By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q3 2023

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q3 2023

INTERCONNECT COMMODITIES

CONNECTORS

- Most of the suppliers’ factories are running at 80% capacity utilization.

- Although many suppliers are seeing weak demand in general, automotive and industrial (power energy) sectors are still robust with relatively strong demand.

- Suppliers are pushing to reduce their inventory levels as more push-outs and cancellations are seen.

- Overall key suppliers’ book-to-bill remain low – hovering around 0.7-0.9:1.

- No sign of supply constraints and overall lead time is improving.

- Supply base remains stable with no tell-tale signs of any suppliers exiting the market.

- The market trends and associated demand have led to key connector suppliers focusing their capacity expansion into the automotive market (EV) and IT datacom markets.

- As part of the China+1 strategy, key connector suppliers are expanding and investing their capacities in the Philippines, India, Mexico, and Poland.

- Generally, the overall pricing in 2nd half of 2023 remains flat.

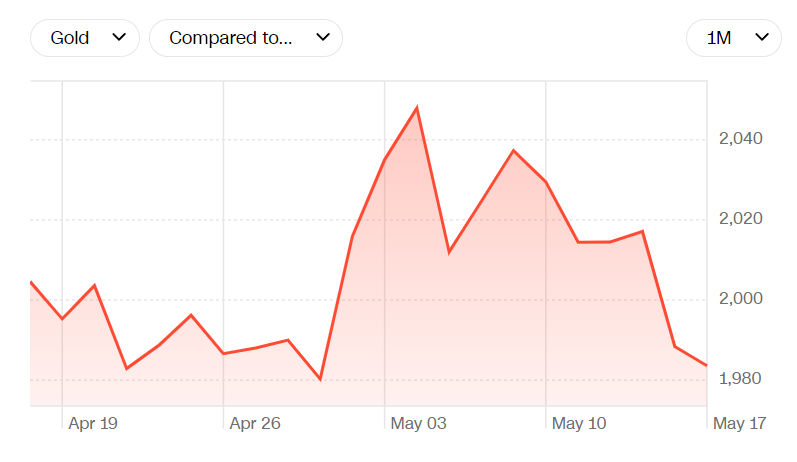

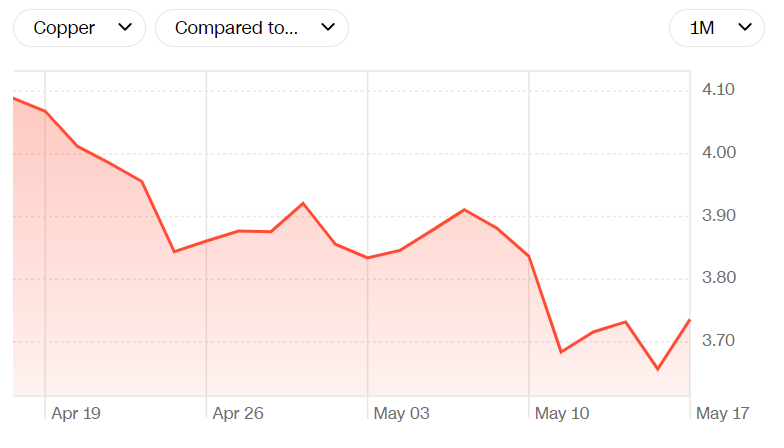

- Metal pricing is stabilizing except for gold which is on the high side. We are seeing cost increases for parts with gold plating.

- Overall manufacturing costs are still impacted due to inflation.

- There are still some price increases on low-margin and legacy products, like headers and receptacles, D-Sub, non-high speed I/O (USD2.0), and labor-intensive RJ45 MagJacks.

