By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Sector Market Report

Mobile Devices

Sector Market Report

Mobile Devices

Get an in-depth analysis of the current state, trends, and future of the mobile devices market, including insights into key drivers, changing product lifecycles, and manufacturing challenges.

Mobile Devices Market

Introduction

The mobile device market is dynamic, with the industry constantly innovating to meet evolving consumer demand. Smartphones and tablets, the cornerstone of this market, are no longer communication tools; they've evolved into productivity powerhouses. Cutting-edge smart wearables, hearables, and clothing are redefining how humans connect with technology, offering health monitoring, augmented experiences, and seamless communication. The rise of 5G networks, advancements in artificial intelligence (AI), and the expanding Internet of Things (IoT) are accelerating the development of increasingly sophisticated mobile devices. This transformation is fueled by the desire for global connectivity, enhanced productivity, personalized experiences, and the adoption of cutting-edge technology. As mobile devices become increasingly integrated into daily life, a comprehensive understanding of this market landscape is crucial to support informed business decisions.

Mobile devices encompass a broad spectrum of portable electronic devices designed for on-the-go use, characterized by their compact size, wireless connectivity, and often incorporating touchscreens, cameras, and internet access. This diverse category includes smartphones, which serve as multifunctional hubs for communication, entertainment, and productivity; wearables like smartwatches and fitness trackers, worn on the body to monitor health and provide notifications; tablets, larger devices optimized for multimedia consumption and light work; smart headsets/hearables, offering enhanced audio experiences and hands-free communication; and smart clothing, a burgeoning field where garments are embedded with technology to track fitness, monitor health, and even react to environmental changes. Mobile devices have become indispensable tools in modern life, integrating into daily routines and reshaping how one interacts with technology and the world.

Scope of work:

-

Smartphones

-

Tablets

-

Smart wearables

-

Smart hearables

-

Smart clothing

The mobile device market from 2021 onwards has been defined by several key trends, with the rollout of 5G networks being the most prominent in facilitating the growth in demand for 5G-capable devices. Concurrently, there's been a growing preference for premium mobile devices with advanced features, reflecting consumers' willingness to invest in higher-quality devices. New-age foldable phones have also entered the mainstream, potentially revolutionizing mobile device design, while sustainability concerns are driving the demand for eco-friendly devices with longer lifespans.

In addition to these trends, the market has witnessed notable shifts in the manufacturing ecosystem. Apple and Samsung, the more dominant players in the market, have maintained their dominance, but other Chinese brands like Xiaomi, Oppo, Huawei, and Vivo have made significant inroads, especially in Asia. The manufacturers have responded to consumer demands by offering extended software support for their devices, addressing concerns about longevity and value.

Supporting these market dynamics are the remarkable technological advancements that have become a hallmark of the recent mobile device landscape. Camera technology, for instance, has significantly improved, with enhanced image and video quality and AI-powered features. High refresh rate displays have become commonplace, offering smoother visuals, while fast-charging technologies have addressed battery life concerns. Artificial intelligence is now deeply integrated into various mobile device functions, enhancing user experiences and personalization.

The mobile device market continues to expand globally, with increasing penetration in developing countries. However, consumer preferences remain diverse, varying by region, age, and income level. While budget mobile devices remain popular in emerging markets, developed countries see a preference for premium models. Brand loyalty plays a crucial role, particularly for Apple and Samsung, which enjoy strong customer loyalty in the premium segment. This diversity highlights the importance of understanding regional nuances and catering to specific consumer needs in different markets.

In summary, the mobile device market is a dynamic and ever-evolving landscape shaped by technological advancements, shifting consumer preferences, and intense competition. The rise of 5G, the demand for premium and sustainable devices, and the continuous innovation in features like cameras, displays, and AI are all critical drivers of this market's growth and transformation. As mobile devices become increasingly integral to human lives, understanding these trends and shifts is essential for businesses to thrive in this competitive arena. Adapting to changing consumer needs, embracing technological advancements like foldable designs and extended reality (XR), and navigating global challenges, including managing leading technology suppliers, will be crucial for companies to succeed in the mobile device market in the upcoming years. The future promises even greater innovation, with mobile devices poised to become more powerful, personalized, and integrated into daily lives.

Mobile Devices Market

Overview

The global mobile device market is experiencing a period of transition and adaptation. While smartphone sales have shown signs of plateauing due to incremental upgrades and market saturation, other segments are emerging as growth drivers. Smart hearables and wearables are popular, offering enhanced connectivity and health-tracking features. Foldable devices are carving out a niche, albeit with high prices and durability concerns. Smart clothing is still in its nascent stage but shows promise in integrating technology seamlessly into everyday life. Tablets, meanwhile, are finding renewed relevance for productivity and entertainment purposes. Overall, the mobile device landscape is diversifying, with innovation focusing on integrating various devices and creating a more connected and personalized user experience.

