By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Sector Market Report

Smart Home & Appliances

Sector Market Report

Smart Home & Appliances

Get an in-depth analysis of the current state, trends, and future of the smart home and appliance technology market, including insights into key drivers, changing product lifecycles, and manufacturing challenges.

Smart Home & Appliances

Introduction

The smart home market is at a critical juncture as the effects of the pandemic diminish. Supply chain complexities, changing consumer sentiment, and economic fluctuations bring significant challenges and opportunities to those operating in the industry. With inventories re-balancing and pent-up demand easing, smart home manufacturers must refine their strategies.

The smart home market is transforming dynamically, reshaping the domestic environment into interconnected, intelligent spaces. This evolution is not just about convenience; it represents a paradigm shift in interacting with living spaces, promising enhanced efficiency, comfort, and security. With the unprecedented growth in AI technologies, at-home voice assistants are poised to transform smart homes into intelligent environments that get more personal with consumers and reflect emotions while learning home and consumer habits.

Scope of the Smart Home and Appliances Industry:

|

|

Indoor appliances, such as fridges, washing machines, driers, ovens, water heaters, coffee makers, water softeners, cleaning robots, etc. |

|

|

Security and access control, such as doors, key locks, gates, motion sensors, doorbells, and security cameras, etc. |

|

|

Entertainment and media, such as TVs, speakers, gaming consoles, tablets, etc. |

|

|

Fitness equipment, such as exercise bikes, treadmills, |

|

|

Health management and sustenance, such as inhalers, metabolism trackers, beds, toothbrushes, etc. |

|

|

Hubs and controllers, such as voice assistants, |

|

|

Outdoor appliances, such as lawnmowers, |

The smart home market is being propelled by growing consumer demand for more controlled and customized living spaces. Demand is bolstered by a collective commitment to sustainability, pushing the boundaries of what smart devices can achieve in terms of energy conservation and eco-friendliness. The recent unveiling of EcoFlow's Delta Pro Ultra™, a substantial portable battery, and the EcoFlow Smart Home Panel 2™ at CES this year underscores the industry's dedication to providing scalable and innovative energy management solutions that cater to the evolving needs of consumers while aligning with the market's move towards sustainability.

The market is evolving, and the scope and capabilities of the smart home ecosystem are expanding. LG's introduction of a groundbreaking AI agent is an excellent example of industry innovation and demonstrates a significant step towards realizing its aspiration of creating a "Zero Labor Home." The agent, equipped with advanced robotics and the Qualcomm® Robotics RB5 Platform, creates intelligent environments responsive and intuitive to user requirements.

GE Lighting also introduced new Cync Undercabinet smart light fixtures at CES 2024 – representing a significant step forward in intelligent lighting by providing users with customizable and convenient options that enhance the functionality and aesthetics of their homes.

The evolution of the smart home market is characterized by several key trends, including an increasing emphasis on device interoperability and the integration of artificial intelligence for more personalized and predictive controls. A notable advancement is the adoption of the Matter IoT standard, which aims to enhance device convergence by ensuring compatibility across various smart home devices. Additionally, innovations such as Ki’s wirelessly powered kitchen appliances have the potential to transform the cooking experience, improving comfort and security through cutting-edge technology. These developments are reshaping the technological landscape and significantly influencing consumer expectations, driving demand for more intuitive and responsive devices.

However, the path towards widespread adoption of these innovations has its challenges. Regulatory standards for device interoperability and data protection are expected to play a critical role in the future. Manufacturers must balance the pace of innovation with ensuring user privacy and security, navigating these concerns carefully to maintain consumer trust.

In summary, 2024 marks a transformative period for the smart home industry. The potential for growth and innovation is immense with advancements in AI, a focus on energy efficiency, and a diverse ecosystem of products and services. EcoFlow's energy management solutions, LG's AI agent, and GE Lighting's bright fixtures are some of the prominent examples demonstrating the technological advancements propelling the market forward. However, addressing consumer concerns, ensuring interoperability, and adapting to regulatory changes will be crucial for the market's sustained expansion and evolution towards more intelligent, intuitive living environments.

Smart Home & Appliances

Market Overview

Global Smart Homes Market Outlook

The smart home market is at a pivotal juncture, with forecasts predicting exponential growth through 2030. In 2023, the market was estimated to be valued at USD 134.8 billion. It is projected to reach USD 154.4 billion by 2024 (Statista), highlighting the global promising interest and investment in smart home technologies. This valuation highlights the current demand and sets the stage for an expected increase in market value, which is projected to reach up to USD 231.6 billion by the end of 2028 (Statista). The compounded annual growth rate (CAGR) is 10.67%, highlighting an optimistic and robust market outlook.

Several key drivers anchor this remarkable trajectory. Firstly, the advancements in IoT and AI technologies have been pivotal. These technological strides have enhanced smart home devices' functionality, efficiency, and user experience, making them more appealing to a broader audience. Secondly, there's a rising global focus on energy efficiency and sustainability. Smart home technologies are at the forefront of this movement, offering solutions that reduce energy consumption and promote sustainable living. Finally, the integration and interoperability of smart home devices have significantly contributed to market growth. As these technologies become more harmonized, users can enjoy a seamless smart home experience, which, in turn, will drive increased adoption.

While almost all the various segments of the smart home market are experiencing growth, Smart Appliances, Control & Connectivity, and Security remain the top three segments, making up nearly 75% of the market value. The continuous growth in the Smart Appliances market over the forecast period is driven by an anticipated sharp decline in cost.

The upcoming period also suggests an era of diversification and innovation within the smart home sector. Consumer demands become more sophisticated as the market matures, pushing companies to innovate continually. This dynamic is expected to introduce new products and services, further enriching the ecosystem and fostering growth. Additionally, the market's evolution will likely be characterized by increased affordability and accessibility. As technology advances and production costs decrease, smart home solutions will become more accessible to a broader demographic, driving market growth.

The current size and forecasted growth of the smart home market reflect technological innovation, environmental consciousness, and consumer demand for convenience and efficiency. This market is poised for expansion and a transformation that could redefine home living.

Regional Outlook

The smart home market in North America is characterized by its maturity, focusing on enhancing convenience, energy efficiency, and security. The region boasts significant strides in integrating AI and voice control, primarily through devices like Amazon's Echo™ and Google Home, which have become household staples. This advancement is propelled by consumers prioritizing compatibility between different devices and systems, aiming for a seamless smart home experience. Despite its advances, the market continues to face increased challenges related to privacy concerns and the complexity of device setup, which requires a certain level of IT expertise. However, growth persists, driven by declining device prices and partnerships between tech companies and homebuilders, aiming to make smart homes accessible to a broader audience. Recent developments include Google's introduction of 'Matter Support' to boost device interoperability and Apple's HomePod®, which can monitor indoor climates, showcasing the ongoing innovation within the region.

Europe's smart home market thrives on a solid commitment to sustainability and energy efficiency. Governmental incentives and a collective drive towards sustainable living practices significantly influence the region's focus. Smart meters and energy management systems are particularly popular, catering to the demand for devices that reduce energy consumption. Additionally, there's a growing trend towards enhanced home security systems. This increase is partly driven by regional conflicts and geopolitical tensions, which, along with shifting migration patterns, have led to a rise in domestic crime rates. Consequently, there's a heightened demand for advanced security products, including surveillance cameras and motion sensors, to ensure household safety. Moreover, the aging population in Europe represents another critical segment, with smart home solutions focusing on safety and accessibility to cater to their needs. Companies like Bosch (Home Connect®) and Siemens (energy-focused solutions) are among the key players, alongside specialized companies like Tado° (smart thermostats), Somfy (connected blinds), and Netatmo (security/monitoring). It's important to note that while the EU has overarching frameworks, regulatory differences across member states can sometimes hinder seamless cross-border device compatibility. Recent developments include Bosch partnering with EU initiatives on standardized energy-efficient solutions, Siemens' new smart appliance line focused on kitchen integration, and Tado° expanding energy-saving partnerships with utility companies. These efforts reflect the dynamic nature of the European smart home industry, which continues to evolve in response to consumer demands and broader societal changes.

The Asia Pacific region, spearheaded by China, boasts the most dynamic smart home growth globally for 2024. This is fueled by increasing disposable income, extensive government-backed smart city initiatives, and a highly tech-savvy population. India and South Korea are significant markets, demonstrating strong demand for convenience-focused and personalized smart home experiences. Companies like Xiaomi (China, affordability focus), Haier (China, strong appliance base), Samsung and LG (South Korea, innovation leaders), and Panasonic (Japan, known for reliability) are dominant players. Unique to this region is the uneven economic landscape, which is expected to contribute to variation in adoption rates. At the same time, China might see widespread uptake, but emerging markets still hold significant untapped potential. Recent developments demonstrate this trend, with Xiaomi's India expansion plans, Haier's AI-powered home solutions, and Samsung's showcasing of futuristic smart home visions at CES 2024.

The smart homes market is emerging in the Middle East and Africa, with an increasing focus on smart security systems and energy efficiency. This region is experiencing a growing demand for integrated home automation systems that offer enhanced safety features and sophisticated energy management capabilities. Companies such as Johnson Controls and Honeywell International Inc. are significant contributors, focusing on developing solutions that cater to the region's unique market needs.

Transformation in Home Living

The transformation in home living through smart home technologies represents a significant shift towards more connected, efficient, and personalized domestic environments. This evolution is marked by several key trends, with notable contributions from industry-leading companies and recent developments showcasing the rapid advancement in this sector.

Convenience and Energy Savings

The adoption of smart home technologies is primarily motivated by the desire for convenience and energy savings. Devices that allow for remote control and automation of daily routines, such as smart lighting systems, thermostats, and appliances, have become increasingly popular. These devices allow users to control their home environment from their smartphones and learn from user habits to optimize settings for energy efficiency.

Philips Hue for lighting and Nest® Thermostat by Google are leading examples in this domain. Philips Hue offers extensive options for smart lighting, including routines and ambiance settings, while the Nest® Thermostat learns schedules and adjusts heating and cooling to save energy.

