By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q2 2024 | APRIL- JUNE

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q2 2024 | APRIL- JUNE

Plastic Packaging: LLDPE/LDPE/HDPE

MARKET DYNAMICS: LLDPE/LDPE.HDPE

High-density polyethylene (HDPE), linear-low-density polyethylene (LLDPE), and low-density polyethylene (LDPE) are commonly used in packaging materials, including plastic bags, bottles, foam, and wrap film, due to their cost-effectiveness, lightweight nature, and exceptional resistance to moisture and chemical degradation. China, the United States, Saudi Arabia, Russia, and Iran are global polyethylene (PE) producers.

- Asia: In this region, many PE manufacturers have recently observed the Lunar New Year holiday and have yet to fully restore their production capacities. Concurrently, the demand from end-users has yet to be entirely realized, resulting in a subdued market trend in the short term, prompting a minor adjustment towards lower prices. Despite the resumption of production by downstream facilities, their operational capacities still need to be utilized. Limited destocking capabilities within the midstream and downstream sectors further impede market growth. Market participants willingly sacrifice profit margins to expedite shipments and reduce inventory levels, with no substantial price hikes anticipated in the immediate future.

- Europe: Within this market, PE prices, particularly for HDPE, have experienced a marginal uptick due to supply constraints and escalating logistics expenses associated with conflicts in the Red Sea region. Despite stable overall demand, the limited availability of materials from the U.S. contributes to this price increase. It is anticipated that prices will continue to show a slight upward trend in the coming months.

- North America: PE prices have maintained a stable and slightly bullish trajectory, supported by robust trading activities. The rise in PE prices can be partly attributed to increased costs of Ethylene feedstock and Naphtha upstream. Furthermore, heightened export demand, particularly from Europe, has allowed producers to sell at higher prices. However, amidst a global economic downturn, significant price surges are unlikely. Consequently, prices are expected to show minor fluctuations soon.

SUPPLY ANALYSIS

- Asia: The production capacity of polyethylene continues to expand. Taking China as an illustrative example, the output in 2023 grew approximately 10% compared to the preceding year. Furthermore, it is anticipated that the production capacity will experience a further increase of roughly 20% in 2024. Simultaneously, the government has introduced new policies to stimulate consumption within the home appliance industry, which is expected to increase the demand for polyethylene (PE). Consequently, the supply and demand dynamics for PE in Asia are poised to rise in tandem.

- Europe: Despite the tight supply conditions in the PE market in Europe due to delays in goods arrival from the Middle East and Asia and limited material quantities from the United States, overall demand in Europe remains stable. This stability is attributed to subdued activity in the end-user industry. Additionally, declining output rates and regional power outages have further reinforced the upward trend in PE demand.

- North America: The demand for PE in North America exhibits a bullish trajectory, with active trading activities. Notably, logistical challenges have led to a surge in export demand, providing producers with increased opportunities to sell their products at premium prices. Consequently, heightened export activity has contributed to reducing excess resin in the domestic market, resulting in tight domestic supplies within North America and exerting upward pressure on domestic PE prices.

PRICING SITUATION

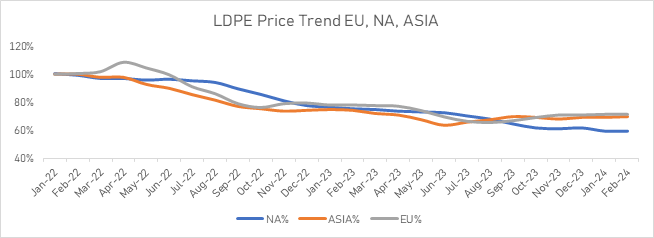

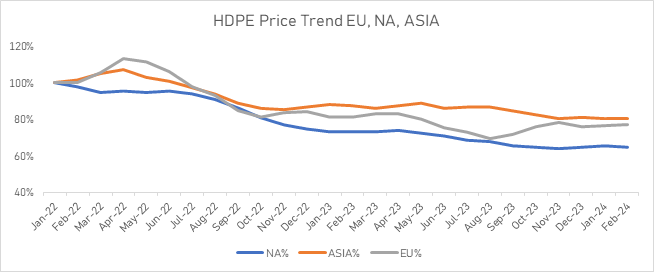

- The price trend charts below reveal an overall downward trajectory in polyethylene (PE) prices across Asia, Europe, and North America over the past two years, with minor fluctuations attributed to demand downturns.

