By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q2 2024 | APRIL- JUNE

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q2 2024 | APRIL- JUNE

Resin: ABS

MARKET DYNAMICS

- Producers in Taiwan and South Korea want to move volumes to other regions as China increases self-sufficiency with ABS production.

- Materials shipping internationally are affected by limitations around the Suez and Panama canals.

- Shipping routes are delayed or extended around South Africa and South America.

- Both logistics costs and transit times have increased, leading to producers passing on these costs.

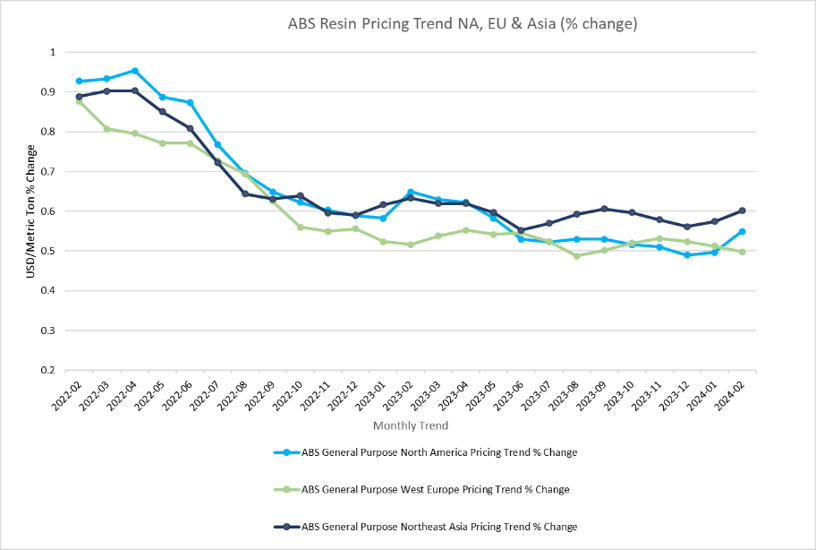

PRICING SITUATION

- North American ABS pricing is trending upward as producers cite raw material increases of Butadiene and Styrene monomers.

- Shipping logistics also play a role in cost increases.

- Increases are upwards of 5% for March.

SUPPLY ANALYSIS

- ABS is readily available globally as demand remains soft and inventories are healthy.

- Producers control their outputs, with most running <80% of their capacity and <70% in China.

- Lead times for off-the-shelf resins are 4-6 weeks for regionally produced grades but 8-12+ weeks for imported or made-to-order grades.

Resin: PA (Nylon)

MARKET DYNAMICS

- Nylon production is expected to increase, with demand growing slightly in the automotive sector.

- Production in the EU is becoming less reliant on imports as energy sources have stabilized.

- North America remains a net exporter, as does China, with increasing net exports of over 20%.

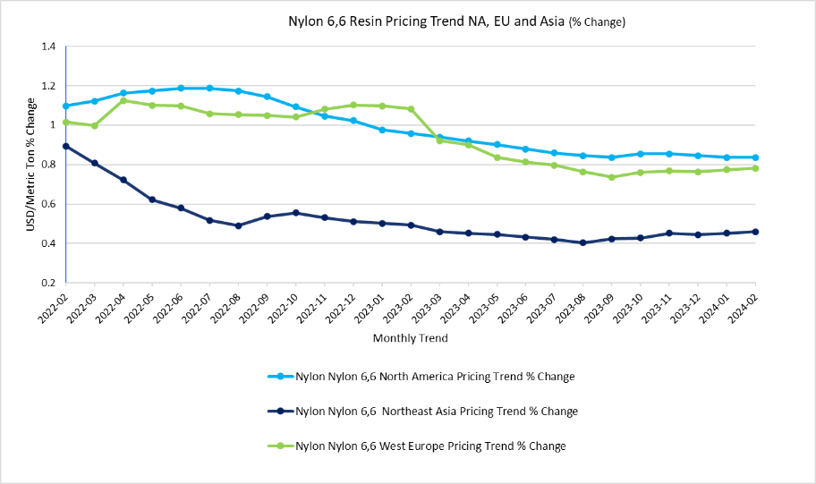

PRICING SITUATION

- Nylon prices are historically low, around 8% less than last year, but are expected to pivot into spring.

- Several major chemical producers are announcing increases expected to carry through to resin prices.

- Asian prices have ticked up ~5% relating to costs associated with HMDA and Adipic Acid

- Feedstock chemicals like Benzene and Caprolactam and overall global logistics threaten more resin increases in the near term.

SUPPLY COMMENTARY

- Nylon 6 and 6/6 supply are generally stable but tight for certain grades.

