By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q4 2023 | OCTOBER - DECEMBER

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q4 2023 | OCTOBER - DECEMBER

METALS & MATERIALS

FERROUS METALS

SUPPLY

- End-user demand is still soft.

- Stocks in China falling to October 2020 lows of 122.8m mt

- Stainless steel increasing by 2.5% month over month and 11.3% year over year given the continued marginal recovery of market conditions - the industry also entered the traditional off-season in June.

- In Q3 2023, shipments from Australia and Brazil remained high, which will keep future supply abundant

MARKET DYNAMICS

- Iron ore futures continue to be influenced by China's stimulus outlook

- The recovering output of steel is coinciding with a further drawdown of inventories.

- Lack of confidence in the construction sector is eating away at the country’s growth that struggles to see consumers remain as resilient as in the US.

- While infrastructure and fixed asset investment continue to slow, implied steel demand points to a marginal recovery in the construction sector.

PRICE

- Steel and iron ore prices gained ground.

- There is still a lot of uncertainty in the steel market. We expect steel prices to remain weak, pushing iron ore prices lower in the near term.

- Price: $115 - $120 mt

Iron Ore Price Index

NON-FERROUS METALS: NICKEL

SUPPLY

- Production out of China is recovering from the previous lows.

- NPI output is also recovering, albeit slowly, with production standing at 784,000mt in physical content, up 0.18% month over month but down 2.62% year over year.

- The new production lines maintained normal schedules, and the output continued to climb.

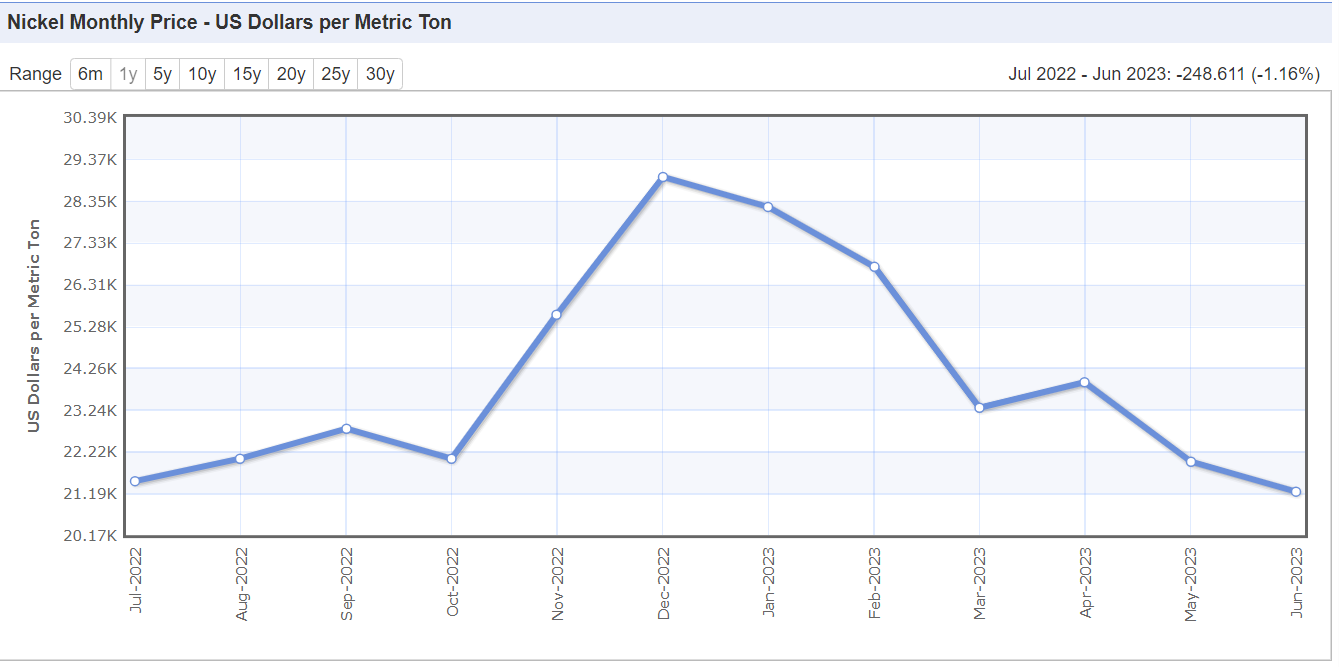

PRICE

- Nickel prices are fluctuating greatly, and the profit margin of electrowinning nickel is not stable. While we still hold our optimistic view of recovery, the positive momentum is being priced further down the curve.

- Range: $20,950-25,950/t

MARKET DYNAMICS

- Nickel sold off at the start of the year, falling by 23% year to date, weighed down by concerns about weak demand and rising output from Indonesia, despite low exports out of the region.

- Ore demand in China remained slack; thus, the port arrivals were slower than expected. We saw China's nickel ore at seven ports decline slightly.

- Some restocking is set to take place as the supply of ore will outweigh the recovery in demand.

LME Nickel Price Index

NON-FERROUS METALS: ALUMINIUM

SUPPLY

- From a supply standpoint, primary aluminum output 3.45m in June, up 1.88% year on year and 1.17% month on month. In the first half of 2023, domestic aluminum output was up by 2.81% year over year.

- As alumina plants in Shanxi and Henan are unwilling to resume or increase production due to poor profitability and bauxite shortages, the total alumina output was 6.54m mt in April, down 4% year over year.

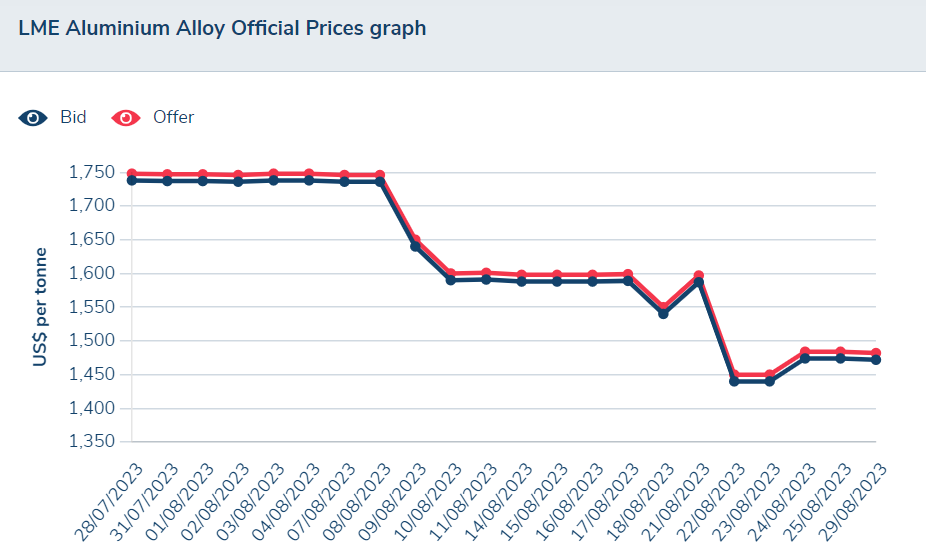

PRICE

- Aluminum prices continued to drift lower in the first half of 2023, losing 11.8% during the 2nd quarter

- Range $2,130-2,400/t.

