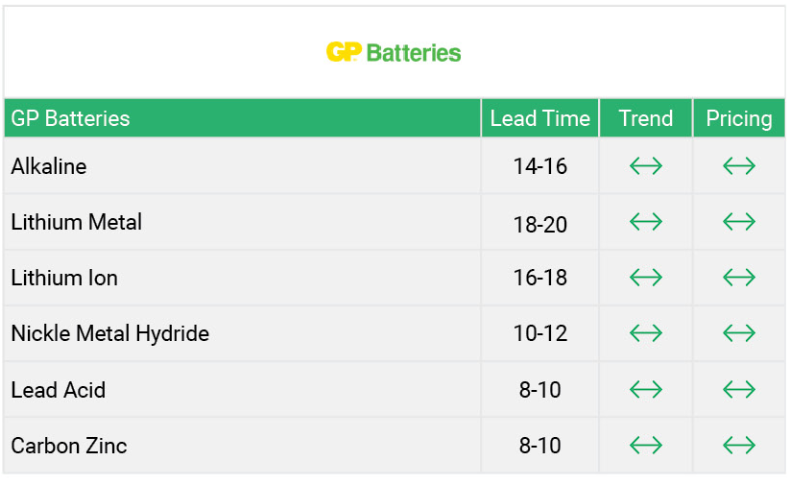

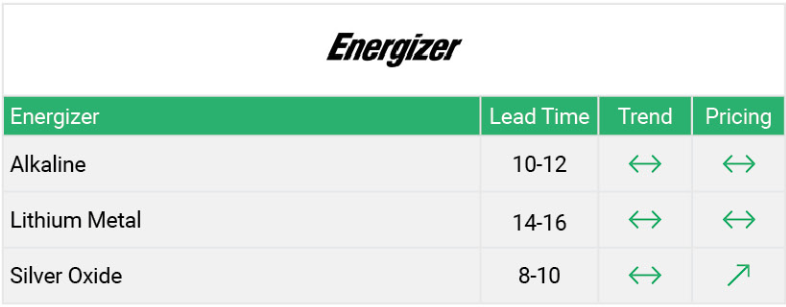

- Lead times remain stable at the quoted average of 8 to 18 weeks, with no sign of supply constraints.

- Most of the battery vendors’ factory capacity utilization is at 50~70%; book-to-bill ratio below 1.0.

- Overall market trends softening as suppliers are seeing more demand drop or become pushed out.

MARKET DYNAMICS

- Despite a 32% year-on-year growth in new energy vehicle sales in the country, reports showed that 10 Chinese new-energy vehicle producers offered new rounds of price cuts to meet second-half sales targets.

- Battery manufacturers for new energy vehicles have seen muted buying activity since the start of the third quarter as their input inventories filled up.

- EVE battery announced to establish a factory in Hungary and Malaysia

- Panasonic plans to build at least two new factories for 4680 battery production in North America by 2030

PRICE

- Lithium carbonate prices reduced compounding signs of low demand for key battery manufacturers.

- Overall, the key suppliers like Panasonic, Tadiran, and GP Battery have kept their pricing flat

- With more capacity available, suppliers are willing to revise the price strategy to secure or get more business allocations.

- There are still some price increases on legacy batteries from Varta and Renata.

Key Head Battery Suppliers Supply Trend

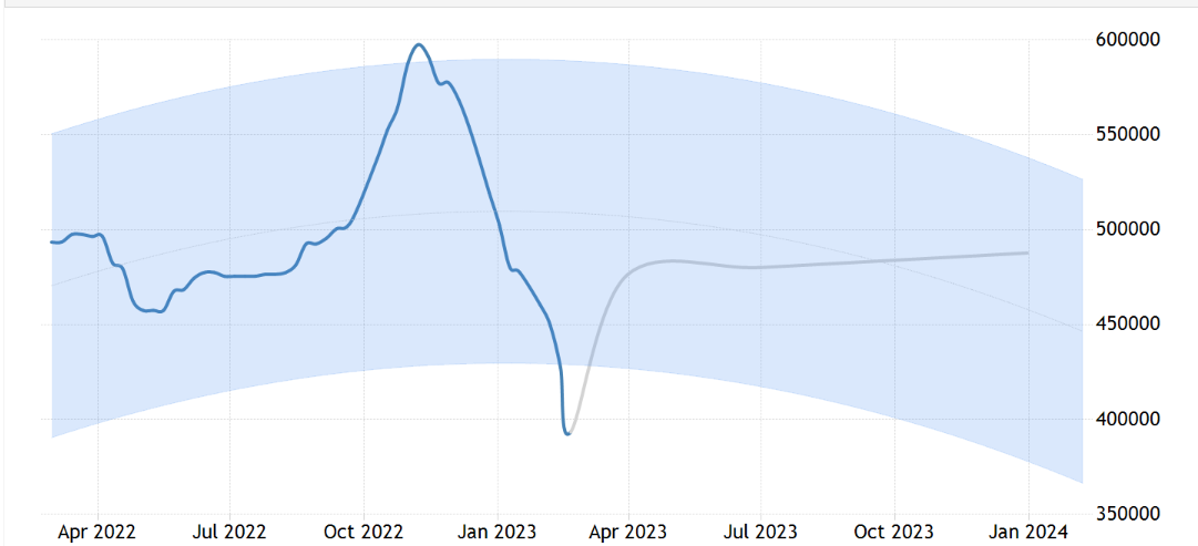

Lithium Carbonate Price Trend in RMB/Tone

Back to Top