Proactive Adjustments and Personalization

With advancements in AI, smart home appliances can now learn user routines and make proactive adjustments. For example, smart thermostats adjust the temperature based on the time of day or occupancy, and smart fridges can keep track of groceries and suggest recipes. LG's ThinQ™ platform integrates AI to enable its appliances, like refrigerators and washing machines, to learn and adapt to users' habits, enhancing convenience and efficiency.

Voice Assistants and Hands-Free Control

Voice assistants like Amazon's Alexa™ and Google Assistant have become central to the smart home experience. They offer hands-free control over a wide range of connected devices. Their integration into smart speakers and other home devices facilitates seamless interaction with the smart home ecosystem.

Amazon has introduced Alexa™ features that make it easier for users to interact with their smart homes, including routines initiated by a single command. Google, similarly, has been enhancing the Assistant's ability to understand and process natural language, making it more intuitive for users to control their smart homes.

Health and Wellness Monitoring

Smart home devices are increasingly used to monitor health and wellness, offering functionalities like sleep tracking, medication reminders, and even air quality monitoring. These devices are especially beneficial for seniors or individuals with chronic conditions, providing caregivers and family members peace of mind.

Withings, a global consumer products company, offers a range of health-oriented smart home devices, including smart scales and health monitors, which integrate seamlessly into the home environment. Now owned by Google, Fitbit has extended its health monitoring capabilities into the smart home, with its wearable devices offering features like sleep tracking and heart rate monitoring.

Sophisticated Security Systems with Computer Vision

Advancements in computer vision have allowed for the development of more sophisticated security systems for smart homes. These systems can recognize objects, detect people, and even control gestures, offering enhanced security and personalization options.

Ring, an Amazon company, is one of the key players integrating computer vision into its doorbells and security cameras, offering features like motion detection and facial recognition. Arlo cameras also feature advanced object detection algorithms, capable of distinguishing between people, animals, vehicles, and packages, providing users with precise alerts about their home environment.

Market Growth Enablers

Energy efficiency: Potential savings with smart appliances are appealing to eco-conscious consumers

The demand for energy efficiency is a pivotal driver in the adoption and evolution of smart home technologies. This drive is fueled by the growing environmental consciousness among consumers and the practical allure of reducing utility bills. Smart thermostats, lighting, and appliances embody the nexus of this trend, offering both tangible cost savings and a pathway to a more sustainable lifestyle.

Smart thermostats, such as Nest® (Google) and Ecobee, are at the forefront of this movement. These devices optimize heating and cooling systems based on the users’ habits and preferences, potentially offering significant savings on energy bills. For instance, the Nest Learning Thermostat saves users an average of 10% to 12% on heating bills and up to 15% on cooling bills. Such savings make these devices eco-friendly choices and financially wise investments over time.

Within smart lighting, Philips Hue™ and LIFX offer solutions beyond mere convenience. These smart bulbs can adjust brightness and color temperature based on the time of day or specific user settings, contributing to energy savings and enhancing the overall living environment. Their ability to be remotely controlled and programmed to turn off when not needed further underscores their efficiency benefits.

Smart appliances, including LG and Samsung refrigerators, washers, and dryers, have also embraced energy efficiency. These appliances often feature eco-friendly modes that reduce energy and water usage without compromising performance. For example, many modern washing machines now have load-sensing technologies to adjust water levels and wash times, conserving water and electricity.

The drive towards energy efficiency in the smart home sector is supported by various incentives and rebate programs offered by utility companies and governments, encouraging the adoption of these technologies. This, combined with the increasing consumer demand for sustainable living practices, ensures that energy efficiency remains a crucial driver of smart home technology adoption and innovation.

This focus on energy efficiency aligns with global sustainability goals. It provides practical benefits to consumers, making it a significant and enduring driver of the expansion of the smart home market.

Accessibility and affordability: Devices are getting affordable, and interfaces are becoming more straightforward with a focus on user experience

The smart home market is experiencing a significant transformation driven by enhanced accessibility and affordability of devices. This evolution is marked by a concerted effort from manufacturers to lower the price points of smart home devices, making them accessible to a broader audience. Moreover, the emphasis on simplifying user interfaces stresses a commitment to ensuring that these technologies can be quickly adopted and used by people with varying levels of tech-savviness.

Companies like Xiaomi and Wyze are leading the charge in offering high-quality smart home devices at competitive prices. Xiaomi, for instance, provides a broad range of affordable smart home gadgets, including lights, sensors, and cameras, that integrate seamlessly with other devices within its ecosystem. Similarly, Wyze has gained popularity for its budget-friendly smart cameras and sensors, making home security and automation more accessible to the average consumer.

The focus on user experience is evident in the design of smart home device interfaces. Companies are investing in developing intuitive apps and control panels that simplify the setup and management of smart home ecosystems.

Edge Computing: Enabling faster response times, reduced latency, and improved privacy

Edge computing is emerging as a critical technological driver in the smart home domain. It addresses the limitations of cloud-based systems by processing data closer to where it is generated. This shift enhances the smart home experience by enabling faster response times, reducing latency, and improving privacy.

Amazon and Google are incorporating edge computing capabilities into their smart home devices to enhance performance and user experience. Amazon's newer Echo™ devices are equipped with local voice control processing, allowing them to respond to basic commands even when the internet connection is down. Google's Nest® devices, similarly, are leveraging edge computing for faster processing of video footage, enabling more efficient and responsive security monitoring.

The integration of edge computing in smart home technologies also addresses privacy concerns by minimizing the amount of data that needs to be sent to the cloud for processing. This means sensitive information, like video footage from security cameras, can be analyzed locally, with only relevant information or alerts being transmitted, enhancing user privacy.

In conclusion, edge computing is not just an enhancement of smart home technology; it's a paradigm shift that promises to make smart homes more responsive, efficient, and secure, meeting the growing consumer demand for quicker, more reliable, and private smart home solutions.

Partnerships: Homebuilders, telecoms, and tech giants collaborate for seamless smart home offerings

Strategic partnerships among homebuilders, telecommunications companies, and technology giants to deliver seamless smart home solutions significantly bolster the smart home market. These collaborations lower the entry barriers for consumers, making smart homes more accessible to a broader audience. Homebuilders, for example, are increasingly integrating smart home technologies directly into their new constructions, offering buyers homes that are smart-ready from the get-go.

A prime example of this trend is the partnership between Lennar and Ring, which created "Lennar Communities Connected by Ring.” This initiative integrates Ring's security systems and smart devices into new Lennar homes, all managed through the Ring app. These homes feature Level smart locks, Honeywell Home thermostats, and Flo by Moen smart water shutoffs, greatly enhancing their safety and functionality. Moreover, SmartRent's collaboration with various homebuilders, including Lennar, underscores the integration of smart technologies into new residential developments.

Additionally, the partnership between Josh.ai and Control4 stands out as a critical integration in the smart home automation space. This collaboration ensures that Josh.ai's advanced voice control systems work seamlessly with Control4's comprehensive automation platforms, providing users with a cohesive and intuitive smart home experience. This synergy allows for streamlined voice-activated control of lighting, security, entertainment systems, and more, reflecting a broader trend toward comprehensive, user-friendly smart home solutions.

Telecommunications companies are making significant inroads by bundling smart home devices and services with their core internet and cable offerings. For instance, Verizon enhances the smart home experience by bundling its 5G Home Internet with various smart devices and services. Similarly, T-Mobile extends its telecommunications expertise into home security by partnering with Vivint, offering advanced smart home security services in select areas.

Improving Interoperability: Ensuring diverse smart devices connect smoothly is crucial for widespread adoption

The drive towards enhancing interoperability among diverse smart devices is crucial for the widespread adoption of smart home technologies. Smooth connections and communication between devices from different manufacturers are essential for creating a user-friendly, integrated smart home environment. Industry giants like Google, Amazon, and Apple have supported initiatives like Matter to address this challenge. Matter aims to develop and promote a universal standard for smart home device compatibility, ensuring that devices, regardless of their manufacturer, can work together seamlessly.

Introducing Matter as a protocol for new connectivity standards is a game-changer for the smart home industry. It promises to simplify consumers' adding and controlling new devices within their homes, fostering an environment where devices work together. This initiative enhances the user experience and encourages further innovation and competition within the market, as manufacturers can focus more on developing unique features and functionalities rather than worrying about compatibility issues.

Market Inhibitors

Cost vs Value: Despite declining prices, smart home tech remains an added expense

The balance between cost and value remains a significant restraint in the smart home market. Despite the general trend of declining prices for smart home technologies, these systems and devices still represent an added expense for many consumers. For potential buyers, investing in smart home technology often hinges on its tangible benefits, such as energy savings and enhanced convenience. These dynamics place considerable pressure on companies within the smart home industry to develop reliable, feature-rich products that are priced at points that make the investment worthwhile for the average consumer.

Manufacturers and service providers are tasked with demonstrating the long-term value of their smart home solutions, ensuring that the initial setup costs are offset by subsequent savings or notable improvements in lifestyle. For example, a smart thermostat that can learn a user's habits and adjust heating and cooling accordingly must not only deliver on its promise of reducing energy bills but also do so at a price point that consumers find acceptable given the expected savings.

This cost-value equation is pivotal in consumer decision-making processes and influences the adoption rate of smart home technologies. As the market continues to evolve, companies are exploring various strategies to address this restraint, including offering scalable solutions that allow consumers to start with a basic setup and expand over time, thus reducing the cost of building a fully integrated smart home system.

Security Concerns: Vulnerability to hacks has been a genuine concern

Security concerns represent a formidable restraint in the expansion of the smart home market. Smart devices' vulnerability to hacks and data breaches, particularly those involving high-security devices like security cameras, poses a significant risk not only to individual privacy but also to overall consumer trust in smart home technology. News of security breaches involving smart devices can swiftly erode consumers' confidence in these products, making them hesitant to adopt such technologies in their homes.

