By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q1 2024 | JANUARY- MARCH

Jabil's Global Commodity Intelligence Archive

Global Commodity Intelligence

Q1 2024 | JANUARY- MARCH

INTERCONNECT COMMODITIES

CONNECTORS

SUPPLY

- Most suppliers’ factories are running at 70-80% capacity utilization.

- Overall, key suppliers’ book-to-bill ratios still hover around 0.8 to 1.0.

- Most suppliers and their distributors still have a high inventory.

- Lead time remains stable for connectors with no supply constraints from key raw materials like metals and resins.

- Generally, demand across market segments could be faster except for Electric Vehicles, Medical, and AI applications.

MARKET DYNAMICS

- Supply base remains stable with no tell-tale sign of any suppliers exiting the market.

- Amphenol closed three acquisitions - Connor Manufacturing Services, Q Microwave, and XMA Corporation.

- Connor Manufacturing Services: Based in Illinois, Connor is a global manufacturer of power interconnect products, including high-voltage busbars for the automotive and industrial markets, with annual sales of approximately USD 100 million.

- Q Microwave: Q Microwave is a designer and manufacturer of mission-critical radio frequency components utilized in military platforms with annual sales of approximately USD 20 million.

- XMA Corporation: Based in New Hampshire, XMA is also a provider of radio frequency components for the military and IT datacom markets, with annual sales of approximately USD 15 million.

- Connor will be included in the Amphenol Interconnect and Sensor Systems Segment, while Q Microwave and XMA will be included in the Amphenol Harsh Environment Solutions Segment.

- Signed an agreement to acquire PCTEL (antennas, industrial IoT products) subject to approval from PCTEL’s shareholders and other customary closing conditions.

Forward-looking markets trend outlook :

- Automotive: Electric Vehicles continue to drive demand growth in this segment.

- Industrial: Capital Equipment and Power Generation markets drive segment demand softening.

- Telecommunications (5G, Cloud, Wireless Network): Hyperscale customer demand is down YoY, partially offset by increasing demand in AI servers and switches.

- Consumer: Demand remains soft in this segment.

- Medical: Demand is generally stable in this segment.

PRICE

-

- Overall connector pricing in 2024 should see costs go downtrend for the PCB Connector Type commonly used across market segments.

- Raw materials pricing remains stable, except for gold pricing, which is still high.

- Suppliers are still experiencing the cost impact on energy, labor, and inflation.

- Most suppliers are open to pricing reviews for new business opportunities and for getting more share on existing business.

- There are still some price increases on low margin and legacy products like Headers and Receptacles, D-Sub, Non-High Speed I/O (USD 2.0), and labor-intensive RJ45 Magjacks.

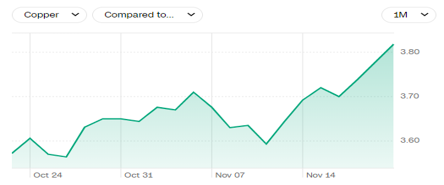

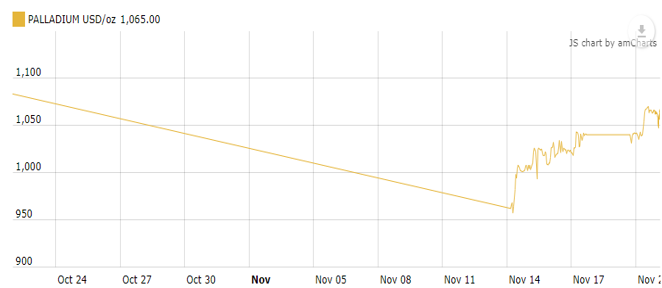

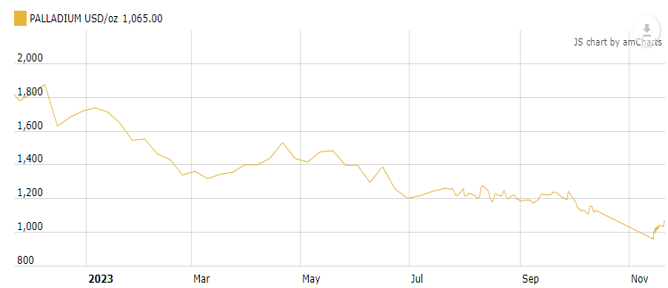

GOLD, COPPER & PALLADIUM PRICE TRENDS

RELAY

SUPPLY

- While the overall utilization of supplier factories is at 60%, there is a notable disparity as series related to the EV, and renewable energy markets continue to operate at a tight capacity, experiencing allocation constraints.

- The book-to-bill ratio remains below one overall. Relays associated with EVs and renewable energy continue to face tight availability, leading to sustained lead times. However, there is a notable trend where end customer requirements are contracting, adding a layer of complexity to the supply-demand dynamics.

- Certain items in TE, specifically the RT and RZ types, continue to be subject to allocation, indicating that TE is still contending with allocation constraints.

- Anticipated growth in the demand for relays is projected in the EV and renewable energy sectors. In contrast, softer demand is observed in home appliances, instrumentation, and capital equipment.