Segment Outlook

Smartphones

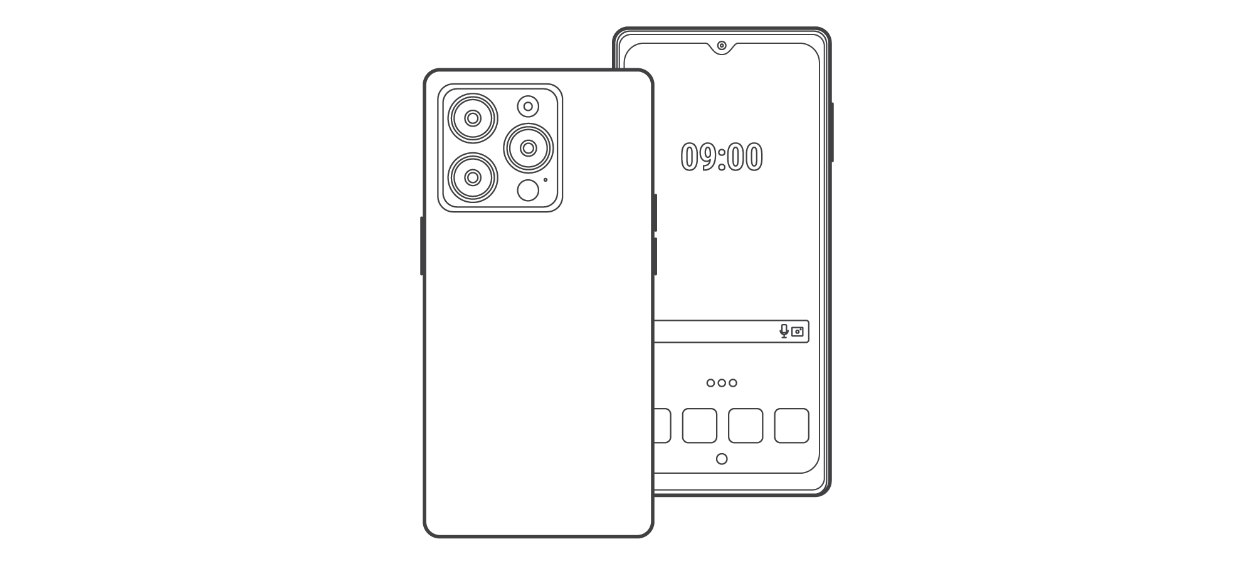

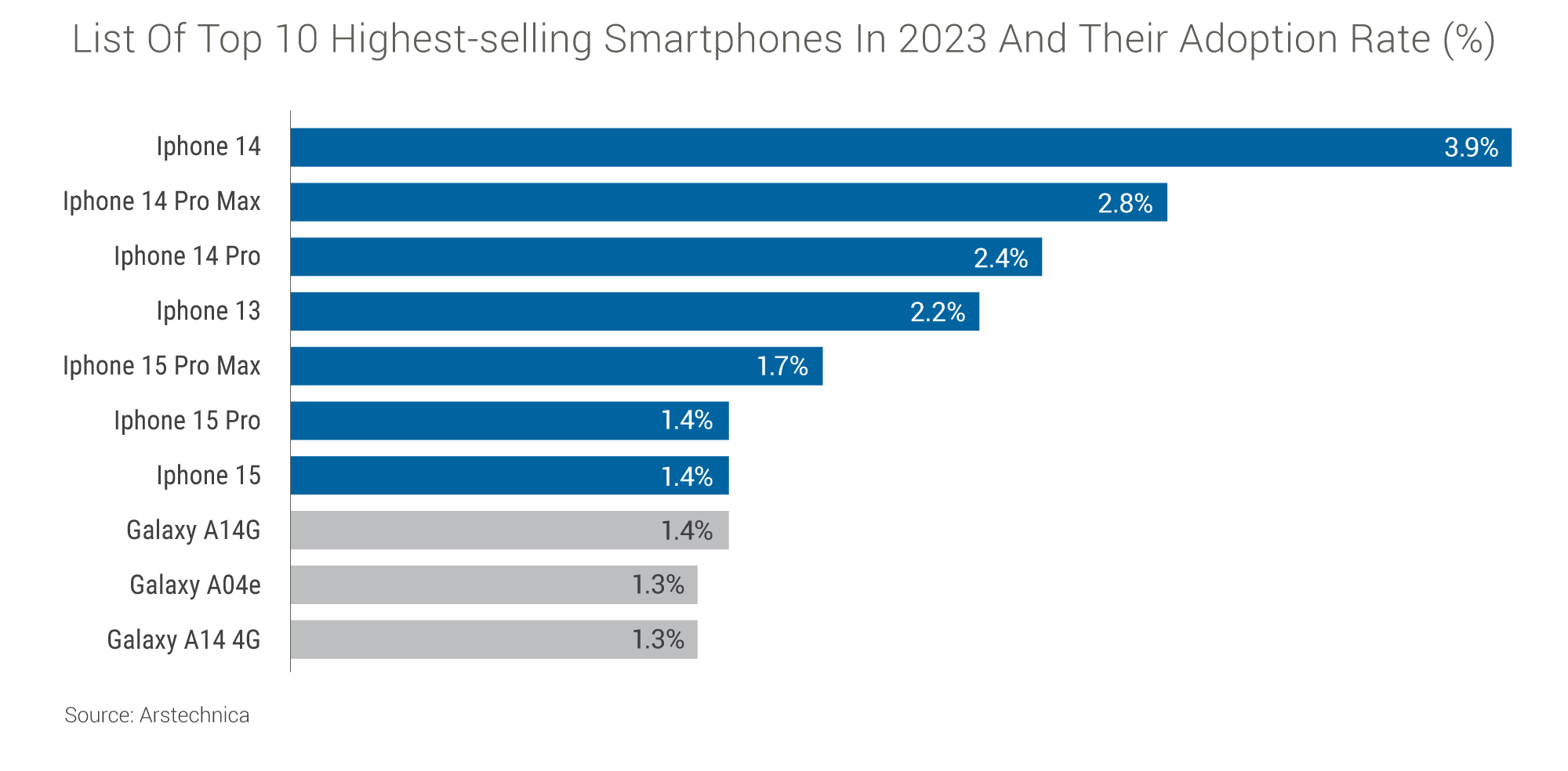

While global smartphone shipment growth might have slowed down in previous years, the market is expected to stabilize and see modest growth due to several factors. One key driver is the replacement cycle for 5G-compatible devices, as companies like Apple and Samsung, among others, continue to release advanced models. Additionally, the rise of foldable smartphones is creating a new niche market segment with premium pricing. According to an article published by Arstechnica in February 2024, the top 7 selling smartphones in 2023 were manufactured by Apple, whereas Samsung manufactured the following 3.

While global smartphone shipment growth might have slowed down in previous years, the market is expected to stabilize and see modest growth due to several factors. One key driver is the replacement cycle for 5G-compatible devices, as companies like Apple and Samsung, among others, continue to release advanced models. Additionally, the rise of foldable smartphones is creating a new niche market segment with premium pricing. According to an article published by Arstechnica in February 2024, the top 7 selling smartphones in 2023 were manufactured by Apple, whereas Samsung manufactured the following 3.

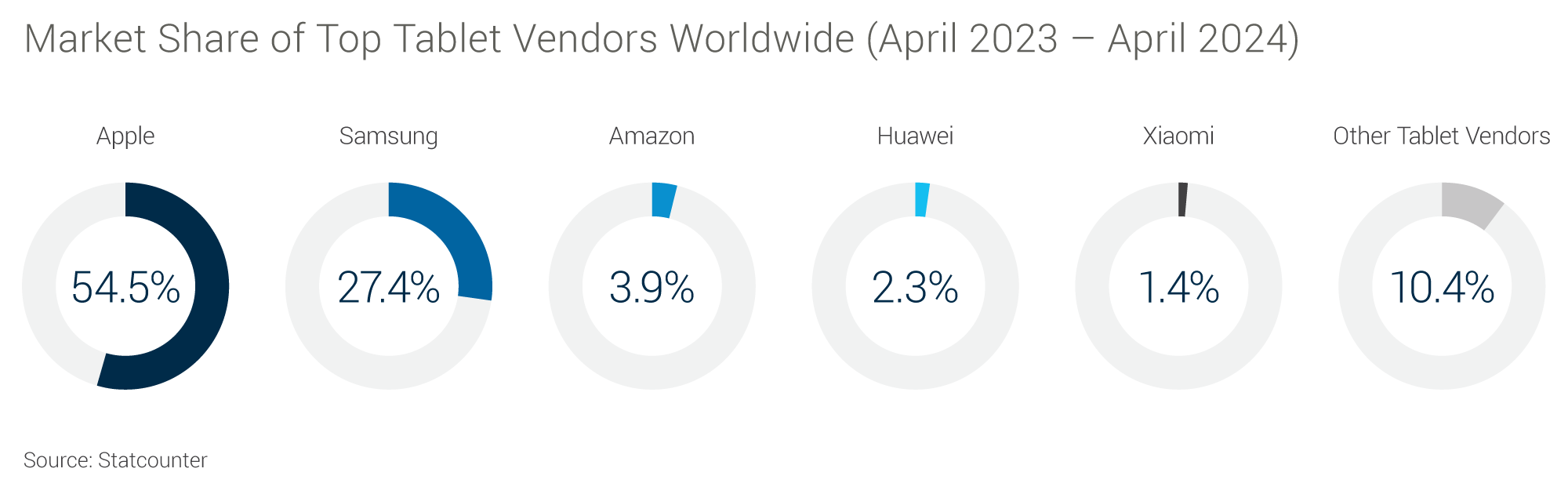

Tablets

According to a report by Canalys, the global tablet market faced a challenging fourth quarter in 2023, with shipments declining 11% compared to the same period in 2022. The total number of tablets shipped for the entire year reached 135.3 million, marking a 10% decrease from the previous year. Despite the overall downturn, the markets in China and India showed positive momentum, offsetting the stagnation observed in other regions.

According to a report by Canalys, the global tablet market faced a challenging fourth quarter in 2023, with shipments declining 11% compared to the same period in 2022. The total number of tablets shipped for the entire year reached 135.3 million, marking a 10% decrease from the previous year. Despite the overall downturn, the markets in China and India showed positive momentum, offsetting the stagnation observed in other regions.

Despite the decline in recent quarters, the tablet market continues to demonstrate its versatility and expanding use cases. Enterprises across education, healthcare, and retail sectors increasingly integrate tablets for their portability, robust features, and intuitive touch interfaces. In 2024, the demand for tablets is anticipated to be fueled by ongoing innovation in design (such as foldable tablets), enhanced graphics capabilities, expanded accessory ecosystems, and, even more significantly, higher-resolution displays. Leaders including Huawei and Samsung are set to launch their tablets (with most of the above features) by the end of 2024.

Smart Wearables

The smart wearables market is witnessing remarkable growth, propelled by increased health-aware consumers and the popularity of fitness trackers and smartwatches. Driving the innovation in this sector, Apple, with its Apple Watch and Fitbit, now a part of Google, is setting benchmarks by introducing sophisticated health monitoring capabilities and ensuring seamless connectivity with smartphones. The market is expected to have a steady upward trajectory in the next three years, emphasizing its potential due to technological advancements and the broadening spectrum of health-related features. As smart wearables become more integrated with healthcare systems, they offer significant prospects for remote patient monitoring and personalized health management. The competitive landscape is diverse, with numerous companies pursuing market share by focusing on user-friendly designs and innovative health-tracking functionalities. This changing market highlights smart wearables' importance in today's digital health world, making them an essential tool for global health and fitness enthusiasts.

The smart wearables market is witnessing remarkable growth, propelled by increased health-aware consumers and the popularity of fitness trackers and smartwatches. Driving the innovation in this sector, Apple, with its Apple Watch and Fitbit, now a part of Google, is setting benchmarks by introducing sophisticated health monitoring capabilities and ensuring seamless connectivity with smartphones. The market is expected to have a steady upward trajectory in the next three years, emphasizing its potential due to technological advancements and the broadening spectrum of health-related features. As smart wearables become more integrated with healthcare systems, they offer significant prospects for remote patient monitoring and personalized health management. The competitive landscape is diverse, with numerous companies pursuing market share by focusing on user-friendly designs and innovative health-tracking functionalities. This changing market highlights smart wearables' importance in today's digital health world, making them an essential tool for global health and fitness enthusiasts.

MOST REPUTED AND POPULAR HEARABLES IN 2023

|

Manufacturer |

Model Name |

Key Features |

Approximate Pricing (USD) |

|

Apple |

Series 8 |

Advanced health tracking (ECG, blood oxygen), crash detection, always-on display, GPS |

Starting at $399 |

|

Apple |

Ultra |

Rugged design, larger display, extended battery life, cellular connectivity, specialized apps |

Starting at $799 |

|

Samsung |

Galaxy Watch 5 |

Wear OS, body composition analysis, ECG, blood pressure monitoring (availability varies by region) |

Starting at $279 |

|

Fitbit |

Charge 5 |

Built-in GPS, EDA sensor for stress management, ECG app, sleep tracking, long battery life |

Starting at $149 |

|

Garmin |

Venu® 2 Plus |

AMOLED display, music storage, Garmin Pay, health snapshot, sleep score |

Starting at $449 |

|

Amazfit |

GTR 3 Pro™ |

AMOLED display, built-in GPS, 150+ sports modes, blood oxygen monitoring, Alexa built-in |

Starting at $199 |

|

Xiaomi |

Mi Band 6 |

AMOLED display, SpO2 monitoring, 30 sports modes, 14-day battery life |

Starting at $45 |

|

Huawei |

Watch GT 3 |

AMOLED display, over 100 workout modes, SpO2 monitoring, wireless charging |

Starting at $229 |

|

Fossil |

Gen 6™ |

Wear OS, faster charging, improved heart rate sensor, NFC for payments |

Starting at $299 |

Data sourced via Secondary Research

Smart Hearing

The smart hearables market, encompassing headsets, earbuds, and technologically advanced hearing aids, continues its explosive growth trajectory. Driven by a seamless wireless experience and the integration of cutting-edge features, smart hearables are rapidly evolving from simple audio devices into essential lifestyle companions. Advancements in audio processing, alongside AI-powered noise cancellation, translate into exceptional sound quality and immersive experiences. The emergence of hearable computing in devices like Apple's Air pods Pro transforms interactions with digital content and enables effortless, hands-free communication. Furthermore, the booming market for electronic infotainment and the rise of the metaverse concept further accelerate demand for versatile smart hearables.