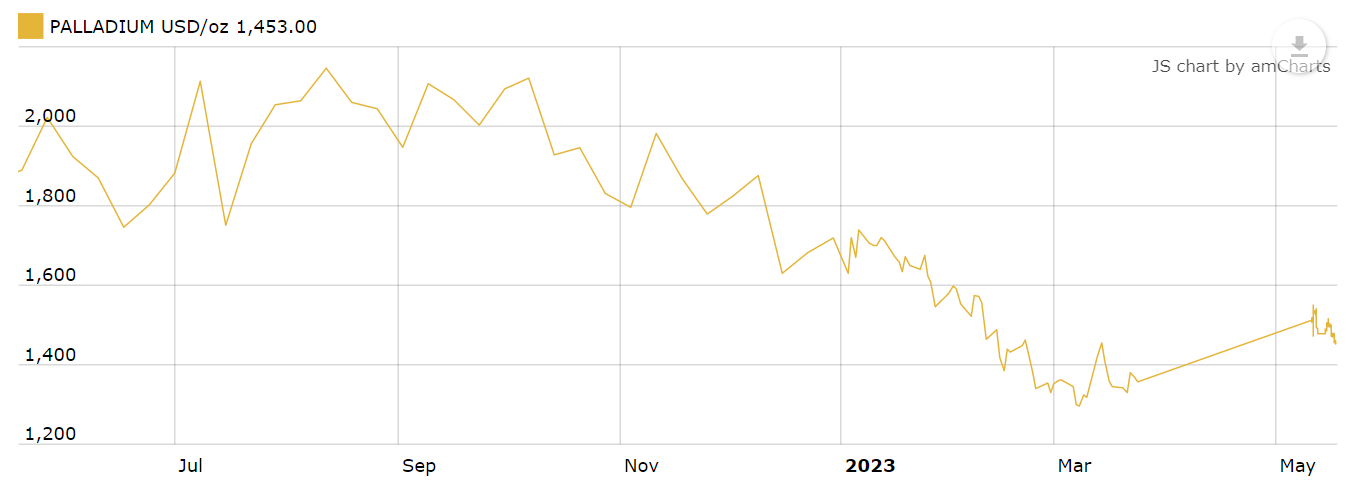

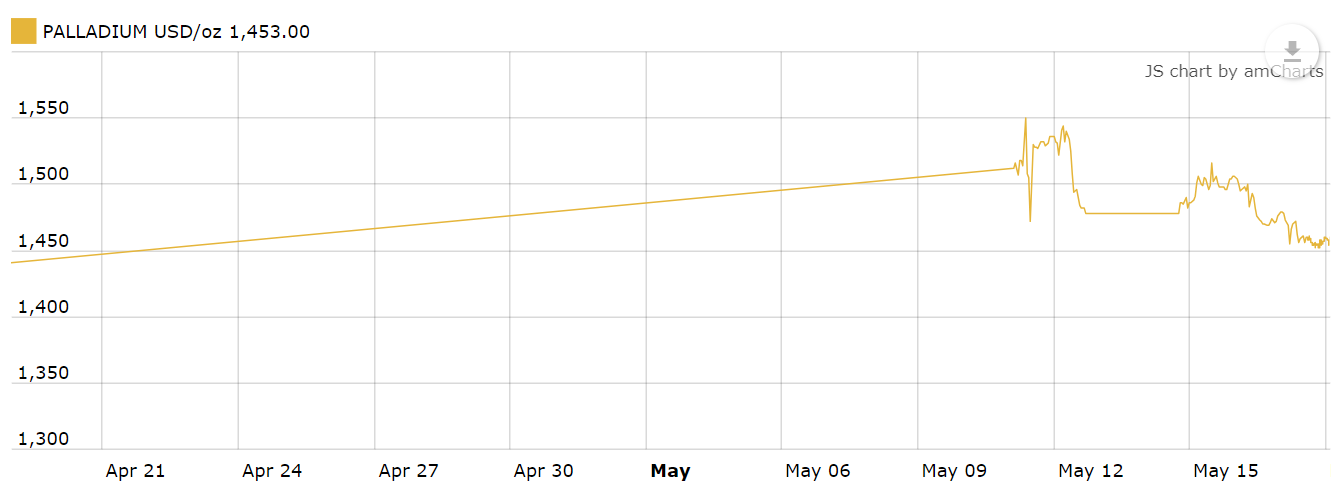

GOLD, COPPER & PALLADIUM PRICE TRENDS

RELAY

- Supplier factory utilization running at 80%, but series related to the EV market are still running very tight and under allocation.

- Book-to-bill ratio is below 1 (overall). EV-related relays are still tight, lead times remain, but end-customer requirements are getting shorter.

- There are certain technologies in TE (RT and RZ type) and Panasonic still under allocation.

- The market demand for relays is expected to grow in EV and renewable energyrelated businesses; home appliance, instrumentation, and capital equipment demand remains soft.

.

- The relay market has been growing in recent years due to increasing demand in various industries such as automotive, manufacturing, and telecommunications. The market remains uncertain as we move into Q3 and Q4 due to geopolitical concerns.

- The relay EV market is booming, especially in China. Numerous new EV car models have been recently released at the Shanghai Automotive Road Show.

- Omron is venturing into small-size latching relays by the end of 2023, a highpower MOSFET relay in 2025, and a high-power DC relay in 2030.

- Overall pricing will remain flat to increase. Raw material costs such as palladium (from Ukraine), gold, and plastic resin are still volatile.