In response, companies operating in the smart home space increasingly recognize the need for robust security protocols at every level of the smart home ecosystem. This includes the device software, their networks, and the cloud services where user data is stored. For instance, manufacturers like Ring and Nest® have implemented two-factor authentication and end-to-end encryption for their devices to safeguard against unauthorized access.

Moreover, there is a growing emphasis on regular software updates and patches to address newly discovered vulnerabilities. Companies are also investing in consumer education, emphasizing the role users play in maintaining the security of their smart homes, such as setting strong passwords and regularly updating device firmware.

To ensure the long-term success and acceptance of smart home technologies, industry players must continue to prioritize and advance security measures. By doing so, they protect their customers and sustain and enhance consumer trust in smart home technologies, which is critical for the market's continued growth.

Setup Complexities: Tech support, explicit interfaces, and compatibility across devices hold a key for future demand

Setup complexities and the learning curve of integrating smart home systems into everyday life represent another restraint to the market's growth. While strides have been made to simplify the installation and setup of these devices, many consumers still find the process daunting. The need for technical support, clear user interfaces, and compatibility across various devices from different manufacturers remains a significant hurdle for broader adoption.

Larger tech companies like Google and Amazon have leveraged their extensive ecosystems to facilitate easier integration of smart home devices. For instance, Amazon's Alexa™ and Google's Assistant® ecosystems support various third-party devices, allowing for relatively straightforward setup processes and integration. Their platforms also offer comprehensive technical support and user guides, which help mitigate the setup complexities.

On the other hand, smaller companies often face challenges in this area, primarily due to their devices' limited compatibility with other ecosystems or the lack of a robust support network. This discrepancy can lead to frustrations among users, who may find it challenging to integrate these devices into their existing smart home setups or troubleshoot issues that arise during installation.

Addressing these setup complexities is crucial for the future demand for smart home technologies. Enhancements in interoperability standards like Matter, combined with improved user interfaces and accessible technical support, determine how consumers can adopt and integrate smart home systems.

Lack of Unifying Standards: Despite efforts like Matter, the market remains fragmented

The lack of unifying standards in the smart home market underscores a significant restraint that hampers its expansion. Despite commendable efforts like the introduction of the Matter protocol aimed at fostering interoperability among diverse devices, the market remains notably fragmented. Devices operating on niche protocols or part of legacy systems often find themselves isolated and unable to communicate with newer, more modern technologies. This fragmentation limits the expansion options for existing smart home setups and complicates the user experience as consumers navigate the compatibility maze when adding new devices to their ecosystems.

This fragmentation highlights the critical importance of open standards and the need for companies to prioritize interoperability in their design philosophy. Open standards promise a future where smart home devices, regardless of their manufacturer, can seamlessly connect and communicate, offering consumers a truly integrated and cohesive smart home experience. The role of initiatives like Matter cannot be overstated in this context. By providing a universal connectivity standard, Matter represents a significant step forward in addressing the interoperability challenges that have long plagued the smart home market.

However, widespread adoption and commitment from across the industry are essential for these efforts to realize their full potential. Large and small companies must embrace these standards and design their products with interoperability as a prime focus. This will enhance the consumer experience by simplifying setup and integration and pave the way for more innovative and expansive smart home ecosystems in the future.

Dependence on High-Speed Internet Infrastructure: Smart home devices are only as "smart" as their connections allow

The effectiveness and efficiency of smart homes are inextricably linked to the reliability and speed of their internet connections. As these homes rely heavily on continuous and stable broadband access for optimal functionality, any disruption in internet service can significantly hamper their capabilities, leading to a less-than-satisfactory user experience. This dependence on high-speed internet infrastructure presents a notable restraint in areas with inconsistent broadband access or network outages.

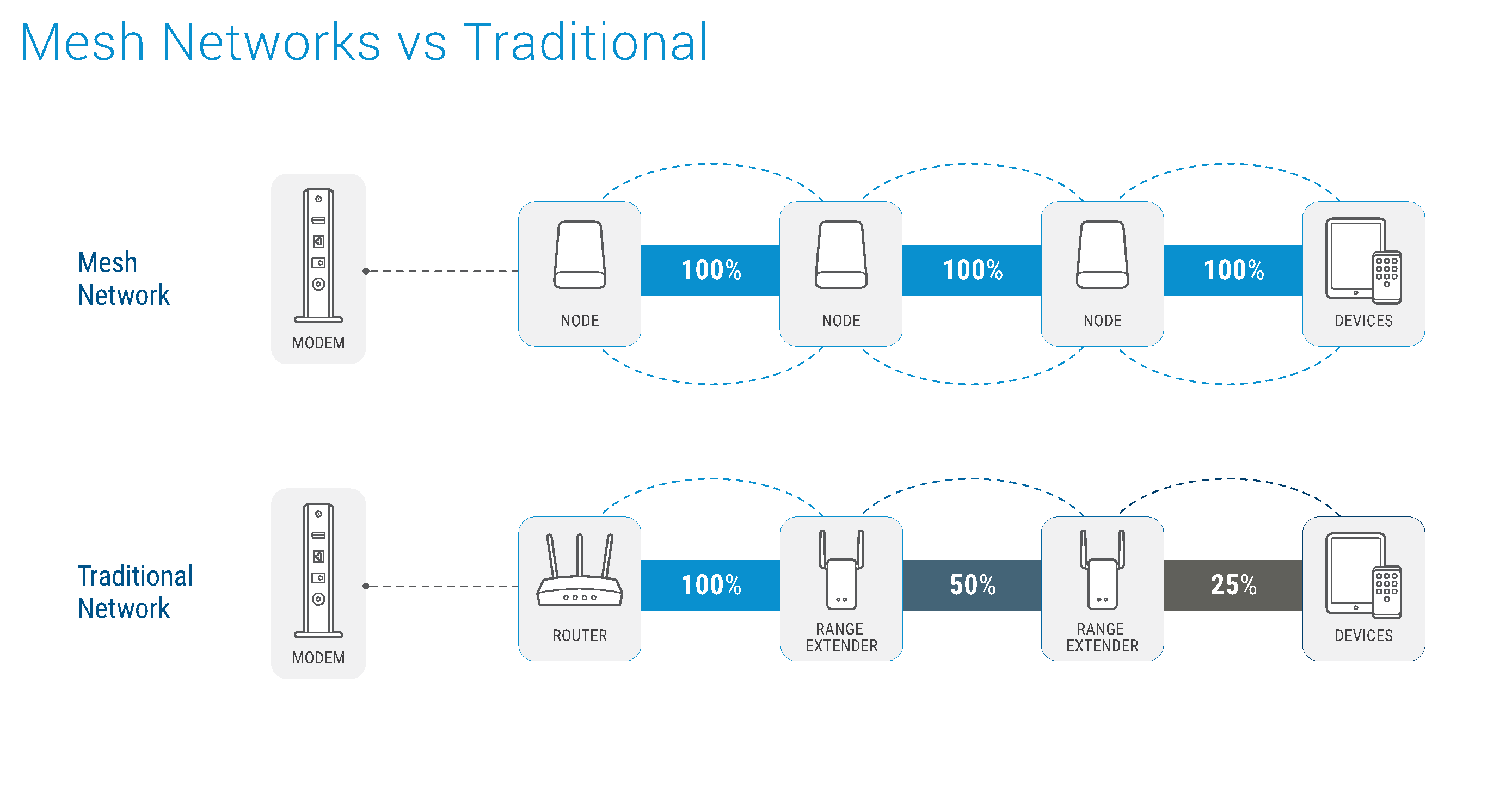

Companies are exploring innovative solutions such as mesh networking technologies and local processing capabilities to mitigate these challenges. Google Nest® Wi-Fi is a prime example of how mesh networking can enhance internet connectivity within the home. By creating a network of interconnected routers, mesh systems ensure comprehensive coverage, reducing the likelihood of dead spots and supporting the seamless operation of smart devices throughout the home.

Furthermore, the adoption of edge computing, where data processing occurs closer to the data source (i.e., within the smart devices themselves), presents another viable solution to this restraint. By enabling local processing, smart home devices can continue to operate effectively even without an internet connection, ensuring that essential functions remain unaffected during outages.

Competitive Landscape

The smart home market is characterized by a dynamic and competitive landscape, with various players from different sectors innovating and contending for dominance. This landscape can be broadly categorized into three segments: traditional home players, tech giants, and specialized providers.

Smart Home & Appliances

Supply Chain

The smart home industry stands at a pivotal juncture, propelled by rapid technological advancements and evolving consumer preferences. Amidst this dynamic landscape, suppliers and manufacturers are tasked with innovating to meet market demands while ensuring the resilience of their supply chains amidst global uncertainties.

This industry is infamous for its short product lifecycles, a market characteristic that presents significant challenges in supply chain management. Maintaining an efficient and responsive supply chain becomes crucial in this fast-paced environment, where brands often produce a product for a single manufacturing run before advancing to the next innovation. As demand for smart home devices and appliances surges, the pressure on the supply chain intensifies. Responding to market demands, Chip suppliers may prioritize producing microcontrollers, memory chips, connectivity devices, and sensors tailored for smart home technologies. Concurrently, the production of components for other industries witnessing a decline in demand might be scaled back. These dynamics underscore the critical nature of agile and strategic supply chain management in navigating market fluctuations.

Companies with robust supplier relationships and advanced supply chain management systems gain a significant advantage in such a competitive landscape. These strengths can lead to market consolidation, as larger companies with more resources are better positioned to absorb disruptions and maintain their market presence.

The aftermath of the pandemic and geopolitical tension tested the resilience of supply chains across industries. Still, smart home devices and appliance Original Equipment Manufacturers (OEMs) experienced a relatively swift recovery in semiconductor availability. With the industry's tendency towards short product lifecycles, OEMs frequently incorporate the latest technology components into their devices, positioning them for quicker adaptation and recovery in the face of supply chain challenges.