The smart hearables market, encompassing headsets, earbuds, and technologically advanced hearing aids, continues its explosive growth trajectory. Driven by a seamless wireless experience and the integration of cutting-edge features, smart hearables are rapidly evolving from simple audio devices into essential lifestyle companions. Advancements in audio processing, alongside AI-powered noise cancellation, translate into exceptional sound quality and immersive experiences. The emergence of hearable computing in devices like Apple's Air pods Pro transforms interactions with digital content and enables effortless, hands-free communication. Furthermore, the booming market for electronic infotainment and the rise of the metaverse concept further accelerate demand for versatile smart hearables.

The hearables market has seen significant growth due to the increasing popularity of wireless headphones. Advancements in technology have driven innovation, making headphones an essential accessory for various devices like mobile phones, laptops, and smart TVs. Smart headphones offer several advantages, such as high-quality sound, convenience, and mobility. The emergence of hearable computing is expected to further boost the market, offering benefits like hands-free communication and better noise cancellation. Additionally, the rising sales of electronic infotainment devices are driving market growth as headphones become increasingly necessary. The hearables market is experiencing a surge in demand and is expected to continue its upward trajectory in the coming years. However, implementing right-to-repair legislation in the U.S. and Europe could limit future shipments, and vendors must find ways to expand revenue streams and capture early market share.

The Asia-Pacific region is expected to dominate the hearable devices market. This is due to young consumers' interest in new technologies, the popularity of jack-less phones, and increased spending on electronics. At the same time, the increase in players launching products has resulted in lower costs, boosting sales. COVID-19 has also aided the demand for hearable devices, especially professional headsets, due to the shift towards remote working.

Top companies in the hearables market, including Apple, Sonova Holding AG, Xiaomi Corporation, and WS Audiology A/S, face fierce competition. They focus on research and development to create advanced and differentiated products to maintain a competitive advantage. Competition remains significant among major suppliers, and leading vendors strive to offer superior products to gain an edge in the market.

KEY HIGH-SELLING SMART WEARABLES

|

Manufacturer |

Product Name |

Product Type |

Features |

Launch Year |

|

Apple |

AirPods Pro (2nd Generation) |

Earbuds |

Active noise cancellation, adaptive transparency, personalized spatial audio, conversation boost, improved battery life, touch controls, sweat and water resistance |

2022 |

|

Sony |

WH-1000XM5 |

Headset |

Advanced noise cancellation, Speak-to-Chat, adaptive sound control, LDAC codec support, long battery life, wearing detection, multipoint connection |

2022 |

|

Jabra |

Elite 7 Pro |

Earbuds |

Multipoint connectivity, adjustable active noise cancellation, HearThrough mode, customizable sound profiles, compact design, long battery life, IP57 water and dust resistance |

2021 |

|

Bose |

QuietComfort® Earbuds |

Earbuds |

Exceptional noise cancellation, customizable sound profiles, comfortable fit, intuitive touch controls, Aware mode, IPX4 water resistance |

2020 |

|

Nura |

NuraTrue Pro™ |

Earbuds |

Personalized sound profile creation, active noise cancellation, social mode, spatial audio, lossless audio support, long battery life |

2022 |

|

Oticon |

Real™ |

Hearing Aid |

BrainHearing technology, MoreSound Intelligence, wind and handling noise reduction, tinnitus relief, rechargeable, Bluetooth connectivity |

2023 |

|

Apple |

AirPods Max |

Headset |

High-fidelity audio, active noise cancellation, transparency mode, spatial audio with dynamic head tracking, Digital Crown control, comfortable design |

2020 |

Data sourced via Secondary Research

Smart Clothing

Smart clothing, also known as high-tech clothing, smart wear, or electronic textiles, combines fashion and technology. These garments are embedded with sensors, microchips, and other electronic components, transforming them into intelligent wearables. By connecting to the internet or other devices like smartphones, smart clothing creates extensive opportunities.

One of the most promising applications of smart clothing is health and fitness tracking. By leveraging the technology, vital signs such as heart rate, body temperature, and movement can be monitored, providing data for health-conscious individuals and healthcare providers alike. Smart clothing also has the potential to enhance safety and security by emitting alerts in dangerous situations or tracking the wearer's location.

The integration of technology into clothing extends beyond personal health and safety. Smart clothing can also monitor the environment, detecting changes in temperature, humidity, and air quality, thus alerting wearers to potential hazards. Additionally, smart clothing can offer enhanced functionality, such as built-in heating or cooling elements, haptic feedback, and the ability to change color or patterns, blurring the lines between fashion and technology.

While still a nascent technology, smart clothing holds immense potential to revolutionize the way one interacts with the garments and the world around them. As technology continues to advance at a rapid pace, it can be anticipated that even more innovative and practical applications for smart clothing will be made available in the future. The possibilities are limitless.

SOME OF THE FULLY COMMERCIALIZED INNOVATIVE SMART CLOTHING SOLUTIONS

|

Manufacturer |

Product Name |

Current Status |

Deployment Status by Region |

Product Description |

|

Wearable X |

Nadi X™ Yoga Pants |

Commercialized |

Global |

Designed to guide the user through yoga poses with gentle vibrations, helping improve posture and alignment. |

|

Levi's & Google |

Levi's Commuter Trucker Jacket with Jacquard |

Commercialized |

Global |

The innovative denim jacket features a touch-sensitive sleeve that allows users to control music, answer calls, get directions, and more with simple gestures. |

|

Clim8 |

Clim8 Intelligent Thermal Clothing |

Commercialized |

Global |

Uses integrated heating elements to actively regulate body temperature, adapting to the wearer's activity levels and the environment. |

|

Hexoskin |

Hexoskin Smart Shirts |

Commercialized |

Global |

Biometric shirts that continuously monitor heart rate, breathing rate, movement, and other vital signs, providing insights for athletes, healthcare professionals, and researchers. |

|

Owlet Baby Care |

Owlet Smart Sock 2 |

Commercialized |

Global |

Provides parents with peace of mind by tracking their baby's heart rate and oxygen levels during sleep and sending alerts to their smartphone if any issues arise. |

|

Supa |

Supa Powered Clothing™ |

Commercialized |

Primarily North America, Europe |

Jackets, vests, and gloves with built-in heating elements powered by rechargeable batteries, keep the wearer warm in cold conditions. |

|

Siren Care |

Siren™ Diabetic Socks and Foot Monitoring |

Commercialized |

Global |

Use temperature sensors to detect early signs of inflammation in the feet, helping people with diabetes prevent foot ulcers and improve their overall health. |

|

Xenoma |

E-Skin™ Sleep & Lounge |

Commercialized |

Primarily Japan, Asia |

Pajamas are embedded with sensors that monitor sleep patterns, body temperature, and movement, providing personalized sleep insights and recommendations for better rest. |

Data sourced via Secondary Research

Regional Outlook

China

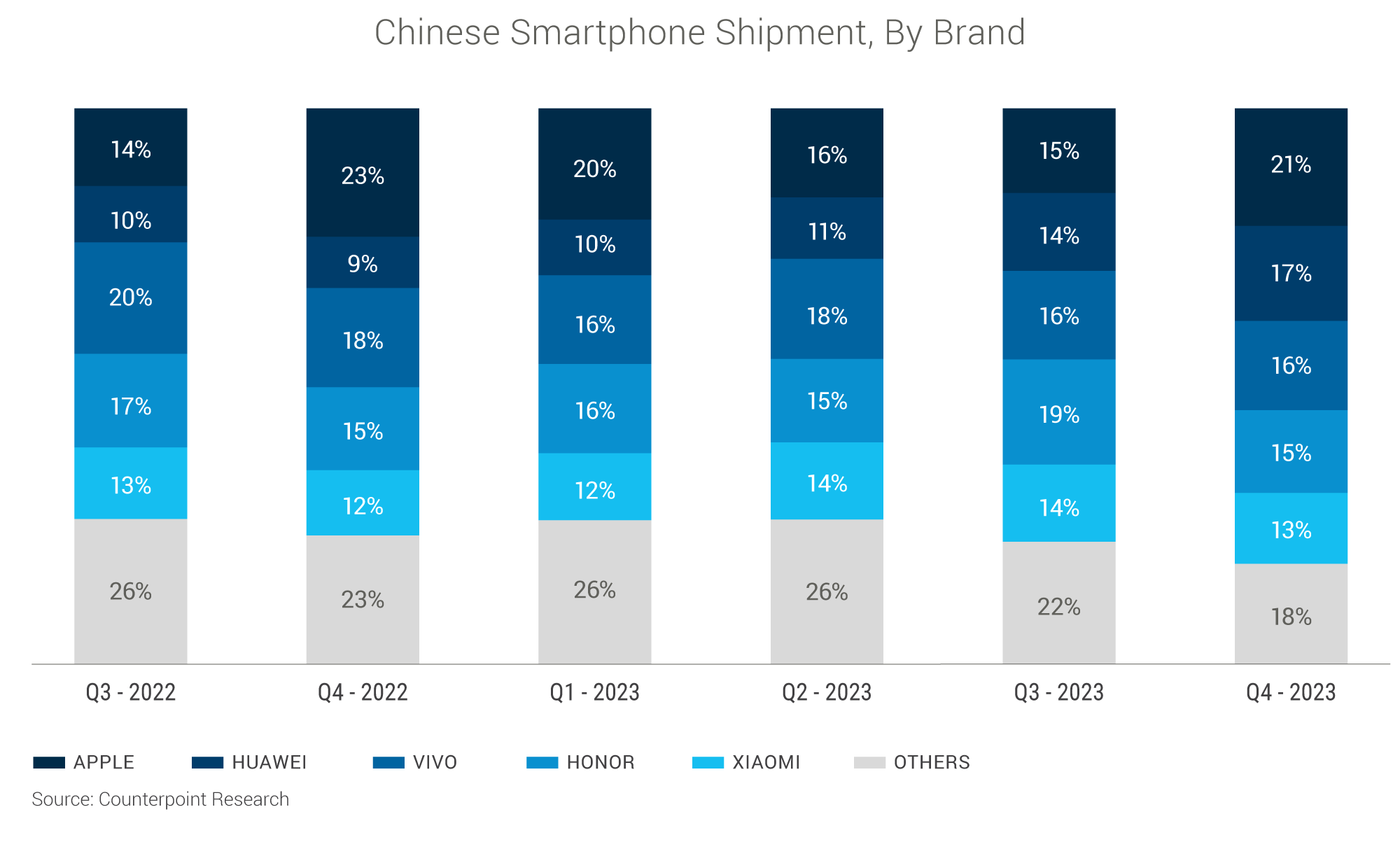

China is expected to remain one of the dominant countries in the global mobile devices market, propelled by its massive consumer base and robust local manufacturing capabilities. With leading companies like Huawei, Xiaomi, and OPPO continuously innovating, China's market share is substantial. However, geopolitical tensions and trade restrictions could impact growth. The aggressive push for 5G adoption and beyond in China makes it likely that a significant portion of mobile sales will be 5G-capable devices in the coming years.

