By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Sector Market Report

Healthcare

Sector Market Report

Healthcare

Discover how the healthcare industry is rapidly innovating, with the convergence of macrotrends and technology accelerations transforming the way care is delivered to patients.

Healthcare Market

Overview

This report presents an overview of macrotrends impacting the global healthcare ecosystem and a deeper discussion of how advanced technology applications across all sectors and care delivery domains are driving the industry’s transformation.

Content is focused upon end markets defined broadly within the following five healthcare subsectors:

Healthcare is an exceptionally difficult market to navigate, combining the complex commercialization requirements of a regulated, quality-imperative market with the increasing speed-to-market challenges more typical of consumer technology. Additionally — and in tandem with the industry's prioritization towards more cost effective, patient-centric care — healthcare’s original equipment manufacturers (OEMs) are adapting to increasing demands for lower cost-of-care models.

Efficiency, scale, and agility are more important than ever in bringing new and improved products to the patients who need them — proven by the fact of the industry’s growing adoption of manufacturing partnerships and outsourcing.

In addition to extending overall capacity, external providers with expertise in advanced technologies, sophisticated supply chain management, and vertically integrated manufacturing processes offer their customers the strategic advantage of a broadened bench of talent and capability, and ultimately, peace of mind.

Healthcare Market

Introduction

The transition to value-based healthcare (VBC) in health systems worldwide continues.

As reported by the World Economic Forum's initiative, the Global Coalition for Value in Healthcare, an estimated $1.8 trillion of annual global health spending accounts for “no” or “minimal contribution” to positive health outcomes. To remediate and ‘bend the cost curve back,’ non-performing costs must be removed from the system by advancing healthcare products and service solutions that deliver the most value.

Across the globe, and with particular urgency within the United States, health systems are shifting from fee-for-service (FFS) reimbursement models, which reward quantity over quality, to VBC payment models, which encourage providers to deliver the best care at the most reasonable cost.

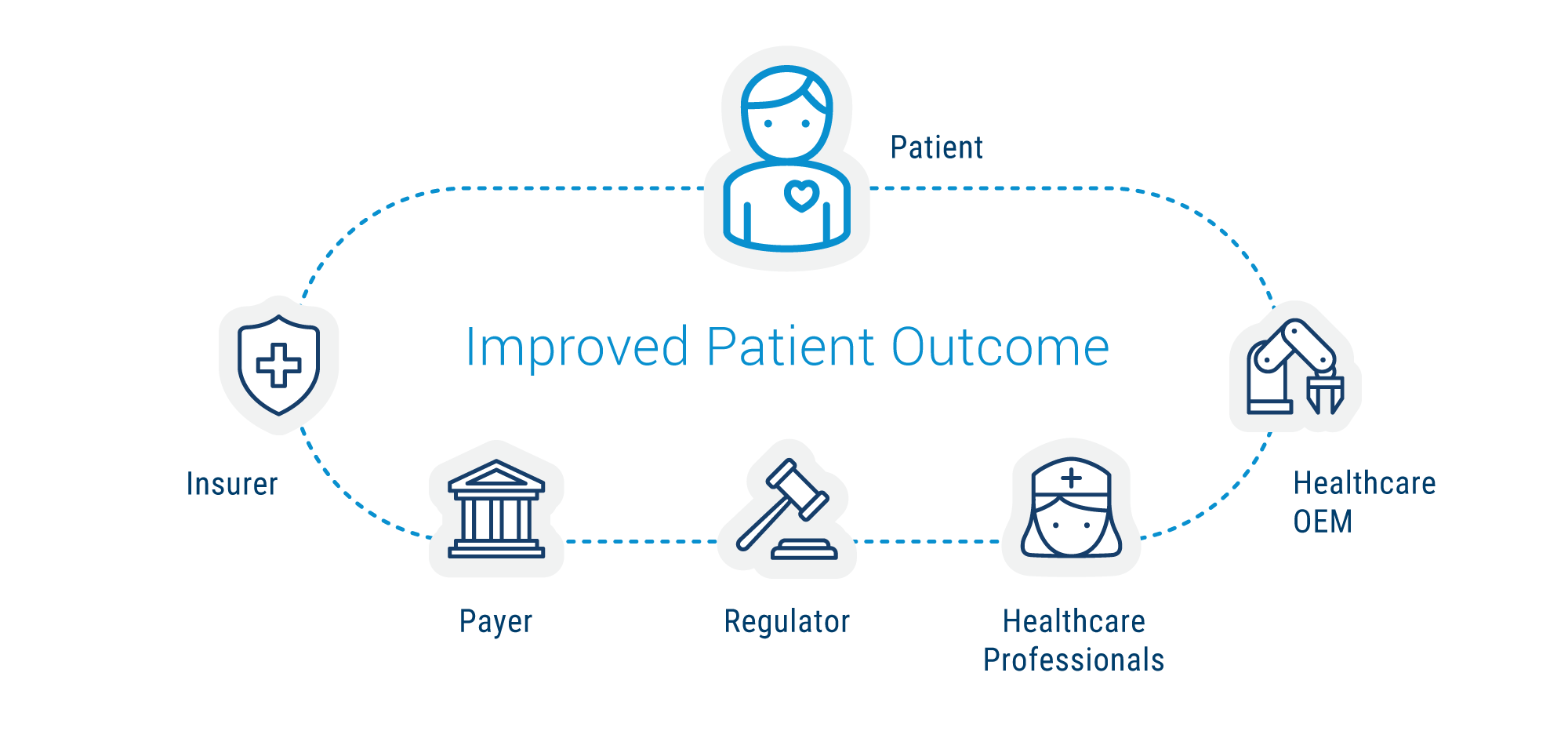

At an elemental level, VBC pressures underpin the economics OEMs must address to maintain and grow their healthcare franchises. At the same time, the drive to improve how care is delivered and experienced is shared across an industry ecosystem of distinct yet interdependent players working to achieve an optimal balance for patients between efficacy, safety, and access to treatment that is non-disruptive to everyday life.

Specific Objectives Across the Ecosystem:

- Patients seek effective treatments.

- Healthcare professionals strive to improve patients’ lives.

- Regulators work towards a balance between clinical outcome and safety.

- Payers and insurance companies work to balance clinical outcomes and total healthcare costs.

- Healthcare OEMs seek approval and reimbursement for their products that will be clinically successful as well as commercially viable.

As technology’s impact on healthcare accelerates, division between product categories and domains blurs. Device companies, diagnostics companies, therapeutics companies, and data companies are, to some extent, all converging onto a shared solutions path for controlling costs and delivering better solutions. Markets are expanding with use cases crossing category silos towards opportunities for broader applications. Increasingly, consumer (i.e., patient) preference is setting the pace and writing the rules.

Healthcare is an industry with increasing forward momentum. Research and development programs by the industry’s OEMs are accelerating innovations in medical technology, surgical practice, precision diagnostics, and digital health — reshaping the delivery of care and offering new opportunities for early diagnosis, personalized treatment, and improved patient outcomes.

Healthcare Macro Trends and Expanding Market Opportunities

Innovations Enabling New Care Settings and Improving Patient Care

Projections, as referenced by a Gartner analyst's presentation in 2022 at the annual HIMSS Global Health Conference & Exhibition, are that by 2025, 40% of healthcare providers will shift 20% of hospital beds to the patient’s home through digitally enabled hospital-at-home services, improving patient experience and outcomes, and reducing the cost of care.

A similar analysis by McKinsey (focused on Medicare expenditures within the United States) estimates that up to $265 billion worth of care services could shift from traditional facilities to the home by 2025 without a reduction in quality or access. For healthcare to remain affordable and sustainable, it needs to move into lower-cost settings whenever possible.

Complex, chronic health conditions demand longitudinal care to manage symptoms, improve quality of life, and reduce the need for high-cost ER visits and hospitalizations. Digital health technology helps close the distance between patient and caregiver, facilitating proactive, high-touch strategies in synch with VBC’s objectives for more effective healthcare delivered at lower cost.

Jabil’s 2024 survey of more than 200 individuals with decision-making responsibility at leading healthcare companies (conducted by research firm SIS Research International) lends further support to the trend, per the nearly unanimous affirmation of digital healthcare value statements by the survey cohort:

- Enables vital patient data collection and analysis.

- Supports continuity of care, improving patient outcomes.

- Facilitates connections between patients and providers.

Over the past decade, digital technology’s footprint within healthcare has broadened significantly, adding more demands upon the technical requirements for manufacturing. Among the evolving set of challenges tracked by Jabil’s surveys over the years — like smaller product architectures (miniaturization) or connectivity protocols — the leading technical domains identified as critical to keeping pace in the industry are optics and sensors.