Also, the COVID-19 pandemic disrupted the supply chain of smart home products while prompting an accelerated digital transformation. Companies such as Amazon and Google experienced logistical challenges yet benefited from a surge in demand as remote work and smart home installations became more prevalent. Similarly, Philips Hue acknowledged these challenges but capitalized on the growing interest in home automation. This period highlighted the critical role of connectivity and smart technologies in modern living, driving an aggressive scaling of production across the industry.

However, this rapid expansion led to unintended consequences, including excess inventory in specific segments by 2023. For example, Samsung Electronics adjusted its production lines to address overstock, particularly in smart TVs and home appliances, reflecting a broader industry trend of recalibrating strategies in response to fluctuating demand. Towards the end of 2024, companies are expected to move towards a 'just-in-case' approach, maintaining strategic buffer stock. Integrating AI and predictive analytics will be crucial for pinpointing potential bottlenecks, allowing for rapid rerouting and contingency planning.

The resilience of the smart home supply chain has been rigorously tested, from semiconductor shortages to the volatile prices of raw materials. Yet, the industry has demonstrated remarkable adaptability, identifying new growth avenues and strategies to enhance profitability. The pandemic accelerated the adoption of smart home technologies and underscored the importance of robust supply chain management and strategic foresight.

As the industry moves forward, suppliers find themselves at a critical juncture where embracing innovation is not merely advantageous but essential for survival. The smart home market will continue to evolve, driven by a commitment to innovation and a deep understanding of consumer needs. The industry's pivot towards more intelligent and integrated home ecosystems places an additional strain on suppliers, urging them to recalibrate their operations and align with the new technological paradigms. The challenges of recent years have laid a foundation for a more connected, efficient, and resilient future, marking an exciting chapter for the smart home industry.

Semiconductor Scarcity and Strategic Countermeasures

The semiconductor shortage represented a significant challenge through 2023, but it is anticipated to present fewer obstacles in 2024. However, companies are adapting through strategic countermeasures. For example, Qualcomm has been entering long-term supply agreements, explicitly focusing on IoT-optimized chips, demonstrating the industry's pivot towards securing essential components for smart home devices. Apple, traditionally reliant on high-end chips, has diversified its supplier base and invested in proprietary chip development to mitigate shortages, ensuring steady production of its smart home products, such as the HomePod mini®.

Similarly, Samsung has increased its focus on semiconductor manufacturing capabilities and chips for IoT devices, indicating a strategic shift to meet the sustained demand for smart home appliances. Meanwhile, Espressif has been at the forefront of this transformation, fueling the growth of affordable smart home gadgets with its ESP8266 and ESP32 microcontroller units. According to ING, adopting these cost-effective solutions has led to an exponential increase in production. The number of devices based on the ESP8266/ESP32 architecture is expected to double to two billion by 2026, a significant jump from none in 2013.

![]()

Supplier Relationship Transformation

The landscape of global supply chains is undergoing a significant transformation, primarily driven by the need for greater resilience and agility. The Jabil Supply Chain Survey highlights this shift, emphasizing the strategic move by Original Equipment Manufacturers (OEMs) towards adopting dual/multi-sourcing strategies. This evolution in supplier relationships is not merely a tactical response to recent disruptions but reflects a more profound recognition of the complexities within modern supply chains.

One of the survey's key findings is the marked increase in OEMs adopting multi-sourcing strategies to mitigate supply chain risks. This approach is increasingly seen as crucial for ensuring business continuity amidst uncertainties. Companies like LG Electronics exemplify this trend, actively diversifying their supplier base beyond just components. They are extending this strategy to encompass logistics services, thereby enhancing their supply chain's resilience against disruptions, be they logistical, geopolitical, or pandemic-related.

This shift towards multi-sourcing also indicates a more significant trend where companies are not only looking to spread their risks but also seeking to capitalize on innovation and competitive pricing offered by a broader base of suppliers. It's a move away from the traditional reliance on single-source suppliers, which, while potentially cost-effective, exposes companies to significant vulnerabilities if that supplier faces challenges.

Furthermore, the survey highlights the role of technology and digital tools in facilitating this transition. Advanced analytics, AI, and machine learning are increasingly being leveraged to quickly predict disruptions and identify alternative suppliers. This technological underpinning is critical for OEMs to make informed decisions about diversifying their supplier base without compromising efficiency or cost-effectiveness.

The Jabil Supply Chain Survey shows OEMs actively rethinking and restructuring their supply chain strategies to adapt to a new normal. By embracing multi-sourcing and investing in digital capabilities, companies are not just looking to survive the next disruption. Still, they are positioning themselves to thrive in an ever-changing global market.

Reshoring and Nearshoring: Strengthening Supply Chain Resilience

As the smart home industry accelerates globally, companies within this sector are progressively embracing reshoring and nearshoring strategies to enhance their supply chain efficiency and resilience. This strategic shift is motivated by a desire to mitigate financial risks, respond to consumer demands more swiftly, and adapt to the rapidly changing technological landscape. By shortening supply chains, these strategies aim to lower logistics costs in an era of increasing unpredictability and to bolster supply chain durability against potential disruptions. This trend toward bringing manufacturing closer to consumer markets directly responds to the recent logistical challenges and economic uncertainties, including the global pandemic and the resulting supply chain bottlenecks.

However, the journey towards reshoring and nearshoring presents challenges, especially in ensuring the availability of a robust supply base and skilled labor force required for the sophisticated smart home technology sector. Establishing such operations, for instance, in regions like Mexico or within the U.S., requires overcoming hurdles related to capacity constraints and the need for highly specialized technical expertise. The industry's pivot from prioritizing cost minimization to emphasizing supply chain resilience and flexibility marks a significant strategic realignment.

The smart home sector's specific challenges and priorities underscore the critical need for this transformation. With the dual objectives of boosting performance and facilitating process enhancements, the industry is ripe for operational innovations and digital transformations. One illustrative example is the U.S. government's policies incentivizing domestic production of critical smart home components, such as semiconductor chips, through legislation like the CHIPS Act. This initiative aims to bridge the domestic production gap and stimulate significant investments in semiconductor manufacturing, a vital component of smart home devices.

Moreover, the global transition towards more sustainable and energy-efficient homes drives investments in domestic manufacturing of green technology components, including smart thermostats, energy management systems, and advanced lighting solutions. Companies are increasingly considering the environmental impact of their supply chains, aligning with consumer expectations for sustainable products.

In summary, the shift towards reshoring and nearshoring in the smart home industry represents a comprehensive strategy to secure supply chains against future disruptions, optimize costs, and swiftly adapt to new technological advancements and consumer expectations. As companies in this sector navigate through these changes, the emphasis will likely remain on achieving a balance between cost, efficiency, and resilience, thus maintaining a competitive edge in an industry characterized by rapid innovation and evolving consumer demands.

Global Supply Chain Evolution: Embracing the Regional Optionality Strategy

In the evolving landscape of the smart home device and appliance industry, brands are increasingly adopting the Regional Optionality strategy to ensure supply chain resilience and reduce dependency on China. This strategic approach entails maintaining existing operations in China while expanding production facilities to other countries.

This strategy stems from a desire to mitigate risks associated with geopolitical tensions and trade uncertainties involving China. By diversifying production, companies aim to create a more stable supply chain that can adapt to changing global dynamics.

Critical destinations for this expansion include Vietnam, Thailand, the Philippines, India, and Malaysia. These countries are attractive due to their labor availability, supportive government policies, and geographical proximity to crucial Asian markets. This proximity is especially beneficial as it provides access to essential mechanical and electronic component supply ecosystems, an advantage not as readily available in regions like Central or South America or Eastern Europe.

However, implementing the Regional Optionality strategy comes with its own set of challenges. Companies must engage in meticulous planning and execution, assessing the risks and benefits of establishing operations in new countries. They must also ensure that the necessary infrastructure and resources are in place to support expanded operations.

Beyond Asia, firms are exploring further global diversification, with Mexico and Eastern Europe emerging as popular options in the broader scope of the Regional Optionality strategy. This international approach not only enhances supply chain robustness but also opens up new markets and opportunities for growth in 2024 and beyond.

The Regional Optionality strategy, embraced by leading contract manufacturers and brands alike, symbolizes a shift toward a more distributed and flexible manufacturing model. As the geopolitical and economic landscapes evolve, this strategy will likely become integral to the industry's global manufacturing and supply chain management approach.

Impact of AI on Supply Chain

In the face of a complex and disrupted global supply chain, artificial intelligence (AI) is a powerful tool for streamlining operations and enhancing efficiency. Jabil’s 2024 Supply Chain Resilience Survey showed that nearly 200 supply chain and procurement decision-makers from some of the world’s leading product brands are planning for and already using AI in their day-to-day processes. The insights provided by the participants highlight critical best practices for successfully integrating AI within supply chain operations.

- The surge in AI applications within supply chain management largely concentrates on enhancing demand planning and inventory management. By leveraging predictive analytics, organizations aim to improve forecasting accuracy and efficiency, optimize resource distribution, and address the imbalance between supply and demand.

- A "data-first" mentality is critical for harnessing AI's full potential in supply chain operations. Success hinges on establishing a robust data management infrastructure and governance framework before deploying AI tools. This foundation ensures data reliability and fosters meaningful insights, underscoring the importance of collaboration and data sharing among stakeholders.

- Preparing the workforce for AI integration involves addressing potential concerns about job displacement and emphasizing AI's role in augmenting human skills. By providing training and hands-on experience with AI technologies, companies can facilitate a smooth transition towards more automated and efficient supply chain processes.