MARKET DYNAMICS

- Weakening global demand expectations in line with extended tightening expectations from key central banks weighed on base metals’ performance.

- We expect the weakness in overall demand to continue in the coming quarter as consumers prove increasingly reluctant to spend.

Aluminum Price Index

OUTLOOK FOR ENGINEERED RESINS

Economy and Energy

- WTI price is USD81.25 per barrel as of 21 Aug 2023.

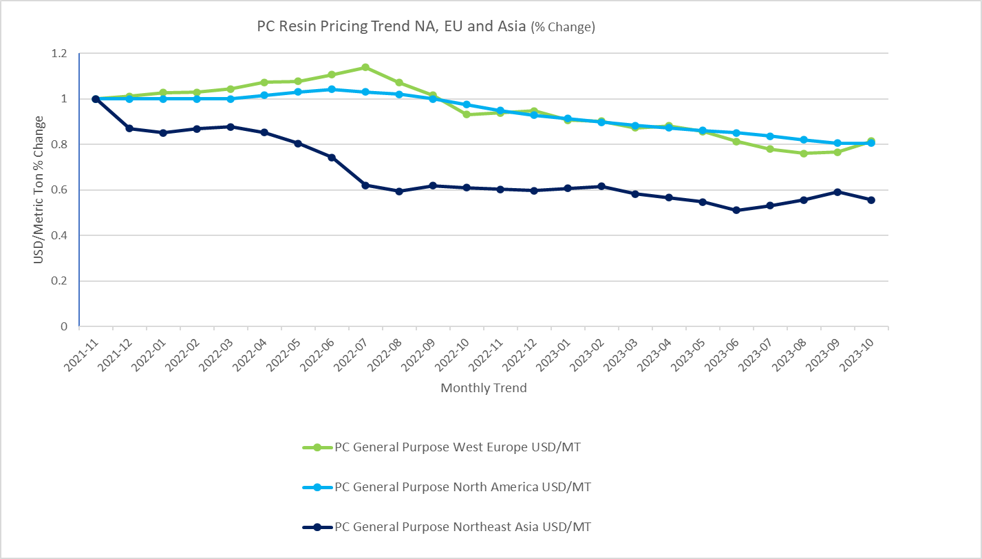

Polycarbonate

- Market conditions continue to be weak; prices are down on lower feedstock costs, lower demand, and lower sales across the region. Similar conditions are expected to prevail through year-end.

- The overall polycarbonate market situation remain stable. Weak demand in many sectors (except for automotive) influenced the industry.

- Falling container rates and improved journey times have led to a big increase in China chemical exports, particularly to Europe.

Polyamide

- Prices are competitive and have receded since the high in the beginning of the year for both nylon 6 and nylon 66. Buyers can get supply in the market at competitive price ranges. Capacity remains fully operational, and supply is reported to be robust.

- Glass fibers are more readily available and at lower prices, while flame retardants supply have improved and more affordable.

Acetal

- Supply is abundant in the market, there are no extended lead times. Currently, buyers can readily buy what is required to fulfill orders.