According to an article published by Counterpoint Research in February 2024:

- China’s smartphone shipments rose 1% year over year in Q4 2023, marking the first quarterly increase in more than two years. This was due to OEMs restocking for newly launched models.

- Though Apple offered big promotions for the iPhone 15 series, it still witnessed a 6% YoY drop in shipments due to fierce competition from Huawei’s return

- Huawei’s shipments almost doubled YoY, driven by the hot-selling Mate 60™ series as well as the newly launched Nova 12™ series

- Xiaomi saw a substantial 13% YoY increase, mainly driven by the newly launched Xiaomi 14 series and Redmi K70 series

- HONOR also saw a 1% YoY uptick

Data sourced from Counterpoint Research

Data sourced from Counterpoint Research

US

The US will likely see sustained growth in the mobile devices sector, driven by a strong consumer preference for high-end smartphones and the rapid rollout of 5G networks. Apple and Samsung remain dominant players, with the former enjoying a loyal customer base. Introducing innovative features and technologies, such as foldable screens and AI-enhanced applications, could spur replacement cycles. However, the market is nearing saturation, with smartphone penetration already high. Growth may increasingly come from wearable devices and smart home technologies.

According to an article published by Statista in August 2022, the number of smartphone users in the US in 2023 is estimated to be around 311.8 million. The number will likely reach 338.5 million by 2030 and 364.2 million by 2040.

Europe

Europe is likely to see steady growth in the mobile device market. Growing demand for smart wearables and hearables, coupled with a mature smartphone market, will lead to a focus on upgrades and premium devices. Additionally, increased awareness surrounding sustainability and device longevity could promote longer replacement cycles within specific demographics. Regulatory pressures regarding repairability and sustainable materials could drive innovation within the European market.

In the 4th Quarter of 2023, the European mobile devices market witnessed a slight dip of 3% in their smartphone Shipment. However, Apple recorded a 1 percent growth to regain the lead position in the European market, reaching 12.4 million units. In comparison, Samsung slipped to the second position with a 12 percent decline to 10.8 million units. Despite this, Samsung maintained its position as the largest vendor throughout 2023 (Telecomlead).

Latin America

LATAM holds significant growth potential for the mobile devices market. Expanding access to mobile networks and increasing the affordability of smartphones will drive adoption, especially in emerging markets within the region. However, economic disparities and infrastructure limitations could hinder growth rates compared to other areas. For 2023, the smartphone market in Latin America experienced a 2% growth, reaching 118.9 million units. The region witnessed signs of recovery in H2 2023 to offset the decline experienced in the first two quarters (Canalys).

Market Growth Enablers

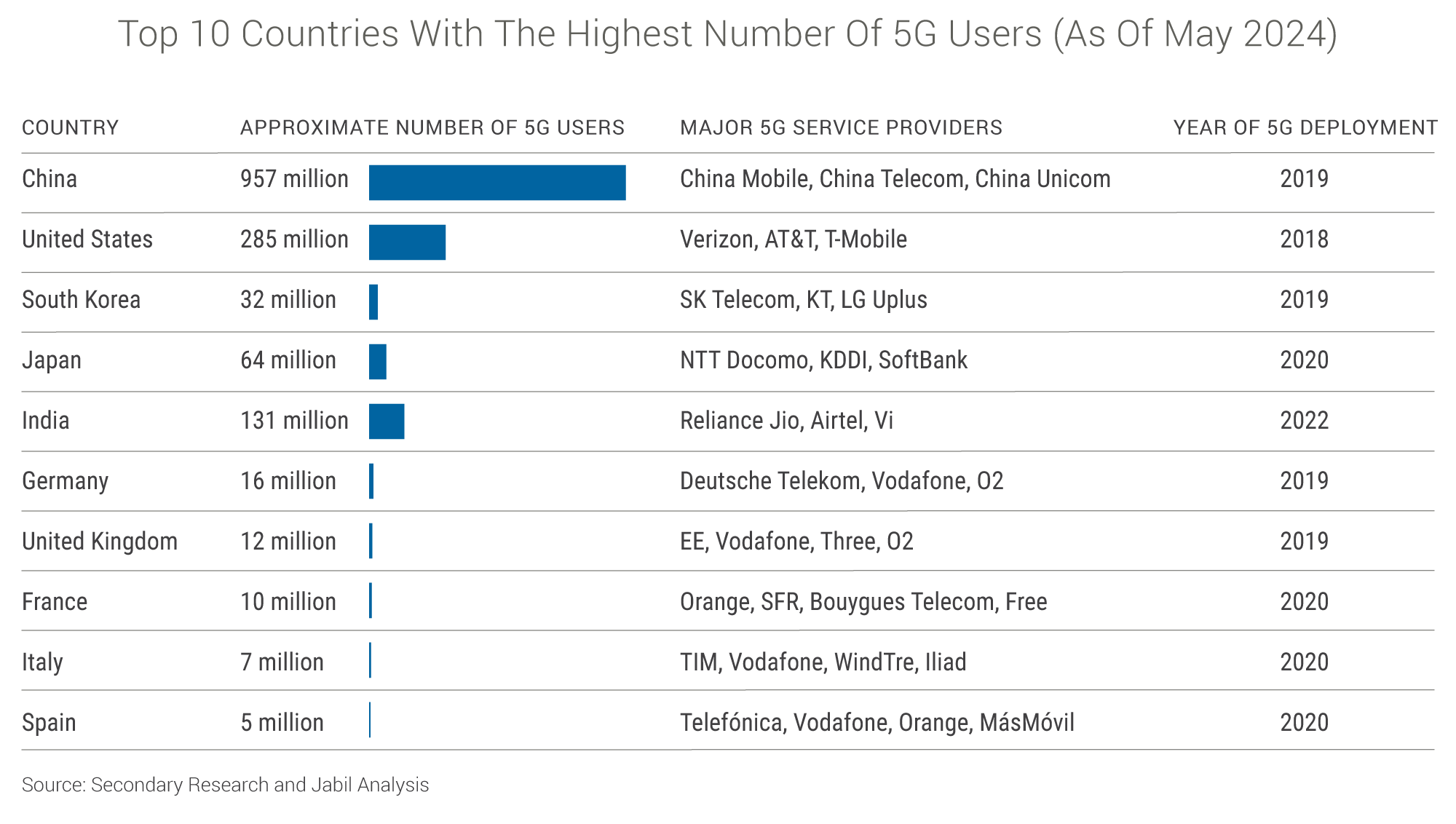

5G Network Expansion

Increased speeds and decreased latency offered by 5G fuel demand for advanced mobile devices capable of handling data-intensive applications, augmented reality experiences, and cloud-based services. Furthermore, the growth of high-quality video streaming on mobile devices drives increased subscriptions to content providers, which fuels demand for devices capable of delivering an exceptional viewing experience. This surge in demand is driving innovation across smartphones, wearables, and hearables.

Data sourced from Secondary Research

Data sourced from Secondary Research

COUNTRIES THAT DEPLOYED 5G INFRASTRUCTURE POST-DECEMBER 2022

|

Region |

Country |

Operator(s) |

Deployment Type |

Deployment Year |

|

Africa |

Ethiopia |

Safaricom Ethiopia |

5G |

Aug 2023 |

|

Gambia |

QCell |

5G |

Jun 2023 |

|

|

French Guiana |

Orange Caraibe, SFR Caraibe |

5G |

2023 |

|

|

South Africa |

Telkom South Africa |

5G |

2023 |

|

|

Asia |

Bangladesh |

Teletalk |

5G |

Dec 2023 |

|

Europe |

Spain |

Orange, Telefónica |

5G (Standalone) |

2023 |

|

Middle East and Africa |

Saudi Arabia |

Zain |

5G (Standalone) |

Mar 2023 |

|

United Arab Emirates |

E& |

5G (Standalone) |

Feb 2023 |

Data sourced from Secondary Research

The Rise of the Internet of Things (IoT)

The interconnectedness of smart devices creates significant demand for smartphones as control hubs, wearables for remote monitoring, and hearables for voice commands. This ecosystem is fueling the overall growth of the mobile device market.

Some of the Major use cases of integration of IoT in Mobile Devices include:

- Samsung smartphones seamlessly integrate with the SmartThings platform, allowing users to control various smart home devices like lights, thermostats, and locks, creating a unified and convenient ecosystem.

- Apple's HomeKit framework provides a secure and user-friendly way for iPhone and iPad users to control compatible smart home devices, offering automation routines and voice control through Siri.

- Android smartphones seamlessly integrate with Google Home, allowing users to control their smart home devices using voice commands through Google Assistant, creating a hands-free and intuitive experience.

Shifting Consumer Preferences for Technology-Centric Living

Consumers demand greater integration between devices, enhanced productivity, and health—and wellness-focused features. This has driven innovation in the mobile device market and resulted in updated use cases.