Portable or wearable devices enabled by these digital technologies are essential to facilitating the shift towards decentralized care models, including home-based and community care settings.

Precision Medicine

Combatting Chronic Disease with Personalized Healthcare Applications

Precision Medicine refers, in its broadest definition, to healthcare tailored for a specific individual. By considering the variability inherent in a patient's genes, as well as impacts from the environment and lifestyle, the goal is to provide more targeted solutions for the right patient to get the right treatment at the right time.

Leveraging genomic analysis to determine the propensity for developing specific health conditions (such as type 2 diabetes or heart disease) combined with big data’s analytic capabilities improves not only individual care but also helps drive real-time information for calibrating treatment models for the collective patient population.

In diabetes care, the sensor technology of a continuous glucose monitoring (CGM) type 2 therapy device has been ported into a new line of consumer wearables intended for more general fitness and wellness purposes. The evolution is towards devices that also measure and manage weight loss and diet and fitness performance through monitoring substances like glucose, lactate, ketones, and more.

Global increases in life expectancy are leading to a higher prevalence of chronic conditions, such as diabetes and cardiovascular diseases, necessitating innovative treatment approaches and healthcare models. Aging populations demand more from health services. By 2050, the world's population of people aged 60 years and older will double to ~2.1 billion. The number of people aged 80 years or older is expected to triple, reaching ~426 million.

Analysis published in 2023 by the World Obesity Federation predicts that by 2035, half of the world’s population—about four billion people—will meet the definitions of being overweight or obese — with an economic impact in excess of $4 trillion USD annually. Numerous conditions (e.g., diabetes, high blood pressure, heart disease, some cancers, fatty liver, sleep apnea, arthritis) are linked to obesity.

Despite these daunting statistics, medical science continues to light the way forward. The emergence of GLP-1 drugs to combat obesity is a significant breakthrough in healthcare. Advances in molecular diagnostics and CRISPR gene editing technologies are paving the way for personalized medicine, where treatments are tailored to an individual's genetic makeup. Expanding utilization of applications such as next-generation sequencing (NGS), liquid biopsy, and companion diagnostics (CDx) are ramping towards a golden age of commercialized biotechnologies.

Growth of Contract Manufacturing in Healthcare

The market’s demands for improved cost efficiencies and faster time-to-market performance drive the shift towards outsourcing across all healthcare domains, rewriting the rules for traditional manufacturing models. Outsourcing for manufacturing solutions continues to experience significant growth, with some estimates targeting more than $500 billion as a valuation for the contract manufacturing market by 2030.

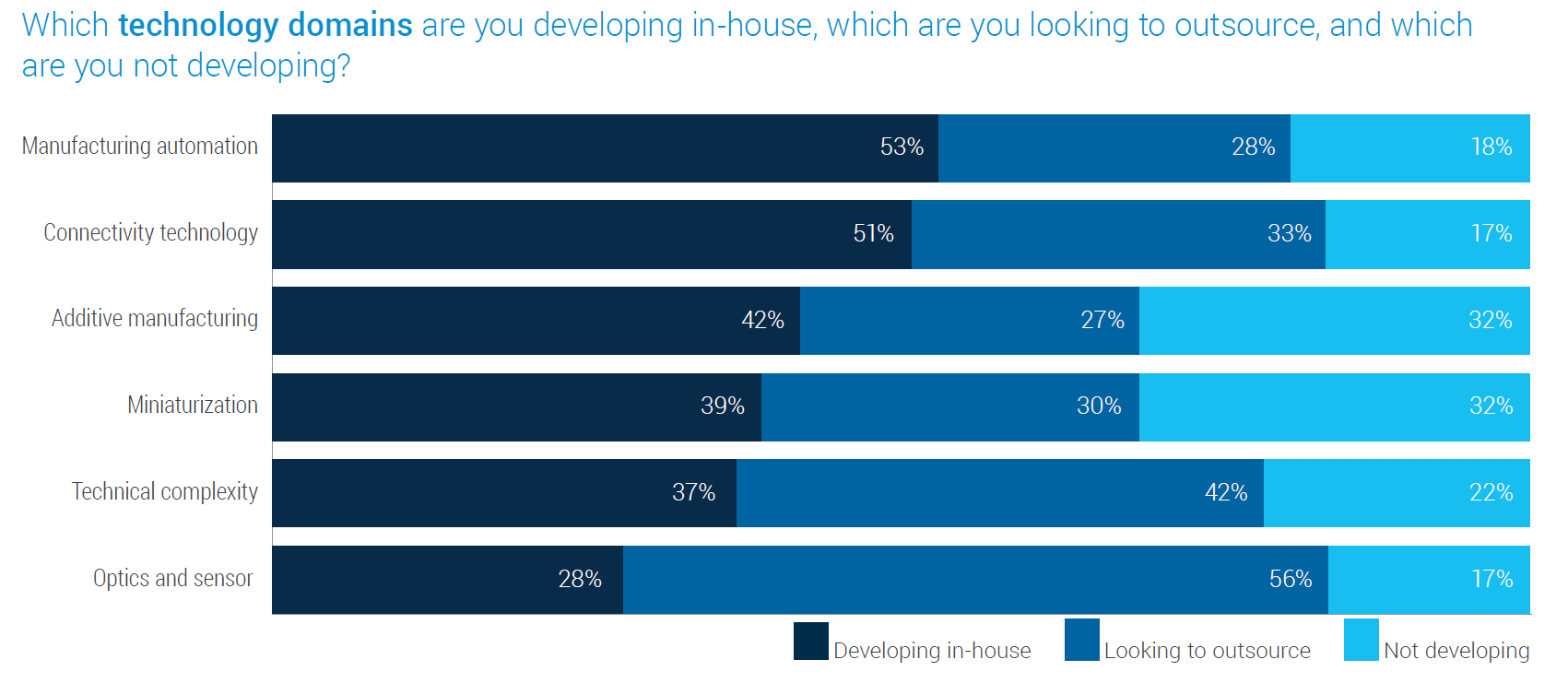

Specialized capabilities are often the deciding elements for companies when choosing between in-house or outsourced solutions. Optics and sensor technologies were identified (per Jabil’s market survey) as having the highest potential for outsourcing, selected by 56% of participants, while the following highest percentage (42%) was for technical complexity, such as expertise in managing tolerances, materials, chemistry, and power management requirements.

Meanwhile, manufacturing automation and connectivity technology are most likely kept in-house, possibly indicating that many of the participants' needs for support developing new capabilities in these more mature technologies have temporarily plateaued.

Since Jabil inaugurated its biennial digital healthcare survey in 2018, the industry's embrace of outsourcing has steadily increased and now represents a considerable majority of companies being polled. Almost three-quarters say they need help navigating changing technologies, supplier, and regulatory landscapes, affirming their plans to engage further with manufacturing partnerships for improved market performance.