PACKAGING

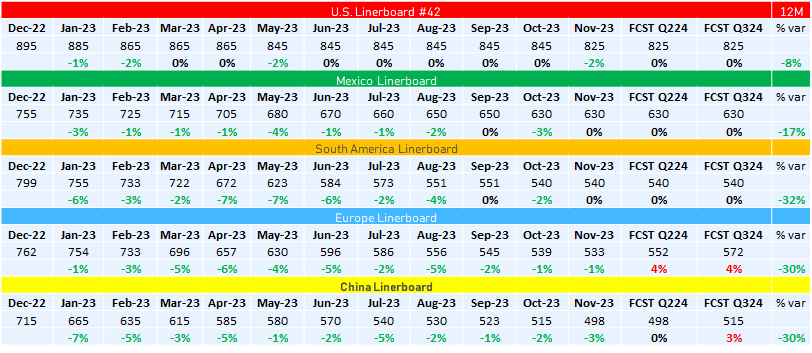

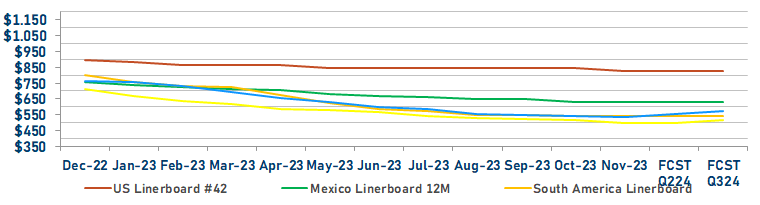

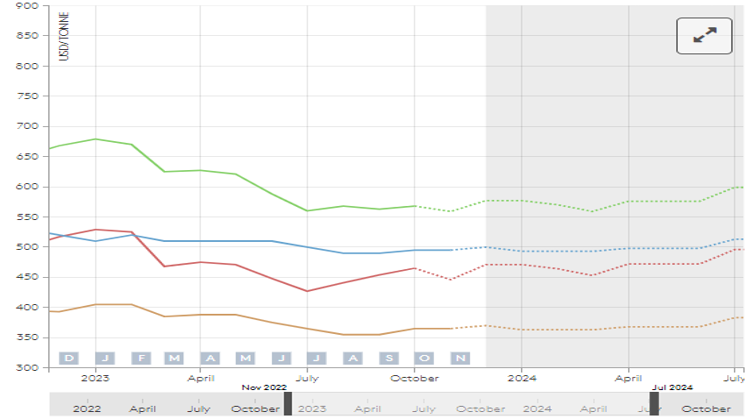

PRICE

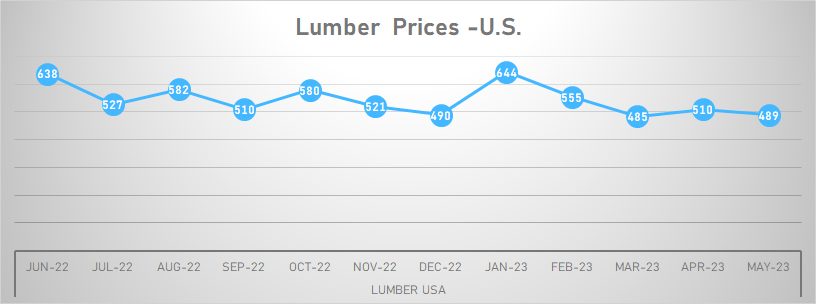

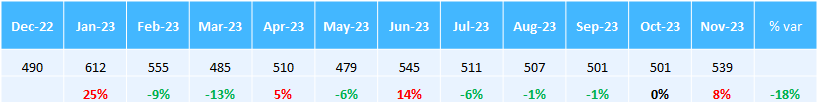

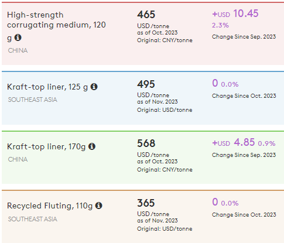

- U.S. brown liner board prices declined $20/ton this month, dropping for the first time in six months

- For Solid Bleached Sulfate boxboard (SBS) folding carton grade, prices remain stable with no change

- Accumulated price reductions on liner boards in some regions are approximately 30% (South America, Europe, and China). We need to challenge suppliers to improve some prices.

- Kraft linerboard pricing to neighboring Mexico dropped $10/ton more this week and was now down by $40-50/ton in the last five months to $610-640 ton at the Laredo.

SUPPLY

- No issues or changes on supply for corrugated linerboard are foreseen during year-end.

- SBS mills are running slow, with a two-week lead time, which is unusual.

- Some downtime is expected during the holidays, but this will not affect supply.

-

Demand is low, and suppliers are not selling finished products as expected for a year-end season

MARKET DYNAMICS

- North American companies seek larger volume or new business at lower prices or longer-term driving discounts on the linerboard open market.

- Boxmakers are trying to use increased capacity to take their liner board prices down

- North America’s Nos. 2 and 3 major integrated companies, WestRock and Packaging Corp of America, each reported sequential box volume improvements for the third quarter compared with the second quarter. Executives at both companies were optimistic about demand continuing to improve.

- Volatile market conditions persist.

- Domestic linerboard prices in Mexico remained under pressure to drop, so mills took more downtime.

- Kraft linerboard prices have declined recently on the domestic market in Italy and Spain, and box demand in Germany is slow.

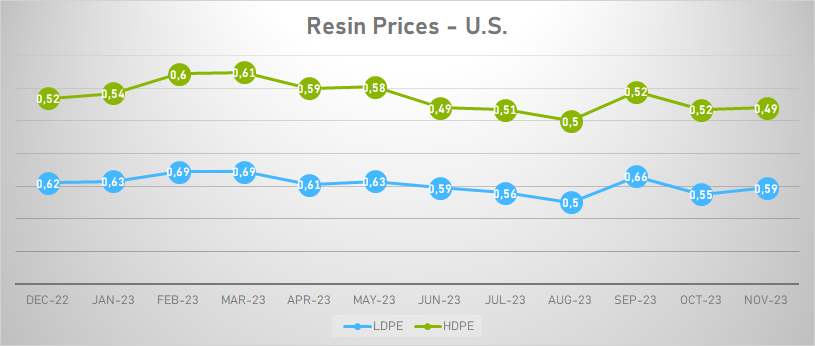

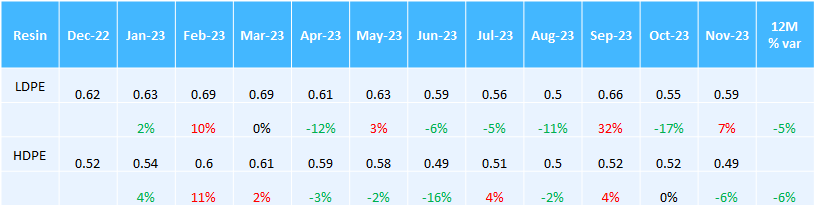

RESINS

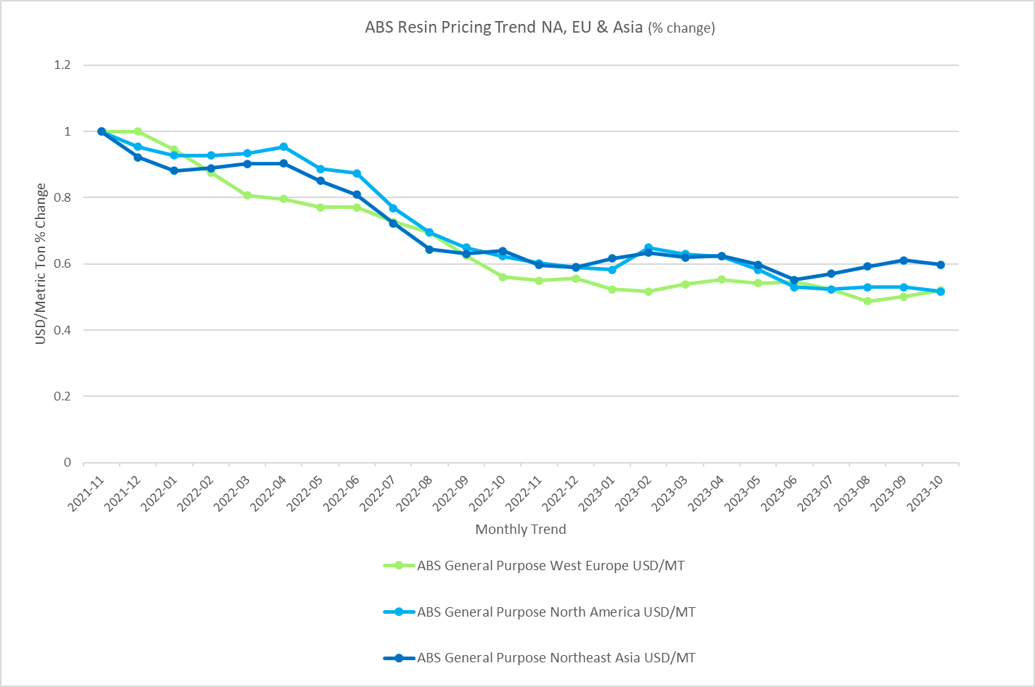

ABS

SUPPLY

- ABS remains stable, with demand historically soft. Due to labor disputes, the U.S. auto industry reduced its forecast by over 20%. Producers are cutting production to minimize inventories. The forecast for 2024 is predicted to be soft.

