By clicking the “I Accept” button, or by accessing, participating, or submitting any information, or using the Jabil Global Intelligence Portal or any of its associated software, you warrant that you are duly authorized to accept the Global Intelligence Portal Terms and Conditions on behalf of your Company, intending to be legally bound hereby, and your company shall be bound by the terms and provisions of the Global Intelligence Portal Terms and Conditions, accessible under the following link Portal T&Cs.

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q4 2024 | OCTOBER - DECEMBER

Jabil's Global Mechanicals Intelligence Archive

Global Mechanicals Intelligence

Q4 2024 | OCTOBER - DECEMBER

Cables

MARKET DYNAMICS

CABLE MARKET ESTIMATES:

- Cable market estimates from Mordor value the global market at approximately $228.42 billion in 2024 and is projected to reach $298.53 billion by 2029, growing at a CAGR of 5.5%.

- Renewable energy in China is experiencing market weakness due to oversupply and low prices.

- The US renewable energy sector faces depressed demand and excess inventory due to high interest rates and subsidy changes.

US-CHINA TRADE TENSIONS ESCALATION:

- New US export controls on semiconductors are intensifying pressure on the industry. Companies must now ensure fabrication occurs outside China and that parent companies are non-Chinese to comply with US Department of Commerce Bureau of Industry and Security (BIS) regulations. Businesses should identify non-Chinese supply chain partners to avoid disruptions after the December 2025 deadline. This may increase overall costs if final products continue manufacturing in China.

COPPER RAW MATERIAL

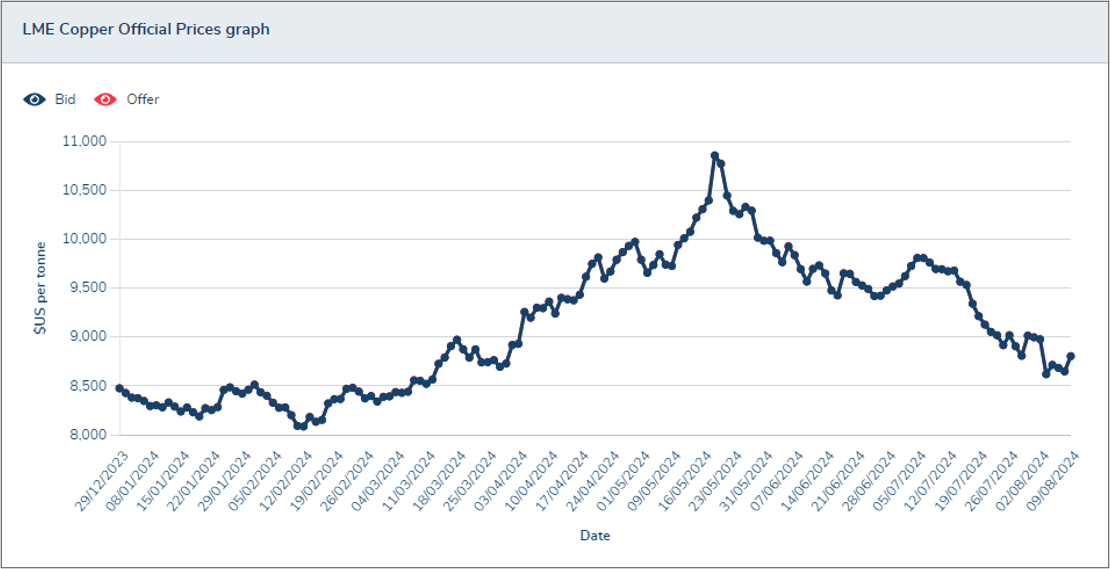

- After surging near-record highs, copper prices have stabilized below USD 9,000.

- A potential 10-day strike at ' 'BHP's Escondida mine in Chile has raised immediate concerns about short-term copper supply impacts. The strike could result in a 50-kilotonne production loss.

- According to Statista, global copper mine production increased from 16 million metric tons in 2010 to approximately 22 million in 2023. While projected to reach 30 million by 2036, this increase may not meet anticipated demand growth.

- A Goldman Sachs report indicates a potential slowdown in the copper mining industry due to decreased investment. Coupled with frequent disruptions in Latin American mines, a copper supply deficit may emerge from 2025 onwards.