Smart Home & Appliances

Technology Trends

Technology Overview

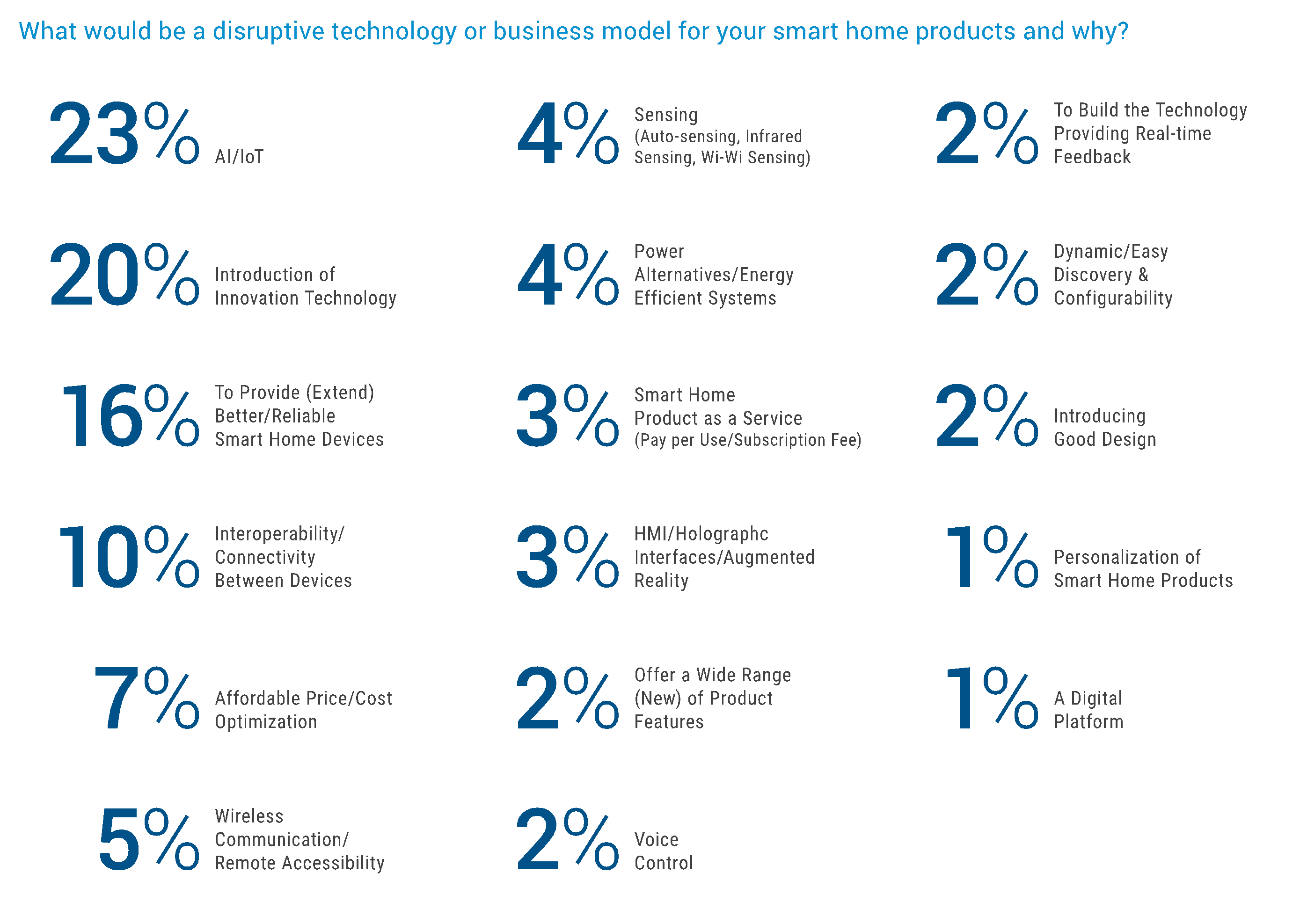

Smart home solution brands consider IoT platforms and AI (23%) as the most significant disruptive technologies to their product development, per a Survey on ‘Smart Homes Technology Trends’ sponsored by Jabil. The survey was conducted among 200+ decision-makers at the smart home device and appliance OEMs. For brands, “disruptive” business models involve interoperability — products connect seamlessly within an existing smart home to increase ease of use and accessibility for consumers — as well as cost optimization strategies to increase consumer adoption. “AI will be our disruptive technology as AI will help collect data from home automation devices, predict user behavior, provide maintenance data, [and] help enhance data security and privacy,” said one respondent. Regarding connectivity, developers want to “improve product interoperability standards, which will help win more customers.” “The biggest [disruptor] would be in ease of connection and set up,” adds another. “We see many connected products sold that the customer never connects.”

Internet of Things (IoT) Connectivity

The IoT Connectivity trend in the smart homes market is evolving rapidly, shaped by technological advances and the integration of new standards. Advent of Matter represents a significant leap towards universal compatibility among smart home devices. As an industry-unifying standard, Matter ensures that devices from different manufacturers, such as lights, thermostats, fridges, and coffee makers, can seamlessly communicate with each other across diverse ecosystems. This development is fueled by collaborations among tech giants like Google, Amazon, and Apple, promising to simplify the user experience in managing smart home environments.

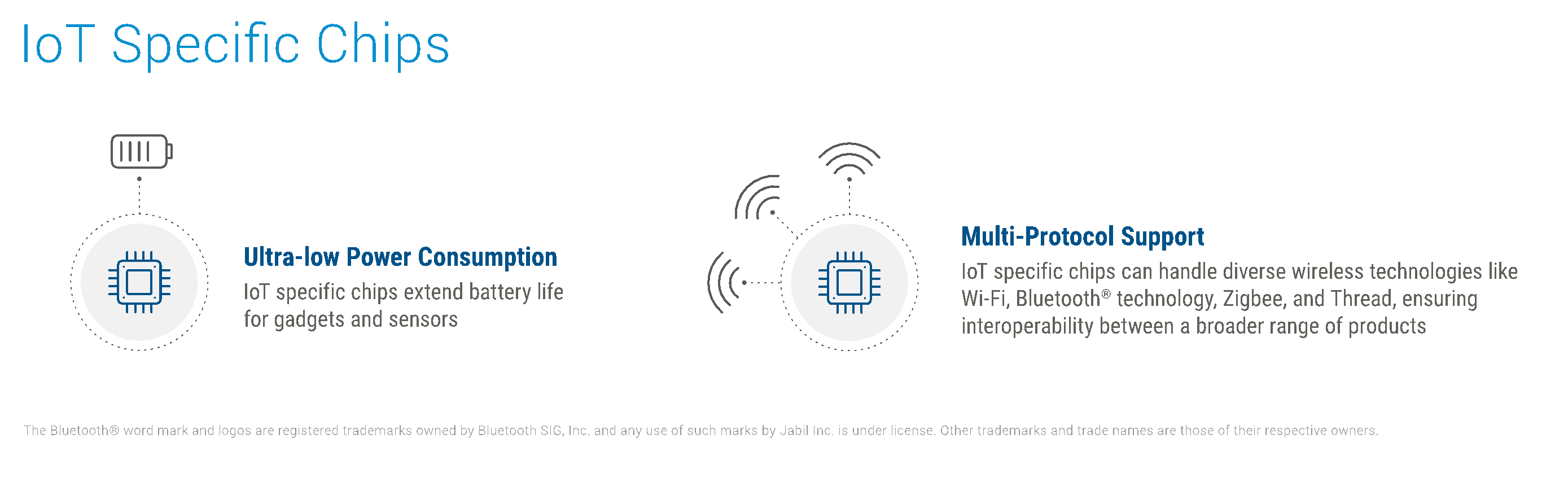

Leading companies like Qualcomm, Broadcom, and Silicon Labs are developing IoT-specific chipsets. These chipsets are designed to be power-efficient and support a broad range of wireless protocols essential for the functionality of smart home devices. The progression in chipset technology is pivotal for enabling seamless communication among various devices, laying the groundwork for more interconnected and efficient smart homes.

The landscape of IoT connectivity is expanding beyond traditional Wi-Fi, incorporating 5G, Wi-Fi 6, Low-Power Wide-Area Networks (LPWAN), and satellite technologies. Each of these technologies plays a crucial role in enhancing the functionality and reliability of IoT networks:

- 5G offers high-speed data transfers and robust connections, essential for real-time data capabilities in smart homes, healthcare, autonomous vehicles, and smart cities.

- Wi-Fi 6 significantly improves bandwidth potential, which is especially beneficial for smart home IoT networks by ensuring faster and more reliable communication between devices.

- LPWAN technology stands out for its effectiveness in connecting low-bandwidth devices over large areas, offering energy efficiency and cost-effectiveness for a vast deployment of IoT devices.

- Satellite connectivity emerges as a solution for geographically separated networks, providing vital services in areas lacking traditional infrastructure.

As the IoT ecosystem expands, security and privacy concerns are increasingly paramount. The industry is responding with more sophisticated security measures, including advanced encryption methods, endpoint protection, and AI-based cybersecurity solutions. These developments are crucial for safeguarding interconnected devices and networks against rising cyber threats.

The adoption of IoT technologies is driving the transformation of urban environments into smart cities. IoT is pivotal in improving traffic management, energy usage, waste management, and healthcare services within these cities, showcasing the potential for increased sustainability, efficiency, and reduced resource wastage.

The integration of AI and machine learning with IoT devices is set to revolutionize the smart homes market shortly by enabling more intuitive and predictive functionalities. This includes enhancing operational efficiency through fault detection and predictive maintenance. Additionally, edge computing is gaining prominence by processing data closer to its source, reducing latency, and improving security, marking a significant shift towards real-time insights and optimized resource utilization.

Integration of Artificial Intelligence (AI) in Smart Homes

Artificial Intelligence (AI) integration into smart homes is progressing rapidly, transforming how humans interact within living environments. Voice assistants like Amazon Alexa™, Google Assistant®, and Apple's Siri® are central to this evolution and have become the core AI hubs for smart homes. These assistants facilitate natural language control and provide access to a wealth of information, making everyday tasks more convenient.