MARKET DYNAMICS

- While some producers try to push prices and reduce production, competitive pressure from Asia exports, mainly Korea and Taiwan, keeps costs competitive. Producers are running at capacity rates of less than 80%, and regions like NA are still seeing areas of excess inventory, which should keep pricing historically low, barring

PRICE

- Pricing is still historically low; prices are starting to rise primarily due to increasing energy and feedstock costs. A key producer has announced an increase of 5 cpp for the end of 2023, with others expected to follow. any further increases on the feedstock side.

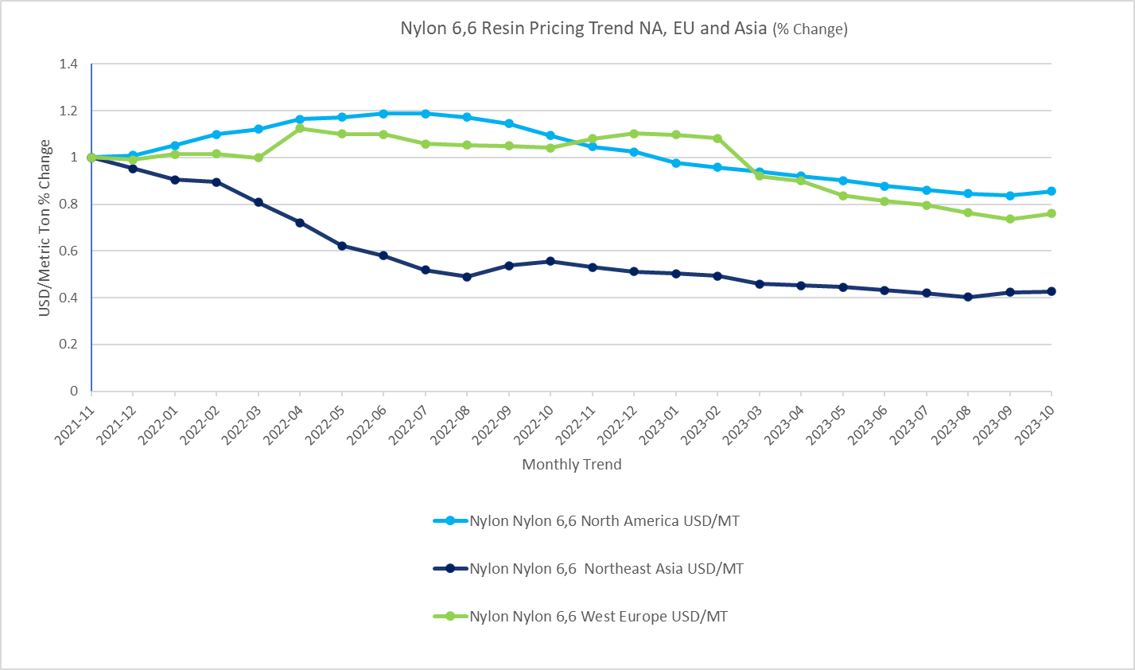

PA (Nylon)

SUPPLY

- Nylon remains stable, with demand historically soft. The U.S. auto industry reduced its forecast due to labor disputes. Producers are cutting production to minimize inventories.

MARKET DYNAMICS

- Suppliers are still dealing in excess inventory due to soft markets globally. Forecasts into 2024 are predicted to be quiet, but as UAW negotiations close, demand will pick back up in the automotive sector.

PRICE

- Nylon pricing has been historically low for the last two years, and indexes are relatively flat. Still, pricing in certain markets is gradually increasing due to rising feedstock and operating costs. Key feedstocks seeing increases include Benzene and Caprolactam.

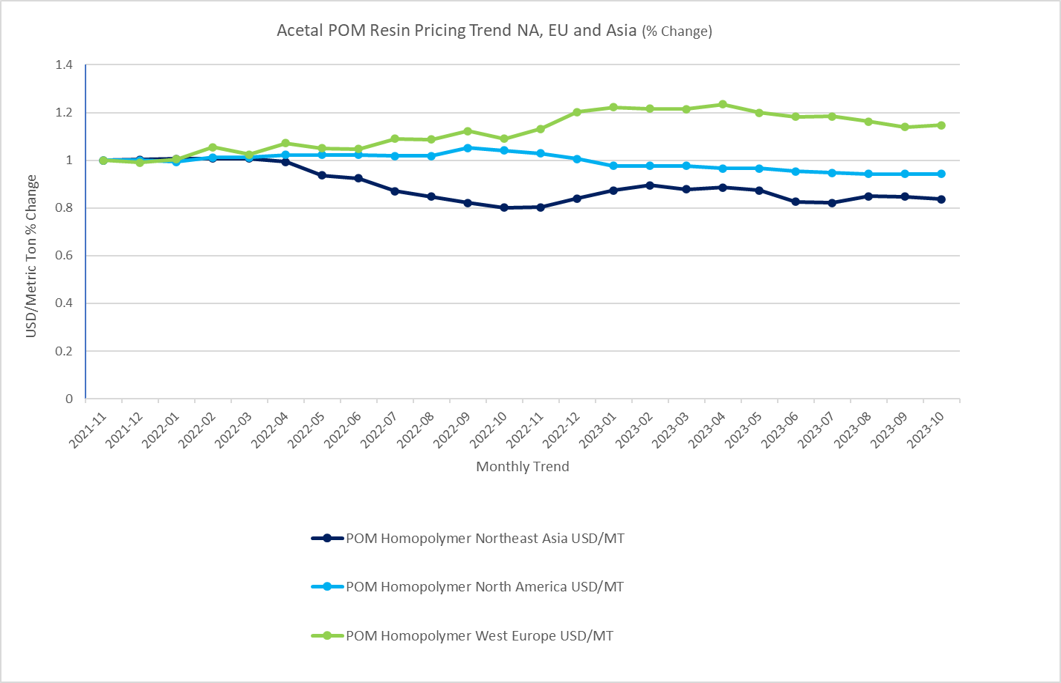

POM

SUPPLY

- The supply of POM remains stable with historically soft demand. The U.S. auto industry reduced its forecast due to labor disputes adding lower orders. Forecasts into 2024 are predicted to be flat to slightly increase as UAW labor disputes get resolved along with normal production rates.