Healthcare Market

Supply Chain and Manufacturing Solutions

Headwinds

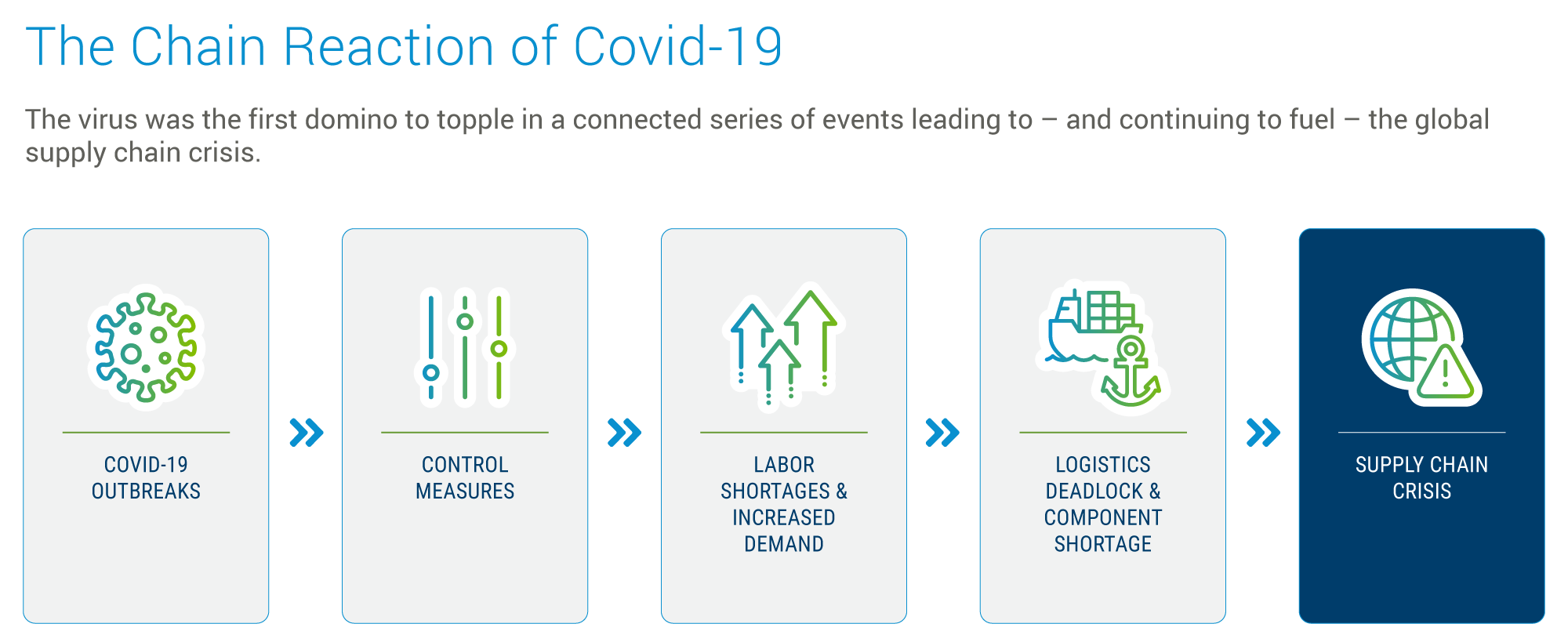

In less than half a decade, healthcare sector supply lines have been challenged by and weathered a range of disruptive factors, including the COVID pandemic and the ongoing impacts of geopolitical tensions. The pandemic led to sudden, unprecedented demand for testing devices and other healthcare products, like PPE, ventilators, and Tyvek® for protective and sterile packaging.

Healthcare’s multi-tiered supply chains, including raw materials, components, assembly, and distribution, proved vulnerable to dramatic swings between shortages and overcapacity. After the initial surge, many segments faced overcapacity as demand normalized, but supply continued to ramp up based on earlier projections.

The last 2+ years have introduced even more pressure into the system, arising from global monetary policy tightening. The transition from an extended low-interest rate environment has been particularly hard for early-stage startups but perhaps even more challenging for more established companies suddenly finding their commitments to innovation requiring an agile change of direction midstream.

Diversification and Localization

In many ways, however, these dynamics have served as a catalyst for improving supply chain performance in preparation for what’s next. Diversification and localization are primary adaptations healthcare OEMs can implement to build more resilience into their supply lines.

The increased complexity and quality demands of healthcare supply chains make them even more susceptible to interruptions. Moving from single to dual sourcing and/or multi-sourcing enables flexibility, providing continuity of supply for OEMs in the face of unforeseen circumstances, such as the inability of a single supplier to meet demand for any reason, from pandemics to geopolitical aggression or failures of transportation infrastructure.

Jabil’s healthcare customers recognize the value to their business of a diverse, robust, and globally distributed supply chain organization, per our management of more than 700,000 parts and relationships with 36,000 global suppliers, equaling $29 billion in annual total spend for 450 of the top brands worldwide.

For products that can, at times, literally mean the difference between life and death, multi-sourcing helps ensure healthcare solutions get where they are needed and without the frustration and cost of sourcing-based delays.

Reshoring and Friendshoring Healthcare Supply Chains

China has long been a popular choice as an Asian manufacturing base, owing to its balance of low-cost and high-skilled labor and deeply established logistics ecosystem. But pandemic and trade tensions have put the fragility of global supply chains at the center of today’s conversations about risk and reward. While low cost is still a primary driver, manufacturers are moving towards more resilience-driven strategies.

Alternative manufacturing bases in Asia, such as Vietnam, India, Singapore, Malaysia, Indonesia, the Philippines, and Thailand, are part of a “China +1” strategy – that expands global production for manufacturers throughout the region, diversifying geographic risk while simultaneously developing a more resilient supply chain.

Vietnam has put a premium on attracting semiconductor and advanced electronics manufacturing, bringing in some of the world’s biggest companies. India’s liberal trade policies, tax reform, and infrastructure investments have primed the pump for accelerating foreign direct investment (FDI). As a result of these reforms, India’s economy has become more export-driven and more inter-linked in global supply chains, unlocking further growth.

For US-based or US-market focused companies, the trend towards reshoring manufacturing capabilities and supply lines is fueled by a desire to insulate from geopolitical tensions, active war zones, and restrictive trade policies, like those straining relations between the United States and China.

Some healthcare supply chains cannot be fully reshored because the cost of replicating them domestically is prohibitive. The alternative, for Americas-focused manufacturers, has been nearshoring in Mexico. More recently the term ‘friendshoring’ — referring to a network of trusted suppliers from friendly countries that offer multiple independent supply paths — has arisen as a more nuanced description with its implied emphasis on de-risking supply lines.

Medical device companies around the world are particularly attracted to the Dominican Republic as a manufacturing base due to its exceptional access to the world’s largest consumer healthcare market, the United States. Medical and pharmaceutical product manufacturing began in the Dominican Republic over 40 years ago. By 2022, exports of these healthcare market products amounted to $2.25 billion USD, accounting for nearly one third of total exports from the country.

Friendshoring helps diversify a manufacturer’s footprint and reduces potential supply headwinds while easing challenges arising from expensive shipping, exhaustive travel, and difficult communications. Other key friendshoring centers for Americas-centric health and medical technology manufacturing are Costa Rica, Puerto Rico, and Mexico.

Focus on Sensors

Medical sensors play a crucial role in healthcare, with a range of applications across all domains. Digital healthcare devices leverage the power of sensors, in combination with optics, and compute capabilities to help close the distance between patient and provider and enable more seamless continuity of care apart from clinical settings.

Sensor Applications in Healthcare:

- Pressure Sensor

- Temperature Sensor

- Humidity Sensor

- Blood Glucose Sensor

- Oxygen Sensor

- Airflow Sensor

Chronic Disease Management

Sensors are designed to measure and transmit data related to vital signs, such as heart rate, blood pressure, temperature, glucose levels, and respiratory rate, among others. Continuous monitoring of a patient’s vital signs allows healthcare professionals to detect any abnormalities or fluctuations in real-time. This facilitates early intervention, personalized treatment plans, and improved patient outcomes.

Hospital to Home / Remote Patient Monitoring (RPM)

Increasingly older populations are driving demand for aging in place healthcare solutions. Sensors that enable remote patient monitoring, reduce the need for frequent hospital visits, and enhance patient comfort and convenience.

The market is competitive, including leading healthcare conglomerates like Medtronic, Philips, and GE Healthcare, as well as companies like Analog Devices, Omron, LifeScan, and Fujitsu. The top 3 companies account for nearly 30% of the sector's sales. In terms of application, blood glucose sensors are the largest segment, also representing about 30%, followed by oxygen sensors, with a share of approximately 25%.

Predictive Product Lifecycle Management

In an era of accelerating innovation, product life cycles are becoming increasingly compressed and are far more prone to disruption exposing companies to potentially significant losses of revenue, profit, and market share.

Predictive lifecycle management helps to identify and analyze potential disruptions, via simulated redesigns and supplier intelligence models, which can predict the size of any potential impact on product revenue, the cost to mitigate it, and the optimal time to address the needed changes. Models can be designed to focus on part decline, taking into account end-of-life (EOL) allocation, market conditions, and technology lifecycle curves to predict both when legacy parts are likely to become unavailable and when they also become so outdated that the products they go into are no longer competitive.

Healthcare Product Lifecycle Dynamics:

- Medical devices/healthcare products have traditionally long lifespans. 8-10 years, even 20 years.

- Digital healthcare/connected aspects of devices have much shorter lifecycles than the underlying therapy aspects of healthcare devices.

- A recent Jabil survey of healthcare industry trends found that 62% of the participants said their production cycles have gotten at least 50% faster over the past decade.

- The basic therapeutic approach may be far more conservative and stable, while the means for delivering the therapy — like connectivity protocols or user interfaces — are align more with consumer technology’s pace.

In an increasingly competitive landscape, healthcare supply chain managers must be able to quantify and act upon any expected disruptions resulting from high-risk components included in their bill of materials. Reducing single or sole-sourced parts as much as is feasibly possible, even if it means additional cost investment up front, will pay dividends in the long run.