Source: London Metal Exchange (LME)

Source: London Metal Exchange (LME)

TECHNOLOGY OVERVIEW

RAPID DEVELOPMENT & DEPLOYMENT OF ARTIFICIAL INTELLIGENCE INFRASTRUCTURE

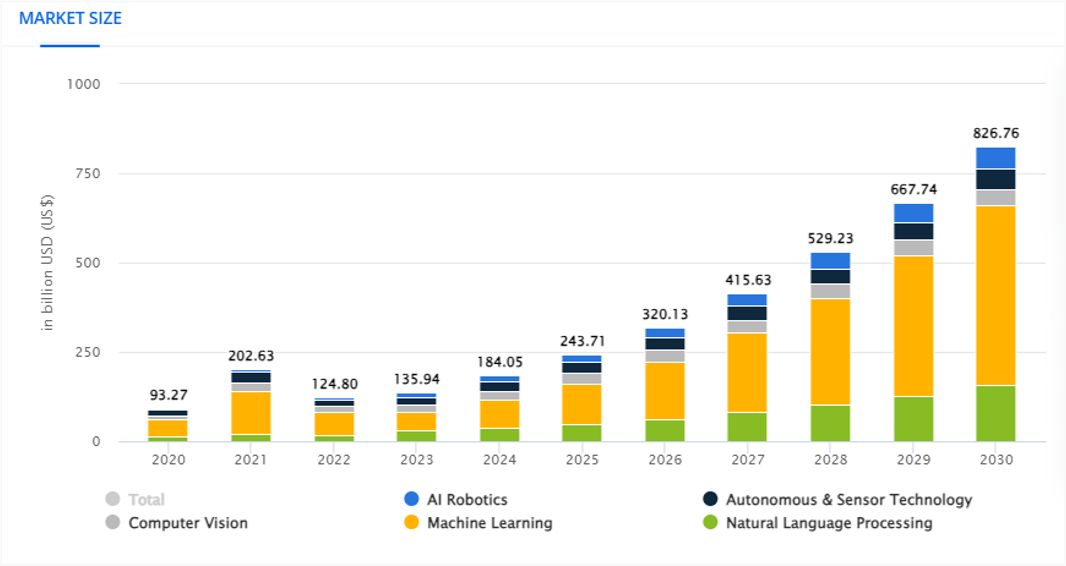

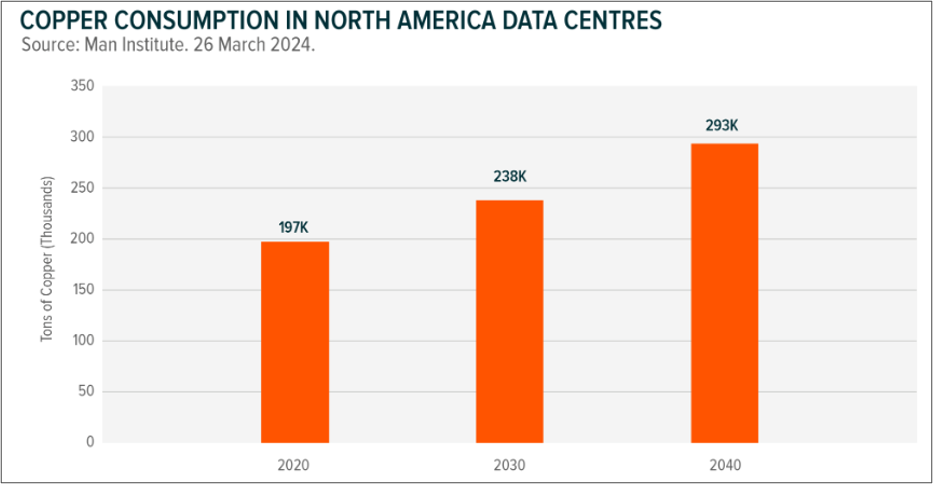

- The rapid development of AI technologies is creating a surge in demand for data transmission, processing, and connectivity. Copper cables, with their reliability, high bandwidth, and low latency, play a critical role in meeting these requirements, thus fueling the growth of the copper cable market.

- For instance, AI models’ insatiable appetite for data processing and training has fueled the construction of massive hyper-scale data centers. These data centers require extensive copper cabling for power distribution, networking, and connecting servers, switches, and storage devices.

- The AI market size is estimated to reach $184 billion in 2024 and is expected to grow at a CAGR of 28.46% to reach $826.76 billion by 2030.