MARKET DYNAMICS

- Asian exports are expected to pressure NA and EU pricing as logistics costs lower. Automotive demand in light vehicles is expected to return from the end of the year to the beginning of '24. DuPont has agreed to sell a majority stake of their Delrin homopolymer acetal business to a private equity firm.

PRICE

- The supply of POM remains stable with historically soft demand. The U.S. auto industry reduced forecasts due to labor disputes. Still, forecasts into 2024 are predicted to be flat to slightly increase as UAW labor disputes get resolved along with normal

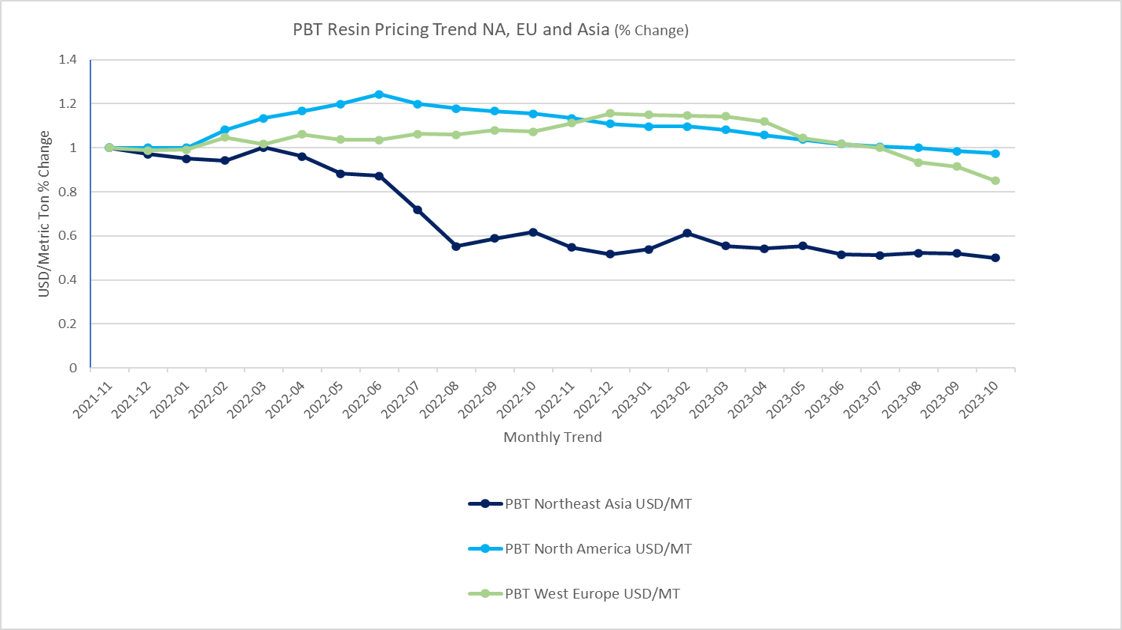

PBT

SUPPLY

- Supply of PBT remains stable or slightly constrained, but demand is historically soft. Forecasts into 2024 are predicted to have a positive outlook with stronger demand in the automotive sector.

MARKET DYNAMICS

- Electronics and electrical applications have been flat, and labor disputes have impeded the automotive sector. A key producer still remains on Force Majeure as alternate grades continue validations. Lower logistics pricing continues to pressure NA and EU markets from Asia exports.

PRICE

- Pricing is now declining as feedstocks see a decline and are stable. Reductions affecting pricing relate to PTA/DMT and BDO, key feedstocks. Natural gas has also been tough and contributed to the stability and pending decline in global prices.

PC

SUPPLY

- The supply of PCs needs to be revised, and now, with a saturated market coupled with weak demand. U.S. auto industry labor disputes have also contributed to soft demand but are expected to return. Producers are cutting production to minimize inventories. Forecasts into 2024 are expected to remain stable as the automotive sector recovery balances global market decline.

MARKET DYNAMICS

-

Demand will recover in 2024 as labor disputes are resolved and markets stabilize.

-

SABIC announced that 1 of 2 PC production lines in Cartagena, Spain, will be shuttered permanently due to market conditions. Production was suspended in October 2022 and is now permanent. Covestro started a mechanical recycling polycarbonate compounding line in Shanghai.

PRICE

- Pricing is still historically low; we are seeing prices starting to rise in the EU primarily due to increasing energy and feedstock costs. Feedstocks Phenol and Acetone are primary contributors. Outside of this, pricing in Asia and NA is stable.

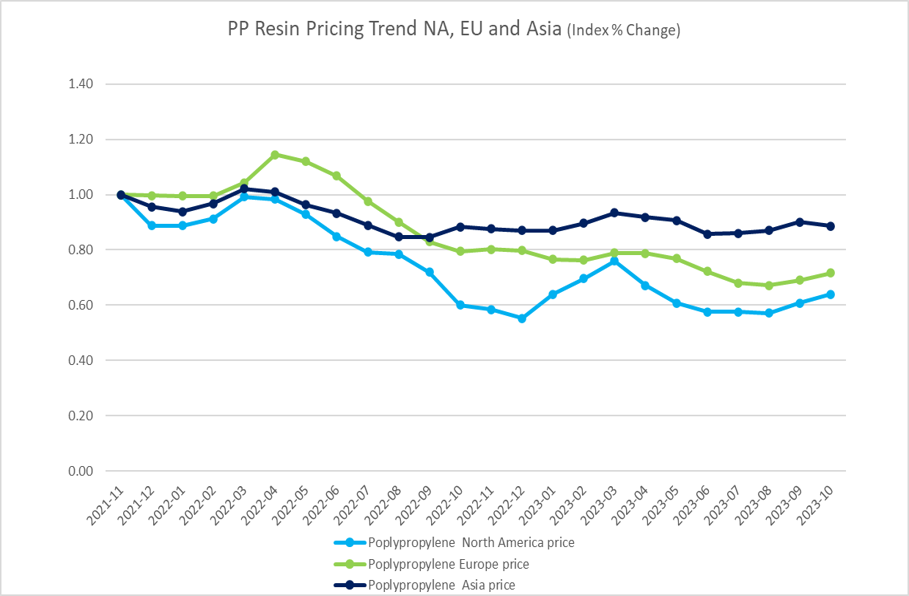

PP

SUPPLY

- Supply remains sufficient even with low operating rates at an average of 70%. Feedstock supplies are balanced long. Demand is expected to remain soft, not showing any significant improvement.