For instance, the development of under-display camera technology, also known as UDC, is an innovative feature that aims to eliminate the visible camera cutout (notch or punch-hole) on smartphone displays. The front-facing camera is placed beneath the screen, allowing a full-screen experience without obstructions. This technology has the potential to revolutionize smartphone design, offering a more immersive viewing experience for users. Several manufacturers like ZTE, Samsung, and Xiaomi have already released smartphones with under-display cameras, and the technology is expected to improve significantly in the coming years.

Advancements in Artificial Intelligence (AI)

On-device AI capabilities enhance camera performance, enable real-time translation within hearables, and improve battery efficiency, driving demand for AI-equipped mobile devices. For instance, in the article published in Samsung’s newsroom, in January 2024, Samsung Electronics Co., Ltd, and Google Cloud announced a new multi-year partnership to bring Google Cloud’s generative artificial intelligence technology to Samsung smartphone users around the globe. Starting with the Samsung Galaxy S24 series announced today at Galaxy Unpacked in San Jose, California, Samsung will be the first Google Cloud partner to deploy Gemini Pro and Imagen 2 on Vertex AI via the cloud to their smartphone devices. (Samsung Newsroom UK)

Growing Importance of Mobile Devices in Emerging Markets

Mobile devices offer access to services such as banking and education in developing economies, potentially driving regional growth. The devices give users access to services that have the potential to contribute to the economic development of the region, including:

- Mobile Banking and Payments: Mobile devices have enabled millions of unbanked populations access to financial services.

- Entrepreneurship: Mobile devices have lowered the barriers to starting and running businesses.

- Digital Services: The rise of mobile apps and platforms has led to the emergence of new industries and jobs in areas like ride-hailing, food delivery, e-commerce, and digital content creation.

- Information Access: Mobile devices provide access to information on health, agriculture, education, and government services, empowering individuals to make informed decisions and improving their overall well-being.

- Mobile Learning: Mobile-based educational platforms and apps have revolutionized education in remote and underserved areas.

Many developing economies prioritize the importance of mobile devices and invest in the associated infrastructure to support connectivity. For instance, M-Pesa in Kenya has transformed the financial landscape, enabling millions to access banking services and boosting economic activity. Mobile banking has played a crucial role in Bangladesh's disaster relief efforts, allowing aid organizations to quickly and efficiently distribute funds to affected populations. Ghana has been using mobile technology to monitor the spread of diseases like Ebola and malaria to enable faster response and containment.

Market Inhibitors

Concerns over Data Privacy and Security

Data privacy and security concerns have cast a shadow over the mobile device market, eroding consumer trust and hindering industry growth. Frequent and increasingly sophisticated cyberattacks and invasive tracking and data collection practices by apps and services have fueled these concerns. Vulnerabilities in operating systems and applications further exacerbate the risks, leaving users' personal information exposed to potential breaches and misuse.

The evolving landscape of data privacy and the need for greater transparency and control over personal information have raised concerns among consumers. This evolving sentiment has the potential to impact consumer confidence, market growth, and regulatory oversight, highlighting the importance for businesses to prioritize transparency and data protection measures to maintain trust and brand reputation. Due to privacy concerns, consumers may become more hesitant to share personal information, upgrade devices, or adopt new technologies. This reluctance can stifle innovation and limit the overall expansion of the mobile device market.

To address these challenges, industry stakeholders are actively implementing solutions. More robust security measures like encryption and biometric authentication are being integrated into devices and apps. Companies strive for greater data collection transparency, offering users more control over their information. Privacy-focused design principles are being adopted to ensure that privacy considerations are embedded from the initial stages of product development. Moreover, compliance with stringent data privacy regulations like GDPR and CCPA is becoming a priority for manufacturers and developers. Educational initiatives are also underway to empower consumers with knowledge about data privacy risks and best practices.

By proactively tackling data privacy and security concerns, the mobile device industry can rebuild consumer trust, foster innovation, and ensure the continued growth of this crucial technology sector. A collaborative effort among manufacturers, developers, regulators, and consumers is essential to create a mobile ecosystem that prioritizes technological advancement and user privacy protection.

Market Saturation in Developed Economies

Demand saturation in developed economies poses a significant hurdle for the mobile device market. In these regions, smartphone penetration has reached a plateau, with most potential customers already owning a device. This market maturity leaves limited room for new customer acquisition and slows overall market growth. Additionally, smartphones' increasing longevity and technological sophistication have extended upgrade cycles, as consumers are less inclined to replace their devices frequently. The absence of groundbreaking innovations further dampens the desire for upgrades, contributing to a stagnant market. Economic factors, such as slowdowns or uncertainties, can deter consumers from making non-essential purchases like new smartphones. Furthermore, growing environmental concerns surrounding electronic waste are prompting consumers to reconsider frequent upgrades, opting to repair or reuse their existing devices instead. These combined factors paint a challenging picture for the mobile device market in developed economies, forcing manufacturers and retailers to seek growth opportunities elsewhere or explore alternative revenue streams like services and accessories.

E-Waste and Sustainability Concerns

E-waste and sustainability concerns overshadow the mobile device market, prompting manufacturers, consumers, and governments to rethink traditional practices and embrace more environmentally responsible approaches.

Consumers are increasingly aware of the environmental concerns and are demanding more sustainable mobile devices. This has led manufacturers to explore innovative solutions, such as using recycled materials, designing for durability and repairability, and implementing take-back programs to encourage responsible disposal. Governments are also introducing regulations to promote e-waste recycling and restrict the use of hazardous substances in electronics.

Sustainability is not only an environmental concern but also a business imperative. Consumers increasingly favor brands prioritizing sustainability, and investors scrutinize companies' environmental practices. Therefore, adopting sustainable practices is a moral responsibility and a strategic move to remain competitive in the market.

Moving forward, the mobile device industry must prioritize sustainable practices throughout the entire product lifecycle, from design and manufacturing to disposal and recycling. This includes reducing the use of virgin materials, minimizing energy consumption, extending product lifespans, and ensuring responsible e-waste management. By embracing sustainability, the mobile device market can mitigate its environmental impact, meet consumer demands, and secure a more accountable and resilient future.

Plateauing Innovation

Plateauing innovation in the mobile device industry significantly threatens its continued growth and vitality. As groundbreaking advancements become less frequent, consumers are less inclined to upgrade their devices, leading to market stagnation and intensified competition among brands. The lack of exciting new features can dampen consumer interest and investor confidence, hindering the industry's ability to generate excitement and attract funding for further research and development. This, in turn, can lead to a shift in consumer focus towards other aspects like affordability and sustainability while potentially driving away top talent seeking more innovative environments. To overcome this challenge, mobile device companies must prioritize substantial research and development efforts, focusing on technologies that can revolutionize user experiences and address emerging needs. Exploring novel form factors and integrating cutting-edge technologies like AR and VR can reignite consumer enthusiasm and ensure the industry's long-term relevance and success. Some of the actual use cases include:

- Samsung's Galaxy S Series: Samsung's flagship Galaxy S series has seen incremental improvements in recent years. The Galaxy S23, while technologically advanced, didn't introduce any groundbreaking features, leading to a less enthusiastic reception from consumers and critics.

- Foldable Phones: While foldable phones like the Samsung Galaxy Z ™ Fold and Flip series have been hailed as innovative, their high price points and durability concerns have limited their mainstream adoption. This suggests that the technology may not yet be mature enough to drive significant growth in the market.

Use Cases

USE CASES FOR ADOPTION OF ADVANCED FEATURES AND HARDWARE IN MOBILE DEVICES

|

Feature |

Mobile Device Manufacturer |

Feature Integrator |

Feature Description |

Date of Deployment |

|

Satellite Connectivity |

Apple (iPhone 14 series) |

Globalstar |

This feature allows users to send emergency SOS messages and share their location even when outside of cellular and Wi-Fi coverage. |

September 2022 |

|

Dynamic Island |

Apple (iPhone 14 Pro series) |

Apple |

This pill-shaped cutout at the top of the display adapts to show alerts, notifications, and Live Activities, offering a new way to interact with the device. |

September 2022 |

|

200MP Camera Sensor |

Samsung (Galaxy S23 Ultra) |

Samsung |

This high-resolution sensor enables users to capture incredibly detailed photos with exceptional clarity. |

February 2023 |

|

4nm Chipset (Snapdragon 8 Gen 2) |

Various Android Manufacturers |

Qualcomm |

This chipset now powers various Android devices, offering improved performance, efficiency, and enhanced AI capabilities. |

Early 2023 |

|

Under-Display Fingerprint Sensor |

Vivo, Xiaomi (selected models) |

Qualcomm (3D Sonic Max) |

This technology enables a more seamless design and a larger recognition area for enhanced security and convenience. |

Varies by model |

Data sourced from Secondary Research

Mobile Devices Market

Supply Chain

Geopolitical Tensions and Supply Chain Realignment

The mobile devices industry faces increased complexity and risk due to heightened geopolitical tensions, particularly between major technology-producing nations. These tensions have led to stricter trade policies, tariffs, and restrictions on technology transfers, significantly impacting global supply chain dynamics. In response, companies are urgently reassessing and realigning their supply chains to reduce dependency on regions with high geopolitical risks. This includes diversifying sourcing and manufacturing locations to more geopolitically stable or neutral countries. Moreover, there is an accelerated trend towards the friend-shoring/nearshoring of critical components where companies prefer to trade with allies or within blocks that share similar regulatory and political frameworks. This strategic shift aims to safeguard access to essential materials and components, such as rare earth metals and advanced semiconductors, which are pivotal for mobile device manufacturing. Additionally, companies are increasingly investing in technology and infrastructure to enhance supply chain visibility and resilience, enabling more agile responses to future geopolitical shifts. For Instance:

- The war between Russia & Ukraine has disrupted the supply of neon gas, a critical component in chip manufacturing. Ukraine is a significant supplier of neon, and the war has led to shortages and price hikes, likely affecting the production of various mobile device components.