Beyond voice control, AI integration in smart homes extends to learning user behaviors and personalizing home automation. Systems like Samsung SmartThings analyze habits to tailor automation for lighting, temperature, and more, significantly enhancing user experience. This personalization extends to smart appliances using AI to predict maintenance needs, minimize downtime, and extend appliance lifespans.

Moreover, AI is revolutionizing health monitoring and environmental control within homes. Wearables integrated with smart home systems can monitor vital signs, alerting medical professionals in emergencies. Similarly, smart homes can now monitor air quality, allergens, and other environmental factors, ensuring a healthier living environment. These advancements are part of a broader trend towards sustainable living, with AI-optimized appliances reducing carbon footprints and utility costs.

Security in smart homes has also seen significant advancements through AI. Advanced facial recognition and motion-sensing technologies enable systems to differentiate between residents, visitors, and potential intruders, enhancing security while maintaining privacy. Furthermore, AI-powered video analytics in security cameras can detect intrusions and suspicious activities, providing homeowners with real-time alerts for immediate action.

AI's integration into smart homes contributes to more sustainable energy management. AI-enabled smart meters offer real-time insights into energy consumption, encouraging more efficient energy use. Combining renewable energy sources, AI facilitates a more sustainable power consumption model within smart homes.

Despite these advancements, integrating AI into smart homes comes with challenges, including privacy and data security concerns, device compatibility and interoperability, and the reliability of AI systems. Addressing these challenges requires ongoing collaboration between manufacturers, policymakers, and homeowners to ensure data privacy, cybersecurity, and seamless device integration.

Cloud Connectivity to Smart Home Devices

Cloud Connectivity to Smart Home Devices is becoming increasingly pivotal in the smart homes market, strengthening functionalities that define the modern, connected living experience. The essence of cloud connectivity lies in enabling remote control and monitoring, providing homeowners the luxury of managing their smart devices from any location. This technology facilitates real-time interactions and plays a crucial role in the predictive and adaptive capabilities of smart home ecosystems.

One of the most compelling aspects of cloud connectivity is its capacity for storing and analyzing historical data. By leveraging this data, AI algorithms can derive insights into user behavior and preferences, fostering the development of more intuitive and responsive smart home solutions. These insights can lead to significant optimizations in energy consumption, security protocols, and overall user experience, making homes more efficient and personalized.

Moreover, the cloud is essential for delivering over-the-air (OTA) updates to smart home devices. These updates are critical for several reasons; for instance, they can introduce new features, enhance existing functionalities, improve device performance, and address security vulnerabilities. The continuous improvement cycle facilitated by OTA updates ensures that smart home devices remain at the cutting edge of technology, offering users the latest advancements without needing physical modifications or replacements.

Looking ahead, the trends in cloud connectivity emphasize more robust security measures, such as Secure Access Service Edge (SASE), which combines comprehensive security solutions with SD-WAN capabilities to protect data across the cloud environment. This focus on security is crucial, given the sensitive nature of the data processed and stored by smart home devices. Additionally, the move towards multi-cloud optimized networks indicates a future where smart homes can seamlessly integrate with various cloud services, enhancing flexibility and scalability.

In summary, cloud connectivity is not just an enabler of remote access and control; it is a foundational technology that drives the evolution of smart homes. From enabling AI-driven insights to ensuring devices are always up-to-date and secure, cloud connectivity is at the heart of making smart homes more adaptive, efficient, and safe.

Integration of 5G Technology

Integrating 5G technology into the smart home ecosystem is expected to be a transformative leap, indicating advancements in responsiveness, connectivity, and immersive experiences. With 5G, low latency is a game-changer for smart homes, particularly for critical applications such as security systems and health monitoring devices. With latency reduced to as low as one millisecond, real-time data processing becomes a reality, significantly improving the efficiency and reliability of smart home devices. This leap in responsiveness is pivotal for applications requiring immediate action, such as emergency responses in security systems or real-time health data analysis.

The increased range and bandwidth provided by 5G technology are set to eliminate connectivity barriers, making it feasible to integrate outdoor smart devices like intelligent sprinklers and security cameras seamlessly into the home ecosystem. This expansion enables homeowners to extend the control and monitoring capabilities to the furthest corners of their property, ensuring a comprehensive smart home experience beyond indoor spaces.

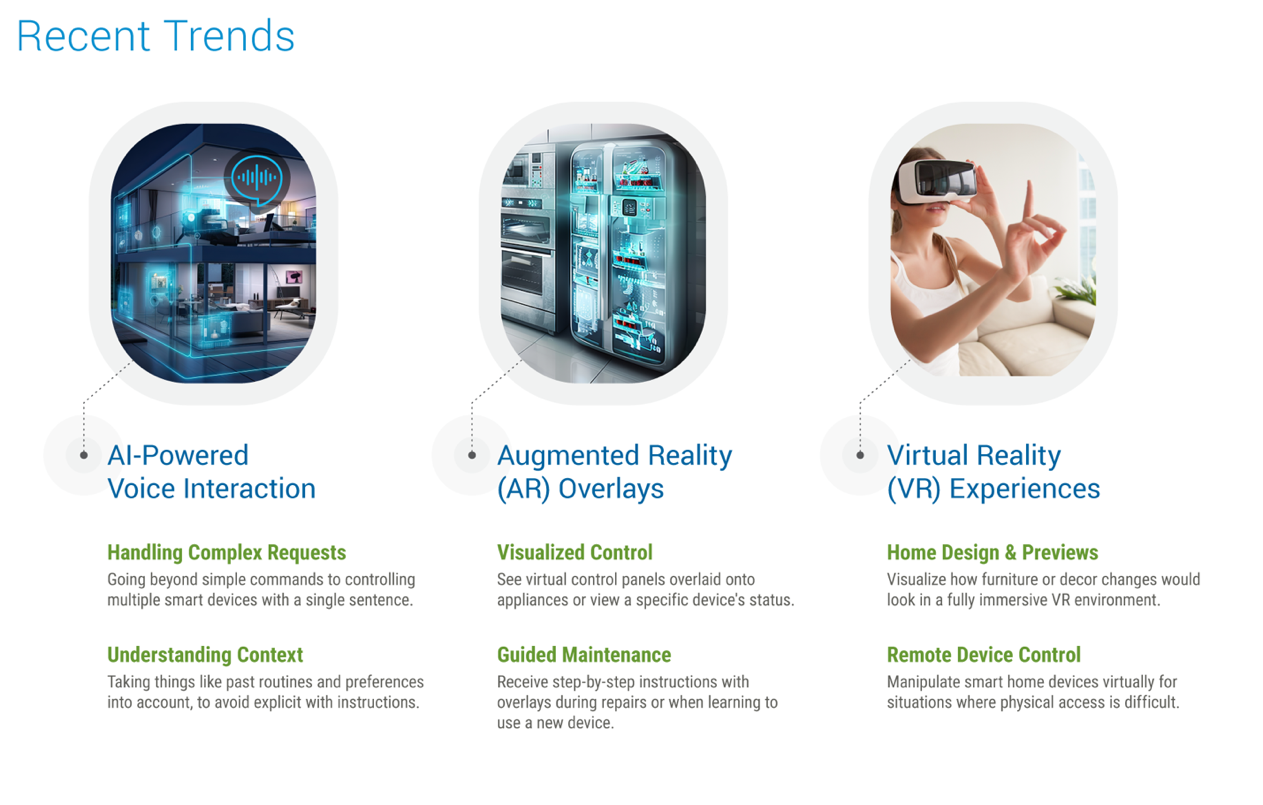

5G's capabilities also open new avenues for augmented and virtual reality (AR/VR) applications within the smart home context. Expect more immersive experiences in interior design, where AR can help visualize real-time changes and troubleshoot appliances. At the same time, VR can guide users through repair processes in a simulated environment. These advancements enhance the user experience and pave the way for innovative home entertainment and education applications.

Another significant advantage of 5G is its ability to support a higher density of connected devices within the same area than earlier generations. This capacity boost means users can add more IoT devices to their network without compromising performance, from bright lights and thermostats to advanced security cameras and sensors. Integrating more devices fosters a more interconnected and intelligent home environment, enabling intricate automation and personalization scenarios.

Lastly, beyond individual homes, 5G plays a crucial role in realizing intelligent cities, which are essentially large-scale extensions of the smart home concept. By enabling numerous devices to connect and communicate efficiently, 5G facilitates improved resource management, traffic flow optimization, and enhanced public safety. The synergy between smart homes and smart cities promises personal convenience and energy efficiency and broader societal benefits such as reduced carbon footprints and improved urban living conditions.

While the potential of 5G in smart homes is immense, it's essential to consider the challenges, including cybersecurity risks, the digital divide, and the environmental impact of deploying more devices and infrastructure. Addressing these challenges requires concerted efforts from industry players, regulators, and the community to ensure that the benefits of 5G-enhanced smart homes are achieved safely.

Mesh Wi-Fi

Mesh Wi-Fi has become a cornerstone for establishing a robust and reliable smart home ecosystem. It effectively addresses the challenge of ensuring comprehensive Wi-Fi coverage throughout the home, accommodating everything from computers and TVs to smart appliances and security systems. The technology distinguishes itself from traditional Wi-Fi extenders by creating a seamless network over a large area through multiple mesh nodes, including a central router and satellite units. This system provides a resilient network with each node communicating over a high-speed backhaul, offering multiple paths back to the router and ensuring no home area is left with weak or no signal. Recent developments of Mesh Wi-Fi systems highlight Google Nest® Wi-Fi Pro, Amazon Eero™, and TP-Link Deco XE75 for their balance of performance and seamless integration.

While Mesh Wi-Fi solves many connectivity issues, it comes at a higher upfront cost than traditional routers. Additionally, some older smart home devices might not connect easily due to the system's reliance on band steering, which could necessitate a separate Wi-Fi network for these devices. Finding the optimal node placement to ensure the best coverage can also be challenging.

While Mesh Wi-Fi solves many connectivity issues, it comes at a higher upfront cost than traditional routers. Additionally, some older smart home devices might not connect easily due to the system's reliance on band steering, which could necessitate a separate Wi-Fi network for these devices. Finding the optimal node placement to ensure the best coverage can also be challenging.