MARKET DYNAMICS

-

Formosa start-up expected in 2024 in Point Comfort, TX, adding 250,000 tonnes/year of PP capacity. Sabic and German waste management provider Landbell signed a long-term cooperation agreement to set up closed-loop plastic packaging systems and scale-up advanced recycling. Ningbo Kingfa's start-up of its first new 400,000 t/y line in Zhejiang, China, increased supply capacity.

PRICE

- In North America, pricing remains in an uptrend as feedstock costs are elevated. Firmer crude oil prices accompanied by problems in propylene production are upholding fees. In the EU, pricing is softening and expected to decrease due to feedstock cost decreasing, weak demand, and sufficient supply—similar trends in Asia with soft demand and pricing expected to remain low.

Die Cut Materials

Protective Film

SUPPLY

- Despite a weak global demand for packaging materials, suppliers maintain adequate production capacity. The supply of protective film remains stable at moderate levels due to persistent inflationary pressures and economic uncertainties. Specifically, the collection of polyethylene (PE) and cast polypropylene (CPP) protective film is steady.

MARKET DYNAMICS

- WACKER is expanding silicone production in China, with operations expected to begin in 2025. Toray is actively promoting its film products in the battery, electric vehicle (EV), and hybrid electric vehicle (HEV) market segments.

PRICE

- The price of polyethylene (PE) and cast polypropylene (CPP) protective film remains stable. While the cost of polyethylene terephthalate (PET) resin has increased slightly, it has not impacted the price of PET protective film.

Adhesive Tape

SUPPLY

- Customer inventory reductions and slower-than-expected demand have stabilized the supply of adhesive tape. Reputable brands like 3M, Nitto, and Tesa maintain steady tape supplies.

MARKET DYNAMICS

- Tesa has completed its Sparta factory expansion, strengthening its North American presence and bolstering sustainability efforts.

- Tesa promotes L-Tape~light-activated Tape, offering ultra-fast activation with the convenience of pressure-sensitive adhesive (PSA) and glue-grade bonding strength.

- 3M is prioritizing automotive electrification, climate technology, and industrial automation in the coming year.

PRICE

- Rising costs have challenged most suppliers, who have adjusted their cost structures to retain existing business. Prices for 3M, Tesa, and Nitto tapes remain unchanged.

Foam

SUPPLY

- Rogers Poron foam supply is stable, with lead times for Rogers BISCO silicone foam reduced from 44 to 9 weeks. Nitto and Sekisui foam supplies remain stable.

MARKET DYNAMICS

-

Rogers' foam products are experiencing strong sales in the renewable energy and Advanced Driver Assistance Systems (ADAS) markets, with significant design wins in the EV market.

-

Dow Chemical is shifting its business focus to Asia Pacific, Latin America, the Middle East, and Africa due to increased business activities in these regions.

-

JSP plans to accelerate the replacement of existing cushioning materials with MIRAMAT ACE.

PRICE

-

ROGERS Poron prices are expected to remain unchanged.

-

Notto and Sekisui foam prices are stable.

-

ARPRO/P-BLOCK expanded polypropylene and STYRODIA expandable polystyrene (EPS) were impacted by unexpected raw material and fuel cost increases, possibly affecting JSP foam prices.

Other Packaging Materials Trends

Americas

|

|

China

Packaging Asia

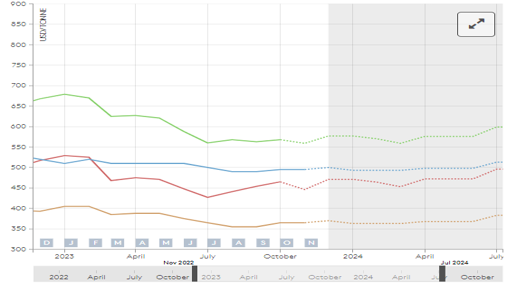

SUPPLY

- Packaging market will remain in a state of oversupply in 2023 due to ongoing increases in capacity, rising competitiveness of imports and weak demand.

- Demand will improve over the second half of the year.

- Oversupply will limit opportunities for a substantial price recovery for packaging grades, and we foresee further declines for the woodfree grades.

MARKET DYNAMICS

- The recovery in the paper and board markets seems to be taking a bit longer than we expected, and we are now a little more pessimistic for the second half. We continue to anticipate demand will improve towards the end of the year.

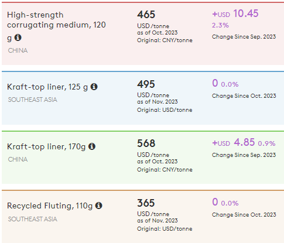

PRICE

- Expected to see price declines for most grades in the near term.

- Recycled containerboard prices grew an average of RMB 50-200 per tonne, while the containerboard markets marginally improved due to the recovering economy and producers continue to take downtime.

- Kraftliner prices remained flat with decreasing supply.

SOLDER

- Solder paste stands out as the most reliable and stable supply within the solder market, presenting a minimal risk of obsolescence. Companies using this type of material experience lower impacts from expired materials, which are crucial components in their processes.

- Solder paste supply remains the primary focus for suppliers, characterized by its stability and the availability of a diverse range of brands and alloys for customers. However, end-users tend to be conservative when trying new brands or products. Solder paste comprises powder metal and flux, with the latter being the proprietary formula for each company. Suppliers depend heavily on their research and development efforts to ensure the success of solder paste in meeting various industry requirements.

- Post-pandemic, the solder paste market has achieved stability with notable supply growth. The soldering flux paste market is expected to exhibit a CAGR of over 6% in the North American region from 2023 to 2032.

- Industries such as automotive, construction, and consumer goods drive the demand for soldering flux paste due to diverse applications. Additionally, the relatively low labor costs facilitate the establishment of numerous regional manufacturing plants.

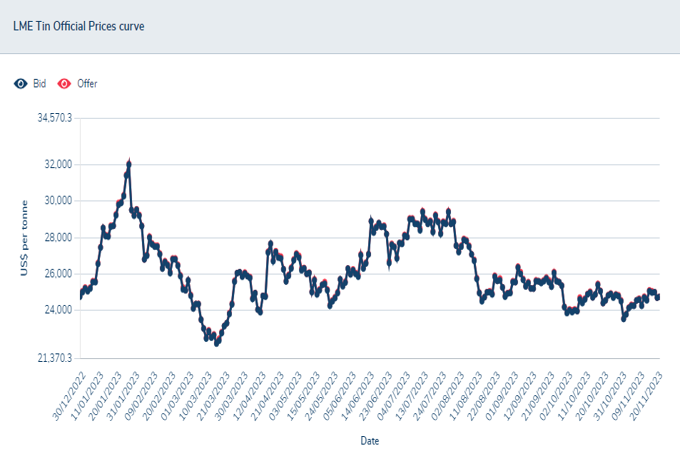

- The solder market exhibits notable sensitivity to various risks within the metals supply chain, encompassing pricing fluctuations and supply uncertainties of tin and other metals, contingent upon global economic conditions, geopolitical factors, and governmental protectionist measures. A container faces a persistent risk factor that potentially impacts its price and supply.