MARKET DYNAMICS

- The market remains uncertain, primarily attributed to geopolitical concerns. China's market performance has not aligned with initial expectations

- Tier 1 relay manufacturers are strategically directing their attention to high-power DC relays, positioning themselves to capitalize on the burgeoning markets of EVs and renewable energy.

- HongFa is gearing up to invest in a new manufacturing facility in the EU, although there is no definitive plan or location announced.

- The relay manufacturer remains unfazed by U.S. sanctions, opting to enhance flexibility by relocating additional production lines back to China.

PRICE

- While overall relay pricing has generally remained stable, certain raw material costs remain volatile. Standard relays are expected to maintain their regular pricing, but solid-state relays may experience fluctuations due to the export control of gallium and germanium (semiconductor raw materials) by China.

- TE's relay and industrial relays from manufacturers like Eaton, ABB, and Schneider, and niche reed relays from Coto and SanYu Switch are still susceptible to cost increases.

- Prices from conventional relay suppliers such as Omron, HongFa, and Fujitsu have remained stable despite certain raw material costs experiencing incremental increases.

SWITCH

SUPPLY

- The overall lead time has remained stable, with no capacity or raw material availability constraints. Many switch suppliers proactively expanded their production capacity in 2022, contributing to the overall stability of the supply chain.

- The book-to-bill ratio is below 1.0, indicating a subdued level of bookings. However, Canada is witnessing an upswing in volume, particularly in the computing sector, with a notable increase in business from customers involved in AI applications.

- The majority of switch suppliers’ factory utilization is around 70%. Notably, these suppliers avoid building up inventory as a standard practice.

MARKET DYNAMICS

- The switch market is transforming, with touch panels and other pressure or touch-sensing components increasingly replacing traditional switches.

- Diptronics has outlined plans to establish a factory in India, with considerations for potential partnerships as part of its strategy to capture the automotive market in India. However, at this stage, these are preliminary plans.

- Panasonic is relocating its plant from Malaysia to China, driven by a strategic move to tap into the robust Chinese market and secure a stronger foothold.

- The integration of CandK and Littelfuse is expected to experience further delays, now extending into 2024.

PRICE

- Overall pricing has remained stable. While there is no immediate constraint regarding capacity or raw materials, factors such as energy costs, labor expenses, and inflation are counteracting the potential for cost reduction.

- Niche industrial switches, supported by Eaton, ABB, Schneider, and others, are poised for potential price increases. This is noteworthy, even in light of Schneider's earlier announcement of price hikes for most industrial switches in the early part of the quarter.

- Following Littelfuse's investigation into CandK's current cost structure, there is an anticipated cost increase from CandK in the near future.

BATTERY

SUPPLY

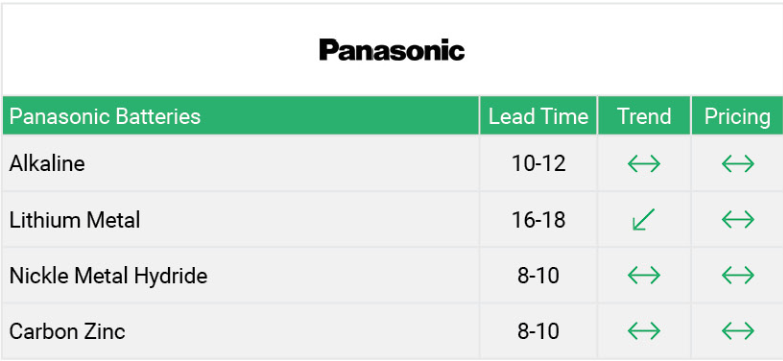

- Leadtime remains stable at the quoted average of eight to 18 weeks, with no sign of supply constraints. China’s local battery vendor lead times have shortened to three to four weeks due to the abundant production capacity; most battery vendors’ factory capacity utilization remains below 70%.

- Market demand for primary batteries and rechargeable batteries remains soft in Q4 and through the first half of 2024

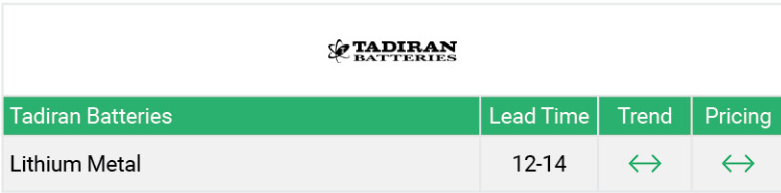

- Potential risk related to supply continuity for the Metering market due to a battery supplier in Israel. Tadiran Batteries, situated in Kiryat Ekron, southeast of Tel Aviv – we recommend working with the team to provide alternate proposals to mitigate risk.

MARKET DYNAMICS

- Leading battery makers, like LG Energy SK On, are scaling back their North American investments and laying off workers as the U.S. electric vehicle industry wrestles with sluggish demand.

- Lithium carbonate prices extended their decline due to lower demand and steady supply.

- Overall, pricing remains flat for key suppliers like Panasonic, Tadiran, and GP battery.

- With more capacity available, suppliers are willing to revise their price strategy to secure or get more business allocation. Best-in-class pricing depends on demand.

Back to Top