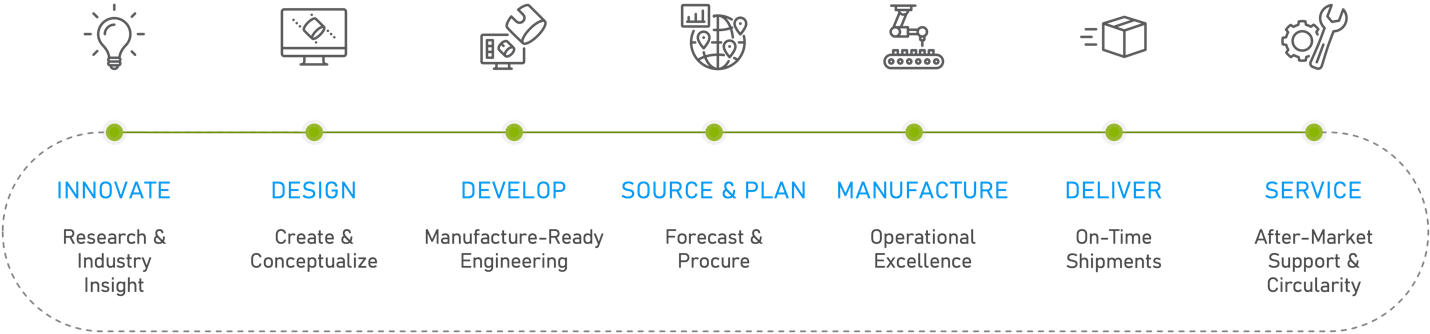

JABIL SOLUTIONS ACROSS THE FULL PRODUCT LIFECYCLE:

Benefits of Modular Design

New product designs and re-designs should be pushed to modular architecture – i.e., designing products such that common underlying components are grouped together. This allows for the technology-based/faster lifecycle componentry to be upgraded as needed.

|

|

|

|

|

Speeds up |

Keeps product |

Avoids need for |

Medtronic, Abbott, Dexcom, and Roche leverage modular designs to enable easy upgrades as technology improves or patient preferences shift to maintain and replace their diabetes care devices' high-velocity components.

Customer-centricity is a key objective in the diabetes care market. Diabetes patients want increasingly frictionless interactions with the devices that deliver care for their disease. The more seamless the delivery, the better. Better still, if monitoring and management can be accommodated by a phone or similar, easy-to-use engagement platform. Touchscreens, user interface technologies, and LEDs are at the point of patient engagement and are where customizations, driven by patient preference, can change multiple times over a product’s lifecycle.

Sustaining Engineering

The ongoing support provided by sustaining engineering services ensures that manufactured products remain competitive, meet regulatory standards, and retain their quality throughout their lifecycle. These services provide exceptional value for OEMs facing competition from non-native healthcare companies, particularly as consumer tech, communications, and software specialists converge upon healthcare product domains.

Key values:

- Component Management — Over time, certain components used in healthcare’s long-lifecycle products may become obsolete or face supply chain disruptions. Sustaining engineers work to find replacements or redesigns that can utilize readily available components without compromising product function or quality.

- Cost Reduction — As a product matures, there may be opportunities to reduce its manufacturing cost through process optimizations, leveraging economies of scale, or utilizing alternative materials or components that maintain quality but are more cost-effective.

- Quality Improvements — Based on feedback from the field, device digital twins, or warranty returns, sustaining engineering can implement changes that enhance product reliability and performance and add new features to keep the product competitive in the market.

- Regulatory Compliance — Sustaining engineers ensure that products continue to meet industry standards post-launch, modifying designs if necessary.

- Addressing Field Issues — If any design-related issues arise from products in the field, sustaining engineers will identify the root cause(s) and implement corrective actions.

Optimizing Demand Prediction with AI/ML

Healthcare customers face extraordinarily complex and often interconnected demand cycles for their products and services. Traditional analytical approaches have improved dramatically over recent years as digitalization has taken hold, but limitations remain. Accurate demand prediction drives financial commitments, materials ordering, and supplier engagement. Harnessing AI and machine learning (ML) for demand forecasting is essential to improving the management of the industry’s OEMs’ supply chains.

As a machine learning system is fed more data, its ability to analyze patterns and deliver accurate, incisive forecasts improves exponentially. AI-driven forecasting can aid in anticipating surges in demand during public health emergencies, enabling healthcare systems to prepare and respond effectively. Even more, it can parse interconnected dynamics and intent between all the factors that impact the consumption of medical and health products.

Jabil’s 2024 Supply Chain Resilience Survey reports that nearly 200 supply chain and procurement decision-makers from some of the world’s leading product brands are planning for and already using AI in their day-to-day processes. The insights provided by the participants highlight key best practices for successfully integrating AI within supply chain operations.

- The surge in AI applications within supply chain management is largely concentrated on enhancing demand planning and inventory management. By leveraging predictive analytics, organizations aim to improve forecasting accuracy and efficiency, thereby optimizing resource distribution and addressing the imbalance between supply and demand.

- A ‘data-first’ mentality is critical for harnessing AI's full potential in supply chain operations. Success hinges on establishing a robust data management infrastructure and governance framework prior to deploying AI tools. This foundation ensures data reliability and fosters meaningful insights, underscoring the importance of collaboration and data sharing among stakeholders.

- Preparing the workforce for AI integration involves addressing potential concerns about job displacement and emphasizing AI's role in augmenting human skills. By providing training and hands-on experience with AI technologies, companies can facilitate a smooth transition towards more automated and efficient supply chain processes.

Healthcare Market

Innovations Transforming Healthcare Domains

Medical Technology and Surgical Solutions

In minimally invasive surgical (MIS) procedures, instead of operating on patients through traditional ‘open’ incisions (3 inches or more), surgery is accomplished with miniaturized instruments that fit through a series of quarter- to half-inch incisions. The surgeon accesses the patient’s anatomy through small trocar enabled ports using specialized elongated instruments and a camera (i.e., laparoscope), providing real-time surgical site imaging. Technical advantages for the surgeon include the potential for better surgical orientation and navigation, with higher magnification and dramatically enhanced perspective.

Robotic-Assisted Surgery (RAS)

Robotic-assisted surgery (RAS) improves capabilities even further. The surgeon typically sits at a surgical console, providing immersive visualization while directing precise and intricate instrument maneuvering through an intuitively controlled, high-dexterity robotic ‘wrist’. RAS eliminates hand tremors, enabling surgeons to perform complex and delicate operations with greater confidence and control.

Robots and their assisting devices are also exceptionally effective for interventions requiring repetitive movements. Other advantages associated with RAS build upon those already established by MIS: shorter hospital stays, faster recoveries, less pain, and fewer complications (i.e., less blood loss and lower pain medication requirements).

At their most basic, surgical robotics systems consist of arms and an end effector; the gripper is one of the most common types of end effector mounted on the end of the robot arm. The primary role of the gripper is to pick and place various objects during the surgical process. Motors and control systems actuate surgical tools and scopes, requiring exceptional mechatronics capabilities for their manufacturing.

Intuitive Surgical continues to dominate the global market with its da Vinci system platform. However, a complete surgical suite overhaul to accommodate the installation of a full RAS system is prohibitively expensive for many hospitals. A surgical robot and its associated control equipment can cost more than $1 million USD and take up a large amount of physical space within the operating room.

Alternative, smaller-footprint, modular solutions provide opportunities for greater utilization, accessibility, and affordability for a range of medical facilities, including ambulatory surgery centers (ASCs). This is particularly true as more surgeons trained with RAS systems enter practice, and the case for lowering overall healthcare costs becomes clearer.

Medtronic (Hugo™), Johnson & Johnson (Monarch®), and Stryker (MAKO®) offer smaller, more adaptable systems. CMR Surgical's Versius system is a modular, cart-based robotic system designed to be small, portable, and flexible. Earlier this year, the company reported its strongest quarter on record, with the number of installations of Versius increasing by more than 50% since 2022.

Leveraging these sophisticated and complex technologies into commercially viable product platforms requires broad expertise across technical domains. Surgical platforms are expected to be fast (operate in real-time with no latency), intuitive, and mechanically precise—a set of challenges demanding competency across the full spectrum of optics engineering and active alignment capabilities, as well as expertise manufacturing small, light, thin, and flexible product architectures with exacting mechanical and electronic specifications.

These complex technologies are not exclusive to healthcare. As new applications and use cases continue to expand across a wide spectrum of industries, healthcare OEMs are turning to manufacturing partnerships that can help them stay at the literal cutting edge of innovation, particularly when capabilities for precision machining, optical and sensor integrations, and injection molding are offered within a vertical stack of services.

OEMs are also concerned about high scrap rates in MIS devices. (Manufacturing scrap is the unusable material from a manufacturing operation that will be discarded; Scrap Rate = Unusable Units / Total Units Produced.) Lean and Six Sigma improvement methodologies are key for manufacturers to identify ways to reduce scrap and make MIS processes more repeatable.