- The ongoing trade war between the US and China has led to tariffs and restrictions on various components and materials used in mobile devices. This has increased costs and caused delays in production and shipping. Notably, Huawei has been significantly impacted, losing access to critical components like Google Mobile Services and 5G chips.

Semiconductor Scarcity and Strategic Countermeasures

As of Q3 of 2024, the semiconductor shortage, while diminishing in severity, continues to challenge mobile device manufacturers. The industry has evolved strategies to mitigate this issue, reflecting a blend of innovation and strategic foresight.

- Strategic Partnerships and Direct Investments: Leading companies, notably Apple and Samsung, have intensified their collaborations with key semiconductor foundries such as TSMC and Samsung Electronics' semiconductor division. These partnerships aim to secure a more reliable chip supply chain and co-develop custom chips tailored for next-generation mobile devices.

- Component Optimization and Design Efficiency: Mobile device makers are refining their product designs to prioritize efficiency, allowing them to integrate more readily available semiconductor components without compromising device performance. This approach includes re-engineering device internals to maximize the utility of each chip and software optimizations that enhance the overall efficiency of the hardware.

- Alternative Materials and Innovation: The search for and development of materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN) for power electronics, graphene for faster-charging batteries and flexible screens, 2D materials for energy-efficient transistors, and organic semiconductors for innovative, flexible electronics has gained momentum. Research into alternative materials aims to alleviate the industry's reliance on specific, scarce components by exploring broader material bases for chip fabrication. This forward-looking strategy addresses the current chip shortages. It lays the groundwork for a more resilient and diversified supply chain capable of supporting the future demands of mobile device manufacturing.

Supplier Relationship Transformation

Mobile device manufacturers have increasingly adopted dual or multi-sourcing strategies, recognizing the risks of supply chain disruptions. For instance, Apple has diversified its component sourcing for the iPhone, engaging with multiple semiconductor suppliers like TSMC and Intel to mitigate risks. Similarly, Samsung has expanded its network of display panel suppliers, incorporating both LG Display and BOE Technology, to ensure a stable supply for its Galaxy series. This shift underscores a strategic pivot towards flexibility and supply assurance, with cost efficiency now balanced against the need for redundancy and risk mitigation.

Localization Imperative

In light of trade tensions and the push for economic security, 2024 has seen a move toward localizing the production of critical mobile device components. The U.S. CHIPS Act, for instance, has incentivized semiconductor manufacturing within the country, leading to significant investments by companies like Intel and TSMC in American-based foundries. Similarly, initiatives like the European Chips Act have spurred companies like STMicroelectronics to expand local manufacturing capabilities in Europe. These efforts aim to secure the semiconductor supply chain against geopolitical risks and ensure access to essential components.

Ecosystem Collaboration

The landscape of mobile device manufacturing has evolved towards a more integrated ecosystem approach characterized by strategic partnerships and collaborations. Google's collaboration with Qualcomm on custom chips for the Pixel smartphones exemplifies this trend, enabling advancements in AI and machine learning capabilities specific to Google's mobile ecosystem. Another example is the partnership between Xiaomi and ISORG, which focuses on developing organic photodetectors for next-generation biometric sensors. These collaborations extend beyond traditional supply relationships, fostering co-innovation and shared technological advancement across different mobile industry segments.

ESG Challenges

The mobile device supply chain faces significant Environmental, Social, and Governance (ESG) challenges due to its intricate nature, global scale, and resource-intensive manufacturing process. Environmentally, extracting rare earth metals and minerals for mobile device components contributes to resource depletion and environmental degradation. The energy-intensive manufacturing, often reliant on fossil fuels, further exacerbates greenhouse gas emissions. Additionally, the short lifespan of mobile devices and rapid technological obsolescence lead to massive electronic waste, posing significant disposal and recycling challenges.

On the governance front, the complexity of the mobile device supply chain hinders transparency and traceability, making it challenging to ensure responsible sourcing throughout the entire process. The potential for corruption in various supply chain stages can further undermine ethical practices. Furthermore, ensuring compliance with environmental and social regulations across multiple jurisdictions presents a formidable challenge, especially in regions with weak governance structures.

Despite these challenges, stakeholders are actively working to address ESG concerns in the mobile device supply chain. Manufacturers are exploring using recycled materials, transitioning to renewable energy sources, and implementing responsible sourcing initiatives. Fair labor practices are being promoted through codes of conduct and audits. Additionally, some manufacturers are embracing circular economy principles, designing products for longevity, repairability, and recyclability to mitigate the growing e-waste problem. A collective effort among manufacturers, governments, NGOs, and consumers is crucial to creating a more sustainable and ethical mobile device industry that minimizes adverse environmental and societal impacts.

China+1

The "China+1" strategy, increasingly adopted by global OEMs, is a response to diversify manufacturing and reduce dependency on China due to various risks, including geopolitical tensions, supply chain disruptions, and rising labor costs. This strategy pushes component suppliers in the semiconductor, passive components, PCBs, and mechanical parts sectors to explore investment opportunities outside of China, notably in Southeast Asia, with India, Vietnam, Thailand, and Malaysia benefiting the most.

Countries like India and Vietnam are becoming significant beneficiaries of this strategy. This shift addresses the de-risking of supply chains and taps into the countries’ substantial export market, which has seen growth in destinations such as the US and Europe. For instance:

- Samsung has invested heavily in Vietnam for years and recently announced plans to build a new $220 million research and development center in Hanoi. This indicates a commitment to deepening its presence in the region.

- While Apple doesn't own Southeast Asian factories, it has increasingly relied on contract manufacturers like Foxconn and Pegatron, which have a significant presence in countries like Vietnam and India.

- Xiaomi has been expanding its production capacity in Indonesia and Vietnam, aiming to reduce its reliance on China.

- Oppo and Vivo have also been setting up new factories or expanding existing ones in Southeast Asia, particularly Vietnam.

Impact of AI on Supply Chain

In the face of a complex and disrupted global supply chain, AI is a powerful tool for streamlining operations and enhancing efficiency. Jabil’s 2024 Supply Chain Resilience Survey showed that nearly 200 supply chain and procurement decision-makers from some of the world’s leading product brands are planning for and already using AI in their day-to-day processes. The insights provided by the participants highlight critical best practices for successfully integrating AI within supply chain operations.

- The surge in AI applications within supply chain management largely concentrates on enhancing demand planning and inventory management. By leveraging predictive analytics, organizations aim to improve forecasting accuracy and efficiency, optimize resource distribution, and address the imbalance between supply and demand.

- A "data-first" mentality is critical for harnessing AI's full potential in supply chain operations. Success hinges on establishing a robust data management infrastructure and governance framework before deploying AI tools. This foundation ensures data reliability and fosters meaningful insights, underscoring the importance of collaboration and data sharing among stakeholders.

- Preparing the workforce for AI integration involves addressing potential concerns about job displacement and emphasizing AI's role in augmenting human skills. By providing training and hands-on experience with AI technologies, companies can facilitate a smooth transition towards more automated and efficient supply chain processes.

Mobile Devices Market

Technology Evolution

5G, 6G, and Connected Ecosystem

The acceleration of 5G adoption and early exploration of 6G's capabilities will underpin a new generation of mobile devices and experiences. Faster speeds, reduced latency, and massive device connectivity will supercharge applications like real-time AR/VR experiences, remote collaboration, high-fidelity cloud gaming, and a flourishing Internet of Things (IoT) landscape. These developments drive innovation across smartphones, wearables, and hearables, enabling unprecedented connectivity and interaction.

CONNECTED ECOSYSTEMS FOUND IN VARIOUS DOMAINS AND THE IMPORTANCE OF MOBILE DEVICES IN EACH CONNECTED ECOSYSTEM

|

Connected Ecosystem |

Role of Mobile Devices/Smartphone |

Key Features |

|

Smart Home |

A central hub for control and automation of devices (lights, thermostats, locks, etc.) |

Remote access, voice commands, automation routines |

|

Wearables (Fitness trackers, smartwatches) |

Data collection, display of notifications and health metrics, integration with health apps |

Activity tracking, heart rate monitoring, sleep analysis |

|

Connected Car |

Integration with infotainment systems, remote start/stop, vehicle diagnostics, location tracking |

Hands-free calling, navigation, music streaming, vehicle health monitoring |

|

Personal Health (Connected medical devices) |

Data collection and transmission (blood glucose levels, blood pressure), appointment reminders, medication tracking |

Remote patient monitoring, personalized health insights, telemedicine |

|

Entertainment (Smart TVs, speakers) |

Remote control, content casting, synchronized playback across devices |

Media streaming, multi-room audio, voice control |

|

Financial Services (Mobile banking) |

Account management, transactions, biometric authentication, fraud detection |

Secure payments, budgeting tools, personalized financial insights |

Data sourced from Secondary Research

Augmented Reality, Virtual Reality, and Immersive Experiences

AR and VR technologies are rapidly evolving and becoming more accessible through mobile devices. From virtual product try-ons and AR-enhanced navigation overlays to immersive gaming and educational content, AR/VR holds the power to transform the ecosystem around users. This integration sparks demand for AR/VR-optimized mobile devices, software, and accessories, creating new possibilities for entertainment, productivity, and beyond. Recent developments include Apple's ARKit and Google's ARCore, which enable developers to create smartphone AR applications, and the Oculus Quest, a standalone VR headset. One of the examples of AR/VR integration in mobile devices is the use of augmented reality (AR) for navigation and wayfinding apps. Google Maps, for instance, offers a feature called "Live View" that uses AR to overlay directions onto the real-world view captured by the phone's camera.

