By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q2 2024 | APRIL- JUNE

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q2 2024 | APRIL- JUNE

Cables

MARKET DYNAMICS

US-CHINA TRADE TENSION

- Trade tensions between the two largest economies in the world had a ripple effect on the global economy.

- Uncertainties surrounding trade policies and tariffs have led to increased volatility in financial markets and have affected business confidence and investment decisions globally.

- Both countries have imposed tariffs on each other's goods. These tariffs can increase costs for businesses and consumers, potentially affecting prices and decreasing demand for certain products.

Manufacturing Strategy For China-owned Companies

- Chinese businesses are investing in new plants outside China to counter the tariffs imposed on their products shipping to the United States.

- Due to its proximity, Vietnam has become an attractive option for them. Most of the factories’ setups in Vietnam are used for final assemblies. Still, as the Vietnam supply chain is considered weak, their raw or low-level materials (plastics, metals, raw cables, components, etc.) are shipped from China.

- There is a growing trend of customers requesting a “China+1” strategy. Big market players like Apple, Samsung, Nike, Adidas, LG, and Foxconn have moved some Chinese factories in favor of Vietnamese factories.

THREE MONTH OUTLOOK

Red-Sea Crisis

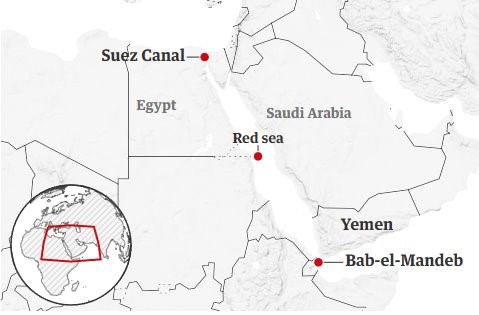

- Since 19 November, there have been more than 20 attacks on commercial vessels in the southern Red Sea and the Bab al-Mandab Strait off Yemen.

- The Red Sea, which the Suez Canal bookends to the north, and the Bab al-Mandab Strait, to the south, is a busy waterway offering access to the Shortest shipping route between Europe and Asia.

- About 12% of global trade, including 30% of global Container traffic, passes through the Red Sea annually. Billions of dollars of traded goods and supplies pass through the Red Sea.

- To mitigate risk, some carriers are being diverted around the Cape of Good Hope, on the southern tip of Africa, increasing the journey by up to two weeks to the duration of the trip and more than 15% shipping costs.

- Insurance risk premiums for sailing through high-risk Areas are also rising. At the start of December, this risk premium paid by shipping companies was just 0.07% of a ship's value but has risen by ~9X to about 0.5% to 0.7% more recently.

Amphenol completed three acquisitions: TPC, Airmar, and LID, which may impact Cable.

- TPC Wire & Cable is a value-added provider of harsh environment cables and cable assemblies for applications across the industrial market, particularly factory automation and heavy equipment.

- Airmar is a leading provider of sensors for the recreational marine, commercial fishing, and industrial markets.

- LID is a high-technology supplier of sensor products to the industrial and automotive markets, focusing on tire pressure monitoring and the associated telematics.

SUPPLY ANALYSIS

Capacity: Major cable suppliers have shared that their capacity utilization is about 30% to 50%, mostly impacted by the downside of Semi-Cap / Capital Equipment and Industrial. Suppliers to the regulated sectors operate at 60% to 70% utilization rates, mostly driven by automotive and transportation.

- The book-to-bill ratio for major suppliers is between 0.8 and 1.0, showing signs that demand is softening across most sectors. The sectors most heavily impacted are semiconductors and consumers, partly because of U.S. bans on exports of high-end computing chips to China. Consumer goods demand also declined sharply in the post-COVID period.

- Sectors involved in Electrical Charging, Renewable Energy, Communications, and Medical (especially those related to in-vitro diagnostics (IVD) devices, radio-frequency ablation, laser, and freeze technologies) are facing a more stable market.

Availability and Inventory: Material availability is generally stable, except for some unique components like fans and sensors, which still face long lead times. Several suppliers reported that inventory levels reached all-time highs around the end of last year but have also seen bookings improve in the Data Center space or businesses involving AI in Q1 2024.

- Generally, during the first half of 2024, demand across market segments was slow, with customers adjusting their demand and channel inventories. Expectations for 2H are more positive with Capital Equipment and expected to improve.

PRICING ANALYSIS

Copper (Cu)

- Copper demand is forecasted to remain strong despite softened demand seen globally.

- Cu prices could skyrocket by 75% to a record high by 2025 as mining supply disruptions coincide with higher demand for the metal, fueled by the push for renewable energy.

- Overall, copper prices will likely remain volatile, influenced by demand trends, supply disruptions, investor sentiment, and macroeconomic conditions.

- However, the long-term outlook for copper remains positive, supported by urbanization, infrastructure growth, and the shift to a low-carbon economy in developing nations.

Low-Level Material (LLM) (plastics, metals, raw cables, components, etc.)

- Price increases are still being announced by manufacturers like Alpha, Belden, and the Tier 1 Connector suppliers, most pointing to inflationary costs from increasing labor, oil, freight, and raw material. Nevertheless, such moves are slowing compared to the frequency of the previous two calendar years.

- This is due to the overall market slowdown and suppliers being more strategic in their decisions on price adjustments, fearing losing more allocation and affecting their top-line revenue.

- The prices of the LLM used in cable assembly, i.e., connectors, terminals, lugs, etc., remain stable.

- However, if the Cu price continues to increase, these LLMs, primarily made of Cu alloy, will face a price hike.

- Similarly, cables like power cords and signal cables/hook-up cables, where Cu represents >95% of the material, will likewise face a price increase.

Back to Top