Source: Statista Market Insights

Source: Statista Market Insights

RISE OF ELECTRIC VEHICLES (EVs)

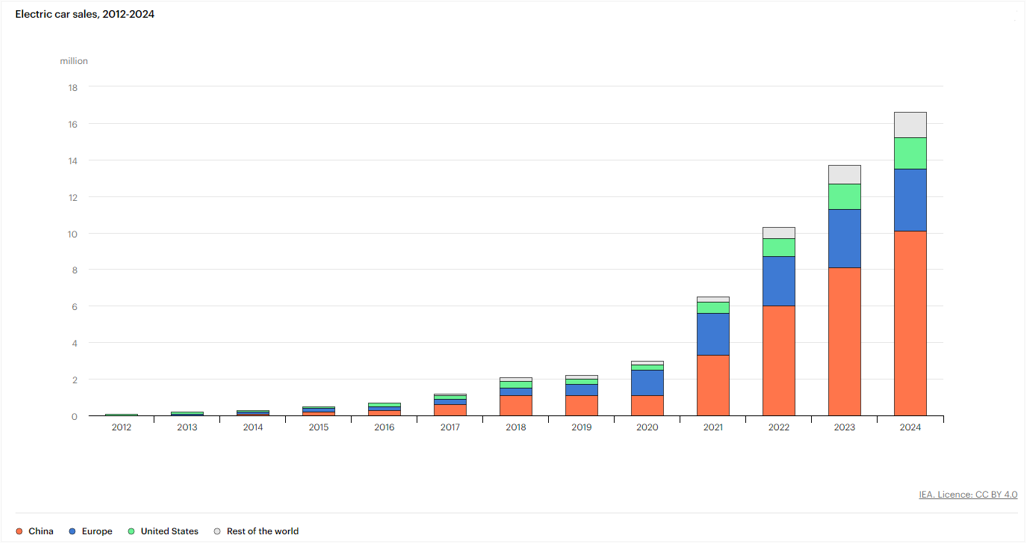

- The growing popularity of EVs is creating a multi-faceted demand for copper cables across various domains, including charging infrastructure, onboard wiring, power grid upgrades, and emerging technologies like V2G and wireless charging.

- Governmental and local policies in major markets like China, the US, and Europe continue accelerating EV adoption through purchase incentives and subsidies.

- Global electric car sales surged 25% year-on-year in the first quarter of 2024, surpassing 3 million units, according to the International Energy Agency (IEA). This momentum is evident in China, where EV sales climbed 31% in July to reach 0.88 million units, representing over two-thirds of global sales that month, as reported by Rho Motion.

- Car manufacturers have reaffirmed their confidence in the strong demand for electric vehicles by transitioning their model lineups into fully electric or hybrid options

Source: International Energy Agency (IEA)

Source: International Energy Agency (IEA)

RECENT DEVELOPMENTS

|

Date |

Cable Manufacturer |

End User (Company 2) |

Development Type |

Description |

Deal Value |

|

June 2024 |

Nexans (France) |

La Triveneta Cavi (Italy) |

Acquisition |

Nexans, a leader in the global energy transition, announces the completion of its acquisition of La Triveneta Cavi, one of the European leaders in medium—and low-voltage cables. The acquisition is a significant leap forward in Nexans’ strategy to become a pure electrification player. |

- |

|

April 2024 |

Prysmian Group (Italy) |

Encore Wire (US) |

Merger |

Prysmian announced that it has entered into a definitive merger agreement under which it will acquire Encore Wire (NASDAQ: WIRE) for $290.00 per share in cash (the “Transaction”). The Transaction represents a premium of approximately 20% to the 30-day volume weighted average share price (VWAP) as of Friday, April 12, 2024, and approximately 29% to the 90-day VWAP as of the same date. |

$290 per share |

|

April 2024 |

Prysmian Group (Italy) |

Aurubis (Germany) |

Contract |

Prysmian and Aurubis have entered into a long-term contract for the supply of copper wire rod. According to the agreement, Aurubis will provide a significant and incremental year-over-year volume of copper wire rod. |

- |

|

April 2024 |

Amphenol Corporation (US) |

- |

Product Development & Launch |

Amphenol TPC Wire & Cable, a leading supplier of high-performance wire, cable, connectors, and assemblies for harsh industrial environments, proudly announces the launch of its latest innovation: ATPC Medium Voltage Cables. |

- |

|

September 2023 |

Prysmian Group (Italy) |

50Hertz (Germany) |

Contract |

Prysmian PowerLink s.r.l, part of Prysmian Group, has been awarded new contracts worth around €1.1 billion in total by 50Hertz, a transmission grid operator in Germany. Under the project, Prysmian will be responsible for designing, manufacturing, supplying, installing, testing, and commissioning the two turnkey projects NOR-11-1 and DC31, with an overall cable length of around 1,000 km. With a power transmission capacity of 2 GW. Submarine and land HVDC (High Voltage Direct Current) ±525 kV cable systems will consist of two single-core copper cables with XLPE insulation, a dedicated XLPE metallic return (DMR) cable, and a fiber optic cable. |

$1.23 Billion (€1.1 billion) |

Source: Press releases & company websites

DEMAND/SUPPLY OVERVIEW

DEMAND COMMENTARY

- While demand in sectors like renewable energy is softening, it's offset by robust growth in electric vehicles, semiconductors, and artificial intelligence, which drive cable demand.