Foldable Devices

Foldable displays leverage organic LED (OLED) technology to create smartphones and tablets that can fold or unfold to increase or decrease screen size. Foldable smartphones and potentially other devices with flexible form factors represent a significant shift in mobile design. Catering to users seeking a balance between expansive displays and portability, foldables expand screens for multitasking, media consumption, and gaming. This trend fuels ongoing innovation in flexible display technology, hinge mechanisms, and software optimization, challenging traditional perceptions of mobile device design.

POPULAR FOLDABLE MOBILE DEVICES

|

Product Name |

Description |

Manufacturer |

Launch Year |

Country/ Region Active |

Product Development Phase |

|

Samsung Galaxy Z Fold 5 |

Foldable smartphone with a large inner display and a smaller outer display. |

Samsung |

2023 |

Global |

Commercialized |

|

Samsung Galaxy Z Flip 5 |

Clamshell foldable smartphone with a compact design and a focus on style. |

Samsung |

2023 |

Global |

Commercialized |

|

Motorola Razr+™ (2023) |

Clamshell foldable smartphone with a large cover display and retro design inspired by the original Razr. |

Motorola |

2023 |

Global |

Commercialized |

|

Google Pixel Fold |

Foldable smartphone with a book-like design and high-quality cameras. |

|

2023 |

USA, Select Markets |

Commercialized |

|

OnePlus Open |

Foldable smartphone with a focus on performance and a sleek design. |

OnePlus |

2023 |

Global |

Commercialized |

|

Tecno Phantom V Fold™ |

Budget-friendly foldable smartphone with a large display and multiple cameras. |

Tecno |

2023 |

India, Select Markets |

Commercialized |

|

Oppo Find N2 |

It is a foldable smartphone with a compact design and a unique hinge mechanism. |

Oppo |

2022 |

China, Select Markets |

Commercialized |

|

Huawei Mate X3 |

Foldable smartphone with a large outer display and a focus on photography. |

Huawei |

2023 |

China, Select Markets |

Commercialized |

|

Vivo X Fold |

Foldable smartphone with a large display and high-end specifications. |

Vivo |

2022 |

China, Select Markets |

Commercialized |

|

Xiaomi Mix Fold 2 |

Foldable smartphone with a slim design and powerful hardware. |

Xiaomi |

2022 |

China |

Commercialized |

Data sourced from Secondary Research

Ultra-Fast Charging Technologies

Innovations in battery technology and charging methods enable faster charging times for mobile devices, significantly reducing the inconvenience of long charging periods. Ultra-fast charging technologies can charge a smartphone battery considerably in just a few minutes, enhancing user convenience and device usability. This considerably impacts consumer satisfaction and device design, pushing manufacturers to adopt these technologies. For instance, Xiaomi introduced 120W fast charging, which can fully charge a phone in less than 20 minutes.

ULTRA-FAST CHARGING TECHNOLOGIES

|

Technology Name |

Charging Time (0-100%) |

Typical Users |

|

Qualcomm Quick Charge 5 |

~15 minutes |

Universal |

|

Oppo SuperVOOC 2.0 |

~38 minutes |

Oppo phone users |

|

OnePlus Warp Charge 65T |

~39 minutes |

OnePlus phone users |

|

Xiaomi HyperCharge 200W |

~8 minutes |

Xiaomi phone users |

Data sourced from Secondary Research

Flexible Electronic Skins

Smart clothing incorporates flexible electronic fabrics that monitor health metrics, such as heart rate and body temperature, or change color based on external stimuli. This technology blends fashion with functionality, offering new ways for wearables to interact with the user's body and environment. The impact on the market could include the latest trends in fashion technology and enhanced athletic performance monitoring. Recent advancements include Google's Project Jacquard, which integrates touch and gesture interactions into textile surfaces.

Next-Generation Wi-Fi

Wi-Fi 6E extends Wi-Fi into the 6 GHz band, providing more bandwidth, higher speeds, and lower latency. This is particularly beneficial for mobile devices, as it enhances the performance of high-bandwidth applications like streaming, gaming, and video conferencing. The adoption of Wi-Fi 6E could significantly impact the market by improving the wireless connectivity experience for users. The primary difference is that Wi-Fi 6E supports the 6 GHz frequency band and the 2.4 GHz and 5 GHz bands already used by Wi-Fi 6.

This 6 GHz band is a significant improvement because it offers:

- More spectrum: Up to 1,200 MHz of additional spectrum is available, more than double the amount available in the 2.4 GHz and 5 GHz bands combined.

- Less congestion: The 6 GHz band is currently unused for Wi-Fi, so there's no interference from existing networks.

- Faster speeds: The increased spectrum and reduced congestion allow faster data transfer rates.

- Lower latency: The reduced congestion and improved efficiency of Wi-Fi 6E can lead to lower latency.

Wearable Health Monitors

Intelligent wearables like fitness trackers and smartwatches now incorporate sensors capable of monitoring various health metrics, including heart rate, blood oxygen levels, and sleep quality. This technology gives users insights into their health and wellness, potentially transforming the healthcare industry by enabling remote patient monitoring and personalized healthcare. Apple Watch Series 7's ability to measure blood oxygen levels and detect irregular heart rhythms has been one of the essential developments within this space.

Advancements in sensor technology have been a key driver in the increased adoption of wearable health monitors. Sensors that are miniaturized and improved in accuracy allow for continuous, noninvasive monitoring of various health parameters such as heart rate, blood oxygen levels, sleep patterns, and physical activity. These sensors are now seamlessly integrated into sleek and comfortable wearable devices, making them more appealing to consumers.

CRITICAL ADVANCED SENSORS INTEGRATED INTO SMART WEARABLE DEVICES

|

Sensor Type |

Major Sensor Manufacturer |

Wearable Device |

Wearable Manufacturer |

Role of Sensor |

|

ECG (Electrocardiogram) |

Analog Devices |

Sense 2™ |

Fitbit |

Measures electrical activity of the heart detects heart conditions |

|

PPG (Photoplethysmography) |

Maxim Integrated |

Watch Series 8 |

Apple |

Measures blood oxygen levels, heart rate variability |

|

Bioimpedance |

Texas Instruments |

Galaxy Watch 5 |

Samsung |

Measures body composition, stress levels |

|

Accelerometer |

STMicroelectronics |

Venu® 2 Plus |

Garmin |

Tracks movement, steps, sleep patterns |

|

Gyroscope |

InvenSense |

4.0 |

Whoop |

Measures orientation, improves activity tracking |

|

Barometric Altimeter |

Bosch Sensortec |

Ring Gen 3 |

Oura |

Measures altitude, tracks sleep stages |

|

Temperature Sensor |

ams AG |

Charge 5™ |

Fitbit |

Monitors skin temperature, detects potential illness |

|

EDA (Electrodermal Activity) |

Silicon Labs |

Embrace2 |

Empatica |

Measures stress levels |

|

SpO2 Sensor |

ams-Osram |

ScanWatch |

Withings |

Measures blood oxygen saturation |

|

Bioelectrical Impedance Analysis (BIA) |

Renesas Electronics |

Ignite 3™ |

Polar |

Measures body composition (fat, muscle mass, etc.) |

Data sourced from Secondary Research

Internet of Things (IoT) Integration

Mobile devices are increasingly becoming the central hub for controlling and interacting with IoT devices like smart home appliances, wearables, and other gadgets. As the IoT ecosystem expands, the demand for mobile devices capable of seamless integration will grow. Integrating health and fitness tracking features is a prominent use case of IoT in mobile devices. For instance, the Apple Watch utilizes an accelerometer, gyroscope, and heart rate sensor to track movement, exercise, and cardiovascular health. It can also measure blood oxygen levels and detect irregular heart rhythms. The watch and the paired iPhone collect and analyze all this data, providing users with personalized insights and recommendations for improving their health and fitness.

Enhanced Processing Power

Mobile processors are becoming increasingly powerful, rivaling the capabilities of some laptops. This increased processing power allows for more demanding applications, smoother multitasking, and better overall performance, making mobile devices more attractive for a broader range of tasks.

EVOLUTION IN PROCESSOR TECHNOLOGY FOR MOBILE DEVICES

|

Processor Technology |

Features |

Manufacturers |

Launch Year (Approx.) |

|

Single-Core |

Basic tasks (calls, messaging, simple apps), Limited clock speeds |

Texas Instruments, Qualcomm |

The early 2000s |

|

Dual-Core |

Smoother multitasking, improved responsiveness |

Qualcomm, Samsung |

Mid-2000s |

|

Quad-Core |

Demanding apps (gaming, video editing), better multitasking |

Qualcomm, Nvidia |

Late 2000s |

|

Octa-Core |

Two clusters (performance and efficiency), balanced power/efficiency |

Qualcomm, MediaTek |

2013 |

|

Heterogeneous |

CPUs, GPUs, and AI accelerators optimized for diverse workloads |

Apple, Huawei |

2017 |

|

Advanced Nodes |

Smaller process nodes, increased power/efficiency |

TSMC, Samsung |

Ongoing |

|

ML Enhancements |

Adaptive performance based on usage patterns |

Qualcomm, Apple |

2018 |

|

5G Optimization |

Processors designed for faster data processing on 5G networks |

Qualcomm, MediaTek |

2019 |

|

Snapdragon® 8 Gen 3 |

Octa-core CPU, Adreno GPU, improved AI processing, ray tracing support, better power efficiency, support for higher refresh rate displays, improved image processing |

Qualcomm |

2023 |

|

Apple A17 Bionic |

Improved performance and efficiency, enhanced machine learning capabilities, advanced image processing, better power management, 5G connectivity support |

Apple |

2023 |

|

MediaTek Dimensity 9300+ |

Octa-core CPU, Immortalis-G715 GPU, support for high refresh rate displays, improved AI processing, 5G connectivity support |

MediaTek |

2023 |

|

Google Tensor G3 |

Focus on machine learning and AI capabilities, improved image processing, enhanced speech recognition, a custom-designed TPU for AI acceleration, and improved power efficiency. |

|

2023 |

|

Exynos™ 2400 |

Octa-core CPU, Xclipse 940 GPU, improved AI processing, support for higher refresh rate displays, 5G connectivity support |

Samsung |

2024 |

Data sourced from Secondary Research

Mobile Devices Market

Jabil Insights on Mobile Devices

From a technological standpoint, the mobile device market is poised for significant growth in the next 3-4 years. The widespread adoption of 5G networks is expected to unlock the full potential of mobile devices, enabling faster speeds, lower latency, and new applications like augmented reality and virtual reality. AI and machine learning advancements will further enhance device capabilities, offering more personalized experiences and improved functionality. The convergence of mobile devices with other emerging technologies like blockchain and IoT will also create new opportunities for innovation and growth.