Orthopedics

Orthopedics is the branch of medicine concerned with correcting or preventing deformities, disorders, or injuries of the skeleton and associated structures. Innovative new approaches within the sector are revolutionizing how musculoskeletal conditions are treated and rehabilitated. Personalized, patient-specific implants and surgical instruments have become the standard of care in an exceptionally competitive, cost-pressured market.

Within the last year, demand for orthopedics solutions has recovered from the softness driven by COVID-related procedure delays. Johnson & Johnson's orthopedics division, DePuy Synthes, expects elevated procedures again in 2024.

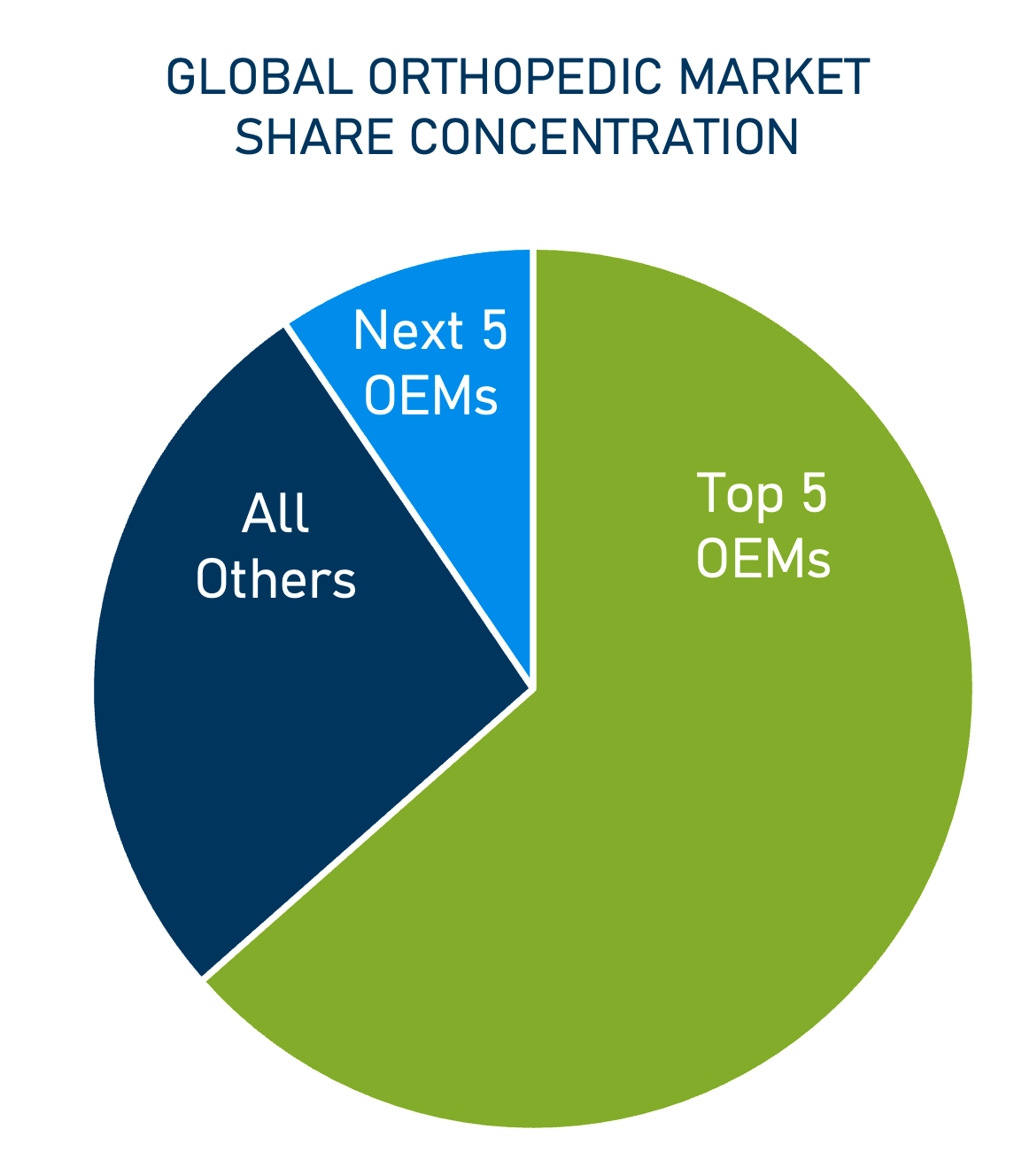

Johnson & Johnson, Zimmer Biomet, Stryker, Medtronic, and Smith & Noble round out the top five OEMs in the sector.

The dominant players in the market have developed broad product portfolios, which include minimally invasive devices, surgical generators, robotic surgery solutions, implants, instruments, and kitting solutions. Finish, package, and sterilization services are additional capabilities rounding out their ecosystem requirements.

Orthopedics manufacturing involves a convergence of technologies. For example, smart implants for knee replacement procedures improve soft tissue balance and implant position through sensor-assisted technology. Connected implants enable the physician to monitor temperature and other vital signs uninterrupted for proper healing and deliver insights, such as gait shift measurements, for fine-tuning longer-term physical therapy.

Additive manufacturing, or AM (the industrial production name for 3D printing), is used to deliver patient-specific solutions and incorporate complex and precise lattice geometries unattainable by traditional machining and manufacturing processes.

Increasing personalization and customization via additive is driving down costs and improving people's experiences with these particularly traumatic procedures. The custom mesh structures produced by 3D printing improves functionality, encouraging bone cell ingrowth and vascularization.

Additional benefits include:

- Reduced surgical complications.

- Reduced hospital and post-acute care costs.

- Minimized revision procedures.

- Increased precision and flexibility.

- Optimized durability and stability.

AM Enables Innovation

Additive manufacturing has proven to be exceptional at unlocking design innovations that are otherwise too complex or cost prohibitive with traditional manufacturing techniques, such as injection molding or CNC machining. Leverage of 3D-printed plastic or metal allows manufacturers to create customized solutions that improve patients’ recovery time and their longer-term health outcomes.

Additive manufacturing designs can be distributed directly and instantaneously from a CAD system, digitally, to a network of printers located wherever needed by the OEM — essentially, anywhere in the world. So, there is no overhead for handling individualized products. This is a frictionless advantage for additives compared to legacy solutions in orthopedics.

The result: greatly reduced lead times compared to conventional techniques, as well as reduced costs related to assembly, warehousing, and supply chain management. Manufacturing to a ‘unit of one’ provides significant savings on both cost and time.

Diagnostics

In-vitro diagnostics medical devices (IVDs) are tools for simplifying the process of capturing, analyzing, and ultimately managing the biological complexity that underlies human disease. Per industry accepted estimates, IVDs influence roughly two-thirds of clinical decision making, yet account for only 2% of healthcare spending. In 2020, the global market size of the IVD market was estimated at $83.4 billion. For 2021, estimates valued the market at just over $87 billion, with a compound annual growth (CAGR) of 4.5% between 2021 and 2027.

Diagnostics and life sciences applications address a range of dynamic emerging market opportunities, including:

- Testing portfolio expansion, post-COVD.

- New imaging technologies refining diagnosis and treatment.

- Personalized care for managing chronic disease enabled by genomics insight and discovery.

Point-of-Need (PON) / Point-of-Care (POC)

Low-cost, small form factor PON/POC devices enable more treatment flexibility than central lab testing while providing rapid sample-to-answer results with molecular-grade confidence. The market is transitioning post-COVID after the initial demand surge for rapid testing and the accompanying build-out of manufacturing capacity. Companies that had invested in capital intensive manufacturing were suddenly faced with minimal revenues, resulting in substantial cash burn and liquidity shortfalls.

The boom-and-bust cycle that has taken hold in over the counter, at-home diagnostics is seen dramatically in the story of Cue Health. At the height of COVID-19, in September 2021, Cue Health went public at $16 per share in a $200 million initial public offering. Not yet three years later, the market capitalization for Cue has dropped below $10 million as the company announced a Chapter 7 voluntary wind down of its business. In a shift to a more show me the money mindset, public markets are no longer rewarding the longer-term potential of company's providing access to vital health information at a consumer's fingertips.

Although muted in terms of public market valuations, the value of these new testing paradigms is not lost on sector adjacent companies, like Pfizer, as demonstrated by their absorption of Lucira Health. Although the company no longer exists, its test lives on. Shortly before the acquisition, Lucira received US Food and Drug Administration Emergency Use Authorization (EULA) for the first over-the-counter molecular test to differentiate SARS-CoV-2 and influenza A and B.