- Asia: PE prices have remained stable, experiencing a slight decline in February 2024. This can be attributed to the recent resumption of work at most terminals following the Lunar New Year, coupled with unreleased market demand. Additionally, the prevailing weakness in the global economy and ongoing production capacity improvements suggest that significant price increases in Asia are unlikely.

- Europe: High-density polyethylene (HDPE) prices rebounded by approximately 8% since September 2023. Meanwhile, low-density polyethylene (LDPE) prices have remained stable with a slight upward trend. Despite stable final demand and only marginal increases in raw material costs, this upward trajectory has been reinforced by reduced output rates, regional outages, and rising import costs. Market participants in the European sector encountered notable price hikes in February.

- North America: PE prices have been stable in recent months. However, starting from February 2024, there has been a slight increase. This can be attributed to heightened demand from downstream industries such as construction and packaging. Furthermore, rising feedstock and crude oil prices have significantly impacted production costs. Additionally, logistical challenges along key transportation routes, notably the Panama Canal and the Red Sea, have contributed to these price fluctuations.

Plastic Packaging: PET

MARKET DYNAMICS

Polyethylene Terephthalate (PET) is widely employed in our packaging products, including blister trays, bottles, films, and sheets. Among these, blister trays hold paramount importance as a sub-commodity.

- Asia: PET production capacity continues to expand. However, several terminal industries face challenges. Taking China as an example, the government endeavors to implement policies that stimulate domestic demand. Nevertheless, mobilizing overall market activity remains challenging in the short term, and substantial market improvement is unlikely. Notably, the Fast-Moving Consumer Goods (FMCG) sector and the food industry constitute significant PET users, contributing to the overall industry’s stability.

- Europe: The ongoing Red Sea crisis threatens PET supply status. Europe heavily relies on PET imports, particularly from Asia, which accounts for over 50% of the European PET imports. Local suppliers have responded by seeking price hikes, leveraging their market position. Despite stable demand, prices are anticipated to rise due to reduced availability and anticipated disruptions in import flows.

- North America: The PET resin market has grown substantially recently. The chart illustrates the price change trend. Key drivers of this increase include PET’s exceptional material properties, such as high tensile strength, clarity, lightweight nature, and recyclability. These attributes make PET a preferred choice for diverse packaging applications. Consequently, prices are expected to remain robust, and the market will continue to exhibit activity. However, considering the current global economic situation, significant price increases are unlikely.

SUPPLY ANALYSIS

- Asia: Many companies have recently resumed operations after the Lunar New Year. However, production capacity has not yet fully recovered, inventories remain unconsumed, and terminal demand remains restrained. Both supply and demand factors are currently subdued. Taking China’s largest PET manufacturer, Sanfangxiang (with an annual output of approximately 3.5 million tons), as an illustrative example, their production capacity for March stands at a mere 60%.

- Europe: The supply and demand dynamics exhibit stability. However, in the United Kingdom, a significant PET manufacturer, Alpek Polyester, has recently declared force majeure regarding the polyethylene terephthalate (PET) supply. Their annual PET production capacity amounts to 220,000 tons. Despite relatively modest demand, certain supply disruptions are anticipated due to force majeure events. Additionally, geopolitical tensions surrounding the Red Sea may further impact supply dynamics.

- United States: The largest market share in the North American PET industry. The escalating demand for convenient, on-the-go packaged goods bolsters the US packaging sector and drives growth in the PET resin market. Furthermore, Mexico's FMCG (Fast-Moving Consumer Goods), food, beverage, and e-commerce sectors contribute to robust demand for PET resin. Consequently, the PET market in North America remains optimistic.