From a regional standpoint, the mobile device market is expected to experience diverse growth trajectories. In developed regions like North America and Europe, growth is expected to be steady but slower due to market saturation. However, emerging markets like India, Southeast Asia, and Africa will rapidly grow as smartphone penetration increases and consumers upgrade to newer models with advanced features. These regions will become critical drivers of the global mobile device market, with local brands playing a significant role in catering to these diverse consumer bases' unique needs and preferences. Additionally, government initiatives to improve digital infrastructure and promote affordable access to mobile devices will further fuel growth in these regions.

Current Market Outlook – Analyst Perspective

- The 5G-driven Growth: The expanding rollout of 5G networks globally fuels demand for 5G-enabled smartphones and other mobile devices. While smartphone penetration is high in some markets, 5G upgrades represent a significant growth engine, particularly for higher-margin devices. However, device affordability may limit the pace of adoption in less developed markets, where 4G remains dominant.

- Lingering Uncertainties and Potential Disruptions: While the mobile device market has weathered the pandemic, ongoing economic conditions and lingering geopolitical tensions remain sources of potential disruption. Inflation and rising input costs might pressure manufacturers and drive some consumers towards budget-friendly options. The industry must watch for the impact of any future chip shortages or supply chain bottlenecks.

- Innovation to Capture User Imagination and Demand: While core functionality is mature, innovations in form factors like foldable (Samsung Galaxy Z Fold4), AI-driven camera enhancements (Google Pixel 7 series), and advanced health monitoring in wearables (Apple Watch Series 8) have the potential to drive growth and stimulate the replacement cycle.

- The Metaverse: While still a long-term vision, investments in AR/VR by Meta (Meta Quest™), Apple (Apple Vision Pro), and others signal the potential for these technologies to become more mainstream. Mobile devices, particularly smartphones, could serve as a gateway to augmented and virtual reality experiences, leading to new feature requirements for processing power, display technology, sensor arrays, and overall form factors.

- For instance, Apple Vision Pro, announced on 5th June 2023, is a mixed-reality headset developed by Apple. It represents Apple's first foray into the spatial computing realm. The headset is designed to seamlessly blend digital content with the user's physical environment, offering a new way to interact with apps, media, and communication tools.

- Vision Pro promises to transport users into new dimensions of digital interaction. While not a smartphone itself, the underlying technologies within Vision Pro foreshadow a potential revolution in mobile devices. Shortly, the industry may witness smartphones boasting even more immersive displays, enhanced audio experiences, and groundbreaking ways to interact with apps beyond touchscreens. The powerful chips powering Vision Pro could also set new benchmarks for smartphone performance. At the same time, its mixed-reality capabilities may usher in an era of deeper integration of AR and VR experiences into the users' daily lives.

Strategic Considerations

- Consumers desire tangible benefits from smart devices. Companies that seamlessly integrate features for home security, energy efficiency, and everyday convenience will hold a competitive edge. The ability to offer a complete smart home solution or integrate easily with dominant ecosystems (Google, Amazon, Apple) will be crucial for market penetration and customer interest.

- The evolving pace of technology poses a challenge for smart home devices, especially concerning longevity and relevance. Companies need to consider how to design products that can be easily updated or upgraded to accommodate new features and standards without necessitating complete replacements.

- Companies like Apple and Samsung illustrate the power of controlling hardware and software. This allows for deeper integration and unique selling propositions. Smaller players will need to forge strong partnerships to create compelling device-plus-service offerings.

- Replacement Cycle: Manufacturers must balance breakthrough innovation with a focus on repairability and long-term software support. Extended longevity initiatives, trade-in programs, and more affordable repair options could encourage upgrades and combat the "good enough" mentality limiting frequent replacements.

- Sustainability and Circular Economy: Most consumers now demand environmentally responsible practices. Companies that are transparent about incorporating recycled materials, reducing packaging, extending product lifecycles, and promoting e-waste recycling programs could gain significant competitive advantage, although this is likely to have cost impacts on production.

- Supply Chain Resilience and Agility: In this unpredictable market, a resilient supply chain isn't just an advantage; it's essential for survival. Dual-sourcing strategies, regional manufacturing capacity, and investments in inventory visibility will help manufacturers mitigate potential disruptions.

- Harnessing AI on the Edge: On-device AI chips enhance image and video processing, battery optimization, and enable seamless translations (Google's Tensor chips). Investing in AI capabilities will be crucial for delivering next-generation user experiences in 2024 and beyond.

- Cybersecurity and Privacy Regulations: With the growing sensitivity of data collected, mobile device players need to proactively bolster security measures and adhere to evolving privacy regulations across markets. Proactive security, such as Knox in Samsung devices, becomes a significant selling point.

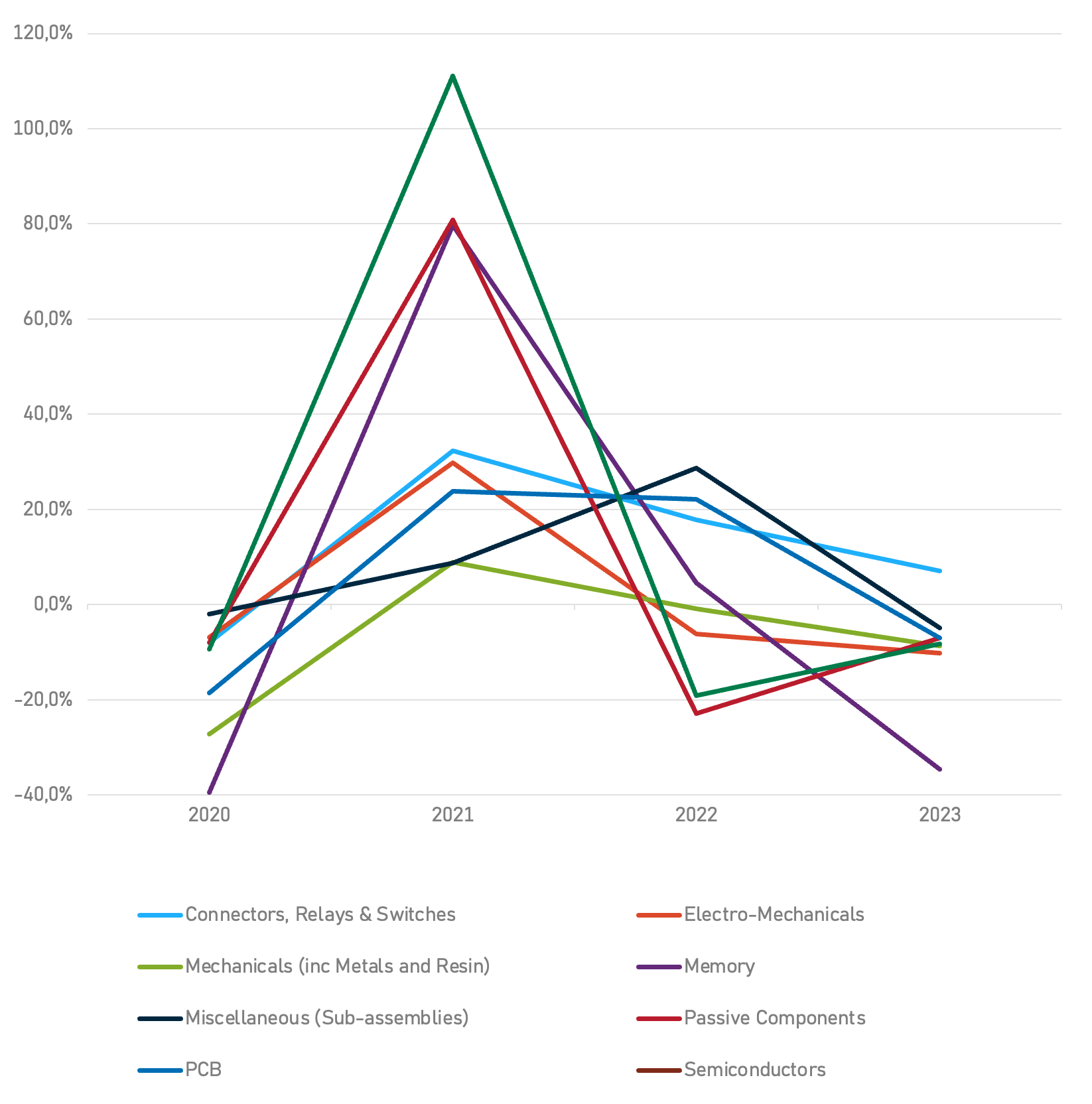

Jabil Spend Analysis

Jabil Spend on the Mobile Devices Sector by Category (2020 vs. 2023)

.2024-07-10-20-18-26.png) Data based on Jabil's historical spending data for the Mobile Device Customer Segment

Data based on Jabil's historical spending data for the Mobile Device Customer Segment

Jabil Spend on Categories YoY (%)

.2024-07-10-20-18-26.png)

Data based on Jabil's historical spending data for the Mobile Device Customer Segment

Back to Top