- Notably, the United Wa State Army (UWSA), the preeminent ethnic group in Myanmar, mandated the cessation of all mining and processing activities in early August to conduct a comprehensive audit of the tin sector. These Wa mines represent over 70% of Myanmar's tin production, a significant portion contributing to the global tin output and serving as the primary source for China's smelting operations. The sustained ban imposed by the UWSA significantly affects China's market demand for tin. Chinese producers have preemptively accumulated reserves of raw and refined tin materials in anticipation of the halt of mining activity. Consequently, the disruption's impact on the supply chain has been relatively constrained thus far. The current landscape prompts a keen interest in observing how manufacturers and refiners strategically pursue acquiring mining companies to ensure sustained production in forthcoming years.

- The reliance on China's mineral processing and manufacturing capabilities is evident through foreign investments and agreements focused on future mineral demand. Joint venture partnerships and strategic cooperation agreements, frequently established by various industries, underscore this dependence.

- Notably, entities like European and U.S. automakers have expressed interest in collaborations with Chinese counterparts, such as Volkswagen's recent announcement of joint ventures with Huayou Cobalt in Guangxi Province, China, and Tsingshan Holding Group in Indonesia, specifically aimed at securing nickel, tin, and cobalt supplies. Ganfeng Lithium signed a long-term supply agreement, indicating a continued interdependency on China's mineral resources and processing capabilities.

- Regarding the silver supply, analysts foresee robust demand propelled by the solar industry. In contrast, limited growth in mine supply is anticipated to bolster silver prices after heightened global interest rates. Silver is an investment and a crucial component in jewelry, electronics, electric vehicles, and solar panels, with the latter gaining prominence amid the global shift towards green energy. Silver prices have declined by 4% this year despite its multifaceted applications, currently resting at $23 per troy ounce, largely due to elevated global interest rates discouraging precious metals investment, which lacks interest returns. The recent firm stance of the U.S. Federal Reserve on interest rates has further exacerbated this trend.

- The forecast for industrial demand in 2023 indicates an anticipated new annual high. This growth is primarily driven by the burgeoning green economy, characterized by increased investments in photovoltaics (PV), power grids, 5G networks, and augmented utilization of automotive electronics and supporting infrastructure. The advancement in PV technology has notably contributed to heightened cell production, surpassing silver thrifting efforts and consequently escalating the demand for electronics and electrical components containing silver.

- In the anticipated landscape of 2023, global mined silver production is forecasted to decline by 2% year-on-year to an estimated 820 million ounces (Moz). This reduction primarily stems from decreased outputs in Mexico and Peru. Mexico is expected to experience a 16 Moz decrease attributed to the suspension of operations at Peñasquito during the second and third quarters due to a labor strike. Nonetheless, the overall production from primary silver mines is projected to increase, primarily driven by the anticipated escalation in production at the Juanicipio mine. Furthermore, the output from lead/zinc mines is set to rise with the commencement of operations at Udokan in Russia. Factors such as diminished by-product credits augmented sustaining capital spending, and rising input costs will collectively contribute to a double-digit year-on-year growth in All-In Sustaining Costs (AISC).

- Despite a weaker demand outlook and a marginal decrease in total supply, the global silver market is foreseen to encounter a substantial physical deficit in 2023, marking the third consecutive year of an annual drought. Projected at 140 Moz, this deficit represents a 45% decrease from the record-high deficit witnessed in 2022, although it remains notably elevated based on historical standards. Notably, Metals Focus anticipates this deficit trend to persist in the silver market for the foreseeable future.

- Is projected an estimated 6% year-on-year increase in the average silver price, reaching $23.10 in 2023. Notably, until November 7, prices have already shown an 8% year-on-year growth. Looking ahead, Metals Focus maintains a stance in favor of a sustained upward trajectory in silver prices, particularly concerning expectations around U.S. interest rates, aligning with the viewpoint of prolonged elevated rates. However, this financial backdrop is less favorable for non-yielding assets like silver. Additionally, the investment attractiveness of silver as an industrial commodity might suffer due to waning confidence in the wake of a decelerating Chinese economy. Consequently, a cautious outlook for silver prices should, in the near term, extend into much The market size is forecast to increase by $840.63 million. The market's growth depends on several factors, including increasing electronic components in vehicles, increasing product launches, and growing customer demand.

- The electronics market includes computers, servers, communications, and consumer goods. Various electronic products need different types and forms of electronic solders. The increasing demand for the miniaturization/automation of mobile devices, touch screens and displays, and medical electronic systems is a driving factor for PCB and surface mount devices.

- The growing demand for these products has led to an increase in the consumption of solder materials. The market for solder materials is also expected to expand due to the rising demand for smart devices and the introduction of energy-efficient electronics. Furthermore, increased manufacturing of electronic devices or gadgets in emerging nations and the development of a significant electronics aftermarket business will likely enhance the demand for solder materials.

- Asia Pacific was the largest market for solder materials in terms of value in 2021.

- Emerging economies are expected to experience significant demand for solder materials because of the expansion of consumer electronics and automotive sectors due to rapid economic development and government initiatives toward economic development. In addition to this, the growing population in these countries represents a strong customer base.

- Asia Pacific is the fastest-growing market for solder materials globally, in terms of value and volume, during the forecast period.

- The market size is forecast to increase by $840.63 million. The market's growth depends on several factors, including increasing electronic components in vehicles, increasing product launches, and growing customer demand.

- The electronics market includes computers, servers, communications, and consumer goods. Various electronic products need different types and forms of electronic solders. The increasing demand for the miniaturization/automation of mobile devices, touch screens and displays, and medical electronic systems is a driving factor for PCB and surface mount devices. The growing demand for these products has led to an increase in the consumption of solder materials. The market for solder materials is also expected to expand due to the rising demand for smart devices and the introduction of energy-efficient electronics. Furthermore, increased manufacturing of electronic devices or gadgets in emerging nations and the development of a significant electronics aftermarket business will likely enhance the demand for solder materials.