Smart Grid Technology

Integrating Smart Grid technology in smart homes transforms energy generated, consumed, and managed, leading to more efficient and sustainable living environments. The cornerstone of this transformation lies in advancements in battery technology, energy monitoring and management through smart meters, the application of Artificial Intelligence (AI), and the development of smart appliances. Additionally, the shift towards grid flexibility and increased interoperability among devices further enhances the efficiency and functionality of smart homes.

Recent advancements in battery technology have resulted in more efficient batteries with higher energy densities and longer lifespans. This paves the way for homes to consume, store, and manage energy more effectively. This includes the potential for homes to feature their own electric vehicle charging stations, encouraging the adoption of electric vehicles.

The trend towards increased collaboration and interoperability among smart home devices aims to overcome challenges like vendor lock-in and fragmented user experiences. By developing and adopting open standards, the industry is moving towards a future where smart home devices from different manufacturers can work together seamlessly, enhancing the user experience and overall efficiency of smart home energy systems.

The integration of smart homes into the smart grid is mutually beneficial. Homeowners gain the potential for lower energy bills and increased resilience while the utility grid becomes more efficient and better equipped to handle growing demands. This mutual relationship is expected to play a pivotal role in the smart home landscape in the near future, driving greater energy awareness, cost optimization, and sustainability.

Cybersecurity in Smart Homes

As smart homes evolve, integrating a multitude of connected devices, cybersecurity has become a paramount concern, demanding an approach that matches the sophistication and complexity of the threats. Adopting enterprise-grade IT networking and security practices within smart home ecosystems is not just a trend but a necessity post-2024. This integration signifies a move towards more secure, reliable cybersecurity solutions and practices, with IT principles such as network segmentation and firewalls becoming standard components of smart home setups.

Manufacturers are responding to these needs by offering advanced networking equipment designed for the smart home channel, allowing integrators to offer their cybersecurity services. This shift is evident in the transformation of residential networks, which now mirror their commercial counterparts in capabilities. This transition is driven by large automation companies and exemplified by brands like Snap One’s Access Networks. This change highlights the importance of adopting enterprise-grade cybersecurity practices in the smart home sector.

In addition to these advancements, the cybersecurity landscape in 2024 is defined by several key trends. The proliferation of IoT devices continues to expand the attack surface for cybercriminals, making robust security protocols and continuous monitoring essential. The industry is also witnessing a rapid adoption of zero-trust frameworks, abandoning traditional perimeter-based security models for a more secure approach that requires verification from everyone, regardless of location or device.

Governments and regulatory bodies are implementing stringent regulations to enforce better data protection practices, highlighting the critical role of compliance in cybersecurity strategies. Furthermore, with the increasing reliance on cloud services, enhancing cloud security postures has become a priority.

These trends illustrate a complex and dynamic cybersecurity landscape that smart home integrators and manufacturers must navigate. The shift towards incorporating enterprise-grade cybersecurity practices and focusing on emerging trends such as Zero Trust, cloud security, and quantum computing encryption signifies a comprehensive approach to safeguarding smart homes against cyber threats.

Human-Machine Interface (HMI)

Human-machine interface (HMI) in smart homes is advancing rapidly, with technologies like holographic projections, natural language processing, and proximity sensing playing a crucial role. These innovations are transforming how users interact with devices at home, making the experience more intuitive and seamless. For instance, home security systems now leverage AI-driven facial recognition to differentiate between residents, guests, and intruders. Voice assistants have become commonplace for controlling various home devices without physical interaction. Recent trends include:

The evolution of HMI is not just limited to these advancements. Integrating HMI with the Internet of Things (IoT) creates new possibilities for home automation. This includes more accessible, speech-based interfaces that cater to a broader range of users, including those with disabilities or technological limitations.

The future of HMI technology in smart homes is expected to unfold in several key directions:

- Intuitive Control Panels: Newer HMI panels are equipped with touchscreen interfaces that simplify operation and enhance safety and customization.

- On-Device Applications: HMIs help monitor machines' vital signs, like speed and temperature, preemptively identifying issues.

- Mobile HMIs: The use of mobile devices as interfaces for IoT systems and smart home control is growing, offering convenience and flexibility.

HMIs in smart homes are now expected to encompass a range of functionalities beyond traditional touchscreens, including voice recognition, gesture recognition, and even holographic interfaces. This diversity in HMI technology is expected to enhance user experience and open up new avenues for home automation, security, and entertainment.

Smart Home & Appliances

Jabil Insights & Strategic Considerations

Jabil Insights

At Jabil, our insights into the smart homes market reveal a trajectory of growth and diversification that we find both promising and pivotal for future developments. Our market analysis draws from a solid established performance baseline, laying the groundwork for a strategic forecast and an actionable roadmap.

The smart home market is experiencing a paradigm shift, marked by rapid technological advancements, evolving consumer preferences, and strategic market maneuvers by key players. This landscape offers a holistic view of opportunities, challenges, and transformative trends shaping the future of intelligent living. The smart home market is poised for exponential growth, driven by the confluence of several pivotal factors.

Leading the charge, companies like Google (with its Nest® products) and Amazon (through Alexa™ enabled devices) continue to innovate, making smart homes more intuitive and integrated. Adopting AI and IoT technologies enhances user experiences through personalized and predictive functionalities, making smart homes convenient and necessary for modern living.

The ubiquity of high-speed internet, bolstered by initiatives like SpaceX's Starlink, removes connectivity barriers, enabling seamless operation of smart home devices even in remote areas. This has expanded the market potential beyond urban centers.

The emergence of standards like Matter is a game-changer, ensuring devices from different manufacturers communicate effortlessly. Companies such as Apple, Signify (formerly Philips Lighting), and Samsung are rallying behind this protocol, signaling a move towards a more interconnected and user-friendly smart home ecosystem.

We see automation and connected technologies as key drivers in the significant appliances segment, enhancing functionality and user experience. The small appliances sector is expected to flourish as consumers increasingly opt for innovative, space-saving solutions that offer convenience without compromise. For home comfort, the trend is leaning towards customizable and adaptive systems that promote well-being through intelligent climate control and ambient adjustments.

However, we see exceptional potential for growth in the outdoor home segment. Starting from a smaller base, this sector is projected to grow rapidly in the next 2 to 3 years, as per our analysis. As lifestyles continue to shift towards more integrated indoor-outdoor living, innovative technology is expanding beyond the confines of the home. From intelligent lighting and weather-responsive systems to smart gardening tools and outdoor entertainment technology, consumers are increasingly looking to bring convenience and control over indoors to outdoor spaces.

In projecting the course of the smart homes market, Jabil envisions a landscape where seamless integration and intelligent design become the standard. Our strategic approach does not simply track these trends. Still, it is actively set to leverage Jabil’s capabilities to meet and anticipate consumer needs, staying ahead of the curve in a rapidly evolving market.

Despite the promising growth trajectory, the market is not without its challenges. The discretionary nature of smart home investments means that economic downturns could impact consumer spending. However, companies like Honeywell and Bosch are countering this by emphasizing energy efficiency and cost savings, appealing to consumers' desire to reduce utility bills. Geopolitical tensions and global supply chain disruptions pose risks. To tackle that, companies are adopting a "China +1" strategy and exploring local manufacturing options to mitigate these challenges. For instance, Amazon has diversified its Echo™ device production lines to include countries like India, enhancing supply chain resilience.