PRICING SITUATION

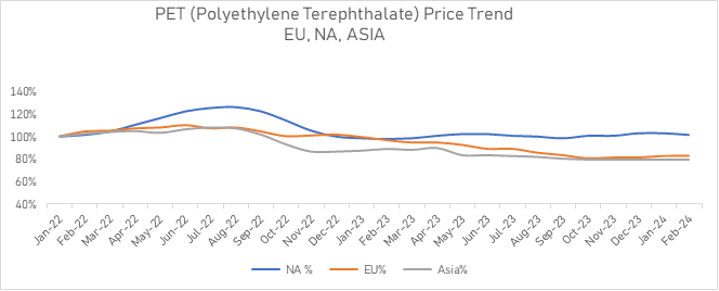

- Asia: PET resin prices have declined in Asia following a slight gain in the first half 2022. Over the past two years, prices have decreased by approximately 20%. This downward trend can be attributed to the prevailing economic downturn, weak terminal demand, and ongoing expansion of production capacity.

- Europe: The European PET resin market has declined over the past two years. This decline is primarily driven by subdued downstream demand and the global economic downturn. However, starting in February, logistical challenges and force majeure events involving major manufacturers have prompted some market traders to raise prices for higher profits.

- United States: PET prices surged by about 25% from the beginning of 2022 to July 2022. Subsequently, prices gradually reverted to their initial levels. Throughout 2023, prices remained stable but exhibited fluctuations. Market traders are striving to increase profits, although overall demand remains lackluster. Consequently, price increases are expected to be more moderate than previously predicted.

Plastic Packaging: Linerboard

MARKET DYNAMICS

The paper and cardboard market is experiencing mixed dynamics, characterized by uncertain demand, restructuring within the industry, and varying regional trends. On the one hand, there are signs of instability, with some major producers announcing permanent closures of sheet plants and restructuring efforts, indicating challenges within the sector. On the other, there is uncertainty about future box demand, as evidenced by a 5% drop in actual box shipments in the US in 2023 compared to the previous year. This decline and concerns about customer resistance to price increases reflect a challenging environment for box manufacturers and converters.

However, there are also pockets of resilience and potential growth. Some regions are seeing steady or improving demand, with major integrated producers anticipating an improvement in box demand in 2024. Despite the overall decline in actual box shipments, there are indications of high per-day demand at certain operations, suggesting localized opportunities for growth. Furthermore, there is a push for price increases in the European market, driven by recycled containerboard producers seeking higher prices.

- Uncertain Demand and Industry Restructuring: The market is characterized by mixed dynamics due to uncertain demand and ongoing restructuring efforts. This uncertainty is exemplified by the announcement of major producers' permanent sheet plant closures, indicating the sector's challenges and changes.

- Signs of Instability: The closure of sheet plants in Ontario province and Connecticut points to instability within the market. These closures may indicate broader industry challenges, such as shifting consumer preferences or economic factors.

- Uncertainty in Box Demand: Future box demand is uncertain, as evidenced by a 5% decline in actual box shipments in the US in 2023 compared to the previous year. This decline may be attributed to several factors, including changes in consumer behavior, economic conditions, and supply chain disruptions.

- Resilience in Certain Regions: Despite the overall uncertainty, some regions are experiencing steady or improving demand. This resilience suggests that market conditions vary geographically, with opportunities for growth in specific areas or segments of the market.

- Price Increases in some regions: In the North American and Asian markets, there is a push for price increases driven by Linerboard and recycled containerboard producers seeking higher prices. This indicates a dynamic pricing environment influenced by regional factors and market conditions.

DEMAND COMMENTARY

Demand for linerboard varies across regions and is influenced by economic conditions, consumer sentiment, and pricing dynamics. Producers must tailor strategies to address region-specific demand challenges and capitalize on growth opportunities. Collaborative efforts among industry stakeholders are essential for navigating market uncertainties and sustaining growth in the linerboard market.

- North America: Linerboard demand demonstrates relative stability in North America, yet converters hesitate to adopt box price increases. Despite slight rises in linerboard prices, converters' caution in shouldering additional costs affects pricing dynamics. Consequently, significant pricing adjustments become challenging for producers, who may need to explore alternative pricing strategies to maintain profitability amidst cautious demand.