Roche, one of the world's largest pharmaceutical companies, has also become a leading provider of IVDs across major disease areas. As part of their strategy to build out their POC diagnostic catalog, Roche announced in January 2024, intention to acquire numerous products from LumiraDx, including LumiraDx’s shoebox-sized analysis instrument and a menu of specialized testing strips. The deal, valued at $350 million USD, will allow Roche to deliver more tests directly to consumers, into homes, pharmacies, doctor’s offices and elsewhere.

For the companies staying in this market, focus is broadening beyond COVID to multiplexed testing addressing a wider array of respiratory diseases, sexually transmitted infections and more. The value proposition remains powerful: enabling people to quickly seek appropriate medical treatment through delivery of precise and prompt diagnostic information — conveniently, and privately.

Diagnostic Imaging Modalities

Robust imaging diagnostics accomplish and inform an invaluable range of clinical “signposts” serving a key role in the healthcare value chain. Sophisticated microscopy technologies, for example, have revolutionized how cellular processes are visualized and monitored which in turn has helped to drive a rapidly growing knowledgebase of molecular composition and the function of biological systems.

As a tool for surgical practice, imaging diagnostics help drive better decision-making, both before and during procedures, as well as clarifying downstream resource requirements. Despite tremendous strides in recent years towards a ‘digital operating room’ via advanced immersive technology systems, the surgical world continues to rely on two-dimensional imaging technology to understand and operate on incredibly complex patient pathology. Improved performance at lower cost — with a greater range of applications — is a primary reason why.

CT scans, X-rays, MRI, ultrasound and other Dx imaging modalities are now leveraging semiconductor solutions as their detection technology, providing much more flexibility for designing smaller form factor devices and systems that are user-centric, while opening the door for more portable solutions. For certain applications, such as diagnostic endoscopy, sophisticated miniaturized camera modules can be commercialized at sustainable costs that enable single use applications.

Ultrasound is one of the most widely used and readily available imaging modalities with utilization in screening and diagnosis, therapy planning, and monitoring. Ultrasound devices are complex products comprised of multiple parts which in many cases are assembled to form a single unibody of components. The weakest link in this chain of components can limit accuracy and effectiveness. Fast changing technology can also make the unibody design strategy vulnerable.

First introduced in the late 1990s, the Sequoia ultrasound system, (originally developed by Acuson) continues today as an industry leader under Siemens Healthineers, the healthcare division of Siemens AG. Sequoia is designed modularly, allowing for easy upgrades and integration of new technologies without the need to replace the entire system. This future-proofing approach means that as new advancements in ultrasound technology emerge, Sequoia systems can be updated to incorporate these innovations, ensuring that they remain state-of-the-art.

Commercial Applications Driven by Accelerating Genomic Insight

When the first whole human genome was sequenced in 2003, the process required 15 years of work, 20 different labs and more than $3 billion. Over the following decades, NGS (next-generation sequencing) has accelerated the rate of DNA sequencing while dropping the cost significantly. To expand the NGS market, smaller, bench-top sequencing instruments are being developed to enable lower cost sequencing options for labs outside of teaching hospitals or sophisticated reference labs. Today, an entire human genome can be sequenced for ~$600.

As a tool for discovery and prediction, NGS and related technologies combined with AI and ML applications will revolutionize not just diagnostics but the entire healthcare sector. These hyper-scaled applications unlock methods for gleaning insights into the cause of disease that cannot be reached through traditional methods of analysis. Johnson & Johnson’s chief data science officer and global head of strategy and operations, Najat Khan makes the case quite simply, telling the Wall Street Journal, “The amount of data is increasing, the algorithms are getting better, the computers are getting better.”

The quantum leap that is unfolding has industry leaders outside healthcare leaning in with predictions — “Where do I think the next amazing revolution is going to come? … There’s no question that digital biology is going to be it. For the very first time in our history, in human history, biology has the opportunity to be engineering, not science,” says Jensen Huang, NVIDIA CEO, as reported by Yahoo Finance.

Liquid Biopsy

A non-invasive medical test that detects biomarkers in a patient's blood or other body fluids, such as urine or saliva. Liquid biopsy testing can detect genetic mutations, circulating tumor cells (CTCs), cell-free DNA (cfDNA), and other molecular markers indicating the presence of cancer or other diseases.

A liquid biopsy procedure is much less invasive than a tissue-based biopsy, preventing complications such as bleeding, infections, and pain. The data from liquid biopsies can be used in place of or alongside that of traditional surgical biopsies.

Next-Generation Sequencing (NGS)

NGS processes are complex, with several steps involved, such as DNA extraction, library preparation, quality control, and bioinformatic analysis. These processes require diverse technical expertise to manage workflows for sophisticated optics, data capture and communications capabilities, as well as requirements for miniaturization, flexible substrates, lyophilized bead handling, and reagent filling.

Companion Diagnostics (CDx)

In-vitro devices that provide information essential for the safe and effective use of a corresponding therapeutic product. CDx helps to unlock insights utilizing techniques such as real time polymerase chain reaction (PCR) and next-generation sequencing (via amplification and decoding of genetic and epigenetic information) for a better understanding of the specific genes, biomarkers, and other biomedical factors impacting an individual's potential to acquire disease or be effectively treated for it.

The ability to determine whether a patient may or may not respond to a given treatment helps to better ensure the best treatment and medicine for that patient without wasting precious time or therapeutic resources with trial and error. In this way, CDx facilitates precision medicine and are invaluable for aligning healthcare outcomes more effectively with value-based care (VBC) efficacy models.

Manufacturing Requirements Across Diagnostics

Across the wide IVD product landscape — from lateral flow and molecular POC testing, liquid biopsy, and CDx tests, to CT scans, ultrasound and complex catheter devices — technical requirements tend to align along two streams: device enabling technology that generates a device’s functionality and commercial technology, i.e., what it takes to manufacture and successfully commercialize the device.

Commercializing diagnostics sector innovation requires flawless, agile product development and manufacturing execution. For example, lab-on-a-chip microfluidic devices require capabilities in:

- Specialized technologies: surface modification, electrowetting, lyophilization, reagent filling, and buffer mixing.

- Environmental controls: dry room and DNA/RNA-free areas.

- Assembly technologies: ultrasonic welding, precision injection molding (plastics and liquid silicone rubber), various types of specialized adhesives, advanced SMT processes, and optical stack assembly.

Complex catheters for diagnostic procedures like angiograms, and other endoscopic applications and systems likewise have highly technical workflows, including micro-assembly, electrical assembly, and test requirements.

The need for very thin-walled, flexible performance demands specialized capabilities and precision execution with:

- Lamination, hot-boxing, and forming on a mandrel.

- Skiving, tipping, coiling, and balloon pleating/folding.

- UV bonding, tensile, and leak testing.

- Lens molding, and optics assembly.

- Active alignment.

- PCBA integration, cabling, bonding, and soldering.

Pharmaceutical Solutions

Macro trends reshaping drug portfolios:

- Demand growth for subcutaneous delivery of large-volume complex biologics.

- Shift to more patient self-administration in the home setting.

- Preference for seamless, patient-centric designs and delivery systems.

- Increasing calls to improve medical device sustainability metrics.

New therapy classes emerging from advances in biologics research are facilitating novel treatment strategies. In the last 15 years, approvals for biologics-based therapies have increased their share of the total pharma market from 16-25%. Pfizer recently acquired Seagen, a global biotechnology company that discovers, develops, and commercializes transformative cancer medicines, with intention to boost the percentage of biologic drugs in their oncology pipeline from 6% to 65% by 2030.

Biologic formulations approved for parenteral administration have likewise increased in recent years, including drug products for intravenous (IV) and subcutaneous administration. For autoimmune diseases, there has been a transition to subcutaneous self-administration in the home setting, eliciting a strong preference from patients who value convenience, as compared to IV administration in a clinical setting.

Typical drug trials can take more than a decade and cost over a billion dollars — even as much as $2 to $3 billion USD per drug. Once an asset is approved for market, the efficacy that has been established in clinical trials continues to depend on patients following their treatment protocols.

Almost 40 years ago, concerns about treatment compliance, adherence, and persistence were aptly summed up by then-US Surgeon General, C. Everett Koop, “Drugs don’t work in patients who don’t take them.”

World Health Organization research reports that adherence and compliance to long-term therapy for chronic illnesses in developed countries average 50%. Since the initial WHO study was released 20 years ago, the numbers have not improved dramatically. Simplifying drug delivery systems with easy-to-use, patient-centric solutions has become a mission-critical goal within pharma. But having delivery systems in supply and ready to go has become equally, if not more important.