- Although demand upside is expected for the semiconductor industry, businesses should be concerned about the export controls implemented by the US Department of Commerce Bureau of Industry and Security (BIS) and the impact on commodity prices and lead time.

Semiconductors

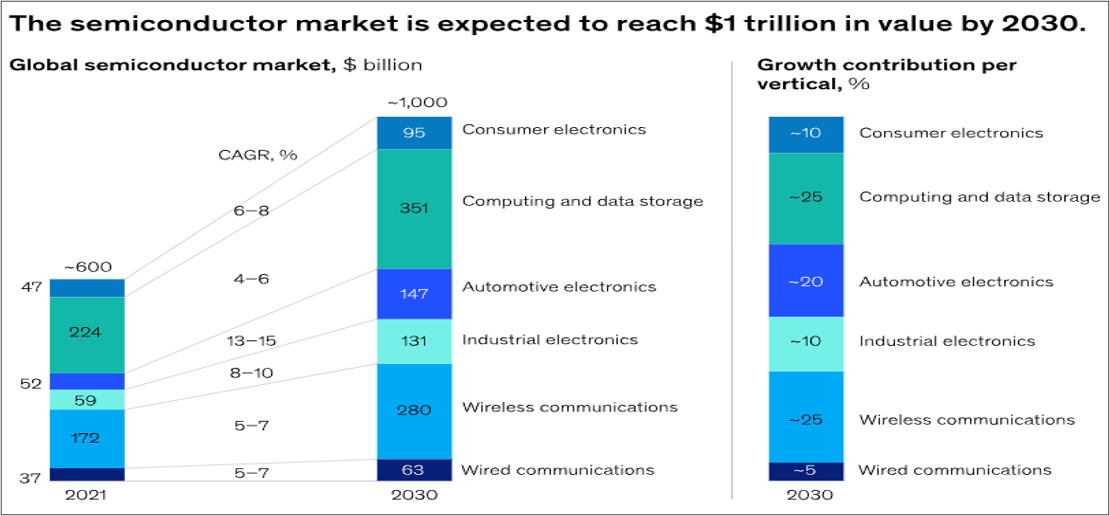

- The semiconductor market's growth and technological advancements create a ripple effect on the demand for copper cables. The increasing complexity of semiconductor manufacturing, the expansion of data centers and HPC infrastructure, and the rise of AI, 5G, IoT, and edge computing all contribute to a greater need for copper cables to support these critical technologies.

- The global semiconductor market is poised to double from $600 billion in 2021 to $1 trillion by 2030, according to McKinsey & Company.

- While wireless communication and computing sectors face short-term challenges like declining mobile phone demand in certain regions, they are projected to lead to long-term growth, followed by automotive and industrial sectors.