- South America: Regarding South America, demand remains stable, bolstered by consistent consumption across various industries. Pricing for linerboard experiences minor fluctuations due to changes in production costs and regional demand dynamics. This stable demand presents an opportunity for producers to uphold pricing stability, contingent upon vigilant monitoring of regional demand trends to align production levels with market needs.

- Europe: On the other hand, Europe witnesses demand for linerboard influenced by discussions of potential price hikes and efforts to mitigate cost pressures. Drops in containerboard prices trigger talks of potential increases, reflecting a nuanced demand environment. Price negotiations highlight the complexity of the European market's demand landscape, necessitating close monitoring of market dynamics and consumer sentiment to adapt pricing strategies effectively.

- Asia: Finally, post-Spring Festival demand could be more active in Asia, particularly impacting linerboard consumption. Incomplete inventory consumption from the holiday period contributes to subdued demand, resulting in suppressed prices. This sluggish demand poses challenges for stimulating market activity, with the possibility of downward pressure on prices affecting profitability for producers if demand does not significantly increase.

SUPPLY ANALYSIS

- North America: Linerboard supply in North America meets demand adequately, although producers face challenges due to resistance to passing through price increases. Large integrated producers continue operations cautiously, considering market dynamics and pricing pressures. Distribution channels ensure efficient delivery of linerboard products across the continent. Despite economic uncertainties, production volumes stay stable to fulfill market demands.

- South America: Supply stays stable in South America, with producers maintaining consistent production levels to meet regional demand. Paper and cardboard manufacturers continue operations to ensure sufficient supply availability. Distribution channels efficiently distribute linerboard products to various industries and end-users across South America.

- Europe: Discussions of potential price hikes and efforts to address cost pressures influence production operations. Producers adjust operations to balance supply levels with demand fluctuations. Despite pricing challenges, production levels are adjusted to maintain adequate supply and meet regional demand.

- Asia: The supply of linerboard stays stable despite sluggish demand. Major players like Jiulong maintain regular production across their paper factories, ensuring consistent availability of linerboard products.

- The landscape is marked by restructuring efforts and shifting dynamics, with major producers announcing the permanent closure of sheet plants.

- The trend is toward consolidation and optimization within the industry to address excess capacity and enhance competitiveness.

- Global factors such as changes in export prices and demand dynamics in key markets influence the overall supply situation.

- Producers must adapt to changing market conditions and optimize operations to remain competitive in a challenging environment.

Robust production capabilities, efficient distribution networks, and established suppliers support linerboard supply across regions. Despite sluggish demand and pricing pressures, producers maintain adequate supply levels to meet market demands. Strategic flexibility and operational efficiency are essential for navigating uncertainties and sustaining growth in the linerboard market

PRICING SITUATION

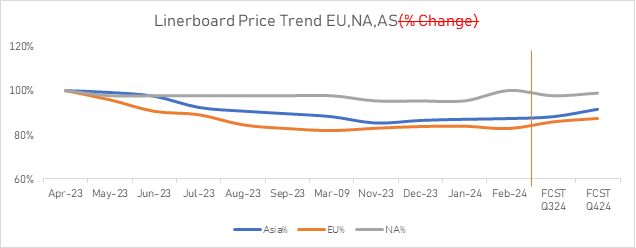

Pricing in the linerboard and corrugate market is complex and influenced by various factors. While there has been a marginal increase in linerboard prices in North America, driven by announcements from major integrated producers, there are some concerns about the sustainability of further price increases. Converter resistance to passing through box price increases, especially if linerboard price increases are perceived as insufficient, underscores the delicate balance between cost pressures and market demand.

Furthermore, the pricing situation is affected by global trends, such as fluctuations in export prices and efforts to raise prices in international markets. The European market, for example, has seen drops in containerboard prices followed by discussions of potential price hikes driven by recycled containerboard producers.

- North America: Linerboard prices increased marginally by $40/ton, representing about half of the $70/ton increase announced by major integrated producers. However, converters resist passing through box price increases, especially if linerboard price increases are perceived as insufficient to cover costs.

Cost pressures, customer resistance, and global market dynamics influence pricing, presenting challenges for producers and converters alike.

Back to Top