In just the last year, the group of medications called glucagon-like peptide 1 (GLP-1) agonists have become so popular for chronic obesity and improving weight management that it has become common to hear of shortages. Lost in the narrative, however, is that the weight loss shot is not in short supply because there is not enough medicine, but because there are not enough injector pens and devices to deliver the therapy. Eli Lilly CEO, David Ricks stated in a Bloomberg interview last summer that making drug delivery devices requires “some of the most complex” production systems on the planet.

Top pharmaceutical companies, like Eli Lilly, value partnerships that provide additional manufacturing capacity and help them scale new acquisitions. Even better to have a single provider for filling, finishing, packaging, and sterilizing as this simplifies supply lines and reduces risk.

It is important to recognize how interconnected successful treatments are for many chronic diseases. Personalized approaches that include coaching, nutrition, exercise, and other guidance in conjunction with drug therapy will drive longer-lasting success for many conditions.

Prioritizing the patient experience in terms of their needs and end-user abilities in product design is also key. Usability and intuitive design are increasingly important as medical devices become more consumer-facing. Providing OEMs more than one user interface design for how their consumers might interact with a product, like an off-the-shelf PCR-quality test, liquid biopsy collection kit, or even a drug delivery device may cost more, in the short term, but will drive greater engagement metrics and product success over the longer horizon.

Connected Clinical Trials

Connected health applications are transforming clinical trials through the leverage of next-generation technologies that reduce patient burden and process timelines.

Integration of digital technology into the clinical trial process plus increasing availability of data and AI-driven analytics has the potential to drive the development of highly personalized therapies that do not require large-scale clinical trials. The industry is increasingly adopting decentralized trial methodology, particularly post-COVID.

Additional benefits provided by digital technologies include:

- Greater R&D productivity.

- More efficient execution of study protocols.

- Meeting enrollment timelines.

- Consistent remote management for those struggling to comply with study protocols.

- Greater trial participant accessibility and diversity.

AI-Driven Drug Discovery

Unlocking the power of AI/ML applications in drug discovery is one of the more exciting developments in healthcare today. A 2023 report from Morgan Stanley projects that the amount allocated to AI/ML in health company budgets will be 10.5% next year, compared to 5.5% in 2022.

Companies like Johnson & Johnson are hoping AI/ML data mining technologies will help them to better understand the molecular traits of diseases and then how to target their drug development efforts to exploit those traits.

Through the company’s division, J&J Innovative Medicine, their Biosignature Platform uses automated screens to provide millions of data points. Algorithms translate the data via AI/ML and help identify compounds and discover novel mechanisms of action for potential new drugs. In traditional drug discovery, screening millions of compounds for therapeutic properties is a very time- and labor-intensive process. Leverage of AI/ML essentially speeds up the selection procedure for identifying the most effective compounds for drug development.

Even small percentage improvements in the process will have a huge impact across the sector. Terence Flynn, Morgan Stanley’s Head of U.S. Biopharma Research, and author of the 2023 report, believes, “Every 2.5% improvement in preclinical development success rates could lead to an additional 30-plus new drug approvals over 10 years. Doubling that could yield 60 new therapies approved, translating into to an additional $70 billion in value for the biopharma industry.”

Precision Health — For a More Personalized Care Journey

Within healthcare, sensors, optics, and computing technologies are hyper-enabling toward shifting care delivery from Hospital to Home and increasing the patient’s own participation in managing their health.

The more patients directly engage in their treatment, the more likely their experiences and insights are to be accommodated by the stakeholders in their care — with the result being more personalized and consumerized solutions. Patient-centricity, ease of use, and configurable and customizable features become more prominent across the entire arc of the patient’s journey.

Care delivery is moving closer to the patient, away from higher cost centers. The new paradigm is built upon digital health technology enhancements (embedded sensors and optics capabilities) as well as data capture, connectivity, and Cloud computing technologies. These same technologies are also enabling greater access for individuals to their own personal health information, regardless of their access to a doctor or health insurance.

As announced by the FDA in their release on March 5, 2024, for the first time, anyone in the United States will soon be able to buy a continuous glucose monitor without a prescription. The FDA cleared Dexcom to market Stelo, the first over-the-counter (OTC) continuous glucose monitor (CGM).

The Dexcom Stelo Glucose Biosensor System is an integrated CGM (iCGM) intended for anyone 18 years and older who does not use insulin, such as individuals with diabetes treating their condition with oral medications, or those without diabetes who want to better understand how diet and exercise may impact blood sugar levels.

The FDA’s first CGM approval was in 2017; the application of the technology has since ramped to a $5 billion USD market with increasing value across a range of medical devices supporting treatment compliance, saving lives, and reducing the burden on the healthcare system just simply through encouraging more individual self-care.

Healthcare Market

Jabil Insights

Partnership & Outsourcing

OEM partnership with manufacturing solutions providers (aka, outsourcing) is increasingly the most competitive model to ensure success in a fast-paced, evolving healthcare industry. Additionally, the industry’s OEMs are looking for trusted manufacturing service providers that have a patient-focused quality culture. Together, the synergies created by these partnerships are the best way to meet the market’s challenge to deliver innovation, improve patient care, and lower overall healthcare costs.

Verticalization

Technology requirements in healthcare devices have become so complex that OEMS need to broaden their bench and align with expertise, such as providers with decades of electronics manufacturing services (EMS) experience, particularly for the continuing growth of digital healthcare and the increasing digital content within healthcare for OEMs (i.e., the digital front door).

But healthcare OEMs have complex manufacturing requirements well beyond printed circuit board assemblies and sensors. Jabil’s work in healthcare spans major disease states, like cardiovascular care, diabetes, and orthopedics supporting customers and bringing state-of-the-art endosurgical, fluid, and medication management, patient monitoring solutions, and more, to market.

Addressing these complex workflows requires, for example, competency and expertise in miniaturizing optics to make lenses and camera modules, electrifying catheters, integrating sensors into minimally invasive devices, doing insert molding and metal injection molding, and precision mechanical assemblies for robotics surgery.

Additionally, the push to new care settings, like ACSs, has increased the need for sterilized medical devices. Packaging and sterilizing in a single site is an enormous advantage in terms of cost and simplifying the supply chain. Aggregating these vital manufacturing requirements under a single integrated manufacturing partner, where capabilities are stacked vertically, provides customers with a much simpler and lower-cost path to market.

Sustainability

The healthcare industry’s journey towards improved sustainability must be addressed proactively:

- Some estimates project that as much as 90% of medical device waste comes from single-use, single-use items.

- As reported by Healthcare without Harm, “If the healthcare sector was a country, it would be the fifth largest greenhouse gas emitter on the planet.”

- All but 20% of a product’s carbon footprint is typically locked in at initial conception.

- Design for sustainability (DfS) must be a paramount concern in this phase of product development.

- Growing emphasis on sustainability and environmental responsibility is influencing healthcare companies to adopt eco-friendly practices, reduce waste, and develop products and services with minimal environmental impact.

As the industry increasingly prioritizes more sustainable medical practices, Jabil has a solution to support our customer's shared commitment for a more circular healthcare industry. Many medical supplies are used once and thrown away, however, medical device reprocessing is an emerging application within healthcare that is making a difference. Earlier this year, Jabil's Maple Grove facility outside Minneapolis marked its 5-year anniversary of delivering safe and reliable products to customers. Reprocessing brings new life to medical devices, while simultaneously reducing device costs by 40-60% and reducing landfill and waste disposal costs.