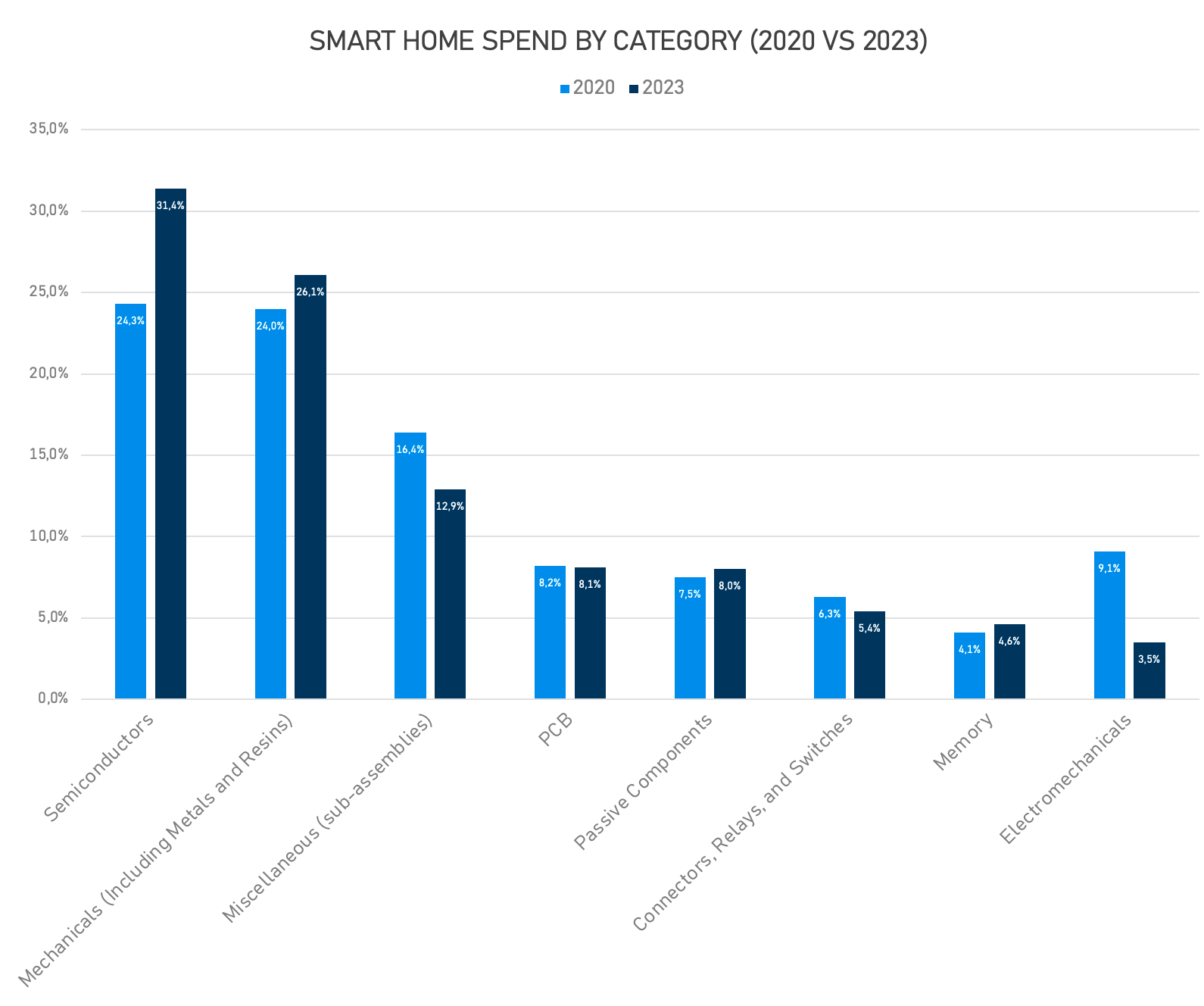

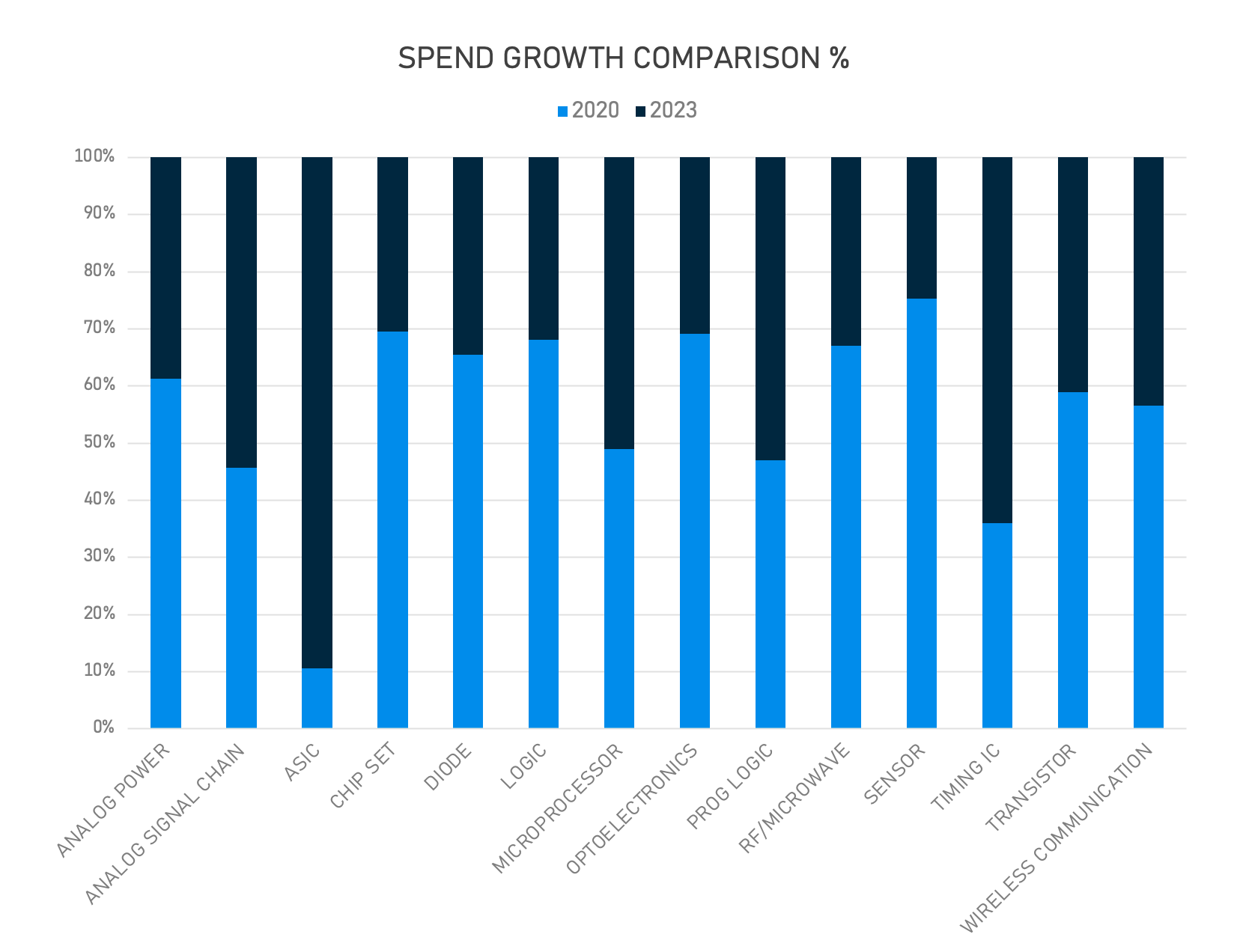

Data based on Jabil's historical spending data for the Smart Home Customer Segment

Data based on Jabil's historical spending data for the Smart Home Customer Segment

The spend (%) for Mechanical components has seen a notable dip in 2023, as compared to 2020. On the other hand, Electronics components such as semiconductor devices, PCBs, Memory, and other Miscellaneous Sub-assemblies have observed a slight growth in demand. This trend indicates the electrification of Smart Home infrastructure. Semiconductor devices are essential to smart homes, acting as the brains, senses, and communication links of various devices. They enable sensing (motion, temperature, etc.), processing (microcontrollers), and connectivity (Wi-Fi, Zigbee). Additionally, they manage power, create user interfaces, and secure the smart home network, showcasing their diverse roles in making homes intelligent and automated.

Strategic Considerations

To navigate the 2024 landscape successfully, as per Jabil analysis, the smart home companies should consider several strategic factors:

- Interoperability as a Success Factor: While not without challenges, initiatives like Matter will continue to drive smart home adoption. The Matter standard, backed by the Connectivity Standards Alliance (which includes Google, Amazon, Apple, and others), promises to break down compatibility barriers between devices from different manufacturers. This simplifies the experience of building a truly integrated smart home.

- Consumer-Centric Offerings: It is crucial to integrate features addressing security, energy efficiency, and convenience. Ring (acquired by Amazon) exemplifies this approach, integrating home security cameras with bright lighting and voice commands for a comprehensive home security solution.

- Sustainability and ESG Focus: With a growing consumer emphasis on sustainability, companies like Philips Hue lead by example, offering energy-efficient lighting solutions and emphasizing their commitment to environmental responsibility. Further, Nest® (Google) and Ecobee leverage sensors and AI to fine-tune home climate control, offering substantial energy savings potential. Schneider Electric moves beyond single devices with whole-home energy monitoring and automation, catering to rising sustainability demands.

- Circular Supply Chains and Device Recycling: As the smart home market expands, it becomes crucial to address the lifecycle of electronic devices through circular supply chains. This approach minimizes waste and supports sustainability by facilitating the recycling and repurposing of components. Companies like Samsung have already started implementing these practices by offering recycling programs and promoting the reuse of electronic parts, setting a benchmark in the industry for environmental responsibility and resource efficiency.

- Adapting to Technological Evolution: The challenge of ensuring device longevity amidst rapid tech evolution is pressing. Companies are addressing this through modular designs and over-the-air updates, as seen with Google Nest devices, allowing continuous improvement without needing physical upgrades.

- Augmented Reality (AR) and Virtual Reality (VR): Although in nascent stages, AR and VR have potential applications in smart homes. IKEA's Place app, which uses AR to help users visualize furniture in their space, hints at the future possibilities of immersive technology in intelligent living.

- Data Security and Privacy: As homes become smarter, they become more vulnerable to cyber threats. Companies like Apple are prioritizing data privacy, leveraging secure enclave technology to protect user information.

- Aging Populations and Smart Homes: The aging population is a sizable growth market, with demand for accessibility features, health monitoring, and remote support solutions within smart home systems.

- Smart Home Rentals See Growth: The rental market is increasingly integrating smart home amenities to attract tech-savvy tenants, with features like smart locks, thermostats, and lighting becoming common selling points. Regulations and standards may evolve to address this sector.

Smart Home Evolution 2024: Monetizing Innovation while Embracing Sustainability

As we navigate through 2024, the smart home devices and appliances industry stands at the forefront of innovation, offering many opportunities for long-term monetization. Original Equipment Manufacturers (OEMs) are exploring beyond traditional business models to embrace new revenue streams. These include subscription-based services, pay-per-use models, and advertising-supported models. Such approaches promise recurring revenue for OEMs and open up novel channels for financial growth.

In addition to these monetization strategies, OEMs are tapping into the wealth of data generated by smart home devices. By selling this data to third parties, they unlock another layer of revenue potential, further expanding their business horizon.

Amid these developments, sustainability has emerged as a critical focus area. Today's consumers are increasingly environmentally conscious, demanding products that align with their values. The movement towards sustainability isn't new; it has been growing for years, influencing consumer behaviors and purchases across various activities, from adopting low-energy bulbs to using energy-efficient appliances. However, the advent of smart homes has dramatically amplified this trend.

Smart homes, with their ability to optimize energy use and reduce waste, present an unparalleled opportunity for sustainability. They promise to enhance the quality of life and safeguard the environment and natural resources. As such, sustainability is no longer just a trend but a pivotal factor in consumer decision-making.

Looking ahead, these trends monetization strategies, data utilization, and a steadfast commitment to sustainability are poised to continue driving the evolution of the smart home devices and appliances market. Manufacturers are expected to refine their offerings further, convenient, efficient, secure, and eco-friendly products, meeting consumers' evolving needs and expectations in 2024 and beyond.

Back to Top