- Lead times are 6-8 weeks.

- Producers are generally running well, albeit dealing with some feedstock issues around cost.

Resin: POM (Acetal)

MARKET DYNAMICS

- The market is competitive, with producers working to get their products specified into designs.

- Imported grades are becoming less attractive due to shipping lanes and challenges with Red Sea and Panama Canal limitations.

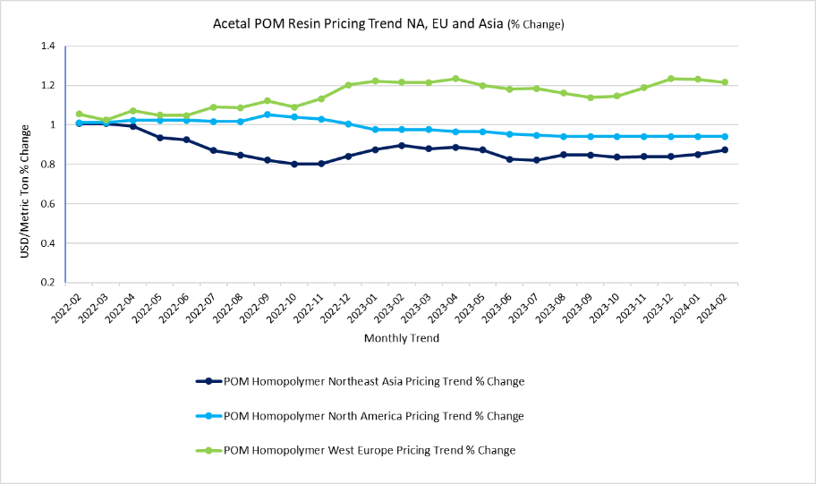

PRICING SITUATION

- Pricing is generally flat globally, with few month-to-month changes seen.

- Pricing is lower by about 10% compared to last year, except for the EU, which remains slightly elevated but similar to last year.

SUPPLY COMMENTARY

- There are no issues with global supply. Most forecasts are predicting flat to diminished demand.

- Imported grades into the EU and feedstocks are affected by Red Sea-related changes in transit times and costs.

- Lead times are four to six weeks depending on grade and additives.

Resin: PBT

MARKET DYNAMICS

- We see flat to soft demand lending to competing producers working to become specified alternates.

- There are still few producers making PBT globally, limiting regional choices.

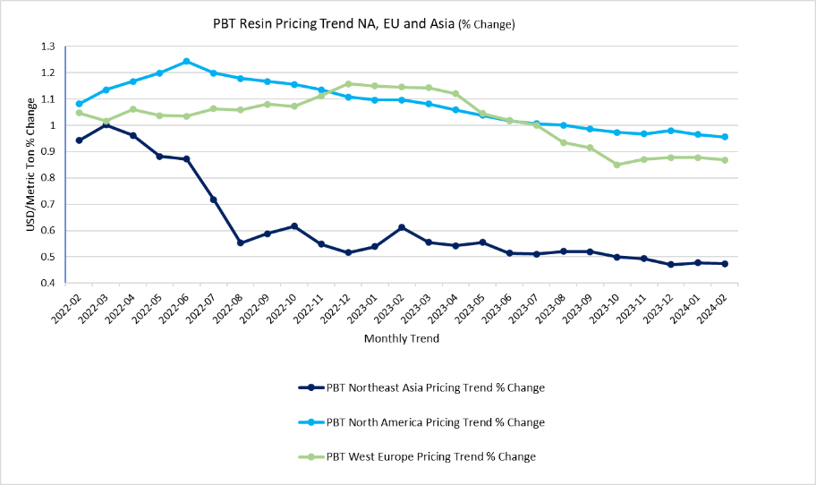

PRICING SITUATION

- Pricing is relatively similar to 2021 levels but expected to creep up as feedstocks and logistical costs become drivers, with the EU having the most exposure to Red Sea-related costs.

- Increased BDO (1,4-butanediol) production in Asia and additional imports may help dampen pricing increases, provided that mainland ports are utilized.

- Asian imports can range from 10-15% less in price than Western pricing.

SUPPLY COMMENTARY

- There are no issues with supply in general, as demand remains flat to soft.

- A key producer is still on Force Majeure with some allocations.

- Lead times remain six to 10 weeks or better.