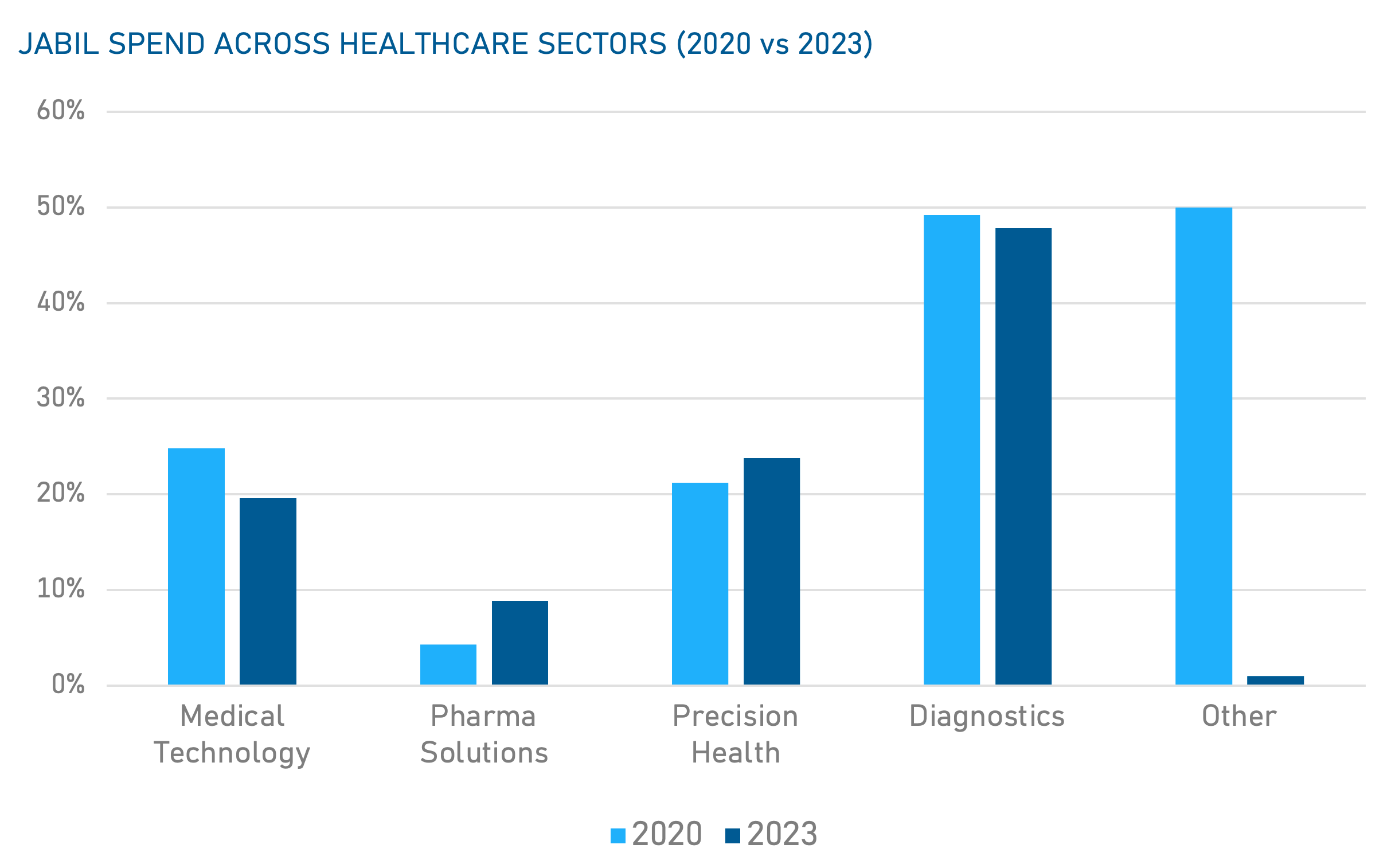

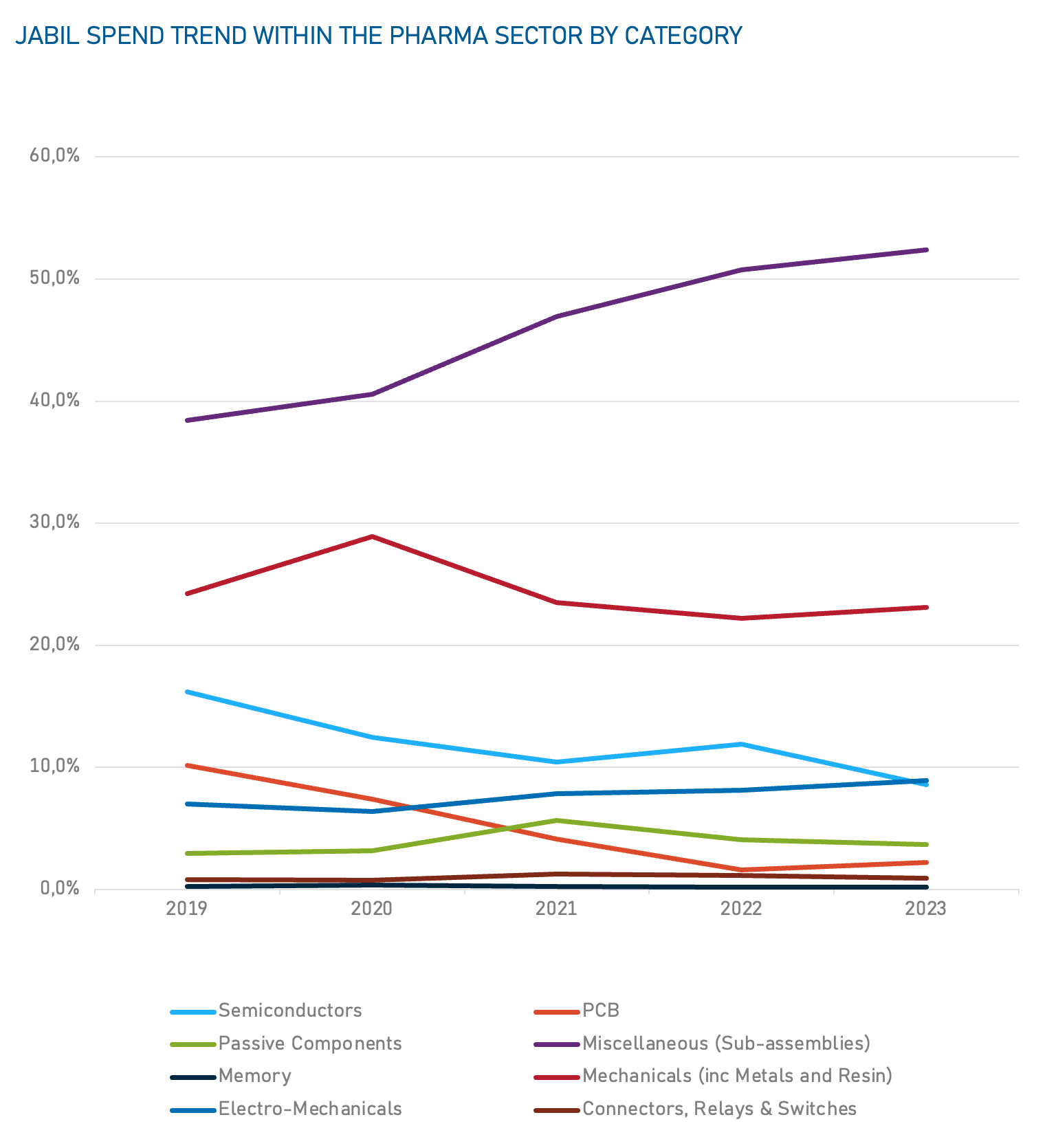

Jabil Spend Analysis

Data based on Jabil's historical spending data for the Healthcare Segment

Data based on Jabil's historical spending data for the Healthcare Segment

Data based on Jabil's historical spending data for the Healthcare Segment

Data based on Jabil's historical spending data for the Healthcare Segment

Healthcare Market

Key Points & Recommendations

Innovative technologies and complex commercialization requirements across all healthcare domains are putting pressure on healthcare OEMs to look outside their own resources for support in meeting the demands and opportunities of a market in transformation. While OEM's intellectual property continues (in most cases) to be developed in-house and controlled in-house, complex medical device production increasingly requires specialized equipment and services.

For healthcare companies adapting to the accelerating pace of change a comprehensive and proactive supply chain strategy that maximizes continuity, sustainability, and competitive advantage has never been more important.

The benefits of collaboration and partnership for OEMs include:

- Hedging potential disruptions through specialized, efficient expertise.

- Unleashing the power of agility into product management strategy.

- Capturing intelligence and assisting in product roadmap development.

- Leveraging regulatory requirements’ experience from different industries.

- Moving at the speed of technological innovation.

- Expanding global market reach and manufacturing footprint.

- Accelerating volume production through leverage of broadened strategic supplier relationships and component-sourcing solutions.

Digital health connects and empowers people and populations to manage health and wellness in ways that are quantifiable, cost-effective, and convenient. Today in healthcare, we are triaged and treated differently and if something can be done remotely, or through a sensor with digital connectivity, it’s getting embraced with much more urgency than ever before.

Digital capabilities are now built into a wide range of healthcare devices, from diagnostics and medical imaging machines to surgical instruments and orthopedics. All these connected devices generate a continuous stream of health data purposed for patient support, predicting, or preventing poor outcomes, and otherwise curating perspective for greater therapy insights and improved health.

As medical treatment continues its migration from higher to lower-cost settings — in tandem with value-based care mandates — Jabil is uniquely positioned to help the globe’s most trusted healthcare brands navigate the industry's shift towards more cost-effective, patient-centric care.

Back to Top