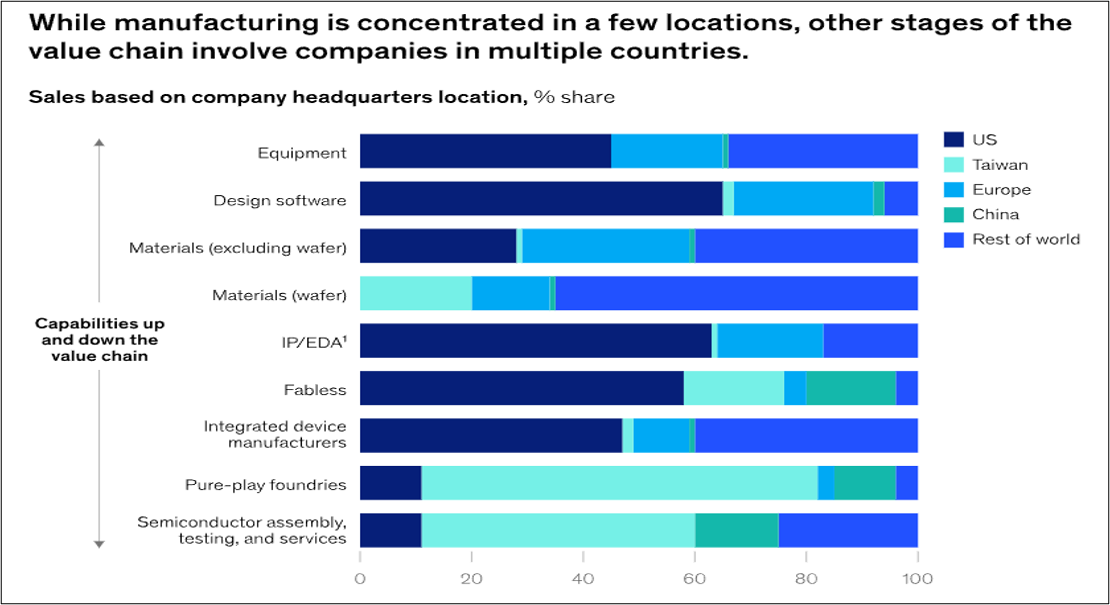

- The US Department of Commerce Bureau of Industry and Security (BIS) has implemented export controls on semiconductor equipment manufacturers to China or Chinese suppliers. Gartner reports a highly fragmented semiconductor supply chain, with no single region dominating any segment except for 'Asia's manufacturing prowess'. Any initiative to remove or adjust the Country of Origin will impact the current supply base and inadvertently impact commodity prices and lead time.

Source: McKinsey & Company

Source: McKinsey & Company

Source: Gartner

Source: Gartner

SUPPLY ANALYSIS

- Major cable suppliers report 40% to 60% manufacturing capacity utilization.

- Suppliers serving the AI, semiconductor, and electric vehicles (EVs) sectors operate at 60% to 70% utilization.

- The book-to-bill ratio for major suppliers shows signs of demand recovery (between 1.0 to 1.2).

- Identifying low-level materials (especially single-source parts) within the controlled Bill of Materials (BOM) is crucial for supply chain stability.

- Copper, a primary cable constituent, is a significant factor.

Copper Supply and Future Outlook:

- Copper Supply is expected to grow but not as fast as demand, primarily due to the time required for new mine construction to be in operation to replace the aging of already existing mines.

- Constructing new mines is capital-intensive, subject to government regulatory approvals, and getting a return on the investment takes time.

- New copper mine projects and expansions are underway in Panama, Indonesia, the United States, and the Democratic Republic of Congo (DRC), where production is expected to surge in 2024.

- Barrick, a leading mining company that produces gold and copper, is increasing its copper focus. It aims to boost production at the Lumwana mine in Zambia to 240 kilotonnes annually over a 36-year lifespan, representing approximately 1% of 2023's global output of 22,104.5 kilotonnes.

- While Chile remains the world's largest copper producer, challenges like declining ore grades and aging mines are slowing production. However, significant investments in recent years are poised to yield new projects and sustain long-term growth. Chile's continued dominance will depend on attracting further investments to offset the impact of aging mines.

PRICING SITUATION

- Copper prices have stabilized after surging past USD$10,000 previously and remain below USD$9,000.

- Copper prices have retreated to March levels primarily due to China's slower-than-expected economic growth of 4.7% in the latest quarter. As the world's largest copper consumer, China's economic performance significantly impacts copper demand.

- While copper prices have stabilized, strong demand from AI data centers is expected to sustain and accelerate copper consumption. Coupled with potential supply shortages, this could drive copper prices upward.

- Cable suppliers are expected to attempt further price increases in response to the surge in copper, especially when China's economic performance is projecting better performance in the upcoming quarters to reach an economic growth of 5.0% for the year, which in turn will lead to more robust demand of copper supply.

- China's Belt and Road Initiative (BRI), with cumulative investments surpassing $1 trillion since 2013 with 149 countries, continues to fuel substantial copper demand through large-scale infrastructure projects. This ongoing investment is expected to drive sustained growth in copper consumption.

KEY TAKEAWAYS

- Geopolitical tensions continue to disrupt supply chains across sectors, including semiconductors, electric vehicles, and renewable energy, impacting commodity prices and lead times.

- The cable market reflects this mixed landscape. While the renewable energy sector experiences softening demand, robust growth in AI, semiconductors, and electric vehicles drives overall market expansion. Major cable suppliers operate at 40-60% capacity, with those serving high-growth sectors running at 60-70%. Encouragingly, book-to-bill ratios have reached 1.0-1.2, indicating demand recovery.

- After peaking above $10,000, copper prices have stabilized below $9,000. However, the sustained growth of AI data centers and global infrastructure and China's strong economic performance for the upcoming quarters will likely rekindle demand, potentially pushing copper prices upward soon.

Back to Top