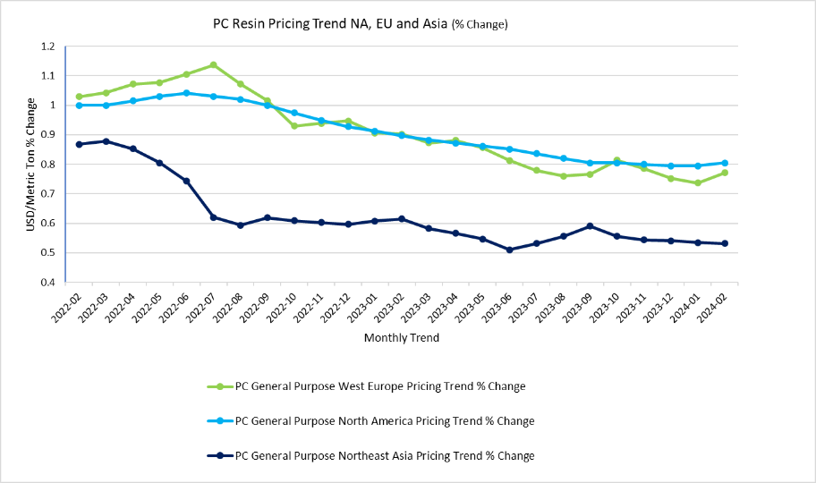

Resin: PC

MARKET DYNAMICS

- Automotive and appliance demand are generally weak but expected to increase slightly later in the year.

- PC production operating rates as low as 60%. As resin producers' production in the EU becomes even less competitive, SABIC announced the permanent closure of its Cartagena, Spain plant.

- ADNOC from UAE is still vying for the purchase of Covestro but no offers have been accepted.

PRICING SITUATION

- Pricing is forecast to rise ~2-9% through March. The cost of production is up 4%, with benzene feedstock up 9% and Phenol costs slightly increasing ~4%.

- Energy costs are still historically high in the EU, although natural gas has decreased significantly.

- Pricing will also be negatively affected by the logistics costs associated with the new longer routes relating to the Red Sea and limitations with the Panama Canal.

- Major producers Covestro and SABIC have both announced increases for March.

SUPPLY COMMENTARY

- PC supply is unconstrained.

- Demand around automotive is forecast to rise 3% into 2024, but demand is now soft globally.

- Lead times remain 8-10 weeks plus transit, less for items in stock and local.

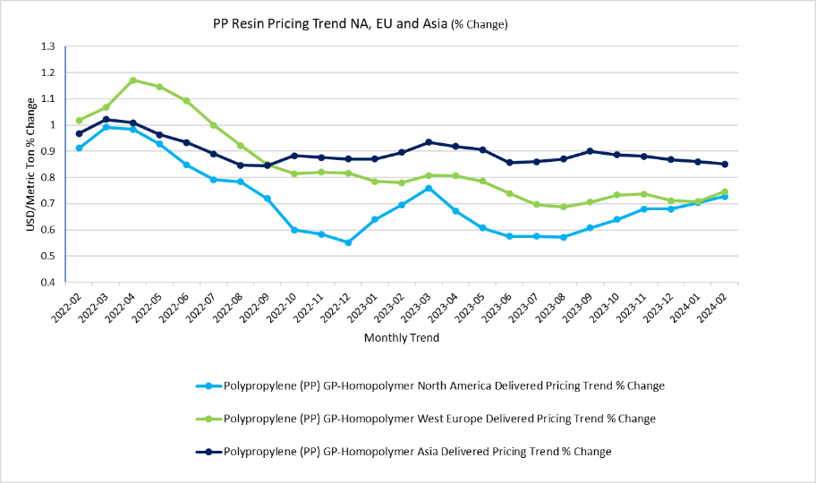

Resin: PP

MARKET DYNAMICS

- Overall demand is stable to weak compared to recent years, but most producers are still pushing for increases, leveraging lower production outputs and Force Majeures in NA and EU.

- The return of La Niña and record high water temperatures in the Atlantic have some meteorologists suggesting a very active Hurricane season.

- Regional hurricanes risk the resin-producing hub on the Gulf of Mexico shorelines from Texas to Louisiana.

PRICING SITUATION

- Pricing has increased in the last few months and is expected to increase another 3-4% into spring.

- Cost drivers were increased feedstock costs, transport costs, and producers controlling capacities.

- Asia is seeing some pricing decreases due to the soft demand.

SUPPLY COMMENTARY

- Supply has become tight, with key producers claiming Force Majeure relating to the cold snap in Texas and issues in the EU around longer lead times with Red Sea diversions, planned maintenance, and labor strikes.

- Producers are also controlling run rates to support pricing and margins.

- Asia demand, while attenuated by the holiday season, is expected to be healthy, with South Korean producers looking to export due to additional domestic China supply coming online.

Back to Top