- Asia Pacific was the largest market for solder materials in terms of value in 2021.

- Emerging economies are expected to experience significant demand for solder materials because of the expansion of consumer electronics and automotive sectors due to rapid economic development and government initiatives toward economic development. In addition to this, the growing population in these countries represents a strong customer base.

- Asia Pacific is the fastest-growing market for solder materials globally, in terms of value and volume, during the forecast period.

- For Solder bar, the largest consumed alloy continues to be the SAC305. Still, some customers who are not automotive or medical opt to use the alloy SN100C because it has good performance, and the pricing is cheaper than SAC305 or any other alloy that contains silver.

- Solder wire will be significant during the mentioned period. There is a factor directly related to demand: if demand increases with clients, the use of solder wire in repair and maintenance increases in various sectors, especially in the consumer electronics, automotive, and infrastructure segments. The increased number of vehicles also leads to a higher requirement for maintenance and repair services, driving the demand for solder wires.

- The Solder Paste Market is expected to increase due to the customers and industries creating and innovating products for segment outlook. These are the growth opportunities for 2027; the product overview is in the following order: wire, bar, paste, and flux, and the most important end users are still consumer electronics and automotive.

- The increasing deployment of automation systems in vehicles leads to the higher integration of advanced electronic components, such as microcontrollers and sensors, to enable in-vehicle communication. The growing trend in the market involves a rising preference for automated soldering solutions. Vendors, increasingly aware of automation benefits and aiming for a competitive edge, have significantly increased the application of automation in soldering. Initially limited to small-scale mechanization, the progression in robotics technology has now facilitated the integration of robots into soldering processes. The incorporation of robots enhances soldering efficiency, elevates soldering quality, boosts productivity, and reduces material wastage.

- The Asia Pacific region is projected to witness substantial demand for solder materials, driven by the growth of the consumer electronics and automotive sectors fueled by rapid economic development and government initiatives.

- The growth in the demand for the solder industry remains closely tied to the automotive and electric vehicle sectors. Pursuing the 2050 zero-emission target for vehicles continues at an accelerated pace, impacting the entire supply chain and related industries. Fueled by the global commitment to decarbonization, major nations are earnestly addressing the challenge, leading to a surge in electric vehicle sales. In the first quarter of 2023 alone, 2.3 million electric vehicles were sold, marking a 25% increase from the same period in 2022. Projections estimate 14 million electric vehicle sales by the end of 2023, constituting approximately 18% of total car sales.

- Solder Bar

- The bar holds crucial significance in the process, and despite narrow profit margins, the potential to alter an alloy within the internal process presents a promising opportunity for cost savings.

- Setting prices for extended periods remains challenging due to the variable cost of raw materials, which depends on global market conditions. The tin supply chain has benefited from a stroke of luck, as the production loss from a major supplier coincided with a time of market surplus. Despite the United Wa State Army's (UWSA) directive to halt mining and processing activities in August for a comprehensive audit of the tin sector, the fortunate circumstance of this occurring during a period of market surplus has mitigated the impact. The Wa mines, responsible for over 70% of Myanmar's production, play a significant role as the world's third-largest tin producer and the primary supplier to China's smelters.

- Tin supply is still on a good path. However, the metal is sensitive to geopolitical factors that could impact production.

- Such as the threats from the United Wa State Army to the Myanmar mining operations. Just this rumor creates an inflationary effect in the pricing, and even though it seems to be in a safe position again, this reminds us how metal production of this metal could be affected at any moment with a big impact on the solder supply.

PRICE

- Tin had a price drop since the beginning of 2023, reaching $32.00 per kg U.S.D (highest point in 2023) as it is an alloy base metal for welding manufacturing. The price drop starting in February 2023 and the behavior in the following months helped maintain a more stable price for welding.

- Tin futures experienced an increase, surpassing the $24,500 per ton threshold, marking a recovery from the one-month low of $23,910 recorded on November 1st. This uptick is attributed to concerns about diminished supply, with mining and processing activities in Myanmar's prominent producing area of Wa remaining halted since August.

- Examining the decline in tin prices, it's crucial to recognize that the prolonged bullish trend during the pandemic established a distinctive environment for in demand. The global lockdowns led to a heightened demand for electronic devices, supporting remote work and increasing the need for semiconductors. As semiconductor manufacturing is a significant driver of tin demand, when the pandemic was alleviated, and the demand for electronic devices declined, so did the market for tin.

- Silver markets have risen from lows of $12 per ounce hit during the COVID-19 pandemic, as investors have purchased physical precious metals and financial instruments as haven assets during the current economic uncertainty.

- The price of silver peaked at $28 in August 2020 and ended the year around $22.

- The price then jumped to the highest in eight years in February 2021, briefly touching the psychological level of $30 per ounce, as the market attracted the attention of retail investors.

- While the price of gold had an unstable behavior in 2023 and has increased since the last month, silver has been stable, having its highest price in April of the same year, reaching USD 26,025 per ounce, and its lowest price. In March, it will be USD 20.09 per ounce.

- As of the end of June 2023, the gold held in London vaults was 8,865 tons (a 0.4% decrease on the previous month), valued at $545.0 billion, equating to approximately 709,200 gold bars. There were also 26,748 tons of silver (a 1.3% increase on the previous month), valued at $19.3 billion, which equates to approximately 891,589 silver bars.

- https://www.bnnbloomberg.ca/commodity-traders-are-taking-more-risk-to-save-cash-1.1886019

- https://www.maximizemarketresearch.com/market-report/global-solder-paste-market/71805/

- https://www.metalsdaily.com/news/silver-news/

- https://www.lme.com/en/Metals/Non-ferrous/LME-Copper#Price+graphs

- https://www.bnnbloomberg.ca/commodity-traders-are-taking-more-risk-to-save-cash-1.1886019

- https://www.reuters.com/markets/commodities/consumer-belt-tightening-hobbles-demand-solder-metal-tin-2022-07-05/

- https://tradingeconomics.com/commodity/tin

- https://www.jmbullion.com/charts/silver-prices/

- https://www.lme.com/en/Metals/Non-ferrous/LME-Tin#Price+graphs

- https://www.lbma.org.uk/prices-and-data/precious-metal-prices#/

- https://www.fool.com/the-ascent/federal-reserve-interest-rates/#:~:text=What%20is%20the%20current%20federal,sixth%20rate%20hike%20this%20year.

- https://tradingeconomics.com/commodity/tin

- https://www.internationaltin.org/sustainable-production/

Back to Top