- We are seeing cost increases, especially from TE, industrial relay (Eaton, ABB, and Schneider), and niche reed relayS from Coto and SanYu Switch due to the raw material, logistics, and energy cost impact in Europe.

- More increases from TE are expected, due to them discontinuing certain less popular series’ as they force end customers to use higher range series as a replacement. The strategy has not been well received by their customers.

- Will continue to monitor the overall situation for the rest of 2023.

SWITCH

- Lead times remain flat with no constrained capacity due to many switch manufacturers investing in their production capacity to meet the growing demand since early 2022.

- Book-to-bill is below 1, with soft bookings.

- Most of the supply base’s factory utilization is around 70% or lower.

- The supply base remains stable and expects to have steady growth, due to increased demand from the automotive (EV) and IoT (Internet of Things) markets.

- Many switch suppliers had invested in expanding their production capacity back in 2022.

- Suppliers (TE/Omron/Apem/E-Switch/KnitterSwitch/Grayhill) remain very OEMfocused with Asian / local tier 2 suppliers an option for low-cost solutions.

- The switch market is striking and being replaced by touch panels or other pressure/touch sensing components.

- Diptronics is moving more production from its China factory to Vietnam. The current ratio is China (60%) vs Vietnam (40%). Target to move another 20% from China to Vietnam to avoid any geopolitical issues.

- Pricing remains flat except for industrial type supported by Eaton, ABB, Schneider, etc.

- There will be cost increases for those manufacturers based in Europe (C&K), due to the raw materials, logistics, and energy cost impact.

- Will continue to monitor the overall situation for the 2nd half of 2023.

BATTERY

- Lead times remain stable at an average of anywhere from 6 to 12 weeks.

- Battery vendor report utilization rates of 50~70%, however, capacity utilization rates are expected to increase in the 2nd half of 2023.

- The latest data showed that NEV sales and output in China soared by 110% yearon-year (April).

- EVE battery announced new factories in Hungary and Malaysia.

- Panasonic plans to build at least two new factories for 4680 battery production in North America by 2030.

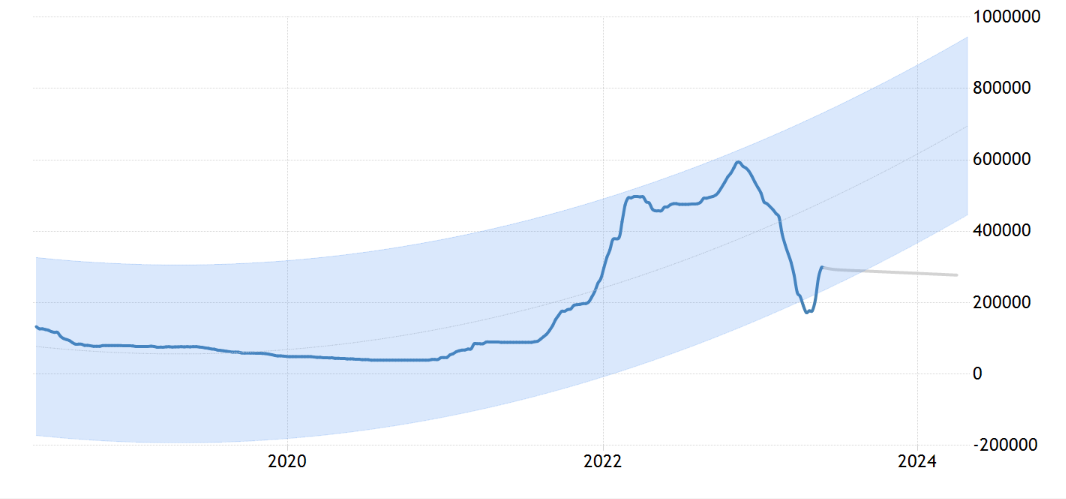

- Lithium carbonate prices were approximately CNY 300,000 per ton in late May, the highest since March and holding the sharp rebound from the 19-month low of CNY 165,500 from April 24th.

- This came amidst a recovery in demand for electric vehicle batteries.

- Factors such as labor shortages and tight transportation continue to restrict the increase in production of lithium ore in Australia, and the high prices of lithium ore underpin lithium prices.

- The contraction of upstream supply and downstream stockpiling is expected to lead to a rebound in lithium prices later this year.

- Due to the overall downstream demand and threat of economic recession, battery vendors will absorb the raw lithium material price increases in order to gain more business allocation.

Lithium Carbonate Price Trend in RMB/Tone

Back to Top